The Mineral Industry of Taiwan in 2004

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Financial Statements for the Nine Months Ended September 30, 2020 and 2019 and Independent Auditors’ Review Report Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019 (Amounts in Thousands of New Taiwan Dollars, Unless Specified Otherwise) (Reviewed, Not Audited) 1. GENERAL Taiwan Semiconductor Manufacturing Company Limited (TSMC), a Republic of China (R.O.C.) corporation, was incorporated on February 21, 1987. TSMC is a dedicated foundry in the semiconductor industry which engages mainly in the manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and the manufacturing of masks. On September 5, 1994, TSMC’s shares were listed on the Taiwan Stock Exchange (TWSE). On October 8, 1997, TSMC listed some of its shares of stock on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADSs). The address of its registered office and principal place of business is No. 8, Li-Hsin Rd. 6, Hsinchu Science Park, Taiwan. The principal operating activities of TSMC’s subsidiaries are described in Note 4. 2. THE AUTHORIZATION OF FINANCIAL STATEMENTS The accompanying consolidated financial statements were reported to the Board of Directors and issued on November 10, 2020. 3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS a. Initial application of the amendments to the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), IFRIC Interpretations (IFRIC), and SIC Interpretations (SIC) (collectively, “IFRSs”) endorsed and issued into effect by the Financial Supervisory Commission (FSC) The initial application of the amendments to the IFRSs endorsed and issued into effect by the FSC did not have a significant effect on TSMC and its subsidiaries’ (collectively as the “Company”) accounting policies. -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Inventec Corporation

(English Translation of Pro Forma Financial Report Originally Issued in Chinese) PEGATRON CORPORATION AND ITS SUBSIDIARIES PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2008 AND 2007 (With Independent Auditors’ Report Thereon) Address: 5F., No.76, Ligong St., Beitou District, Taipei City 112, Taiwan Telephone: 886-2-8143-9001 - 1 - TABLE OF CONTENTS Contents Page Cover Page 1 Table of Contents 2 Independent Auditors’ Report 3 Pro Forma Consolidated Balance Sheets 4 Pro Forma Consolidated Statements of Income 5 Pro Forma Consolidated Statements of Changes in Stockholders’ Equity 6 Pro Forma Consolidated Statements of Cash Flows 7 Notes to Pro Forma Consolidated Financial Statements (1) Organization and Business 8 (2) Summary of Significant Accounting Policies 8-28 (3) Reasons for and Effects of Accounting Changes 28 (4) Summary of Major Accounts 28-49 (5) Related-Party Transactions 50-56 (6) Pledged Assets 56 (7) Significant Commitments and Contingencies 57-58 (8) Significant Catastrophic Losses 59 (9) Significant Subsequent Events 59 (10) Others 59 (11)Additional Disclosures 60-61 (12)Segment Information 61-62 - 2 - (English Translation of Financial Report Originally Issued in Chinese) PEGATRON CORPORATION AND ITS SUBSIDIARIES PRO FORMA CONSOLIDATED BALANCE SHEETS DECEMBER 31, 2008 AND 2007 (All Amounts Expressed in Thousands of New Taiwan Dollars, Except for Share Data) December 31, 2008 December 31, 2007 Amount % Amount % ASSETS Current Asset: Cash (Notes 2 and 4(1)) $ 27,065,987 12 26,294,882 9 Financial assets reported -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

Of 21 Voya Emerging Markets Index Portfolio Portfolio Holdings As of August 31, 2021 (Unaudited)

Voya Emerging Markets Index Portfolio Portfolio Holdings as of August 31, 2021 (Unaudited) Ticker Security Name Crncy Country Price Quantity Market Value VNET 21Vianet Group, Inc. USD China 19.79 8,311 $164,475 QFIN 360 DigiTech, Inc. USD China 22.80 8,162 $186,094 601360 360 Security Technology, Inc. - A Shares CNY China 1.84 29,600 $54,506 1530 3SBio, Inc. HKD China 1.11 111,500 $124,214 JOBS 51job, Inc. USD China 76.80 2,743 $210,662 3319 A-Living Smart City Services Co. Ltd. HKD China 3.97 54,250 $215,608 2018 AAC Technologies Holdings, Inc. HKD China 5.54 72,500 $401,916 AOTHAI Abdullah Al Othaim Markets Co. SAR Saudi Arabia 30.74 4,275 $131,424 M AEV Aboitiz Equity Ventures, Inc. PHP Philippines 0.86 180,620 $155,767 ABG Absa Group Ltd. ZAR South Africa 10.83 70,934 $768,205 ADCB Abu Dhabi Commercial Bank PJSC AED United Arab Emirates 2.04 280,089 $572,661 ADIB Abu Dhabi Islamic Bank PJSC AED United Arab Emirates 1.54 99,971 $153,456 ADNOC Abu Dhabi National Oil Co. for Distribution PJSC AED United Arab Emirates 1.23 199,367 $245,264 DIS ACC ACC Ltd. INR India 33.00 7,090 $233,946 2345 Accton Technology Corp. TWD Taiwan 10.13 50,000 $506,568 2353 Acer, Inc. TWD Taiwan 0.91 286,462 $259,982 ADE Adani Enterprises Ltd. INR India 21.72 26,370 $572,781 ADANIG Adani Green Energy Ltd. INR India 14.60 38,606 $563,753 R ADSEZ Adani Ports & Special Economic Zone, Ltd. -

