Natwest Black Account Mortgage Rates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

The Rose Review of Female Entrepreneurship

The Alison Rose Review of Female Entrepreneurship Contents Section 1: Foreword 2 Section 2: Executive summary 5 Section 3: Creating value for the UK economy 17 Section 4: Scope and approach 23 Section 5: The female entrepreneurial landscape in the UK 29 Section 6: Opportunities to improve 41 Section 7: Key learnings from global best practice 73 Section 8: Our recommendations 79 Section 9: Appendix 99 The Alison Rose Review of Female Entrepreneurship | 1 Section 1 Foreword I firmly believe that the disparity that exists between female and male entrepreneurs is unacceptable and holding the UK back. The unrealised potential for the UK economy is enormous. This is why I was pleased to accept the invitation from Robert Jenrick MP, Exchequer Secretary to the Treasury, to carry out this review into barriers to female entrepreneurship. We have a shared ambition to strengthen the UK’s position as one of the best places in the world for women to start and grow a business. Business has a significant part to play in making the UK the best place to start and scale a business regardless of gender. It is clear that tailored support from specialists who understand the different challenges that female business owners face, as well as the way they think and run their business, makes a real difference to success rates. Our ambition – through the implementation of the recommendations in this report and joined-up action from the private and public sectors – is to break down the barriers to achieving our aspiration and unlock the potential that exists within the UK economy. -

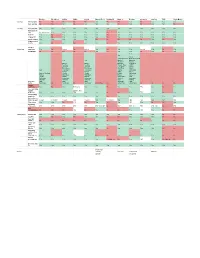

You Can View the Full Spreadsheet Here

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Meet the Exco

Meet the Exco 18th March 2021 Alison Rose Chief Executive Officer 2 Strategic priorities will drive sustainable returns NatWest Group is a relationship bank for a digital world. Simplifying our business to improve customer experience, increase efficiency and reduce costs Supporting Powering our strategy through customers at Powered by Simple to Sharpened every stage partnerships deal with capital innovation, partnership and of their lives & innovation allocation digital transformation. Our Targets Lending c.4% Cost Deploying our capital effectively growth Reduction above market rate per annum through to 20231 through to 20232 CET1 ratio ROTE Building Financial of 13-14% of 9-10% capability by 2023 by 2023 1. Comprises customer loans in our UK and RBS International retail and commercial businesses 2. Total expenses excluding litigation and conduct costs, strategic costs, operating lease depreciation and the impact of the phased 3 withdrawal from the Republic of Ireland Strategic priorities will drive sustainable returns Strengthened Exco team in place Alison Rose k ‘ k’ CEO to deliver for our stakeholders Today, introducing members of the Executive team who will be hosting a deep dive later in the year: David Lindberg 20th May: Commercial Banking Katie Murray Peter Flavel Paul Thwaite CFO CEO, Retail Banking NatWest Markets CEO, Private Banking CEO, Commercial Banking 29th June: Retail Banking Private Banking Robert Begbie Simon McNamara Jen Tippin CEO, NatWest Markets CAO CTO 4 Meet the Exco 5 Retail Banking Strategic Priorities David -

Lender Action Required What Do I Need to Do? Express Payments?

express lender action required what do i need to do? payments? how will i be paid? You can request to be paid within Phone Accord Mortgaegs’ Business Support Team 24 hours of the lender confirming Accord Mortgages Telephone Registration on 03451200866 and ask them to add ‘TMA’as a Yes completion by requesting a payment payment route. through ‘TMA My Portal’. Affirmative Finance will release Registration is required for Affirmative Finance, the payment to TMA on the day of Affirmative No Registration however please state ‘TMA’ when putting a case No completion. TMA will then release Finance through. the payment to the you once it is received. Aldermore products are only available via carefully selected distribution partners. To register to do business with Aldermore go to https;//adlermore- brokerportal.co.uk/MoISiteVisa/Logon/Logon.aspx. You can request to be paid within If you are already registered with Aldermore the on 24 hours of the lender confirming Aldermore Online Registration Yes each case submission you will be asked if you are completion by requesting a submitting business though a Mortgage Club, tick payment through ‘TMA My Portal’. yes and then select ‘TMA’. If TMA is not already in your drop down box then got to ‘Edit Profile’ on the ‘Portal’ and add in ‘TMA’ Please visit us at https://www. Payment will be made every postoffice4intermediaries.co.uk/ and Monday to TMA via BACs. Bank of Ireland Online registration https://www.bankofireland4intermediaries. No Payment is calculated on the first co.uk/ and click register, you will need a Monday 2 weeks after completion profile for each brand. -

