Preliminary Audited Results and Trading Update 18 February 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Retailers.Xlsx

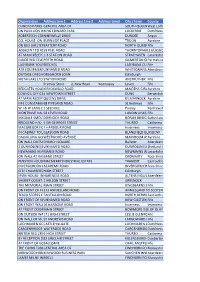

THE NATIONAL / SUNDAY NATIONAL RETAILERS Store Name Address Line 1 Address Line 2 Address Line 3 Post Code M&S ABERDEEN E51 2-28 ST. NICHOLAS STREET ABERDEEN AB10 1BU WHS ST NICHOLAS E48 UNIT E5, ST. NICHOLAS CENTRE ABERDEEN AB10 1HW SAINSBURYS E55 UNIT 1 ST NICHOLAS CEN SHOPPING CENTRE ABERDEEN AB10 1HW RSMCCOLL130UNIONE53 130 UNION STREET ABERDEEN, GRAMPIAN AB10 1JJ COOP 204UNION E54 204 UNION STREET X ABERDEEN AB10 1QS SAINSBURY CONV E54 SOFA WORKSHOP 206 UNION STREET ABERDEEN AB10 1QS SAINSBURY ALF PL E54 492-494 UNION STREET ABERDEEN AB10 1TJ TESCO DYCE EXP E44 35 VICTORIA STREET ABERDEEN AB10 1UU TESCO HOLBURN ST E54 207 HOLBURN STREET ABERDEEN AB10 6BL THISTLE NEWS E54 32 HOLBURN STREET ABERDEEN AB10 6BT J&C LYNCH E54 66 BROOMHILL ROAD ABERDEEN AB10 6HT COOP GT WEST RD E46 485 GREAT WESTERN ROAD X ABERDEEN AB10 6NN TESCO GT WEST RD E46 571 GREAT WESTERN ROAD ABERDEEN AB10 6PA CJ LANG ST SWITIN E53 43 ST. SWITHIN STREET ABERDEEN AB10 6XL GARTHDEE STORE 19-25 RAMSAY CRESCENT GARTHDEE ABERDEEN AB10 7BL SAINSBURY PFS E55 GARTHDEE ROAD BRIDGE OF DEE ABERDEEN AB10 7QA ASDA BRIDGE OF DEE E55 GARTHDEE ROAD BRIDGE OF DEE ABERDEEN AB10 7QA SAINSBURY G/DEE E55 GARTHDEE ROAD BRIDGE OF DEE ABERDEEN AB10 7QA COSTCUTTER 37 UNION STREET ABERDEEN AB11 5BN RS MCCOLL 17UNION E53 17 UNION STREET ABERDEEN AB11 5BU ASDA ABERDEEN BEACH E55 UNIT 11 BEACH BOULEVARD RETAIL PARK LINKS ROAD, ABERDEEN AB11 5EJ M & S UNION SQUARE E51 UNION SQUARE 2&3 SOUTH TERRACE ABERDEEN AB11 5PF SUNNYS E55 36-40 MARKET STREET ABERDEEN AB11 5PL TESCO UNION ST E54 499-501 -

RNS Number : 5018I Mccoll's Retail Group Plc 12 August 2021 THIS

RNS Number : 5018I McColl's Retail Group plc 12 August 2021 THIS ANNOUNCEMENT IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE PUBLICATION, DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN MCCOLL'S RETAIL GROUP PLC OR ANY OTHER ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION WITH, ANY INVESTMENT DECISION IN RESPECT OF MCCOLL'S RETAIL GROUP PLC. THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION. 12 August 2021 McColl's Retail Group plc ("McColl's", the "Company", or the "Group") Proposed Firm Placing and Open Offer to raise up to £35 million at a price of 20 pence per New Ordinary Share Background McColl's, the leading neighbourhood retailer, with an estate of over 1,200 managed convenience stores and newsagents, today announces, further to the separate announcement of its H1 2021 interim results today, its intention to conduct a capital raising to accelerate the Company's growth strategy (the "Capital Raising"). The Capital Raising will comprise: i. a non-pre-emptive firm placing of 150,000,000 new ordinary shares of £0.001 each in the capital of the Company (the "New Ordinary Shares") at the Offer Price (as defined below) per New Ordinary Share to raise up to £30 million (the "Firm Placing") and ii. -

