Chapter 9 City of Detroit, Michigan, Case No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Front Cover 01-2012.Ppp

The Official Publication of the Worldwide TV-FM DX Association JANUARY 2012 The Magazine for TV and FM DXers Anxious Dxers Camp out on a Snowy New Years Eve Anticipating huge Discounts on DX Equipment at Ozzy’s House of Antennas. Paul Mitschler Happy New DX Year 2012! Visit Us At www.wtfda.org THE WORLDWIDE TV-FM DX ASSOCIATION Serving the UHF-VHF Enthusiast THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, GREG CONIGLIO, KEITH McGINNIS AND MIKE BUGAJ. Editor and publisher: Mike Bugaj Treasurer: Keith McGinnis wtfda.org Webmaster: Tim McVey wtfda.info Site Administrator: Chris Cervantez Editorial Staff: Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, Peter Baskind, Bill Hale and John Zondlo, Our website: www.wtfda.org; Our forums: www.wtfda.info _______________________________________________________________________________________ We’re back. I hope everyone had an enjoyable holiday season! So far I’ve heard of just one Es event just before Christmas that very briefly made it to FM and another Es event that was noticed by Chris Dunne down in Florida that went briefly to FM from Colombia. F2 skip faded away somewhat as the solar flux dropped down to the 130s. So, all in all, December has been mostly uneventful. But keep looking because anything can still happen. We’ve prepared a “State of the Club” message for this issue. -

Fall 2004 Federal Bar Association - Eastern District of Michigan Chapter - 46 Years of Service to Our Federal Bench and Bar

www.FBAmich.org FBA N ewsletter Fall 2004 Federal Bar Association - Eastern District of Michigan Chapter - 46 years of service to our Federal Bench and Bar State of The Court Luncheon President’s September 23rd Column Dennis M. Barnes The Chapter will kick off its annual Luncheon As summer winds down Program on Thursday, September 23, 2004, at the and we approach our Sep- Hotel Pont-chartrain. The reception will begin at tember State of the Court 11:30 a.m., with a luncheon following at 12:00 noon. luncheon, I am happy to The featured speaker will be Chief Judge Bernard report that the state of the A. Friedman, who will deliver the annual “State of FBA’s Eastern District of the Court” address. Judge Denise Page Hood will Michigan Chapter is excellent. The Chapter has an honor pro bono attorneys. Tickets are $25 for Chap- active schedule of activities, a thriving committee sys- ter members, $30 for non-members and $20 for ju- tem, and membership is at an all-time high. Indeed, last year we received the Presidential Excellence dicial law clerks. Law firm sponsorships are still Award from the National FBA, in recognition of su- available for this luncheon and the three luncheons perior Chapter activities in the areas of administra- to be held in the coming months. To register online tion, membership, programming and member out- for the luncheon, visit the Chapter’s website at reach. www.fbamich.org and click on Events and Activi- These achievements yield even greater opportu- ties. For more information, contact Program Chair nities for the future, as we look forward to another Barbara McQuade at (313)226-9725 or e-mail outstanding year of Chapter activities. -

Promoting Your Store Right in Your Hometown !

Real People. Real Help. Real Close. Promoting Your Store Right in Your Hometown ! To All Illinois Hardware Dealers: In 2008, MHA launched a special program for our Wisconsin members called My Local Hardware Store!™. The goal: help stores move beyond traditional product and price advertising and communicate your unique advantages of service, convenience, product knowledge, and local ownership. Clearly, these are the independent hardware retailer’s benefit over big box competitors. MHA aired commercials on radio stations across the state, primarily using the Green Bay Packers broadcasts and programming. We got very positive responses from consumers, participating stores, and the industry. In 2009, we want to offer a similar program for TM Illinois MHA members. The following pages outline our proposed program with the University of Illinois football broadcasts on radio stations across the state. Participating stores will have their store name, location, and owner/manager’s name included in radio commercials that air on their local radio stations carrying University of Illinois football broadcasts. The program would begin in early September and run through November 2009. Take time to read through the following pages and then fill in the final page and fax it back to MHA as soon as possible. We need your response no later than June 15, 2009. This is a special opportunity to use the power of your association to promote what your store does best, to a large audience, branding your store right in your home town. As always, we welcome your questions and comments at Midwest Hardware Association at 1-800-888-1817. -

