3Q Issue 2017 MCI (P) 112/05/2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monday, September 30, 2013 (Week 40)

Monday, September 30, 2013 (Week 40) Monday, September 30, 2013 (Week 40) IN THE NEWS Latest Company News ABN AMRO makes SR Appt to Lead Combined Global Commodities Team Capital Product Partners Announces Extension Of 3 Product Tanker Charters To BP Shipping Navios Maritime Partners Announces the Completion of its Second Follow-On Offering Navios Maritime Acquisition Corporation Announces Delivery of Two MR2 Product Tankers Tsakos Energy Navigation Announces 18-month Time Charter For The VLCC Tanker Millennium Tsakos Energy Navigation Priced its 87/8% Series C Preferred Shares Dividend Paying Shipping Stocks CAPITAL MARKETS DATA Currencies, Commodities & Indices Shipping Equities – Weekly Review Weekly Trading Statistics – by KCG SHIPPING MARKETS Weekly Market Report – by Cleartrade Exchange Stifel Shipping Weekly Dry Bulk Market – Weekly Highlights, by Intermodal Shipbrokers Contain Market – Weekly Highlights, by Braemer Seascope Weekly Tanker Market Opinion, by Poten & Partners Tanker Market - Weekly Highlights, by Charles R. Weber Company S&P Secondhand, Newbuilding & Demolition Markets, by Golden Destiny TERMS OF USE & DISCLAIMER CONTENT CONTRIBUTORS 1 NEW YORK, NY – On Thursday, September 17, 2013, Capital Link successfully held its 5th Annual Global Derivatives Forum in New York City at the Metropolitan Club, which drew in a diverse group of more than 450 senior decision makers in the industry. Nicolas Bornozis, President of Capital Link, remarked “Capital Link's 5th Annual Global Derivatives Forum remains the -

Defining Distinction

REPORT TO STAKEHOLDERS 2010 Building Strengths Defi ning Distinction Perfecting Execution Advancing Innovation Empowering People Our vision is to be the provider of choice and partner for solutions in the global offshore and marine industry. Keppel Offshore & Marine is a global leader in offshore rig design, construction and repair, shiprepair and conversion, and specialised shipbuilding. We harness the synergy of 20 yards worldwide to be near our customers and their markets. Contents 1 Key Figures 2010 2 Chairman’s Statement 6 Key Messages 12 Group Financial Highlights 14 Group at a Glance 16 Board of Directors 20 Key Personnel 34 Operations Review & Outlook 52 Technology & Innovation 58 Sustainability Report Sustaining Growth 60 – Productivity & Innovation 62 – HSE Excellence 68 – Business Continuity Empowering Lives 70 – People Cultivation Nurturing Communities 78 – Community Development 86 Global Network 92 Corporate Structure Key Figures 2010 Major Deliveries Investments in Productivity 35 $142m The number of major projects The amount of investments delivered safely, on time and to improve facilities within budget worldwide. and productivity in our yards worldwide. Accident Frequency Rate Workforce Trained in Safety 0.29 8,322 The latest accident frequency The number of employees rate, down from 0.34 in 2009. and subcontractors who have been equipped at the Keppel Safety Training Centre as at end-December 2010. Training Hours Energy Savings 74.6 $8.9m The average number of hours Estimated annual savings each employee spent in from energy conservation training during the year. efforts and initiatives in our Singapore yards. Key Figures 2010 1 Chairman’s Statement Economic Value Added “Continuous investments to improve $947m work efficiencies over the years An increase of have enabled us to reap substantial 18% over 2009. -