Multiple Group Description Trading Name Number and Street Name

Multiple Group Description Trading Name Number And Street Name Post Code Tesco Supermarkets TESCO BALLYMONEY CASTLE ST CASTLE STREET BT53 6JT Tesco Supermarkets TESCO COLERAINE 2 BANNFIELD BT52 1HU Tesco Supermarkets TESCO PORTSTEWART COLERAINE ROAD BT55 7JR Tesco Supermarkets TESCO YORKGATE CENTRE YORKGATE SHOP COMPLEX BT15 1WA Tesco Express TESCO CHURCH ST BALLYMENA EXP 99-111 CHURCH STREET BT43 8DG Tesco Supermarkets TESCO BALLYMENA LARNE ROAD BT42 3HB Tesco Express TESCO CARNINY BALLYMENA EXP 144 BALLYMONEY ROAD BT43 5BZ Tesco Extra TESCO ANTRIM MASSEREENE CASTLEWAY BT41 4AB Tesco Supermarkets TESCO ENNISKILLEN 11 DUBLIN ROAD BT74 6HN Tesco Supermarkets TESCO COOKSTOWN BROADFIELD ORRITOR ROAD BT80 8BH Tesco Supermarkets TESCO BALLYGOMARTIN BALLYGOMARTIN ROAD BT13 3LD Tesco Supermarkets TESCO ANTRIM ROAD 405 ANTRIM RD STORE439 BT15 3BG Tesco Supermarkets TESCO NEWTOWNABBEY CHURCH ROAD BT36 6YJ Tesco Express TESCO GLENGORMLEY EXP UNIT 5 MAYFIELD CENTRE BT36 7WU Tesco Supermarkets TESCO GLENGORMLEY CARNMONEY RD SHOP CENT BT36 6HD Tesco Express TESCO MONKSTOWN EXPRES MONKSTOWN COMMUNITY CENTRE BT37 0LG Tesco Extra TESCO CARRICKFERGUS CASTLE 8 Minorca Place BT38 8AU Tesco Express TESCO CRESCENT LK DERRY EXP CRESCENT LINK ROAD BT47 5FX Tesco Supermarkets TESCO LISNAGELVIN LISNAGELVIN SHOP CENTR BT47 6DA Tesco Metro TESCO STRAND ROAD THE STRAND BT48 7PY Tesco Supermarkets TESCO LIMAVADY ROEVALLEY NI 119 MAIN STREET BT49 0ET Tesco Supermarkets TESCO LURGAN CARNEGIE ST MILLENIUM WAY BT66 6AS Tesco Supermarkets TESCO PORTADOWN MEADOW CTR MEADOW -

Free School Meals Voucher Scheme Parent/Carer Faqs for More Information on How to Use Your Free School Meals Voucher, Please Read the User Guide

Free school meals Voucher scheme parent/carer FAQs For more information on how to use your free school meals voucher, please read the user guide Contents 1. What’s the difference between an eCode and an eGift card? . 2 2. How do I use my eCode to select a supermarket eGift card? . 2 3. I can’t redeem my eCode? . 2 4. What supermarkets can I pick from? . 3 5. How do I know what the value of the eCode is? . 3 6. Do I have to use the full value of the eCode when choosing my eGift card(s)? . 3 7. Can I choose to redeem my eCode at more than one supermarket? . 3 8. How long do I have to redeem the eCode? . 3 9. What happens if my eCode has expired? . 4 10. My school has ordered an eCode for me, but it hasn’t come through to my email? . 4 11. What can I purchase in-store with the eGift card? . 4 12. How do I know the value of the eGift card I have received? . 4 13. How do I use a supermarket eGift card? . 4 14. Can I get a refund for my eGift card? . 5 15. My eGift card barcode won’t scan in store . 5 16. I can’t see the barcode in the eGift card email . 6 17. How long does the supermarket eGift card last for? . 6 18. Can the vouchers be used in-store and online? . 6 19. I have ordered an eGift card, but it hasn’t come through to my email? . -

