LWHA 2014 Select Major US Hotel Sales Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotel Administration 1962-1963

CORNELL UNIVERSITY ANNOUNCEMENTS JULY 24, 1962 HOTEL ADMINISTRATION 1962-1963 SCHOOL OF HOTEL ADMINISTRATION ACADEMIC CALENDAR (Tentative) 1962-1963 1963-1964 Sept. 15. ...S ..................Freshman Orientation......................................................Sept. 21... .S Sept. 17...M ..................Registration, new students..............................................Sept. 23...M Sept. 18...T ..................Registration, old students................................................Sept. 24...T Sept. 19...W ..................Instruction begins, 1 p.m.................................................Sept. 25...W Nov. 7....W ..................Midterm grades due..........................................................Nov. 13...W Thanksgiving recess: Nov. 21.. .W ..................Instruction suspended, 12:50 p.m.................................. Nov. 27...W Nov. 26...M..................Instruction resumed, 8 a.m..............................................Dec. 2 ....M Dec. 19. .. .V V ..................Christmas recess..................................................................Dec. 21... .S Instruction suspended: 10 p.m. in 1962, 12:50 p.m. in 1963 Jan. 3.. .Th ..................Instruction resumed, 8 a.m............................................. Jan. 6... ,M Jan. 19 S..................First-term instruction ends............................................Jan. 25 S Jan. 21....M...................Second-term registration, old students......................Jan. 27....M Jan. 22. ...T ...................Examinations begin.........................................................Jan. -

Fall Hospitality Report Manhattan 2015

FALL HOSPITALITY REPORT (2015) MANHATTAN FALL HOSPITALITY REPORT MANHATTAN 2015 1 | P a g e FALL HOSPITALITY REPORT (2015) MANHATTAN EXECUTIVE SUMMARY According to the Starr report, Manhattan’s hotel sector has been growing by over 4.0 % since 2010 both by ADR and number of rooms. The demand still far exceeds supply especially for 5 star brands. Early in the hotel recovery in 2011, three star brands grew in number of rooms and ADR initially. As the recovery went into full swing by late 2013, four and five star hotel development continued to outpace three star hotel growth. Global investors are seeking five star hotel product in Manhattan and at $1.0 million up to $2.0 million per key. For instance, Chinese investors bought the Waldorf Astoria and the Baccarat Hotels both at substantially above $1.0 million per key. Manhattan is one of the best hotel markets in the world between growing tourism and inexpensive accommodations compared to other global gateway cities like London, Paris, Moscow, Hong Kong, etc. Any established global hotel brand also requires a presence in Manhattan. In 2014 alone, 4,348 keys were added to Manhattan’s existing 108,592 rooms. Currently, another 14,272 rooms are under construction in the city and about 4000 keys (1/3) are for boutique hotels. As of July 2015, the Manhattan market has approximately 118,000 keys. They are segmented as follows: Currently, there is a 4.0% annual compounded growth rate. Despite this growth, demand for hotel rooms from tourism, conventions, cultural events, and corporate use continues to grow as Manhattan is one of the most desirable locations for all of the above uses especially tourism from Asia and Europe. -

Media Contact: Jessica Busch Phone: (858) 217-3572 Email: [email protected]

Media Contact: Jessica Busch Phone: (858) 217-3572 Email: [email protected] FOR IMMEDIATE RELEASE CUMMING CONTINUES FOCUS ON STRATEGIC NATIONWIDE EXPANSION WITH OPENING OF NEW YORK CITY OFFICE, BRINGS ON SEVERAL INDUSTRY VETERANS NEW YORK - (Oct. 15, 2013) – Cumming, an international project management and cost consulting firm, announced today it will further expand its East Coast presence with the opening of a New York office and the hiring of veteran talent. Supporting a nationwide growth plan, the construction management firm’s Midtown office located at 60 East 42nd Street will focus on serving the Greater New York City-area and growing its client base. “Expanding Cumming’s geographical footprint with a New York City office and adding leaders that have deep Tri-State experience, will allow us to better serve our clients as construction in the region continues to rebound,” said Peter Heald, President at Cumming. While the firm has been involved with numerous projects in the Greater New York City-area since 1998 - representing approximately $2 billion in development value - Cumming is solidifying its commitment to clients by adding a physical office and key senior talent. Regional project experience includes: EDITION New York, Waldorf Astoria New York, World Trade Center Towers 2 & 4, West 57th Street by Hilton Club, New York Public Library, Westchester County Medical Center, 432 Park Avenue, and SUNY College of Nanoscale Science and Engineering, among many others. Cumming’s New York-based team specializes in program, project and cost management. The team supports clients nationwide and across a broad range of building sectors. Noteworthy regional leaders that have recently joined the firm include: • John Perez, Vice President - Joining Cumming as Vice President, John has more than 26 years of construction and facilities management experience. -

