Firozabad Ceramics Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GLASS LANTERNS P R O D U C T S

+91-9837006913 Glass World https://www.indiamart.com/gargenterprises-firozabad/ We are one of the widely acclaimed companies engaged in the manufacture and export of intricately designed glass and metal products in INDIA. Our exclusive product catalogue, which includes Glass Christmas Decoration, Glass Candle Holders, ... About Us We are one of the widely acclaimed companies engaged in the manufacture and export of intricately designed glass and metal products in INDIA. Our exclusive product catalogue, which includes Glass Christmas Decoration, Glass Candle Holders, Glass, Glass Vase, Glass Votive Holders, Glass Cake Covers, Glass Decanters/Perfume Bottles, Glass Lamps, Glass Lantern & various Glass/Metal Decorative Artwares, hosts a magnificent variety in accordance to the latest trends and styles at best competitive and affordable prices. The product range we offer are amazing and beautifully created keeping with the minutes detailing. While creating products our designers take care that quality is taken care and not ignored. Our assortment of products are stunning and dazzling. We are well known decorative glassware exporters. We are currently supplying to more that 20 countries worldwide. For more information, please visit https://www.indiamart.com/gargenterprises-firozabad/aboutus.html GLASS LANTERNS P r o d u c t s & S e r v i c e s LAN- 2364 Glass Lanterns LAN-1543 Glass Lanterns LAN-1519 Glass Lanterns LAN -01 Glass Lanterns CHRISTMAS DECORATION P r o d u c t s & S e r v i c e s CH-01 Christmas Decoration CH-02 Christmas Decoration -

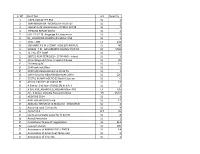

SL NO Short Text Unit Quantity 1 CAPX-I/18-20 TPT RSA

SL NO Short Text Unit Quantity 1 CAPX-I/18-20 TPT RSA SU 1 2 MAHARASHTRA - MONOLITH-FRONTLIT SU 1 3 Operation & maintenance of PMCC Oct'18 SU 7 4 PIPELINE REPAIR WORK SU 1 5 002_12.07.18_Air gauge & Compressor SU 5 6 01_HOARDING BOARDS @ Lakshmi KSK SU 1 7 10 KL TANK EA 234 8 100 MMD X 6 M L COMP. HOSE B/E 4IN FLA( SU 46 9 118235- T-M--HANUMAPPA-FILLING-STATION EA 5794 10 14.2 KG STP DONE SU 31 11 185721 PCM PETROLEU - 17 M HMS - Inland SU 1 12 2 hoardings and Poles Tirupati FS Biswa SU 20 13 20 Desktop PC SU 11 14 20 kl tank installtion SU 1 15 20 kl tank Reaplacement at kargil f/s SU 1 16 24Hrs-Security w&wAlliedServices-24Hrs SU 229 17 272761 KUMAR AGENCIES-Backlit Section SU 6 18 425 KG FACILITY AT JAIPUR BP SU 16 19 A Site for 2nd Year-178460 SRI M.K.R. A SU 2 20 A SITE KSK_AGARKHED_4816483 (Non PM) EA 705 21 AC - 3 phase, Variable Frequency Drive TO 252.5 22 ADDITIVE 5014 SU 1 23 Addl vehicle for training SU 17 24 ADDL DU INSTLN AT JK MAKAKVI _KHANAPUR SU 2 25 Adjoining road-Civil works SU 4 26 ADO-CAT-B SET 95 27 alarm annunciator panel for Hi & HiHi l SU 8 28 Anand Petroleum SU 1 29 Ankleshwar Taluka-CP Upgradation SU 513 30 ausgram station SU 196 31 Automation of ABINAV FUEL CENTER SU 14 32 Automation of Aman Fuel Thole road SU 9 33 Automation of new ROs SU 2 34 Automation of new ROs(navodya f.s ) SU 4 35 Automation of new ROs-Delhi DO SU 1 36 AUTOMATION UPS WORK AT JAIN PETROLEUM SU 1 37 AUTOMATION UPS WORK AT SANWALIA PATIDAR SU 9 38 Automation works at shahid prakash pati SU 33 39 B Site for 1st Year-307696 MARUDHAN AGE SU -

