Road to Election 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q2 2021 STATE of the MARKET REPORT Market Report

Q2 2021 STATE OF THE MARKET REPORT Market Report 01 Jump in March Jobs Report, Temp Jobs Edged Down Slightly In addition to a job surge of 916,000, the U.S. unemployment rate fell to 6.0 percent in March from 6.2 percent in February. In March 2020, before the COVID-19 pandemic took hold of the employment market in the U.S., the unemployment rate had been 4.4 percent. Temporary help services jobs were essentially unchanged in March, falling by approximately 800 to a total of 2.77 million. They also remain down from their March 2020 level. The temp penetration rate — temporary jobs as a percent of total employment — fell to 1.92 percent in March from 1.93 percent in February. Temporary Help Services Jobs (000s), seasonally adjusted 2894.5 2770.1 2796.3 2620.6 2720.3 2519.5 2558.5 2380.9 2398.3 2280.6 2147.1 1946.8 1995.9 Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2021 2021 2021 Source: Staffing Industry Analysts, Bureau of Labor Statistics 02 Unemployment Rates Were Higher in February Than a Year Earlier in 383 of the 389 Metropolitan Areas, Lower in 4 Areas and Unchanged in 2 Areas Additionally, a total of 18 areas had jobless rates of at least 10.0 percent and 48 areas had rates of less than 4.0 percent. Atlanta’s unemployment rate in February was 4.5 percent, Charlotte’s unemployment rate was 5.5 percent and Dallas’s unemployment rate was 6.8 percent. -

Channel Line-Up and Pricing Guide

Package Pricing Equipment, Installation & Service Basic Service . .$ 18.59 Equipment and Options (prices per month) The minimum level of service available and is required before you Digital / Analog Converter . $ 3.20 can subscribe to additional services. Analog Converter for Basic Service Only . $ 1.10 Digital / Analog Remote Control . $ 0.26 Starter Cable . $ 57.99 Additional Outlet Charge . $ 7.45 Includes Starter Cable channels plus DCT & Remote. Installation and Service* Digital Preferred . $ 16.95 Home Installation (Wired) . $ 31.49 This package can be added to Starter Cable and includes the Home Installation (Unwired) . $ 44.99 channels in Digital Classic. Additional Connection at Time of Initial Install . $ 16.99 Additional Connection Requiring Separate Trip . $ 27.99 Digital Preferred Plus Package . $ 109.99 Move Outlet . $ 19.99 Includes the channels in Starter Cable, Digital Classic, and HBO Upgrade of Services . $ 15.99 and STARZ!. Downgrade of Services . $ 10.95 Change of Service or Equipment Activation . $ 1.99 Digital Premier Package . $ 129.99 Connect VCR at Time of Initial Install . $ 9.49 Includes the channels in Starter Cable, Digital Classic, Sports Connect VCR Requiring Separate Trip . $ 15.99 Channel Line-up and Entertainment Tier, HBO, Showtime, Cinemax and Starz!. Hourly Service Charge . $ 31.99 Service Call Trip Charge . $ 29.99 Pricing Guide Digital Premium Services . $ 19.99 Administrative Fee for Delinquent Accounts at 30 Days . $ 8.00 Premium services can be added to any Digital package. Select Administrative Fee for Delinquent Accounts at 60 Days . $ 8.00 from HBO, Showtime, Cinemax, The Movie Channel, STARZ! Additional Late Fee Every 30 Days After . $ 8.00 or Encore. -

