Broker Upgrades and Downgrades & Key Uk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Fund Factsheet

Fund Factsheet Unicorn UK Ethical Income B Acc Fund Information Fund Aim The Unicorn UK Ethical Income Fund aims to provide an income by investing in UK companies which Sector meet the ACD’s ethical guidelines. For this purpose, UK companies are defined as those which are IA UK Equity Income incorporated or domiciled in the UK, or have a significant part of their operations in the UK. Selection Manager's Name of such ethical equities will be undertaken on the basis of thorough company analysis, with ethical and Fraser Mackersie socially responsible criteria reviewed at the point of investment and quarterly thereafter. Simon Moon Sector: IA UK Equity Income Date Manager Appointed Apr 2016 Performance % Launch Date 40 Apr 2016 35 Fund Size(£m) 30 £83.36 25 20 Yield* (See page2) 3.46 % 15 10 XD Dates Jul 01, Apr 01, Jan 04, Oct 01 5 0 Last Distribution 01/07/21 (XD Date) -5 31/08/21 (Pay Date) -10 1.60(Distribution) -15 OCF -20 0.81 % -25 Oct 16 Apr 17 Jul Oct Jan 18 Apr Jul Oct Jan 19 Apr Jul Oct Jan 20 Apr Jul Oct Jan 21 Apr Jul 23/09/2016 - 24/09/2021 Powered by data from FE Unicorn UK Ethical Income B Acc IA UK Equity Income Discrete Performance - 12 months to 31/12/20 Morningstar Analyst 2020 2019 2018 2017 2016 Rating Fund -14.63 25.73 -9.65 16.79 - N/A FE Crown Stock Sector Average -10.73 20.07 -10.54 11.32 8.84 Rating Cumulative Performance to 31/08/21 1 Yr 2 Yrs 3 Yrs 4 Yrs 5 Yrs Fund 30.64 15.25 12.71 13.51 37.49 Stock Sector Average 31.26 14.97 10.63 15.10 27.14 Performance Analysis - Annualised 3 years Growth Rate % Volatility -

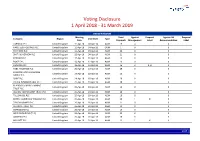

Global Voting Activity Report to March 2019

Voting Disclosure 1 April 2018 - 31 March 2019 UNITED KINGDOM Meeting Total Against Proposal Against ISS Proposal Company Region Vote Date Type Date Proposals Management Label Recommendation Label CARNIVAL PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 19 0 0 HANSTEEN HOLDINGS PLC United Kingdom 11-Apr-18 04-Apr-18 OGM 1 0 0 RIO TINTO PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 22 0 0 SMITH & NEPHEW PLC United Kingdom 12-Apr-18 04-Apr-18 AGM 21 0 0 PORVAIR PLC United Kingdom 17-Apr-18 10-Apr-18 AGM 15 0 0 BUNZL PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 19 0 0 HUNTING PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 16 2 3, 8 0 HSBC HOLDINGS PLC United Kingdom 20-Apr-18 13-Apr-18 AGM 29 0 0 LONDON STOCK EXCHANGE United Kingdom 24-Apr-18 18-Apr-18 AGM 26 0 0 GROUP PLC SHIRE PLC United Kingdom 24-Apr-18 18-Apr-18 AGM 20 0 0 CRODA INTERNATIONAL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 18 0 0 BLACKROCK WORLD MINING United Kingdom 25-Apr-18 19-Apr-18 AGM 15 0 0 TRUST PLC ALLIANZ TECHNOLOGY TRUST PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 10 0 0 TULLOW OIL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 16 0 0 BRITISH AMERICAN TOBACCO PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 20 1 8 0 TAYLOR WIMPEY PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 21 0 0 ALLIANCE TRUST PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 13 0 0 SCHRODERS PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 19 0 0 WEIR GROUP PLC (THE) United Kingdom 26-Apr-18 20-Apr-18 AGM 23 0 0 AGGREKO PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 20 0 0 MEGGITT PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 22 1 4 0 1/47 -

