Project Report on Maruti Suzuki

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Green Driver: Driving Behaviors Revisited on Safety

ARCHIVES OF TRANSPORT ISSN (print): 0866-9546 Volume 47, Issue 3, 2018 e-ISSN (online): 2300-8830 DOI: 10.5604/01.3001.0012.6507 GREEN DRIVER: DRIVING BEHAVIORS REVISITED ON SAFETY Nurul Hidayah Binti MUSLIM1, Arezou SHAFAGHAT2, Ali KEYVANFAR3, Mohammad ISMAIL4 1,4 Faculty of Civil Engineering, Universiti Teknologi Malaysia, Skudai, Johor, Malaysia 2,3 MIT-UTM MSCP Program, Institute Sultan Iskandar, Universiti Teknologi Malaysia, Skudai, Malaysia 2,3 Department of Landscape Architecture, Faculty of Built Environment, Universiti Teknologi Malaysia, Skudai, Johor, Malaysia 3 Facultad de Arquitectura y Urbanismo, Universidad Tecnológica Equinoccial, Calle Rumipamba s/n y Bourgeois, Quito, Ecuador 3 Center for Energy Research, Jacobs School of Engineering, University of California, San Diego, USA Contact: 2) [email protected] (corresponding author) Abstract: Interactions between road users, motor vehicles, and environment affect to driver’s travel behavior; however, frailer of proper interaction may lead to ever-increasing road crashes, injuries and fatalities. The current study has generated the green driver concept to evaluate the incorporation of green driver to negative outcomes reduction of road transportation. The study aimed to identify the green driver’s behaviors affecting safe traveling by engaging two research phases. Phase one was to identify the safe driving behaviors using Systematic literature review and Content Analysis methods. Phase one identified twenty-four (24) sub-factors under reckless driving behaviors cluster, and nineteen (19) sub-factors under safe driving practice cluster. Second phase was to establish the actual weight value of the sub-factors using Grounded Group Decision Making (GGDM) and Value Assignment (VA) methods, in order to determine the value impact of each sub-factor to green driving. -

From Import Substitution to Integration Into Global Production Networks: the Case of the Indian Automobile Industry Prema-Chandra Athukorala and C

From Import Substitution to Integration into Global Production Networks: The Case of the Indian Automobile Industry Prema-chandra Athukorala and C. Veeramani∗ This paper examines the growth trajectory and the current state of the Indian automobile industry, paying attention to factors that underpinned its transition from import substitution to integration into global production networks. Market-conforming policies implemented by the government of India over the past 2 decades, which marked a clear departure from protectionist policies in the past, have been instrumental in transforming the Indian automobile industry in line with ongoing structural changes in the world automobile industry. India has emerged as a significant producer of compact cars within global automobile production networks. Compact cars exported from India have become competitive in the international market because of the economies of scale of producing for a large domestic market and product adaptation to suit domestic market conditions. Interestingly, there are no significant differences in prices of compact cars sold in domestic and foreign markets. This suggests that the hypothesis of “import protection as export promotion” does not hold for Indian automobile exports. Keywords: automobile industry, foreign direct investment, global production networks, India JEL codes: F13, F14, L92, L98 I. Introduction The global landscape of the automobile industry has been in a process of notable transformation over the past 3 decades. Until about the late 1980s, automobile production remained heavily concentrated in the United States, Japan, and Western Europe (known as the “triad”). While the leading automakers headquartered in the triad had assembly plants in many developing countries, most of these plants served domestic markets under heavy tariff protection. -

A Study on Customer Satisfaction Towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore by Dilip Kumar M 1IA17MBA18 Submitted To

