Taiwan RISK & COMPLIANCE REPORT DATE: March 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Taiwan Stock Exchange Jun. 9, 2018

Foreign Listings on TWSE Taiwan Stock Exchange Jun. 9, 2018 1 Big U.S. companies like Apple Inc. and Pfizer Inc. have the world’s largest corporate bond market in their backyard. So why have they been rushing to Taiwan lately to issue debt? The reason: a feature of the Taiwanese bond market that—for now—makes it easy and relatively cheap for companies to redeem any debt they issue there before its due date. For sure, the Formosa bond market—so-called after the Portuguese Issuer Currency Scale name for the island—is tiny compared with the U.S.’s $8.6 trillion corporate bond market. Yet blue-chip companies including Apple, AT&T USD 5,344 mil. Pfizer, Verizon Communications Inc. and Comcast Corp. have each issued north of $1 billion of such debt this year. AT&T Inc. issued a Apple USD 2,377 mil. $1.43 billion 30-year Formosa bond with a 5.5% coupon earlier this month. Pfizer USD 1,065 mil. In the Formosa market, the call option adds only an extra 0.1 Verizon USD 5,214 mil percentage point to 0.15 percentage point in yield, compared with 0.8 percentage point to a full percentage point in other markets, Source: WSJ according to Deutsche Bank’s Mr. Stephen. 2 Outline I. Why IPO? II. Why Taiwan? III. How to List on TWSE? IV. Foreign Listed Companies on TWSE V. Summary VI. Appendix 3 I. Why IPO? 4 Benefits of IPO What Boss Worries ! The cost of regulatory compliance, business succession plan, dilution of shareholding etc. -

Taiwan Stock Exchange Principles for Financial Market Infrastructure

Taiwan Stock Exchange Principles for Financial Market Infrastructure Disclosure Report (CCP&SSS) Responding institution: Taiwan Stock Exchange Corporation Jurisdiction(s) in which the FMI operates: Taiwan Authority(ies) regulating, supervising or overseeing the FMI: the Securities and Futures Bureau of the Financial Supervisory Committee The date of this disclosure is 2018.9.12. This disclosure can also be found at http://www.twse.com.tw/ For further information, please contact [email protected] 1 TABLE OF CONTENTS I. Executive summary………………………………………………..…4 II. Summary of major changes since the last update of the disclosure…………………………………………………………….11 III. General background of TWSE……………………………………..12 IV. Principle-by-principle summary narrative disclosure……………13 Principle 1: Legal basis……………………………………………...13 Principle 2: Governance……………………………………………..15 Principle 3: Framework for the comprehensive management of risks……………………………………………………...22 Principle 4: Credit risk………………………………………………28 Principle 5: Collateral………………………………………………..39 Principle 6: Margin…………………………………………………..41 Principle 7: Liquidity risk…………………………………………...44 Principle 8: Settlement Finality……………………………………..51 Principle 9: Money settlements……………………………………...53 Principle 10: Physical deliveries…………………………………….54 Principle 11: Central securities depositories………………………..55 Principle 12: Exchange-of-value settlement systems………………55 Principle 13: Participant-default rules and procedures…………...55 Principle 14: Segregation and portability…………………………..57 Principle 15: General business risk…………………………………60 -

The Mineral Industry of Taiwan in 2004

THE MINERAL INDUSTRY OF TAIWAN By Pui-Kwan Tse Taiwan is an island that is located south of Japan and east encourage Taiwanese businesses to stay in Taiwan and would of mainland China in the Pacific Ocean. In 2004, Taiwan’s attract foreign businesses to set up global logistics centers in economy grew by 5.7%, which was the largest increase since Taiwan. Developing service industries such as entertainment, 2000. After reaching a peak of 7.9% in the second quarter, environmental protection, medicine and healthcare, and tourism the economy slowed to 3.3% in the fourth quarter because of and sports recreation would enhance the quality of life in higher global oil prices and the deceleration of export growth Taiwan. The CEPD projected that the service sector would during the second half of the year. The economic growth was grow 6.1% per year through 2008 and that the percentage of the generated by private consumption and investment. Private GDP generated by the service sector would increase to 67% in consumption increased by 3.1% and private investment rose by 2008 from 63.5% in 2003 (Taiwan Headlines, 2004b§; 2005d§). 28.2% compared with that of the previous year. The recovery The Taiwan authorities carried out the second phase of of the information and communication technologies industry Taiwan’s financial reform program in 2004. The number of was the main reason for the increased business investment. In state-owned banks (banks in which the government held 30% 2004, Government fixed investment decreased by 4.2% because or more interest) would be reduced to 6 from 12 at yearend of higher prices on construction materials and because some 2005. -