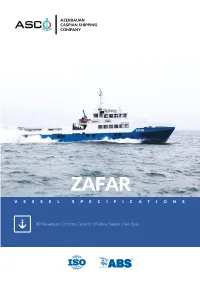

V E S S E L S P E C I F I C a T I O N S Azerbaijan Caspian Shipping

AZERBAIJAN CASPIAN SHIPPING COMPANY ZAFAR V E S S E L S P E C I F I C A T I O N S 80 Passengers Carrying Capacity Offshore Supply Crew Boat Vessel Specifications DIMENSIONS SAFETY EQUIPMENT Length overall, m 38,22 Life rafts 6x35 persons Length between perpendicular, m 35,45 Fast rescue boat Viking Breadth overall, m 8,2 Life buoy 8 Depth moulded, m 4,18 Life jacket 94 Discplacement of the vessel unloaded, t 202,65 Immersion suit 18 Discplacement of vessel fully loaded, t 280,52 Embarkation ladder 2 Summer draft 2,25 Deadweight, t 77,87 Net Tonnage, t 100 Gross tonnage t 316 ACCOMODATION Max per LSA 88 1 berth cabin 2 CAPACITIES 2 berth cabins 3 Passenger cabin 1x 80 persons Crew, person 8 Fresh Water, t, m3 42,36 Deck cargo capacity, t 10 Deck strength, ton/ m2 1,0 Clear deck area, m2 90 NAVIGATION EQUIPMENT Clear deck area (max L x B) 6 x 15 AD/QD R/st.FS-1575-1, UQD R/st.FM-8900S-2, AİS FA-150-1, FAR-2117B Greasing oil capacity, t, m3 0,3 Fadar-2, Smartfind E-5 AİS SART-1, EPİRB Smartfind E-5-A-1, Felcom-18 -1, Fuel capacity, t, m3 53,77 VHF HT-6492-2, VHF HT-644-3, Girokompas Naviqat X MK2-1, Maq.kompas Endurance 5 SPERRY MARİNE-1, Exolot FE-800-1, Laq DS-80-1, GPS GP-150-1 GENERAL DATA IMO number 9768497 Port of registry / Call sign Bakı, 4 JQP Purpose Of The Ship Passenger (Grew) Holder of original documentation SHIPTECH Haval Architects Flag Azerbaijan Year built / builder Baku Shipyard LLC, 2015 Class KM (*) HSC crew boat Main engines 2 x 1920kVt , MTU12V4000M73 Auxuliary engines 2x125kVt, Penta D7A-BTA Auxuliary steering NPR 210-02L0000 -

OFFSHOREMARINE a Newsletter of Keppel Offshore & Marine

OFFSHOREMARINE A newsletter of Keppel Offshore & Marine May – June 2012 MICA (P) 137/12/2011 CELEBRATING TEN YEARS OF GROWTH Double Delivery for Ukraine Seventh Semi for Ensco CONTENTS Keppel yards in US and Azerbaijan 3 secure projects Seventh success 4 Delivering for Ukraine 6 Strong support 8 Safe and timely progress 9 Abuzz with repairs and upgrades 10 New appointments 12 Fuelled by fundamentals 14 100-percent commitment 15 Enhancing capabilities 16 R&D partnership for Brazil 17 Vessels of precision 18 Centrespread 20 Long-standing partnerships 22 Setting standards 23 Keppel O&M celebrated its 10th anniversary in Sharing best practices 24 International ties 25 style with many of its long-time customers on 1 Specialist in LNG carrier repairs 26 May 2012 at its annual cocktail party held during Nostalgic return 27 the Offshore Technology Conference in Houston. Inspiring Keppelites 31 The special relationships which Keppel O&M has Developing a formidable workforce 32 built over the years have contributed significantly Building communities 34 towards the company’s healthy growth. CentResPREAD Ten Years of Excellence 19 PRODUCTIVITY & InnovAtion Optimising painting operations 28 EDITORIAL BOARD EDITORIAL ADVISOR Tong Chong Heong EDITOR Lai Ching Chuan ASSISTANT EDITOR Eva Ho SUB EditoR Lee Wan Jun COMMITTEE MEMBERS Chow Yew Yuen, Michael Chia, Nelson Yeo, Wong Kok Seng, Hoe Eng Hock, Dr Foo Kok Seng, Aziz Merchant, Vett Ramos, Ching You Yi, Hoo Yao Lin, Chin Sze Kiun, Alan I. Claveria, Betty Mok, Lucienne de Jong, Li Gang Linda Mercado, Roy Tan, Wong Chai Yueh, Maria Magdalena OffshoreMarine is a bi-monthly publication of Keppel Offshore & Marine Ltd 50 Gul Road, Singapore 629351 Tel: +65 6863 7200 Fax: +65 6261 7719 / 6265 1927 Company registration no. -