A Project Report (17MBAPR407) A study on Customer Satisfaction towards Bharat Benz, Trident Automobiles Pvt Ltd, Bangalore By Dilip Kumar M 1IA17MBA18 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Prof. Archana Vijay Mr. Harsha H Assistant Professor, Marketing Head Department of MBA, AIT Bharat Benz Department of MBA Acharya Institute of technology, Soldevanahalli, Hesaraghatta Main Road, Bengaluru March 2019 TRIDENT AUTOMOBILES PRIVATE LIMITED # 1, Lower Palace Orchards, Sankey Road , Bangalore - 560 003. Tel: 91-80-4343 3333 Fax: 91-80-2336 8152 CIN: U50500KA1997PTC023159 Date: 02-04-2019 TO WHOM SO EVER IT MAY CONCERN This is to certify that Mr. Dilip Kumar M (Reg No:llAl 7MBA18) who is pursuing his Post Graduation Degree in MBA from "Visvesvaraya Technology University" has successfully completed his Internship on "Customer Satisfaction Towards Bharath Benz" in our organization from the period of 03 rd January 2019 to 16th February 2019. His performance & conduct during the internship was good. We wish him all the very best for his future endeavor. Your's faithfully, For Trident Automobiles Pvt Ltd., Metha Nanjappa General Manager - HR URL : www.tridentautomobiles.com '!),zwe ,;ilOHU ,I ~~ /@) ACHARYA INSTITUTE OF TECHNOLOGY (Affiliated to Visvesvaraya Technolog ical Un iversity, Belagav i, Approved by AICTE, New Delh i and Accredited by NBA and NAAC) Date: 05/04/2019 CERTIFICATE This is to certify that Mr. Dilip Kumar M bearing USN HAI 7MBA18 is a bonafide student of Master of Business Administration course of the Institute 2017-19 batch, affiliated to Vi svesvaraya Technological Universit'J, Belagavi. -

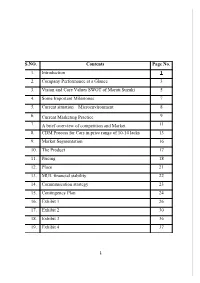

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4. Some Important Milestones 7 5. Current situation – Microenvironment 8 6. Current Marketing Practice 9 7. A brief overview of competition and Market 11 8. CDM Process for Cars in price range of 10-14 lacks 13 9. Market Segmentation 16 10. The Product 17 11. Pricing 18 12. Place 21 13. MUL financial stability 22 14. Communication strategy 23 15. Contingency Plan 24 16. Exhibit 1 26 17. Exhibit 2 30 18. Exhibit 3 36 19. Exhibit 4 37 1 1. I NTRODUCTION Maruti Suzuki India Ltd. – Company Profile Maruti Suzuki India Ltd. (current logo) Maruti Udyog Ltd. (old logo) Maruti Suzuki is one of the leading automobile manufacturers of India, and is the leader in the car segment both in terms of volume of vehicle sold and revenue earned. It was established in February, 1981 as Maruti Udyog Ltd. (MUL), but actual production started in 1983 with the Maruti 800 (based on the Suzuki Alto kei car of Japan), which was the only modern car available in India at that time. Previously, the Government of India held a 18.28% stake in the company, and 54.2% was held by Suzuki of Japan. However, in June 2003, the Government of India held an initial public offering of 25%. By May 10, 2007 sold off its complete share to Indian financial institutions. Through 2004, Maruti Suzuki has produced over 5 million cars. Now, the company annually exports more than 50,000 cars and has an extremely large domestic market in India selling over 730,000 cars annually. -

