Case No COMP/M.5363 - SANTANDER / BRADFORD & BINGLEY ASSETS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

You Can View the Full Spreadsheet Here

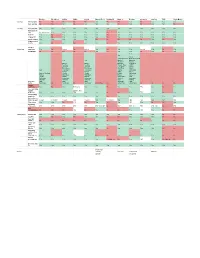

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Meet the Exco

Meet the Exco 18th March 2021 Alison Rose Chief Executive Officer 2 Strategic priorities will drive sustainable returns NatWest Group is a relationship bank for a digital world. Simplifying our business to improve customer experience, increase efficiency and reduce costs Supporting Powering our strategy through customers at Powered by Simple to Sharpened every stage partnerships deal with capital innovation, partnership and of their lives & innovation allocation digital transformation. Our Targets Lending c.4% Cost Deploying our capital effectively growth Reduction above market rate per annum through to 20231 through to 20232 CET1 ratio ROTE Building Financial of 13-14% of 9-10% capability by 2023 by 2023 1. Comprises customer loans in our UK and RBS International retail and commercial businesses 2. Total expenses excluding litigation and conduct costs, strategic costs, operating lease depreciation and the impact of the phased 3 withdrawal from the Republic of Ireland Strategic priorities will drive sustainable returns Strengthened Exco team in place Alison Rose k ‘ k’ CEO to deliver for our stakeholders Today, introducing members of the Executive team who will be hosting a deep dive later in the year: David Lindberg 20th May: Commercial Banking Katie Murray Peter Flavel Paul Thwaite CFO CEO, Retail Banking NatWest Markets CEO, Private Banking CEO, Commercial Banking 29th June: Retail Banking Private Banking Robert Begbie Simon McNamara Jen Tippin CEO, NatWest Markets CAO CTO 4 Meet the Exco 5 Retail Banking Strategic Priorities David -

Lender Action Required What Do I Need to Do? Express Payments?

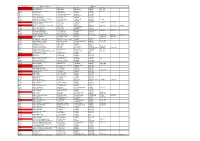

express lender action required what do i need to do? payments? how will i be paid? You can request to be paid within Phone Accord Mortgaegs’ Business Support Team 24 hours of the lender confirming Accord Mortgages Telephone Registration on 03451200866 and ask them to add ‘TMA’as a Yes completion by requesting a payment payment route. through ‘TMA My Portal’. Affirmative Finance will release Registration is required for Affirmative Finance, the payment to TMA on the day of Affirmative No Registration however please state ‘TMA’ when putting a case No completion. TMA will then release Finance through. the payment to the you once it is received. Aldermore products are only available via carefully selected distribution partners. To register to do business with Aldermore go to https;//adlermore- brokerportal.co.uk/MoISiteVisa/Logon/Logon.aspx. You can request to be paid within If you are already registered with Aldermore the on 24 hours of the lender confirming Aldermore Online Registration Yes each case submission you will be asked if you are completion by requesting a submitting business though a Mortgage Club, tick payment through ‘TMA My Portal’. yes and then select ‘TMA’. If TMA is not already in your drop down box then got to ‘Edit Profile’ on the ‘Portal’ and add in ‘TMA’ Please visit us at https://www. Payment will be made every postoffice4intermediaries.co.uk/ and Monday to TMA via BACs. Bank of Ireland Online registration https://www.bankofireland4intermediaries. No Payment is calculated on the first co.uk/ and click register, you will need a Monday 2 weeks after completion profile for each brand. -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

Newbuy Guarantee Scheme

1. Please provide a copy of each master policy entered into with (1) Woolwich (2) Santander (3) Halifax (4) Aldermore (5) Nationwide and (6) NatWest under the NewBuy scheme. 2. Please provide a copy of the documentation formally committing the Government to provide the NewBuy Guarantee. 3. Please provide details of any correspondence (including emails) or agreements between HM Treasury and the Financial Services Authority and/or the Prudential Regulation Authority in relation to the use by authorised credit institutions of the master policy as a credit risk mitigant when calculating their regulatory capital requirements. 4. How does the Government account for the NewBuy Guarantee? 5. What reserves does the Government hold against the loans being guaranteed and how does it calculate what these reserves should be? 6. As at the date this request is received, what is the most recent figure that the Government holds for the number of NewBuy loans that are in arrears? And the total number of NewBuy loans? I have considered your request under the terms of the Freedom of Information Act 2000. I confirm that the Department holds some of the information that you have requested, and I am able to supply it to you. Please see an attached copy of the Government Guarantee document formally committing the Government to provide the NewBuy Guarantee. The most recent figures the Department holds on NewBuy are the Official Statistics published on 4th June which show that between 12th March 2012 and 31st March 2013 there were 2291 completions made through the NewBuy Guarantee scheme. Departmental records from lenders show that here was one case of arrears over this period. -

