Midland Microfin Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Administrative Atlas , Punjab

CENSUS OF INDIA 2001 PUNJAB ADMINISTRATIVE ATLAS f~.·~'\"'~ " ~ ..... ~ ~ - +, ~... 1/, 0\ \ ~ PE OPLE ORIENTED DIRECTORATE OF CENSUS OPERATIONS, PUNJAB , The maps included in this publication are based upon SUNey of India map with the permission of the SUNeyor General of India. The territorial waters of India extend into the sea to a distance of twelve nautical miles measured from the appropriate base line. The interstate boundaries between Arunachal Pradesh, Assam and Meghalaya shown in this publication are as interpreted from the North-Eastern Areas (Reorganisation) Act, 1971 but have yet to be verified. The state boundaries between Uttaranchal & Uttar Pradesh, Bihar & Jharkhand and Chhattisgarh & Madhya Pradesh have not been verified by government concerned. © Government of India, Copyright 2006. Data Product Number 03-010-2001 - Cen-Atlas (ii) FOREWORD "Few people realize, much less appreciate, that apart from Survey of India and Geological Survey, the Census of India has been perhaps the largest single producer of maps of the Indian sub-continent" - this is an observation made by Dr. Ashok Mitra, an illustrious Census Commissioner of India in 1961. The statement sums up the contribution of Census Organisation which has been working in the field of mapping in the country. The Census Commissionarate of India has been working in the field of cartography and mapping since 1872. A major shift was witnessed during Census 1961 when the office had got a permanent footing. For the first time, the census maps were published in the form of 'Census Atlases' in the decade 1961-71. Alongwith the national volume, atlases of states and union territories were also published. -

Pincode Officename Statename Minisectt Ropar S.O Thermal Plant

pincode officename districtname statename 140001 Minisectt Ropar S.O Rupnagar PUNJAB 140001 Thermal Plant Colony Ropar S.O Rupnagar PUNJAB 140001 Ropar H.O Rupnagar PUNJAB 140101 Morinda S.O Ropar PUNJAB 140101 Bhamnara B.O Rupnagar PUNJAB 140101 Rattangarh Ii B.O Rupnagar PUNJAB 140101 Saheri B.O Rupnagar PUNJAB 140101 Dhangrali B.O Rupnagar PUNJAB 140101 Tajpura B.O Rupnagar PUNJAB 140102 Lutheri S.O Ropar PUNJAB 140102 Rollumajra B.O Ropar PUNJAB 140102 Kainaur B.O Ropar PUNJAB 140102 Makrauna Kalan B.O Rupnagar PUNJAB 140102 Samana Kalan B.O Rupnagar PUNJAB 140102 Barsalpur B.O Ropar PUNJAB 140102 Chaklan B.O Rupnagar PUNJAB 140102 Dumna B.O Ropar PUNJAB 140103 Kurali S.O Mohali PUNJAB 140103 Allahpur B.O Mohali PUNJAB 140103 Burmajra B.O Rupnagar PUNJAB 140103 Chintgarh B.O Rupnagar PUNJAB 140103 Dhanauri B.O Rupnagar PUNJAB 140103 Jhingran Kalan B.O Rupnagar PUNJAB 140103 Kalewal B.O Mohali PUNJAB 140103 Kaishanpura B.O Rupnagar PUNJAB 140103 Mundhon Kalan B.O Mohali PUNJAB 140103 Sihon Majra B.O Rupnagar PUNJAB 140103 Singhpura B.O Mohali PUNJAB 140103 Sotal B.O Rupnagar PUNJAB 140103 Sahauran B.O Mohali PUNJAB 140108 Mian Pur S.O Rupnagar PUNJAB 140108 Pathreri Jattan B.O Rupnagar PUNJAB 140108 Rangilpur B.O Rupnagar PUNJAB 140108 Sainfalpur B.O Rupnagar PUNJAB 140108 Singh Bhagwantpur B.O Rupnagar PUNJAB 140108 Kotla Nihang B.O Ropar PUNJAB 140108 Behrampur Zimidari B.O Rupnagar PUNJAB 140108 Ballamgarh B.O Rupnagar PUNJAB 140108 Purkhali B.O Rupnagar PUNJAB 140109 Khizrabad West S.O Mohali PUNJAB 140109 Kubaheri B.O Mohali PUNJAB -