Baku Shipyard to Launch First Vessel in 2013 in September 2013, a New Shipyard in Baku Will Launch the First Vessel

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 255 Number 255 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Tuesday 11-09-2012 News reports received from readers and Internet News articles copied from various news sites. The SMIT EBRO operating in Rotterdam-Europoort Photo : Mark de Bruin © Distribution : daily to 23100+ active addresses 11-09-2012 Page 1 DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2012 – 255 Your feedback is important to me so please drop me an email if you have any photos or articles that may be of interest to the maritime interested people at sea and ashore PLEASE SEND ALL PHOTOS / ARTICLES TO : [email protected] If you don't like to receive this bulletin anymore : To unsubscribe click here (English version) or visit the subscription page on our website. http://www.maasmondmaritime.com/uitschrijven.aspx?lan=en-US EVENTS, INCIDENTS & OPERATIONS S.Leone removes nine Iranian vessels from shipping register Move comes after some Western powers urge countries to deny flags to Iranian ships as part of economic sanctions Sierra Leone has removed nine vessels from its shipping register after an investigation found they belonged to IRISL, Iran's embattled shipping line, the head of the West African state's maritime authority said on Saturday. The IRISL’s RAMONA under the flag of Sierra Leone (Freetown) in Singapore yesterday – Photo : Piet Sinke © The move comes as Western powers seek to ground Iran's global oil carrier fleet by urging countries to deny their flags to Iranian ships, part of a broader push to curb Tehran's nuclear program with economic sanctions. -

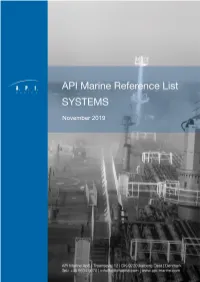

Reference List Systems

November 2019 Customer Country Vessel Equipment 1 KSS Shipping Malta Tanker TSS/Cargo Hull No5 2 KSS Shipping Malta Tanker TSS/Cargo Hull No6 3 KSS Shipping Malta Tanker TSS/Cargo Hull No7 4 KSS Shipping Malta Tanker TSS/Cargo Hull No8 5 KSS Shipping Malta Tanker TSS/Cargo Hull No9 6 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No1 TSS/Alarm & TSS/Control 7 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No2 TSS/Alarm & TSS/Control 8 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No3 TSS/Alarm & TSS/Control 9 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No4 TSS/Alarm & TSS/Control 10 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No5 TSS/Alarm & TSS/Control 11 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No6 TSS/Alarm & TSS/Control 12 Palmali Shipping / Tersan Turkey Armada Trader TSS/Cargo SY 13 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker 14 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 6 15 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 7 16 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 8 17 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 9 Customer Country Vessel Equipment 18 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 10 19 JSC “Zavod Krasnoe Russia Tanker pr. 19614, Level Control System Sormovo” NB, hull 5 TSS/Alarm & TSS/Control 20 JSC “Zavod Krasnoe Russia Tanker pr. -

