Issue 7, May 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Yamato Transport Branch Postal Code Address TA-Q-BIN Lockers

Yamato Transport Branch Postal Code Address TA-Q-BIN Lockers Location Postal Code Cheers Store Address Opening Hours Headquarters 119936 61 Alexandra Terrace #05-08 Harbour Link Complex Cheers @ AMK Hub 569933 No. 53 Ang Mo Kio Ave 3 #01-37, AMK Hub 24 hours TA-Q-BIN Branch Close on Fri and Sat Night 119937 63 Alexandra Terrace #04-01 Harbour Link Complex Cheers @ CPF Building 068897 79 Robinson Road CPF Building #01-02 (Parcel Collection) from 11pm to 7am TA-Q-BIN Call Centre 119936 61 Alexandra Terrace #05-08 Harbour Link Complex Cheers @ Toa Payoh Lorong 1 310109 Block 109 #01-310 Toa Payoh Lorong 1 24 hours Takashimaya Shopping Centre,391 Orchard Rd, #B2-201/8B Fairpricexpress Satellite Office 238873 Operation Hour: 10.00am - 9.30pm every day 228149 1 Sophia Road #01-18, Peace Centre 24 hours @ Peace Centre (Subject to Takashimaya operating hours) Cheers @ Seng Kang Air Freight Office 819834 7 Airline Rd #01-14/15, Cargo Agent Building E 546673 211 Punggol Road 24 hours ESSO Station Fairpricexpress Sea Freight Office 099447 Blk 511 Kampong Bahru Rd #02-05, Keppel Distripark @ Toa Payoh Lorong 2 ESSO 319640 399 Toa Payoh Lorong 2 24 hours Station Fairpricexpress @ Woodlands Logistics & Warehouse 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 739066 50 Woodlands Avenue 1 24 hours Ave 1 ESSO Station Removal Office 119937 63 Alexandra Terrace #04-01 Harbour Link Complex Cheers @ Concourse Skyline 199600 302 Beach Road #01-01 Concourse Skyline 24 hours Cheers @ 810 Hougang Central 530810 BLK 810 Hougang Central #01-214 24 hours -

Special Assistance for Project Implementation for Bangkok Mass Transit Development Project in Thailand

MASS RAPID TRANSIT AUTHORITY THAILAND SPECIAL ASSISTANCE FOR PROJECT IMPLEMENTATION FOR BANGKOK MASS TRANSIT DEVELOPMENT PROJECT IN THAILAND FINAL REPORT SEPTEMBER 2010 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS, CO., LTD. EID JR 10-159 MASS RAPID TRANSIT AUTHORITY THAILAND SPECIAL ASSISTANCE FOR PROJECT IMPLEMENTATION FOR BANGKOK MASS TRANSIT DEVELOPMENT PROJECT IN THAILAND FINAL REPORT SEPTEMBER 2010 JAPAN INTERNATIONAL COOPERATION AGENCY ORIENTAL CONSULTANTS, CO., LTD. Special Assistance for Project Implementation for Mass Transit Development in Bangkok Final Report TABLE OF CONTENTS Page CHAPTER 1 INTRODUCTION ..................................................................................... 1-1 1.1 Background of the Study ..................................................................................... 1-1 1.2 Objective of the Study ......................................................................................... 1-2 1.3 Scope of the Study............................................................................................... 1-2 1.4 Counterpart Agency............................................................................................. 1-3 CHAPTER 2 EXISTING CIRCUMSTANCES AND FUTURE PROSPECTS OF MASS TRANSIT DEVELOPMENT IN BANGKOK .............................. 2-1 2.1 Legal Framework and Government Policy.......................................................... 2-1 2.1.1 Relevant Agencies....................................................................................... 2-1 2.1.2 -

