Future Plc Annual Report and Accounts 2017 Annual Report and Accounts 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

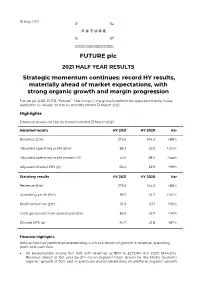

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Pressreader Magazine Titles

PRESSREADER: UK MAGAZINE TITLES www.edinburgh.gov.uk/pressreader Computers & Technology Sport & Fitness Arts & Crafts Motoring Android Advisor 220 Triathlon Magazine Amateur Photographer Autocar 110% Gaming Athletics Weekly Cardmaking & Papercraft Auto Express 3D World Bike Cross Stitch Crazy Autosport Computer Active Bikes etc Cross Stitch Gold BBC Top Gear Magazine Computer Arts Bow International Cross Stitcher Car Computer Music Boxing News Digital Camera World Car Mechanics Computer Shopper Carve Digital SLR Photography Classic & Sports Car Custom PC Classic Dirt Bike Digital Photographer Classic Bike Edge Classic Trial Love Knitting for Baby Classic Car weekly iCreate Cycling Plus Love Patchwork & Quilting Classic Cars Imagine FX Cycling Weekly Mollie Makes Classic Ford iPad & Phone User Cyclist N-Photo Classics Monthly Linux Format Four Four Two Papercraft Inspirations Classic Trial Mac Format Golf Monthly Photo Plus Classic Motorcycle Mechanics Mac Life Golf World Practical Photography Classic Racer Macworld Health & Fitness Simply Crochet Evo Maximum PC Horse & Hound Simply Knitting F1 Racing Net Magazine Late Tackle Football Magazine Simply Sewing Fast Bikes PC Advisor Match of the Day The Knitter Fast Car PC Gamer Men’s Health The Simple Things Fast Ford PC Pro Motorcycle Sport & Leisure Today’s Quilter Japanese Performance PlayStation Official Magazine Motor Sport News Wallpaper Land Rover Monthly Retro Gamer Mountain Biking UK World of Cross Stitching MCN Stuff ProCycling Mini Magazine T3 Rugby World More Bikes Tech Advisor -

Memory External Drives Ssds

2015 PRODUCT CATALOG External Drives SSDs Memory Capacity up to 32TB Experience the ultimate More Memory = A Faster Mac Thunderbolt | USB | eSATA | FireWire performance upgrade! Save up to 50% vs. Factory from $75.99 p.17 120GB–2TB from $67.00 p.03 from $17.99 p.11 1-866-692-7100 1-815-308-7001 International +1-815-338-4751 www.newertech.com www.owcdigital.com 03 OWC Solid State Drives 09 OWC Data Doubler 11 Simply the most advanced software RAID for Mac. OWC Memory SoftRAID offers performance and flexibility far beyond hardware RAID, delivering state-of-the-art 16 NewerTech Accessories drive certification, always-on health monitoring, detailed email notification, and fully customizable RAID modes. SoftRAID is the most advanced software RAID engine for Mac. 17 OWC External Storage • SoftRAID delivers a complete RAID control and feature set 31 OWC Optical Drives • Always-on disk health monitoring with email notification • System wide predictive disk-failure analysis 36 OWC Thunderbolt Solutions • Comprehensive drive certification 41 • Fast RAID rebuild times OWC Expansion Docks • RAID 0, 1, 4, 5, and 1+0 support 47 NewerTech NuPower Batteries • Support for multiple RAID volumes across the same disks Discover ultra-high-performance external storage enhanced by SoftRAID 5. Check 49 Try it free today at www.softraid.com out the ThunderBay 4 on p.35 Accessories The most advanced RAID engine for Mac. $179.00 SoftRAID Lite – just $49.00 Want the incredibly robust disk-health monitoring and drive certification tools of SoftRAID 5, but only need support for RAID 0 & 1? Meet SoftRAID Lite, your essential RAID utility for Mac OS X v10.6.8 and later. -

