April, 2018 — Dividendrank Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEWELL RUBBERMAID INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents As filed with the Securities and Exchange Commission on March 17, 2016 Registration No. 333-208989 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT NO. 3 TO FORM S-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 NEWELL RUBBERMAID INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 3089 36-3514169 (State or Other Jurisdiction of (Primary Standard Industrial (I.R.S. Employer Incorporation or Organization) Classification Code Number) Identification Number) Three Glenlake Parkway Atlanta, Georgia 30328 (770) 418-7000 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) Bradford R. Turner, Esq. Senior Vice President, General Counsel and Corporate Secretary Newell Rubbermaid Inc. Three Glenlake Parkway Atlanta, Georgia 30328 (770) 418-7000 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) Copies to: Robert A. Profusek, Esq. John E. Capps, Esq. Clifford E. Neimeth, Esq. Lizanne Thomas, Esq. Executive Vice President—Administration, General Alan I. Annex, Esq. Joel T. May, Esq. Counsel and Secretary Gary R. Silverman, Esq. Jones Day Jarden Corporation Greenberg Traurig, LLP 1420 Peachtree Street 1800 North Military Trail MetLife Building Atlanta, Georgia 30309 Boca Raton, Florida 33431 200 Park Avenue (404) 521-3939 (561) 447-2520 New York, New York 10166 (212) 801-9200 Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement is declared effective and upon the satisfaction or waiver of all other conditions to consummation of the merger transactions described herein. -

Sunbeam Corporation: “Chainsaw Al,” Greed, and Recovery

1 Sunbeam Corporation: “Chainsaw Al,” Greed, and Recovery INTRODUCTION When John Stewart and Thomas Clark founded the Chicago Flexible Shaft Company in Dundee, Illinois, in 1897, they probably never expected that their company would grow into a huge conglomerate and face ethical and financial dilemmas more than 100 years later. Like many corporations, the firm has survived many crises. It has changed its name, acquired rival companies, added new product lines, gone through bankruptcy, restructured, relocated, and hired and fired many CEOs, including “Chainsaw Al” Dunlap. Today, Sunbeam has grown into a well-known brand of consumer products used for cooking, health care, and personal care. MORE THAN ONE HUNDRED YEARS OF CHANGE The first products that Sunbeam manufactured and sold were agricultural tools. In 1910 the company began manufacturing electrical appliances, one of the first being a clothes iron. At that time, Stewart and Clark began using the name Sunbeam in advertising campaigns, although the company did not officially change its name to the Sunbeam Corporation until 1946. Sunbeam’s electric products sold well even during the Great Depression when homemakers throughout the country quickly accepted the Sunbeam Mixmaster, automatic coffee maker, and pop-up toaster. The years following the Great Depression were times of growth and innovation for Sunbeam. The next major development came in 1960 when Sunbeam acquired rival appliance maker John Oster Manufacturing Company, which helped make Sunbeam the leading manufacturer of electric appliances. During the 1980s, a period of relatively high inflation and interest rates, corporations were going through acquisitions, mergers, restructurings, and closings—doing whatever they could to continue operating profitably. -

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2011 Parent Company names is provided here as a reference for facilities filing their RY 2012 reports using paper forms. For RY 2012, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3F CHIMICA AMERICAS INC 3G MERMET CORP 3M CO 5N PLUS INC A & A MANUFACTURING CO INC A & A READY MIX INC A & E CUSTOM TRUCK A & E INC A FINKL & SONS CO A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT & SON INC A TO Z DRYING -