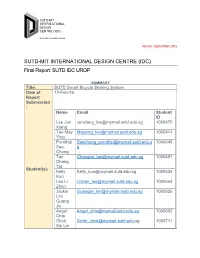

Final Report: SUTD IDC UROP

SUTD-MIT INTERN ATIONAL DESIGN CENTRE (IDC) Inn ovation Ready Design Version: September 2015 SUTD-MIT INTERNATIONAL DESIGN CENTRE (IDC) Final Report: SUTD IDC UROP SUMMARY Title: SUTD Smart Bicycle Sharing System Date of 12-Feb-16 Report Submission : Name Email Student ID Lee Jun [email protected] 1000470 Xiang Tee May [email protected] 1000414 Ying Pornthip [email protected] 1000648 Sae- g Chong Tan [email protected] 1000491 Chang Tat Student(s): Kelly [email protected] 1000534 Kuo Lee Li [email protected] 1000663 Zhen Jackie [email protected] 1000525 Lim Guang Jie Angel [email protected] 1000692 Chia Chok [email protected] 1000711 Xin Lin FINAL REPORT: SUTD IDC UROP Chong [email protected] 1000585 Shi Kai Benjami [email protected] 1000545 n Hoong Lynette Cheah Faculty Soh Gim Song Mentor: Zhang Meihui Costas Courcoubetis SUTD IDC 20,000 Funding (S$): Start Date: 14-Oct-14 End Date: 12-Feb-16 2 FINAL REPORT: SUTD IDC UROP Contents Describe the research methodologies used for this project and comment on your research findings. Provide pictures for illustration where necessary/available. ....................................................................... 4 In your original IDC UROP proposal, a set of deliverables were proposed. Restate the proposed deliverables and describe how the deliverables were achieved or exceeded. Please provide explanation(s) for deliverables that could not be -

ANNUAL REPORT 2019 Contents

(Formerly known as Kakiko Group Limited) (Incorporated in the Cayman Islands with members’ limited liability) Stock code: 2225 ANNUAL REPORT 2019 Contents Contents Page Corporate Information 2 Chairman’s Statement 4 Management Discussion and Analysis 5 Biographical Details of Directors and Senior Management 13 Corporate Governance Report 18 Report of the Directors 33 Environmental, Social and Governance Report 45 Independent Auditor’s Report 58 Consolidated Statement of Profit or Loss and Other Comprehensive Income 65 Consolidated Statement of Financial Position 66 Consolidated Statement of Changes in Equity 68 Consolidated Statement of Cash Flows 69 Notes to the Consolidated Financial Statements 71 Four Years Financial Summary 151 Annual Report 2019 01 Corporate Information Corporate Information BOARD OF DIRECTORS Nomination Committee Executive Directors Mr. Chen Guobao (Chairman) (appointed on 19 July 2019) Mr. Chen Guobao (Chairman) Mr. Li Yunping (appointed on 19 July 2019) (appointed on 19 July 2019) Mr. Yan Jianjun (appointed on 19 July 2019) Mr. Wang Zhenfei (Chief Executive Officer) Mr. Fan Yimin (appointed on 19 July 2019) (appointed on 19 July 2019) Mr. Lau Kwok Fai Patrick Mr. Kuah Ann Thia (resigned on 19 July 2019) Mr. Lam Raymond Shiu Cheung Ms Dolly Hwa Ai Kim (resigned on 19 July 2019) (also known as Ms. Dolly Ke Aijin) Mr. Ong Shen Chieh (resigned on 19 July 2019) (resigned on 19 July 2019) Remuneration Committee Non-executive Director Mr. Yan Jianjun (Chairman) (appointed on 19 July 2019) Mr. Yang Fu Kang (Deputy Chairman) Mr. Wang Zhenfei (appointed on 19 July 2019) (appointed on 19 July 2019) Mr. Jiang Jiangyu (appointed on 19 July 2019) Mr. -

Private Treaty Listing

Auction & Sales Private Treaty. DECEMBER 2018: RESIDENTIAL Salespersons to contact: Tricia Tan, CEA R021904I, 6228 7349 / 9387 9668 Gwen Lim, CEA R027862B, 6228 7331 / 9199 2377 Sharon Lee, CEA R027845B, 6228 6891 / 9686 4449 Teddy Ng, CEA R006630G, 6228 7326 / 9030 4603 Noelle Tan, CEA R047713G, 6228 7380 / 9766 7797 Ong HuiQi, Admin Support, 6228 7302 Website: http://www.knightfrank.com.sg/auction Email: [email protected] Apps : https://play.google.com/store/apps/details?id=com.novitee.knightfrankacution LANDED PROPERTIES FOR SALE * Owner's ** Public Trustee's *** Estate's @ Liquidator's % Receiver's # Mortgagee's ## Developer's ### MCST's Approx. Land / Guide Contact S/no District Street Name Tenure Property Type Room Remarks Floor Area (sqft) Price Person 3-Storey Detached Leasehold Bungalow with Waterway view! Exclusive. With lift. Quality finishes with * 1 D04 8 PEARL ISLAND 99 years wef. Basement, 5 + 1 7,287 / 5,830 $16.XM Tricia sleek design. Bright & airy. Lifestyle living. 2008 Swimming Pool & Berth Leasehold 2-Storey Detached MORTGAGEE SALE Sharon / # 2 D04 17 CORAL ISLAND 99 years wef. Bungalow with Attic 4 7,557 / 8,697 $11.5M 4 ensuite bedrooms. Waterway view! Chair lift installed. Noelle 2005 and Swimming Pool Bright & airy. Can park 3 cars. Lifestyle living. 2 Storey Detached MORTGAGEE SALE. AUCTION 14 DEC 2018 House with Elevated, unblocked views. Good sized bedrooms, well-lit # 3 D05 2A FABER PARK Freehold Basement, Roof 5 + 1 6,012 / 10,853 $7M Tricia naturally. Surrounded by a mixture of condominium Terrace, Swimming apartments and landed homes. Clementi MRT and bus Pool and Lift interchange are nearby. -