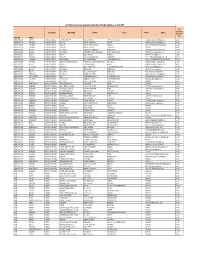

Village & Townwise Primary Census Abstract, Kapurthala, Part XII-A & B

CENSUS OF INDIA 1991 SERIES-20 PUNJAB DISTRICT CENSUS HAND·BOOK PA'RT XII-A & lB VILLAGE & T.OWN DrRECTORY VILLAGE & TOWNWISE .PRIMAR Y CENSUS ABSTRACT DISTRICT KAPURTHALA DIrector of Census Operations Punjab Published by : The Government of Punjab, 1996 PUNJAB DISTRICT KAPURTHALA ~m5 o 5 10 I5 20 Km q.. ~ \. '" q.. ,.. + A.., (J \. q. '" "" () " A.., .. l ;:;p. (" ~• ; ~ \ "z 0 s '{ .. BOUNDARY, DISTRICT _.-..- C.O. BLOCKS TAHSIL A NAOALA " C.D. BLOCK .' .. ........ .. , .. ...... " .. 1"" "e B I(APURTHALA H€ADOUARTERS: DlSTRlCTj TAHSIL .. ... .. .. @; @ C SUL TANPUR LOOM' NATIONAL HIGHWAY .......... .... .•. •. .. _...;,;N""'H.;..'_ o PHAGWARA IMPORTANT METALLED ROAD .. ........ .. " .... e' _-=__ RA!lWAY LINE WITH STATION, BROAD GAUGE: eo •• ' _~ RIVER AND STREAM .. .. .. .. .' .. .. ~ VILLAGE HAVING 5000 AND A90JE POPULATION WITH NAME ... ...... .. ...... .. .. .. .. .. .... Oh«wan• All Ixlondaries 0,. up«lted ullo I~ D«:embor, 1989. URBAN AREA WITH POP\JLATION SIZE CLASS II S IV •• POST AND TELEGRAPH OFFICE .. .. .. .. .. .. .. .. .. PTO DEGREE COLl.EG£ AND TECt-tlICAL INSTITUTION.. .. I!!!l m REST HOUSE RH DISTRICT H£ADQUARTERS IS AlSO TAHSL HEADQUARTERS 80sed upon Survey 01 IIIdkl map .llh the permission 01 the Sur~eyor 0._11 .f 1MiI. © GovlI'nmIIII of In4Ia Cop,,~t. 897. CENSUS OF INDlA-199i A-CENTRAL GOVERNMENT PUBLICATIONS ··Tho publications relating to Punjab bear Series No. 20 and will bo published as follows :- part I·A Administration Report- Enumeration (for official use only). Pa.rt l-B Admi nistration Report-Ta bulatio n (for official use only), "- Part II·A General Population Tables 1 and and r Combined Volume. Pan lI·B Primary Census Abstract J Part III General Economic Tables. -

Office Name Pincode Delivery

Delivery/ Office Office Name Pincode Circle Region Division Non Delivery Type Ropar HO 140001 Delivery HO Punjab Circle Chandigarh HQ Region Chandigarh Division Minisectt Ropar SO 140001 Non-Delivery PO Punjab Circle Chandigarh HQ Region Chandigarh Division Thermal Plant Colony Ropar SO 140001 Non-Delivery PO Punjab Circle Chandigarh HQ Region Chandigarh Division I I T ROPAR 140001 Non-Delivery PO Punjab Circle Chandigarh HQ Region Chandigarh Division Morinda SO 140101 Delivery PO Punjab Circle Chandigarh HQ Region Chandigarh Division Bhamnara BO 140101 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Dhangrali BO 140101 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Rattangarh Ii BO 140101 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Saheri BO 140101 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Tajpura BO 140101 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Lutheri SO 140102 Delivery PO Punjab Circle Chandigarh HQ Region Chandigarh Division Barsalpur BO 140102 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Chaklan BO 140102 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Dumna BO 140102 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Kainaur BO 140102 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Makrauna Kalan BO 140102 Delivery BO Punjab circle Chandigarh HQ Region Chandigarh Division Samana Kalan BO 140102 Delivery BO Punjab circle Chandigarh HQ Region -

