Corporate Data and Shareholder Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The BCCI Affair

The BCCI Affair A Report to the Committee on Foreign Relations United States Senate by Senator John Kerry and Senator Hank Brown December 1992 102d Congress 2d Session Senate Print 102-140 This December 1992 document is the penultimate draft of the Senate Foreign Relations Committee report on the BCCI Affair. After it was released by the Committee, Sen. Hank Brown, reportedly acting at the behest of Henry Kissinger, pressed for the deletion of a few passages, particularly in Chapter 20 on "BCCI and Kissinger Associates." As a result, the final hardcopy version of the report, as published by the Government Printing Office, differs slightly from the Committee's softcopy version presented below. - Steven Aftergood Federation of American Scientists This report was originally made available on the website of the Federation of American Scientists. This version was compiled in PDF format by Public Intelligence. Contents EXECUTIVE SUMMARY ................................................................................................................................ 4 INTRODUCTION AND SUMMARY OF INVESTIGATION ............................................................................... 21 THE ORIGIN AND EARLY YEARS OF BCCI .................................................................................................... 25 BCCI'S CRIMINALITY .................................................................................................................................. 49 BCCI'S RELATIONSHIP WITH FOREIGN GOVERNMENTS CENTRAL BANKS, AND INTERNATIONAL -

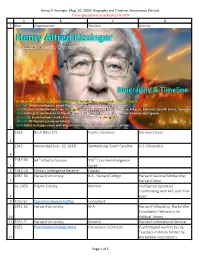

Henry A. Kissinger. (Aug

Henry A. Kissinger. (Aug. 20, 2020). Biography and Timeline. Anonymous Patriots. *.xlsx spreadsheet attached to this PDF A B C D 1 Year Organization Position Activity Henry Alfred Kissinger (b. 1923, Fuerth, Germany) Biography & Timeline Dedicated his career to the (British) Pilgrims Society "new world order" 200-year plan ca. 1948: British intelligence; joined Pilgrims Society; Pilgrims Rockefeller "advisor" 1948: Runner for the Marshall Plan stolen gold created by Pilgrims Society Stimson, Acheson, Marshall, Sarnoff, Dulles, Donovan 1971: Killed gold standard w/ 12 Nixon Pilgrims Cabinet members incl. Volcker; ran American intelligence 1971-2008: Exploited Swiss Bank of International Settlements stolen gold 2007-09: VP Pilgrims Society w/ Volcker 2008: Killed mortgage values with Pilgrims Clinton, Bush, Obama, Summers, Volcker 2 1923 Birth (May 27) Fuerth, Germany German Citizen 3 1943 Naturalized (Jun. 19, 1943) Spartanburg, South Carolina U.S. Citizenship 4 1943-46 84th Infantry Division 970th Counter-Intelligence 5 Corps 6 1946-59 Military Intelligence Reserve Captain 1947-50 Harvard University B.A., Harvard College Harvard National Scholarship; 7 Harvard Detur ca. 1950 Pilgrim Society Member Intelligence operative coordinating with MI6 and "Five 8 Eyes" 9 1950-61 Operations Research Office Consultant 1951-52 Harvard University M.A. Harvard Fellowship; Rockefeller Foundation Fellowship for 10 Political Theory 11 1951-71 Harvard University Director Harvard International Seminar 1952 Psychological Strategy Board Consultant to Director Psychological warfare (using Tavistock Institute funded by 12 Rockefeller Foundation) Page 1 of 5 Henry A. Kissinger. (Aug. 20, 2020). Biography and Timeline. Anonymous Patriots. *.xlsx spreadsheet attached to this PDF A B C D 1 Year Organization Position Activity 13 1952-54 Harvard University Ph.D. -