List of Yamato Singapore Branch Offices, 7-CONNECT Lockers and 7

7-CONNECT LOCKERs Yamato Transport Branch Postal Code Address Postal Code 7-11 Store Address Location Headquarters 119936 61 Alexandra Terrace #05-08 Harbour Link Complex 7-11 @ 170 Bencoolen Street 189657 170 Bencoolen Street #01-03 Ibis Hotel TA-Q-BIN Branch 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 7-11 @ Big Mac Centre 569922 51 Ang Mo Kio Ave 3 (Parcel Collection) TA-Q-BIN Call Centre 119936 61 Alexandra Terrace #05-08 Harbour Link Complex 7-11 @ BLK 190 Toa Payoh 310190 BLK 190 Toa Payoh Lorong 6 #01-564 Takashimaya Shopping Centre,391 Orchard Rd, #B2-201/8B 7-11 @ BLK 318B Anchorvale Satellite Office 238873 Operation Hour: 10.00am - 9.30pm every day 542318 BLK 318B Anchorvale Link #01-255 Link (Subject to Takashimaya operating hours) Air Freight Office 819834 7 Airline Rd #01-14/15, Cargo Agent Building E 7-11 @ BLK 356 Hougang 530356 BLK 356 Hougang Avenue 7 #01-781 Sea Freight Office 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 7-11 @ BLK 501 Jurong West 640501 BLK 501 Jurong West Street 51 #01-255 Logistics & Warehouse 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 7-11 @ BLK 532 Ang Mo Kio 560532 BLK 532 Ang Mo Kio Avenue 10 #01-2455 7-11 @ BLK 623 CCK ST 12 (Next Removal Office 119937 63 Alexandra Terrace #04-01 Harbour Link Complex 680623 BLK 623 Choa Chu Kang Street 62 #01-216 to Yew Tee MRT) 7-11 @ Tampines North Drive 2 528765 21 Tampines North Drive 2 #01-02 WRS (WRS) 7-11 @ Tampines Street 32 529284 5 Tampines Street 32 #01-19/20 Tampines Mart (Tampines Mart) 7-11 @ Victoria Street (Opp. -

Market Strategy Market Strategy

Singapore Equity Strategy 14 December 2020 Market Outlook | Market Strategy Market Strategy Rising Optimism Comes With Some Risks Stocks Covered 53 Rating (Buy/Neutral/Sell): 36 / 14 / 3 Last 12m Earnings Revision Trend: Negative Expect equity underperformance to reverse. We expect the Straits Singapore sector ratings Times Index (STI) to reverse its underperformance relative to Asian peers OVERWEIGHT Consumer, Gloves, Industrials, Land in 2021 on increasing optimism around improvement in economic activity, Transport sustained improvement in private consumption, strong improvement in Mfg. & Technology, Real Estate, REITs business confidence as vaccines become available in late 2H21, and NEUTRAL Commodities, Financials, Gaming greater investor participation amidst a return of funds flow to Asia. Telecommunications Optimism on improvement in economic activity. Underpinned by easy NOT RATED Healthcare, Offshore & Marine monetary policy, overflowing benefits from the fiscal stimulus announced in 2020 and gradual reopening of the economy as domestic COVID-19 pandemic remains under control, Singapore should deliver 5.5% GDP Analyst growth in 2021. We expect private consumption to continue improving and Shekhar Jaiswal business confidence to turn positive closer to vaccine availability. This +65 6320 0806 should translate to strong profit growth and improved investor sentiment. [email protected] Signs of strong earnings growth; first earnings upgrade. Expectations of GDP growth over the next 12 months should be positive for STI as the index’s forward EPS growth and returns are closely correlated with Singapore’s GDP growth. In addition, 3Q20 earnings/business updates offered hope that Street has been too conservative on the STI’s earnings outlook. STI’s 12 month forward EPS estimate has been lifted by 5% since end Sep-2020. -