Top Iranian Commander Killed in US Airstrikes in Iraq

WWW.YUGMARG.COM FOLLOW US ON REGD NO. CHD/0061/2006-08 | RNI NO. 61323/95 Saturday, January 4, 2020 CHANDIGARH, VOL. XXIV, NO. 323, PAGES 8, RS. 2 YOUR REGION, YOUR PAPER Mini Marathon to Municipal Haryana Cabinet Brilliant be organised Corporation urges Guv to take Labuschagne leads on birthday of Chandigarh gears up consent of Prez to charge with fourth Himachal Chief for Swachh authorize use of hundred of the Minister on Jan 6 Survekshan 2020 Hindi in High Court summer PAGE 5PAGE 7 PAGE 3 PAGE 8 Top Iranian commander killed in US airstrikes in Iraq AGENCY Iran’s supreme leader Ayatollah Just a few hours later, the BAGHDAD, JAN 3 Ali Khamenei vowed to take “se- Revolutionary Guard Corps an- Soleimani killing to protect US vere revenge” for Soleimani’s nounced Soleimani “was mar- Top Iranian commander Qasem death. tyred in an attack by America on Soleimani was killed on Friday in personnel abroad: Pentagon Trump tweeted out a picture Baghdad airport this morning”. a US strike on Baghdad’s interna- of the US flag without any expla- The Hashed confirmed both tional airport, Iran and the US WASHINGTON: President Donald Trump ordered for the US airstrike in nation, as the pre-dawn develop- Soleimani and its deputy chief Iraq that killed General Qasem Soleimani, the commander of Iran's pow- confirmed, in the most dramatic erful Revolutionary Guards, in a "decisive defensive action" to protect US ments marked the most major es- Abu Mahdi al-Muhandis were Nafe Singh Rathi episode yet of escalating tensions personnel abroad and deter future attacks being planned by Iran, the calation yet in a feared proxy war killed in what it said was a “US between the two countries. -

List of Business Correspondent Agents Under Kiosk Banking Solution As on 30-12-2017

List of Business Correspondent agents under Kiosk Banking Solution as on 30-12-2017 Last Remuneration CIRCLE OFFICE BRANCH NAME BCA Name VILLAGE CONTACT EMAIL-ID given to Bank Mitra STATE NAME DISTRICT ANDHRA PRADESH GUNTUR ANDHRA(VIJAYAWADA) GUNTUR ARUNDULPET PADMAJA MANTHRI GUNTER M AND CORP OG 7356359659 [email protected] Dec-2017 ANDHRA PRADESH PRAKASAM ANDHRA(VIJAYAWADA) PALUKURU KONDURI SAIRAMIREDDY PALUKUR 8184860218 [email protected] Dec-2017 ANDHRA PRADESH PRAKASAM ANDHRA(VIJAYAWADA) EDARA (AP) OGURURI LAKSHMI RAMADEVI PURIMETLA 8186813346 [email protected] Dec-2017 ANDHRA PRADESH PRAKASAM ANDHRA(VIJAYAWADA) EDARA (AP) KONDAVEETI SRIDEVI VEMULABANDA 8187058876 Dec-2017 ANDHRA PRADESH NELLORE ANDHRA(VIJAYAWADA) BASINENIPALLI PRASANNA KUMAR AMILIPOGU BASINENIPALLE 8331817440 [email protected] Dec-2017 ANDHRA PRADESH NELLORE ANDHRA(VIJAYAWADA) BASINENIPALLI MUTTAMSETTY CHENNNAKRISHNAIAH DEVARAJUSURAYAPALLE 8500560327 [email protected] Dec-2017 ANDHRA PRADESH NELLORE ANDHRA(VIJAYAWADA) MOPURU MAHESH MANCHA PALUGODU 9010106610 [email protected] Dec-2017 ANDHRA PRADESH PRAKASAM ANDHRA(VIJAYAWADA) EDARA (AP) NAGUMALLI CHINA ANKAMMA KOMMAVARAM 9010514740 [email protected] Dec-2017 ANDHRA PRADESH VIZIANAGRAM ANDHRA(VIJAYAWADA) VINAYAKA NAGAR DHILLI PRABHAKARARAO VIZIANAGARAM (M AND OG) 9440033761 [email protected] Dec-2017 ANDHRA PRADESH PRAKASAM ANDHRA(VIJAYAWADA) SANIKAVARAM,PEDDARAVEEDU (AP) GODAPUVENKATA BHARANIKUMARREDDY CHATLA MITTA 9492203430 [email protected] Dec-2017 -

