Capital Adequacy Regulation (CAR)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

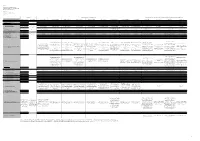

Basel III: Post-Crisis Reforms

Basel III: Post-Crisis Reforms Implementation Timeline Focus: Capital Definitions, Capital Focus: Capital Requirements Buffers and Liquidity Requirements Basel lll 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 1 January 2022 Full implementation of: 1. Revised standardised approach for credit risk; 2. Revised IRB framework; 1 January 3. Revised CVA framework; 1 January 1 January 1 January 1 January 1 January 2018 4. Revised operational risk framework; 2027 5. Revised market risk framework (Fundamental Review of 2023 2024 2025 2026 Full implementation of Leverage Trading Book); and Output 6. Leverage Ratio (revised exposure definition). Output Output Output Output Ratio (Existing exposure floor: Transitional implementation floor: 55% floor: 60% floor: 65% floor: 70% definition) Output floor: 50% 72.5% Capital Ratios 0% - 2.5% 0% - 2.5% Countercyclical 0% - 2.5% 2.5% Buffer 2.5% Conservation 2.5% Buffer 8% 6% Minimum Capital 4.5% Requirement Core Equity Tier 1 (CET 1) Tier 1 (T1) Total Capital (Tier 1 + Tier 2) Standardised Approach for Credit Risk New Categories of Revisions to the Existing Standardised Approach Exposures • Exposures to Banks • Exposure to Covered Bonds Bank exposures will be risk-weighted based on either the External Credit Risk Assessment Approach (ECRA) or Standardised Credit Risk Rated covered bonds will be risk Assessment Approach (SCRA). Banks are to apply ECRA where regulators do allow the use of external ratings for regulatory purposes and weighted based on issue SCRA for regulators that don’t. specific rating while risk weights for unrated covered bonds will • Exposures to Multilateral Development Banks (MDBs) be inferred from the issuer’s For exposures that do not fulfil the eligibility criteria, risk weights are to be determined by either SCRA or ECRA. -

Capital Adequacy Ratio, Bank Credit Channel and Monetary Policy Effect 203

Chapter 16 Provisional chapter Capital Adequacy Ratio, Bank Credit Channel and Capital Adequacy Ratio, Bank Credit Channel Monetary Policy Effect and Monetary Policy Effect Li Qiong Li Qiong Additional information is available at the end of the chapter Additional information is available at the end of the chapter http://dx.doi.org/10.5772/64477 Abstract This chapter, based on the theory model derived from bank credit transmission channel and the balanced panel data of 18 Chinese commercial banks from 2008 to 2012, con- ducts empirical test and carries out classified study of China’s bank credit transmission channel and the effect of capital adequacy ratio on credit channel. Results show that the bank characteristics have, on a micro level, heterogeneity effects on credit transmission channel of monetary policy. Banks of higher capital adequacy ratio and smaller asset size are more vulnerable to the impacts of monetary policy. Therefore, the author pro- poses policy suggestions from the perspectives of optimizing the structure of financial markets and improving the monetary policy effect. Keywords: monetary policy, bank credit channel, bank characteristics, capital ade- quacy ratio 1. Introduction The credit channel is the main transmission mechanism by which bank capital adequacy ratio affects monetary policy effect. The credit channel emphasizes the important role of bank assets and liabilities in the transmission mechanism of monetary policy. The bank loan channel theory claims that monetary policy will affect the real economy by changing the bank loan supply behaviors. After the 2008 financial crisis, the Basel Agreement III rushed out. Interna- tional agencies generally raised the bar of commercial bank capital regulation, which stipu- lated the minimum capital ratio and improved the capital adequacy ratio at the same time. -

2019 Capital Adequacy Ratio Report

AGRICULTURAL BANK OF CHINA LIMITED 中國農業銀行股份有限公司 2019 CAPITAL ADEQUACY RATIO REPORT Contents 1 Overview......................................................................................................................................4 1.1 Profile................................................................................................................................4 1.2 Capital Adequacy Ratio.................................................................................................... 5 1.3 Disclosure Statement........................................................................................................ 6 2 Risk Management Framework.....................................................................................................8 2.1 Firm-wide Risk Management........................................................................................... 8 2.2 Risk Appetite.................................................................................................................... 8 2.3 Structure and Organization of Risk Management.............................................................9 2.4 Risk Management Policies and Systems........................................................................ 10 2.5 Risk Management Tools and IT Systems....................................................................... 11 3 Information on Composition of Capital.....................................................................................14 3.1 Scope for Calculating Capital Adequacy Ratio............................................................. -