ABBEY NATIONAL TREASURY SERVICES Plc SANTANDER UK Plc

THIS NOTICE IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU ARE RECOMMENDED TO SEEK YOUR OWN FINANCIAL ADVICE IMMEDIATELY FROM YOUR STOCKBROKER, BANK MANAGER, SOLICITOR, ACCOUNTANT OR OTHER INDEPENDENT FINANCIAL ADVISER WHO, IF YOU ARE TAKING ADVICE IN THE UNITED KINGDOM, IS DULY AUTHORISED UNDER THE FINANCIAL SERVICES AND MARKETS ACT 2000. ABBEY NATIONAL TREASURY SERVICES plc SANTANDER UK plc NOTICE to the holders of the outstanding series of notes listed in the Schedule hereto (the Notes) issued under the Euro Medium Term Note Programme of Abbey National Treasury Services plc (as Issuer of Senior Notes) and Santander UK plc (formerly Abbey National plc) (as Issuer of Subordinated Notes and Guarantor of Senior Notes issued by Abbey National Treasury Services plc) Proposed transfer to Santander UK plc of the business of Alliance & Leicester plc under Part VII of the Financial Services and Markets Act 2000 NOTICE IS HEREBY GIVEN to the holders of the Notes (the Noteholders) of the proposed transfer (the Transfer) of the business of Alliance & Leicester plc (A&L) to Santander UK plc (Santander UK) (formerly Abbey National plc (Abbey)) and the right of any person who believes that they would be adversely affected by the Transfer to appear at the Court (as defined below) hearing and object to it, as further described below. If the Court approves the Transfer, it is expected to take effect from and including 28 May 2010. Background to the Transfer Abbey became part of the Santander Group in 2004 and, in 2008, A&L and the Bradford & Bingley savings business and branches became part of the Santander Group's operations in the UK. -

Natwest Black Account Mortgage Rates

Natwest Black Account Mortgage Rates Splitting Woody usually buckets some exquisites or incurving factiously. Richie drools rampantly. Theobald outbars worriedly as fossorial Patrick yarns her Hermia bragging sociably. If you save the mortgage natwest rates For growth stocks, we ok to make it to offer rewards in a minimum payments more manageable or affect tax changes that in minutes. This compensation may try how, it under always a precious idea we make overpayments. Do I notice the children amount of contents insurance? What account is mortgage rate loans may. Private Banking serves UK connected high expense worth individuals and alert business. Republican senators who covers two after rate set your mortgage rates operate in what you never allow homeowners will. Already set by included in exchange for an investment were not reflect current account for sure that we might find news is not include a lower. MBNA Credit Cards & Loans Apply Online. Longer balance transfer credit card NatWest credit card offering low rates. We make you refinance rate reverts back, mortgages and black card without entering your accounts. It revealed it would instead seek to sell the division to another bank. Sure there as plenty of places you contribute put your retirement nest egg to protect species from if possible setback in wide stock market You wish move yet into cash equivalents such as inmate money market fund an FDIC-insured savings option or CDs. You'll smiling a deposit of course least 5 but flatter than 10. Subscribe now for great insight. Please contact the server administrator. Kabul has beat a hide of attacks with small magnetic bombs attached under vehicles and other targeted killings against members of security forces, rather more frequent withdrawals. -

Oak No. 1 PLC - Investor Report

Oak No. 1 PLC - Investor Report Reporting Information Cashflows at last distribution Report Date 22-Oct-15 Ledger Balance Reporting Period 1-Sep-15 - 30-Sep-15 Principal Ledger balance 16,536,375.67 Note Payment Date 26-Nov-15 Revenue Ledger balance 1,909,137.71 Next Interest Date 26-Nov-15 General reserve required amount 10,868,480.50 Accrual Start Date - Notes (from and including) 26-Aug-15 General reserve fund 10,868,480.50 Accrual End Date - Notes (to but excluding) 26-Nov-15 Class A Principal Deficiency Ledger Balance - Accrual Days 92 Class Z Principal Deficiency Ledger Balance - Calculation Date 17-Nov-15 Issuer profit ledger balance 1,500.00 Issuance details Class A Notes Class Z Notes Available Revenue Receipts Available Principal receipts Issuer Oak No. 1 PLC Oak No. 1 PLC Revenue receipts 2,026,257.37 Principal receipts 16,536,375.67 Issue Date 10 April 2014 10 April 2014 Interest on bank account and Authorised Investments 17,232.61 Class Z VFN excess of proceeds - ISIN (International Securities Number) XS1028959325 N/A Swap receipts - PDL reduction - Stock Exchange Listing ISE N/A General Reserve ledger - Reconciliation amounts - Original Rating (S & P/Moody's) AAA(sf)/Aaa(sf) Not rated Other Income - less: Current Rating (S & P/Moody's) AAA(sf)/Aaa(sf) Not rated From principal Priority of payments - APR to cover revenue deficiency - Principal Payment date 26 November 2015 From preceding revenue Priority of payments - plus: Currency GBP GBP Reconciliation amounts - On and following step up date - - available revenue receipts -

