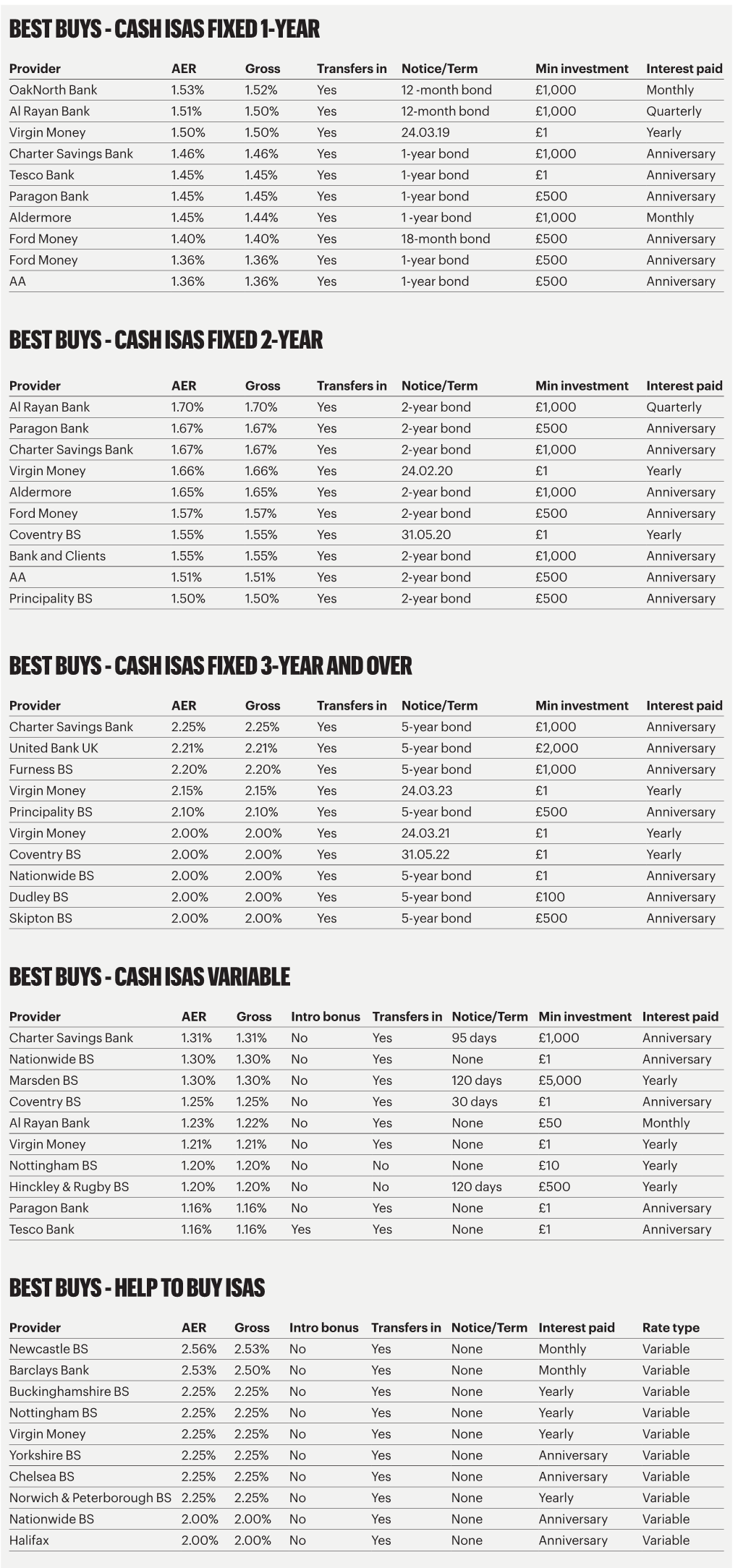

Cash Isas Fixed 1-Year Best Buys

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

Banks-List-1908.Pdf

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 31st August 2019 (Amendments to the List of Banks since 31st July 2019 can be found below) Banks incorporated in the United Kingdom Abbey National Treasury Services Plc DB UK Bank Limited ABC International Bank Plc Access Bank UK Limited, The EFG Private Bank Limited ADIB (UK) Ltd Europe Arab Bank plc Ahli United Bank (UK) PLC AIB Group (UK) Plc FBN Bank (UK) Ltd Al Rayan Bank PLC FCE Bank Plc Aldermore Bank Plc FCMB Bank (UK) Limited Alliance Trust Savings Limited Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