Charles Luckman Papers, 1908-2000

http://oac.cdlib.org/findaid/ark:/13030/c8057gjv No online items Charles Luckman Papers, 1908-2000 Clay Stalls William H. Hannon Library Loyola Marymount University One LMU Drive, MS 8200 Los Angeles, CA 90045-8200 Phone: (310) 338-5710 Fax: (310) 338-5895 Email: [email protected] URL: http://library.lmu.edu/ © 2012 Loyola Marymount University. All rights reserved. Charles Luckman Papers, CSLA-34 1 1908-2000 Charles Luckman Papers, 1908-2000 Collection number: CSLA-34 William H. Hannon Library Loyola Marymount University Los Angeles, California Processed by: Clay Stalls Date Completed: 2008 Encoded by: Clay Stalls © 2012 Loyola Marymount University. All rights reserved. Descriptive Summary Title: Charles Luckman papers Dates: 1908-2000 Collection number: CSLA-34 Creator: Luckman, Charles Collection Size: 101 archival document boxes; 16 oversize boxes; 2 unboxed scrapbooks, 2 flat files Repository: Loyola Marymount University. Library. Department of Archives and Special Collections. Los Angeles, California 90045-2659 Abstract: This collection consists of the personal papers of the architect and business leader Charles Luckman (1909-1999). Luckman was president of Pepsodent and Lever Brothers in the 1940s. In the 1950s, with William Pereira, he resumed his architectural career. Luckman eventually developed his own nationally-known firm, responsible for such buildings as the Boston Prudential Center, the Fabulous Forum in Los Angeles, and New York's Madison Square Garden. Languages: Languages represented in the collection: English Access Collection is open to research under the terms of use of the Department of Archives and Special Collections, Loyola Marymount University. Publication Rights Materials in the Department of Archives and Special Collections may be subject to copyright. -

Chaim Gross (1904-1991)

CHAIM GROSS (1904-1991) BORN: Wolowa, East Austria EDUCATION: 1919, 1920 Academy of Art, Budapest 1921 Kunstgewerbe Schule, Vienna 1921-1926 Educational Alliance Art School, New York 1922-1925 Beaux-Arts Institute of Design, New York 1926 Arts Students League, New York ONE-PERSON EXHIBITIONS: 1932 Exhibition of Sculpture by Chaim Gross, Gallery 144, New York 1935 Sculpture, Boyer Galleries, Philadelphia, PA 1935 Store Studio Galleries, Boston, MA 1937 Chaim Gross, Boyer Galleries, Boyer Galleries NYC, New York 1939 Sculpture Chaim Gross, Cooperative Gallery, Newark, New Jersey 1942 Associated American Artists Galleries, New York 1943 Associated American Artists Galleries, New York 1945 Chaim Gross, Muriel Latov Interiors, Springfield, MA 1946 Associated American Artists Galleries, New York 1946 Massillon Museum, Massillon, OH 1947 Associated American Artists Galleries, New York 1948 Associated American Artists Galleries, New York 1949 Associated American Artists Galleries, New York 1950 Massillon Museum, Massillon, OH 1952 Chaim Gross Sculpture & Drawings, State Teachers College, New Paltz, NY Chaim Gross Watercolors & Sculpture, Philadelphia Art Alliance, Philadelphia, PA Associated American Artists Galleries, New York 1953 Chaim Gross Exhibition The Jewish Museum, New York, NY Sculptures & Drawings, Muriel Latow Gallery, Springfield, MA 1955 Sculptures, Watercolors & Drawings, The Shore Studio Galleries, Boston, MA 1957 Chaim Gross Exhibition, Duveen-Graham Gallery, New York 1961 Chaim Gross, Marble Arch Gallery, Miami, FL 1962 Chaim -