Spring 2 0 1 9

W I N E L I S T | S P R I N G 2 0 1 9. IST EDITION. MMXIX. V A J R A B E V E R A G E P R O G R A M The VAJRA BEVERAGE PROGRAM is a thoughtfully curated list of wines, spirits and libations; designed to enhance the simple flavors of Vajra’s Nepalese and Indian cuisine and heritage. The experience of visible flavors and aromas of the cuisine, when paired with the best wines and spirits and concoctions thereof, is what we aspire to impart with our guests in their every visit. A lot of thought and time has been invested in order to bring together the perfect harmony of flavors, aromas and visual appeasements. With a perfect bottle of wine or the perfect cocktail crafted with you in the mind, Vajra is a place where we all get together, to celebrate life, family and friendships. This volume is an extension of VAJRA’s affable personality and amalgamation of many forms of hospitality and culture developed through the years in hospitality business. As we encourage our guests to partake in all forms of merriment, we implore, let this volume guide you. And that you guide us with your knowledge, as we constantly learn and evolve. Our staff will make sure your every question is answered, and that you will enjoy your evening with us. No sane man can afford to dispense with debilitating pleasures; no ascetic can be considered reliably sane. ~Robert M. Parker, Jr. 2 C O N T E N T I. -

Choosing Entry Mode to Mainland China

東海管理評論【特刊】 民國一百年,第十二卷,第一期,71-120 Choosing Entry Mode to Mainland China Joung -Yol Lin*, Batchuluun AMRITA** Abstract The Economic Cooperation Framework Agreements (ECFA) is an agreement between the Republic of China (Taiwan) and People’s Republic of China (Mainland China), which was signed on June 29, 2010. The ECFA can have a far reaching impact on bilateral businesses relationship of the two parties, further strengthening the financial infrastructure and enhancing financial stability. Currently, thirteen Taiwanese banks meet the capital adequacy or stake acquisition requirements in the mainland China; on the contrary, five mainland Chinese banks meet the capital adequacy and operation experience requirements for opening a representative office in Taiwan. Consequently, a merger of banks and related options between the two regions are under discussion. In a review of the ECFA and other reports, Taiwanese banks will be able to progress further on the banking business in the mainland market within 2 years. However, there are still many uncertainties and questions concerning bank characteristics after ECFA; such as competitive position, market efficiency, long term returns and dimensional stability. This paper investigates theoretical and empirical studies and application of PESTEL analysis on the major factors in the macro environment of China. Specific attention is made in regards to the securities, banking and insurance aspects. The vital finding of this study is investigation of the entry mode strategy for the Chinese market with a long –term vision to foster into global competition. Finally, in order to intensify the competitive advantage, this paper explores a viable model for Taiwanese Banks to structure their products and services upon. -

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Financial Statements for the Nine Months Ended September 30, 2020 and 2019 and Independent Auditors’ Review Report Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019 (Amounts in Thousands of New Taiwan Dollars, Unless Specified Otherwise) (Reviewed, Not Audited) 1. GENERAL Taiwan Semiconductor Manufacturing Company Limited (TSMC), a Republic of China (R.O.C.) corporation, was incorporated on February 21, 1987. TSMC is a dedicated foundry in the semiconductor industry which engages mainly in the manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and the manufacturing of masks. On September 5, 1994, TSMC’s shares were listed on the Taiwan Stock Exchange (TWSE). On October 8, 1997, TSMC listed some of its shares of stock on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADSs). The address of its registered office and principal place of business is No. 8, Li-Hsin Rd. 6, Hsinchu Science Park, Taiwan. The principal operating activities of TSMC’s subsidiaries are described in Note 4. 2. THE AUTHORIZATION OF FINANCIAL STATEMENTS The accompanying consolidated financial statements were reported to the Board of Directors and issued on November 10, 2020. 3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS a. Initial application of the amendments to the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), IFRIC Interpretations (IFRIC), and SIC Interpretations (SIC) (collectively, “IFRSs”) endorsed and issued into effect by the Financial Supervisory Commission (FSC) The initial application of the amendments to the IFRSs endorsed and issued into effect by the FSC did not have a significant effect on TSMC and its subsidiaries’ (collectively as the “Company”) accounting policies. -

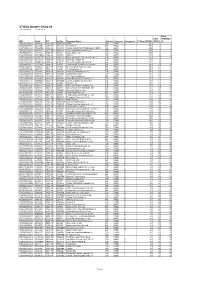

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

ICE® Factset® Taiwan Core Semiconductor Index (ICEFSTS)

ICE® FactSet® Taiwan Core Semiconductor Index (ICEFSTS) Version 1.0 Valid from November 19, 2020 Contents Version History: ................................................................................................................................................ 1 1. Index summary .............................................................................................................................................. 2 2. Governance ................................................................................................................................................... 3 3. Index Description .......................................................................................................................................... 5 4. Publication..................................................................................................................................................... 6 4.1 Publication of Index values. .................................................................................................................... 6 4.2 Exceptional market conditions and corrections....................................................................................... 6 4.3 Changes to the Index ............................................................................................................................... 7 5. Calculation .................................................................................................................................................... 9 5.1 Calculation of the Index -

