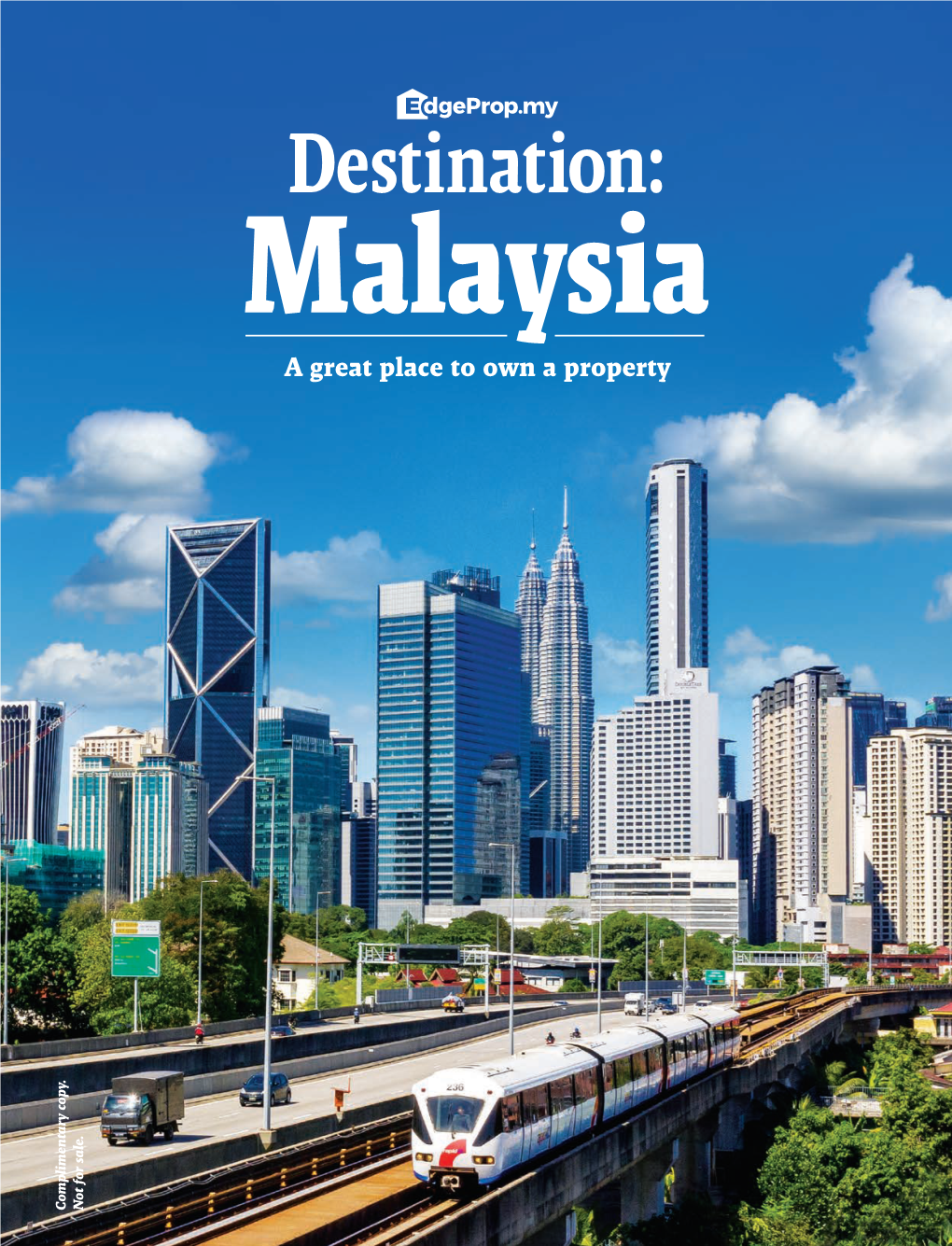

Destination: Malaysia a Great Place to Own a Property Complimentary Copy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1St Half 2008