Hindustan Motors' Sales Growth Continues, Kolkata, March 07

PRESS RELEASE Hindustan Motors’ sales growth continues 166 % jump in Feb. 2013 sales following Jan. upswing KOLKATA, March 7, 2013: CK Birla Group’s flagship company Hindustan Motors Ltd. (HM) bolstered its sales performance by registering 166.45 per cent growth in February vis-a-vis its sales in February last year (2012). Significantly, the company’s year-on-year sales had surged by 104.37 per cent this January (2013) as well. Heading steadily towards a turnaround, HM posted a 147 per cent increase in net profit to Rs. 20.36 crore in the quarter ending December 31, 2012, against a net loss of Rs. 42.81 crore for the corresponding period in the previous financial year. Hindustan Motors’ Managing Director & CEO, Mr. Uttam Bose, stated, “This has been achieved by leveraging the strengths of brand loyalty and operational excellence. With steady and continuous growth in HM’s sales numbers, the company’s march towards a revival has become more pronounced and promising. Regular ramping up of cost-efficient production, increase in sales through expanding distribution and financing networks, and focus on voice of customer have contributed to the sharp growth in the past few months. With several strategic and tactical measures striking roots, Hindustan Motors is all set to continue and sustain the improvement trend in the coming months.” During the month under review (February 2013), HM sold 826 passenger and light commercial vehicles compared with 310 vehicles in February last year. January 2013 witnessed the company selling 748 vehicles compared to a sale of 366 vehicles in January 2012. -

Maruti Suzuki India Ltd

Business in India Content 1. Success Stories of Japanese companies in India a) Suzuki b) Daikin c) KUMON Global 2. Success story of McDonald in India 3. Corporate Frauds 4. GST Maruti Suzuki India Ltd. Connected For Success Sustained Performance 1.57 million cars in the financial year 2016-17 9.8% growth Hyundai, sold close to 509,707 units in 2016- 17 7 6 5 4 sales (mn) yr 2 3 sales (mn) Yr 1 2 1 0 2015-16 2016-17 Background • Founded in 1981 • To provide affordable mobility to India’s masses • Minute detail-orientation of the Japanese • Observing customers in detail, identifying their needs • Aligning the whole value chain to deliver this need at an appropriate value Guiding Principle . Osamu Suzuki’s conviction . “Cleanliness would drive effectiveness” . Check signs of inefficiency and waste . Every employee is equal . Open offices, one uniform, a common canteen for everyone from sweeper to Managing Director Philosophy that drove Maruti’s success Smaller, lighter, lesser and more beautiful “1 component, 1 gram, 1 yen” initiative . Identify cost improvements of at least ¥1 as well as weight reduction of at least one gram. Mobilized an army of about 6,000 employees Exchange programmes • Adherence to standards • Continuous improvement of standards via Kaizen • Management principles such as 3G, 3K, 3M and 5S. • Phased manufacturing programme • Balance between handholding and leveraging competition • Quality of components: increased cooperation between OEM and supplier • Financially responsible: Displaying real profits in books • Create more value than potential tax “savings” Digital training academy • First large-scale deployment of satellite broadband solution • Facilitating training in a corporate environment. -

Eicher Motors

Techno Funda Pick SiScrip IDiI-Direct Co de AiAction Target UidUpside Maruti Suzuki MARUTI Buy in the range of 5770-5910 6640.00 14% Eicher Motors EICMOT Buy in the range of 23300-23600 27450.00 17% Time Frame: 6 Months Research Analysts Dharmesh Shah [email protected] Nishit Zota [email protected] January 27, 2017 Techno Funda Pick: Maruti Suzuki (MARUTI) Time Frame: 6 Months CMP: | 5885. 00 BiBuying Range: | 5770-5910 Tt|Target: | 6640. 00 UidUpside: 14% Stock Data Key technical observations Recommended Price 5770-5910 The share price of Maruti has remained in a secular uptrend since 2014 as it continues to form higher peak and higher Price Target 6570 trough in all time frame and has consistently generated superior returns for investors over the long term. Within this structural bull run, the stock has undergone periodic phases of consolidation providing fresh entry opportunities for 52 Week High 5974 medium term players to ride the uptrend. We believe the consolidation over the last three months has approached 52 Week Low 3193 maturity and the stock provides a good entry opportunity for medium term investors. 50 days EMA 5474 The stock rebounded from a major support area ... 200 days EMA 4995 The stock after hitting a life-time high of | 5974 in the first week of November 2016 has entered a corrective 52 Week EMA 4888 consolidation phase to work off the excesses post the breakout rally from March 2016 low of | 3185 to the life-time *Recommendation given on i-click to gain on January high of 5974. -