Formosa Plastics Corp

Formosa Plastics Corp. Primary Credit Analyst: Apple Lo, Hong Kong (852) 2533-3542; [email protected] Secondary Contact: Raymond Hsu, CFA, Taipei (8862) 8722-5827; [email protected] Table Of Contents Rationale Outlook Standard & Poor's Base-Case Scenario Company Description Business Risk Financial Risk Liquidity Other Credit Considerations Group Influence Ratings Score Snapshot Reconciliation Related Criteria And Research WWW.STANDARDANDPOORS.COM/RATINGSDIRECT OCTOBER 29, 2015 1 1472237 | 302312798 Formosa Plastics Corp. Business Risk: SATISFACTORY CORPORATE CREDIT RATING Vulnerable Excellent bbb+ bbb+ bbb BBB+/Stable/-- Financial Risk: INTERMEDIATE Highly leveraged Minimal Anchor Modifiers Group/Gov't Greater China Regional Scale Taiwan National Scale cnA+/--/-- twAA-/Stable/twA-1+ Rationale Business Risk: Satisfactory Financial Risk: Intermediate • Strong operating efficiency and product diversity. • Improving cash flow adequacy in 2015-2016. • Strong domestic market position in the • Anticipated improvement in the group's leverage, petrochemical and oil refining industries. due to improving profitability and debt reduction • Higher risk non-core investments. efforts. • Highly cyclical commodity chemical industry. • Reduction of ownership in and debt guarantee on • Asset concentration and rising regulatory risk on Formosa Ha Tinh Steel Corp. environmental protection. • Disposable investment enhances its financial flexibility. WWW.STANDARDANDPOORS.COM/RATINGSDIRECT OCTOBER 29, 2015 2 1472237 | 302312798 Formosa Plastics Corp. Outlook: Stable The rating outlook is stable, based on our assessment that the Formosa Plastics (FP) group will continue to lower its debt through its operating cash flows, repayment of intercompany loans from affiliate companies, and lower debt guarantee for Vietnam-based Formosa Ha Tinh Steel following the completion of capital injections by strategic investors. -

Mediatek Inc. 2011 Annual Report

MediaTek Inc. 2011 Annual Report Publish Date: March 31, 2012 MediaTek annual report is available online at: TSE website: http://newmops.tse.com.tw MediaTek website: http://www.mediatek.com/en/Investor/financial03.php MediaTek Inc. | 2011 Annual Report 1 WorldReginfo - d74a30db-28e7-434a-ae22-237bcf5db662 Contact Information Spokesperson: Name: David Ku Title: Chief Financial Officer TEL: +886-(0)3-567-0766 Email: [email protected] Deputy Spokesperson: Name: Sophia Liang Title: Director, Investor Relations Division TEL: +886-(0)3-567-0766 Email: [email protected] MediaTek Inc. Headquarters: Address: No. 1, Dusing Rd. 1, Hsinchu Science Park, Hsinchu, Taiwan, R.O.C., 300 TEL: +886-(0)3-567-0766 Fax: +886-(0)3-578-7610 MediaTek Inc. Taipei Office: Address: No. 15, Lane 91, Sec. 1, Neihu Rd., Neihu District, Taipei, Taiwan, R.O.C., 114 TEL: +886-(0)2-2659-8088 Transfer Agent: Company: Chinatrust Commercial Bank, Corporate Trust Service Department Address: 5F, No. 83, Chungching S. Rd., Sec. 1, Taipei, Taiwan, R.O.C. TEL: +886-(0)2-2181-1911 Website: http://www.chinatrust.com.tw Independent Auditor: Company: Ernst & Young Auditors: Shao-Pin Kuo, Hsin-Min Hsu Address: 9F, No.333, Keelung Rd., Sec. 1, Taipei, Taiwan, R.O.C. TEL: +886-(0)2-2720-4000 Website: www.ey.com/tw MediaTek Inc. Website: Website: www.mediatek.com MediaTek Inc. | 2011 Annual Report 2 WorldReginfo - d74a30db-28e7-434a-ae22-237bcf5db662 2011 MediaTek Annual Report Table of Contents 1. Letter to Shareholders ............................................................................................................. 5 2. Company Profile ....................................................................................................................... 7 2.1. MediaTek Company Profile ................................................................................................ 7 2.2. Milestones........................................................................................................................ 7 3. -