Research Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1st Half 2008 Contents Kuala Lumpur Hotel • Condominium Market 2 • Office Market 5 • Retail Market 8 • Hotel Market 10 Penang Property Market 12 Retail Johor Bahru Property Market 14 Residential Office Executive Summary Kuala Lumpur • The high end condominium market stabilised in the first half of 2008 in terms of take up, capital values and rentals. • Rentals and occupancies of prime offices continued to rise due to the current tight supply of good quality office buildings. • Several retail centres located at fringes of KL City are undergoing refurbishment works to remain competitive. • The performance of the hotel industry had been resilient attributed to high tourist arrivals and receipts, which led to the increase in average room rates and occupancies. Penang • Most of the high end condominium projects which are nearing completion have been sold, with prices being revised upwards. • The retail industry performed well with higher tourist arrivals in Penang. • The asking rentals of newly completed offices with better IT facilities are ranging from RM2.50 to RM3.50 per sq ft per month. Johor • The high end residential market is gaining momentum with the positive development of Iskandar Malaysia. • Prime retail centres continued to enjoy growth in rentals and occupancies. • Office sector remains healthy at an average occupancy of 70%. 2 Real Estate Highlights - Kuala Lumpur | Penang | Johor Bahru • 1st Half 2008 Knight Frank Figure 1 Projection of Cumulative Supply Kuala Lumpur High End Condominium Market for High End Condominium (2008 - 2010) Market Indications 30,000 The high end condominium market generally stabilised during the first six months of the year with one 25,000 notable new project, The Regent Residences (across Twin Towers), recording prices in excess of RM2,500 per sq ft. -

Kenanga Islamic Fund

KENANGA ISLAMIC FUND ANNUAL REPORT For the Financial Year Ended 31 December 2019 cover.indd 1 3/16/20 2:28 PM KENANGA ISLAMIC FUND Contents Page Corporate Directory ii - iii Directory of Manager’s Offices iv Fund Information 1 Manager’s Report 2 - 6 Fund Performance 7 - 9 Trustee’s Report 10 Shariah Adviser’s Report 11 Independent Auditors’ Report 12 - 14 Statement by the Manager 15 Financial Statements 16 - 47 KIF_Revised13Mar2020.indd 1 16/3/2020 10:08:39 AM CORPORATE DIRECTORY Manager: Kenanga Investors Berhad Company No. 199501024358 (353563-P) Registered Office Business Office Level 17, Kenanga Tower Level 14, Kenanga Tower 237, Jalan Tun Razak 237, Jalan Tun Razak 50400 Kuala Lumpur, Malaysia 50400 Kuala Lumpur, Malaysia Tel: 03-2172 2888 Tel: 03-2172 3000 Fax: 03-2172 2999 Tel: 03-2172 3080 E-mail: [email protected] Website: www.KenangaInvestors.com.my Board of Directors Investment Committee Datuk Syed Ahmad Alwee Alsree (Chairman) Syed Zafilen Syed Alwee (Independent Syed Zafilen Syed Alwee (Independent Member) Director) Peter John Rayner (Independent Peter John Rayner (Independent Member) Director) Imran Devindran Abdullah (Independent Imran Devindran Abdullah (Independent Member) Director) Ismitz Matthew De Alwis Ismitz Matthew De Alwis Norazian Ahmad Tajuddin (Independent Norazian Ahmad Tajuddin (Independent Member) Director) Company Secretary: Norliza Abd Samad (MAICSA 7011089) Level 17, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. External Fund Manager: Kenanga Islamic Investors Berhad Company No. 199701036457 (451957-D) Registered Office Business Office Level 17, Kenanga Tower Level 14, Kenanga Tower 237, Jalan Tun Razak 237, Jalan Tun Razak 50400 Kuala Lumpur, Malaysia 50400 Kuala Lumpur, Malaysia Tel: 03-2172 2888 Tel: 03-2172 3000 Fax: 03-2172 2999 Tel: 03-2172 3080 Trustee: Universal Trustee (Malaysia) Berhad Company No. -

Annual Report 2018

ANNUAL REPORT 2018 MALAYSIAN ENGLISH LANGUAGE TEACHING ASSOCIATION 2 TABLE OF CONTENT Mission and Vision 3 Message From The President 4 National and International Partnership 6 Committee 11 Membership Record 12 Bureau Reports Journal 14 Research and Development 16 Training 18 Technologies 19 Publication 20 Chapters 22 Special Interest Groups 27 Special Projects 28 MELTA Chapters 33 2018 MELTA International Conference 42 2018 MELTA International Research Conference in English Language Education 44 3 MISSION AND VISION Mission To promote English language teaching at all levels To bring English language teachers together, allowing them to share experiences and research To acquaint teachers with current thinking in ESL/EFL teaching To introduce the Malaysian ELT community to ESL/EFL professionals from outside Malaysia and introduce Malaysia to those from abroad Vision To make MELTA the foremost English language professional body in Malaysia To make MELTA one of the foremost ELT organisations in the world To ensure that all English language teachers in Malaysia are directly or indirectly affiliated to MELTA To be recognized as one authority for continuous professional development of English language teachers To pool together all expertise and resources for ELT in Malaysia, and make them available for teachers all over the country To liaise with major ELT organizations in the ESL/EFL world To help the Government to promote English language usage among Malaysians 4 MESSAGE FROM THE PRESIDENT Introduction 2018 marked the 60th Anniversary of MELTA as an ELT organisation in Malaysia. The journey of 60 years has been eventful, progressive and impactful in many ways. In 2018 the Malaysian English Language Teaching Association (MELTA) continued to undertake a wide range of activities supported by its vision and mission to be the leading Malaysian non-governmental education professional organisation. -