Jarden, LLC V. ACE American Insurance Company, Et

IN THE SUPERIOR COURT OF THE STATE OF DELAWARE JARDEN, LLC f/k/a and as successor by ) merger to JARDEN CORPORATION, ) ) C.A. No. N20C-03-112 AML CCLD Plaintiff, ) ) v. ) ) ACE AMERICAN INSURANCE ) TRIAL BY JURY OF COMPANY, ALLIED WORLD ) TWELVE DEMANDED NATIONAL ASSURANCE COMPANY, ) BERKLEY INSURANCE COMPANY, ) ENDURANCE AMERICAN INSURANCE ) COMPANY, ILLINOIS NATIONAL ) INSURANCE COMPANY, ) NAVIGATORS INSURANCE COMPANY, ) ) Defendants. ) Submitted: April 20, 2021 Decided: July 30, 2021 MEMORANDUM OPINION Upon Defendants’ Motion to Dismiss: GRANTED David Baldwin, Esquire of BERGER HARRIS Wilmington, Delaware, Attorney for Plaintiff Jarden LLC Robert J. Katzenstein, Esquire of SMITH KATZENSTEIN & JENKINS LLP, Wilmington, Delaware, Michael R. Goodstein, Esquire of BAILEY CAVALIERI LLC, Columbus, Ohio, David H. Topol, Esquire, and Matthew W. Beato, Esquire, of WILEY REIN LLP, Washington, D.C., Attorneys for Defendants ACE American Insurance Company and Navigators Insurance Company Marc S. Casarino, Esquire of WHITE & WILLIAMS LLP, Wilmington, Delaware, Maurice Pesso, Esquire, and William J. Brennan, Esquire of KENNEDYS CMK LLP, New York, New York, Attorneys for Defendant Allied World National Assurance Company Joanna J. Cline, Esquire, Emily L. Wheatley, Esquire of TROUTMAN PEPPER HAMILTON SANDERS LLP, Wilmington, Delaware, Jennifer Mathis, Esquire of TROUTMAN PEPPER HAMILTON SANDERS LLP, San Francisco, California, and Brandon D. Almond, Esquire of TROUTMAN PEPPER HAMILTON SANDERS LLP, Washington, D.C., Attorneys for Defendant Berkley Insurance Company Kurt M. Heyman, Esquire, Aaron M. Nelson, Esquire of HEYMAN ENERIO GATTUSO & HIRZEL LLP, Wilmington, Delaware, Scott B. Schreiber, Esquire, William C. Perdue, Esquire of ARNOLD & PORTER KAYE SCHOLER LLP, Washington D.C., Attorneys for Defendant Illinois National Insurance Company Carmella P. -

JARDEN CORPORATION (Exact Name of the Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM SD SPECIALIZED DISCLOSURE REPORT JARDEN CORPORATION (Exact name of the registrant as specified in its charter) Delaware 001-13665 35-1828377 (State or other jurisdiction of (Commission (IRS Employer incorporation or organization) File Number) Identification No.) 1800 North Military Trail Boca Raton, Florida 33431 (Address of principal executive offices) (Zip code) John E. Capps (561) 447-2520 (Name and telephone number, including area code, of the person to contact in connection with this report.) Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014 Section 1. Conflict Minerals Disclosure Item 1.01 Conflict Minerals Disclosure and Report This Specialized Disclosure Report on Form SD of Jarden Corporation (together with its subsidiaries, “Jarden”, the “Company”, “us”, “our” or “we”) for calendar year 2014 (the “2014 Reporting Period”) is provided in accordance with Rule 13p-1 (“Rule 13p-1”) under the Securities Exchange Act of 1934 (the “1934 Act”), the instructions to Form SD, and the Public Statement on the Effect of the Recent Court of Appeals Decision on the Conflict Minerals Rule issued by the Director of the Division of Corporation Finance of the Securities and Exchange Commission on April 29, 2014 (the “SEC Statement”). Please refer to Rule 13p-1, Form SD and the 1934 Act Release No. -

2020 Corporate Citizenship Report 2

Building Better Together 2020 Corporate Citizenship Report 2 Contents Moving onwards and upwards ....................................... 3 Reducing our environmental impact ............................. 31 Letter from our President & CEO ........................................................... 4 Carbon emissions and energy use ......................................................33 2020 highlights ......................................................................................... 6 Our sustainability goals .........................................................................35 A culture of sustainability .....................................................................39 Embarking on a new era ..................................................7 Innovation, sustainable design and circularity ..................................40 Our company and brands ....................................................................... 9 Product safety .........................................................................................44 Our values ................................................................................................11 Corporate citizenship philosophies .....................................................12 Sourcing responsibly and ethically ............................... 46 Corporate governance ...........................................................................13 Standards of integrity ............................................................................48 Ethics and compliance ..........................................................................15 -

