The Estate (Inheritance) Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preview Chapter 7: a Few Good Women

7 A Few Good Women Zhou Qunfei grew up poor in Hunan Province, where she worked on her family’s farm to help support her family. Later, while working at a factory in Guangdong Province, she took business and computer courses at Shen- zhen University. She started a company with money she saved working for a watch producer. In 2015 she was the world’s richest self-made woman, with a fortune of $5.3 billion, according to Forbes. Her wealth comes from her company, Lens Technology, which makes touchscreens. It employs 60,000 people and has a market capitalization of nearly $12 billion. Lei Jufang was born in Gansu Province, one of the poorest areas of northwest China. After studying physics at Jiao Tong University, she cre- ated a new method for vacuum packaging food and drugs, which won her acclaim as an assistant professor. On a trip to Tibet she became fascinated by herbal medicines. In 1995 she founded a drug company, Cheezheng Tibetan Medicine, harnessing her skill in physics and engineering to exploit the untapped market for Tibetan medicine. Her company has a research institute and three factories that produce herbal healing products for con- sumers in China, Malaysia, Singapore, and North and South America. She has amassed a fortune of $1.5 billion. In most countries, women get rich by inheriting money. China is dif- ferent: The majority of its women billionaires are self-made. Zhou Qunfei and Lei Jufang are unusual because they established their own companies. Most of the eight Chinese female self-made company founders worth more than $1 billion made their money in real estate or in companies founded jointly with husbands or brothers. -

September 22, 2019 Democracies Become Oligarchies When Wealth Is

UNIVERSITY OF CALIFORNIA, BERKELEY BERKELEY • DAVIS • IRVINE • LOS ANGELES • MERCED • RIVERSIDE • SAN DIEGO • SAN FRANCISCO SANTA BARBARA • SANTA CRUZ EMMANUEL SAEZ AND GABRIEL ZUCMAN PROFESSORS OF ECONOMICS 530 EVANS HALL #3880 BERKELEY CA 94720 -3880 [email protected] [email protected] September 22, 2019 Democracies become oligarchies when wealth is too concentrated. A progressive wealth tax is the most direct policy tool to curb the growing concentration of wealth in the United States. It can also restore tax progressivity at the very top of the wealth distribution and raise sorely needed tax revenue to fund the public good. Senator Sanders' very progressive wealth tax on the top 0.1% wealthiest Americans is a crucial step in this direction. We estimate that Sanders’ wealth tax would raise $4.35 trillion over a decade and fully eliminate the gap between wealth growth for billionaires and wealth growth for the middle class. Combining progressive wealth taxation with policies to rebuild middle class wealth is what the United States needs to ensure vibrant and equitable growth for the future. We have analyzed Senator Sanders’ proposal to impose a progressive annual wealth tax on American households with net worth (sum of all assets net of debts) above $32 million. The tax rate would start at 1% of net worth from $32 to $50 million, increase to 2% on net worth from $50 to $250 million, 3% from $250 to $500 million, 4% from $500 million to $1 billion, 5% from $1 to $2.5 billion, 6% from $2.5 to $5 billion, 7% from $5 to $10 billion, and 8% on wealth over $10 billion (the brackets apply for married taxpayers and are halved for singles). -

Political Capture and Economic Inequality

178 OXFAM BRIEFING PAPER 20 JANUARY 2014 Housing for the wealthier middle classes rises above the insecure housing of a slum community in Lucknow, India. Photo: Tom Pietrasik/Oxfam WORKING FOR THE FEW Political capture and economic inequality Economic inequality is rapidly increasing in the majority of countries. The wealth of the world is divided in two: almost half going to the richest one percent; the other half to the remaining 99 percent. The World Economic Forum has identified this as a major risk to human progress. Extreme economic inequality and political capture are too often interdependent. Left unchecked, political institutions become undermined and governments overwhelmingly serve the interests of economic elites to the detriment of ordinary people. Extreme inequality is not inevitable, and it can and must be reversed quickly. www.oxfam.org SUMMARY In November 2013, the World Economic Forum released its ‘Outlook on the Global Agenda 2014’, in which it ranked widening income disparities as the second greatest worldwide risk in the coming 12 to 18 months. Based on those surveyed, inequality is ‘impacting social stability within countries and threatening security on a global scale.’ Oxfam shares its analysis, and wants to see the 2014 World Economic Forum make the commitments needed to counter the growing tide of inequality. Some economic inequality is essential to drive growth and progress, rewarding those with talent, hard earned skills, and the ambition to innovate and take entrepreneurial risks. However, the extreme levels of wealth concentration occurring today threaten to exclude hundreds of millions of people from realizing the benefits of their talents and hard work. -