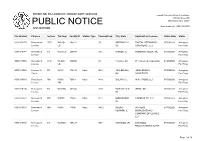

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-1-200803-01 | PUBLISH DATE: 08/03/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000119275 Renewal of LPD WNGS- 190222 33 GREENVILLE, DIGITAL NETWORKS- 07/30/2020 Accepted License LD SC SOUTHEAST, LLC For Filing 0000119148 Renewal of FX W253CR 200584 98.5 MARION, IL FISHBACK MEDIA, INC. 07/30/2020 Accepted License For Filing 0000118904 Renewal of LPD WLDW- 182006 23 Florence, SC DTV America Corporation 07/29/2020 Accepted License LD For Filing 0000119388 License To FS KLRC 174140 Main 90.9 TAHLEQUAH, JOHN BROWN 07/30/2020 Accepted Cover OK UNIVERSITY For Filing 0000119069 Renewal of FM WISH- 70601 Main 98.9 GALATIA, IL WISH RADIO, LLC 07/30/2020 Accepted License FM For Filing 0000119104 Renewal of FX W230BU 142640 93.9 ROTHSCHILD, WRIG, INC. 07/30/2020 Accepted License WI For Filing 0000119231 Renewal of FM WXXM 17383 Main 92.1 SUN PRAIRIE, CAPSTAR TX, LLC 07/30/2020 Accepted License WI For Filing 0000119070 Renewal of AM WMIX 73096 Main 940.0 MOUNT WITHERS 07/30/2020 Accepted License VERNON, IL BROADCASTING For Filing COMPANY OF ILLINOIS, LLC 0000119330 Renewal of FX W259BC 155147 99.7 BARABOO, WI BARABOO 07/30/2020 Accepted License BROADCASTING CORP. For Filing Page 1 of 29 REPORT NO. PN-1-200803-01 | PUBLISH DATE: 08/03/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. -

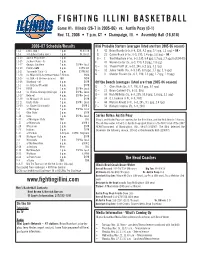

FIGHTING ILLINI BASKETBALL Game #1: Illinois (26-7 in 2005-06) Vs

FIGHTING ILLINI BASKETBALL Game #1: Illinois (26-7 in 2005-06) vs. Austin Peay (0-1) Nov. 13, 2006 • 7 p.m. CT • Champaign, Ill. • Assembly Hall (16,618) 2006-07 Schedule/Results Illini Probable Starters (averages listed are from 2005-06 season) 11-1 Lewis (exh.) 7 p.m. W, 83-58 F – 42 Brian Randle (r-Jr, 6-8, 220, 8.5 ppg, 5.4 rpg, 1.5 apg) - OR - 11-8 SIU-Edwardsville (exh.) 7 p.m. W, 76-57 G – 25 Calvin Brock (r-So., 6-5, 195, 1.4 ppg, 1.6 rpg) - OR - 11-13 Austin Peay State 7 p.m. G – 1 Trent Meacham (r-So., 6-2, 195, 6.4 ppg, 1.7 rpg, 2.7 apg in 2004-05) 11-15 Jackson State - & 7 p.m. F – 41 Warren Carter (Sr., 6-9, 220, 4.8 ppg, 2.8 rpg) 11-17 Georgia Southern 7 p.m. ESPN+ Local C – 55 Shaun Pruitt (Jr., 6-10, 245, 6.2 ppg, 5.1 rpg) 11-19 Florida A&M 4 p.m. ESPN 360 11-21 Savannah State - & 7 p.m. ESPN 360 G – 31 Jamar Smith (So., 6-3, 185, 8.0 ppg, 1.7 rpg, 1.3 apg) 11-24 vs. Miami(OH)-& (Hoffman Estates) 7:30 p.m. WCIA G – 3 Chester Frazier (So., 6-2, 190, 1.3 ppg, 1.7 rpg, 1.9 apg) 11-25 vs. TBA - & (Hoffman Estates) TBA WCIA 11-28 Maryland - @ 6 p.m. ESPN Off the Bench (averages listed are from 2005-06 season) 12-2 vs. -