In Re: Appraisal of Jarden Corporation

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE : IN RE: APPRAISAL OF : CONSOLIDATED JARDEN CORPORATION : C.A. No. 12456-VCS : MEMORANDUM OPINION Date Submitted: May 1, 2019 Date Decided: July 19, 2019 Stuart M. Grant, Esquire, Cynthia M. Calder, Esquire, Kimberly A. Evans, Esquire, Kelly L. Tucker, Esquire and Vivek Upadhya, Esquire of Grant & Eisenhofer P.A., Wilmington, Delaware, Attorneys for Petitioners. Srinivas M. Raju, Esquire, Brock E. Czeschin, Esquire, Robert L. Burns, Esquire, Sarah A. Clark, Esquire and Matthew W. Murphy, Esquire of Richards, Layton & Finger, P.A., Wilmington, Delaware and Walter W. Davis, Esquire, Michael J. McConnell, Esquire and Robert A. Watts, Esquire, of Jones Day, Atlanta, Georgia, Attorneys for Respondent Jarden Corporation. SLIGHTS, Vice Chancellor This statutory appraisal action arises from a merger whereby Newell Rubbermaid, Inc. (“Newell”) acquired Jarden Corporation (“Jarden” or the “Company”) (the “Merger”) for cash and stock totaling $59.21 per share (the “Merger Price”). Petitioners, Verition Partners Master Fund Ltd., Verition Multi-Strategy Master Fund Ltd., Fir Tree Value Master Fund, LP and Fir Tree Capital Opportunity Master Fund, LP (together “Petitioners”), were Jarden stockholders on the Merger’s effective date and seek a judicial appraisal of the fair value of their Jarden shares as of that date. At the close of the trial, I observed, “[w]e are in the classic case where . very-well credentialed experts are miles apart. There’s some explaining that is required here to understand how it is that two very well-credentialed, I think, well- intended experts view this company so fundamentally differently.”1 This observation was prompted by the all-too-frequently encountered disparity in the experts’ opinions regarding Jarden’s fair value. -

Category Name

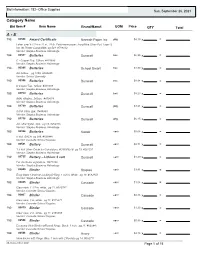

Bid Information: 182--Office Supplies Sun, September 26, 2021 Category Name Bid Item # Item Name Brand/Manuf. UOM Price QTY Total A - E 182- 02388 Award Certificate Neenah Paper Inc pkg $4.19 x = Letter size/ 8 1/2 in x 11 in, 24 lb. Parchment paper, Ivory/Blue Silver Foil, Laser & Ink Jet Printer Compatible, pg 543 #709122 Vendor: Staples Business Advantage 182- 02387 Batteries Duracell box $6.95 x = C - Copper Top, 12/box. #410699 Vendor: Staples Business Advantage 182- 00395 Batteries School Smart box $4.90 x = AA 24/box. pg 1058, #084985 Vendor: School Specialty 182- 00396 Batteries Duracell box $8.84 x = D CopperTop, 12/box. #410698 Vendor: Staples Business Advantage 182- 01760 Batteries Duracell box $8.23 x = AAA, Alkaline, 24/box. #479074 Vendor: Staples Business Advantage 182- 01729 Batteries Duracell pkg $3.01 x = AAAA Ultra, 2pk. #446848 Vendor: Staples Business Advantage 182- 01736 Batteries Duracell pkg $6.15 x = AA, ultra digital, 8/pk. pg 12, #202179 Vendor: Staples Business Advantage 182- 00394 Batteries Kodak each $0.68 x = 9 Volt, EACH pg 386, #028446 Vendor: Cascade School Supples 182- 06581 Battery Duracell each $0.71 x = 1.5 Volt Silver Oxide for Calculators, #D303/357B pg 13, #287201 Vendor: Staples Business Advantage 182- 01735 Battery - Lithium 3 volt Duracell each $1.29 x = For electronic organizers. #273169 Vendor: Staples Business Advantage 182- 02049 Binder Staples each $3.91 x = Easy Open ClearVue Locking D-Ring, 1 1/2 in. White. pg 19, #082656 Vendor: Staples Business Advantage 182- 00405 Binder Cascade each $1.04 x = Clear view, 1 1/2 in. -