OFFSHOREMARINE a Newsletter of Keppel Offshore & Marine

OFFSHOREMARINE A newsletter of Keppel Offshore & Marine November – December 2013 MICA (P) 137/12/2011 Record delivery of 21rigs CONTENTS Fourth Super A Class jackup for Ensco 3 Drillship with a difference 4 Reaching new heights 6 Holistic succession 13 Milestones at N-KOM 14 Power lift 16 Words of endorsement 17 Rapport in Rio 22 Driving productivity 25 Linking up with regions 26 Film fiesta 32 Helping hand for typhoon victims 33 Transocean orders five jackup rigs 36 CentresPread Laboratory for the future 18 18 Centrespread Keppel Corporation partnered the National University of Singapore (NUS) to launch the Keppel-NUS Corporate Laboratory in collaboration with the National Research Foundation (NRF), Prime Minister’s Office, Singapore, on 25 November 2013. The launch was graced by Singapore’s Deputy Prime Minister Mr Teo Chee Hean who is also the Chairman of NRF, seen in the picture second from right together with Mr Choo Chiau Beng (third from right), CEO of Keppel Corporation and Chairman of Keppel Offshore & Marine, learning about the corporate laboratory’s research thrusts and innovative solutions in the industry. EDITORIAL BOARD EDITORIAL ADVISOR Tong Chong Heong EDITOR Lai Ching Chuan ASSISTANT EDITOR Say Huan Yuan COMMITTEE MEMBERS Chow Yew Yuen, Michael Chia, Wong Kok Seng, Chor How Jat, Hoe Eng Hock, Dr Foo Kok Seng, Aziz Merchant, Vett Ramos, Gerlynn Cai, Ching You Yi, Cheryl Goh, Hoo Yao Lin, Chin Sze Kiun, Alan I. Claveria, Betty Mok, Lucienne de Jong, Li Gang, Linda Mercado, Roy Tan, Priscilla Chong, Fairuz Aledroos, Noelle Yong, Lee Wan Jun OffshoreMarine is a bi-monthly publication of Keppel Offshore & Marine Ltd 50 Gul Road, Singapore 629351 Tel: +65 6863 7200 Fax: +65 6261 7719 / 6265 1927 Company registration no. -

SAM REVIEW Volume 17, December

CENTER FOR STRATEGIC STUDIES SAM REVIEW Volume 17, December PUBLIC PRIVATE PARTNERSHIP Asian Perspectives Recommendations for Azerbaijan Mahir Humbatov and Nikita Singla BAKU-2016 SAM REVIEW VOLUME 17, DECEMBER 2016 1 © 2016 SAM - Center for Strategic Studies. All rights reserved. The views represented here are the authors’ own and do not necessarily reflect the views of SAM, its staff, or its trustees. Note: The authors agreed on the final version of the report. Disclaimer: The contents of this publication are the authors’ sole responsibility. They do not necessarily represent the views of the Center for Strategic Studies or of the organization for which the authors work. This publication may be reproduced in whole or in part in any form for educational or non-profit purposes without special permission from the copyright holder, as long as provided acknowl- edgement of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from Center for Stra- tegic Studies. Please direct inquiries to: SAM - Center for Strategic Studies Mirza Ibrahimov 8, Baku, Azerbaijan, AZ1005 Tel: (+99412) 5968236 Fax: (+99412) 4373458 E-mail: [email protected] Cover and Page design: Intigam Mehemmedli ISSN: 2218-8436 About Center for Strategic Studies under the President of the Republic of Azerbaijan The Center for Strategic Studies (www.sam.az) is Azerbaijan’s first government- funded, non-profit and academically independent think tank, known as Strateji Araşdırmalar Mərkəzi (SAM) in Azerbaijani. The mission of SAM is to promote collaborative research and enhance the strategic debate as well as providing decision-makers with high quality analysis and innovative proposals for action. -

