Tom Freston, Viacom Inc. Co-President, Co-Chief Operating

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bezouška, Jakl, Jaklová, Krejčí, Mencl, Petrov, Poledníček, Zvěřinová Omluveni: Jehlička, Nastoupilová, Novák, Šincl Ověřovatel: Bartoš 18

Zápis z 18. zasedání 2020, konaného ve dnech 10. a 18. 11. 2020 10. 11. Přítomni: Bezouška, Jakl, Jaklová, Krejčí, Mencl, Petrov, Poledníček, Zvěřinová Omluveni: Jehlička, Nastoupilová, Novák, Šincl Ověřovatel: Bartoš 18. 11. Přítomni: Bezouška, Jakl, Jaklová, Jehlička, Krejčí, Nastoupilová, Mencl, Petrov, Poledníček, Šincl, Zvěřinová Omluveni: Novák Ověřovatel: Bartoš 1 RRTV/2020/790/bla: Schválení programu 18. zasedání 2020 - Rada schvaluje program ve znění projednaných změn 7-0-0 2 RRTV/2020/724/zem: POLAR televize Ostrava, s.r.o. / TV / POLAR 2 / zvláštní přenosové systémy / řízení o udělení licence / ústní jednání dne 10. listopadu 2020, 13:30 h - Rada uděluje společnosti POLAR televize Ostrava, s.r.o., IČ 258 59 838, se sídlem Boleslavova 710/19, Mariánské Hory, 709 00 Ostrava, dle § 25 zákona č. 231/2001 Sb., licenci k provozování televizního vysílání šířeného prostřednictvím zvláštních přenosových systémů na 12 let; označení (název) programu: POLAR 2; základní programová specifikace: Regionální informační program; výčet států, na jejichž území bude vysílání zcela nebo převážně směřováno: Česká republika; hlavní jazyk vysílání: čeština; časový rozsah vysílání: 24 hodin denně; identifikace přenosového systému: dálkový přístup - internet; informace o přístupu k vysílání: www.polar.cz, POLAR HbbTV, v rozsahu žádosti doručené Radě dne 21. září 2020 pod č.j. RRTV/13438/2020-vra. 11-0-0 3 RRTV/2020/685/zem: Střední škola a Základní škola, Vimperk, Nerudova 267 / příspěvková organizace / TV / Vimperské zpravodajství / kabely / řízení o udělení licence / ústní jednání dne 10. listopadu 2020, 13:40 h - Rada uděluje právnické osobě Střední škola a Základní škola, Vimperk, Nerudova 267, IČ 004 77 419, se sídlem Nerudova 267, Vimperk, PSČ 38501, dle § 25 zákona č. -

Top Quark Pair Production Close to Threshold: Top Mass, Width and Momentum Distribution

CERN-TH/99-59 DESY 99-047 hep-ph/9904468 April 1999 Top Quark Pair Production Close to Threshold: Top Mass, Width and Momentum Distribution A. H. Hoanga and T. Teubnerb a Theory Division, CERN, CH-1211 Geneva 23, Switzerland b Deutsches Elektronen-Synchrotron DESY, D-22603 Hamburg, Germany Abstract + The complete NNLO QCD corrections to the total cross section σ(e e− Z∗,γ∗ tt¯), → → in the kinematic region close to the top-antitop threshold, are calculated by solving the corresponding Schr¨odinger equations exactly in momentum space in a consistent momentum cutoff regularization scheme. The corrections coming from the same NNLO QCD effects to the top quark three-momentum distribution dσ/d ~k are determined. We discuss the origin | t| of the large NNLO corrections to the peak position and the normalization of the total cross section observed in previous works and propose a new top mass definition, the 1S mass M1S, which stabilizes the peak in the total cross section. If the influence of beamstrahlung and initial state radiation on the mass determination is small, a theoretical uncertainty on the 1S top mass measurement of 200 MeV from the total cross section at the linear collider seems possible. We discuss how well the 1S mass can be related to the MS mass. We propose a consistent way to implement the top quark width at NNLO by including electroweak effects into the NRQCD matching coefficients, which can then become complex. PACS numbers: 14.65.Ha, 13.85.Lg, 12.38.Bx. CERN-TH/99-59 April 1999 1 Introduction + + It will be one of the primary goals of a future e e− linear collider (LC) or µ µ− pair collider (FMC) to measure and determine the properties of the top quark, whose existence has been confirmed at the Tevatron (M = 173.8 5 GeV [1]). -