PUBLICATIONS Publications

PUBLICATIONS Publications Asia and Europe: Cooperating for Energy Security François Godement, Françoise Nicolas, and Taizo Yakushiji, eds. Because of broad similarities in their economies, energy security—the availability of energy at all times, in various forms, in sufficient quanti- ties, and at affordable prices—is an issue of common concern for Asia and Europe. Any option chosen by one region will necessarily reverberate in the other. In particular, the rise in energy demand in Asia, most of all in China, will have obvious implications for Europe, as well as for the rest of the world. This report from the Council for Asia-Europe Cooperation (CAEC) task force on energy security examines the strategic implications of each region’s choices for the other region, compares existing and poten- tial schemes for regional cooperation, and defines areas for interregional cooperation. For example, one significant finding of the task force, a group comprised of Asian and European political scientists and economists, was a need for expertise transfer from the more advanced to the less advanced countries in the partnership. (English: JCIE, 2004) Asia and Europe: Global Governance as a Challenge to Co-operation William Wallace and Young Soogil, eds. The end of the Cold War and the terrorist attacks of September 11, 2001, have brought about profound changes in international politics. The world is in desperate need of a new system of global governance, a structure for consultation and cooperation among states to maintain global order, to contain disorder, to promote global prosperity through shared manage- ment of an open world economy, and to address the difficult issues of global equity, rights, and justice. -

JP Morgan Chase Sofya Frantslikh Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 3-14-2005 Mergers and Acquisitions, Featured Case Study: JP Morgan Chase Sofya Frantslikh Pace University Follow this and additional works at: http://digitalcommons.pace.edu/honorscollege_theses Part of the Corporate Finance Commons Recommended Citation Frantslikh, Sofya, "Mergers and Acquisitions, Featured Case Study: JP Morgan Chase" (2005). Honors College Theses. Paper 7. http://digitalcommons.pace.edu/honorscollege_theses/7 This Article is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Thesis Mergers and Acquisitions Featured Case Study: JP Morgan Chase By: Sofya Frantslikh 1 Dedicated to: My grandmother, who made it her life time calling to educate people and in this way, make their world better, and especially mine. 2 Table of Contents 1) Abstract . .p.4 2) Introduction . .p.5 3) Mergers and Acquisitions Overview . p.6 4) Case In Point: JP Morgan Chase . .p.24 5) Conclusion . .p.40 6) Appendix (graphs, stats, etc.) . .p.43 7) References . .p.71 8) Annual Reports for 2002, 2003 of JP Morgan Chase* *The annual reports can be found at http://www.shareholder.com/jpmorganchase/annual.cfm) 3 Abstract Mergers and acquisitions have become the most frequently used methods of growth for companies in the twenty first century. They present a company with a potentially larger market share and open it u p to a more diversified market. A merger is considered to be successful, if it increases the acquiring firm’s value; m ost mergers have actually been known to benefit both competition and consumers by allowing firms to operate more efficiently. -

PEI June2020 PEI300.Pdf

Cover story 20 Private Equity International • June 2020 Cover story Better capitalised than ever Page 22 The Top 10 over the decade Page 24 A decade that changed PE Page 27 LPs share dealmaking burden Page 28 Testing the value creation story Page 30 Investing responsibly Page 32 The state of private credit Page 34 Industry sweet spots Page 36 A liquid asset class Page 38 The PEI 300 by the numbers Page 40 June 2020 • Private Equity International 21 Cover story An industry better capitalised than ever With almost $2trn raised between them in the last five years, this year’s PEI 300 are armed and ready for the post-coronavirus rebuild, writes Isobel Markham nnual fundraising mega-funds ahead of the competition. crisis it’s better to be backed by a pri- figures go some way And Blackstone isn’t the only firm to vate equity firm, particularly and to towards painting a up the ante. The top 10 is around $30 the extent that it is able and prepared picture of just how billion larger than last year’s, the top to support these companies, which of much capital is in the 50 has broken the $1 trillion mark for course we are,” he says. hands of private equi- the first time, and the entire PEI 300 “The businesses that we own at Aty managers, but the ebbs and flows of has amassed $1.988 trillion. That’s the Blackstone that are directly affected the fundraising cycle often leave that same as Italy’s GDP. Firms now need by the pandemic, [such as] Merlin, picture incomplete. -