Download Full Profile

Bookings: [email protected] http://www.kuahjenhan.com “Audiences love him and his international appeal is going to take him far. Brilliantly funny” — Time Out KL ABOUT Jenhan has performed at sold-out shows in Malaysia’s urban towns: “Kuah Jenhan is KL, PJ, Ipoh, Penang, JB. He has the darling of the been honoured to share the stage Malaysian comedy with fellow comedians in Melbourne, scene… Inventive Brisbane, Sydney, and Singapore. and intelligent.” ! “… A maestro comedy act, combining — Tom Rhodes Radio, A highly sought-after entertainer at superbly constructed jokes with his Stand-up comedian, own life experiences…” writer, corporate events, Jenhan has — Umar Rana, Comedy Masala producer charmed crowds of 150 to 8,000 TV host people. His accessible humour and “… The kind of guy you want to performance ethics earns him the bring home to meet your Mom” respect and accolades of some of — venusbuzz.com the most experienced comics in Malaysia and the region. ! Jenhan is an Esquire columnist, a radio & voice-over talent, a scriptwriter for TV, feature films, and the performing arts. He has been associated with global brands such as Philips, Ben Sherman, Levi’s, “… One of the and TEDxKL. hardest-working ! funnymen in show As of 2014, Jenhan’s Twitter account business” gains about 100 followers a month. THEATRE / STAGE 2014 • Geng Lawak (all-Bahasa performance) • White Rabbit Red Rabbit (experimental script by Nassim Soleimanpour, without director, rehearsal, or set) • Kumar Vs Malaysia - a 2 day sold out stand up show featuring Kumar of Singapore. • Lawak Ke Der 3 - A Bahasa comedy show in Istana Budaya. -

Maklumat Perkhidmatan Feri Penumpang (Utara)

MAKLUMAT PERKHIDMATAN FERI PENUMPANG (UTARA) Kuah – Kuala Perlis – Kuala Kedah – Pulau Payar – Pulau Pinang KAPASITI BIL. SYARIKAT FERI PENUMPANG New Frontier 114 New Frontier 156 1. Suria Intensif Sdn. Bhd. New Frontier 163 New Frontier 203 Angel Express 150 Kenangan 1 117 Kenangan 2 200 Kenangan 3 209 Kenangan 6 239 Lambaian 1 162 Lambaian 3 155 Langkawi Ferry Services Sdn.Bhd Alaf Baru 1 116 2. (Ferry Line Ventures) Alaf Baru 2 152 Alaf Baru 3 116 Alaf Baru 6 110 Lada 1 360 Lada 2 338 Lada 3 373 Zon 1 160 Coral Island 1 499 Coral Island 2 217 Coral Island 3 217 Ekspres Bahagia 226 Ekspres Bahagia 2 252 Ekspres Bahagia 3 160 Ekspres Bahagia (Langkawi) Ekspres Bahagia 5 80 3. Sdn.Bhd Ekspres Bahagia 7 80 Ekspres Bahagia 9 120 Ekspres Bahagia 18 266 Ekspres Bahagia 88 270 Ekspres Bahagia 98 499 Excel Express 1 150 Excel Express 3 210 Sea Jet 2 193 Star City Express 264 New Frontier 3 156 4. Rowvest Langkawi Sdn.Bhd New Frontier 5 163 New Frontier 6 203 Angel Express 150 My Ferry 401 My Ferry 2 403 Labuan Exp.6 166 Labuan Exp.7 181 Labuan Exp.8 163 5. JMV Ferry Sdn.Bhd Fortune Exp 1 156 Fortune Exp 2 160 My Master 316 Marine Star 2 215 Marine Star 3 106 My Ferry 401 My Ferry 2 430 Labuan Exp.6 166 Labuan Exp.7 181 Labuan Exp.8 163 6. Samavest & Cahaya Biru Fortune Exp 1 156 Fortune Exp 2 160 My Master 316 Marine Star 2 215 Marine Star 3 106 JADUAL PERJALANAN PERKHIDMATAN FERI PENUMPANG DI LANGKAWI LALUAN BIL. -