Newbuy Guarantee Scheme

1. Please provide a copy of each master policy entered into with (1) Woolwich (2) Santander (3) Halifax (4) Aldermore (5) Nationwide and (6) NatWest under the NewBuy scheme. 2. Please provide a copy of the documentation formally committing the Government to provide the NewBuy Guarantee. 3. Please provide details of any correspondence (including emails) or agreements between HM Treasury and the Financial Services Authority and/or the Prudential Regulation Authority in relation to the use by authorised credit institutions of the master policy as a credit risk mitigant when calculating their regulatory capital requirements. 4. How does the Government account for the NewBuy Guarantee? 5. What reserves does the Government hold against the loans being guaranteed and how does it calculate what these reserves should be? 6. As at the date this request is received, what is the most recent figure that the Government holds for the number of NewBuy loans that are in arrears? And the total number of NewBuy loans? I have considered your request under the terms of the Freedom of Information Act 2000. I confirm that the Department holds some of the information that you have requested, and I am able to supply it to you. Please see an attached copy of the Government Guarantee document formally committing the Government to provide the NewBuy Guarantee. The most recent figures the Department holds on NewBuy are the Official Statistics published on 4th June which show that between 12th March 2012 and 31st March 2013 there were 2291 completions made through the NewBuy Guarantee scheme. Departmental records from lenders show that here was one case of arrears over this period. -

Natwest Group

Prospectus dated 26 November 2020 NatWest Group plc (incorporated in Scotland with limited liability under the Companies Acts 1948 to 1980, registered number SC045551) £40,000,000,000 Euro Medium Term Note Programme On 22 February 1994, NatWest Markets Plc (formerly known as The Royal Bank of Scotland plc) entered into a £1,500,000,000 (since increased from time to time to £40,000,000,000) Euro Medium Term Note Programme (the "Programme") and issued a prospectus on that date describing the Programme. Further prospectuses describing the Programme were issued by NatWest Group plc (the "Issuer" or "NatWest Group") and NatWest Markets Plc, the latest prospectus being issued on 21 November 2019. This Prospectus supersedes any previous prospectus. Any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This does not affect any Notes issued before the date of this Prospectus. Under the Programme, the Issuer may, subject to compliance with all relevant laws, regulations and directives, from time to time, issue notes (the "Notes") denominated in any currency agreed by the Issuer and the relevant Dealer(s) (as defined below). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed £40,000,000,000 (or its equivalent in other currencies, subject to increase as provided herein). Notes to be issued under the Programme may comprise (i) unsubordinated Notes (the "Ordinary Notes") and (ii) Notes which are subordinated as described herein with a maturity date and with terms capable of qualifying as Tier 2 Capital (as defined herein) (the "Tier 2 Notes"). -

Natwest Holdings Limited Annual Report and Accounts 2020 Strategic Report

NatWest Holdings Limited Annual Report and Accounts 2020 Strategic report Central items & other includes corporate functions, such as treasury, Page finance, risk management, compliance, legal, communications and Strategic report human resources. NWB Plc, NWH Ltd’s largest subsidiary, is the main Presentation of information 2 provider of shared services and Treasury activities for NatWest Group. Principal activities and operating segments 2 The services are mainly provided to NWH Group however, in certain Description of business 2 instances, where permitted, services are also provided to the wider Performance overview 2 NatWest Group including the non ring-fenced business. Stakeholder engagement and s.172(1) statement 3 Description of business Board of directors and secretary 6 Business profile Financial review 7 As at 31 December 2020 the business profile of the NWH Group was Risk and capital management 10 as follows: Report of the directors 76 Total assets of £496.6 billion. Statement of directors’ responsibilities 81 A Common Equity Tier 1 (CET1) ratio at 31 December 2020 of Financial statements 82 17.5% and total risk-weighted assets (RWA) of £135.3 billion. Customers are served through a UK and Irish network of Presentation of information branches and ATM services, and relationship management NatWest Holdings Limited (‘NWH Ltd’) is a wholly owned subsidiary of structures in commercial and private banking. NatWest Group plc, or ‘the holding company’ (renamed The Royal Bank of Scotland Group plc on 22 July 2020). NatWest Holdings The geographic location of customers is predominately the UK Group (‘NWH Group’) comprises NWH Ltd and its subsidiary and and Ireland. -

Natwest Markets Plc Registration Document

Dated 22 March 2019 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Acts 1948 to 1980, registered number SC090312) Registration Document TABLE OF CONTENTS Page Introduction ................................................................................................................................................................... 1 Documents Incorporated by Reference .......................................................................................................................... 2 Important Information for Investors .............................................................................................................................. 3 Risk Factors ................................................................................................................................................................. 13 Selected Consolidated Financial Information and Other Data ..................................................................................... 32 Operating and Financial Review ................................................................................................................................. 35 Description of the Group ............................................................................................................................................. 79 Selected Statistical Data and Other Information .......................................................................................................... 97 Risk Management ..................................................................................................................................................... -