Taiwan: Policy Drive for Innovation

Taiwan: Policy Drive for Innovation Highlights from GRIPS Development Forum Policy Mission Kenichi Ohno (GRIPS) May 2011 Topics The GRIPS Development Forum Team, with Japanese, Ethiopian and Vietnamese members, visited the Republic of China (Taiwan) during March 21-25, 2011. The following issues were studied: Evolution of policy and key industries Policy making process Research institutes Hsinchu Science Park Export processing zones SME Policy Profile of Taiwan Area – 36,191 km 2 Population – 23 million Per capita income – US$19,046 (2010) Industry policy focus (key industry) 1950s – Import substitution (food) 1960s – Export expansion (textile) 1970s – Infrastructure (petrochemical) 1980s – Economic liberalization (IT) 1990s – Industrial upgrading (integrated circuits) 2000s – Global deployment (liquid crystal display) Policy Evolution 1950s to mid 1980s— “Governing the Market” model with strong state and powerful bureaucracy; SMEs as main producers and exporters After mid 1980s—(i) growth of private sector; (ii) rise of large domestic firms, relative decline of SMEs & FDI; (iii) trade liberalization; (iv) economic interaction with Mainland China Current issues: - Innovation, R&D, soft power, national brands - Foster larger firms to compete globally - Cope effectively with Mainland China Silicon Island Taiwan has transformed itself from agro exporter (rice, sugar, bananas) to top ICT manufacturer with global shares as below: MADE IN TAIWAN: MADE BY TAIWAN: Direct export from Taiwan Including overseas production Mask ROM 93.8% Motherboard 95.5% IC foundry 66.4% Notebook PC 95.0% Blank optical disk 63.0% Server 88.9% IC package 44.4% WLAN CPE 81.0% Electronic glass fabric 39.0% Cable Modem 78.6% IC design 27.0% Car navigation device 76.9% DRAM 21.8% LCD monitor 71.8% Note: global market share in 2009 reported by the Ministry of Economic Affairs, ROC. -

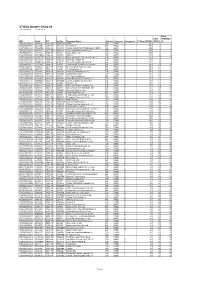

Listing Changes in 2003

Listing Changes in 2003 Listings Name Code Date Listings Name Code Date Common First Financial Holding Co. Ltd. 2892 2-Jan Compal Communications Inc. 8078 9-Dec Stocks Johnson Health Tech. Co., Ltd. 1736 9-Jan Sitronix Technology Corp. 8016 25-Dec Makalot Industrial Co., Ltd. 1477 21-Jan Formosa Petrochemical Corp 6505 26-Dec KING BILLION ELECTRONICS CO., LTD. 3056 3-Mar Taiwn Chang Type Industrial Co., Ltd. 541 19-Mar Depository FORMOSA EPITAXY INCORPORATION 3061 11-Apr Receipts Mustek Limited 9104 20-Jan MIN AIK TECHNOLOGY CO., LTD. 3060 21-Apr Cal-Comp Electronics(Thailand) Public Co., Ltd. 9105 22-Sep GENERAL PLASTIC INDUSTRIAL CO., LTD. 6128 16-Jun Warrants Gemtek Technology Co., Ltd. 4906 30-Jun CyberTAN Technology, Inc. 3062 28-Jul Yunta Core Pacific-Uni-President Enterprises Corp. Jul. 03 0768 3-Jan SYSAGE THCHNOLOGY CO., LTD. 6112 4-Aug Fubon-Chinatrust Group Jan. 04 0769 6-Jan JYE TAI PRECISION INDUSTRIAL. CO., LTD. 6165 4-Aug Fubon-Sinopac Holdings Jan. 04 0770 8-Jan RECHI PRECISION CO., LTD. 4532 4-Aug Jih Sun-Asustek Jan. 04 0771 9-Jan CAMEO COMMUNICATIONS, INC. 6142 4-Aug China Trust-Fubon Financial Jul. 03 0772 10-Jan TECO ENTERPRISE CO., LTD. 6119 4-Aug Yuanta Core Pacific-Asustek Computer Jul. 03 0773 16-Jan Wistron Corporation 3231 19-Aug Masterlink-Pou Chen Jul. 03 0774 17-Jan SIGURD MICROELECTRONICS CORP. 6257 25-Aug Yuanta Core Pacific-Via Technologies Jul. 03 0775 20-Jan HannStar Board Corp. 5469 25-Aug Sinopac-Siliconware Jul. 03 0777 21-Jan EverFocus Electronics Corp. -

