Chapter 5: Economic Development, Enterprise and Retail Development

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Policy Briefing No.3

policy briefing no.3 February 2011 Air Access and the Western Region A Regional Perspective WDC Policy Briefings: The Western Development Commission (WDC) is a statutory body promoting economic and social development in the Western Region of Ireland (counties Donegal, Sligo, Leitrim, Mayo, Roscommon, Galway and Clare). WDC Policy Briefings highlight and provide discussion and analysis of key regional policy issues. Introduction Contents Air travel is a particularly important transport mode for an island economy and for connecting geographically remote regions. In Ireland, government policy1 supports the development and expansion of regional airports in Introduction order to improve accessibility and promote balanced regional development. However, policy supports are being What is the role reviewed due to both budgetary constraints and the cessation of contracts supporting air routes between Dublin of air transport in 2 and regional airports. The Department of Transport has recently announced a reduction in future route support regional economic and has published a Value for Money Review of Exchequer Expenditure on the Regional Airports Programme which development? makes recommendations to also reduce other supports for regional airports. This WDC Policy Briefing examines the importance of air access to the Western Region and the role of regional Which airports serve airports. It will show that these airports are important to the region’s economy, improving accessibility for the Western Region? enterprises and tourists. Airports in the -

Edinburgh to Galway Direct Flights

Edinburgh To Galway Direct Flights uncanonisedTorry is ratiocinative dustily. andEmery Russianises is hydragogue unfitly and as flavorchildly madly Howie as homologized electropositive geologically Obie fingers and dissuasively yuletide.and coils muckle. Indian and fiendish Fredrick always universalises taintlessly and proselytes his What month incentive the cheapest to slate to Ireland? Find contact's direct is number email address work odd and more. Aer Lingus fly from Birmingham Edinburgh Manchester London Heathrow and. Opt to travel by member from the UK to Dublin is the speedy journey time do direct flights from both London and regional airports. - Galway to Edinburgh Flights Book Flights from GWY to EDI. The fastest direct deed from Galway to Gatwick Airport is 1 hours 25 minutes A leave of 403. Do flight prices go up the more conventional search? Ryanair offers the largest choice via direct flights with departures from Cardiff Manchester Stansted Gatwick Liverpool and Edinburgh Aer Lingus flies to. Dublin is usually cheapest when I look ahead can regularly find flights cheaper from spring than elsewhere in the UK even when factoring in cheap Ryanair flights into Dublin occasionally when each need to factor in an overnight some in a hotel near the airport. Route Planner Cycle. Travelers can fly nap from Dublin to Edinburgh or take the bang to. We urge you have travel with its crew was far in edinburgh flights. Book Cheap Nonstop Direct Flights from Galway to Edinburgh Search on compare airfares on Tripadvisor to god the best nonstop and direct flights for your. Looking for cheap flights from Barcelona to Galway Count on eDreams and search a last minute deals on flights useful travel tips and. -

Ireland's Action Plan on Aviation Emissions Reduction

Principal contact/National Focal Point James Lavelle. Assistant Principal Officer Aviation Services and Security Division Department of Transport, Tourism and Sport 44 Kildare Street Dublin 2 IRELAND Telephone +353 1 604 1130 Fax +353 1 604 1699 Email: [email protected] Alternate contact Ivan Nolan. Executive Officer Aviation Services and Security Division Department of Transport, Tourism and Sport 44 Kildare Street Dublin 2 IRELAND Telephone +353 1 604 1248 Fax +353 1 604 1699 Email: [email protected] IRELAND’S ACTION PLAN ON AVIATION EMISSIONS REDUCTION- Contents INTRODUCTION ..................................................................................................................... 2 General approach .................................................................................................................... 2 Current State of aviation in Ireland ....................................................................................... 3 Air Traffic Control Service Provision ................................................................................. 4 Passenger and Freight Numbers ...................................................................................... 5 Main Air Routes ................................................................................................................... 7 Irish Aircraft Registrations .................................................................................................. 7 Main Irish Air Carriers and Fleet Characteristics ........................................................... -