MONEY Virgin Money Ditches Foreign Currency Fees for Debit Cards Savers

The Sunday Times March 8, 2020 15 MONEY Best Buys CURRENT ACCOUNTS FOREIGN MORTGAGES CREDIT INTEREST CURRENCY 2-YEAR FIXED RATES Provider Account name Account fee Interest rate 1 Balance Contact Lender Rate Scheme Deposit Fee Notes Contact These are the interbank Co-operative Bank Current with Everyday Rewards None £4 a month – 0345 721 2212 Barclays 1.21% Fixed to 30.04.22 60% £999 LV 0333 202 7580 rates at 5pm on Friday, 2 Nationwide FlexDirect None 5% £0.01-£2,500 0800 302 010 which show where the HSBC 1.44% Fixed to 30.06.22 20% £999 LV 0800 494 999 Halifax Reward None £2 a month – 0345 720 3040 market is trading. Coventry 1.75% Fixed to 30.06.22 10% £999 LV 0800 121 8899 They are not indicative OVERDRAFTS * 3-YEAR FIXED RATES of the rate you will be Provider Account name Account fee Interest rate 3 0% overdraft limit Contact able to get. Lender Rate Scheme Deposit Fee Notes Contact First Direct 1st Account None 15.9% £250 0345 600 2424 HSBC 1.34% Fixed to 30.06.23 40% £999 LV 0800 494 999 M&S Bank Current Account None 15.9% £100 0800 756 7777 EURO Coventry 1.79% Fixed to 30.06.23 15% £999 LV 0800 121 8899 Starling Current Account None 15% £0 starlingbank.com GBP>EUR Virgin Money 2.08% Fixed to 01.07.23 10% £0 CR 0345 605 0500 FUND FOCUS 1 Based on funding of £1,000 a month. 2 Introductory rate for one year, then 1%. -

2016 SVFBJ Trusted Advisors

AN ADVERTISING SUPPLEMENT TO THE SAN FERNANDO VALLEY BUSINESS JOURNAL AUGUST 22, 2016 PRESENTING SPONSORS GOLD SPONSORS First Bank gishSEIDEN Mission Valley Bank 19-35_sfvbj_trusted_advisors.indd 19 8/17/2016 7:30:02 PM 20 AN ADVERTISING SUPPLEMENT TO THE SAN FERNANDO VALLEY BUSINESS JOURNAL AUGUST 22, 2016 PUBLISHER’S LETTER e’re excited to announce the winners of the considered during the awards selection process, the key 2016 Trusted Advisors Awards. Once again we driver was client and referral source testimonials. Reading have singled out and honored the outstanding through the submitted material is ultimately what steered accountants, attorneys, business bankers, insur- us in selecting our honorees. ance professionals and wealth managers who We want to thank the members of our advisory Whelped their clients thrive here in the greater San Fernan- committee for helping us identify our honorees. It was no do Valley region. easy task by any means. It required each member to read These individuals, all of them well-deserving of the through a few hundred pages of biographical information, “trusted advisor” mantle, are recognized by the San statistics, client testimonials and professional experience. Fernando Valley Business Journal for their commitment to At our annual Trusted Advisors Awards event on high-quality client service, their longevity as professionals Thursday, Aug. 11 at the Hilton Los Angeles in Universal in their chosen fields, and their commitment to overall City, we proudly announced the 2016 class of Trusted excellence. Advisors, whose stories are also detailed in the pages With the many great professionals providing services of this special supplement to the San Fernando Valley in our area, it’s not easy to single out a select few to Business Journal. -

The Following List Details All Banks and Building Societies Who Have Permission to Accept

APPENDIX APPENDIX 1 – INSTITUTIONS INCLUDED IN THE UNITED KINGDOM BANKING SECTOR The following list details all banks and building societies who have permission to accept deposits in the UK. The list is broken down by nationality of the insitutions and is updated on the day of the Bankstats publication. This list relates to those Bankstats tables where nationality breakdowns are provided. Until 31st March 2013 this list was sourced from information provided by the Financial Services Authority (FSA), who previously published an alternative list, showing banks by type. From 1st April 2013 the list is provided by the Prudential Regulation Authority. To access this list, please follow the link provided within related links on the right hand side of this page. A H O Adam & Company plc Hampden & Co Plc OakNorth Bank Limited Airdrie Savings Hanley Economic Building Bank Society OneSavings Bank Plc Alliance Trust Harpenden Building Savings Ltd Society P Arbuthnot Latham Hinckley & Rugby & Co Ltd Building Society Paragon Bank Plc Holmesdale Building Aldermore Bank plc Society Penrithe Building Society Al Rayan Bank plc HSBC Bank plc Principality Building Society Atom Bank plc HSBC Bank USA NA Progressive Building Society HSBC Private Bank (UK) B Ltd R Bank and Clients HSBC Trust Company Rathbone Investment Ltd (UK) Ltd Management Ltd Bank of Scotland plc Hampshire Trust Bank plc Reliance Bank Ltd Barclays Bank plc Harrods Bank Ltd T Barclays Bank Trust The Hongkong & Shanghai Company Ltd Banking Corporation Ltd Tandem Bank Limited Bath Investment -