Pillar 3 (Basel Iii) Disclosures As on 31.03.2021 Central Bank of India

PILLAR 3 (BASEL III) DISCLOSURES AS ON 31.03.2021 CENTRAL BANK OF INDIA Table DF-1: Scope of Application (i) Qualitative Disclosures: The disclosure in this sheet pertains to Central Bank of India on solo basis. In the consolidated accounts (disclosed annually), Bank‟s subsidiaries/associates are treated as under a. List of group entities considered for consolidation Name of the Whether the Explain the Whether the Explain the Explain the Explain the entity / Country entity is method of entity is method of reasons for reasons if of incorporation included consolidation included consolidation difference in consolidated under under the method under only one accounting regulatory of of the scopes scope of scope of consolidation of consolidation consolidation consolidation (yes / no) (yes / no) Cent Bank Yes Consolidatio Yes NA NA NA Home Finance n of the Ltd./ India financial statements of subsidiaries in accordance with AS- 21. Cent Bank Yes Consolidatio Yes NA NA NA Financial n of the Services financial Ltd./India statements of subsidiaries in accordance with AS- 21 Uttar Bihar Yes Consolidatio No NA NA Associate: Gramin Bank, n of the Not under Muzzaffarpur/ financial scope of regulatory India statements of Consolidation subsidiaries in accordance with AS- 23 1 Uttar Banga Yes Consolidatio No NA NA Associate: Kshetriya n of the Not under Gramin Bank, financial scope of regulatory Cooch Behar/ statements of Consolidation India subsidiaries in accordance with AS- 23 Indo-Zambia Yes Consolidatio No NA NA Joint Bank Ltd. n of the Venture: Not /Zambia. financial under scope of regulatory statements of Consolidation subsidiaries in accordance with AS- 23 b. -

Navigating Through the Pandemic from a Position of Strength

Navigating Through the Pandemic from a Position of Strength Citi’s Commitment Supporting ICG Clients And Customers During these uncertain times, Citi remains well- Our ICG colleagues are working around the clock We are actively supporting our consumer clients positioned from a capital and liquidity to help our institutional clients navigate volatile through this unprecedented time. perspective. markets and manage their business needs as the • We continue to serve our customers while taking We have a strong balance sheet and will continue economic impacts of the pandemic continue to measures to help reduce the spread of COVID-19. to actively support our clients and customers evolve. As such, we have temporarily adjusted branch hours through this challenging period. • In BCMA, we continue lending to companies in and closed some locations. greatly affected industries, including airlines, leisure, • We were one of the first banks to announce industrials, autos and energy. We are helping blue assistance measures for impacted consumers and Key Financial Metrics chip multinationals strengthen their liquidity positions small businesses in the U.S. and are presenting clients with additional options to • Citibank's individual and Small Business customers (As of September 30, 2020) equitize and monetize. We are proud to work closely impacted by COVID-19 may be eligible for the Managing well through this crisis year-to-date with governments and the public sector to find following assistance measures, upon request. liquidity alternatives and have been working on the • Significant earnings power with ~$7B of net issuance of social bonds to support countries in the - Retail Bank: Fee waivers on monthly service income, despite ~$11B increase in credit Emerging Markets. -

Capital-Instruments-Key-Features-Table

Capital instruments of UBS Group AG (consolidated) and UBS AG (consolidated and standalone) as of 31 March 2016 Key features Ordered by issuance date within each category Based on Swiss SRB Basel III phase-in requirements Issued on 4 May 2016 Share capital Additional Tier 1 capital instruments (Basel III compliant) Additional Tier 1 capital / Tier 2 capital instruments in the form of hybrid instruments and related subordinated notes (non-Basel III compliant) UBS Group AG, Switzerland, or other employing UBS Group AG, Switzerland, or other UBS Preferred Funding Trust IV UBS AG, Switzerland UBS Preferred Funding Trust V UBS AG, Switzerland 1 Issuer (country of incorporation; if applicable, branch) UBS Group AG, Switzerland UBS AG, Switzerland UBS Group AG, Switzerland UBS Group AG, Switzerland UBS Group AG, Switzerland UBS Group AG, Switzerland UBS AG, Switzerland UBS Group AG, Switzerland UBS AG, Switzerland entities of the Group employing entities of the Group Delaware, US Cayman branch Delaware, US Cayman branch 1a Instrument number 001 002 003 004 005 006 007 008 009 010 011 012 013 014 015 2 Unique identifier (e.g. ISIN) ISIN: CH0244767585 ISIN: CH0024899483 - ISIN: CH0271428309 ISIN: CH0271428317 ISIN: CH0271428333 ISIN: CH0286864027 - - ISIN: CH0317921697 - ISIN: US90263W2017 - ISIN: US90264AAA79 - 3 Governing law(s) of the instrument Swiss Swiss Swiss / NY, US Swiss law Swiss law Swiss law Swiss law Swiss law Swiss / NY, US Swiss law Swiss law Delaware, US NY, US Delaware, US NY, US Regulatory treatment 4 Transitional Basel III -