HURRICANE HARVEY HAMMERS TEXAS – Tony Purcell

Volume 5, Number 10, October 2, 2017 by Larry A. Quinn HURRICANE HARVEY HAMMERS TEXAS – Tony Purcell (Texas State Networks, Dallas, TX) reports that Hurricane Harvey made landfall August 25, between Port Aransas and Port O'Connor, TX, as a Category 4 storm with winds of 130 mph. “In a four-day period, many areas received more than 40 inches of rain as the slow-moving storm meandered over east Texas causing catastrophic flooding. The resulting floods did massive damage to the cotton crop and threatened more than a million head of cattle.” At the time, cotton growers in the region were harvesting what appeared to be the best crop in a decade. In fact, most of the crop in the 51-county disaster area had been harvested with modules, each weighing 10 metric tons, covered with tarps and stored in fields and gin yards. Tony added, “The 100 mph winds ripped the tarps off and scattered the cotton over several square miles. The rain finished the job, and all was lost. The destruction of modules combined with the loss of unharvested cotton in the fields is estimated at 400,000 to 500,000 bales.” There were 1.2 million head of cattle in the affected area. “That's about 25 percent of the herd in the nation's #1 cattle producing state. With Harvey only moving at 4 mph to 5 mph, ranchers moved a lot of their cattle to higher ground and, in many cases, completely out of the area. While there are no numbers available yet, death loss is expected to be minimal.” Slow movement of the storm also resulted in record flooding. -

Millikin Quarterly

MMillikinillikin Quarterly fall 2006 FFOODOOD FFOROR TTHOUGHT:HOUGHT: HHOWOW SSTUDENTSTUDENTS HAVEHAVE CCHANGEDHANGED CAMPUSCAMPUS DDININGINING The Millikin Mission: To Deliver on the Promise of Education At Millikin, we prepare students for • Professional success; • Democratic citizenship in a global environment; • A personal life of meaning and value. MMillikinillikin QuarterlyQuarterly Vol. XXII, No. 3 Fall 2006 Produced by the Offi ce of Alumni and Development. E-mail comments to: [email protected] Millikin Quarterly (ISSN 8750-7706) (USPS 0735- 570) is published four times yearly; once during each of the fi rst, second, third and fourth quarters by Millikin University, 1184 West Main Street, Deca- tur, Illinois 62522-2084. Periodicals postage paid at Decatur, Illinois. POSTMASTER: Send address changes to Millikin Quarterly, Millikin University, 1184 West Main Street, Decatur, IL 62522-2084. Telephone: 217-424-6383, or call toll-free to 1-877-JMU-ALUM. o deliver on the promise of “T education.” This promise is at the core of our mission statement and this is what we must do at Millikin to prepare our students for life ahead. As a university, we produce intellec- tual capital. We’re not in the business of producing widgets; we’re in the business of challenging minds and changing lives. And we need to do it well. When Millikin students leave here, we have equipped them intellectually so they can handle that fi rst job and successfully make the transition to the ones that may lie ahead. They are prepared for profes- sional success, democratic citizenship in a global environment and a personal life of meaning and value. -

United States District Court in the Eastern District of Michigan Southern Division

2:08-cv-10643-PJD-MKM Doc # 19 Filed 07/29/08 Pg 1 of 2 Pg ID 85 UNITED STATES DISTRICT COURT IN THE EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION MARK EDWARD ANDERSON, Plaintiff, CASE NO. 2:08-CV-10643-PJD-MKM v. HON. PATRICK J. DUGGAN WASTE MANAGEMENT OF MICHIGAN, INC. Defendant. JEDO LAW FIRM, PLC LITTLER MENDELSON PLC James O. Edokpolo (69766) Charles C. DeWitt (P26636) Attorney for Plaintiff William B. Balke (P35272) 110 South Clemens Avenue Attorneys for Defendant Lansing, Michigan 48912 200 Renaissance Center, Suite 3110 (517) 944-2038 Detroit, Michigan 48243 [email protected] (313) 446-6401 or 446-6403 [email protected] [email protected] LITTLER MENDELSON, PC Paul E. Bateman (6188371) Michael A. Wilder (6291053) Attorneys for Defendant 200 North LaSalle Street, Suite 2900 Chicago, Illinois 60601 (312) 372-5520 [email protected] [email protected] ORDER APPROVING WAIVER AND RELEASE OF PLAINTIFF’S FMLA CLAIMS AND DISMISSAL OF CASE At a session of said Court held in the Theodore Levin United States Courthouse, City of Detroit, County of Wayne, State of Michigan, on July 29, 2008. PRESENT: Honorable Patrick J. Duggan United States District Court Judge This matter is before the Court upon submission of the parties’ Joint Motion for Order Approving Waiver and Release of Plaintiff’s FMLA Claims and Dismissal of Case, and the 2:08-cv-10643-PJD-MKM Doc # 19 Filed 07/29/08 Pg 2 of 2 Pg ID 86 stipulation of the parties by their undersigned counsel, and the Court being otherwise fully advised in the premises; IT IS HEREBY ORDERED that upon consideration, the Court finds said Motion well taken, and therefore, this Motion is GRANTED and the Court approves of the waiver and release of all Plaintiff’s claims under the Family Medical Leave Act, 29 U.S.C. -