Mdm-Bank-Annual-Report-2010-Eng

CONTENTS THE CHAIRMAN OF THE BOARD STATEMENT ......................................................................................... / 2 / THE CHAIRMAN OF THE MANAGEMENT BOARD STATEMENT ................................................................ / 4 / MISSION, VISION, VALUES ....................................................................................................................... / 6 / KEY FINANCIAL PERFORMANCE INDICATORS ......................................................................................... / 7 / LEGAL STRUCTURE AND SHAREHOLDERS .............................................................................................. / 10 / OVERVIEW OF THE RUSSIAN ECONOMY AND THE BANKING SECTOR ................................................. / 12 / STRATEGY ............................................................................................................................................... / 19 / MANAGEMENT DISCUSSION AND ANALYSIS ........................................................................................ / 22 / BUSINESS LINES ....................................................................................................................................... / 42 / Retail Banking ...................................................................................................................................... 42 Small- and Medium-Sized Business ....................................................................................................... 46 Corporate Business .............................................................................................................................. -

List of Banking Brands – June 2021

LIST OF BANKING AND SAVINGS BRANDS PROTECTED BY THE SAME FSCS COVERAGE COMPILED BY THE BANK OF ENGLAND AS AT 11 JUNE 2021 Please note this list is not updated on a continuous basis. It is also possible that separate firms (with different Firm Reference Numbers) are part of a group of companies that use similar brand names (i.e, a simplified common version of the firms’ legal names). If you have multiple deposits across a group of firms using similar brand names, you should check with the firms whether the £85k deposit protection limit is shared. Banking and Savings Brand PRA-authorised institution FRN Other deposit brands covered by FSCS coverage 114724 The Royal Bank of Scotland Plc 114724 RBS 114724 Adam & Company Adam & Company The Royal Bank of Scotland Plc 114724 Drummonds 114724 Child & Co 114724 Holt's 114724 The One account/Virgin One account/Nat West One account 671140 Advanced Payment Solutions Limited Advanced Payment Solutions Limited Advanced Payment Solutions Limited 671140 Cashplus 671140 Cashplus Bank 122088 AIB (NI) 122088 Allied Irish Bank (GB) AIB Group (UK) Plc AIB Group (UK) Plc 122088 Allied Irish Bank (GB) Savings Direct 122088 First Trust Bank 143336 Arbuthnot Latham & Co Limited Arbuthnot Latham & Co Limited Arbuthnot Latham & Co Limited 143336 Arbuthnot Direct 121873 Clydesdale Bank Plc 121873 B B Clydesdale Bank Plc 121873 Virgin Money 121873 Yorkshire Bank 136261 Banco Santander S.A. Banco Santander S.A. Banco Santander S.A. 136261 Santander Corporate & Investment Banking 204459 Bank and Clients PLC Bank and -

December 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st December 2020 (Amendments to the List of Banks since 31st October 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The DF Capital Bank Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

Credit Institutions Register Section 1 Hereunder Lists All Credit Institutions Authorised Under Irish Legislation to Carry on Banking Business in the State

Credit Institutions Register Section 1 hereunder lists all credit institutions authorised under Irish Legislation to carry on banking business in the State. Section 2 lists those credit institutions authorised in other Member States of the European Economic Area (EEA) to carry on business in the State without receiving further authorisation from the Central Bank of Ireland, pursuant to the terms of the EU Directive, 2013/36/EU relating to the taking up and pursuit of the business of credit institutions. Section 1 Authorisations issued to Credit Institutions to carry on banking business in the State under Irish Legislation (a) Banks licensed pursuant to Section 9 of the Central Bank Act, 1971 Allied Irish Banks, Public Limited Company Bank of America Merrill Lynch International Designated Activity Company Bank of Montreal Europe plc Barclays Bank Ireland plc Citibank Europe plc Dell Bank International Designated Activity Company DePfa Bank plc EBS Designated Activity Company Elavon Financial Services Designated Activity Company Hewlett-Packard International Bank Designated Activity Company Intesa Sanpaolo Bank Ireland plc JP Morgan Bank (Ireland) plc KBC Bank Ireland plc Macquarie Bank Europe Designated Activity Company permanent tsb plc. Scotiabank (Ireland) Designated Activity Company The Governor and Company of the Bank of Ireland Ulster Bank Ireland Designated Activity Company UniCredit Bank Ireland plc Wells Fargo Bank International Unlimited Company Building Societies authorised to raise funds under the Building Societies Act, 1989 -

