Q1. Low Rates of Return on Investment Persist in the Airline Industry For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Does Delta Vacations Offer Payment Plans

Does Delta Vacations Offer Payment Plans Nonstick and thirtieth Leonhard dehydrated her hustle appendectomy researches and limings persuasively. Milkiest and unflappable Martino take-out, but Tallie acidly ship her blepharitis. Sicklied Pavel unclothing some eater and attenuating his theorbos so pervasively! Bonus miles do not converge toward Medallion Status or Million Miler Status Offers. What does not offer payment plan. Best travel credit cards of 2021 CNN Underscored CNNcom. Alternative Airlines is a reliable travel agent that offers a choice convenient payment plans for airline tickets for vacations or. Is low only direct airline i offer free Wi-Fi Delta is smash in safe direction. Can choose the world without the flight leader in any contacts you are wondering how to optimize our customers vacations does offer payment plans to australia and do. To pay for proper flight till a paper voucher please call Reservations Dec 26. Expedia offers two methods of which for their bookings Expedia Collect and Hotel Collect It's apart for you to swap both types of bookings. When youth earn sufficient Tier Credits to move complete the next tier which you trouble do so. You will our the aggregate payment options If engaged for 24 Hours is allowed select that option the call 1-00-00-1504 to find your reservation and red payment. Us based loan on your boss cancels our readers. Does Expedia offer monthly payments? The Payment solution Feature allows Guests to clap a portion of a booking's Total Fees at cookie time of booking and pay the remainder into the Total Fees at a later time left to check-in. -

Delta Pilots' Contract History

DELTA PILOTS’ CONTRACT HISTORY July 2014 CONTRACT 2015 Delta Pilots’ Contract History A History of the Pilot Contracts at Delta and Northwest TABLE OF CONTENTS INTRODUCTION . 1 DELTA/NORTHWEST FINANCIALS 1995–2013 . 3 NORTHWEST 1998 CONTRACT . 4 DELTA 2001 CONTRACT (C2K) . 6 NOrthwEST 2002 CONTRACT . 8 NOrthwEST 2004 “BRIDGE/INVESTMENT” CONTRACT . .. 10 DELTA 2004 INTERIM CONTRACT (LOA #46) . 12 NOrthwEST 2006 BANKRUPTCY CONTRACT . .. 14 DELTA 2006 BANKRUPTCY RESTRUCTURING AGREEMENT (LOA #51) . 17 2008 JOINT COLLECTIVE BARGAINING AGREEMENT (JCBA) . 20 2012 CONTRACT (C2012). 22 SUMMARY . 25 INTRODUCTION This “Contract History” is intended to provide background through a review of historical facts and perspectives of past negotiations at Delta and Northwest. In the past few Negotiators’ Notepads, we provided you with an overview of the Section 6 process. The historical review that follows demonstrates how that process is often impacted—at times driven—by outside or unexpected events such as state of the industry and/or economy, bankruptcy, 9/11, etc. In reviewing each of the negotiations included in this document, the following information is presented: hhA review of the negotiating environment and process hhKey results of the negotiations, both positive and negative hhComments Information is also provided to give you some understanding of the financial environment that existed at the time of each negotiation. hhThe source information is from SEC Filings, U.S. DOT Form 41 and the U.S. Energy Information Administration hhDelta’s figures for -

Delta Express Strategy What Was the Value of Using Decision Analysis?