Auto, IT Firms Lead Growth Surge

ADVANCE TAX COLLECTION Auto, IT firms lead growth surge SHRIMI CHOUDHARY such as State Bank of India (SBI) and KEY CONTRIBUTORS New Delhi, 22 June ICICI Bank reported lower (but dou- Amount paid (in ~ cr) YoY growth (%) ble-digit) growth in tax payment. Maruti Suzuki 150 200 Tech Mahindra 190 35 Sharp growth in advance tax payment According to officials, the first- by India Inc has been led mainly by quarter numbers have been compared Hero Motocorp 126 96 SBI 1,910 21 automakers and technology giants with the beginning of the pandemic- TCS 1,160 65 HUL 397 20 including Maruti Suzuki, Hero induced lockdown, so automatically L&T 30 50 Cipla 126 20 MotoCorp, Tata Consultancy (TCS), the figures showed a sharp jump. The and Infosys. second instalment will have a clearer P&G 32 45 NTPC 485 10 These four companies reported a picture, they said. Infosys 720 44 Dr Reddy’s 60 9 jump between 44 per cent and 200 per Meanwhile, final advance tax col- ICICI Bank 800 39 HDFC Bank 2,100 8 cent in the April-June quarter of this lection by companies showed 51 per financial year on account of a low base. cent growth (YoY) for the first quarter. Note: Figures for April 1-June 21 Source: CBDT sources Even top financial institutions Turn to Page 13 > > FROM PAGE 1 Auto, IT firms lead growth surge Earlier, the preliminary data impact on the companies’ increased its tax outflow by Suzuki paid ~150 crore. showed a growth rate of 146 growth. 35 per cent at ~190 crore. -

Project Report on “A STUDY of CONSUMER BEHAVIOURS and SATISFACTION with HYUNDAI MOTORS”

Project Report ON “A STUDY OF CONSUMER BEHAVIOURS AND SATISFACTION WITH HYUNDAI MOTORS” Submitted for the partial fulfilment for the award Of Bachelor of Business Administration from Chaudhary Charan Singh University, Meerut 2012-15 Submitted To: SHANTI INSTITUTE OF TECHNOLOGY MEERUT Under The supervision of: - Submitted By:- Mr. RAHUL SHARMA PAWAN KUMAR (H.O.D, of BBA, Dept ) BBA VI SEM Roll No. 3396526 DEPARTMENT OF MANAGEMENT SHANTI INSTITUTE OF TECHNOLOGY MEERUT BATCH-2012-15 1 DECLARATION I, PAWAN KUMAR under signed hereby declare that the project report on “A STUDY OF CONSUMER BEHAVIOURS AND SATISFACTION WITH HYUNDAI MOTORS” . The empirical finding in this reports are based on the annual reports of the company. While preparing this report submitted to Project Guide Mr. Rahul Sharma H.O.D., BBA Department , SIT Meerut, , I have not copied material from any report. PAWAN KUMAR BBA VI SEM Roll No. 3396526 2 ACKNOWLEDGEMENT I would sincerely thank our all faculty members because without whose guidance this project would not have been possible. I would also like to thank them for giving an opportunity to conduct this summer training and extending me full support and co-operation towards the completion to this Project I express my gratitude Project Guide Mr. Rahul Sharma H.O.D., BBA Department , SIT Meerut to all those mentioned above and also the senior functionaries of the organization, who helped me directly and indirectly to make this project a success. Once again I express my gratitude to Hyundai for their kind co-operation and having given me an opportunity to associate myself with the major producers of commercial vehicles in the country. -