Celebrating 99 Years

CELEBRATING 99 YEARS of customer excellence and over $3 billion in annual revenue At D&H, our business model is rooted in the tradition of taking a hands-on role in helping you achieve your goals THE SERVICE & SELECTION YOU NEED • 5 fully-optimized distribution centers • Flexible order submission via EDI, AS2, • dandh.com comprehensive web site with delivering 98.6% of the BPI in 1-2 days XML with total transaction security enhanced searching, ordering, tracking ground (4-Domestic, 1-Canada) • Deep stocking inventory and wide • D&H Mobile App for iPad® and iPhone® • Relationships with all carriers product selection • Extremely fast, always accurate delivery • Direct-to-end-user shipments with fully • Dedicated inventory analysis • One-on-one personal attention customizable shipping and packaging options • Priority allocations • Flexible credit options • All backed by dedicated inside & field sales teams to focus on your business needs • 99 years of distribution experience being a trusted advisor to the channel • We make your business our priority Toronto, Ontario Chicago, IL Harrisburg, PA Fresno, CA Atlanta, GA Home Environment | Floor Care | Outdoor Living & Cooking | Lighting | Weather Monitoring | Clocks, Clock Radios & Watches | Cookware & Bakeware Cutlery & Flatware | Gadgets & Tools | Indoor Living | Small Appliances | Personal Care | Pet Care | Toys | Home Improvement Contact: Bob Careless, Home & Outdoor Sales Manager I 717-255-7854 I [email protected] www.dandh.com/home HOLC0517 D&H Home & Outdoor Selection Exclusively at -

Pure Fishing and Jarden

Analyst & Investor Day Presentation March 10, 2010 1 Cautionary Statement Cautionary note about forward-looking statements and non-GAAP financial measures Please note that in this presentation, we may discuss events or results that have not yet occurred or been realized, commonly referred to as forward- looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of the Company. Such discussion and statements will often contain words as expect, anticipate, believe, intend, plan and estimate. Such forward-looking statements include statements regarding the Company’s adjusted earnings per share, repurchase of shares of common stock from time to time under the Company’s stock repurchase program, the outlook for the Company’s markets and the demand for its products, earnings per share, estimated sales, segment earnings, cash flows from operations, free cash flow, future revenues and gross, operating and EBITDA margin improvement requirement and expansion, leverage, organic growth, the success of new product introductions, growth in costs and expenses, the impact of commodities and transportation costs, the Company’s ability to consummate, and the impact of announced acquisitions, divestitures, restructurings, and other unusual items, including the Company’s ability to successfully close announced acquisitions, and integrate and obtain the anticipated results and synergies from its acquisitions. These projections and statements are based on management's estimates and assumptions with respect to future events and financial performance, and are believed to be reasonable, though are inherently difficult to predict. Actual results could differ materially from those projected as a result of various factors and risks, including those described from time to time in the Company’s periodic and other reports filed with the Securities and Exchange Commission. -

Newell Brands Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED COMMISSION FILE NUMBER DECEMBER 31, 2017 1-9608 NEWELL BRANDS INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) DELAWARE 36-3514169 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 221 River Street Hoboken, New Jersey 07030 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (201) 610-6600 Securities registered pursuant to Section 12(b) of the Act: TITLE OF EACH CLASS NAME OF EACH EXCHANGE ON WHICH REGISTERED Common Stock, $1 par value per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

I Believe That in Five Years Time, When We Look Back

The image of JAH-Man, the symbol above, was created by the winners of our 2008 Annual Report cover competition, Janine Laudicina, Angelo Rombley, Adam Rutstein and Aaron Stowell, a talented team of Jarden Consumer Solutions employees, based on a concept developed by the supply chain team. The JAH-Man name incorporates our ticker symbol, and the figure itself represents the brands of everyday life and epitomizes Jarden striding purposefully into the future. Table of contents 2 Chairman’s Letter 6 Outdoor Solutions 8 Consumer Solutions 10 Branded Consumables 12 Process Solutions 13 Selected Financial Data 15 Management’s Discussion & Analysis 31 Financial Statements Corporate Strategy: Since our inception in 2001, Jarden has evolved into a world-class consumer products company with a diverse product line and a global footprint. Our strategic objective is to build on our solid foundation and drive future growth. We strive to accomplish this by leveraging our brand equity and leading market positions while continually reinvesting in the business to create innovative new products; products that provide consumers with the experience and value they associate with our brands. Simultaneously, we are focused on leveraging our scale to drive continuous improvements in our operations. We are proud of our best-in-class corporate governance infrastructure, and operational and financial controls. We believe the combination of these initiatives will allow us to deliver continued long-term growth and consistent results for our shareholders. Corporate Profile: Jarden Corporation is a leading provider of niche consumer products. Jarden operates in three primary business segments through a number of well recognized brands, including: Outdoor Solutions: Abu Garcia®, Berkley®, Campingaz® and Coleman®, Fenwick®, Gulp!®, JT®, K2®, Marker®, Marmot®, Mitchell®, Penn®, Rawlings®, Shakespeare®, Stearns®, Stren®, Trilene® and Volkl®; Consumer Solutions: Bionaire®, Crock-Pot®, FoodSaver®, Health o meter®, Holmes®, Mr.