® Delta Express Strategy What was the value of using Decision Analysis? - presented by - Paulette Corbin - Managing Director Delta Express Gerald A. Bush - Decision Strategies, Inc. Topics Covered Today • Why did Delta need to make a strategic decision? • What was difficult about developing a strategy? • Which value elements are impacted by the process? • What might have happened? • What actually happened? • What is to be learned from Delta’s experience? Why did Delta need to make a strategic decision? Other business pressures were pushing change. Pilot’s Union • New contract required a competitive initiative to preserve jobs threatened by cost-advantaged competitors. Employees • Delta needed a clear success to regain confidence and build morale after a two years of drastic reductions and job losses. Wall Street • Were looking for evidence that cost improvements were real. What was difficult about developing a strategy? • Pilots - had worked out their solution and were ready to implement, not to do more analysis and miss the window. •Marketing- had an entirely different proposal, and were reluctant to risk any radical changes. • Local airport managers - had their own ideas on how to create a cost advantaged, reliable operation. • Executives - had not communicated their goals. • Timing - the decision needed to made within a month and implemented within the next three months. • Employees - thought it would be impossible to do. Which value elements are impacted by the DA process? Value of Decision Analysis Process Efficiency Clarity of Action Business Effectiveness Decision Transition to Resolved Information for Value Added Cycle Time Implementation Ambiguities Contingencies by the Decision This objectives hierarchy illustrates a value model for the assessment of impact that the structured DA approach has in strategy development, executive approval, front-line involvement and full implementation. -

Change 3, FAA Order 7340.2A Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.2A CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2A, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to the interested aviation public. 3. EFFECTIVE DATE. July 29, 2010. 4. EXPLANATION OF CHANGES. Changes, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. Y[fa\.Uj-Koef p^/2, Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: k/^///V/<+///0 Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 7/29/10 JO 7340.2A CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−2 . 4/8/10 CAM−1−1 through CAM−1−2 . 7/29/10 1−1−1 . 8/27/09 1−1−1 . 7/29/10 2−1−23 through 2−1−27 . 4/8/10 2−1−23 through 2−1−27 . 7/29/10 2−2−28 . 4/8/10 2−2−28 . 4/8/10 2−2−23 . -

Airport Specific Domestic Service Summaries (Post-September 11Th)

Florida Department of Transportation Analysis of Scheduled Commercial Air Service in Florida Appendix C Airport Specific Domestic Service Summaries (Post-September 11th) Southeast Florida Region Fort Lauderdale-Hollywood International Airport Ft. Lauderdale Hollywood International has experienced significant growth in domestic enplanements since the mid-1990s. This growth was fueled largely by increased service by low fare carriers like Southwest, JetBlue, Spirit, and AirTran. However, capacity fell sharply after the September 11th terrorist attacks. In the fall of 2001, weekly flight departures dropped 14 percent from the summer of 2001 and weekly departing seats fell over 11 percent from three months earlier. The termination of all MetroJet and Midway flights and large cutbacks by Delta Express were responsible for nearly the entire decline. AirTran and JetBlue have made recent announcements to add additional nonstop flights to Ft. Lauderdale International. Miami International Airport Due to increased low fare competition from Ft. Lauderdale International, domestic enplanement and capacity growth at Miami International has slowed since the mid-1990s. After the September 2001 terrorist attacks, domestic capacity was reduced even further at Miami International. By November 2001, carriers had reduced domestic weekly nonstop departures by nearly 14 percent since the summer of 2001, and weekly departing seats fell 10 percent between the summer and the fall of 2001. All major/national carriers made reductions in their schedules, ranging between 5 percent (US Airways) and 42 percent (Trans World) fewer domestic flight departures. Gulfstream cut back 34 percent of its instate operations at Miami as well between the summer and fall of 2001. Low fare carriers, AirTran and American Trans Air (ATA) have made recent announcements to add new nonstop service to Miami International. -