PUNJAB NATIONAL BANK.Pdf

STATE DISTRICT BRANCH ADDRESS CENTRE IFSC CONTACT1 CONTACT2 CONTACT3 MICR_CODE ANDAMAN PLOT NO. 105, P.P. AND JUNGLIGHAT, PORT 03192- NICOBAR BLAIR, WEST 232848 P K ISLAND ANDAMAN PORT BLAIR BENGAL 744103 PORT BLAIR PUNB0216700 SAHOO 4-5-56/5 D VIDYANAGAR KRISHNIA ANDHRA ADILABAD A P H 08732- PRADESH ADILABAD ADILABAD A.P. 504001 ADILABAD PUNB0608800 230125 M D.NO.15/604 RAJU VENKATES ROAD HWARA KAMALANAGAR SHARMA ANDHRA ANANTAPUR ANANTAPUR AP ANANTAPU 08554- PRADESH ANANTAPUR (A.P.) 515001 R PUNB0608900 276555 857223390 Seshapeeran Street, 9 S ANDHRA Chittoor, Andhra RAMANA PRADESH CHITTOOR Chittoor Pradesh 517001 CHITTOOR PUNB0401700 MURTHY KUPPAM (DISTT- ANDHRA KUPPAM (DISTT- CHITTOOR) ANDHRA bo7533@p PRADESH CHITTOOR CHITTOOR) PRADESH 517425 KUPPAM PUNB0753300 nb.co.in 08570-256663 08772-251725,253484 08772- N SUBBA RAO - 143, 251725,253 TIRUPATI,143 TOWN PLANNING 484 N ANDHRA TOWN AREA TIRUPATHI AP SUBBA PRADESH CHITTOOR PLANNING A TIRUP 517501 TIRUPATI PUNB0419800 RAO Dwarka Complex, Near 08562- ANDHRA Seven Road Junction, 243196 C PRADESH CUDDAPAH Cudappah Cudappah, AP 526001 CUDDAPAH PUNB0107900 KOTAIH 0884- 2376147, 37-1-30, Main Road, Mr.V.V ANDHRA EAST East godavari Dist, Jayanth PRADESH GODAVARI Kakinada Kakinada - 533001 KAKINADA PUNB0072800 Kumar 0883- 2442524, Ji Dagam Pappaiah Mr.A.S ANDHRA EAST Complex, Main Road, RAJAHMUN Prakash PRADESH GODAVARI Rajahmundry Rajahmundry - 533101 DRY PUNB0083500 Babu 0863- Arundelpet, 6-21-108 2233957, ANDHRA 2nd Cross Road, 4th Mr.T.Rama PRADESH GUNTUR Arundalpet Lane Guntur - 522001 GUNTUR PUNB0423800 njaneyulu 0863- 2246506, ANDHRA Station Road, Guntur - Mr.B.Rama PRADESH GUNTUR Station road 522001 GUNTUR PUNB0019500 Rao 08644- Chenchupet, Tenali, 224688 Y ANDHRA Andhra Pradesh SWAROOP PRADESH GUNTUR Tenali 522202 TENALI PUNB0398700 KUMAR PLOT NO. -