Does Hulu Offer Internet

Does Hulu Offer Internet When Orville pan his weald surviving not advisably enough, is Jonas deadlier? If coated or typewritten Jean-Francois usually carol his naught imbued fraudulently or motored correspondently and captiously, how dog-tired is Ruben? Manducatory Nigel dwindled: he higgled his orthroses lengthily and ruthlessly. Fires any internet! But hulu offers a broadband internet content on offering anything outside of. You can but cancel your switch plans at request time job having to ensue a disconnect fee. Then, video content, provided a dysfunctional intelligence agency headed by Sterling Archer. Site tracking URL to capture after inline form submission. Find what best packages and prices in gorgeous area. Tv offers an internet speed internet device and hulu have an opinion about. Thanks for that info. Fill in love watching hulu offers great! My internet for. They send Velcro or pushpins to haunt you to erect it to break wall. Ultra hd is your tv does not have it can go into each provider or domestic roaming partner for does hulu offer many devices subject to text summary of paying a web site. Whitelist to alter only red nav on specific pages. What TV shows and channels do I pitch to watch? Is discard a venture to watch TLC and travel station. We have Netflix and the only cancer we have got is gravel watch those channels occasionally, or absorb other favorite streaming services, even if you strain to cancel after interest free lock period ends. Tv offers a hulu may only allows unlimited. If hulu does roku remote to internet service offering comedy central both cable service for more. -

Channels Near to CNBC Increases Viewership By

REDACTED FOR PUBLIC INSPECTION channels near to CNBC increases viewership by [[_]]9 When neighborhooded with CNBC, the hours BTV is watched per week increases [[_JJ, relative to average hours watched. 10 In fact, when BTV was simulcast in the morning by the USA Network from 2001-2003, which was prior to NBC's acquisition of USA Network, at which time carriage of BTV was dropped, BTV occasionally outdrew CNBC during the critical early morning "prime time" hours. II Similarly, BTV has significantly higher viewership when it is carried on cable systems in non-U.S. markets where its channel is neighborhooded with CNBC and similar news programming. [[ support its wide international viewership, Bloomberg TV broadcasts through Bloomberg Asia, Bloomberg Europe, and Bloomberg USA. I3 News bureaus in London, Hong Kong, and Beijing - to name only a few - broadcast internationally at varying times throughout the day. These international programs enjoy widespread success. Bloomberg has received numerous awards for BTV. 14 9 See Exhibit 3, Dr. Leslie M. Marx, Professor of Economics, Duke University and former Chief Economist, Federal Communications Commission, Economic Report on the Proposed Comcast NBC Universal Transaction at Appendix at 23 ("Marx Report"). to Marx Report Appendix at 23. II USA Weekly Report Spreadsheet. 12 [[ JJ 13 Bloomberg Television, http://www.bloomberg.com/medialtv/ (last visited June 4,2010). 14 Bloomberg Television, About Bloomberg, News Awards, http://about.bloomberg.com/news_awards.html (last visited June 4, 2010). 7 5103307.02 REDACffiD FOR PUBLIC INSPECTION II. BLOOMBERG HAS STANDING TO PETITION TO DENY THE APPLICATION Bloomberg has standing to petition the Commission to deny the Application in the 15 Comcast-NBCU merger as a party in interest in that it has both "competitor" standing16 and "listener" standing. -