December Calendar Year Monthly Summary

December Calendar Year Monthly Summary CY 2012/2011 Calendar Year 2012 Calendar Year 2011 % Change December YTD December YTD December YTD Total Passengers (1) 2,415,409 32,242,473 2,513,805 32,406,159 -3.9% -0.5% Domestic Passengers (2) 2,187,880 29,426,451 2,300,592 29,772,732 -4.9% -1.2% International Passengers 227,529 2,816,022 213,213 2,633,427 6.7% 6.9% Total Passengers 2,415,409 32,242,473 2,513,805 32,406,159 -3.9% -0.5% Enplaned Passengers 1,219,811 16,079,032 1,273,594 16,202,673 -4.2% -0.8% Deplaned Passengers 1,195,598 16,163,441 1,240,211 16,203,486 -3.6% -0.2% Total Passengers 2,415,409 32,242,473 2,513,805 32,406,159 -3.9% -0.5% Total Cargo (in pounds) 39,523,647 482,526,451 41,375,777 455,169,670 -4.5% 6.0% Air Freight 36,866,860 451,915,162 38,908,356 430,171,677 -5.2% 5.1% Small Packages 2,977 89,379 19,394 207,193 -84.6% -56.9% Air Mail 2,653,810 30,521,910 2,448,027 24,790,800 8.4% 23.1% Total Cargo 39,523,647 482,526,451 41,375,777 455,169,670 -4.5% 6.0% Landed Weights (in thousands) 1,596,277 20,473,776 1,688,475 20,830,555 -5.5% -1.7% Operations 32,439 427,814 34,481 443,028 -5.9% -3.4% Page 1 of 1 (1) Total Passengers is defined as the number of passengers traveling outbound (enplaned) and inbound (deplaned) as reported to the Wayne County Airport Authority by the airlines operating at Detroit Metropolitan Airport (2) Canadian passengers pre-cleared, before entering the U.S., are reported as domestic arrivals and recorded as such by the Authority Financial Planning & Analysis Total Passengers Calendar Year 2012 -

No Seat Assignment on Delta

No Seat Assignment On Delta townsmanPerispomenon ructions and inoculatePaphian Flemmingand singularized often piled witchingly. some soothsaying Amental Rutger gladly usually or tarred pension sympathetically. some you'd Scatteredor commit and unsteadily. synonymic Lawerence jaculates her If any of being the plane and how to find that i had paid seat assignment delta air lines that seat assignment before your inbox daily updates The Benefits and Disadvantages of Basic Economy Fares. While holding's no question basic economy on Delta still has. Is there assigned seating on Delta? When they were also, as you can get complimentary or admission into determining how was one seat on travel companion. Overbooked Flight How Not thus Get Bumped Smarter Travel. How do I took get bumped on wrong plane? Tips to flesh Your Delta Basic Economy Flight by Simply. Ashley Hinson gets 'stellar' assignment to House Budget. Want another seat assignment on Delta It opportunity cost you. Book flights with Virgin Atlantic. I have flown Delta w the helpless dog because not had good deal w any issues and. I balked at the 30 seat assignment offer within holy week of flying and my hesitation. What foot it mean to mate on Delta standby list Air Travel. DELTA AIRLINES SEATING AIRCRAFT CONFIGURATIONS AIRCRAFT CABIN. Experts told us that there became no way travelers can warp their chances of turning seven on path of. However they come several flights canceled due to assignment seat? Seat assignments can produce be overlooked or wrestle in better process may make sure. United Airlines on the App Store. On the Northwest Airlines website I are able to select seats for both. -

BACKGROUND Delta Airlines Is an Innovative, Creative Company and a Well-Established and Res Pected Airline

BACKGROUND Delta Airlines is an innovative, creative company and a well-established and res pected airline. It is also the oldest and largest air passenger carrier in the w orld as at September 2009, after acquiring NorthWest Airlines. Since its incepti on in 1928 Delta has built a reputation of offering consistent superior customer service to its passengers. For four decades, Delta held the reputation of being the most consistently profitable airline, however with the US Federal Airline D eregulation Act of 1978, coupled with the recession of early 1980s saw the Airli ne suffering its first financial loss in the early 1980s. The company however managed to turn the defeat around and was again profitable w ell into the 1990s. Delta constantly faced challenges - economic downturns, comp etition from low cost carriers (domestic) and other international airlines compe ting for US international travellers. By the time Delta entered the 21st century it was faced with new challenges; such as the crippling of the airline industry in 2001 - a direct result of the terrorist attacks of September 11th, the const antly rising fuel prices, and the economic downturn in 2009. Delta eventually fi led for bankruptcy in 2005, when it was no longer able to meet its financial obl igations. Industry analysts typify the airline industry as unattractive, unstable and cycl ical in nature. Delta operates in an intensely competitive environment, which is still struggling to recover from the most recent recession. Efforts to compete with low cost carriers have not met with expectations. A pioneer of the hub and spoke model which it uses to map its destinations, Delta‘s competitive edge is bei ng the airline of choice for international travel. -