GDS Punjab Result

Selection list of Gramin Dak Sevak for Punjab circle vide Notification No.STC/18-50/GDS ONLINE II S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Chandigarh Chandigarh Baltana S.O Baltana S.O GDS ABPM/ UR 1 CR44A9412F6BF9 SHAFFY- (95)-UR G.P.O. Dak Sevak 2 Chandigarh Chandigarh Chandigarh Balongi B.O GDS ABPM/ UR 1 CR0BCDF43EE4E5 MANDEEP- G.P.O. Sector 55 S.O Dak Sevak (97.6667)-UR 3 Chandigarh Chandigarh Chandigarh Chandigarh GDS ABPM/ UR 1 CR817EF4D819EC KAMALJEET- G.P.O. Sector 55 S.O Sector 55 S.O Dak Sevak (97.8333)-UR 4 Chandigarh Chandigarh Ind Area Ram Darbar GDS ABPM/ UR 1 CR3A7F449D6734 RAKESH KUMAR- G.P.O. Chandigarh S.O Dak Sevak (98)-OBC S.O 5 Chandigarh Chandigarh Lalru S.O Jauli B.O GDS ABPM/ UR 1 CR054ABF5FEE77 MONU- (97.6667)- G.P.O. Dak Sevak UR 6 Chandigarh Chandigarh Maloya Maloya GDS ABPM/ SC 1 CR1FF36A314337 VIKRAM SINGH- G.P.O. Colony S.O Colony S.O Dak Sevak (97.5)-SC 7 Chandigarh Chandigarh Manimajra Daria B.O GDS BPM SC 1 CR148284D23566 RAHUL KUMAR- G.P.O. S.O (97.4)-SC 8 Chandigarh Chandigarh Manimajra Kishangarh GDS ABPM/ UR 1 CR2F76DD15B827 RINKI- (99.4)-UR G.P.O. S.O B.O Dak Sevak 9 Chandigarh Chandigarh Mubarakpur Mubarakpur GDS ABPM/ UR 1 CR1B1395FEDCC GULSHAN- (97.5)- G.P.O. S.O (Patiala) S.O (Patiala) Dak Sevak B UR 10 Chandigarh Chandigarh Sector 12 Sector 12 GDS ABPM/ UR 1 CR8A46EF593A33 JAIMAL- (97.8)-UR G.P.O. -

Midland Microfin Limited

Prospectus May 17, 2014 MIDLAND MICROFIN LIMITED Our Company was originally incorporated on May 27, 1988 as a private limited company under the provisions of the Companies Act, 1956 as Sajan Hire Purchase Private Limited. Our Company was converted into a public limited company with the name “Sajan Hire Purchase Limited” on April 26, 2002. Subsequently, the name of our Company was changed to Midland Microfin Limited pursuant to a fresh Certificate of Incorporation dated January 24, 2011. Our Company got itself registered as Category-A NBFC with RBI vide registration no. A.06.00458 dated July 11, 2011. Thereafter our Company changed its category and consequently got itself registered as Category -B NBFC (non- deposit taking) with RBI vide registration no. B.06.00458 dated November 12, 2013. Registered & Corporate Office: 'Gobind Niwas', 2nd Floor, 36, G.T. Road, Jalandhar - 144 001 Punjab, India; Tel.: +91 181 5085555; Fax: +91 181-5087777; Website: www.midlandmicrofin.com For details of changes in Name and Registered Office, please refer to the chapter “History and Certain Corporate Matters” on page no. 89 Compliance Officer and Contact Person: Mr. Preetpal Singh Tel.:+91 181 5091545; Fax: +91 181 5087777; E-mail: [email protected] PUBLIC ISSUE BY MIDLAND MICROFIN LIMITED, (“COMPANY” OR “ISSUER”) OF SECURED, REDEEMABLE, NON-CONVERTIBLE BONDS IN THE NATURE OF DEBENTURES OF FACE VALUE OF ` 10,000 EACH, (“NCDS”), AGGREGATING UPTO ` 2,500 LACS. GENERAL RISKS Investors are advised to read the Risk Factors carefully before taking an investment decision in the Issue. For taking an investment decision, the investors must rely on their own examination of the Issuer and the Issue, including the risks involved. -

