Buniineniai Euffee

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unclaimed Dividend Page : 1 Bank Name :Sbi for the Year :2009-2010 ------Slno Name/Address Amount Due Date War

SMS PHARMACEUTICALS LIMITED STATEMENT SHOWING THE LIST OF SHARE HOLDERS - UNCLAIMED DIVIDEND PAGE : 1 BANK NAME :SBI FOR THE YEAR :2009-2010 ---------------------------------------------------------------------------------------- SLNO NAME/ADDRESS AMOUNT DUE DATE WAR. NO. ---------------------------------------------------------------------------------------- 1.RAMESH RAVI 2000.00 23-OCT-2017 409692 F-2 SIRI PLAZA SIVARAMA RAJU STREET LOYOLA GARDENS 520008 2.RAVI JAYASRI 2000.00 23-OCT-2017 409696 40-9/1-15 VASYYANAGAR 520008 3.NEERAJA MANDAVA 2000.00 23-OCT-2017 409708 F-3, ANNAPURNA APARTMENTS AMEERPET 500016 4.RATNAKUMARI GUTTIKONDA 2000.00 23-OCT-2017 409726 4-79 BALANAGAR CROSS ROADS NEAR MASEED 500037 5.PADMA TAMMINEEDI 4000.00 23-OCT-2017 409733 H NO 7 1 277/198/2 OPP 174/C LIGH BEHIND ESI MEDICAL DEPO S R NAGAR HYDERABAD 500038 6.RAMBABU BANDARUPALLY 1507.00 23-OCT-2017 409734 H NO 8 3 231/A1/74 SRIKRISHNANAGAR YOUSUFGUDA HYDERABAD 500045 7.RAM PRASAD CHERUKURI 2000.00 23-OCT-2017 409736 LIG 80 APIIC COLONY JEEDIMETLA 500055 8.PURNACHANDRA RAO VENIGALLA 2000.00 23-OCT-2017 409753 RITHUNAGAR POST KOPPALTHI (CAMP) BODHAN (MANDAL) 503185 9.KONERU SURESH BABU 2500.00 23-OCT-2017 409774 SFI ARUNA PALACE KRM COLONY, SEETHAMMADHARA VISAKHAPATNAM 530013 10.SRIDHAR CHILUKURI 2000.00 23-OCT-2017 409781 S/O. CH KRISHNA MURTHY JAYANAGAR COLONY, SIDDIKERE ROAD 583227 ---------------------------------------------------------------------------------------- PAGE TOTAL : 22007.00 CUM TOTAL : 22007.00 ---------------------------------------------------------------------------------------- -

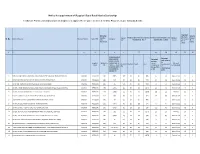

List of Ineligible Candidates for the Post of District Co-Ordinator

List of Ineligible Candidates for the Post of District Co-ordinator Education Application Sl.No Name of the Candidate Father name DOB Gender Local District Qualification (PG/ Name of the University Percentage Work Experience Remarks NO Degree) 2 yrs Exp as a District Coordinator at APT 1 20 Bheemisetty Sai Manoj Sreekanth 14/07/1993 M Prakasam Degree DR.BR University 58 Onine Ineligible. Not having PG. Sri 3 yrs Ineligible. Having Post Graduation degree with out 2 32 Patnam Siva Prasad Gopal 07-12-1995 M Kurnool MBA Krishnadevaraya Univers 70.5 specialization in Computer skills ity 3 42 Mokkarala Venkateswarlu Pulla Akkaiah 06-10-1992 M Guntur M.Tech JNTUK 70 Ineligible. Not having experience 15 yrs Ineligible. Having Post Graduation degree with out 4 59 Cherukuri Suseela Dhana Raju 04-06-1976 F Guntur M.Sc Dravidian University 83.8 specialization in Computer skills 9 yrs Ineligible. Having Post Graduation degree with out 5 65 Nazir Shaik Allisaheb 15-02-1983 M Krishna MBA ANU 62 specialization in Computer skills 2 yrs 6 66 Chukka Lokesh Omkar 07-08-1995 M Guntur Degree JNTUK 62 Ineligible. Not having PG. 10 yrs Ineligible. Having Post Graduation degree with out 7 67 Dande Joseph Kumar Bala Sundara Raju 14-07-1972 M Guntur M.Sc ANU 80 specialization in Computer skills Computer Operator 1 yr experience 8 70 Shaik Afroze Gouse 18-10-1988 F Kurnool B.com ANU 51.63 Ineligible. Not having PG. 9 73 Guntuku Vedavalli Sudarsana Rao 13-05-1994 F Srikakulam MCA JNTUK 76.6 Ineligible. -