General Safety Regulation Draft

EUROPEAN COMMISSION Brussels, 17.5.2018 SWD(2018) 190 final COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying the document Proposal for a Regulation of the European Parliament and of the Council on type- approval requirements for motor vehicles and their trailers, and systems, components and separate technical units intended for such vehicles, as regards their general safety and the protection of vehicle occupants and vulnerable road users, amending Regulation (EU) 2018/… and repealing Regulations (EC) No 78/2009, (EC) No 79/2009 and (EC) No 661/2009 {COM(2018) 286 final} - {SEC(2018) 270 final} - {SWD(2018) 191 final} EN EN Table of Contents List of abbreviations and glossary of terms ............................................................................... 5 1. Introduction: Political and legal context ............................................................................. 7 1.1. Political context ............................................................................................................ 7 1.2. Legal context ................................................................................................................ 8 1.2.1. Vehicle safety legislation under the type-approval framework ............................ 9 1.3. Adapting the legislation to vehicle safety developments ............................................. 9 1.4. Contribution of vehicle safety legislation to road safety in general .......................... 10 2. What is the problem and why is it a problem? ................................................................. -

Equity Strategy

FOR EXTERNAL DISTRIBUTION TO THE FOLLOWING GROUP OF CUSTOMERS ONLY: 1. Accredited Investors (Singapore: Priority Banking). Further distribution of this publication to other group(s) is STRICTLY PROHIBITED. India Top Picks equity strategy This reflects the views of the Wealth Management Group equities | 07 March 2014 Sensex consolidating in a narrow range Contents No changes to our Top Picks this month Sensex consolidating in a narrow range 1 On Watch: India Top Picks 2 – Maruti Suzuki (MSIL IN) to Cut (waiting for a rebound) India Top Picks Review 2 – Tata Power (TPWR IN) and HPCL (HPCL IN) or Oil India Range-bound till elections 7 (OINL IN) under consideration to Add Technical Commentary 8 Indian markets were up last month because of better-than- India Top Picks – Results Update 18 expected inflation data and pre-election opinion polls suggesting Sector – Performance & Valuations 19 that the BJP-led coalition is the frontrunner for forming the next List of Equity Market Commentary Publication 21 government at the Centre. Important Information 22 Of the stocks we highlight, we believe those with the most favourable technicals are Cipla (CIPLA IN), Lupin (LPC IN) and Tech Mahindra (TECHM IN). We would advocate investors consider adding to these names at current levels. In the Interim Union Budget, the Finance Minister surprised the market by announcing that the FY14 fiscal deficit would be 4.8%, 20bps lower than previously forecast. Other highlights include the lack of populist measures ahead of the budget and excise duty Rob Aspin, CFA reduction in automobiles, capital goods and non-consumer Head, Equity Investment Strategy durables. -

A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra

International Journal of Marketing, Sales and Brand Management Volume 1 Issue 2 A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra Mukund S Assistant Professor Department of M.B.A Marian International Institute of Management, Kuttikkanam, Kerala Corresponding Author’s email: [email protected] DOI: http://doi.org/ 10.5281/zenodo.3626835 Abstract The intrinsic value or the real value of any stock should be known to the investor prior to the initiation of investment in the particular company. Therefore fundamental analysis can be used to find out the intrinsic value. Fundamental analysis is based on certain factors including industry, competition, operational efficiency, dividend policy, capital structure, ratios etc. Those factors tend to change according to the industry and economy. Indian automobile industry had witnessed a growth rate of 8 % during 2019-20. The fuel prices have played an important role in the growth of automobile industry when it comes to price sensitive consumers in India. This study has attempted to analyze the fundamental components of three Indian made automobiles by using various financial and statistical techniques. Maruti stands No. 1 in the segment followed by TATA. Keywords: Automobile Industry, Dividend policy, Fundamental analysis, Operational efficiency, Ratios. INTRODUCTION to sales. 2017-18 can be considered as Indian automobile industry is a lucrative their best time of sales. It marked a double industry which is currently one of the digit growth rate from 1st April 2017 to largest markets in the world with regards 31st March 2018. We have taken three 1 Page 1-9 © MANTECH PUBLICATIONS 2019.