PDF File Generated From

OCCASION This publication has been made available to the public on the occasion of the 50th anniversary of the United Nations Industrial Development Organisation. DISCLAIMER This document has been produced without formal United Nations editing. The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization (UNIDO) concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries, or its economic system or degree of development. Designations such as “developed”, “industrialized” and “developing” are intended for statistical convenience and do not necessarily express a judgment about the stage reached by a particular country or area in the development process. Mention of firm names or commercial products does not constitute an endorsement by UNIDO. FAIR USE POLICY Any part of this publication may be quoted and referenced for educational and research purposes without additional permission from UNIDO. However, those who make use of quoting and referencing this publication are requested to follow the Fair Use Policy of giving due credit to UNIDO. CONTACT Please contact [email protected] for further information concerning UNIDO publications. For more information about UNIDO, please visit us at www.unido.org UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna International Centre, P.O. Box -

Quarterly Journal of the All India Glass Manufacturers' Federation

Vol. 6 | No. 1 | April - June 2018 Quarterly Journal of The All India Glass Manufacturers’ Federation Bi-lingual Special Feature • Drawing Competition - Adopt a Glass Bottle • Soda Ash for Glass Manufacturing • Opportunities and Challenges posed by the Environment for the Glass Industry in India • The Glass Industry Waking up to its Needs • Hot Sealing of Aluminium Films on Glass Containers • Safety Considerations of Architectural Glass • Float Glass Process and Applications – Revisited: Part I • Life Cycle Analysis (LCA) of Container Glass in India – 2017 • Cold End Project between the Ganges and Yamuna Rivers • Indian Pharmaceutical Plants serve the World • Float Glass Process Technology – Revisited: Part II • Raising our Glasses to the Glass Industry Upcoming Events - Aug 17 (Details on page # 22) • Interactive Session on Industry- related Risk and Opportunities • Ist AIGMF Glass Awards • Annual General & Executive Committee Meetings 1st Prize (winning entry) of Drawing Competition on ‘Adopt a Glass Bottle’ held on World Environment Day - June 5, 2018 812 NEW DELHI HOUSE, 27 BARAKHAMBHA ROAD, NEW DELHI-110001, INDIA Telephone: + 91 11 23316507 Fax: + 91 11 23350357 E-Mail: [email protected] Website: www.aigmf.com 812 NEW DELHI HOUSE, 27 BARAKHAMBHA ROAD, NEW DELHI-110001, INDIA Telephone: + 91 11 23316507 Fax: + 91 11 23350357 E-Mail: [email protected] Website: www.aigmf.com GLASS MELTING GLASS FORMING We provide integrated oxyfuel technology using We provide low cost, compact and modular cost effective on-site oxygen generators based hydrogen generators using SMR technology on VSA technology and suitable combustion capable of producing ultra high purity system to maximise performance, enhance (99.999%) gas required for glass manufactur- productivity and decrease emissions in glass ing process. -

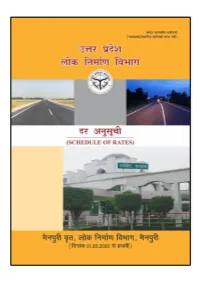

S.O.R 2020(1)