Crystal Reports

PROVISIONAL MERIT LIST SPECIAL RECRUITMENT DRIVE FOR DIFFERENTLY ABLED PERSONS, 2020-21 FILLING OF BACKLOG VACANCIES RESERVED FOR DIFFERENTLY ABLED IN VARIOUS DEPARTMENTS, GUNTUR DISTRICT Group-IV * Name of Post: 01. Junior Assistant Category: OH Qualificaon: Any Degree & Knowledge in Computer Automaon No. of Posts: General-3 * The GPA percentage in the qualifying academic examinaons has been considered as standard of merit in calculang the merit of the candidates, where the Universies have awarded the GPA in their Marks Memorandum / Provisional Cerficate. In case, if the Universies have awarded marks in lieu of GPA, the Group Marks (Part-II) have been considered as merit. Sl. Appln. Name of the Candidate Father's Name & Address Disability Sadaram Date of Age as on Gender Employment Navity Qualificaon Marks Max. % of Addional Remarks Eligible / No. No. % Cerficate Birth 01-07-2020 M / F Regd. No. Local / Gained Marks Marks Aer Scruny Qualificaon Ineligible issued Non Marks Max. % of Y / N local Gained Marks Marks 12 3 4 56 7 8 910 1112 1314151617 18 19 20 21 151PAPARAJU K PAPARAJU ANJANEYA SARMA, 90 Y 05/20/198931y, 1m, 11d M F1/2007/05201 L B.SC Computers1136 190059.7895 1137195058.3077 B.SC Computers Eligible CHAITANYA 6-178 SAIRAM TOWENSHIP NEAR MEDICAL COMPLEX SATTENAPALLI ROAD NARASARAOPET, NARASARAOPETA (R), Narasaraopet, Phone: 7702421204 258DAVALA DAVALA SOLMON RAJU, SOLASA 88 Y 06/17/199327y, 0m, 14d M F1/2012/06791 L B.A 1342 170078.9412 7.901079.0000 B.A Eligible VEERAKUMAR VILLAGE, SOLASA, Edlapadu, Phone: 9700684207 364VENKATA -

Annual Report 2018-2019

CCL PRODUCTS (INDIA) LIMITED ANNUAL REPORT (2018-19) New Freeze Dried Plant located at Kuvvakolli Village, Chittoor District, Andhra Pradesh, India. Annual Report 2018-19 58TH ANNUAL GENERAL MEETING Wednesday, 07th August, 2019 at 09.30 A.M. at Sarojini Picture Palace situated at Duggirala – 522 330 Guntur Dist. Andhra Pradesh INDIA Contents Page No. Company Information 2 Notice 4 Directors’ Report 31 Annexures to Directors’ Report 42 Business Responsibility Report 81 Report on Corporate Governance 93 Financial Statements Standalone Financial Statements Independent Auditors’ Report 117 Balance Sheet 127 Statement of Profit & Loss 128 Statement of Changes in Equity 129 Cash Flow Statement 131 Notes on Accounts 132 Consolidated Financial Statements Independent Auditors’ Report 165 Balance Sheet 173 Statement of Profit & Loss 174 Statement of Changes in Equity 175 Cash Flow Statement 177 Notes on Accounts 178 Attendance Slip 215 Proxy Form 217 1 Annual Report 2018-19 Company Information Board of Directors Auditors Mr. Challa Rajendra Prasad, Executive Chairman M/s.Ramanatham & Rao, Mr. Vipin K. Singal Chartered Accountants Mr. K. Chandrahas, IRS (Retd.) Ft.no.302, Kala Mansion Mr. J. Rambabu, IAS (Retd.) (upto 31.03.2019) Sarojini Devi Road Mr. K. K. Sarma Secunderabad – 500 003, T.S., India. Mr. B. Mohan Krishna Mr. G.V. Krishna Rau IAS (Retd.) Internal Auditors Mrs. Kulsoom Noor Saifullah Mrs. Challa Shantha Prasad M/s. Ramesh & Co. Dr. Lanka Krishnanand Chartered Accountants Mr. Kode Durga Prasad, IPS (Retd.) H.No: 6-3-661/B/1 Mr. Kosaraju Veerayya Chowdary, IRS (Retd.) (w.e.f. 25.06.2019) Sangeeth Nagar, Somajiguda Mr. -