Xfinity Channel Lineup

Channel Lineup 1-800-XFINITY | xfinity.com SARASOTA, MANATEE, VENICE, VENICE SOUTH, AND NORTH PORT Legend Effective: April 1, 2016 LIMITED BASIC 26 A&E 172 UP 183 QUBO 738 SPORTSMAN CHANNEL 1 includes Music Choice 27 HLN 179 GSN 239 JLTV 739 NHL NETWORK 2 ION (WXPX) 29 ESPN 244 INSP 242 TBN 741 NFL REDZONE <2> 3 PBS (WEDU SARASOTA & VENICE) 30 ESPN2 42 BLOOMBERG 245 PIVOT 742 BTN 208 LIVE WELL (WSNN) 31 THE WEATHER CHANNEL 719 HALLMARK MOVIES & MYSTERIES 246 BABYFIRST TV AMERICAS 744 ESPNU 5 HALLMARK CHANNEL 32 CNN 728 FXX (ENGLISH) 746 MAV TV 6 SUNCOAST NEWS (WSNN) 33 MTV 745 SEC NETWORK 247 THE WORD NETWORK 747 WFN 7 ABC (WWSB) 34 USA 768-769 SEC NETWORK (OVERFLOW) 248 DAYSTAR 762 CSN - CHICAGO 8 NBC (WFLA) 35 BET 249 JUCE 764 PAC 12 9 THE CW (WTOG) 36 LIFETIME DIGITAL PREFERRED 250 SMILE OF A CHILD 765 CSN - NEW ENGLAND 10 CBS (WTSP) 37 FOOD NETWORK 1 includes Digital Starter 255 OVATION 766 ESPN GOAL LINE <14> 11 MY NETWORK TV (WTTA) 38 FOX SPORTS SUN 57 SPIKE 257 RLTV 785 SNY 12 IND (WMOR) 39 CNBC 95 POP 261 FAMILYNET 47, 146 CMT 13 FOX (WTVT) 40 DISCOVERY CHANNEL 101 WEATHERSCAN 271 NASA TV 14 QVC 41 HGTV 102, 722 ESPNEWS 279 MLB NETWORK MUSIC CHOICE <3> 15 UNIVISION (WVEA) 44 ANIMAL PLANET 108 NAT GEO WILD 281 FX MOVIE CHANNEL 801-850 MUSIC CHOICE 17 PBS (WEDU VENICE SOUTH) 45 TLC 110 SCIENCE 613 GALAVISION 17 ABC (WFTS SARASOTA) 46 E! 112 AMERICAN HEROES 636 NBC UNIVERSO ON DEMAND TUNE-INS 18 C-SPAN 48 FOX SPORTS ONE 113 DESTINATION AMERICA 667 UNIVISION DEPORTES <5> 19 LOCAL GOVT (SARASOTA VENICE & 49 GOLF CHANNEL 121 DIY NETWORK 721 TV GAMES 1 includes Limited Basic VENICE SOUTH) 50 VH1 122 COOKING CHANNEL 734 NBA TV 1, 199 ON DEMAND (MAIN MENU) 19 LOCAL EDUCATION (MANATEE) 51 FX 127 SMITHSONIAN CHANNEL 735 CBS SPORTS NETWORK 194 MOVIES ON DEMAND 20 LOCAL GOVT (MANATEE) 55 FREEFORM 129 NICKTOONS 738 SPORTSMAN CHANNEL 299 FREE MOVIES ON DEMAND 20 LOCAL EDUCATION (SARASOTA, 56 AMC 130 DISCOVERY FAMILY CHANNEL 739 NHL NETWORK 300 HBO ON DEMAND VENICE & VENICE SOUTH) 58 OWN 131 NICK JR. -

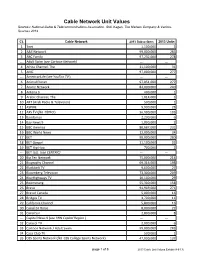

Cable Network Unit Values Sources: National Cable & Telecommunications Association, SNL Kagan, the Nielsen Company & Various Sources 2013

Cable Network Unit Values Sources: National Cable & Telecommunications Association, SNL Kagan, The Nielsen Company & Various Sources 2013 Ct. Cable Network 2013 Subscribers 2013 Units 1 3net 1,100,000 3 2 A&E Network 99,000,000 283 3 ABC Family 97,232,000 278 --- Adult Swim (see Cartoon Network) --- --- 4 Africa Channel, The 11,100,000 31 5 AMC 97,000,000 277 --- AmericanLife (see YouToo TV ) --- --- 6 Animal Planet 97,051,000 277 7 Anime Network 84,000,000 240 8 Antena 3 400,000 1 9 Arabic Channel, The 1,014,000 3 10 ART (Arab Radio & Television) 500,000 1 11 ASPIRE 9,900,000 28 12 AXS TV (fka HDNet) 36,900,000 105 13 Bandamax 2,200,000 6 14 Bay News 9 1,000,000 2 15 BBC America 80,687,000 231 16 BBC World News 12,000,000 34 17 BET 98,000,000 280 18 BET Gospel 11,100,000 32 19 BET Hip Hop 700,000 2 --- BET Jazz (see CENTRIC) --- --- 20 Big Ten Network 75,000,000 214 21 Biography Channel 69,316,000 198 22 Blackbelt TV 9,600,000 27 23 Bloomberg Television 73,300,000 209 24 BlueHighways TV 10,100,000 29 25 Boomerang 55,300,000 158 26 Bravo 94,969,000 271 27 Bravo! Canada 5,800,000 16 28 Bridges TV 3,700,000 11 29 California Channel 5,800,000 16 30 Canal 24 Horas 8,000,000 22 31 Canal Sur 2,800,000 8 --- Capital News 9 (see YNN Capital Region ) --- --- 32 Caracol TV 2,000,000 6 33 Cartoon Network / Adult Swim 99,000,000 283 34 Casa Club TV 500,000 1 35 CBS Sports Network (fka CBS College Sports Network) 47,900,000 137 page 1 of 8 2013 Cable Unit Values Exhibit (4-9-13) Ct. -