Rosseau, Brendan 2019 Astronomy Thesis Title

Rosseau, Brendan 2019 Astronomy Thesis Title: The Intellectual Marketplace: The Evolution of Space Exploration from Copernicus to von Braun & Beyond Advisor: Jay Pasachoff Advisor is Co-author: None of the above Second Advisor: Released: release now Authenticated User Access: Yes Contains Copyrighted Material: No The Intellectual Marketplace: The Evolution of Space Exploration from Copernicus to von Braun & Beyond by Brendan L. Rosseau Dr. Jay Pasachoff, Advisor A thesis submitted in partial fulfillment of the requirements for the Degree of Bachelor of Arts with Honors in Astronomy WILLIAMS COLLEGE Williamstown, Massachusetts May 8, 2019 TABLE OF CONTENTS Acknowledgments ……………………………………………………………………………………………….. 2 Abstract ………………………………………………………………………………………………………………. 3 Thesis Prologue ………………………………………………………………………………………... 4 Introduction …………………………………………………………………………………... 6 Part I: Early Astronomy ………………………………………………………………….. 11 Part II: Space Exploration in the New World ……………………………….….... 25 Part III: Spaceflight ………………………………………………………………………... 43 Looking Back & Looking Ahead ….………………………………………………….… 60 Appendix Endnotes ………………………………………………………………………………………. 64 About the Author …………………………………………………………………………… 68 Citations ……………………………………………………………………………………….. 69 1 ACKNOWLEDGMENTS I would like to express my great appreciation to Professor Jay Pasachoff, Field Memorial Professor of Astronomy at Williams College, for his invaluable contributions to this thesis and to my education in astronomy. I am particularly grateful for the assistance given by -

Preliminary Results FY 2020

Preliminary results FY 2020 25 November 2020 1 2 Agenda ● Overview ● FY 2020 financial review ● Progress against our strategy in FY 2020 ● Recommended offer for GoCo Group plc ● Summary & outlook 3 Exceptional results, Values led 01 ahead of expectations... 02 execution... ● Strong core values facilitated ● Group revenue up 53% to agile response to the rapidly £339.6m, underpinned by changing landscape acquisitions and media organic ● Operating leverage driving revenue growth of 23% adjusted operating margin ● Continued growth in adjusted expansion to 28% operating profit, up 79% to ● Continue to be highly cash £93.4m Continued generative, with adjusted free ● Adjusted free cash flow growth cash flow of 103% of adjusted of 79% strength of operating profit ● Exceptional performance performance despite COVID-19 underpinned ...delivered by ongoing ...enables strong by delivery 03 focus on strategy 04 acquisitions performance ● TI Media integration ● Continued shift in revenue, completed, savings of £20m with Media division now 65% 1 identified, with focus now on of revenues (Sept 2020) building revenue ● Geographical diversification monetisation, with launch of 6 continues with US now 43% of new sites revenue (Sept 2020)1 2 ● Barcroft and SmartBrief both ● Online audience growth of in BAU mode, delivering in 56%, with organic audience line with plans up 48%, driving sales ● Recommended offer for performance in Media GoCo Group plc announced today (25 November) 4 1 Sept month 2020 shown to reflect TI Media acquisition 2 Google Analytics online users. -

Magazine Subscriptions

Magazine Subscriptions PTP 2707 Princeton Drive Austin, Texas 78741 Local Phone: 512/442-5470 Outside Austin, Call: 1-800-733-5470 Fax: 512/442-5253 e-mail: [email protected] Website: www.magazinesptp.com Jessica Cobb Killeen ISD Bid for 16-20-06-207 (Magazine Subscriptions) 7/11/16 Purchasing Dept. Retail Item Percent Net Unit Ter Unit No. Discount Price Subscription Title Iss. m Price 0001 5.0 MUSTANG & SUPER FORDS now Muscle Mustangs & Fast Fords 12 1Yr. $ 44.99 30% $ 31.49 0002 ACOUSTIC GUITAR 12 1Yr. $ 36.95 30% $ 25.87 0003 ACTION COMICS SUPERMAN 12 1Yr. $ 29.99 30% $ 20.99 0004 ACTION PURSUIT GAMES Single issues through the website only 12 1Yr. $ - 0005 AIR & SPACE SMITHSONIAN 6 1Yr. $ 28.00 30% $ 19.60 0006 AIR FORCE TIMES **No discount 52 1Yr. $ 58.00 0% $ 58.00 0007 ALFRED HITCHCOCKS MYSTERY MAGAZINE 12 1Yr. $ 32.00 30% $ 22.40 0008 ALL YOU 2015 Dec: Ceased 12 1Yr. $ - 0009 ALLURE 12 1Yr. $ 15.00 30% $ 10.50 0010 ALTERNATIVE PRESS 12 1Yr. $ 15.00 15% $ 12.75 0011 AMAZING SPIDER-MAN 12 1Yr. $ 64.00 15% $ 54.40 0012 AMERICA (National Catholic Weekly) 39 1Yr. $ 60.95 15% $ 51.81 0013 AMERICAN ANGLER 6 1Yr. $ 19.95 30% $ 13.97 0014 AMERICAN ANNALS OF THE DEAF **No discount 4 1Yr. $ 95.00 0% $ 95.00 0015 AMERICAN BABY 2015 May: Free Online at americanbaby.com 12 1Yr. $ - 0016 AMERICAN CHEERLEADER 6 1Yr. $ 17.95 30% $ 12.57 0017 AMERICAN COWBOY 6 1Yr. $ 26.60 15% $ 22.61 0018 AMERICAN CRAFT 6 1Yr. -