Real Estate Alert

NOVEMBER 12, 2014 Cushman Asking Parent for Capital to Expand Signaling a shift in direction,Cushman & Wakefield’s new chief executive is 3 Big DC-Area Grocery Center for Sale pressing the company’s parent to pump in some $580 million of capital to help the brokerage compete against increasingly aggressive rivals. 3 Net-Leased Listing in Silicon Valley Former Goldman Sachs executive Edward Forst, who took Cushman’s helm in 3 Fund Ready to Develop Apartments January, is arguing the infusion is necessary for the company to defend its crum- bling position as the third-largest global commercial real estate brokerage, accord- 4 Rockpoint Snares NY Apartments ing to Cushman insiders. The capital could be used to acquire other brokerages and recruit talent across service lines internationally, with a priority on investment 6 Ace Hotel Available in Downtown LA sales, especially in the U.S. 8 Canadian Vehicle Holds First Close It’s unclear how Forst’s plan will be received by Cushman’s parent, Exor, a con- glomerate controlled by the Agnelli family of Italy. Exor’s previous reluctance to 10 Value-Added Rental Play Near Atlanta back growth at Cushman was seen as the reason behind the abrupt resignation of See CUSHMAN on Page 12 10 JP Morgan Markets Bay Area Offices 10 Puerto Rican Bank Shops Shaky Loans Heitman to Buy Chicago Trophy From Tishman 10 Buyer Sought for Ore. Business Park Heitman has emerged as the winning bidder for the office tower at 353 North 11 Carr Shops ‘Spy Tech’ Offices in Va. Clark Street in Chicago, beating out a mix of foreign and domestic investors. -

Hlili'fil'i'ltlflmflfieflflflflflmw Wuum

RRRIES wuum HllIlI'fil‘I'lTllflmflfiEflfllflflfllmW97 EASTON’S FOOTWEAR Loel Lawshee—Proprietor QUALITY SHOES FOR THE WHOLE FAMILY We Guarantee You Complete Comfort Satisfaction Guaranteed or Your Money Refunded We Have Thousands of Satisfied Customers ST. LOUIS, MO. PHONE—FR 1-8463 ”Amzzred Protection for t/ae Negro Trawler” THE NEGRO TRAVELERS9 G R E E N B O O K Published by VICTOR H. GREEN & COMPANY 200 West 135th Street New York 30, N. Y. 1959 EDITION ALMA D. GREEN, Editor and Publisher NORVERA DASHIEL Assistant Editor DOROTHY ASCH Advertising Director EVELYN WOOLFOLK Sales Correspondent J. C. MILES Travel Director EDITH GREENE Secretary . zflfifis‘ :M“\a mm-“I" , wfi W.]W in , Copyright 1959 by Victor H. Green & Co. All Rights Reserved FOREWORD No travel guide is perfect. The changing conditions as all know contribute to this condition. ‘ The listings in this guide are carefully checked, despite this, past experiences have shown that from the time that we check to the time that you use our guide, changes have been made. Therefore, at this point may we emphasize that these 11stings are printed just as they are presented to us and we would like your cooperation and understanding, that the pub- lishers are not responsible after this check has been made. If you should experience unpleasant or unsatisfactory serv- ice at any of the places listed, you will do your fellow traveler a favor by reporting this place to us. INFORMATION In planning your trip or tour, secure a road map from your local service station for the trip that you expect to take. -