Chicago Fed Letter: Understanding the New World Order of Private

ESSAYS ON ISSUES THE FEDERAL RESERVE BANK OCTOBER 2010 OF CHICAGO NUMBER 279a ChicagoFedLetter Understanding the new world order of private equity by William Mark, lead examiner, Supervision and Regulation, and head, Private Equity Merchant Banking Knowledge Center, and Steven VanBever, lead supervision analyst, Supervision and Regulation The Federal Reserve System’s Private Equity Merchant Banking Knowledge Center, formed at the Chicago Fed in 2000 after the passage of the Gramm–Leach–Bliley Act, sponsors an annual conference on new industry developments. This article summarizes the tenth annual conference, The New World Order of Private Equity, held on July 21–22, 2010. Tokickofftheconference,1Carl lossofcompetitivenessoverthelong Tannenbaum,FederalReserveBank termfortheU.S.andotherdeveloped ofChicago,reflectedbrieflyonthe economiesrelativetoChinaandother decadesincethepassageoftheGramm– emergingcountries.Hutchinsciteda Leach–BlileyAct.Theseyearssawexten- numberofnegativeindicatorsintheU.S., sivefinancialinnovation,alongwiththe suchasrisinghealthcareandenergy removalofregulatorybarriersthat costs,thetradedeficit,governmental traditionallyseparatedtheactivities budgetdeficits,lossofleadershipintech- ofcommercialandinvestmentbanks. nologicalinnovation,laggingeducational Thefinancialcrisispromptedareeval- systems,andpoliticalpolarization. By a number of measures, uationofmanyviewsthathadbeen the state of private equity widelyheld,culminatinginPresident State of the industry has improved since the worst ObamasigningtheDodd–FrankWall ApanelledbyMarkO’Hare,Preqin of the financial crisis, but StreetReformandConsumerProtection Ltd.,exploredtheevolvingroleofpri- ActonJuly21,2010(bycoincidence, vateequity(PE)intheeconomyand many features of the asset thefirstdayoftheconference). ininvestorportfolios.ItfeaturedPaul class have been altered. -

DEAR CAMPAIGNERS Facturing Company in British Columbia

RAINFOREST ACTION NETWORK February 1S97 Y C O T T U I S H X t- C:r.; : • Y V ‘. A M P A X G N TURNING MITSU BISHI GREEN : i •> i ., / ;■ ,u , . DEAR CAMPAIGNERS facturing Company in British Columbia. CCMC is not only the world's largest Howdy! As the Interim Campaign Coordi disposable wooden chopstick manufactur nator, the new year has brought many ing plant, but it also wastes up to 85% of the challenges for me. It has also brought ■: wood that it cuts because it is not white opportunities to expand the boycott and enough. take it in new directions. Your constant and heartfelt work has First of all, I would like to thank all of you • ^ pushed Mitsubishi to divest from these • for your hard work. Because of that work, ,'t '■ ' ■' ' < <G ecological nightmares. Your continued ; - last year the Boycott Mitsubishi Campaign pressure will bring about the fundamental was truly successful. Forty-seven busi changes in Mitsubishi that will stop future nesses signed-on to the Corporate Responsi * f*I f projects like these from becoming realities. * - ■: i V x. ~ ^-xxX; H bility Campaign which is working to stop the ecological and culturally destructive In 1997, much of our work will focus on practices of Mitsubishi, MacMillan Bloedel expanding the public awareness of the and Georgia-Pacific. Fourteen more colleges Mitsubishi boycott. The Fourth Annual and universities passed resolutions banning Haiku Project will once again enlist thou Mitsubishi products and recruiters from sands of children and adults around the their campuses until Mitsubishi changes its „ ,W,VJj -; world to flood Mitsubishi Corporation's ;v' • forestry practices. -