Summary of Investments by Type

COMMON INVESTMENT FUNDS Schedule of Investments March 31, 2017 SUMMARY OF INVESTMENTS BY TYPE Cost Market Value Fixed Income Investments $ $ Short-term investments 42,653,484 42,653,484 Bonds 175,482,352 175,327,122 Mortgage-backed securities 22,199,796 21,785,061 Emerging markets debt 9,619,817 10,899,147 Bank loans - high income fund 20,985,176 23,595,337 Total Fixed Income Investments 270,940,624 274,260,151 Equity-Type Investments Mutual funds Domestic 9,234,353 12,420,750 International 18,849,681 18,688,379 Common stocks Domestic 152,833,551 187,487,257 International 216,167,277 227,850,648 Total Equity-Type Investments 397,084,862 446,447,034 Alternative Investments Funds of hedge funds 38,264,990 46,247,453 Real estate trust fund 6,876,041 10,104,141 Total Alternatives Investments 45,141,031 56,351,594 TOTAL INVESTMENTS 713,166,517 777,058,779 Page 1 of 32 COMMON INVESTMENT FUNDS Schedule of Investments March 31, 2017 SUMMARY OF INVESTMENTS BY FUND Cost Market Value Fixed Income Fund $ $ Short-term investments 13,092,627 13,092,627 Bonds 143,036,345 143,362,214 Mortgage-backed securities 21,372,523 20,977,317 Emerging markets debt 9,619,817 10,899,147 Bank loans - high income fund 20,985,176 23,595,337 208,106,487 211,926,642 Domestic Core Equity Fund Short-term investments 9,127,791 9,127,791 Common stocks 134,983,626 165,021,220 Futures - (5,950) Private placement 4,150 4,150 144,115,567 174,147,211 Small Cap Equity Fund Short-term investments 2,937,066 2,937,066 Mutual funds 9,234,353 12,420,750 Common stocks 17,845,775 22,467,836 -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

CDP Climate Change Report 2015 United Kingdom Edition

CDP Climate Change Report 2015 United Kingdom Edition Written on behalf of 822 investors with US$95 trillion in assets CDP Report | October 2015 1 Contents Foreword 3 Global overview 4 2015 Leadership criteria 8 The Climate A List 2015 10 2015 FTSE 350 Climate Disclosure Leadership Index (CDLI) 12 Investor engagement in the UK 13 Profile: BT Group 14 United Kingdom snapshot 16 Profile: SSE 18 Natural Capital 20 Appendix I 24 Investor signatories and members Appendix II 25 FTSE 350 scores Appendix III 30 Responding FTSE SmallCap climate change companies Please note: The selection of analyzed companies in this report is based on market capitalization of regional stock indices whose constituents change over time. Therefore the analyzed companies are not the same in 2010 and 2015 and any trends shown are indicative of the progress of the largest companies in that region as defined by market capitalization. Large emitters may be present in one year and not the other if they dropped out of or entered a stock index. ‘Like for like’ analysis on emissions for sub-set of companies that reported in both 2010 and 2015 is included for clarity. Some dual listed companies are present in more than one regional stock index. Companies referring to a parent company response, those responding after the deadline and self-selected voluntary responding companies are not included in the analysis. For more information about the companies requested to respond to CDP’s climate change program in 2015 please visit: https://www.cdp.net/Documents/disclosure/2015/Companies-requested-to-respond-CDP-climate-change.pdf Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). -

Artisan International Value Fund Institutional Share Class (As of September 30, 2013)