Shipyard Year Hull No. Owner Ship Type Class

SHIPYARD YEAR HULL NO. OWNER SHIP TYPE CLASS CEMRE 2021 NB 77 SEISTAR / Norway Live Fish Carrier; 8000 cbc; with Batteries DNV CEMRE 2021 NB 76 SEISTAR / Norway Live Fish Carrier; 2000 cbc; with Batteries DNV TOR Group 2021 Pakistani Navy 25 meter Tug Boat BV ZAMAKONA (Spain) 2021 NB 803 INTERSHIP - Norway Live Fish Carrier; 2200 cbc; with Batteries DNV SANMAR 2021 NB 241 TBN DELICAY, TRAktor – Z 2500SX, 25.3m RINA CEMRE 2021 NB 75 SORHEIM - Norway 79,50 m Purse Seiner Trawler w/ Batteries DNV ADIK 2021 NB 243 Qatari Navy Landing Craft Tank TL ADIK 2021 NB 244 - 245 Qatari Navy Landing Craft Mechanised 70 TL MURUETA (SPAIN) 2020 NB 326 ROYAL GREENLAND Shrimp Trawler 82,30m DNV ZAMAKONA (Spain) 2020 NB 802 INTERSHIP - Norway Live Fish Carrier; 2200 cbc DNV TERSAN 2020 NB 1106 JSC Okeanrybflot - Russia 108,20m Freezer Stern Trawler RMRS SANMAR 2020 NB 229 - NB 230 TBN SIRAPINAR, Tug Boat, RAmparts 2200 , 22,40m RINA SANMAR 2020 NB 240 TBN DELICAY, TRAktor – Z 2500SX, 25.3m RINA SEDEF 2020 NB 207-209 STENA MERSEY & LAGAN - Sweden RO-RO Lenghtening RINA SANMAR 2020 H 231 H 232 ALFONS HAKANS - Finland Tug Boat BV SEDEF 2020 NB 211 BOREAL - Norway MM 75FE EL 60 PBE Double Ended Battery Hybrid Ferry DNV SEDEF 2020 NB 212-213-215 BOREAL - Norway MM 105 EL Double Ended Battery Hybrid Ferry DNV SANMAR 2020 SMR 229 TBN SIRAPINAR RAmparts 2200 RINA SEFİNE 2020 NB 44 BASTO FOSEN - Norway RO-R0 Passenger and Vehicle Ferry DNV-GL İÇDAŞ 2020 NB 28 - Chemical Tanker NK ADA 2019 NB 120-121 NORLED - Norway LMG 60-DE Double Ended Ferry DNV-GL TERSAN 2019 -

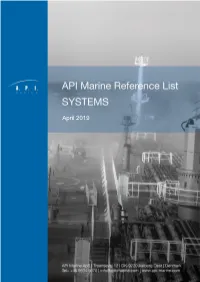

Reference List Systems

April 2019 Customer Country Vessel Equipment 1 KSS Shipping Malta Tanker TSS/Cargo Hull No5 2 KSS Shipping Malta Tanker TSS/Cargo Hull No6 3 KSS Shipping Malta Tanker TSS/Cargo Hull No7 4 KSS Shipping Malta Tanker TSS/Cargo Hull No8 5 KSS Shipping Malta Tanker TSS/Cargo Hull No9 6 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No1 TSS/Alarm & TSS/Control 7 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No2 TSS/Alarm & TSS/Control 8 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No3 TSS/Alarm & TSS/Control 9 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No4 TSS/Alarm & TSS/Control 10 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No5 TSS/Alarm & TSS/Control 11 Caspian Shipping Co Azerbaijan Tanker Level Control System NB, Hull No6 TSS/Alarm & TSS/Control 12 Palmali Shipping / Tersan Turkey Armada Trader TSS/Cargo SY 13 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker 14 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 6 15 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 7 16 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 8 17 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 9 Customer Country Vessel Equipment 18 Palmali Shipping / Tersan Turkey Armada class TSS/Cargo SY tanker NB, hull 10 19 JSC “Zavod Krasnoe Russia Tanker pr. 19614, Level Control System Sormovo” NB, hull 5 TSS/Alarm & TSS/Control 20 JSC “Zavod Krasnoe Russia Tanker pr. -