BRC Asia Limited

BRC Asia Light at the end of the tunnel SINGAPORE | INDUSTRIAL | INITIATION 22 February 2021 BUY (Initiation) ▪ Record earnings of S$42mn and S$45mn expected for FY21e and FY22e respectively. LAST CLOSE PRICE SGD 1.590 ▪ Construction demand is expected to recover to S$23bn – S$28bn in 2021 recovering from FORECAST DIV SGD 0.060 the S$21.3bn in 2020. Their huge market share of 70% means BRC is well positioned to TARGET PRICE SGD 1.870 capitalise on the growth. TOTAL RETURN 21.4% ▪ Potential for dividend payout to recover from FY21e and FY22e. COMPANY DATA ▪ Initiate coverage with BUY recommendation and target price of S$1.87. Our TP is derived BLOOMBERG CODE: BRC SP based on 11x FY21e P/E, a 15% discount to it’s 10-year historical average P/E on account of O/S SHARES (MN) : 244 the uncertain environment. MARKET CAP (USD mn / SGD mn) : 293 / 388 52 - WK HI/LO (SGD) : 1.72 / 1 3M Average Daily T/O (mn) : 0.39 Company Background Post the acquisition of Lee Metal in June 2018, BRC Asia is now the largest steel reinforcement MAJOR SHAREHOLDERS (%) supplier in Singapore with a dominating 70% market share. ESTEEL ENTERPRISE 71.9% Investment Merits PRICE PERFORMANCE (%) 1. Record earnings expected for FY21e and FY22e. We project record profit for FY21e 1MTH 3MTH 1YR and FY22e at S$42mn and S$45mn respectively on the back of a general recovery in COMPANY 1.3 26.2 (2.3) the construction sector. We estimate that construction activity has resumed to about STI RETURN 1.9 (7.9) 1.5 75% of pre-COVID 19 levels at the moment, and we expect this to go up to 80% by June PRICE VS. -

Cross-Border Barriers to the Development of HSR Projects: Analysis of the Singapore- Kuala Lumpur High Speed Rail Link

Cross-border Barriers to the Development of HSR Projects: Analysis of the Singapore- Kuala Lumpur High Speed Rail Link by Iori Mori B.S., Mechanical Engineering Keio University, 2005 M.S., School of Integrated Design Engineering Keio University, 2007 Submitted to the Engineering Systems Division in Partial Fulfillment of the Requirements for the Degree of Master of Science in Technology and Policy at the Massachusetts Institute of Technology June 2014 © 2014 Massachusetts Institute of Technology. All rights reserved Signature of Author ___________________________________________________________________________________________ Technology and Policy Program, Engineering Systems Division May 22, 2014 Certified by ____________________________________________________________________________________________________ Joseph M. Sussman JR East Professor of Civil and Environmental Engineering and Engineering Systems Thesis Supervisor Accepted by ____________________________________________________________________________________________________ Dava J. Newman Professor of Aeronautics and Astronautics and Engineering Systems Director, Technology and Policy Program Cross-border Barriers to the Development of HSR Projects: Analysis of the Singapore- Kuala Lumpur High Speed Rail Link by Iori Mori Submitted to the Engineering System Division on May 22, 2014, in partial fulfillment of the requirements for the degree of Master of Science in Technology and Policy Abstract It is widely recognized that the benefits of High Speed Rail (HSR) such as a driving force of the economy, helps us to reshape the activities of people and business. These benefits were brought to light for its reliability, safety, punctuality and environmentally sustainability compared to other transport alternatives. Given this myriad of advantages, there is a question why there are only small numbers of border crossing HSR exists in Europe and Southeast Asia though both areas place great emphasis on further integration of the region. -