List of Ineligible Candidates for the Post of Town Co-Ordinator

List of Ineligible Candidates for the Post of Town Co-ordinator Education Application Name of the Sl.No Name of the Candidate Father name DOB Gender Local District Qualification Percentage Work Experience Remarks NO University (PG/ Degree) 1 1137 Potla Hanumantha Rao Venkateswarlu 04-08-1983 M Guntur MCA IGNOU 58.83 3yrs worker as MIS in skill develoment-center Ineligible. Not having 1st Class PG. 2 1477 R Lakshmidevi Venkata Reddy 06-02-1985 F Ananthapuram PG SVU 50.3 14 years experience at APMSS program as DRP Ineligible. Information furnished incomplete 3 941 Banavathu Govind Naik Devula 07-03-1976 M Guntur PG ANU 51 Housing Apartment data entry operator Ineligible. Information furnished incomplete Kakatiya 3 1/2 years Documentation & MIS Reports ,10 1/2 4 472 T Srinivasa Rao Somaiah 08-12-1969 M Guntur PG 52 Ineligible. Information furnished incomplete University years Backend Operations Administration 5 293 Bibi Ayesha Khadarjilani abdul 01-04-1987 F Krishna PG ANU 52.6 Ineligible. Information furnished incomplete 6 305 Thoka Madhu Babu Ganga prasad 15/8/1989 M Guntur PG ANU 54 Ineligible. Information furnished incomplete 7 580 Kodavati PrasadRao Raja Rao 04-12-1984 M Guntur PG ANU 60 3years school , college HM Ineligible. Information furnished incomplete Tangellamudi Basava Pun 3years Exp in Data Analysis in trigo software and 2 8 754 Sai Babu 25/7/1983 M Guntur PG ANU 60 Ineligible. Information furnished incomplete na Rao years in Repalle Municipality 9 657 Doppalapudi Raviteja Prasada rao 03-04-1987 M Guntur PG ANU 60 Ineligible. Information furnished incomplete 10 1350 Shaik Mastan Vali Noor bai Saida 08-12-1992 M Guntur PG JNTUK 61.55 Java Script Ineligible. -

Unclaimed Dividend Page : 1 Bank Name :Sbi for the Year :2015-2016 ------Slno Name/Address Amount Due Date War

SMS PHARMACEUTICALS LIMITED STATEMENT SHOWING THE LIST OF SHARE HOLDERS - UNCLAIMED DIVIDEND PAGE : 1 BANK NAME :SBI FOR THE YEAR :2015-2016 ---------------------------------------------------------------------------------------- SLNO NAME/ADDRESS AMOUNT DUE DATE WAR. NO. ---------------------------------------------------------------------------------------- 1.CHANDULAL G SHETH 48.00 23-OCT-2023 742738 24,HOOD ROAD WIMBLEDON LONDON SW2Q QSR, 2.RAMA C SHETH 48.00 23-OCT-2023 742739 24,HOOD ROAD WIMBLEDON LONDON,SW2Q QSR 3.BHARAT C SHETH 48.00 23-OCT-2023 742740 24,HOOD ROAD WIMBLEDON LONDON,SW2Q QSR 4.RITA B SHETH 48.00 23-OCT-2023 742741 24,HOOD ROAD WIMBLEDON LONDON,SW2Q QSR 5.RAMACHNADRA RAO VEMULAPALLI 180.00 23-OCT-2023 742742 3400, DORAL DRIVE WATERLOO IOVA 50701,USA 6.PRASAD RAO VDM RAVELLA 200.00 23-OCT-2023 742743 6918 N LATROBE SKOKIE ILLINOIS USA,60077 7.PRASANNA KUMAR TUMMALA 20.00 23-OCT-2023 742744 H NO 21,KAMALAPURI COLONY PHASE - 3 INDIRA NAGAR,HYDERABAD 8.JAGAN MOHAN RAO K 2.00 23-OCT-2023 742745 C/O VORIN LABORATORIES LTD , GADDAPOTHARAM VILLAGE ZINNARAM MANDAL 9.SRINIVASULU GADIKOTA 2.00 23-OCT-2023 742746 VORIN LABORATORIES LTD GADDAPOTHARAM MEDAK DIST JINNARAM MANDAL 10.VIJAYANARAYNA DEVINENI 4.00 23-OCT-2023 742747 VIJAYA NAGAR GAS COMPANY AMEERPET HYDERABAD 11.JHANSI LAKSHMI VADLAMUDI 4.00 23-OCT-2023 742748 8-3-676/1/A/2 YELLAREDDY GUDA HYDERABAD 12.KRISHNA MURTHY KORA 4.00 23-OCT-2023 742749 8-3-721/1/16/1/1 YELLAREDDY GUDA HYDERABAD ---------------------------------------------------------------------------------------- PAGE TOTAL : 608.00 CUM TOTAL : 608.00 ---------------------------------------------------------------------------------------- SMS PHARMACEUTICALS LIMITED STATEMENT SHOWING THE LIST OF SHARE HOLDERS - UNCLAIMED DIVIDEND PAGE : 2 BANK NAME :SBI FOR THE YEAR :2015-2016 ---------------------------------------------------------------------------------------- SLNO NAME/ADDRESS AMOUNT DUE DATE WAR. -