The Influence of the Los Angeles ``Oligarchy'' on the Governance Of

The influence of the Los Angeles “oligarchy” onthe governance of the municipal water department (1902-1930): a business like any other or a public service? Fionn Mackillop To cite this version: Fionn Mackillop. The influence of the Los Angeles “oligarchy” on the governance of the municipal wa- ter department (1902-1930): a business like any other or a public service?. Business History Conference Online, 2004, 2, http://www.thebhc.org/publications/BEHonline/2004/beh2004.html. hal-00195980 HAL Id: hal-00195980 https://hal.archives-ouvertes.fr/hal-00195980 Submitted on 11 Dec 2007 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. The Influence of the Los Angeles “Oligarchy” on the Governance of the Municipal Water Department, 1902- 1930: A Business Like Any Other or a Public Service? Fionn MacKillop The municipalization of the water service in Los Angeles (LA) in 1902 was the result of a (mostly implicit) compromise between the city’s political, social, and economic elites. The economic elite (the “oligarchy”) accepted municipalizing the water service, and helped Progressive politicians and citizens put an end to the private LA City Water Co., a corporation whose obsession with financial profitability led to under-investment and the construction of a network relatively modest in scope and efficiency. -

Democracy & Philanthropy

DEMOCRACY & PHILANTHROPY The Rockefeller Foundation and the American Experiment the rockefeller foundation centennial series democracy & philanthropy the rockefeller foundation and the american experiment By Eric John Abrahamson Sam Hurst Barbara Shubinski Innovation for the Next 100 Years Rockefeller Foundation Centennial Series 2 Chapter _: Democracy & Philanthropy 3 4 Chapter _: Democracy & Philanthropy 5 6 Chapter _: Democracy & Philanthropy 7 8 Chapter _: Democracy & Philanthropy 9 Preface from Dr. Judith Rodin 14 Foreword – Justice Sandra Day O'Connor 18 1 The Charter Fight 24 11 Government by Experts 52 111 Philanthropy at War 90 © 2013 by Rockefeller Foundation have been deemed to be owned by 1v The Arts, the Humanities, The Rockefeller Foundation Centennial Series the Rockefeller Foundation unless we and National Identity 112 Foreword copyright Justice Sandra Books published in the Rockefeller were able to determine otherwise. Day O’Connor Foundation Centennial Series provide Specific permission has been granted All rights reserved. case studies for people around the by the copyright holder to use the v Foundations Under Fire 144 world who are working “to promote the following works: well-being of humankind.” Three books Top: Rockefeller Archive Center Equal Opportunity for All 174 Bottom: John Foxx. Getty Images. highlight lessons learned in the fields Ruthie Abel: 8-9, 110-111 v1 of agriculture, health, and philanthropy. Art Resource: 26 Three others explore the Foundation’s Book design by Pentagram. The Johns Hopkins Bloomberg School of v11 Democracy and Design work in Africa, Thailand, and the United Public Health: 57 States. For more information about Democracy & Philanthropy: Department of Special Collections in America's Cities 210 the Rockefeller Foundation Centennial and University Archives, Marquette The Rockefeller Foundation and initiatives, visit http://centennial. -

Jan Sobieski's Latifundium and the Soldiers (1652-1696)

Open Military Studies 2020; 1: 62–69 Research Article Magdalena Ujma* Jan Sobieski’s latifundium and the soldiers (1652-1696) https://10.1515/openms-2020-0105 Received Oct 26, 2020; accepted Nov 07, 2020 Abstract: An analysis of the relationship between Jan III Sobieski and the people he distinguished shows that there were many mutual benefits. Social promotion was more difficult if the candidate for the office did not come from a senatorial family34. It can be assumed that, especially in the case of Atanazy Walenty Miączyński, the economic activity in the Sobieski family was conducive to career development. However, the function of the plenipotentiary was not a necessary condition for this. Not all the people distinguished by Jan III Sobieski achieved the same. More important offices were entrusted primarily to Marek Matczyński. Stanisław Zygmunt Druszkiewicz’s career was definitely less brilliant. Druszkiewicz joined the group of senators thanks to Jan III, and Matczyński and Szczuka received ministerial offices only during the reign of Sobieski. Jan III certainly counted on the ability to manage a team of people acquired by his comrades-in-arms in the course of his military service. However, their other advantage was also important - good orientation in political matters and exerting an appropriate influence on the nobility. The economic basis of the magnate’s power is an issue that requires more extensive research. This issue was primarily of interest to historians dealing with latifundia in the 18th century. This was mainly due to the source material. Latifundial documentation was kept much more regularly in the 18th century than before and is well-organized. -