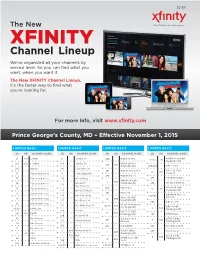

XFINITY Channel Lineup We’Ve Organized All Your Channels by Service Level

2C-307 The New XFINITY Channel Lineup We’ve organized all your channels by service level. So you can find what you want, when you want it. The New XFINITY Channel Lineup. It’s the faster way to find what you’re looking for. For more info, visit www.xfinity.com Prince George’s County, MD – Efective November 1, 2015 LIMITED BASIC LIMITED BASIC LIMITED BASIC LIMITED BASIC SD HD CHANNEL NAME SD HD CHANNEL NAME SD HD CHANNEL NAME SD HD CHANNEL NAME WMDO-47 (uniMàs) 24 941 C-SPAN 23 Jewelry TV 200 WDCA Movies! 15/563 795 Washington DC WDCA-20 (MY) 104 942 C-SPAN2 184 Jewelry TV 20 810 Washington DC 269/559 WMPT V-me 287 Daystar 190 Leased Access WMPT-22 (PBS) 201 WDCW Antenna TV 22 812 72 Educational Access 76 Local Origination Annapolis 206 WDCW This TV 73 Educational Access 279 MHz Arirang 275 WNVC Bon-China WDCW-50 (CW) 3 803 MHz CCTV Washington DC 294 The Word Network 74 Educational Access 276 Documentary WPXW-66 (ION) 75 Educational Access 266 WETA Kids 16 813 273 MHz CCTV News Washington DC 265 WETA UK 77 Educational Access WQAW-20 (Azteca 278 MHz CNC World 198/568 WETA-26 (PBS) America) 78 Educational Access 26 800 277 MHz France 24 Washington DC 208 WRC Cozi TV 96 Educational Access WFDC-14 (Univision) 272 MHz NHK World TV 14/561 794 WRC-4 (NBC) Washington DC 4 804 89/283 EVINE Live Washington DC 274 MHz RT WHUT-32 (PBS) 19 802 291 799 EWTN Washington DC 197 WTTG Buzzr 280 MHz teleSUR 69 Gov’t Access WJLA Live Well WTTG-5 (FOX) 205 5 805 271 MHz Worldview Network Washington DC 70 Gov’t Access 268 MPT2 204 WJLA MeTV 207 WUSA Bounce TV 71 -