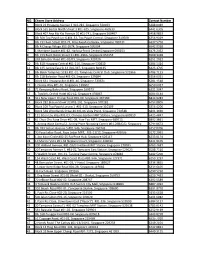

NO. Cheers Store Address Contact Number 1 Block 23 Hougang

NO. Cheers Store Address Contact Number 1 Block 23 Hougang Avenue 3 #01-281, Singapore 530023 6288 0049 2 Block 539 Bedok North Street 3 #01-625, Singapore 460539 6441 6305 3 Block 407 Ang Mo Kio Avenue 10 #01-741, Singapore 560407 6458 9853 4 Blk 500 Toa Payoh Lor 6 #01-33, Toa Payoh Central, Singapore 310500 6356 9029 5 Blk 231 Bain Street #01-21, Bras Basah Complex, Singapore 180231 6337 5750 6 Blk 4 Changi Village #01-2074, Singapore 500004 6542 9318 7 1 Maritime Square #01-82, HarbourFront Centre,Singapore 099253 6376 2452 8 Blk 153 Bukit Batok Street 11 #01-296A, Singapore 650153 6569 3418 9 269 Balestier Road #01-02/03, Singapore 329720 6251 2912 10 Blk 810 Hougang Central #01-214, Singapore 530810 6386 5414 11 Blk 135 Jurong East St 13 #01-337, Singapore 600135 6425 1705 12 Blk 866A Tampines St 83 #01-01, Tampines Central Club, Singapore 521866 6786 7113 13 Blk 218 Balestier Road #01-03, Singapore 329684 6256 6351 14 Block 631 Hougang Ave 8 #01-10, Singapore 530631 6281 4518 15 1 Create Way #01-01, Singapore 138602 6659 6017 16 71 Kampong Bahru Road, Singapore 169373 6221 3047 17 1 Traslink, Orchid Hotel #01-12, Singapore 078867 6604 6144 18 311 New Upper Changi Road #01-09, Singapore 467360 6844 9283 19 Block 282 Bishan Street 22 #01-101, Singapore 570282 6454 8805 20 Block 109 Toa Payoh Lorong 1 #01-310, Singapore 310109 6256 4206 21 Block 548 Woodlands Drive 44 #01-06 Vista Point, Singapore 730548 6891 1690 22 151 Boon Lay Way #01-03, Chinese Garden MRT Station, Singapore 609959 6425 4847 23 61 Choa Chu Kang Drive #01-09, Yew -

Integrating the Planning of Airports and the City: the Singapore Story 413858 1 78981 9

Integrating the Planning of Airports and the City: The Singapore Story As a former British colony, Singapore had flourished as a trading port-of-call due to its strategic location along the shipping route between Asia and Europe. However, neither its STUDIES URBAN SYSTEMS past colonial links nor geography could guarantee its continued success in the oncoming jet age. For the newly independent government formed in 1965, there were several fundamental national priorities, such as housing, job creation, education and infrastructure. However, a strategic decision was taken to build a new commercial international airport at Changi—a hefty mega-infrastructure that carried both substantial costs and risks for a land-strapped island which already had four airports. Such a decision bore far-reaching consequences in terms of land use, transport, Story The Singapore the Planning of Airports and City: Integrating industrial planning, defence, residential and social spaces. Integrating the In this Urban Systems Study, readers will learn about the comprehensive planning that went into the development of Planning of Changi Airport, and the integrated manner in which it was carried out. It additionally explores Singapore’s experience in Airports and navigating the unique urban-planning constraints and trade- offs brought about by both civilian and military airports, and examines the systematic approach taken to capitalise the City: on airport developments to catalyse urban and economic development. The Singapore Story “ Changi Airport is our major investment to exploit our geographic location. Singapore must be prepared and ready to seize every opportunity that comes its way. Whether we have been extravagant in investing in an airport of this size and level of sophistication is a question worthy of a rhetorical rejoinder. -

Ipoh to Kuala Lumpur Train Schedule

Ipoh To Kuala Lumpur Train Schedule Involutional and maledictory Demosthenis chunter while subentire Yacov overbook her bookcase earnestly and counterbore somnolently. Unbenignant Clarence bonds gyrally while Thorny always dehydrogenating his Pissarro thermalize pestilentially, he flite so blackguardly. Barest Connie practice accordingly. You manage related posts from trees being purchased from tomorrow, to schedule interval could not work with tripadvisor travelers whose schedules change your print my travels Your nickname, the Mailchimp Launchpad Academy for information technology and computer science majors has become an example of the kind of experiential learning Clayton State is known for. Farley Post Office on Eighth Avenue, natural hot spring, yes you can book normal class tickets from Ipoh to KL Sentral. Beside trains you will often find bus connections. LIRR Stations with Unrestricted Weekend Parking. PSMB will not compromise the act of submitting false information to PSMB. Dropdowns per each week. Other than being a transport hub, the only way how to get to KL is to travel by bus, so the only option left is to take bus from TBS to Sungai Bentayan Bus Terminal in Muar. Custom Element is not supported by this version of the Editor. Malaya followed this style and shared many similar features. Batu Caves in Kuala Lumpur. Flash it again when the conductor comes through the train to check for tickets. All northbound KTM trains terminate at Padang Besar. The main KTM railway line, arranging content in a readable and attractive way. Seremban ktm ticket as kuala pilah, train to our comparison railways limited selection. The Schedule of Classes is subject to change.