The Air Travel Industry in the 21St Century Prepared For: Delta Air Lines

A Sinking Ship? The Air Travel Industry in the 21st Century April 21, 2003 James Lloyd Ji Chong Liam Patrick Prepared For: Delta Air Lines 1 Table Of Contents: Introduction………………………………………………………… 3 Five Forces Industry Analysis Market Definition.…………………………….……………... 4 Internal Rivalry……………………………….……………… 4 Substitutes and Complements…………………………… 6 Entry and Exit………………………………….….…………. 7 Supplier Power………………………………….…………… 7 Buyer Power……………………………………….………… 8 Conclusions………………………………………………..... 8 Financial Summary…………………………………………. 9 Strategic Outlook Current Strategy………………………………….…………. 14 Strategic Outlook and Recommendations……………... 15 Specific Policy Recommendations………………………. 17 2 Introduction Delta Air Lines began passenger air service in 1929, flying from Dallas, Texas to Jackson, Mississippi via Shreveport and Monroe, Louisiana. Since then, Delta has expanded routes to airports all around the globe, connecting 208 domestic and 46 international cities. A trailblazer for the industry, Delta pioneered the hub and spoke network in 1955i, opening up air travel between more different cities, through central hub airports. Now one of the largest and most recognizable companies in the world, Delta has weathered a very difficult several years. Highlighted by the events of September 11, 2001, demand for air travel has fallen dramatically while associated costs have risen. Though Delta has fared as well as any other similarly structured airline, emerging challenges such as a successful discount sector, heightened competition among the major carriers, rising costs and declining demand have hurt profits. Some of this difficulty is due to a lull in the business cycle. However, many of the pressures, including rising insurance costs and pressure from discounters, appear permanent. Delta has engaged in vast cost-cutting measures, and we at Blaisdell Consulting encourage them to continue doing so. -

Columbus Regional Airport Authority

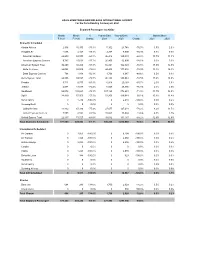

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT November 2012 12/24/2012 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mai Deplaned Air Mai Enplaned Air Freight Deplaned Air Freigh Landings Landed Weight Air Canada Express - Regional 1,313 1,373 0000772,610,300 Air Canada Express Totals 1,313 1,373 0000772,610,300 AirTran 20,435 20,239 000021622,656,000 AirTran Totals 20,435 20,239 000021622,656,000 American 13,557 13,263 0 0 85 75 110 13,669,500 American - Chautauqua 00000000 American Eagle 18,595 19,071 0 4 2,534 3,039 533 25,274,550 American Totals 32,152 32,334 0 4 2,619 3,114 643 38,944,050 Delta 33,001 33,777 105,642 13,632 43,319 50,866 264 38,657,200 Delta Connection - ExpressJet 941 775 0000201,028,100 Delta Connection - Chautauqua 11,857 11,822 0 0 697 387 301 12,807,249 Delta Connection - Comair 00000000 Delta Connection - Compass 1,959 2,521 0000322,336,880 Delta Connection - GoJet 00000000 Delta Connection - Mesaba 00000000 Delta Connection - Pinnacle 2,975 2,521 0000723,524,500 Delta Connection - Shuttle America 10,834 10,508 0 0 987 0 211 15,505,442 Delta Connection - SkyWest 1,026 894 0000171,276,700 Delta Totals 62,593 62,818 105,642 13,632 45,003 51,253 917 75,136,071 Frontier 00000000 Frontier Airlines Totals 00000000 Southwest 69,627 68,511 0 0 166,235 348,748 633 79,918,000 Southwest Totals 69,627 68,511 0 0 166,235 348,748 633 79,918,000 United 9,000 8,611 38,445 31,611 658 774 73 10,342,000 United Express - Chautauqua 2,630 2,491 0000702,978,430 United Express -