artisan international value fund institutional share class (as of september 30, 2013) This is an offering of shares of an Artisan Fund and does not create a relationship between the investor and Artisan Partners. The Notes and Disclosures section of this presentation contains important information. Readers are encouraged to review it carefully. Investors should consider carefully before investing the fund’s investment objective, risks and charges and expenses. For a prospectus or summary prospectus, which contains that information and other information about the fund, please call us at 1-800-399-1770. Please read the prospectus or summary prospectus carefully before you invest or send money. artisan international value fund is closed to most new investors. please refer to the prospectus for new account eligibility criteria. for sophisticated institutional investor use only. artisan international value fund CONTENTS TAB SECTION I FIRM OVERVIEW II INVESTMENT PHILOSOPHY AND PROCESS III PORTFOLIO STATISTICS APPENDIX FUND PERFORMANCE BIOGRAPHIES NOTES AND DISCLOSURES The Notes and Disclosures section of this presentation contains information important to a complete understanding of the material presented. Please review it carefully. artisan partners distributors, llc INTV-MF artisan international value fund FIRM FACTS • Founded in 1994; solely focused on providing high value-added Growth investment strategies • Global Opportunities • U.S. Mid-Cap Growth • U.S. Small-Cap Growth • Five autonomous investment teams managing thirteen investment strategies for sophisticated, institutional investors Global Equity • Principal offices in Milwaukee, San Francisco, Atlanta, New York and • Global Equity • Global Small-Cap Growth London, with 294 associates • Non-U.S. Growth • Non-U.S. Small-Cap Growth • Approximately $96.9 billion under management as of September 30, 2013 U.S. -

Top Federal Industry Leaders

Top Federal Industry Leaders Prior Prior Rank Company Contracts Rank Page Rank Company Contracts Rank Page 1 Lockheed Martin Corp. $36.9 billion 1 157 51 AP Moeller - Maersk A/S $1.3 87 63 2 Boeing Co. $30.3 2 80 52 Sierra Nevada Corp. $1.3 75 206 3 General Dynamics Corp. $15.4 3 124 53 Johns Hopkins University $1.3 50 148 4 Raytheon Co. $14.5 4 189 54 Finmeccanica SpA $1.3 49 120 5 Northrop Grumman Corp. $12.5 5 174 55 Deloitte Touche Tohmatsu Ltd. $1.3 62 110 6 United Technologies Corp. $9.0 6 226 56 MITRE Corp. $1.3 52 166 7 SAIC Inc. $7.4 8 198 57 UT-Battelle LLC $1.3 53 231 8 BAE Systems PLC $6.3 9 72 58 Navistar International Corp. $1.2 43 171 9 L-3 Communications Holdings Inc. $6.0 7 155 59 SRA International Inc. $1.2 60 208 10 Huntington Ingalls Industries Inc. $5.9 10 139 60 Refinery Associates of Texas $1.2 NR 191 11 McKesson Corp. $4.6 12 162 61 Cardinal Health Inc. $1.2 65 90 12 Bechtel Group Inc. $4.2 13 75 62 University of California $1.2 66 228 13 Booz Allen Hamilton Holding Corp. $4.0 16 82 63 Dell Inc. $1.2 46 109 14 URS Corp. $3.9 17 229 64 Pfizer Inc. $1.1 57 184 15 Computer Sciences Corp. $3.8 15 103 65 Alliance Contractor Team $1.1 44 57 16 DynCorp International Inc. -

Global ESG Investment Q2 ESG Report 2020 02 Global ESG Report

Global ESG Investment Q2 ESG Report 2020 02 Global ESG Report Contents Introduction 03 Examples of engagement 04 ESG voting and engagement summary 05 Engagement summary Q2 2020 06 AstraZeneca – Covid-19 Vaccine Development 09 China Resources Land – Sustainable Real Estate 10 CIE Automotive – Board Oversight & Covid-19 11 Cubic Corporation – Board Structure 12 Johnson & Johnson – Opioid Oversight & Voting Resolution 13 Mersin Port – Environmental Impacts 14 Polyus – Supporting Employees & Covid – 19 15 Royal Dutch Shell – Climate Change Transition 16 Total – Emission Targets & Voting Resolution 17 Verizon – Employee Management 18 Voting and engagement “ Our quarterly ESG report summary 2020 provides a summary of Company Topics discussed our research, company UK AstraZeneca Covid-19 Vaccine Development engagement and voting Shell Climate Change Transition activities. The report’s EU CIE Automotive Board Oversight & Covid-19 objective is to inform, Total Emission Targets & disclose and create discussion. Voting Resolution US We welcome comments J&J Opioid Oversight & Voting and observations.” Cubic Corporation Resolution Verizon Board Structure Employee Management EM Supporting Employees & Polyus Covid-19 Mersin Port Environmental Impacts China Resources Land Sustainable Real Estate Companies chosen are for illustrative purposes only to demonstrate our ESG Investment process and is not intended to be an indication of performance, investment recommendation or solicitation. Global ESG Report 03 Introduction In our first-quarter report, we highlighted the unprecedented impacts that Covid-19 has had and the challenges that it presents to companies globally. Over this quarter, we have continued to engage with our investee companies and, on the whole, have been encouraged by the significant steps that they have taken, both to adapt their near-term strategies and to Andrew Mason consider the potential impacts on their longer-term strategies. -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