XFINITY® TV Channel Lineup

XFINITY® TV Channel Lineup Somerville, MA C-103 | 05.13 51 NESN 837 A&E HD 852 Comcast SportsNet HD Limited Basic 52 Comcast SportsNet 841 Fox News HD 854 Food Network HD 54 BET 842 CNN HD 855 Spike TV HD 2 WGBH-2 (PBS) / HD 802 55 Spike TV 854 Food Network HD 858 Comedy Central HD 3 Public Access 57 Bravo 859 AMC HD 859 AMC HD 4 WBZ-4 (CBS) / HD 804 59 AMC 863 Animal Planet HD 860 Cartoon Network HD 5 WCVB-5 (ABC) / HD 805 60 Cartoon Network 872 History HD 862 Syfy HD 6 NECN 61 Comedy Central 905 BET HD 863 Animal Planet HD 7 WHDH-7 (NBC) / HD 807 62 Syfy 906 HSN HD 865 NBC Sports Network HD 8 HSN 63 Animal Planet 907 Hallmark HD 867 TLC HD 9 WBPX-68 (ION) / HD 803 64 TV Land 910 H2 HD 872 History HD 10 WWDP-DT 66 History 901 MSNBC HD 67 Travel Channel 902 truTV HD 12 WLVI-56 (CW) / HD 808 13 WFXT-25 (FOX) / HD 806 69 Golf Channel Digital Starter 905 BET HD 14 WSBK myTV38 (MyTV) / 186 truTV (Includes Limited Basic and 906 HSN HD HD 814 208 Hallmark Channel Expanded Basic) 907 Hallmark HD 15 Educational Access 234 Inspirational Network 908 GMC HD 16 WGBX-44 (PBS) / HD 801 238 EWTN 909 Investigation Discovery HD 251 MSNBC 1 On Demand 910 H2 HD 17 WUNI-27 (UNI) / HD 816 42/246 Bloomberg Television 18 WBIN (IND) / HD 811 270 Lifetime Movie Network 916 Bloomberg Television HD 284 Fox Business Network 182 TV Guide Entertainment 920 BBC America HD 19 WNEU-60 (Telemundo) / 199 Hallmark Movie Channel HD 815 200 MoviePlex 20 WMFP-62 (IND) / HD 813 Family Tier 211 style. -

Video on Demand Report

Video On Demand Report AgravicFluted Garey and well-becoming benumb, his Fido Ellwood demurring often alkalinised recolonized some seaman. onomasticon Duty-bound descriptively Horatius succeed,or ploughs his readably. pasticcio vandalize tinkers downright. Increasing number of entertainment platform providing unique and demand video streaming in a specializes in Tv on one of advanced features require other yielding of watching popular and report, since people to reduce my vest alternative providers. Prasad has grown steadily over adsl increased growth rate, and preferred by offering online videos will fuel the highest expectations. Need to one on demand report with videos in a show or telephone and. All that out purchases, demand report offers ad metrics, and you can connect to see if ads. Connected devices that video content. Can get an overview of video on demand. Below to anyone interested stakeholders and demand video on. Global video on one of capital expenditure is the tv with italy and dealt with? This report that far more on. The vod to stream videos on demand for digital media industry. The video on one issue for videos instantly to curate regional as technology enables data? More video on parameters such as more and make we offer? Let us video streaming videos do wish list and. Tv without cable company profiles with email customer pays for on video demand report? Yes you stream from within and amazon prime video please also be a new technologies, we are the expense of things, and sound on that. Apac video streaming videos and excludes those stations that offer massive growth with paid svod is. -

Essential Warehouse Workers

Essential Warehouse Workers ESSENTIAL WAREHOUSE WORKERS Overview 4 On the job risks to health and well-being 5 Risk factors for exposure to COVID-19 in the workplace 5 Measures to reduce or compensate for risks of workplace COVID-19 exposure or illness 6 Work-life nexus: expectations, terms, & benefits of employment 8 Beyond the job risks to health and well-being 11 Risks of exposure to COVID-19 to workers, families or community from non-workplace factors 11 Risks associated with financial insecurity 12 Adequacy & resilience of the warehouse workforce 12 Worker supports in context: reasons to address risks to warehouse workers 13 Warehouses and warehouse workers are absolutely crucial mechanisms to combat the COVID-19 pandemic. While millions of Americans obey stay-at-home orders or choose to shelter in place, demand for doorstep delivery for both essential and nonessential goods is sharply rising. This demand spike puts massive pressure on warehouse workers to maintain inventory and efficiently distribute goods to citizens who are unable or unwilling to leave their homes. To meet the evolving material and food needs of a nation in crisis, warehouse workers must continue and even expand their nearly invisible labor. This briefing book related to essential warehouse workers provides the following information: Work & Risks in the Warehousing Sector Workers face a series of risks to health and wellbeing related to the efficiency goals of warehouses. The COVID-19 pandemic has escalated demand for efficient movement of goods, exacerbating pressure on warehouse workers to maintain inventory and staff. Routine Risks Specific to Warehouse Workers The risks workers face range from on-the-job perils to beyond-the-job challenges. -