Incoming Letter: Taipei Exchange Main Board and Taipei Exchange

New York Paris Northern California Madrid Washington DC Tokyo São Paulo Beijing London Hong Kong James C. Lin Partner Resident Hong Kong Partners Davis Polk & Wardwell 852 2533 3368 tel William F. Barron* Gerhard Radtke* Hong Kong Solicitors 852 2533 1768 fax Bonnie Chan* Martin Rogers † The Hong Kong Club Building [email protected] Karen Chan † Patrick S. Sinclair* 3A Chater Road Paul K. Y. Chow* † Miranda So* Hong Kong James C. Lin* James Wadham † Hong Kong Solicitors * Also Admitted in New York † Also Admitted in England and Wales August 29, 2019 Re: Application for Designation of the Taipei Exchange Main Board and Taipei Exchange Bond Market as a “Designated Offshore Securities Market” Michael Coco, Chief Office of International Corporate Finance Division of Corporation Finance United States Securities and Exchange Commission 450 Fifth Street. N.W. Washington, DC 20549 Dear Mr. Coco: We are writing to the United States Securities and Exchange Commission (the “SEC” or the “Commission”) on behalf of the Taipei Exchange (the “TPEx”) to apply for the classification of a “designated offshore securities market” for purposes of Regulation S (“Regulation S”) under the U.S. Securities Act of 1933, as amended, for (i) the portion of the TPEx known as the Taipei Exchange Main Board (the “TPEx Main Board”) and (ii) the portion of the TPEx known as the Taipei Exchange Bond Market (the “TPEx Bond Market” and together with the TPEx Main Board, the “TPEx Platforms”). Designation is being sought in order to assist market participants to the TPEx Platforms who are eligible for the safe harbor provision provided by Rule 904 of Regulation S to satisfy the requirements specified in that rule when reselling securities “in, on or through the facilities of” the TPEx Platforms. -

Inventec Corporation

(English Translation of Pro Forma Financial Report Originally Issued in Chinese) PEGATRON CORPORATION AND ITS SUBSIDIARIES PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2008 AND 2007 (With Independent Auditors’ Report Thereon) Address: 5F., No.76, Ligong St., Beitou District, Taipei City 112, Taiwan Telephone: 886-2-8143-9001 - 1 - TABLE OF CONTENTS Contents Page Cover Page 1 Table of Contents 2 Independent Auditors’ Report 3 Pro Forma Consolidated Balance Sheets 4 Pro Forma Consolidated Statements of Income 5 Pro Forma Consolidated Statements of Changes in Stockholders’ Equity 6 Pro Forma Consolidated Statements of Cash Flows 7 Notes to Pro Forma Consolidated Financial Statements (1) Organization and Business 8 (2) Summary of Significant Accounting Policies 8-28 (3) Reasons for and Effects of Accounting Changes 28 (4) Summary of Major Accounts 28-49 (5) Related-Party Transactions 50-56 (6) Pledged Assets 56 (7) Significant Commitments and Contingencies 57-58 (8) Significant Catastrophic Losses 59 (9) Significant Subsequent Events 59 (10) Others 59 (11)Additional Disclosures 60-61 (12)Segment Information 61-62 - 2 - (English Translation of Financial Report Originally Issued in Chinese) PEGATRON CORPORATION AND ITS SUBSIDIARIES PRO FORMA CONSOLIDATED BALANCE SHEETS DECEMBER 31, 2008 AND 2007 (All Amounts Expressed in Thousands of New Taiwan Dollars, Except for Share Data) December 31, 2008 December 31, 2007 Amount % Amount % ASSETS Current Asset: Cash (Notes 2 and 4(1)) $ 27,065,987 12 26,294,882 9 Financial assets reported -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

The Impact of the Global Economic Crisis on Cross Strait Relatiions

Track Two Dialogue on EU-China-Relations and Cross Strait Relations London, LSE, 29-31 May 2009 A workshop jointly organised by Stiftung Wissenschaft und Politik (SWP), Berlin, London School of Economics (LSE), London and Shanghai Institutes for International Studies (SIIS), Shanghai, with the friendly support of the Robert Bosch Stiftung GmbH, Stuttgart. Discussion Paper Do not cite or quote without author’s permission The Political Impact of the Global Economic Crisis on Cross Strait Relations Christopher R Hughes London School of Economics and Political Science SWP Ludwigkirchplatz 3–4 10719 Berlin Phone +49 30 880 07-0 Fax +49 30 880 07-100 www.swp-berlin.org 1 In the years leading up to Taiwan’s 2008 elections a number of measures were planned by the CCP and the KMT to liberalise cross-Strait relations and give Taiwan’s economy a substantial boost under a future Ma Ying-jeou administration. Few people predicted that in September 2008 this process would be thrown into turmoil by the deepening of the global financial crisis. Policies that had been devised for improving cross-strait relations in the context of growth in world trade and investment have had to be reassessed in the context of a recession in Taiwan and a serious slowdown of the mainland economy. How this interplay between economic policy and public opinion plays out will be crucial for shaping the future of cross-Strait relations. While it is too late to predict the outcome, this paper will explore the importance of cross-Strait economic relations for Taiwan’s politics, make a preliminary assessment of the political impact of the economic crisis on cross-strait relations and point to some speculative scenarios for the future.