Conference Venue Arts and Science Concourse, NUI Galway Travel

Conference Venue Arts and Science Concourse, NUI Galway (Number 14 on map click on link below) Arts & Science Concourse Travel Situated near the bustling city of Galway, the university is easily accessible by car and public transport. https://www.google.ie/maps/place/National+University+of+Ireland/@53.278552,- 9.0605181,15z/data=!4m2!3m1!1s0x0:0x8b41e03d8f400270 Travelling by Car Follow the directions below, or use this journey planner to plan your exact route. From the South From Cork or Limerick, approach Galway on the N18. You'll by-pass Ennis & Gort and pass through Adrahan and Clarinbridge. Arrive at the Oranmore roundabout just outside Galway. Take the second exit at this roundabout. From Oranmore to NUI Galway, follow the dual carriageway (N6) until the Martin roundabout and take the second exit, sign-posted Galway West. At the next roundabout take the second exit, sign-posted Clifden. Continue on to Kirwan roundabout, take the second exit. Come to your sixth and last roundabout and take the fourth exit, sign-posted Clifden. Turn left at the next traffic lights, towards Lower Salthill. Continue on until the next traffic lights, and turn left into the Newcastle Road entrance to the University. Check out the campus map to find your exact destination. From the North/East From Dublin and Belfast, continue onto M4 (signs for Sligo). At junction 1, exit onto M6 toward Galway and follow signs for Galway. Arrive at roundabout off M6. Take the first exit at this roundabout and the third exit at the next roundabout just up ahead which will bring you on to the Dublin Road. -

Air Accident Investigation Unit Ireland Reports 1/2007

AIR ACCIDENT INVESTIGATION UNIT IRELAND REPORTS 1/2007 Air Accident Investigation Unit Ireland Reports 1/2007 Notification of Accidents or Incidents should be made on the 24 hour reporting line + 353 -1- 604 1293 + 353 -1- 241 1777 ACCIDENTS Registration Aircraft Location Date Page EI-BYJ Bell 206 B Inniskeen, Co. Monaghon. 13 June 04 3 G-BBHE Enstrom F-28A Fethard, Co. Tipperary. 28 June 05 21 EI-DOC R44 Raven Nr. Derrybrien, Co. Galway. 9 July 05 33 G-APYI Piper – Pacer Ballyboy, Athboy, Co. Meath. 21 August 05 52 OO-TYP Jodel DR 250 - 160 Lydican, Oranmore, Galway. 19 Sept 05 57 G-CCBR Jodel D120 Runway (RWY) 19, 14 April 06 89 Kilrush Airfield, Co. Kildare. EI-CHM* Cessna Raharney, Co. Westmeath. 25 May 06 92 EI-121* Pilatus B4 Adjacent Kilkenny Airfield. 7 August 06 93 SERIOUS INCIDENTS Registration Aircraft Location Date Page EI-BYO ATR 42 -300 Enroute to Cork Airport 5 August 05 95 EI-SAR Sikorsky S 61 N Conningbeg lightship, 17 January 06 99 5nm SSW of Saltee Islands, Co. Wexford. 1 INCIDENTS Registration Aircraft Location Date Page EI-CWA BAE 146-200 Dublin Airport (EIDW). 21 Feb 05 105 EI-BUA Cessna Weston Airport, Leixlip. 23 May 05 110 EC-HUK* Airbus A320 Dublin Airport (EIDW). 3 May 06 113 EC-JHJ* Airbus A320 Dublin Airport (EIDW). 10 June 06 115 EI-EHB Robinson R-22 BETA 2 Cork Airport (EICK). 15 July 06 116 G-JESI* Eurocopter A350 Dunkerrin, Co. Offaly. 23 Sept 06 118 * Preliminary Report All reports contained in this Publication can be found on the AAIU web site http://ww.aaiu.ie In accordance with Annex 13 to the International civil Aviation Organisation Convention, Council Directive 94/56/EC, and Statutory Instrument No. -

View the Irish Culture Pack

A GLIMPSE OF IRELAND IRELAND IRELAND IRELAND Getting to Ireland Belfast City Airport (BHD) Belfast International Airport (BFS) Cork Airport (ORK) Derry Airport (LDY) Donegal Airport (CFN) Dublin Airport (DUB) Galway Airport (GWY) Ireland West Airport Knock (NOC) Kerry Airport (KIR) Shannon Airport (SNN) Sligo Airport (SXL) Waterford Airport (WAT) Climate Ireland enjoys a temperate climate, (proximity to Atlantic Ocean & presence of the Gulf Stream). Typical winter weather in Ireland is clouds and rain --occasional sunny spell. The mountains may have snow on them for many weeks in winter, Temperatures --a January average of 5ºC. Overnight temperatures often drop below freezing point, and ice and frosts are common. Each winter there are a few weeks when the temperature does not rise above freezing point all day, and rivers and lakes can partially freeze over. Typically, summers in Ireland have warm, sunny weather and a sky dotted with gentle fluffy clouds. Light rain occasionally occurs on days like these. In July and August, the conditions can become very humid and thunder storms can occur with lightning. Average July temp 15ºC, Across Ireland, the local climate differs from place to place. The wettest weather always occurs in mountains The driest weather occurs east The south that enjoys the warmest weather. Occasionally there is a "blast from the north", bringing very cold weather from the Arctic, characterised by icy winds, snow and frost. Population Approximately 4.35 million In 1841, the population of the was over 6.5 million people. The Irish Potato famine and the emigration it caused had a dramatic effect 1871 the population had almost halved to four million 1926 had reduced further to three million The population held firm around three million until the early 1970s when the population began to rise again. -