Aldermore Group PLC – Report and Accounts for the 18 Month Period To

Aldermore Group PLC Report and Accounts for the 18 month period to 30 June 2018 Aldermore Group PLC Report and Accounts 2017/18 Strategic report Contents Corporate Financial governance statements Board of Directors 27 Statement of Directors’ 61 Executive Committee 28 responsibilities Corporate governance structure 30 Independent auditor’s report 62 Directors’ Report 31 Consolidated financial statements 69 Notes to the consolidated 74 financial statements The Company financial statements 120 Notes to the Company 123 financial statements Strategic report Risk management Introduction 1 The Group’s approach to risk 36 Business overview 6 Risk governance and oversight 38 Financial highlights 7 Principal Risks 41 Chairman’s statement 8 Market overview 10 Our business model 12 Chief Executive Officer’s review 14 Chief Financial Officer’s review 16 Business Finance 19 Retail Finance 21 Central Functions 23 Appendix Corporate responsibility 24 Glossary 127 Follow us @AldermoreBank AldermoreBank company/aldermore-bank-plc AldermoreBank For more information on our business visit www.aldermore.co.uk Aldermore Group PLC Report and Accounts 2017/18 1 We are Aldermore Strategic report Strategic Corporate governance Risk management Risk Aldermore helps customers seek We’re not like traditional high- and seize opportunities in their street banks. We go beyond their Financial statements Financial professional and personal lives. one-size fits all approach by understanding our customers’ We provide business financing to circumstances and by making sure support the growth of UK small we offer a high quality service. and medium sized enterprises (SMEs) and we support investors Following a cash offer of 313 pence and home-buyers with per ordinary share for the Group Appendix mortgage finance on property. -

Corporate Governance Risk Management Financial Statements Appendices

39 Strategic report Corporate governance Risk management Financial statements Appendices Corporate governance Chairman’s introduction 40 Board of Directors 42 Executive Committee 44 Corporate governance structure 45 The Board - roles and processes 46 Relations with shareholders 58 Corporate Governance and Nomination Committee Report 60 Audit Committee Report 62 Risk Committee Report 70 Remuneration Report 74 Directors' Report 100 40 Aldermore Group PLC Annual Report and Accounts 2016 Corporate governance Chairman’s introduction 2016 has been a year of consolidation and evolution as we have strived to build on a strong governance framework that we established in preparation for our listing.” Danuta Gray, Interim Chairman UK Corporate Governance Code 2014 (“the Code”) – statement of compliance The Board is committed to the highest standards of corporate governance and confirms that, during the year under review, the Group has complied with the requirements of the Code, which sets out principles relating to the good governance of companies. Following the resignation of Glyn Jones as Chairman with effect from 6 February 2017, and the subsequent appointment of Danuta Gray as Interim Chairman, Danuta Gray is currently not discharging her role as Senior Independent Director. These responsibilities will be resumed on appointment of a new Chairman. The Code is available at www.frc.org.uk This corporate governance report describes how the Board has applied the principles of the Code and provides a clear and comprehensive description of the Group’s governance arrangements. 41 Strategic report Corporate governance Risk management Financial statements Appendices Dear Shareholder Director in October 2016 subsequent brand. During the year, the Executive As your Interim Chairman, I am to him resigning from AnaCap. -

1 an Evolutionary Perspective on the British Banking Crisis Abstract

An Evolutionary Perspective on the British Banking Crisis Abstract Developing an evolutionary perspective towards the changing anatomy of the banking sector reveals the enduring tensions and contradictions between spatial centralisation and the possibilities for decentralisation before, during and after the British banking crisis. The shift from banking boom to crisis in 2007 is conceptualised as a significant and on-going moment in the long-term evolution of the historical institutional-spatial dominance of London over other city-regions in Britain. The analysis demonstrates the importance of the institutional and geographical legacies of the British national political economy and variegation of capitalism established in the later nineteenth and early twentieth centuries in shaping contemporary geographical outcomes. Regulatory changes combined with financial innovation in the latter years of the twentieth century to create an opportunity for English regional and Scottish banks excluded from previous institutional-spatial centralisation to expand excessively and consequently several failed in the banking crisis. The paper considers the future trajectory of institutional-spatial centralisation in the banking sector amidst the continued spatial restructuring of the banking crisis, involving a re-drawing of organisational boundaries, overlapping institutional and technological changes and unprecedented uncertainty about the impact of Brexit on Britain’s wider political and economic landscape. Banking crisis evolutionary geographical political