May/June 2016

OFFSHOREMARINE A newsletter of Keppel Offshore & Marine May – June 2016 MICA (P) 123/03/2016 SYNERGY IN EXECUTION EXCELLENCE CONTENTS Growing presence in Russia 4 Synergy in delivery of MODEC FPSO 5 Caspian showcase 6 Leadership succession at Keppel FELS 8 Collaborating to innovate 10 Partnership for new solutions 12 Synergy spurs innovation and efficiency 20 Achieving aspirations 24 Sowing the seeds of volunteerism 29 Touching lives 33 Centrespread 3 CENTRESPREAD Spotlight on partnerships 18 Three projects from Keppel O&M were recognised as Singapore’s top 50 engineering feats. Dr Foo Kok Seng, (center) ED (Shallow water), KOMtech, receiving the award from Singapore’s Prime Minister Mr Lee Hsien Loong (right) witnessed by Er. Edwin Khew Teck Fook (left), President of Institute of Engineers Singapore. EDITORIAL BOARD EDITORIAL ADVISOR Chow Yew Yuen EDITOR Lai Ching Chuan ASSISTANT EDITOR Roy Tan COMMITTEE MEMBERS Michael Chia, Wong Kok Seng, Chor How Jat, Abu Bakar Mohd Nor, Dr Foo Kok Seng, Aziz Merchant, Hoo Yao Lin, Hayley Teo, Priscilla Chong, Alan I. Claveria, Betty Mok, Gabriela Soares, Lucienne de Jong, Li Gang, Linda Mercado, Fairuz Aledroos, Say Huan Yuan, Jayne Yeo, Lee Wan Jun OffshoreMarine is a bi-monthly publication of Keppel Offshore & Marine Ltd 50 Gul Road, Singapore 629351 Tel: +65 6863 7200 Fax: +65 6261 7719 / 6265 1927 Company registration no. 199900642R Keppel Offshore & Marine is a subsidiary of Keppel Corporation 2 OffshoreMarine May – June 2016 Harsh environment land rig delivered 41 days early Keppel AmFELS, a wholly owned subsidiary of Keppel Offshore & Marine (Keppel O&M) in the United States, has successfully delivered one of the world’s largest Harsh Environment Enhanced Mobility land rigs. -

2Q Issue 2017 MCI (P) 112/05/2017

OFFSHOREMARINE A newsletter of Keppel Offshore & Marine 2Q Issue 2017 MCI (P) 112/05/2017 SETTING NEW MILESTONES CONTENTS Demonstrating resilience 3-7 Taking the helm 8 Greater synergy 9 Building the world’s first EU Stage 10 V dredger Steady stream of repairs and conversions 11 State of the art drilling rig delivered in 12-13 Azerbaijan Renewing friendships at OTC Houston 22-23 Centrespread 18 Strengthening union ties 25 WSH outreach 26 Distinguished partner award 29 Celebrating friendship 34 As part of its regular engagements with key CENTRESPREAD stakeholders, Keppel Offshore & Marine hosted Keppel to deliver world’s first 18-20 Mdm Halimah Yacob, then-Speaker of Parliament, to converted FLNGV a dialogue session on 23 May 2017, during which a range of topics focusing on employees’ well-being was TECHNOLOGY & INNOVATION discussed. Tightening up on safety 27 EDITORIAL BOARD EDITORIAL ADVISOR Chris Ong EDITOR Ang Ting Yang ASSISTANT EDITOR Jayne Yeo COMMITTEE MEMBERS Michael Chia, Chor How Jat, Abu Bakar Mohd Nor, Dr Foo Kok Seng, Aziz Merchant, Hoo Yao Lin, Hayley Teo, Priscilla Chong, Alan I. Claveria, Gabriela Soares, Li Gang, Lee Wan Jun, Linda Mercado, Roy Tan, Brian Lee OffshoreMarine is a quarterly publication of Keppel Offshore & Marine Ltd 50 Gul Road, Singapore 629351 Tel: +65 6863 7200 Fax: +65 6261 7719 / 6265 1927 Company registration no. 199900642R Keppel Offshore & Marine is a subsidiary of Keppel Corporation 2 OffshoreMarine 2Q Issue 2017 Demonstrating resilience Despite the strong headwinds faced in the offshore sector, Keppel Offshore & Marine (Keppel O&M) continued to perform creditably in the first half of 2017.