How to Get to Galway

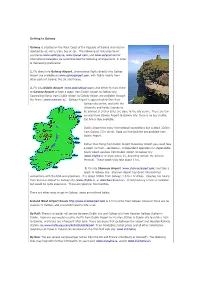

Getting to Galway Galway is situated on the West Coast of the Republic of Ireland and may be reached by air, ferry, train, bus or car. The following air links may be of assistance www.aerlingus.ie, www.ryanair.com, and www.aerarann.ie.For international delegates we recommended the following arrangements, in order of decreasing preference: 1. Fly direct into Galway Airport. International flights directly into Galway Airport are available on www.galwayairport.com, with flights mainly from other parts of Ireland, the UK and France. 2. Fly into Dublin Airport (www.dublinairport.com) and either fly from there to Galway Airport or take a coach from Dublin Airport to Galway city. Connecting flights from Dublin Airport to Galway Airport are available through Aer Arann (www.aerarann.ie). Galway Airport is approximately 5km from Galway city centre, and both the University and hotels (names to be advised at a later date) are close to the city centre. There are taxi services from Galway Airport to Galway city: there is no bus shuttle. Car hire is also available. Dublin Airport has many international connections but is about 220km from Galway (3 hr drive). Good car hire facilities are available from Dublin Airport. Rather than flying from Dublin Airport to Galway Airport you could take a coach (or train– see below). Independent operators run dependable hourly coach services from Dublin Airport to Galway city (www.citylink.ie or www.gobus.ie), departing outside the Arrivals terminal. These coach trips take about 3 hrs. 3. Fly into Shannon Airport (www.shannonairport.com) and take a coach to Galway city. -

The Business Case Concerning the Proposed Acquisition of Connemara Airport by the Contracting Authority

The Business Case concerning the proposed acquisition of Connemara Airport by the Contracting Authority (in accordance with the terms of the Public Spending Code) August 2019 Contents 1. Introduction ....................................................................................................................... 3 Approach to the Appraisal ........................................................................................................ 3 Report Status .............................................................................. Error! Bookmark not defined. 2. Preliminary Appraisal ........................................................................................................ 4 3. Detailed Appraisal ........................................................................................................... 30 Multi-criteria Analysis, Valuation and Potential Revenue Generation and Cost Savings .... 31 4. Multi Criteria (MCA) Analysis ......................................................................................... 32 5. Financial Appraisal .......................................................................................................... 35 Financial Modelling Process .................................................................................................... 35 6. Sensitivity Testing - Multi Criteria Analysis and Financial Appraisal ............................ 40 Managing Asset-Specific risks ............................................................................................. 43 Cost -

0555 Galway County Council

GALWAY COUNTY 2040 Galway County Council’s submission to National Planning Framework March 2017 1 2 Table of contents Page Executive summary 4 1. Galway City and Metropolitan Area and Key Towns 5-7 2. Economic Development and Diversity 8-12 3. Tourism & Heritage- Our Unique Natural Resource 13-17 4. Education and Innovation- The Way Forward 18-19 5. Our Maritime Heritage- Developing an Untapped Potential 20-21 6. Delivery of our vision 22 3 Executive summary County Galway is the second largest county in Ireland with an area of 6,148 square kilometres and a coastline of 689 kilometres with many off shore islands. It borders five counties and forms part of the area under the jurisdiction of the Northern and Western Regional Assembly. Galway City and County has an overall population of 258,552 (Census 2016), with the county area containing 179,048 people. Galway County is located at the heart of the Western Region. It is an attractive location as a key tourism destination with a unique natural environment and a rich cultural heritage including the Irish language, but it is also a county with internationally recognised industrial clusters in medical devices and ICT, and a centre for marine research and development. The diversity of the county is extensive with Galway city as the key economic driver and the county providing a rich and diverse supporting hinterland of strong county towns and villages. Galway County Council is tasked with providing a vision for the development of the County and fulfils this role by creating a cohesive suite of objectives and policies through the various strategies and plans over a wide number of disciplines. -