Annual Report 2008 Download (PDF:3.5MB)

What is MC’s Value ? Contents 1 Feature Section: Evaluating Mitsubishi Corporation’s Corporate Value 2 Corporate Profile 3 Organizational Structure 4 Network 15 Financial Highlights 17 To Our Stakeholders 30 Review of Operations 30 Business Groups at a Glance 34 Business Innovation Group 38 Industrial Finance, Logistics & Development Group 42 Energy Business Group 46 Metals Group 50 Machinery Group 54 Chemicals Group 58 Living Essentials Group 62 Global Strategies 64 Corporate Governance and Internal Control 77 Corporate Section 86 Financial Section 161 Corporate Data Forward-Looking Statements This annual report contains forward-looking statements about Mitsubishi Corporation’s future plans, strategies, beliefs and performance that are not historical facts. They are based on current expectations, estimates, forecasts and projections about the industries in which Mitsubishi Corporation operates and beliefs and assumptions made by management. As the expectations, estimates, forecasts and projections are subject to a number of risks, uncertainties and assumptions, they may cause actual results to differ materially from those projected. Mitsubishi Corporation, therefore, wishes to caution readers not to place undue reliance on forward-looking statements. Furthermore, the company undertakes no obligation to update any forward-looking statements as a result of new information, future events or other developments. Risks, uncertainties and assumptions mentioned above include, but are not limited to, commodity prices; exchange rates and economic -

The Kissinger Associates Firm: a New Vehicle for British Influence

Click here for Full Issue of EIR Volume 9, Number 36, September 21, 1982 The Kissinger Associates firm: a new vehicle for British influence by Scott Thompson When Henry A. Kissinger first emerged in control of U.S. have had a longer friendship with him than with any other executive branch policy during the late 1960s, it was the leading British political figure." A trustee of the Aspen In Trilateral Commission and that less-well-known conduit of stitute, Gyllenhammar helped Anderson arrange a computer European oligarchical policy, the Bilderberg Society, which interface among Aspen, Control Data in Sweden, IFIAS ensured Kissinger's rise to power and controlled his activi (which serves as a Swedish-basedfront for the Muslim Broth ties. A new vehicle has been prepared for Kissinger's re erhood), Soviet computers, and IIASA, the Vienna-based emergence as the leading U. S. enforcer of the programs think tank of the KGB-linked Djermen Gvishiani. Gyllen dictated to the United States by the British and European hammar is also a Chase International board member. oligarchy: Kissinger Associates, Inc. General Brent Scowcroft, who was Kissinger's Nation Kissinger Associates, a Washington, D.C.-based "con al Security Council deputy until named as his replacement as sulting firm," boasts the following board members: National Security Adviser. It was Scowcroft, Kissinger, and Lord Carrington, former British Foreign Secretary� De Haig who ran the White House inside track of Watergate, spite his resignation over the Malvinas crisis, Lord Carring supported from the outside by the Washington Pbst'$ trial ton remains one of the most influential "one world" strate by-press attacks. -