The Men Who Built America

“THE AMERICAN ECONOMY WAS LINKED BY RAILROADS, FUELED BY OIL AND BUILT BY STEEL.” Cornelius Vanderbilt, John D. Rockefeller, Andrew Carnegie, Episode 1: A New WAR BEGINS J.P. Morgan, Henry Ford – their names are synonymous with As the nation attempts to rebuild following the destruction of the innovation, big business and the American Dream. These leaders Civil War, Cornelius Vanderbilt is the first to see the need for unity sparked incredible advances in technology while struggling to to regain America’s stature in the world. Vanderbilt makes his mark consolidate their industries and rise to the top in shipping and then the railroad industry. Railroads stitch together of the business world. The Men Who Built America™ chronicles the the nation, stimulating the economy by making it easier to move connections between these iconic businessmen and explores the goods across the country. But Vanderbilt faces intense competition way they shaped the country, transforming the early on, showing that captains of industry will always be chal- U.S. into a global superpower in just 50 years. lenged by new innovators and mavericks. Tracing their roles in the oil, steel, railroad, auto and financial Key TERMS to DEFINE industries, this series uses stunning CGI and little-known stories to ARCHETYPE, ENTREPRENEUR, INFRASTRUCTURE, INGENUITY, examine the lives of these iconic tycoons. How did these leaders INNOVATION advance progress, and what were the costs and consequences of American industrial growth? What role did everyday Americans Discussion Questions play in this growth, and how were their voices heard? This series is an excellent companion for course units on business, American 1. -

Explaining Variations in the Billionaire-Intensity of GDP

Picture credit: khunaspix/Bigstock.com Expert Comment Why do some countries have more billionaires than others? Explaining variations in the billionaire-intensity of GDP Copyright © 2018 by Dialogue of Civilizations Research Institute The right of Vladimir Popov to be identified as the author of this publication is hereby asserted. The views and opinions expressed in this publication are those of the original author(s) and do not necessarily represent or reflect the views and opinions of the Dialogue of Civilizations Research Institute, its co-founders, or its staff members. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law. For permission requests, please write to the publisher: Dialogue of Civilizations Research Institute gGmbH Französische Straße 23 10117 Berlin Germany +49 30 209677900 [email protected] 1 Dialogue of Civilizations Research Institute Why some countries have more billionaires than others? Explaining variations in the billionaire-intensity of GDP Vladimir Popov The Forbes magazine annual list of billionaires and their wealth provides enough data so that the number of billionaires per unit of GDP and the ratio of their wealth-to-GDP can be calculated for various countries. These measures of billionaire intensity vary greatly – sometimes by one or even two orders of magnitude. This paper offers descriptive statistics of the geographical distribution of billionaires and a preliminary analysis of factors that determine the country variations of billionaire intensity indicators. -

BILLIONAIRE PANDEMIC WEALTH GAINS of 55%, OR $1.6 TRILLION, COME AMID THREE DECADES of RAPID WEALTH GROWTH April 15, 2021

BILLIONAIRE PANDEMIC WEALTH GAINS OF 55%, OR $1.6 TRILLION, COME AMID THREE DECADES OF RAPID WEALTH GROWTH April 15, 2021 Whether measured over 13 months or 31 years, the growth of U.S. billionaire wealth is both astounding and troubling based on Forbes data as of April 12, 2021. Billionaire wealth growth has perversely accelerated over the 13 months of global pandemic. But the piling up of fortunes at the top has proceeded at a rapid clip for decades even as the net worth of working Americans lagged and public services deteriorated. Tax reforms of the type proposed by President Biden would begin to reverse these damaging trends. GROWTH OF BILLIONAIRE WEALTH DURING THE FIRST-THREE MONTHS OF THE PANDEMIC Between March 18, 2020, and April 12, 2021,the collective wealth of American billionaires leapt by $1.62 trillion, or 55%, from $2.95 trillion to $4.56 trillion. [See data table here]. That increase in billionaire wealth alone could pay for nearly 70% of the 10-year, $2.3 trillion cost of President Biden’s proposed jobs and infrastructure plan—the American Jobs Plan. As of April 12, there were six American “centi-billionaires”—individuals each worth at least $100 billion [see table below]. That’s bigger than the size of the economy of each of 13 of the nation’s states. Here’s how the wealth of these ultra-billionaires grew during the pandemic: ● Amazon’s Jeff Bezos, almost a “double-centi-billionaire” with a net worth of nearly $197 billion, is up 74% over the last 13 months. -