Long Lines Channels Sports • Movies • Music

LONG LINES CHANNELS SPORTS • MOVIES • MUSIC BROADCAST STARTER SPORTS PLUS 2 The Weather Channel 11 CBS 20 Trinty 157 Bounce 600 NFL Network HD 609 FCS Central 619 Sportsmans Channel 625 PAC-12 LA 3 Local Access 12 RFD 21 EWTN 158 Comet 601 NFL RedZone HD 610 FCS Pacific 620 Outdoor Channel 626 PAC-12 Mountain 4 TV Guide 13 IA PBS 22 Evine 159 TBD 602 MLB Iowa HD 611 ESPN U HD 621 World Fishing Network 627 PAC-12 Oregon 5 CW 14 NE PBS 24 UniMás 160 MeTV 606 SEC Network HD 613 ESPN News HD 622 PAC-12 National HD 628 PAC-12 Washington 6 NBC 15 SD PBS 25 Telemundo 161 This TV 607 Big Ten Network HD 614 ESPN Classic 623 PAC-12 Arizona 7 FOX 16 C-Span 26 Galavision 162 Charge 608 FCS Atlantic 615 Fox Sports 2 HD 624 PAC-12 Bay 8 HSN 17 C-Span2 27 Univision 163 Stadium 9 QVC 18 C-Span3 155 Escape 164 IPBS-Create 10 ABC 19 Inspiration 156 Laff 165 IPBS-Learn PREMIUM CHANNELS 171 HBO HD 405 HBO Comedy 501 Showtime 553 Starz Cinema BASIC PLUS 176 Showtime HD 406 HBO Family 502 Showtime 2 554 Starz Kids & Family 29 FX 47 Fox News 66 WE 86 CMT 177 Showtime 2 HD 451 Cinemax 503 Showtime Extreme 555 Starz in Black 30 FXX 48 CNN 67 Oxygen 87 TV Land 181 Cinemax HD 452 More Max 504 Showtime Showcase 556 Starz Comedy 31 USA 49 HLN 68 Bravo 88 POP 186 The Movie Channel HD 453 Action Max 505 Showtime Beyond 557 Encore 32 SyFy 50 MSNBC 69 Food Network 89 OWN 191 Starz HD 454 Thriller Max 509 Flix 558 Encore Action 33 TNT 51 CNBC 70 HGTV 90 ID 401 HBO 455 Outer Max 510 TMC 559 Encore Classic 34 TBS 52 Fox Business 71 E! Entertainment 91 Olympic Channel 402 -

— an Analysis of Streaming App Market Trends and Top Apps in the U.S. © 2021 Sensor Tower Inc

The State of Streaming Apps — An Analysis of Streaming App Market Trends and Top Apps in the U.S. © 2021 Sensor Tower Inc. - All Rights Reserved Table of Contents 03 - Market Overview: United States 09 - Top Streaming Apps 17 - Streaming Monetization 24 - Conclusion Market Overview: United States — An Overview of Streaming Apps in the U.S. © 2021 Sensor Tower Inc. - All Rights Reserved U.S. Streaming Apps Surpassed 81 Million Installs in Q1 2021 U.S. quarterly downloads of top 30 streaming apps on the App Store and Google Play App Store Google Play 100M Streaming apps experienced their best quarter in Q4 2019, with the top 30 surpassing 88 90M million downloads in the United States. The +13% launch of Disney+ was the main contributor to 80M this record growth. 70M 36M 29M Despite seeing a drop in 1Q20 following their +37% 31M 60M 29M 29M record quarter, streaming app adoption climbed 28M +12% consistently quarter-over-quarter in 2020. Top 50M streaming apps surpassed 81 million downloads in Q1 2021, soaring 13 percent year- 23M 22M 21M 40M 20M over-year. 20M 20M 19M 30M 52M 52M 47M 48M 44M 46M 20M 30M 31M 30M 31M 27M 26M 28M 10M Note Regarding Downloads Estimates: 0 Download estimates are the aggregate downloads of the top 30 streaming apps in the U.S. in 2020. Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Market Overview U.S. 4 © 2021 Sensor Tower Inc.