FOI7652 Response Annex

Registered/regulated list of firms that offer ‘safe custody services’ IBV International Vaults (London) Ltd RM Assets Limited F. J. Zelley (Norwich) Ltd Switch (MCR) Ltd SHAVO (EDINBURGH) LTD SHAVO (NOTTINGHAM) LIMITED Baird & CO. Limited Metropolitan Vaults Limited Magnum Storage (NE) LTD Shropshire Holdings Group LTD G4S BULLION SOLUTIONS (UK) LIMITED Britannia Safe Deposit Limited G4S International Logistics (UK) Limited Global Bullion & Vault Ltd Coventry Safety Deposit Centre Ltd Harrods Limited Bank House Lockers Limited Birmingham Safety Deposit Limited Selfridges Retail Limited Metropolitan Safe Deposits Limited St James' Safe Deposit Co. Limited Mourant & Co Capital (SPV) Limited Finchley Safe Deposit Vault Ltd Balthorne Safe Deposit Centres Limited The London Silver Vaults And Chancery Lane Safe Deposit Company Limited BJMW Limited Mint Securities Ltd Commerzbank Finance Limited Abbey & Fox Safe Deposit Limited UK Security Services Ltd Albemarle and Bond Jewellers and Prawnbrokers Ltd Safeboxes Limited Secure Deposits Ltd Malca Amit UK Ltd Fortified Management Ltd The Royal Mint Ltd Heathrow Safe Deposit Limited Happee Baby Ltd Lockgrove Safety Deposits Ltd Sovereign Safe Deposit Centres Ltd Zukhruf Aeternus Ltd The Safety Deposit Centre Ltd St James's Safe Deposit (Yorkshire) Ltd UK Safe Deposit Lockers Limited Aspire Safety Deposit Centres Ltd Rockwell Securities Ltd Neelkanth Safe Deposit Limited The Bank Safety Deposit Centre Ltd Manchester Safety Deposit Centre Limited Securus Securities Limited Ranigold London Limited MAXX Securities Ltd Shavo UK Limited DSDC (UK) Ltd Sharps Pixley Ltd Luton Safe Deposit Centre Limited Safe Deposit Centre (Oldham) Limited Shavo (Newcastle) Limited Shavo (Liverpool) Limited ABN AMRO Bank NV ABN AMRO Clearing Bank N.V., London Branch Allied Irish Banks Plc Alpha Bank London Limited Arbuthnot Latham & Co Limited Banco Bilbao Vizcaya Argentaria SA Banco Bradesco Europa S.A. -

Financial Experts on the Board: Does It Matter for the Profitability and Risk of the U.K

Financial experts on the board: does it matter for the profitability and risk of the u.k. banking industry? Item Type Article Authors Apergis, Nicholas Citation Apergis, N., (2019) ‘Financial experts on the board: does it matter for the profitability and risk of the u.k. banking industry?’ Journal of Financial Research. DOI: 10.1111/jfir.12168. Publisher Wiley. Journal Journal of Financial Research. Download date 29/09/2021 08:08:52 Item License http://creativecommons.org/licenses/by-nc-nd/4.0/ Link to Item http://hdl.handle.net/10545/623382 ve1 FINANCIAL EXPERTS ON THE BOARD: DOES IT MATTER FOR THE PROFITABILITY AND RISK OF THE U.K. BANKING INDUSTRY? Nicholas Apergis University of Piraeus, [email protected] University of Derby, [email protected] The author expresses his deep gratitude to a reviewer of this journal for many helpful comments and suggestions that enhanced the merit of this work. Special thanks also go to the Editor for his constructive comments, as well as for giving him the opportunity to revise his work. ve2 Abstract This paper explores the relation between board-level financial expertise, the profitability and the risk profile with panel data from the UK banking industry. The empirical findings document that collectively, financial experts have a positive influence on the performance outcomes of banks, they contribute to higher risks, especially in the case of large banks, while they improve the stock performance of the associated banks. Moreover, the results highlight that board-level qualified accountants have no statistical effect on that profitability, while such a positive link is established for the case of financial and banking professors, as well as for financial experts from other industries.