530 CIAO BRAMPTON on ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb

frequency callsign city format identification slogan latitude longitude last change in listing kHz d m s d m s (yy-mmm) 530 CIAO BRAMPTON ON ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb 540 CBKO COAL HARBOUR BC VARIETY CBC RADIO ONE N50 36 4 W127 34 23 09-May 540 CBXQ # UCLUELET BC VARIETY CBC RADIO ONE N48 56 44 W125 33 7 16-Oct 540 CBYW WELLS BC VARIETY CBC RADIO ONE N53 6 25 W121 32 46 09-May 540 CBT GRAND FALLS NL VARIETY CBC RADIO ONE N48 57 3 W055 37 34 00-Jul 540 CBMM # SENNETERRE QC VARIETY CBC RADIO ONE N48 22 42 W077 13 28 18-Feb 540 CBK REGINA SK VARIETY CBC RADIO ONE N51 40 48 W105 26 49 00-Jul 540 WASG DAPHNE AL BLK GSPL/RELIGION N30 44 44 W088 5 40 17-Sep 540 KRXA CARMEL VALLEY CA SPANISH RELIGION EL SEMBRADOR RADIO N36 39 36 W121 32 29 14-Aug 540 KVIP REDDING CA RELIGION SRN VERY INSPIRING N40 37 25 W122 16 49 09-Dec 540 WFLF PINE HILLS FL TALK FOX NEWSRADIO 93.1 N28 22 52 W081 47 31 18-Oct 540 WDAK COLUMBUS GA NEWS/TALK FOX NEWSRADIO 540 N32 25 58 W084 57 2 13-Dec 540 KWMT FORT DODGE IA C&W FOX TRUE COUNTRY N42 29 45 W094 12 27 13-Dec 540 KMLB MONROE LA NEWS/TALK/SPORTS ABC NEWSTALK 105.7&540 N32 32 36 W092 10 45 19-Jan 540 WGOP POCOMOKE CITY MD EZL/OLDIES N38 3 11 W075 34 11 18-Oct 540 WXYG SAUK RAPIDS MN CLASSIC ROCK THE GOAT N45 36 18 W094 8 21 17-May 540 KNMX LAS VEGAS NM SPANISH VARIETY NBC K NEW MEXICO N35 34 25 W105 10 17 13-Nov 540 WBWD ISLIP NY SOUTH ASIAN BOLLY 540 N40 45 4 W073 12 52 18-Dec 540 WRGC SYLVA NC VARIETY NBC THE RIVER N35 23 35 W083 11 38 18-Jun 540 WETC # WENDELL-ZEBULON NC RELIGION EWTN DEVINE MERCY R. -

Chief Engineers

Chief Engineers Waltz. Kenneth R. WMMB. Melbourne Watkins: C. E. WINZ, Hollywood Illinois Wright, Otis C WJNO. West Palm Beach Bailey. Fred WJBC, Bloomington Yarbrough. J. E. WDBO. Orlando Barker, Vincent S. WFRL. Freeport Baum. Jack R. WDWS. Champaign Bragger, John R WILL. Urbana Georgia Cassons. G. J. WLDS. Jacksonville Aderhold. Harvey WCON. Atlanta DeCosta. Lester WJOL. Joliet Akerman, Ben WGST. Atlanta Dewing, H. L. WCVS. Springfield Andrews. John S. WBLJ. Dalton DeWitt. Clayton C. WLBK. DeKalb Bates. Bill WTWA. Thomson Ebel, A. James WDZ. Tuscola Beaty. Lamar WMGA. Moultrie Ebel. James A. WMBD. Peoria Bobo, Rabun F. WRDW, Augusta Fisher, Edward WHOW. Clinton Brannen. Lynne WFOM. Marietta Franklin. Scott WCRA. Effingham Brown. Hudoe WSAC. Columbus Frye. A. P WMBI. Chicago Brown, Keith F. WGOA. Gainsville Oladson, Elmer L. WEBQ, Harrisburg Callicott, C. M WTNT. Augusta Raerle. John WGEM, Quincy Church. Ernest WKLY. Hartwell Horetman. Ed WENR, Chicago Cram. Paul B WAGA, Atlanta tacker, Edward W. WAIT. Chicago Daughtery. C. F WSB. Atlanta Harrell. Robert WEAN. Kankakee Dennis. Ralph WGOV, Valdosta Hayes. E. P WRFC. Cicero Drewry. L. D. WRFC. Athens Morin. Carl WWIL, Peoria Duke, Tommy WDEC, Americus Kitner. John WMRO. Aurora Evans. Bill WGAU. Athena Lewicki Chester WEDC, Chicago Gamble. Joe A. WRBL. Columbus Livesay, Ray WLBH. Mattoon Goodrich. H. S. WEML. Macon Lunkinen. Rudolph WIRL. Peoria Hanssen. Thomas WERE. Fitzgerald Luftgens, Howard C. WMAQ, Chicago Hattaway, Robbie O. WMVG, Milledgeville Lynch. Larry WQUA. ?doline Holt. David J. WEGE, Atlanta McCann, Lawrence WLPO LaSalle Honey. Jim WDWD. Dawson Matin. T. G WDAN, Danville Hooper. Chessley F WI.BB, Carrollton Meyers. -