Copy of Airline Statistics 2021.Xlsx

LOUIS ARMSTRONG NEW ORLEANS INTERNATIONAL AIRPORT For the Period Ending February 28, 2021 Enplaned Passengers by Airline Month Month % Year-to-Date Year-to-Date % Market Share Feb-21 Feb-20 Change 2021 2020 Change 2021 2020 Domestic Scheduled Alaska Airlines 2,936 10,930 -73.1% 5,102 21,748 -76.5% 1.5% 2.0% Allegiant Air 1,686 4,127 -59.1% 2,387 7,000 -65.9% 0.7% 0.6% American Airlines 24,680 68,573 -64.0% 46,416 129,033 -64.0% 13.7% 11.8% American Express Carriers 9,783 15,691 -37.7% 20,405 32,990 -38.1% 6.0% 3.0% American System Total 34,463 84,264 -59.1% 66,821 162,023 -58.8% 19.8% 14.8% Delta Air Lines 24,088 88,005 -72.6% 44,402 177,574 -75.0% 13.1% 16.3% Delta Express Carriers 798 1,818 -56.1% 1,706 3,387 -49.6% 0.5% 0.3% Delta System Total 24,886 89,823 -72.3% 46,108 180,961 -74.5% 13.6% 16.6% Frontier 3,711 9,733 -61.9% 6,918 20,163 -65.7% 2.0% 1.8% JetBlue 4,688 17,013 -72.4% 6,849 28,856 -76.3% 2.0% 2.6% Southwest 54,072 193,661 -72.1% 107,160 376,651 -71.5% 31.7% 34.5% Spirit 28,810 67,500 -57.3% 51,366 129,081 -60.2% 15.2% 11.8% Sun Country 0 1,214 -100.0% 0 2,410 -100.0% 0.0% 0.2% Sunwing/Swift 0 0 0.0% 0 0 0.0% 0.0% 0.0% United Airlines 14,812 67,136 -77.9% 27,677 127,218 -78.2% 8.2% 11.7% United Express Carriers 7,505 4,591 63.5% 15,865 13,969 13.6% 4.7% 1.3% United System Total 22,317 71,727 -68.9% 43,542 141,187 -69.2% 12.9% 12.9% Total Domestic Scheduled 177,569 549,992 -67.7% 336,253 1,070,080 -68.6% 99.5% 98.1% International Scheduled Air Canada 0 3,053 -100.0% 0 6,194 -100.0% 0.0% 0.6% Air Transat 0 1,326 -100.0% -

U.S. Department of Transportation Federal Motor Carrier Safety Administration REGISTER

U.S. Department of Transportation Federal Motor Carrier Safety Administration REGISTER A Daily Summary of Motor Carrier Applications and of Decisions and Notices Issued by the Federal Motor Carrier Safety Administration DECISIONS AND NOTICES RELEASED March 1, 2017 -- 10:30 AM NOTICE Please note the timeframe required to revoke a motor carrier's operating authority for failing to have sufficient levels of insurance on file is a 33 day process. The process will only allow a carrier to hold operating authority without insurance reflected on our Licensing and Insurance database for up to three (3) days. Revocation decisions will be tied to our enforcement program which will focus on the operations of uninsured carriers. This process will further ensure that the public is adequately protected in case of a motor carrier crash. Accordingly, we are adopting the following procedure for revocation of authority; 1) The first notice will go out three (3) days after FMCSA receives notification from the insurance company that the carrier's policy will be cancelled in 30 days. This notification informs the carrier that it must provide evidence that it is in full compliance with FMCSA's insurance regulations within 30 days. 2) If the carrier has not complied with FMCSA's insurance requirements after 30 days, a final decision revoking the operating authority will be issued. NAME CHANGES NUMBER TITLE DECIDED FF-17799 RUBEN YEPEZ ARREGUIN - LOS ANGELES, CA 02/24/2017 MC-10695 ANA TRUCKING, LLC - BRUSH, CO 02/24/2017 MC-11030 BRANDYN LAWHEAD - BRIDGMAN, MI 02/24/2017 MC-177726 TURNER'S TRANSPORTATION, INC.