Business Rate Relief Cases

Ratepayer Property Ref Address Address Address Address Postcode Mandatory Relief Discretionary Relief Small Business Relief Empty Property Relief Local Discount (inc Retail Relief) 126 GREAT NORTH ROAD LLP 100129852265 COMMUNAL AREAS GND FLR 126 GREAT NORTH ROAD HATFIELD HERTS AL9 5JN NO NO YES NO NO 1ST CUFFLEY SCOUT GROUP 100513650200 1ST CUFFLEY SCOUT GROUP CHURCH CLOSE, CUFFLEY POTTERS BAR, HERTS EN6 4LS YES YES NO NO NO 1ST HATFIELD SCOUT GROUP 100145100010 1ST HATFIELD SCOUT GROUP LONGMEAD HATFIELD HERTS AL10 0AH NO NO NO NO YES 1ST NORTHAW SCOUT & GUIDE GROUP 100553830472 ADJ 47A NORTHAW ROAD WEST NORTHAW POTTERS BAR HERTS EN6 4NP YES YES NO NO NO 1ST WELWYN SCOUT GROUP 100745850170 1ST WELWYN SCOUT GROUP LOCKLEYS DRIVE WELWYN, HERTS AL6 9LU YES YES NO NO NO 1ST WGC (ST FRANCIS) SCOUT GROUP 100008820900 1ST WGC (ST FRANCIS) SCOUT GROUP BROCKSWOOD LANE WELWYN GARDEN CITY HERTS AL8 7BG YES YES NO NO NO 2ND & 7TH WGC SCOUT GROUP 100081300991 ADJ TO OUR LADY RC JMI SCHOOL WOODHALL LANE WELWYN GARDEN CITY HERTS AL7 3TF YES YES NO NO NO 3MS MUSIC LTD 100165780040 LEAN TOO AT SYMONDS HYDE FARM SYMONDS HYDE FARM HATFIELD HERTS AL10 9BB NO NO YES NO NO 3RD & 9TH WGC SCOUT GROUP 100029540000 SCOUT & GUIDE HQ GREAT DELL WELWYN GARDEN CITY HERTS AL8 7HP YES YES NO NO NO 5 STAR TAXIS 100057990045 4E PEARTREE FARM PEARTREE LANE WELWYN GARDEN CITY HERTS AL7 3UW NO NO YES NO NO 648 GROUP LTD 100158000065 6A PARKHOUSE COURT HATFIELD HERTS AL10 9RQ NO NO NO NO YES 6TH WGC SCOUT GROUP 100002100311 AUTUMN GROVE WELWYN GARDEN CITY HERTS AL7 4DB YES -