What Is the Us Position on Offshore Tax

S. Hrg. 107–152 WHAT IS THE U.S. POSITION ON OFFSHORE TAX HAVENS? HEARING BEFORE THE PERMANENT SUBCOMMITTEE ON INVESTIGATIONS OF THE COMMITTEE ON GOVERNMENTAL AFFAIRS UNITED STATES SENATE ONE HUNDRED SEVENTH CONGRESS FIRST SESSION JULY 18, 2001 Printed for the use of the Committee on Governmental Affairs ( U.S. GOVERNMENT PRINTING OFFICE 75–473 DTP WASHINGTON : 2001 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 11-MAY-2000 12:59 Dec 04, 2001 Jkt 000000 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 75473.TXT SAFFAIRS PsN: SAFFAIRS COMMITTEE ON GOVERNMENTAL AFFAIRS JOSEPH I. LIEBERMAN, Connecticut, Chairman CARL LEVIN, Michigan FRED THOMPSON, Tennessee DANIEL K. AKAKA, Hawaii TED STEVENS, Alaska RICHARD J. DURBIN, Illinois SUSAN M. COLLINS, Maine ROBERT G. TORRICELLI, New Jersey GEORGE V. VOINOVICH, Ohio MAX CLELAND, Georgia PETE V. DOMENICI, New Mexico THOMAS R. CARPER, Delaware THAD COCHRAN, Mississippi JEAN CARNAHAN, Missouri ROBERT F. BENNETT, Utah MARK DAYTON, Minnesota JIM BUNNING, Kentucky JOYCE A. RECHTSCHAFFEN, Staff Director and Counsel HANNAH S. SISTARE, Minority Staff Director and Counsel DARLA D. CASSELL, Chief Clerk PERMANENT SUBCOMMITTEE ON INVESTIGATIONS CARL LEVIN, Michigan, Chairman DANIEL K. AKAKA, Hawaii SUSAN M. COLLINS, Maine RICHARD J. DURBIN, Illinois TED STEVENS, Alaska ROBERT G. TORRICELLI, New Jersey GEORGE V. VOINOVICH, Ohio MAX CLELAND, Georgia PETE V. DOMENICI, New Mexico THOMAS R. CARPER, Delaware THAD COCHRAN, Mississippi JEAN CARNAHAN, Missouri ROBERT F. -

Exhibit 2181

Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 1 of 4 Electronically Filed Docket: 19-CRB-0005-WR (2021-2025) Filing Date: 08/24/2020 10:54:36 AM EDT NAB Trial Ex. 2181.1 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 2 of 4 NAB Trial Ex. 2181.2 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 3 of 4 NAB Trial Ex. 2181.3 Exhibit 2181 Case 1:18-cv-04420-LLS Document 131 Filed 03/23/20 Page 4 of 4 NAB Trial Ex. 2181.4 Exhibit 2181 Case 1:18-cv-04420-LLS Document 132 Filed 03/23/20 Page 1 of 1 NAB Trial Ex. 2181.5 Exhibit 2181 Case 1:18-cv-04420-LLS Document 133 Filed 04/15/20 Page 1 of 4 ATARA MILLER Partner 55 Hudson Yards | New York, NY 10001-2163 T: 212.530.5421 [email protected] | milbank.com April 15, 2020 VIA ECF Honorable Louis L. Stanton Daniel Patrick Moynihan United States Courthouse 500 Pearl St. New York, NY 10007-1312 Re: Radio Music License Comm., Inc. v. Broad. Music, Inc., 18 Civ. 4420 (LLS) Dear Judge Stanton: We write on behalf of Respondent Broadcast Music, Inc. (“BMI”) to update the Court on the status of BMI’s efforts to implement its agreement with the Radio Music License Committee, Inc. (“RMLC”) and to request that the Court unseal the Exhibits attached to the Order (see Dkt.