Regulatory Capital and Risk Management Pillar 3 Disclosures

2021 HSBC Bank Canada Regulatory Capital & Risk Management Pillar 3 Supplementary Disclosures As at March 31, 2021 HSBC Bank Canada Pillar 3 Supplementary Disclosure First Quarter 2021 1 Contents Page Notes to users 3 Road map to Pillar 3 disclosures 4 Capital and RWA 5 Regulatory Capital Disclosure - CC1 5 Overview of Risk Weighted Assets (RWA) - OV1 6 Credit Risk 6 RWA flow statements of credit risk exposures under IRB - CR8 6 Market Risk 6 RWA flow statements of market risk exposures under an Internal Model Approach (IMA) - MR2 7 Leverage Ratio 7 Summary comparison of accounting assets vs. leverage ratio exposure measure (LR1) 7 Leverage Ratio Common Disclosure (LR2) 8 Glossary 9 2 HSBC Bank Canada Pillar 3 Supplementary Disclosure First Quarter 2021 Notes to users Regulatory Capital and Risk Management Pillar 3 Disclosures The Office of the Superintendent of Financial Institutions (“OSFI”) supervises HSBC Bank Canada (the “Bank”) on a consolidated basis. OSFI has approved the Bank’s application to apply the Advanced Internal Ratings Based (“AIRB”) approach to credit risk on our portfolio and the Standardized Approach for measuring Operational Risk. Please refer to the Annual Report and Accounts 2020 for further information on the Bank’s risk and capital management framework. Further information regarding HSBC Group Risk Management Processes can be found in HSBC Holdings plc Capital and Risk Management Pillar 3 Disclosures available on HSBC Group’s investor relations web site. The Pillar 3 Supplemental Disclosures are additional summary -

Global Crisis Impact in Banking System for Western Balkan Countries

Economics Questions, Issues and Problems, ISBN 978-80-89691-07-4 Global Crisis Impact in Banking System for Western Balkan Countries © Denada HAFIZI National Commercial Bank Shkodra Branch, Shkodra, Albania [email protected] © Irjan BUSHI Universiteti Metropolitan i Tiranes, Tirana, Albania [email protected] The current global economic crisis has affected in banking system for Western Balkan countries. This concern is expressed with the contraction of lending, fallen of the volume of remittances, fallen of international trade, and fallen of foreign direct investments. The aim of this paper is to present an overview of the credit risk that the banking system function for Western Balkan Countries faces. For all these countries will be presented the trend of NPLs for all these countries for a time series of 2008-2012. After, from data taken from international monetary fund we will give some conclusions for the main problems that increased credit risk. Introduction According to IIBF (2010) the definitions of NPLs, ROE, ROA, EM and Regulatory capital as a percent of risk-weighted assets is as below: Definition of Nonperforming Loan – NPLs : A sum of borrowed money upon which the debtor has not made his or her scheduled payments for at least 90 days. Definition of Return on Assets – ROA : An indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. The formula for return on assets is : ROA = Net Income/Total assets. Definition of Return on Equity – ROE : The amount of net income returned as a percentage of shareholders equity. -

2Q21 Net Profit of USD 2.0Bn, 19.3% Return on CET1 Capital

Investor Relations Tel. +41-44-234 41 00 Media Relations Tel. +41-44-234 85 00 Ad Hoc Announcement Pursuant to Article 53 of the SIX Exchange Regulation Listing Rules 2Q21 net profit of USD 2.0bn, 19.3% return on CET1 capital “We sustained our business momentum in 2Q21 as we continued to be a trusted partner for clients. Our focus on growth, relentless execution and evolution of our strategic initiatives drove strong financial performance across all businesses, resulting in a pre-tax profit of USD 2.6bn.” Ralph Hamers, Group CEO Group highlights We are executing We are delivering on We are committed relentlessly our strategic initiatives to driving higher for our clients to drive growth and returns by unlocking efficiency the power of UBS 2.0 0.55 19.3 14.5 USD bn USD % % Net profit Diluted earnings RoCET1 capital CET1 capital ratio attributable to per share UBS Group AG shareholders UBS’s 2Q21 results materials are available at ubs.com/investors The audio webcast of the earnings call starts at 09:00 CEST, 20 July 2021 UBS Group AG and UBS AG, Media Release, 20 July 2021 Page 1 of 17 Investor Relations Tel. +41-44-234 41 00 Media Relations Tel. +41-44-234 85 00 Group highlights We are executing relentlessly We are delivering on our strategic for our clients initiatives to drive growth and efficiency Our clients continued to put their trust in us as was During 1H21, we facilitated more than USD 18bn of evident from the continued momentum in flows and investments into private markets from private and volume growth. -