mÙkj izns'k yksd fuekZ.k foHkkx INDEX Sl. Chapter Description Page No. No. 1 - INDEX 1 2 - OFFICE ORDER 2 3 - IMPORTANT INSTRUCTIONS 3-6 4 - EXTRA CONDITIONS FOR LABOUR WORK ONLY 7 5 1 MATERIALS 8-16 6 2 LABOUR 17-18 7 3 CARTAGE 19-22 8 4 EARTH WORK 23 9 5 CONCRETE WORK 24-25 10 6 BRICK WORK 26 11 7 DAMP PROOF COARSE 27 12 8 ANTI TERMITE TREATMENT 28 13 9 DOORS & WINDOWS 29-33 14 10 MILD STEEL & IRON WORK 34-36 15 11 ROOF WORK 37-40 16 12 CEILING AND LINING 41-45 17 13 PLASTER & POINTING 46-48 18 14 FLOORING 49-52 19 15 PAINTING & DISTEMPERING 53-56 20 16 WHITE WASHING & COLOUR WASHING 57 21 17 DEMOLITION & DISMANTLING 58-59 22 18 MARBLE WORK IN WALL LINING ETC. 60 23 19 MISCELLANEOUS 61-62 24 20 ROAD WORK 63-66 25 21 WATER SUPPLY MATERIALS 67-69 26 22 SANITARY MATERIALS 70-71 27 23 WATER SUPPLY WORKS 72-80 28 24 SANITARY FITTINGS 81-84 29 25 DRAINAGE 85-87 30 26 ANNUAL REPAIRS 88 31 27 TRAFFIC SIGN 89-90 32 - CONSUMPTION OF BUILDING MATERIALS 91-92 Page 1 Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 CHAPTER-1 MATERIAL Schedule PWD Rate in MATERIALS Unit Item No. Spec. No. Rs. 1- BRICK (a) Class 150 1.1.1 1000 Nos 5800.00 (b) Class 100 1.1.2 1000 Nos 5600.00 (c ) Straight over brunt Class-275 1.1.4 1000 Nos 5400.00 (d) Tiles, Bull Nose Drip Course Brick 1.1.4 1000 Nos 5700.00 2- BRICK BALLAST (a) Overburnt brick ballast 40mm gauge 1.2 Cum 1200.00 (b) Class-150 brick ballast 25mm gauge 1.2 Cum 1300.00 (c ) Brick Bats of O.B.B./Class150 1.2 Cum 900.00 Fly ash Brick (Specification/Strengh should not be less than bricks 2(A) 1000 Nos 6100.00 150) (Size-230mmx110mmx75mm) Autoclaved Aerated Concrete (AAC) Block conforming to IS-2185- 2(B) 2005(part-III) including loading, cartage upto site, unloading, cum 3000.00 stacking including all levies and octroi, royalities if any 3(A) STONE BALLAST (From Khera Thakur Quarry) 45-90 mm guage stone ballast. -

Ministry Launches Campaign Against Unlicensed Nurseries

QATAR | Page 20 SPORT | Page 1 Millions of Al-Attiyah passengers eases to experience victory at Summer in Rally of Qatar at HIA Lebanon terminal published in QATAR since 1978 MONDAY Vol. XXXX No. 11294 September 2, 2019 Muharram 3, 1441 AH GULF TIMES www. gulf-times.com 2 Riyals Amir invited to attend Kuala Lumpur Summit In brief Qatari Diar to develop QATAR | Phone talk Amir gets invitation US embassy staff to visit Jordan His Highness the Amir Sheikh Tamim residences in Dushanbe bin Hamad al-Thani held yesterday a telephone conversation with King Abdullah II bin al-Hussein of Jordan. QNA The US ambassador said he is de- During the call, they reviewed the Dushanbe lighted to start the fi rst steps of the strong brotherly relations between project. He also said he was excited the two countries and ways to boost to work with Qatari Diar, which will them for the benefit of the two atari Diar has signed a pre- provide the embassy staff with ac- countries and brotherly peoples, liminary agreement to devel- commodation of international besides discussing a number of Qop 42 residential units for the standards and high quality. topics of common interest. King US embassy staff in the Tajik capital, Several US government represent- Abdullah invited the Amir to visit Dushanbe. atives also expressed their desire to Jordan, and His Highness welcomed Under the agreement, Qatari Diar work with Qatari Diar as a strategic the invitation. Company is to prepare plans and en- partner in other countries. gineering designs for the residential Diar Dushanbe is a unique devel- QATAR | Offi cial units. -