Negeri Kompleks Perikanan Ikan Alamat No. Telefon / No. Fax Perlis

Kompleks No. Telefon / Negeri Perikanan Alamat No. Fax Ikan Kuala Kompleks Perikanan LKIM Kuala Perlis, 04-985 1708 / Perlis Kg. Perak, 02000 Kuala Perlis 04-985 3695 Perlis Kompleks Pemeriksaan Ikan LKIM Padang 04-949 2048 / Padang Besar, 02100 Padang Besar, Besar 04-949 0766 Perlis. Kuala Pelabuhan Perikanan LKIM Kuala Kedah, 04-732 0780 Kedah Kampung Keluncur, 06250 Alor Setar, samb. 165 (Baru) Kedah. Kompleks Perikanan LKIM Sg. Udang, 04-465 5542 / Sg. Udang Sungai Udang, 06090 Yan, Kedah. 04-465 5024 Kompleks Perikanan LKIM Tg. Dawai d/a 04-457 2106 / Tg. Dawai PNK Tg. Dawai 08110 Bedong Kedah 04-457 4298 Kompleks Perikanan LKIM Kuala Sala, 04-769 1000 / Kuala Sala 06800 Kota Sarang Semut, 04-769 1202 Kedah Kuala Kompleks Perikanan LKIM Kuala 04-794 0243 Sanglang Sanglang, 06150 Air Hitam, Kedah. Kompleks Perikanan LKIM Kuala Muda, 04-437 7201 Kuala Dewan KUNITA, Tepi Sungai 08500 Kota 04-437 7202 / Muda Kuala Muda, Kedah. 04-437 7200 Kompleks Perikanan LKIM Penarak, Plot 04-966 6102 / Penarak 1, Mukim Kuah 07000 Langkawi, Kedah. 04-967 1058 Jeti Nelayan Chenang, Mukim 04-952 3940 / Chenang Kedawang, 07000 Langkawi, Kedah. 04-952 3947 Batu Kompleks Perikanan LKIM Batu Maung, 04-626 4858 / Maung 11960 Batu Maung, Pulau Pinang. 04-626 2484 (MITP) Kompleks Perikanan LKIM Teluk Bahang, Teluk 04-885 1097 / Jalan Hassan Abbas, 11050 Teluk Bahang 04-881 9190 Bahang, Pulau Pinang. Pulau Pinang Kompleks Perikanan LKIM Kuala Muda, D/A Persatuan Nelayan Kawasan Kuala 04-397 2203 / Seberang Perai No. 10B, Jalan Perai Muda 04-367 9796 Jaya 6, Bandar Baru Perai Jaya 13700 Perai, Pulau Pinang Kompleks Perikanan LKIM Jelutong, 04-626 1858 / Jelutong Lebuh Sungai Pinang 1, 11960 Jelutong, 04-626 1184 Pulau Pinang Kompleks Perikanan LKIM Lumut, 05-691 2673 / Perak Lumut Kampung Acheh, 32000 Sitiawan, Perak. -

PLANNING MALAYSIA Journal of the Malaysian Institute of Planners ______

PLANNING MALAYSIA Journal of the Malaysian Institute of Planners ________________________________________________________________________ Advisor Professor Dato’ Dr. Alias Abdullah Editor-in-Chief Professor Dato’ Dr. Mansor Ibrahim International Islamic University Malaysia (IIUM) Local Editorial Board Members Professor Dr. Muhammad Abdul Mohit - International Islamic University Malaysia (IIUM) Professor Dr. Ismawi Hj. Zen - International Islamic University Malaysia (IIUM) Professor Dr. Ho Chin Siong - Universiti Teknologi Malaysia (UTM) Professor Dr. Jamilah Mohamad - Universiti Malaya (UM) Professor Dr. Ghani Salleh - Universiti Sains Malaysia (USM) Professor Dr. Badaruddin Mohamed - Universiti Sains Malaysia (USM) Professor Dr. Ruslan Rainis - Universiti Sains Malaysia (USM) Assoc. Professor Dr. Dasimah bt. Omar - Universiti Teknologi Mara (UITM) Assoc. Professor Dr. Jamalunlaili Abdullah - Universiti Teknologi Mara (UITM) Datin Paduka Dr. Halimaton Saadiah Hashim - Universiti Kebangsaan Malaysia (UKM) Assoc. Professor Dr. Ainul Jaria Maidin - International Islamic University Malaysia (IIUM) Professor Dato’ Dr. Ibrahim Komoo - Universiti Kebangsaan Malaysia (UKM) Assoc. Professor Dr. Suhana Shamsuddin - Universiti Teknologi Malaysia (UTM) Dr. M. Zainora Asmawi - International Islamic University Malaysia (IIUM) Dr. Mohamed Thalha bin Hj. Alithamby (MIP) Khairiah Binti Talha (MIP) Ishak Ariffin (MIP) Kamalruddin Shamsuddin (JPBD); Dr. Dolbani Mijan (JPBD) International Editorial Board Professor Emeritus Dr. Richard E. Klosterman - (University -