Direct Equity Investments 310315

Security Name ISIN ABERDEEN ASSET MANAGEMENT PLC COMMON STOCK GBP 10 GB0000031285 AMEC FOSTER WHEELER PLC COMMON STOCK GBP 50 GB0000282623 ANTOFAGASTA PLC COMMON STOCK GBP 5 GB0000456144 ASHTEAD GROUP PLC COMMON STOCK GBP 10 GB0000536739 BHP BILLITON PLC COMMON STOCK GBP 0.5 GB0000566504 ARM HOLDINGS PLC COMMON STOCK GBP 0.05 GB0000595859 WS ATKINS PLC COMMON STOCK GBP 0.5 GB0000608009 BARRATT DEVELOPMENTS PLC COMMON STOCK GBP 10 GB0000811801 BELLWAY GBP0.125 GB0000904986 BALFOUR BEATTY PLC COMMON STOCK GBP 50 GB0000961622 BTG ORD GBP0.10 GB0001001592 BIOSCIENCE INVESTMENT TRUST ORD GBP0.25 GB0001121879 BRITISH LAND CO PLC/THE REIT GBP 25 GB0001367019 SKY PLC COMMON STOCK GBP 50 GB0001411924 TULLOW OIL PLC COMMON STOCK GBP 10 GB0001500809 J D WETHERSPOON PLC COMMON STOCK GBP 2 GB0001638955 DIPLOMA ORD GBP0.05 GB0001826634 BOVIS HOMES GROUP GBP0.50 GB0001859296 AVIVA PLC COMMON STOCK GBP 25 GB0002162385 CRODA INTERNATIONAL PLC COMMON STOCK GBP 10 GB0002335270 DIAGEO PLC COMMON STOCK GBP 28.93518 GB0002374006 SCHRODERS VTG SHS GBP1 GB0002405495 ELEMENTIS PLC COMMON STOCK GBP 5 GB0002418548 DCC PLC COMMON STOCK GBP 0.25 IE0002424939 DAIRY CREST GROUP PLC COMMON STOCK GBP 25 GB0002502812 BAE SYSTEMS PLC COMMON STOCK GBP 2.5 GB0002634946 DERWENT LONDON PLC ORD GBP 0.05 GB0002652740 BRITISH AMERICAN TOBACCO PLC COMMON STOCK GBP 25 GB0002875804 ELECTROCOMPONENTS ORD GBP0.10 GB0003096442 SPECTRIS PLC COMMON STOCK GBP 5 GB0003308607 PREMIER FARNELL ORD GBP0.05 GB0003318416 FENNER PLC COMMON STOCK GBP 25 GB0003345054 FIRSTGROUP ORD GBP0.05 GB0003452173 -

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021 FTF - FTF Franklin UK Mid Cap August 31, 2021 Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B132NW2 ASHMORE GROUP PLC 5,750,000 £22,954,000 1.89% N/A N/A 0066701 AVON PROTECTION PLC 701,792 £13,186,671 1.08% N/A N/A 0090498 BELLWAY PLC 925,000 £32,550,750 2.68% N/A N/A B3FLWH9 BODYCOTE PLC 4,450,000 £42,920,250 3.53% N/A N/A BMH18Q1 BYTES TECHNOLOGY GROUP PLC 4,500,000 £23,130,000 1.90% N/A N/A 0231888 CRANSWICK PLC 935,000 £37,082,100 3.05% N/A N/A 0265274 DERWENT LONDON PLC 825,000 £31,292,250