SYNDICATION Partner with Future OUR PURPOSE

SYNDICATION Partner With Future OUR PURPOSE We change people’s lives through “sharing our knowledge and expertise with others, making it easy and fun for them to do what they want ” CONTENTS ● The Future Advantage ● Syndication ● Our Portfolio ● Company History THE FUTURE ADVANTAGE Syndication Our award-winning specialist content can be used to further enrich the experience of your audience. Whilst at the same time saving money on editorial costs. We have 4 million+ images and 670,000 articles available for reuse. And with the support of our dedicated in-house licensing team, this content can be seamlessly adapted into a range of formats such as newspapers, magazines, websites and apps. The Core Benefits: ● Internationally transferable content for a global audience ● Saving costs on editorial budget so improving profit margin ● Immediate, automated and hassle-free access to content via our dedicated content delivery system – FELIX – or custom XML feeds ● Friendly, dynamic and forward-thinking licensing team available to discuss editorial requirements #1 ● Rich and diverse range of material to choose from ● Access to exclusive content written by in-house expert editorial teams Monthly Bookazines Global monthly Social Media magazines users Fans 78 2000+ 148m 52m Source: Google Search 2018 SYNDICATION ACCESS the entire Future portfolio of market leading brands within one agreement. Our in context licence gives you the ability to publish any number of features, reviews or interviews to boost the coverage and quality of your publications. News Features Interviews License the latest news from all our Our brands speak to the moovers and area’s of interest from a single shakers within every subject we write column to a Double Page spread. -

ABC Consumer Magazine Concurrent Release - Dec 2007 This Page Is Intentionally Blank Section 1

December 2007 Industry agreed measurement CONSUMER MAGAZINES CONCURRENT RELEASE This page is intentionally blank Contents Section Contents Page No 01 ABC Top 100 Actively Purchased Magazines (UK/RoI) 05 02 ABC Top 100 Magazines - Total Average Net Circulation/Distribution 09 03 ABC Top 100 Magazines - Total Average Net Circulation/Distribution (UK/RoI) 13 04 ABC Top 100 Magazines - Circulation/Distribution Increases/Decreases (UK/RoI) 17 05 ABC Top 100 Magazines - Actively Purchased Increases/Decreases (UK/RoI) 21 06 ABC Top 100 Magazines - Newstrade and Single Copy Sales (UK/RoI) 25 07 ABC Top 100 Magazines - Single Copy Subscription Sales (UK/RoI) 29 08 ABC Market Sectors - Total Average Net Circulation/Distribution 33 09 ABC Market Sectors - Percentage Change 37 10 ABC Trend Data - Total Average Net Circulation/Distribution by title within Market Sector 41 11 ABC Market Sector Circulation/Distribution Analysis 61 12 ABC Publishers and their Publications 93 13 ABC Alphabetical Title Listing 115 14 ABC Group Certificates Ranked by Total Average Net Circulation/Distribution 131 15 ABC Group Certificates and their Components 133 16 ABC Debut Titles 139 17 ABC Issue Variance Report 143 Notes Magazines Included in this Report Inclusion in this report is optional and includes those magazines which have submitted their circulation/distribution figures by the deadline. Circulation/Distribution In this report no distinction is made between Circulation and Distribution in tables which include a Total Average Net figure. Where the Monitored Free Distribution element of a title’s claimed certified copies is more than 80% of the Total Average Net, a Certificate of Distribution has been issued. -

O N T H E 12 U P Hamish Anderson Aussie Blues-Rock Man Hurries up and Waits

MONITOR PEOPLEPEOPLE ✪ NNEWSEws ✪ NONOISEISE O N T H E 12 U P HAMISH ANDERSON Aussie blues-rock man hurries up and waits here’s a trend This approach pervades with being horribly writing I find too often that I’ll among young every aspect of Hamish’s patronising – suggests an ear get distracted by a message or bluesmen, process. Part Tom Petty, part JJ that’s gifted rather than I’ll open up social media and T much like the Cale, his deftly-constructed honed. Trust us: sounding this get lost. When writing on a perennial boy 2017 debut album Trouble led relaxed in the digital age takes typewriter you can be totally racer, to play guitar with to him touring the US a lot of work. in your zone.” go-faster stripes, souping up alongside Vintage Trouble and “I write on a typewriter He’ll need that focus: 2018 knackered licks with frippery Kenny Wayne Shepherd last when I can,” expands is already shaping up to be a and cold pace. LA-based, year. But it’s his gravelly Hamish. “Because you really big year, with second-album Australian-born songwriter guitar work – undress-y, have to commit to what you sessions and a trip to Europe Hamish Anderson is a very louche and noticeably slower write and you can eliminate on the cards. “The goal is to different proposition. He playing than his peers – that distractions. I use my phone perform in the UK in 2018,” favours the slow burn. truly sets him apart. Lyrical to get ideas down quickly as reveals Hamish.