Cluster Profile Firozabad Glass Industries

Cluster Profile Firozabad glass industries Firozabad UTTAR PRADESH Certificate of originality Original work of TERI done under the project “INDIA: TERI-SDC Partnership: Scaling up Energy Efficient Technologies in Small Enterprises (EESE)” This document may be reproduced in whole or in part and in any form for educational and non-profits purposes without special permission, provided acknowledgement of the source is made. SDC and TERI would appreciate receiving a copy of any publication that uses this document as a source. Suggested format for citation TERI. 2015 Cluster Profile Report – Firozabad glass industries New Delhi: The Energy and Resources Institute 12 pp. [Project Report No. 2014IE15] Disclaimer This document is an output of a research exercise undertaken by TERI supported by the Swiss Agency for Development and Cooperation (SDC) for the benefit of MSME sector. While every effort has been made to avoid any mistakes or omissions, TERI and SDC would not be in any way liable to any persons/organisations by reason of any mistake/ omission in the publication. Published by T E R I Press The Energy and Resources Institute Darbari Seth Block IHC Complex, Lodhi Road New Delhi-110 003 India For more information Project Monitoring Cell T E R I Tel. 2468 2100 or 2468 2111 Darbari Seth Block E-mail [email protected] IHC Complex, Lodhi Road Fax 2468 2144 or 2468 2145 New Delhi – 110 003 Web www.teriin.org India India +91 • Delhi (0)11 Contents ACKNOWLEDGEMENTS Overview of cluster ................................................................................................................ 1 Products and production capacity ....................................................................................... 1 Energy scenario in the cluster ............................................................................................... 2 Production process ................................................................................................................ -

Quarterly Journal of the All India Glass Manufacturers' Federation Inside

Vol. 4 | No. 1 | April - June 2016 www.aigmf.com Quarterly Journal of The All India Glass Manufacturers’ Federation Bi-lingual Inside Interview Special Feature Yoshihiko Sano • Sustainability in Glass President of Nipro Corporation • A Note on Closed Glass Companies in the USA • Nipro Injects Innovation into Pre- for Artistic Appreciation filled Syringes and Targets US Expansion • Efficient Workflow: Automation and Digitisation Reduce Production and Handling Costs Upcoming Events (Sept 2, 2016) • FEA Studies of Impact Loads on NNPB Refillable • Enhancing Profitability by Empowering Workforce Bottles • Business Opportunities for Indian Glass Companies at Port of Duqm, • Energy Efficient Renovation Boost for Added- Sultanate of Oman Value Glazing • AIGMF Executive Committee Meeting / AGM Main Story Glass Packaging Supporting Swachh Bharat Abhiyaan (Clean India Campaign) event at Central Glass and Ceramic Research Institute (CSIR-CGCRI), Kolkata Page No. 6 Technical Articles Prof. (Dr.) A. K. Bandyopadhyay Prof. (Dr.) A Sustainable 50 for postage postage for 50 ` ASS ASS www.aigmf.com Building and Packaging material - An Publication GlASS Gl Gl 500 (within India) + + India) (within 500 ` ` Overseas: US$ 60 (including postage and bank charges) bank and postage (including 60 US$ Overseas: Order Print Copies: Print Order Price: Price: PORT OF DUQM Duqm, 100% Foreign Ownership the preferred Tax -exemption for 30 years Free Repatriation of Capital Special Economic & profi ts No minimum capital requirement No currency restrictions Zone for your No personal income tax Exemption from import & overseas export duties Usufruct agreements up to 50 years renewable investment One-stop station service For more information, contact: Port of Duqm Company SAOC Tel: (+968) 24342800 | Fax: (+968) 24587343 | [email protected] | www.portduqm.com 2 Kanch | Vol. -

Assessment of Indoor Radon, Thoron and Their Decay Products in the Surrounding Areas of Firozabad, Uttar Pradesh, India