Q3 2014 Major US Hotel Sales

LW Hospitality Advisors: Q3 2014 Select Major U.S. Hotel Sales Survey NO. OF ESTIMATED ESTIMATED PROPERTY LOCATION ROOMS SALES PRICE PRICE/ROOM BUYER SELLER Courtyard Anaheim at Disneyland Resort Anaheim CA 153$ 32,500,000 $ 212,418 N/A Chesapeake Lodging Trust Marriott Silicon Valley Fremont CA 357$ 50,000,000 $ 140,056 Ashford Hospitality Trust, Inc. AIG Figueroa Hotel Los Angeles CA 285$ 65,000,000 $ 228,070 GreenOak Real Estate & Urban Lifestyle Hotels N/A Luxe City Center Hotel 1 Los Angeles CA 178$ 105,000,000 $ 589,888 Shenzhen Hazens Real Estate Group Co. Emerik Properties Corp. JW Marriott San Francisco Union Square San Francisco CA 337$ 147,000,000 $ 436,202 Chesapeake Lodging Trust Thayer Lodging, Brookfield Hotel Properties Hotel De Anza San Jose CA 100$ 22,000,000 $ 220,000 Lowe Enterprises Saratoga Capital Marriott Warner Center Woodland Hills CA 474$ 90,000,000 $ 189,873 Laurus Corp. Teachers Retirement Fund of Illinois Hyatt Place Denver/Cherry Creek Glendale CO 194$ 32,000,000 $ 164,948 Chatham Lodging Trust JV DiNapoli Capital Partners and Rockwood Capital Park Hyatt Washington Washington DC DC 216$ 100,000,000 $ 462,963 Westmont Hospitality Group Hyatt Hotels Corp. Residence Inn Boca Raton Boca Raton FL 120$ 12,000,000 $ 100,000 BRE Newton Hotels Property Owner LLC Les Res Boca Raton LLC il Lugano Fort Lauderdale FL 104$ 21,600,000 $ 207,692 Claremont Ft. Lauderdale Suites LLC il Lugano LLC Westin Diplomat Resort & Spa 2 Hollywood FL 998$ 535,000,000 $ 536,072 Thayer Lodging Group United Association DoubleTree Grand Key Resort Key West FL 215$ 77,000,000 $ 358,140 RLJ Lodging Trust N/A Inn at Key West Key West FL 106$ 47,500,000 $ 448,113 DiamondRock Hospitality Five Mile Capital b2 miami downtown 3 Miami FL 241$ 57,000,000 $ 236,515 HHR Eat Downtown Miami LLC CRP/InSite Biscayne Princess Ann Hotel Miami Beach FL 45$ 10,000,000 $ 222,222 DHB Collins Hospitality PAH-I and PAH-II Hampton Inn Ft. -

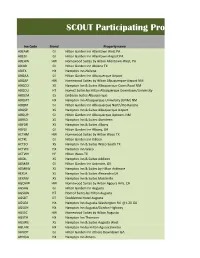

SCOUT Participating Property List

SCOUT Participating Property List Inn Code Brand Property name ABEAW GI Hilton Garden Inn Allentown West PA ABEGI GI Hilton Garden Inn Allentown-Airport PA ABEHW HW Homewood Suites by Hilton Allentown-West, PA ABIAB GI Hilton Garden Inn Abilene TX ABITX HX Hampton Inn Abilene ABQAA GI Hilton Garden Inn Albuquerque Airport ABQAP HW Homewood Suites by Hilton Albuquerque-Airport NM ABQCO XS Hampton Inn & Suites Albuquerque-Coors Road NM ABQDU HT Home2 Suites by Hilton Albuquerque Downtown/University ABQEM ES Embassy Suites Albuquerque ABQMT HX Hampton Inn Albuquerque-University (UNM) NM ABQRR GI Hilton Garden Inn Albuquerque North/Rio Rancho ABQSP XS Hampton Inn & Suites Albuquerque Airport ABQUP GI Hilton Garden Inn Albuquerque Uptown, NM ABRSD XS Hampton Inn & Suites Aberdeen ABYDR XS Hampton Inn & Suites Albany ABYGI GI Hilton Garden Inn Albany, GA ACTHM HW Homewood Suites by Hilton Waco TX ACTKL GI Hilton Garden Inn Killeen ACTSO XS Hampton Inn & Suites Waco-South TX ACTWC HX Hampton Inn Waco ACTWH HF Hilton Waco TX ADDIL XS Hampton Inn & Suites Addison ADMAR GI Hilton Garden Inn Ardmore, OK ADMRW XS Hampton Inn & Suites by Hilton Ardmore AEXLA XS Hampton Inn & Suites Alexandria LA AEXMV XS Hampton Inn & Suites Marskville AGOHW HW Homewood Suites by Hilton Agoura Hills, CA AGSAG GI Hilton Garden Inn Augusta AGSAW HT Home2 Suites by Hilton Augusta AGSDT DT Doubletree Hotel Augusta AGSGA HX Hampton Inn Augusta-Washington Rd. @ I-20 GA AGSGH HX Hampton Inn Augusta/Gordon Highway AGSSC HW Homewood Suites by Hilton Augusta AGSTH HX Hampton -