Request for Proposal (Rfp) for Selection of Architectural Consultant

REQUEST FOR PROPOSAL REQUEST FOR PROPOSAL (RFP) FOR SELECTION OF ARCHITECTURAL CONSULTANT for Upgrading and standardizing the passenger amenities with improved aesthetics in 21 Bus Stations across the Andhra Pradesh State (Study of the existing amenities in the Bus Stations, suggest modifications for their Upgradation along with improved aesthetics and preparation of Architectural working plans, 3D views , Detailed Specifications, quantity & rate analysis for the proposed modifications and to furnish Completion Report after completion of the works by the Department) Mode of Selection : Cost based Selection among Prequalified bidders September ’2020 Tender Inviting Authority CHIEF CIVIL ENGINEER APSRTC 1stFloor, RTC House, PNBS, Vijayawada- 520013 BIDDER 1 CHIEF CIVIL ENGINEER REQUEST FOR PROPOSAL BIDDER 2 CHIEF CIVIL ENGINEER REQUEST FOR PROPOSAL ANDHRA PRADESH STATE ROAD TRANSPORT CORPORATION NIT. No.7/CCE/AP/2020-21 dt.27.08.2020 e’-TENDER NOTICE Andhra Pradesh State Road Transport Corporation (APSRTC) invites proposals from interested registered Architects / Architectural firms for providing Consultancy services for upgrading and standardizing the passenger amenities with improved aesthetics in 21 Bus Stations across the Andhra Pradesh State. It is proposed to select the Architectural Consultancy through on line bidding in accordance with the procedure set out herein. The name of the Assignment is “Providing Architectural Consultancy for upgrading and standardizing the passenger amenities with improved aesthetics in 21 Bus Stations across the Andhra Pradesh State”. The details of the proposals are available in the Request for Proposal (RFP) document. Competitive Bids are invited from the eligible bidders on “e-Tender process” through online. The above work will be awarded to L1 bidder. -

Canara Bank(400)

Department of Supervision Branch Audit Allocation Report Branch Audit - 2020-2021 Canara Bank(400) No. of Sr. No UCN Firm Name and Branches Branch District State Address allocated Name A A A M & CO 1 333570 A-58 IST FLOOR 3 SECTOR-65 ALIGARH KELANAGAR Aligarh Uttar Pradesh ALIGARH MAIN Aligarh Uttar Pradesh NOIDA INDUSTRIAL Gautam Buddha FINANCE Nagar Uttar Pradesh BRANCH A A JANAWADE & CO FLAT NO 606 A WING AISHARYAM COMFORT, 2 1000006 NR ADOR WELDING 3 COMPANY KHANDOBAMAL AKURDI PUNE KARVE Maharashtra ROAD II Pune PUNE KIRKEE Maharashtra BAZAAR Pune PUNE MODEL Maharashtra COLONY Pune A A S A AND ASSOCIATES 3 260138 SBI ATM BUILDING IST 3 FLOOR, UDIT NAGAR BANGALORE JAYANAGAR Bangalore Karnataka SHOPPING Urban COMPLEX BANGALORE LAVELLE Bangalore Karnataka ROAD Urban BANGALORE, Bangalore HSR LAYOUT Urban Karnataka A A SINGH & CO HARMONY ARCADE 4 333555 CHAMBER NO 19-20, 3 17/1 TELEGRAPH ROAD THE MALL BACHGAON Firozabad Uttar Pradesh Mahamaya CHITTUPUR Nagar Uttar Pradesh SHYAMPUR Fatehpur Uttar Pradesh A A SOLAO & CO 5 891444 PLOT NO 8 SURVE 3 NAGAR GITTIKHADA Nagpur Maharashtra N 1 Generated On 21-Jul-2021 LAW COLLEGE SQUARE, Nagpur Maharashtra NAGPUR WADI Nagpur Maharashtra A A VIRANI & ASSOCIATES HOUSE NO Y 8 6 1003133 RAMNATH CITY, 3 KORADI ROAD BOKHARA GANDHIBAG, NAGPUR Nagpur Maharashtra KALMESHWA R Nagpur Maharashtra NAGPUR KHAMLA Nagpur Maharashtra A ANAND & CO NEAR DR.P K DAS CIVIL 7 334687 LINES, NEAR HOTEL 3 RAJ MAHEL RETAIL ASSETS HUB Moradabad Uttar Pradesh MORADABAD SPECIALISED SME BRANCH, Moradabad Uttar Pradesh MAJHOLA -