Available online a t www.scholarsresearchlibrary.com Scholars Research Library Archives of Applied Science Research, 2011, 3 (1):77-82 (http://scholarsresearchlibrary.com/archive.html) ISSN 0975-508X CODEN (USA) AASRC9 Assessment of indoor radon, thoron and their decay products in the surrounding areas of Firozabad, Uttar Pradesh, India Mohd Zubair* , M Shakir Khan, Deepak Verma Department of Applied physics, Z.H. College of Engineering & Technology, Aligarh Muslim University, Aligarh 202002, India ______________________________________________________________________________ ABSTRACT Study of indoor radon/thoron has been carried out in some dwellings of Firozabad, Uttar Pradesh, India using LR-115 type II plastic track detectors. Radon is an invisible radioactive gas that occurs naturally in the environs. It comes from the natural breakdown of uranium in soils and rocks. Lung cancer risk depends upon the concentration of radon and their decay products in air above recommendation level. In the present study the value of concentration of radon ranges from 31.5 to 141.4 Bqm -3 whereas the value of thoron concentration ranges from 9.3 to 75.2 Bqm -3. The value of radon progeny ranges from 3.4 to 15.3 Bqm -3 while the value of thoron progeny ranges from 3.3 to 27.3 Bqm -3. The inhalation dose varies from 0.15 to 0.71 mSv.y -1.The annual exposure (Rn + Tn) in terms of WLM ranges from 0.24 to 1.46 while annual exposure (Rn + Tn) in terms of mjhm -3 ranges from 0.85 to 5.17 with an average of 2.9. The life time fatality risk of the residents of the study area ranges from 0.72 × 10 -4 to 4.38 × 10 -4 with an average value of 2.5 × 10 -4. -

GID 2016.Pdf

SUPPLIERS & GLASSWORKS COMPLETE GLASS PROFILES DIRECTORY th Special cast irons & alloys 27 annual for glass moulds edition S Suppliers’ Profiles S Yellow Pages S Agents & 2 - Copia omaggio € sales offices "ÉÊUÊÊ S Glassworks’ addresses S Associations *ÃÌiÊÌ>>iÊ-«>ÊÊ-«i`âiÊÊ>LL>iÌÊ«ÃÌ>iÊÊÇä¯ÊÊ Fonderie Valdelsane S.p.A. Strada di Gabbricce, 6 - P.O. BOX 30 - 53035 MONTERIGGIONI (Siena) - ITALY Tel. +39.0577.304730 - Fax. +39.0577.304755 - [email protected] NARIO DE N www.fonderievaldelsane.com FO Supplemento al n. 168 - no. 4/2016 di Glass Machinery Plants & Accessories, Smartenergy S.r.l., Dir. Resp. Marco Pinetti, Supplemento al n. 168 - no. 4/2016 di Glass MachineryDir. Plants & Accessories, Smartenergy S.r.l., At home in the world of glass NIKOLAUS SORG EME MASCHINENFABRIK INTERNATIONAL GmbH FEUERUNGSBAU SORG KERAMIK GmbH & Co KG CLASEN GmbH UND SERVICE GmbH SERVICE GmbH Nikolaus Sorg GmbH & Co. KG | Stoltestraße 23 | 97816 Lohr am Main/Germany | Phone: +49 (0) 9352 507 0 | E-Mail: [email protected] | www.sorg.de , Tomorrow s Technology Today The World’s leading glass companies come to FIC with their Electric Boost/Heating projects E-Glass Installations up to 3,500kW in oxy- Display Glass Numerous installations of fired furnaces for extra tonnage and improving up to 1000kW installed power for TFT/LCD glasses glass quality to eliminate strand breakages. using tin oxide electrode blocks to achieve exceptional glass quality. Container Glass Various installations in flint and coloured glasses, up to 2,500kW for Electric Furnaces Developing new increased output and quality. furnace designs for most glass types, including opal. -