The Effect of Capital Adequacy Ratio, Net Interest Margin and Non-Performing Loans on Bank Profitability: the Case of Indonesia

International Journal of Economics and Business Administration Volume V, Issue 3, 2017 pp. 58-69 The Effect of Capital Adequacy Ratio, Net Interest Margin and Non-Performing Loans on Bank Profitability: The Case of Indonesia Pasaman Silaban1 Abstract: The purpose of this study is to test and determine the Bank's health level consisting of capital adequacy ratio (CAR), net interest margin (NIM), and non performing loans (NPL) partially or simultaneously on bank profitability based on data from the Indonesian Stock Exchange. The population of this study is all state and private banks listed in the Indonesian Stock Exchange (ISE) amounting to 40. Observations are conducted from 2012 to 2016. The results indicate that capital adequacy ratio (CAR) does not have a significant effect on bank profitability. Net interest margin (NIM) improves the growth of bank profitability. This can happen because NIM has a component of net interest in its ratio. Non performing loans (NPL) have a negative effect on bank profitability. Keywords: Capital adequacy ratio, net interest margin, non performing loan, profitability. 1Professor at the Faculty of Economics of Universitas HKBP Nommensen, Medan, North Sumatra, Indonesia. Email: [email protected] S. Pasaman 59 1. Introduction Banks are the most important financial institutions and greatly affect both micro and macro economics. Banks have a large share of the market, which is about 80 percent of the overall financial system (Abidin, 2007). Given the importance of the role that banks play in Indonesia, decision makers need to perform adequate performance evaluations. The level of health of the bank is important for maintaining the stability of the national financial system (Thomson, 1991). -

On the Rising Complexity of Bank Regulatory Capital Requirements: from Global Guidelines to Their United States (US) Implementation

Journal of Risk and Financial Management Review On the Rising Complexity of Bank Regulatory Capital Requirements: From Global Guidelines to their United States (US) Implementation James R. Barth 1 and Stephen Matteo Miller 2,* 1 Lowder Eminent Scholar in Finance, Auburn University, Auburn, AL 36849, USA; [email protected] 2 Senior Research Fellow, Mercatus Center at George Mason University, Fairfax, VA 22030, USA * Correspondence: [email protected] Received: 2 October 2018; Accepted: 30 October 2018; Published: 1 November 2018 Abstract: After the Latin American Debt Crisis of 1982, the official response worldwide turned to minimum capital standards to promote stable banking systems. Despite their existence, however, such standards have still not prevented periodic disruptions in the banking sectors of various countries. After the 2007–2009 crisis, bank capital requirements have, in some cases, increased and overall have become even more complex. This paper reviews (1) how Basel-style capital adequacy guidelines have evolved, becoming higher in some cases and overall more complex, (2) how the United States (US) implementation of these guidelines has contributed to regulatory complexity, even when omitting other bank capital regulations that are specific to the US, and (3) how the US regulatory measures still do not provide equally valuable information about whether a bank is adequately capitalized. Keywords: bank regulation; capital adequacy standards; regulatory complexity; US banking crises JEL Classification: G01; G28; K20; L51; N22; N42 1. Introduction1 Banks are vital in facilitating the exchange of goods and services by providing a payment system and channeling savings to productive investment projects that foster economic activity. -

Education Note Lead Analyst Understanding Bank Capital UBS Financial Services, Inc

UBS Wealth Management Research / 26 March 2008 a b Education Note Lead analyst Understanding Bank Capital UBS Financial Services, Inc. Dean Ungar, CFA At a glance Asset Class: Equity This education note explains different capital measures used by regulators and analysts to assess the capital adequacy of US banking organizations. Capital adequacy moves onto the radar screen Large write-downs of securities backed by subprime mortgages along with increasing loan losses resulted in losses or minimal earnings per share at a number of US banks in 2007. Overall, earnings for the sector were down approximately 25% during the year. And stormy days are far from over. The outlook for 2008 includes further increases in loan losses and addi- tional credit costs as banks need to augment loan loss reserve levels. The pressure on bank earnings has had an adverse effect on bank capital levels. The average Tier 1 capital ratio (Tier 1 capital/risk-weighted assets) Chart 1 for US banks with market capitalization (cap) of USD 1 billion or more de- Tangible equity ratio – 10 largest banks clined from 11.2% as of 31 December, 2006 to 10.8% as of 31 Decem- ber, 2007. For the top 10 largest banks, the Tier 1 ratio declined from Tangible equity ratio - 10 largest banks 9.1% to 8.0% over the same period. Despite the decline, these ratios are 7.50 well above the 6.0% level that regulators consider well-capitalized. In fact, as of year-end 2007, there was no bank with market cap of USD 1 billion 7.00 or more with a Tier 1 ratio below 6.5%.