Oak No. 1 PLC - Investor Report

Oak No. 1 PLC - Investor Report Reporting Information Cashflows at last distribution Report Date 22-Oct-15 Ledger Balance Reporting Period 1-Sep-15 - 30-Sep-15 Principal Ledger balance 16,536,375.67 Note Payment Date 26-Nov-15 Revenue Ledger balance 1,909,137.71 Next Interest Date 26-Nov-15 General reserve required amount 10,868,480.50 Accrual Start Date - Notes (from and including) 26-Aug-15 General reserve fund 10,868,480.50 Accrual End Date - Notes (to but excluding) 26-Nov-15 Class A Principal Deficiency Ledger Balance - Accrual Days 92 Class Z Principal Deficiency Ledger Balance - Calculation Date 17-Nov-15 Issuer profit ledger balance 1,500.00 Issuance details Class A Notes Class Z Notes Available Revenue Receipts Available Principal receipts Issuer Oak No. 1 PLC Oak No. 1 PLC Revenue receipts 2,026,257.37 Principal receipts 16,536,375.67 Issue Date 10 April 2014 10 April 2014 Interest on bank account and Authorised Investments 17,232.61 Class Z VFN excess of proceeds - ISIN (International Securities Number) XS1028959325 N/A Swap receipts - PDL reduction - Stock Exchange Listing ISE N/A General Reserve ledger - Reconciliation amounts - Original Rating (S & P/Moody's) AAA(sf)/Aaa(sf) Not rated Other Income - less: Current Rating (S & P/Moody's) AAA(sf)/Aaa(sf) Not rated From principal Priority of payments - APR to cover revenue deficiency - Principal Payment date 26 November 2015 From preceding revenue Priority of payments - plus: Currency GBP GBP Reconciliation amounts - On and following step up date - - available revenue receipts -

National Westminster Bank Plc Annual Report and Accounts 2019

National Westminster Bank Plc Annual Report and Accounts 2019 natwest.com Strategic report Franchises Page Commercial & Private Banking (CPB), combining the reportable Strategic report segments of Commercial Banking and Private Banking ceased to Presentation of information 1 operate as one business area and the franchise Personal & Ulster, Description of business 1 combining the reportable segments of UK Personal Banking and Ulster Principal activities and operating segments 1 Bank RoI was also disbanded. The reportable operating segments Performance overview 1 remain unchanged and no comparatives have been restated. Stakeholder engagement and s.172(1) statement 3 Principal activities and operating segments Board of directors and secretary 5 NWB Group serves customers across the UK and Ireland with a range Top and emerging risks 6 of retail and commercial banking products and services. A wide range Financial review 7 of personal products are offered including current accounts, credit Capital and risk management 10 cards, personal loans, mortgages and wealth management services. Report of the directors 65 NWB Plc is the main provider of shared service activities for RBS Statement of directors’ responsibilities 69 Group. This includes the provision of Treasury services on behalf of Financial Statements 70 the ring-fenced bank and RBS Group. Risk factors 150 The reportable operating segments are as follows: Forward-looking statements 163 UK Personal Banking serves individuals and mass affluent customers Presentation of information in the UK and includes Ulster Bank customers in Northern Ireland. National Westminster Bank Plc (‘NWB Plc’) is a wholly-owned subsidiary of NatWest Holdings Limited (‘NWH Ltd’ or ‘the intermediate Commercial Banking serves start-up, SME, commercial and corporate holding company’). -

The Royal Bank of Scotland Group Plc 27 April 2018 Ring Fenced Structure

The Royal Bank of Scotland Group plc 27 April 2018 Ring Fenced Structure - Director Changes The Royal Bank of Scotland Group plc (together with its subsidiaries "RBS") today announces changes to the composition of boards of Directors in connection with the Ring- Fencing Transfer Scheme (the "Scheme") under Part VII of the Financial Services and Markets Act 2000 which is expected to be implemented on 30 April 2018. Implementation of the Scheme will be a significant step towards the restructuring of RBS to comply with the UK ring-fencing legislation that requires the separation of essential banking services from investment banking services from 1 January 2019. As previously announced, under the Scheme, The Royal Bank of Scotland plc (RBS plc) will: transfer its UK retail & commercial banking business to Adam & Company PLC (Adam); transfer its covered bonds in issue and Mentor business to National Westminster Bank Plc (NatWest); and transfer branches and other properties to either NatWest or Adam. At the same time, RBS plc will be renamed “NatWest Markets Plc”, Adam will be renamed “The Royal Bank of Scotland plc” and assume banknote-issuing responsibility. After the Scheme and subsequent restructuring is completed in 2018, NatWest Holdings Limited will have direct ownership of The Royal Bank of Scotland plc (formerly Adam & Company plc), National Westminster Bank Plc and Ulster Bank Ireland DAC. NatWest Holdings Limited will have indirect ownership of Coutts & Company and Ulster Bank Limited. The non-ring-fenced entities will be NatWest Markets Plc (formerly RBS plc) that will continue to undertake RBS’s finance, risk management and trading activities; and The Royal Bank of Scotland International Limited (RBSI), along with Isle of Man Bank Limited, which will continue to serve the markets and customers it serves today.