AP H2 FINAL .Xlsx

Notice for appointment of Regular / Rural Retail Outlet Dealerships Hindustan Petroleum Corporation Ltd proposes to appoint Retail Outlet dealers in Andhra Pradesh, as per following details: Fixed Fee / Estimated Security Minimum monthly Type of Minimum Dimension (in M.)/Area of Finance to be arranged by the Mode of Deposit Name of location Revenue District Type of RO Category Bid amount Sl. No Sales Site* the site (in Sq. M.). * applicant (Rs. in Lakhs) selection (Rs. in (Rs. in Potential # Lakhs) Lakhs) 12 345678 9a9b101112 SC/SC CC-1/SC CC- Estimated 2/SC PH/ST/ST Estimated fund required CC-1/ST CC-2/ST working for Regular / MS+HSD in PH/OBC/OBC CC- capital (Draw of (CC/DC/C Frontage Depth Area development Rural Kls 1/OBC CC-2/OBC requirement Lots/Bidding) FS) of PH/OPEN/OPEN for operation infrastructure CC-1/OPEN CC- of RO at RO 2/OPEN PH 1 WITH IN 6 KMS FROM G KONDURU, ON G KONDURU TO GANGINENI ROAD(NOT ON NH) KRISHNA REGULAR 100 OPEN DC 30 30 900 25 60 Draw of Lots 15 5 2 KONATHAMATMAKUR VILLAGE, ON DAMULURU TO VATSAVAI ROAD KRISHNA REGULAR 100 OBC DC 30 30 900 25 60 Draw of Lots 15 4 3 ON SH 192, MAKKAPETA, ON CHILLAKALLU TO VATSAVAI ROAD KRISHNA REGULAR 100 SC CFS 30 30 900 0 0 Draw of Lots 0 3 4 ON RHS , FROM IBRAHIMPATNAM CROSS ROAD TO ANUMANCHIPALLI VILLAGE ON NH 65 KRISHNA REGULAR 150 OPEN DC 35 45 1575 25 75 Draw of Lots 15 5 5 ON RHS, FROM KAMBHAMPADU TO A KONDURU ON NH-30 KRISHNA REGULAR 150 OPEN CC 35 45 1575 25 10 Bidding 30 5 6 POLICE CONTROL ROOM TO KAY HOTEL (ELURU ROAD), VIJAYAWADA KRISHNA REGULAR 250 OBC DC 18 18 -

Development of World Class Multi-Purpose Sports Hub at Amaravati, Andhra Pradesh on Design-Built- Finance-Operate-Transfer (DBFOT) PROJECT INFORMATION MEMORANDUM

Development of World class Multi-Purpose Sports Hub at Amaravati, Andhra Pradesh on Design-Built- Finance-Operate-Transfer (DBFOT) PROJECT INFORMATION MEMORANDUM Contents 1 Sports infrastructure profile ........................................................................................................... 4 1.1 Sports Infrastructure in India: ..................................................................................................... 4 1.1.1 Assessment of Sports Facilities in India: ...................................................................... 9 1.2 Sports Infrastructure in Andhra Pradesh .................................................................................. 10 1.3 Sports infrastructure in the Capital Region of Andhra Pradesh ............................................... 10 1.4 Regional Demand for sporting facilities ................................................................................... 12 1.5 Events Basket .......................................................................................................................... 13 1.5.1 Cricket ......................................................................................................................... 13 1.5.2 Football ....................................................................................................................... 13 1.5.3 Hockey ........................................................................................................................ 14 2 Amaravati capital city ................................................................................................................... -