Attendee Bios

ATTENDEE BIOS Ejim Peter Achi, Shareholder, Greenberg Traurig Ejim Achi represents private equity sponsors in connection with buyouts, mergers, acquisitions, divestitures, joint ventures, restructurings and other investments spanning a wide range of industries and sectors, with particular emphasis on technology, healthcare, industrials, consumer packaged goods, hospitality and infrastructure. Rukaiyah Adams, Chief Investment Officer, Meyer Memorial Trust Rukaiyah Adams is the chief investment officer at Meyer Memorial Trust, one of the largest charitable foundations in the Pacific Northwest. She is responsible for leading all investment activities to ensure the long-term financial strength of the organization. Throughout her tenure as chief investment officer, Adams has delivered top quartile performance; and beginning in 2017, her team hit its stride delivering an 18.6% annual return, which placed her in the top 5% of foundation and endowment CIOs. Under the leadership of Adams, Meyer increased assets managed by diverse managers by more than threefold, to 40% of all assets under management, and women managers by tenfold, to 25% of AUM, proving that hiring diverse managers is not a concessionary practice. Before joining Meyer, Adams ran the $6.5 billion capital markets fund at The Standard, a publicly traded company. At The Standard, she oversaw six trading desks that included several bond strategies, preferred equities, derivatives and other risk mitigation strategies. Adams is the chair of the prestigious Oregon Investment Council, the board that manages approximately $100 billion of public pension and other assets for the state of Oregon. During her tenure as chair, the Oregon state pension fund has been the top-performing public pension fund in the U.S. -

Rapporto PEM 2017

® Italia 2017 Si ringrazia: SCIENTIFIC BOARD RESEARCH TEAM Anna Gervasoni (President) Francesco Bollazzi (Project Manager) LIUC - Università Cattaneo LIUC - Università Cattaneo Roberto Del Giudice (Vice President) Andrea Odille Bosio LIUC - Università Cattaneo LIUC - Università Cattaneo Francesco Bollazzi LIUC - Università Cattaneo Andrea Bonaccorsi Università di Pisa Ludovico Ciferri International University of Japan Guido Corbetta Università Commerciale Luigi Bocconi Giorgio Di Giorgio LUISS Guido Carli Christoph Kaserer Technische Universität München Josè Martì Pellon Universitad Complutense De Madrid Alessia Muzio AIFI - Associazione Italiana del Private Equity, Venture Capital e Private Debt Luciano Olivotto Università Ca’ Foscari Venezia 2 Private Equity Monitor 2017 3 4 Premessa Introduction Con l’edizione 2017 il Rapporto Private Equity Monitor – PEM® giunge alla This report is the seventeenth edition of Private Equity Monitor – PEM®. sua diciassettesima pubblicazione. After up and down in the last years, 2017 confirms and strengthens the Dopo alcuni anni di alti e bassi, il 2017 conferma ed, anzi, accentua la huge hike recorded in the previous two-year period, showing a meaningful decisa ripresa registrata nel biennio precedente, evidenziando un livello level for what concerns investment activity, which has already returned to significativo dell’attività di investimento, che già dal 2015 è tornata ad pre-crisis level since 2015. attestarsi, nella sostanza, sui livelli precedenti alla crisi. In fact, during this year, the level -

Jpmorgan Chase & Co. Annual Report 2014

A Culture of Excellence EXCEPTIONAL CLIENT SERVICE OPERATIONAL EXCELLENCE A COMMITMENT TO INTEGRITY, FAIRNESS AND RESPONSIBILITY A GREAT TEAM AND WINNING CULTURE We distributed the principles to our employees and regulators and followed up with a more extensive “How We Do Business – The Report,” which is available on our public website. We recently launched a firmwide Culture and Conduct Program to Matt Zames further reinforce the behavioral standards implicit in these Business Principles. The program is not about Our firm has a rich, 200-year history manage to the needs of our critical reinventing our culture but recom- of serving its clients and customers stakeholders – shareholders, clients, mitting to it. It considers our culture, with integrity and establishing customers and employees – given our business models, tone from senior relationships based on trust. It is significance to worldwide markets executives, governance and incen- our responsibility to preserve and and the global economy. We continue tive structures; how they influence build upon the solid values on to respond to the changing regulatory daily decision making at all levels; which this firm was founded. The landscape, including requirements and the impact of those decisions on tone we set as stewards of the firm for G-SIBs, and we are evaluating our clients, our reputation and the is critical, and managing a culture the businesses we manage and the integrity of the markets. Our objec- of excellence, as well as integrity, products and services we offer in the tive is to instill in our employees a requires us to have a sophisticated context of these new requirements.