Hotel Development in NYC Hotel Development In

Hotel Development in NYC Hotel Development in NYC Welcome to New York. From the Bronx to Brooklyn, across Queens to Staten Island’s new North Shore, new hotel properties are joining the dynamic developments in Manhattan, as the hotel pipeline in New York City continues to outpace the US growth picture. With a range of ground up new buildings, restorations of historic buildings, and expansions, the outlook for new inventory supports the city’s Welcome. Always. message to visitors offering accommodations to suit all traveler needs and preferences. Over the past decade the city has attracted new brands, international properties, authentic neighborhood independents, and a wide-ranging collection of select service brands, business class hotels, lifestyle and boutique properties, and new luxury destinations. This report covers almost 200 hotels and projects, including almost a dozen new entries, that represent an additional 20,000 rooms to the city’s already diverse inventory. At the current pace, the city is expected to reach almost 139,000 rooms in active inventory by the end of 2021. For calendar year 2018, 18 new hotels opened with a total of approximately 3,400 rooms added to the City’s supply. Among the new openings are the upscale Park Terrace across from Bryant Park in midtown, the Aliz Hotel Times Square, the City’s first TownePlace Suites by Marriott, the Insignia Hotel in Brooklyn, a member of the Ascend Collection, Mr. C Seaport, a Leading Hotels of the World member, and The Assemblage John Street, a co-working space with extended stay accommodations in Lower Manhattan. -

A Self Guided Tour

Things to See in Midtown Manhattan | A Self Guided Tour Midtown Manhattan Self-Guided Tour Empire State Building Herald Square Macy's Flagship Store New York Times Times Square Bank of America Tower Bryant Park former American Radiator building New York Public Library Grand Central Terminal Chanin Building Chrysler Building United Nations Headquarters MetLife Building Helmsley Building Waldorf Astoria New York Saks Fifth Avenue St. Patrick's Cathedral Rockefeller Center The Museum of Modern Art Carnegie Hall Trump Tower Tiffany & Co. Bloomingdale's Serendipity 3 Roosevelt Island Tram Self-guided Tour of Midtown Manhattan by Free Tours By Foot Free Tours by Foot's Midtown Manhattan Self-Guided Tour If you would like a guided experience, we offer several walking tours of Midtown Manhattan. Our tours have no cost to book and have a pay-what-you-like policy. This tour is also available in an anytime, GPS-enabled audio tour . Starting Point: The tour starts at the Empire State Building l ocated at 5th Avenue between 33rd and 34th Streets. For exact directions from your starting point use this helpful G oogle directions tool . By subway: 34th Street-Herald Square (Subway lines B, D, F, N, Q, R, V, W) or 33rd Street Station by 6 train. By ferry: You can now take a ferry to 34th Street and walk or take the M34 bus to 5th Avenue. Read our post on the East River Ferry If you are taking one of the many hop-on, hop-off bus tours such as Big Bus Tours or Grayline , all have stops at the Empire State Building. -

Hotel Development in NYC Hotel Development In

Hotel Development in NYC Hotel Development in NYC Welcome to New York. The hotel pipeline of active developments, renovations, restorations, and expansions continues to outpace the US growth picture. With an active inventory across the five boroughs of more than 117,300 hotel rooms; the city is attracting new brands, international properties, authentic neighborhood independents, and a wide-ranging collection of select service brands, business class hotels, lifestyle and boutique properties, and new luxury destinations. This report covers more than 200 hotels and projects that represent almost 40,000 net room additions to the city’s diverse inventory between 2015 and 2020-2021. So far, this year, we have added six new hotels representing 1,685 additional rooms through April 2018. Looking out to 2020 there are another 121 projects in the development pipeline bringing the room capacity to 138,000 rooms or more. Exciting developments through the second half of 2018 will include the Times Square Edition, a new citizen M Hotel, the Spanish AC Hotel in downtown, two new Moxy branded properties (Chelsea and Downtown), and a new Ace hotel-affiliated Sister City on the Bowery. Brooklyn will see the opening of several independents including Baltic Huis, The Hoxton Brooklyn, and the Bond Hotel. Queens hotel development is moving beyond the airports to exciting neighborhoods in Long Island City, Flushing, Jamaica and Fresh Meadows as several properties will open including a Hilton Garden Inn, Hotel Indigo, SpringHill Suites and a dual branded Courtyard by Marriott/Fairfield Inn & Suites. Less well known, but definitely on the visitor map, are the new developments in both the Bronx and Staten Island.