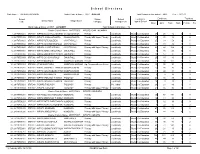

S C H O O L D I R E C T O

S c h o o l D i r e c t o r y State Name : ANDHRA PRADESH District Code & Name : 2817 GUNTUR Total Schools in this district : 4902 Year : 2011-12 School School School Location & Enrolment Teachers Code School Name Village Name Category Management Type of School Boys Girls Total Male Female Total Block Code & Name: 281707 ACHAMET Total Schools in this block : 72 Cluster Code & Name: 2817070006 MPUPS, CHALLAGARIKA 1 28170700401 0707008 - MPPS (SC) CHALLAGARIGACHALLAGARIGA Primary Local body Rural Co-Educational 27 45 72 3 0 2 28170700402 0707309 - MPUPS CHALLAGARIGA CHALLAGARIGA Primary with Upper Primary Local body Rural Co-Educational 38 48 86 3 2 3 28170700601 0707011 - MPPS PUTLAGUDEM CHINTAPALLI Primary Local body Rural Co-Educational 25 33 58 2 1 4 28170700602 0707012 - MPPS (SC)CHINTHAPALLI CHINTAPALLI Primary Local body Rural Co-Educational 14 18 32 1 1 5 28170700605 0707303 - MPUPS CHINTHAPALLI CHINTAPALLI Primary with Upper Primary Local body Rural Co-Educational 49 60 109 4 3 6 28170700301 0707004 - MPPS (MAIN) GINJUPALLI GINJUPALLI Primary Local body Rural Co-Educational 9 16 25 0 1 7 28170700302 0707005 - MPPS GINJUPALLI THANDAGINJUPALLI Primary Local body Rural Co-Educational 19 12 31 0 2 8 28170700303 0707006 - MPPS (SC) GINJUPALLI GINJUPALLI Primary Local body Rural Co-Educational 25 15 40 1 1 9 28170700102 0707052 - MPPS MADIPADU MADIPADU AGRAHARAMPrimary Local body Rural Co-Educational 77 84 161 3 5 10 28170700103 0707605 - ZPHS MADIPADU MADIPADU AGRAHARAMUp. Primary with sec./H.sec Local body Rural Co-Educational 43 50 -

Trade Marks Journal No: 1960, 10/08/2020

Trade Marks Journal No: 1960, 10/08/2020 Reg. No. TECH/47-714/MBI/2000 Registered as News Paper p`kaSana : Baart sarkar vyaapar icanh rijasT/I esa.ema.raoD eMTa^p ihla ko pasa paosT Aa^ifsa ko pasa vaDalaa mauMba[- 400037 durBaaYa : 022 24101144 ,24101177 ,24148251 ,24112211. Published by: The Government of India, Office of The Trade Marks Registry, Baudhik Sampada Bhavan (I.P. Bhavan) Near Antop Hill, Head Post Office, S.M. Road, Mumbai-400037. Tel: 022 24101144, 24101177, 24148251, 24112211. 1 Trade Marks Journal No: 1960, 10/08/2020 Anauk/maiNaka INDEX AiQakairk saucanaaeM Official Notes vyaapar icanh rijasT/IkrNa kayaa-laya ka AiQakar xao~ Jurisdiction of Offices of the Trade Marks Registry sauiBannata ko baaro maoM rijaYT/ar kao p`arMiBak salaah AaoOr Kaoja ko ilayao inavaodna Preliminary advice by Registrar as to distinctiveness and request for search saMbaw icanh Associated Marks ivaraoQa Opposition ivaiQak p`maaNa p`~ iT.ema.46 pr AnauraoQa Legal Certificate/ Request on Form TM-46 k^apIra[T p`maaNa p`~ Copyright Certificate t%kala kaya- Operation Tatkal saava-jainak saucanaaeM Public Notices iva&aipt Aavaodna Applications advertised class-wise: 2 Trade Marks Journal No: 1960, 10/08/2020 vaga- / Class - 1 11-97 vaga- / Class - 2 98-120 vaga- / Class - 3 121-390 vaga- / Class - 4 391-422 vaga- / Class - 5 423-1472 vaga- / Class - 6 1473-1558 vaga- / Class - 7 1559-1697 vaga- / Class - 8 1698-1725 vaga- / Class - 9 1726-2129 vaga- / Class - 10 2130-2270 vaga- / Class - 11 2271-2433 vaga- / Class - 12 2434-2528 vaga- / Class - 13 2529