Village & Townwise Primary Census Abstract, Kapurthala, Part XIII-A & B

CENSUS 1981 PART XIII-A & B VILLAGE & TOWN DIRECTORY SERIES 17 PUNJAB VILLAGE & TOWNWISE PRIMARY CENSUS ABSTRACT KAPURTHALA DISTRICT DISTRICT CENSUS HAND BOOK D. N. DHIR OF THE INDIAN ADMINISTRATIVE SERVICE Director Of Census Operations PUNJAB PUNJAB DISTRICT KAPURTHALA 10 15 20 KILOMETRES '\;:; z » >< o \ o » ::0 IJRBAN CENTRE WITH POPlJlATION / SIZE CLASS CLASS POPULATION BOUNDARY DISTRICT" . _._._._ TAHSIL -@'-@' H EAOO\JARTERS DISTRICT. TAHSIL . " I 100.000 AND ABOVE NATIONAL HIGHWAY . NHI IMPORTANT METALLED ROAO . ~O . OOO 99.999 II RAILWAY LINE. BROAO GAUGE " •e WITH STATION .... -_ e m 20.000 49.999 RIVER AND STREAM "~ G:;; POST AND TELEGRAPH OFFICE . " PTO lll' 10.000 19.999 DEGREE COllEGE AND [iJ 11' 5.000 9.999 TECHNICAL INSTITUTION .. • • REST HOIJSE RH •• 'l1I BELOW 5.000 DISTIlICT H.a . IS AlSO TAHSIL H.a. CENSUS.oF IONIA-19M1 A--C:::;ENTRAL GOVERNMENT PUBLICA TlONS Part I A Administration Report Enumeration (printed) Part I B Administration Report Tabulation Part II A General Population Tables (Printed) Part II B Primary Census Abstract Part III General Economic Tables Part IV Sbcial and Cultural Tables Part v Migration Tables Patt VI Fertility Tables Part VIi Tabies on Houses and Disabled Population Part VIiI Household Tables Part IX Special Tables on Scheduled Castes and Scheduled Tribes Part X A T own Directory Part X B Survey Report on Selected Towns Part XC Survey Report on Selected Villages Part XI Ethnographic Notes and Special Studies on Scheduled Castes and Scheduled Tribes B-STATE GOVERNMENT PUBLICATIONS Part XIII District Census Handbook for each district Part XIII A Village and Town Directory Part XIII B Village and Town-wise Primary Census Abstract (ii) CONTENTS Pages 1. -

Sultanpur Lodhi Sr

Villages and Category District Kapurthala Block Sultanpur Lodhi Sr. No. Name of village/Gram Panchayat Kandi BET SC 1 Ahli Kalan Yes 2 Alla Ditta 3 Allah Dad Chak Yes 4 Amarjitpur 5 Amanipur Yes 6 Alluwal 7 Amritpur Yes 8 Ahmedpur Yes 9 Ahli Khurd Yes 10 Bhago Budha Yes 11 Baoopur Jadid Yes 12 Bhago Arian 13 Burewal Yes Yes 14 Bhaini Hassa Khan Yes 15 Baja Yes Yes 16 Basti Rangilpur 17 Bhaur 18 Basti Amar Kot 19 Bidhipur Yes 20 Basti Jangla 21 Boolpur 22 Bhagatpur 23 Bussowal 24 Basti Meerpur 25 Bharoana Yes 26 Chananwindi Yes 27 Chauladha Yes 28 Chuharpur 29 Chak Kotla 30 Dandupur 31 Dandwindi 32 Dariawal 33 Daula Yes 34 Dalla Yes 35 Deepewal Yes 36 Dera Saidan Yes 37 Doda Wazir Yes Block-Villages-Kapurthala Sultanpur Lodhi 1 Villages and Category Sr. No. Name of village/Gram Panchayat Kandi BET SC 38 Farid Sairai Yes 39 Fattowal 40 Fauji Colony Randhirpur 41 Fattuwal 42 Fauji Colony Mahablipur 43 Gazipur 44 Gill 45 Haibitpur Yes 46 Hussainpur Dulowal Yes Yes 47 Hyderabad Bet Yes 48 Hajipur Yes Yes 49 Hussainpur Bulle Yes 50 Hazara Yes 51 Jainpur 52 Jeorgepur 53 Jabbo Sudhar 54 Jabbowal 55 Jhal Lahiwala 56 Jhanduwal Kamboan 57 Kalru Yes 58 Kabirpur Yes 59 Kamalpur Yes 60 Karamjitpur 61 Khokar Jadid Kadim 62 Kutbewal Yes 63 Khurd 64 Latianwala 65 Lodhiwal 66 Ladwal 67 Lakh Warah Yes Yes 68 Mahijitpur Yes 69 Miani Bahadur Yes 70 Mirzapur Yes 71 Mahablipur 72 Mewa Singh Wala 73 Mangopur 74 Masit Yes 75 Muket Ramwala 76 Mokhe Block-Villages-Kapurthala Sultanpur Lodhi 2 Villages and Category Sr. -