Kuala Lumpur

Powered by Powered by Kuala Lumpur Residential Market Update January 2019 The formation of a new government following Malaysia’s recent general election is already having a positive impact Economic indicators on the economy. Nominal quarterly GDP growth for Malaysia, Malaysia-wide unemployment, inflation and the overnight policy rate Consumer sentiment has been improving following the three month tax holiday, with the introduction of the GDP Quarter-on- Malaysia Overnight zero-rating of the Goods and Services Tax (GST), effective 1.7% Quarter Growth 3.25% Policy Rate from 1st June 2018, and the re-introduction of the Sales and Q2 2018 September 2018 Services Tax (SST) on 1st September 2018. This has been reinforced by strong employment and a low inflation rate; in Unemployment Rate Inflation Rate August 2018, unemployment levels stood at 3.4% and the 3.4% August 2018 0.2% August 2018 inflation rate was low at 0.2%. In the second quarter of 2018, the Business Conditions Index Nominal GDP growth Unemployment Rate Inflation Rate 6% (BCI), published by the Malaysian Institute of Economic Research, hit its highest level for the past 13 quarters at 5% 116.3 points. In addition, the continuing development of Kuala 4% Lumpur’s new financial district, Tun Razak Exchange, looks set 3% to further boost Malaysia’s growing financial services sector. 2% Keeping pace with rapid urbanisation is the development 1% progress of transport infrastructure in Greater Kuala Lumpur 0% (GKL). The completed and on-going Light Rail Transit (LRT) and Mass Rapid Transit (MRT) lines are enhancing mobility and -1% connectivity within the region, and helping to transform GKL -2% into a sustainable and liveable metropolis. -

Integrated Management of Malaysian Road Network Operations Through ITS Initiatives: Issues, Potentials and Challenges

Integrated management of Malaysian road network operations through ITS Initiatives: issues, potentials and challenges Moazzem Hossain Malaysia University of Science and Technology (MUST) GL33, Kelana Square, Kelana Jaya, PJ 47301, Selangor, Malaysia [email protected] Abstract During the last twenty five years, rapid urbanization and industrialization have resulted considerable growth of Malaysian highway network. Apart from few specialized industrial zones, most of the industrial zones are established in close proximity of the urban areas in order to ensure the smooth supply of manpower especially for the dominating manufacturing sectors. This phenomenon resulted in a number of large regional units of transport demand base involving high private motorized trips and truck dependent freight trips. The growth of car and truck trips especially in the regions including sea ports is putting tremendous pressure on the capacity of these regions’s road network which cannot be subdued by only physical extension of the network which often proved to be costly also. As a result, a number of such regions e.g. Klang Valley, Penang and Johor Baru are experiencing the problems of congestion, accidents and air pollution on their highway network. In many developed countries integrated intelligent transport system (ITS) initiatives applied to these sorts of regional bases have been claimed to be successful in alleviating those problems in a cost-effective manner. This paper will investigate the issues related to such integrated application of ITS initiatives in Malaysia on a regional basis with particular focus on Klang Valley region. Starting from the basic ITS functionality, the paper will identify the potential focus areas such as data gathering, data communication among and across jurisdictions, System flexibility, smart use of alternative routes, public-private collaboration and integration of public-private agencies in terms of regional ITS operational needs. -