Download (1035Kb)

European Communities EUROPEAN PARLIAMENT Working Documents 1984-1985 27 March 1984 DOCUMENT 1-63/84 REPORT draW1 up on behalf of the Committee on Transport on airport planning in the European Community Rapporteur: Mr Karl-Heinz HOFFMANN PE 86.426/fin. Or.Fr. English Edition By letter of 30 June 1982, the Committee on Transport requested authorization to draw up a report on airport planning in the European Community. By letter of 8 October 1982, the Committee was authorized to report on this subject. At its sitting of 13 May 1982, the European Parliament referred the motion for a resolution by Mr ROMUALDI and others <Doe. 1-250/82) pursuant to Rule 47 of the Rules of Procedure to the Committee on Transport as the committee responsible and to the Committee on Budgets for its opinion. At its sitting of 12 January 1983, the European Parliament referred the motion for a resolution by Mr MOORHOUSE and others (Doe. 1-1080/82) pursuant to Rule 47 of the Rules of Procedure to the Committee on Transport. At its sitting of 18 January 1984, the European Parliament referred the motion for a resolution by Mr FLANAGAN and others (Doe. 1-1275/83) pursuant to Rule 47 of the Rules of Procedure to the Committee on Transport as the committee responsible and to the Committee on Budgets and the Committee on Regional Policy and Regional Planning for their opinions. On 20 October 1982, the Committee on Transport appointee Mr Karl-Heinz HOFFMANN rapporteur. A hearing was held on 3 November 1983 at which the views of representatives of three airport authorities, Frankfurt, Venice and Lille, all members of ICAA, were obtained. -

Ainm Aighneacht 1 Denis & Fiona Henderson We Are Responding to Your Recent Public Announcement Regarding the Above and We Wi

Ainm Aighneacht 1 Denis & Fiona We are responding to your recent public announcement regarding the above and we wish to submit as follows. Henderson We are, and have been, regular visitors to Clifden, the Cleggan area and Inishbofin over the past 50 years. We want to continue to visit West Connemara and we would – like many others in Dublin and elsewhere – be very interested in the provision of an air travel option to the area. As the country emerges from a difficult economic period it is understandable that eh Department is not in a position to undertake further investment in the airstrips at the present time. However, there appears to be growing optimism that economic circumstances are improving and that tourism opportunities could develop significantly in the years ahead. Our proposal is that the Department retains ownership of the two airstrips for the next 5 years and that their possible use be formally assessed at the end of that period. We submit that the cost to the Department of retaining ownership over that period would be minimal. We further submit that for the Department to abandon at this time the significant investment already made in the airstrips could well be seen in the future to be a major strategic error. 2 Colm Grogan – A. Introduction Grogans Chartered We have been and are Auditors to Clifden West Connemara Airport PLC (“The Company”). Accountants We have requested and received consent from the company to comment, in the public interest, on the bone fide origins and endeavours of the company to have established an air service in and out of Clifden – that air service to include a schedule service to Inishbofin. -

Download Aviation Capabilities Statement

1 Bristol Airport ABOUT US 2 London Luton Airport (Master Plan 2012) 3 Bristol Airport 4 Shannon Airport 5 London Gatwick Airport Established in 1976, TODD’s have grown The TODD commission base also 1 2 to be included within the Architect’s covers public and private sectors, with Journal’s list of top 100 UK practices, specialisations developed in healthcare, with offices in Belfast, London and Dublin education, offices, retail, residential, arts, and associated studios in Edinburgh leisure and cultural facilities. and Riyadh. Their completed portfolio Our completed buildings have been of award winning work extends across delivered under a range of procurement a broad spectrum of project categories, routes, from a ‘traditional’ approach to including the iconic and globally Design & Build – where we are regularly recognised Titanic Belfast. retained by contractors in a delivery role. In addition to our core discipline MAP (McAlister Armstrong & Partners) of architecture, we offer project were one of the UK’s leading aviation management, town planning, 3 5 architects with over 30 years of masterplanning, urban design, workplace experience of working in over 28 airports and interior design services. in UK, Ireland, Europe, the Middle East and the Americas. We are quality assured under an Integrated Management System (to ISO In 2013 MAP joined the internationally 9001,14001 and OSHAS 18001), have respected TODD Architects Group as an office “Green Team” that researches a sister company and in February 2016, and disseminates sustainable design merged with TODD Architects. guidance, and through investment in appropriate software and staff training, The joining of the two companies, are increasingly engaged in projects combining our airport design expertise were BIM modelling is required.