I General Area of South Quee

Organisation Address Line 1 Address Line 2 Address Line3 City / town County DUNDAS PARKS GOLFGENERAL CLUB- AREA IN CLUBHOUSE OF AT MAIN RECEPTION SOUTH QUEENSFERRYWest Lothian ON PAVILLION WALL,KING 100M EDWARD FROM PARK 3G PITCH LOCKERBIE Dumfriesshire ROBERTSON CONSTRUCTION-NINEWELLS DRIVE NINEWELLS HOSPITAL*** DUNDEE Angus CCL HOUSE- ON WALLBURNSIDE BETWEEN PLACE AG PETERS & MACKAY BROS GARAGE TROON Ayrshire ON BUS SHELTERBATTERY BESIDE THE ROAD ALBERT HOTEL NORTH QUEENSFERRYFife INVERKEITHIN ADJACENT TO #5959 PEEL PEEL ROAD ROAD . NORTH OF ENT TO TRAIN STATION THORNTONHALL GLASGOW AT MAIN RECEPTION1-3 STATION ROAD STRATHAVEN Lanarkshire INSIDE RED TELEPHONEPERTH ROADBOX GILMERTON CRIEFFPerthshire LADYBANK YOUTHBEECHES CLUB- ON OUTSIDE WALL LADYBANK CUPARFife ATR EQUIPMENTUNNAMED SOLUTIONS ROAD (TAMALA)- IN WORKSHOP OFFICE WHITECAIRNS ABERDEENAberdeenshire OUTSIDE DREGHORNDREGHORN LOAN HALL LOAN Edinburgh METAFLAKE LTD UNITSTATION 2- ON ROAD WALL AT ENTRANCE GATE ANSTRUTHER Fife Premier Store 2, New Road Kennoway Leven Fife REDGATES HOLIDAYKIRKOSWALD PARK- TO LHSROAD OF RECEPTION DOOR MAIDENS GIRVANAyrshire COUNCIL OFFICES-4 NEWTOWN ON EXT WALL STREET BETWEEN TWO ENTRANCE DOORS DUNS Berwickshire AT MAIN RECEPTIONQUEENS OF AYRSHIRE DRIVE ATHLETICS ARENA KILMARNOCK Ayrshire FIFE CONSTABULARY68 PIPELAND ST ANDREWS ROAD POLICE STATION- AT RECEPTION St Andrews Fife W J & W LANG LTD-1 SEEDHILL IN 1ST AID ROOM Paisley Renfrewshire MONTRAVE HALL-58 TO LEVEN RHS OFROAD BUILDING LUNDIN LINKS LEVENFife MIGDALE SMOLTDORNOCH LTD- ON WALL ROAD AT -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

Free School Meals FAQ's

Free school meals Select Grocery parent/carer FAQs For more information on how to use your free school meals voucher, please read the full user guide Contents 1. What’s the difference between an eCode and an eGift card? . 2 2. How do I use my eCode to select a supermarket eGift card? . 2 3. I can’t redeem my eCode? . 2 4. What supermarkets can I pick from? . 3 5. How do I know what the value of the eCode is? . 3 6. Do I have to use the full value of the eCode when choosing my eGift card(s)? . 3 7. Can I choose to redeem my eCode at more than one supermarket? . 3 8. How long do I have to redeem the eCode? . 3 9. What happens if my eCode has expired? . 3 10.My school has ordered an eCode for me, but it hasn’t come through to my email? . 4 11.What can I purchase in-store with the eGift card? . 4 12.How do I know the value of the eGift card I have received? . 4 13.How do I use a supermarket eGift card? . 4 14.Can I get a refund for my eGift card? . 5 15.My eGift card barcode won’t scan in store . 5 16.How long does the supermarket eGift card last for? . 6 17. Can the vouchers be used in-store and online? . 6 18.I have ordered an eGift card, but it hasn’t come through to my email? . 6 19.I can’t see the barcode in the eGift card email . -

UNITED STATES BANKRUPTCY COURT District of Delaware 824 Market Street, 3Rd Floor Wilmington, DE 19801