Emerging 2012

FT Emerging Newcomers FT Emerging 500 2012 Newcomers to the list Emerging Company Country Sector rank 2012 Sociedad Química y Minera Chile Chemicals 120 China Communications Construction China Construction & materials 123 New China Life Insurance China Life insurance 145 Ultrapar Participacioes Brazil Gas, water & multiutilities 175 San Miguel Brewery Philippines Beverages 206 PTT Global Chemical Thailand Oil & gas producers 211 Inter Rao UES Russia Electricity 217 BYD China Automobiles & parts 240 Alrosa Russia Mining 290 Arca Continental Mexico Beverages 294 Lojas Americanas Brazil General retailers 319 Tiger Brands South Africa Food producers 337 Far EasTone Telecommunications Taiwan Mobile telecommunications 338 Exito Colombia Food & drug retailers 346 Great Wall Motor China Automobiles & parts 360 SinoHydro China Construction & materials 362 Ayala Land Philippines Real estate investment & services 363 Total Access Communications Thailand Mobile telecommunications 364 Telekom Malaysia Malaysia Fixed line telecommunications 368 Alinma Bank Saudi Arabia Banks 370 Bank of the Philippine Islands Philippines Banks 372 YTL Malaysia Gas, water & multiutilities 377 Cheng Shin Rubber Industries Taiwan Automobiles & parts 383 BR Malls Brazil Real estate investment & services 384 Ideal Mexico Construction & materials 387 President Chain Store Taiwan Food & drug retailers 391 Masraf Al Rayan Qatar Banks 395 Inner Mongolia Yili Industrial China Food producers 398 SM Prime Holdings Philippines Real estate investment & services 402 Ayala Philippines -

China Steel Corporation and Subsidiaries

China Steel Corporation and Subsidiaries Consolidated Financial Statements for the Three Months Ended March 31, 2021 and 2020 and Independent Auditors’ Review Report The engagement partners on the reviews resulting in this independent auditors’ review report are Jui-Hsuan Hsu and Cheng-Hung Kuo. Deloitte & Touche Taipei, Taiwan Republic of China May 7, 2021 Notice to Readers The accompanying consolidated financial statements are intended only to present the consolidated financial position, financial performance and cash flows in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards, procedures and practices to review such consolidated financial statements are those generally applied in the Republic of China. For the convenience of readers, the independent auditors’ review report and the accompanying consolidated financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language independent auditors’ review report and consolidated financial statements shall prevail. - 2 - CHINA STEEL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thousands of New Taiwan Dollars) March 31, 2021 (Reviewed) December 31, 2020 (Audited) March 31, 2020 (Reviewed) ASSETS Amount % Amount % Amount % CURRENT ASSETS Cash and -

The Mineral Industry of Taiwan in 2015

2015 Minerals Yearbook TAIWAN [ADVANCE RELEASE] U.S. Department of the Interior November 2018 U.S. Geological Survey The Mineral Industry of Taiwan By Spencer D. Buteyn Taiwan is an island with limited mineral resources. In 2015, produced 21.4 million metric tons (Mt) of steel and was the Taiwan’s real gross domestic product (GDP) increased by 0.65% fifth-ranked crude steel producer in Asia, behind China, Japan, to $472 billion1 [15,616 billion Taiwan new dollars (TWD)] India, and the Republic of Korea. The value of iron and steel compared with a 3.9% increase in 2014. The county’s economy exports fell by nearly 25% in 2015. This was the largest relied heavily on exports and, therefore, depended considerably decrease in iron and steel exports since 2009. This decrease on world market demand. Mineral products accounted for about was attributed to lower global steel prices and the expansion of 8% of exports. China (excluding Hong Kong) was the leading China’s steel production capacity. The quantity of iron and steel destination of Taiwan’s exports, accounting for 25% of exports, exports to China and Hong Kong decreased by 14% and 50%, followed by Hong Kong, 13%; the United States, 12%; and respectively. Taiwanese steel exports to Europe were affected Japan, 6%. Exports to European Union (EU) member countries by a 12% tariff placed on cold-rolled flat stainless steel from accounted for 8% of Taiwan’s exports (Directorate General Taiwan in March by the EU. The quantity of iron and steel of Budget, Accounting and Statistics, 2016, p.