School Membership Pack

SCHOOL MEMBERSHIP PACK 1. Introduction Letter p. 2 2. Membership Application Form p. 4 3. Pre-Membership Visit Survey Form p. 8 4. Candidate School Staff List Form p. 11 5. Pre-Membership Visit Report p. 12 6. Application Procedure Flowchart p. 29 7. FOBISIA Constitution p. 30 8. FOBISIA By-Laws p. 41 9. Pre-Membership Visit Document Checklist p. 60 10. Schedule of School Membership Fees p. 61 11. School Membership FAQs p. 62 FOBISIA Chair | Mr. Anthony Rowlands | [email protected] FOBISIA CEO | Mr. John Gwyn Jones | [email protected] Dear Applicant, RE INVITATION TO APPLY FOR FOBISIA MEMBERSHIP FOR YOUR SCHOOL Thank you for your interest in becoming a FOBISIA Member School. Membership is open to schools located in Asia that provide a British-type curriculum for a significant majority of students. To qualify as members, schools must satisfy the membership criteria as set out in FOBISIA’s Constitution and By-laws, and successfully complete the application process as set out in Regulation 6 of the Constitution. The governing body of a school must approve the application. To apply for membership of FOBISIA, please prepare a Letter of Intent, which is an official letter from the Head of School (max. one A4-page) providing some context for the application, e.g. history of the school, current status, reasons for wanting to join FOBISIA. Please also complete the following forms and email them, along with your Letter of Intent, to FOBISIA (To: [email protected] ): • Initial Application Form (F1) • Pre-Membership Visit Survey Form (F2) • Staff List Form (F3) Please ensure you retain a copy of these documents as they may be required for reference in a subsequent stage of the application process, should a Pre-Membership Visit be recommended by FOBISIA’s Membership Committee. -

Understand Costs for Government to Take Over Highway Concessions - Dr M BERNAMA 25/02/2019

Understand costs for government to take over highway concessions - Dr M BERNAMA 25/02/2019 KLANG, Feb 25 (Bernama) -- Prime Minister Tun Dr Mahathir Mohamad has urged the public to understand the costs that have to be borne by the government to take over highway concessions from the concessionaires. He said this was important because the process of acquiring highway concessions involved the people's money, collected via taxes. “The government needs to buy a highway, but with whose money? It’s the money from tax collected from the people...Then the roads, which must be maintained from time to time, (costs for them) will also be borne by the government and no longer by the concession companies. “This also means that some of the taxes we collected must be used to maintain the roads, depriving the government of money for other projects that are also necessary,” he said at a press conference after officiating a Metrod Holdings Bhd plant here, today. Dr Mahathir said this in response to public criticisms after the government issued a statement on talks with Gamuda Berhad to take over four highway concessions that the company had a majority stake in, namely the Shah Alam Expressway (KESAS), Damansara-Puchong Expressway (LDP), Sprint Expressway and the Stormwater Management and Road Tunnel (SMART Tunnel). Among the criticisms were that the government did not take over the highway concession from PLUS Malaysia Bhd and for introducing ‘congestion charges’ instead of the outright abolition of tolls. According to a statement issued by the Prime Minister’s Office on Saturday, the government intends to abolish the existing toll mechanism when it successfully takes over the concession of the four expressways. -

4150204 Chapter 3.Pdf

CHAPTER 3 RESEARCH METHODOLOGY 3.1 Introduction This chapter presents an in-depth discussion on the methodology used in this study including the research design, instruments used, population of sample, sampling approach, data collection and the data analysis procedure. In the literature, methodology is defined as a way of collecting data, describing, illustrating and predicting situations by using chosen methods or techniques (Bryman 2012; Bryman & Bell 2007; Creswell 2014; Rajasekar et al. 2016). Basically, research methodology is the process that guides the research. Creswell (2014) added that the researchers are required to recognise and understand their ontological and epistemological orientations within their personal paradigm as this will determine the entire course of their research project. 3.2 Research Paradigm In research, Ticehurst and Veal (2000) connotes that research paradigms are the basic set of philosophies related to the nature of the world proposed by the researcher. Thomas (2003) added that these basic philosophical beliefs of the researcher reveal his/her perception and understanding of the world’s reality, together with the methods that assist him/her in obtaining the knowledge of that reality. It is necessary for the researcher to be able to justify and provide an explanation of the 111 reality, using the ontological, epistemological and methodological approaches (Banister et al., 2011). A research paradigm should have four main components – (i) what is the nature of the phenomenon under study; (ii) how can the researcher know of this phenomenon; (iii) what methodology can be used to study the phenomenon; and (iv) what tools or techniques can be employed to study the phenomenon (Gringeri et al., 2013).