Case 19-12330-KBO Doc 326 Filed 08/14/20 Page 1 of 100 UNITED STATES BANKRUPTCY COURT District of Delaware 824 Market Street, 3rd Floor Wilmington, DE 19801 In Re: Chapter: 7 Fleetwood Acquisition Corp. 4076 Specialty Place Longmont, CO 80504 EIN: 46−4533051 Case No.: 19−12330−KBO Fleetwood Fixtures Highcountry Millwork NOTICE OF CONVERSION NOTICE IS HEREBY GIVEN that the debtor(s) chapter 11 petition has been converted to a chapter 7 petition on 6/23/20. Una O'Boyle, Clerk of Court Related J/A Debtors are listed below 19−12331 High Country Millwork, Inc. 46−5197294 19−12332 Fleetwood Industries, Inc. 23−1897530 NOTE: If you previously filed a Proof of Claim in this case, you do not need to file another Proof of Claim. If you previously filed a Motion/Request for Allowance and/or payment of an administrative expense claim that has not yet been ruled upon, you will receive written notice in the future when your administrative expense claim(s) will be scheduled for hearing. Dated: 8/12/20 (VAN−031) Case 19-12330-KBO Doc 326 Filed 08/14/20 Page 2 of 100 United States Bankruptcy Court District of Delaware In re: Case No. 19-12330-KBO Fleetwood Acquisition Corp. Chapter 7 Debtor CERTIFICATE OF NOTICE District/off: 0311-1 User: SH Page 1 of 99 Date Rcvd: Aug 12, 2020 Form ID: van031 Total Noticed: 5931 Notice by first class mail was sent to the following persons/entities by the Bankruptcy Noticing Center on Aug 14, 2020. db +Fleetwood Acquisition Corp., 4076 Specialty Place, Longmont, CO 80504-5400 15119448 +1-800-Got-Junk?, Opperations, 156 West 29Th St, 3Rd Floor, New York, NY 10001-5315 15119445 +1000 Bulbs.com, 2140 Merritt Dr., Garland, TX 75041-6135 15119446 +1000Bulbs, 2140 Merritt Dr, Garland, TX 75041-6135 15119447 +11X17 Inc., PO Box 117, Jacksonville, TX 75766-0117 15119449 +1877 Floor Guy, 12 Mccaullough Drive Suite 10, New Castle, DE 19720-2076 15119450 +19 Tinder Box International, ATTN Wayne Best, 391 W. -

Grocery Retail Structure 2016

Grocery Retail Structure 2016 Stores Change Store numbers Change Store numbers Change Co-operative Societies 2015 2016 Y-O-Y Multiple Retailers 2015 2016 Y-O-Y Specialist CTNs 2015 2016 Y-O-Y The Co-operative Group 1,836 1955 6.5% Tesco 504 504 0.0% Mccoll's Retail Group (Martins/RS McColl’s) 516 450 -12.8% Midcounties 181 159 -12.2% Tesco (attached) 485 485 0.0% JCR (Rippleglen) 85 86 1.2% Southern 188 185 -1.6% Tesco (standalone) 19 19 0.0% Aleef News 15 30 100.0% Scotmid 160 154 -3.8% Morrisons 333 334 0.3% Other CTNs 2,385 2301 -3.5% Central England 155 151 -2.6% Morrisons (attached) 317 318 0.3% Co-operatives Store numbers Change TOTAL 3,001 2,867 -4.5% SUPERMARKETS SUPERSTORES HYPERMARKETS East of England 82 84 2.4% Morrisons (standalone) 16 16 0.0% 2015 2016 2015 2016 2015 2016 2015 2016 Y-O-Y Lincolnshire 64 66 3.1% Sainsbury's 299 303 1.3% The Co-operative Group 726 679 – – – – 726 679 -6.5% Chelmsford Star 35 30 -14.3% Sainsbury's (attached) 281 278 -1.1% Central England 104 118 3 3 – – 107 121 13.1% Specialist Off-licences Heart of England 23 24 4.3% Sainsbury's (standalone) 18 25 38.9% Midcounties 63 64 – – – – 63 64 1.6% Bargain Booze (total) 463 465 0.4% Tamworth 12 11 -8.3% Asda 261 280 7.3% East of England 50 55 – – – – 50 55 10.0% Bargain Booze 223 223 0.0% Other Co-operatives 29 31 6.9% Asda (attached) 240 257 7.1% Scotmid 37 36 – – – – 37 36 -2.7% Bargain Booze Plus 214 214 0.0% TOTAL 2,765 2,850 3.1% Asda (standalone) 21 23 9.5% Southern 20 19 – – – – 20 19 -5.0% Wine Rack 26 28 7.7% Co-operative Societies 256 246 -3.9% Lincolnshire 15 16 – – – – 15 16 6.7% Majestic Wine Warehouse 211 216 2.4% 14 15 1 1 FORECOURTS The Co-operative Group (attached) 13 8 -38.5% Channel Islands – – 15 16 6.7% Whittalls (incl. -