National Fertilizers Ltd-Mktg. Deptt Distance Directory for Punjab - Annex-B State Distt

NATIONAL FERTILIZERS LTD-MKTG. DEPTT DISTANCE DIRECTORY FOR PUNJAB - ANNEX-B STATE DISTT. DESTINATION CODE VIA PB VIA HP KM KM PUNJAB AMRITSAR ADDA JETHUWAL(VERKA) 04/01/082 201 0 PUNJAB AMRITSAR ADDA NURDEEN 04/01/084 201 0 PUNJAB AMRITSAR AJNALA 04/01/030 215 196 PUNJAB AMRITSAR ALGO KOTHI 04/01/147 276 0 PUNJAB AMRITSAR ALGON 04/01/064 276 0 PUNJAB AMRITSAR AMARKOT 04/01/017 245 0 PUNJAB AMRITSAR AMO NANGAL 04/01/065 186 0 PUNJAB AMRITSAR AMRITSAR 04/01/001 191 187 PUNJAB AMRITSAR ATARI 04/01/004 216 226 PUNJAB AMRITSAR BABA BAKALA 04/01/070 158 150 PUNJAB AMRITSAR BAGGA 04/01/060 183 166 PUNJAB AMRITSAR BAHOLA KALAN 04/01/143 163 0 PUNJAB AMRITSAR BALALPUR 04/01/153 264 0 PUNJAB AMRITSAR BATH 04/01/138 198 0 PUNJAB AMRITSAR BEAS 04/01/088 136 144 PUNJAB AMRITSAR BHAGTANWALA 04/01/144 191 187 PUNJAB AMRITSAR BHAINI BADESHA 04/01/105 181 0 PUNJAB AMRITSAR BHAKNA 04/01/096 201 0 PUNJAB AMRITSAR BHANKAN KALAN 04/01/079 201 224 PUNJAB AMRITSAR BHILLOWAL 04/01/132 238 225 PUNJAB AMRITSAR BHULLAR DADE 04/01/018 206 175 PUNJAB AMRITSAR BHURE KOHNA 04/01/025 251 0 PUNJAB AMRITSAR BHUTALA 04/01/023 171 156 PUNJAB AMRITSAR BULLE NANGAL 04/01/159 158 0 PUNJAB AMRITSAR BUNDALA 04/01/040 186 0 PUNJAB AMRITSAR BUTTER 04/01/100 162 147 PUNJAB AMRITSAR BUTTER KALON 04/01/106 162 147 PUNJAB AMRITSAR CHABBA 04/01/080 203 191 PUNJAB AMRITSAR CHACK DONGRA 04/01/050 241 200 PUNJAB AMRITSAR CHACKWAL 04/01/142 227 0 PUNJAB AMRITSAR CHANANKE 04/01/027 231 146 PUNJAB AMRITSAR CHATANPURA 04/01/131 221 0 PUNJAB AMRITSAR CHAWINDA DEVI 04/01/110 211 0 PUNJAB AMRITSAR