Media Oligarchs Go Shopping Patrick Drahi Groupe Altice

MEDIA OLIGARCHS GO SHOPPING Patrick Drahi Groupe Altice Jeff Bezos Vincent Bolloré Amazon Groupe Bolloré Delian Peevski Bulgartabak FREEDOM OF THE PRESS WORLDWIDE IN 2016 AND MAJOR OLIGARCHS 2 Ferit Sahenk Dogus group Yildirim Demirören Jack Ma Milliyet Alibaba group Naguib Sawiris Konstantin Malofeïev Li Yanhong Orascom Marshall capital Baidu Anil et Mukesh Ambani Rupert Murdoch Reliance industries ltd Newscorp 3 Summary 7. Money’s invisible prisons 10. The hidden side of the oligarchs New media empires are emerging in Turkey, China, Russia and India, often with the blessing of the political authorities. Their owners exercise strict control over news and opinion, putting them in the service of their governments. 16. Oligarchs who came in from the cold During Russian capitalism’s crazy initial years, a select few were able to take advantage of privatization, including the privatization of news media. But only media empires that are completely loyal to the Kremlin have been able to survive since Vladimir Putin took over. 22. Can a politician be a regular media owner? In public life, how can you be both an actor and an objective observer at the same time? Obviously you cannot, not without conflicts of interest. Nonetheless, politicians who are also media owners are to be found eve- rywhere, even in leading western democracies such as Canada, Brazil and in Europe. And they seem to think that these conflicts of interests are not a problem. 28. The royal whim In the Arab world and India, royal families and industrial dynasties have created or acquired enormous media empires with the sole aim of magnifying their glory and prestige. -

1430-N-Broad-St-Nomination.Pdf

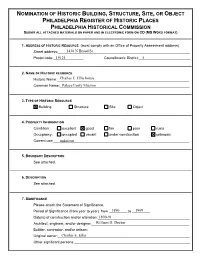

NOMINATION OF HISTORIC BUILDING, STRUCTURE, SITE, OR OBJECT PHILADELPHIA REGISTER OF HISTORIC PLACES PHILADELPHIA HISTORICAL COMMISSION SUBMIT ALL ATTACHED MATERIALS ON PAPER AND IN ELECTRONIC FORM ON CD (MS WORD FORMAT) 1. ADDRESS OF HISTORIC RESOURCE (must comply with an Office of Property Assessment address) Street address:__________________________________________________________1430 N Broad St ________ Postal code:_______________19121 Councilmanic District:_______________5 ___________ 2. NAME OF HISTORIC RESOURCE Historic Name:__________________________________________________________Charles E. Ellis house ________ Common Name:_________________________________________________________Palace/Unity Mission ________ 3. TYPE OF HISTORIC RESOURCE Building Structure Site Object 4. PROPERTY INFORMATION Condition: excellent good fair poor ruins Occupancy: occupied vacant under construction unknown Current use:________unknown____________________________________________________ ________ 5. BOUNDARY DESCRIPTION See attached. 6. DESCRIPTION See attached. 7. SIGNIFICANCE Please attach the Statement of Significance. Period of Significance (from year to year): from _________1890 to _________1909 Date(s) of construction and/or alteration:_____________________________________1890-91 _________ Architect, engineer, and/or designer:________________________________________William H. Decker _________ Builder, contractor, and/or artisan:__________________________________________ _________ Original owner:_________________________________________________________Charles -

This Year's Edition

CO-AUTHORS: Chuck Collins directs the Program on Inequality and the Common Good at the Institute for Policy Studies, where he also co-edits Inequality.org. His most recent book is Is Inequality in America Irreversible? from Polity Press and in 2016 he published Born on Third Base. Other reports and books by Collins include Reversing Inequality: Unleashing the Transformative Potential of An More Equal Economy and 99 to 1: How Wealth Inequality is Wrecking the World and What We Can Do About It. His 2004 book Wealth and Our Commonwealth, written with Bill Gates Sr., makes the case for taxing inherited fortunes. Josh Hoxie directs the Project on Opportunity and Taxation at the Institute for Policy Studies and co- edits Inequality.org. He co-authored a number of reports on topics ranging from economic inequality, to the racial wealth divide, to philanthropy. Hoxie has written widely on income and wealth maldistribution for Inequality.org and other media outlets. He worked previously as a legislative aide for U.S. Senator Bernie Sanders. Acknowledgements: We received significant assistance in the production of this report. We would like to thank our colleagues at IPS who helped us throughout the report. The Institute for Policy Studies (www.IPS-dc.org) is a multi-issue research center founded in 1963. The Program on Inequality and the Common Good was founded in 2006 to draw attention to the growing dangers of concentrated wealth and power, and to advocate policies and practices to reverse extreme inequalities in income, wealth, and opportunity. The Inequality.org website (http://inequality.org/) provides an online portal into all things related to the income and wealth gaps that so divide us.