Metals in Foods Packaged in Aluminium Containing Food Packaging Materials

© Crown Copyright 2013 Metals in foods packaged in aluminium containing food packaging materials Report to the Food Standards Agency November 2013 The Food and Environment Research Agency Sand Hutton York YO41 1LZ UK Tel: +44(0)1904 46 2000 Web: www.defra.gov.uk/fera Email: [email protected] / [email protected] PROJECT INFORMATION Report Number: FD 13/04 Author: E. L. Bradley Date: November 2013 Project title: Metals in foods packaged in aluminium containing food packaging materials Sponsor: Food Standards Agency Aviation House 125 Kingsway London WC2B 6NH Sponsor’s Project Number: A04016 Fera Project Number: R6NO Fera File Reference: FLN 8903 Principal Workers: M. Baxter, N. Brereton L. Lister, L. Rose Team Leader: E. L. Bradley Distribution: 1. J. Briggs (FSA) 2. E. L. Bradley 3. Fera Library - 2 - CONTENTS Page No. SUMMARY 7 1. Sample details 8 2. Survey sample receipt, preparation and analysis 8 3. Profiling sample preparation 8 4. Results 10 4.1 Survey samples 10 4.2 Metal profiling samples 10 - 3 - LIST OF TABLES Page No. Table 1. Sample details 12 Table 2. Samples selected for the profiling studies 36 Table 3. Concentrations of aluminium, arsenic, cadmium, chromium, copper, 37 lead, manganese, mercury, nickel and selenium in the foodstuffs Table 4. Concentrations of aluminium, arsenic, cadmium, chromium, copper, 49 lead, manganese, mercury, nickel and selenium in the DORM3 – fish protein reference material (9 batches) Table 5. Concentrations of aluminium, arsenic, cadmium, chromium, copper, 49 lead, manganese, mercury, nickel and selenium in the N8414 - Bovine muscle reference material (9 batches) Table 6. -

COVID Winter Grant Scheme – Food and Grocery Vouchers 1

COVID Winter Grant Scheme – Food and Grocery Vouchers 1. Why am I receiving this letter? You are receiving these vouchers because your child is in receipt of free school meals. 2. What do I do with this eCode? Before you go shopping you need to download an eGift card. To do this you need to: Go to www.selectyourcompliment.co.uk/grocery Enter your eCode that is on your letter in the box that says, 'enter your unique code’, the select ‘Redeem’; Then select a supermarket; Enter the amount you are claiming; Add it to your basket; Checkout and enter the email address you would like the eGift card sent to; Your eGift card will be processed and sent; You will need to allow up to 24 hours for it to be delivered to your inbox. 3. How much are the eGift cards worth? Each eCode contained in this letter will allow you to download an eGift card worth £30. 4. What can I buy with the eGift card? The eGift card can be used to buy food and groceries only. 5. Can I have cash instead of the eGift card? Unfortunately, we are unable to distribute cash. 6. Where can I spend these eGift cards? These eGift cards can be spent at: Morrisons Tesco Sainsbury’s Asda Waitrose M&S food McColl’s (including RS McColl’s and Martin’s) Aldi 7. I have ordered an eGift card, but it hasn’t come through to my email? It can take up to 24 hours for an eGift card to arrive.