ANIMAL SCIENCES Previous Issue : Vol

THE INDIAN JOURNAL OF ANIMAL SCIENCES Previous Issue : Vol. 80, No.2, pp. 89–188 Vol. 80, No.3 March 2010 CONTENTS ANIMAL HEALTH Molecular typing of field isolate of Salmonella by using random amplified polymorphic DNA (RAPD) 191 Anand Kumar and Mumtesh Kumar Saxena Occurrence of gastrointestinal parasites in domestic yaks in Sikkim 195 H Rahman, P Pal and S Bandyopadhyay Evaluation of methanolic extract of Allium sativum and Saussurea costus in yaks with infectious 199 keratoconjunctivitis Samiran Bandyopadhyay, T K Biswas, D Sasmal, I Samanta and M K Ghosh Ultrasound guided biopsy and fine needle aspiration biopsy of splenic and prostatic affections in dogs 203 S K Mahajan, S S Singh, J Mohindroo, N S Saini, N Singh and N K Sood Effect of granulosa cells monolayer and oviductal epithelial cells co-culture on cleavage rate and 209 embryo development of in-vitro fertilized goat oocytes K P Singh, Atul Saxena, S D Kharche and Praneeta Singh Changes in endometrial histology following enrofloxacin therapy in crossbred cows suffering from endometritis 213 J K Prasad, M S Saxena, S K Rastogi and J P Korde Serum lipid profile during lactation in buffalo 217 P M Tripathi, S D Ingole, B T Deshmukh, A S Nagvekar and S V Bharucha Clinico-haematobiochemical profile in chronic anaemic crossbred cattle 220 R K Bhardwaj, C S Randhawa, S S Randhawa And P S Dhaliwal Short Communications Isolation and molecular characterization of avian pathogenic Escherichia coli and Pseudomonas 225 aeruginosa from mortality in ducks in Kashmir, India S D Qureshi, S -

ASHA Data Base Firozabad Name of Name of ID No.Of Population S.No

ASHA Data Base Firozabad Name Of Name Of ID No.of Population S.No. Name Of Block Name Of Sub-Centre Name Of ASHA Husband's Name Name Of Village District CHC/BPHC ASHA Covered 1 2 3 4 5 6 7 8 9 10 1 Firozabad Araon Araon M/C Araon 2701001 Akhilesh Kumari Manoj Kumar Baijua Khas 2052 2 Firozabad Araon Araon Dhatri 2701002 Alka Bhuvnesh Kumar Dhatri 1723 3 Firozabad Araon Araon Aswai 2701003 Anita Devi Veerendra Singh Nagla Madari 765 4 Firozabad Araon Araon Peethepur 2701004 Anita Devi Ram Naresh Saifpur 806 5 Firozabad Araon Araon Sothra 2701005 Anjana Devi Upendra Singh Sothra 2616 6 Firozabad Araon Araon Mandai 2701006 Anwari Begum Jameel Kahn Mohammadpur 2850 7 Firozabad Araon Araon Sothra 2701007 Babita Devi Indra Devi Darigapur 1180 8 Firozabad Araon Araon Bamai 2701008 Babli Devi Gyanedra Kumar Nagla Gumani 284 9 Firozabad Araon Araon Bhadesara 2701009 Chanchal Pachori Sudhakar Pachauri Bhadesara 3237 10 Firozabad Araon Araon M/C Araon 2701010 Geeta Devi Satendra Kumar Imaliya 581 11 Firozabad Araon Araon Bharol 2701011 Gyan Sri Mahaveer Bharol 4653 12 Firozabad Araon Araon Kanthari 2701012 Hari Bheji Ram Sanehilal Kanthari 136 13 Firozabad Araon Araon Shekhupur 2701013 Hemlata Ajab Singh Fakkarpur 601 14 Firozabad Araon Araon Sarsoli 2701014 Indra Devi Ramesh Chandra Senjani 536 15 Firozabad Araon Araon M/C Araon 2701015 Jasoda Devi Deshraj Sapuri 468 16 Firozabad Araon Araon Sothra 2701016 Kalpana Anil Kumar Sarakh 1770 17 Firozabad Araon Araon Hussainpur Baijua 2701017 Kamlesh Kumari Pooran Singh Hazipur 1190 18 Firozabad Araon