British Sky Broadcasting Group Plc Annual Report 2009 U07039 1010 P1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647 Mm Scale: 100%

British Sky Broadcasting Group plc Annual Report 2009 U07039 1010 p1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647mm Scale: 100% Table of contents Chairman’s statement 3 Directors’ report – review of the business Chief Executive Officer’s statement 4 Our performance 6 The business, its objectives and its strategy 8 Corporate responsibility 23 People 25 Principal risks and uncertainties 27 Government regulation 30 Directors’ report – financial review Introduction 39 Financial and operating review 40 Property 49 Directors’ report – governance Board of Directors and senior management 50 Corporate governance report 52 Report on Directors’ remuneration 58 Other governance and statutory disclosures 67 Consolidated financial statements Statement of Directors’ responsibility 69 Auditors’ report 70 Consolidated financial statements 71 Group financial record 119 Shareholder information 121 Glossary of terms 130 Form 20-F cross reference guide 132 This constitutes the Annual Report of British Sky Broadcasting Group plc (the ‘‘Company’’) in accordance with International Financial Reporting Standards (‘‘IFRS’’) and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS and is dated 29 July 2009. This document also contains information set out within the Company’s Annual Report to be filed on Form 20-F in accordance with the requirements of the United States (“US”) Securities and Exchange Commission (the “SEC”). However, this information may be updated or supplemented at the time of filing of that document with the SEC or later amended if necessary. This Annual Report makes references to various Company websites. The information on our websites shall not be deemed to be part of, or incorporated by reference into, this Annual Report. -

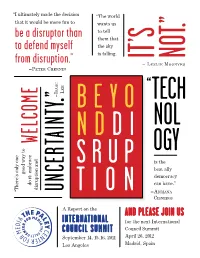

Be a Disruptor Than to Defend Myself from Disruption.”

“I ultimately made the decision “The world that it would be more fun to wants us be a disruptor than to tell them that to defend myself the sky is falling. from disruption.” IT’s NOT.” – Le s L i e Mo o n v e s –Pe t e r Ch e r n i n aac e e s i ” – L “ . BEYO TECH NOL WELCOME NDDI OGY SRUP is the best ally democracy can have.” disruption and UNCERTAINTY good way to do it: embrace “There’s only one TION –Ad r i A n A Ci s n e r o s A Report on the AND PLEASE JOIN US INTERNATIONAL for the next International COUNCIL SUMMIT Council Summit September 14, 15, 16, 2011 April 26, 2012 Los Angeles Madrid, Spain CONTENTS A STEP BEYOND DISRUPTION 3 | A STEP BEYOND DISRUPTION he 2011 gathering of The Paley Center for Me- Tumblr feeds, and other helpful info. In addi- dia’s International Council marked the first time tion, we livestreamed the event on our Web site, 4 | A FORMULA FOR SUCCESS: EMBRacE DISRUPTION in its sixteen-year history that we convened in reaching viewers in over 140 countries. Los Angeles, at our beautiful home in Beverly To view archived streams of the sessions, visit 8 | SNAPSHOTS FROM THE COCKTAIL PaRTY AT THE PaLEY CENTER Hills. There, we assembled a group of the most the IC 2011 video gallery on our Web site at http:// influential thinkers in the global media and en- www.paleycenter.org/ic-2011-la-livestream. -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

Quincy School District Transportation Routes

QUINCY SCHOOL DISTRICT TRANSPORTATION ROUTES & HUB STOPS FOR 2014-2015 (Add 1 Hour to AM Times for Late Start Monday's) 10/31/2014 BUS TIME HUB STOPS BUS TIME HUB STOPS UPDATED 8/29/14 1/2 Day ** Open Enrollment & Special Circumstance Students Requiring Transportation From Outside Student's Neighborhood School Attendance Area Should Contact Transportation to Arrange For Transportation - Accommodations Will Be Made To The Greatest Extent Possible ** Pick-up HUB #1 - Quincy Drop off HUB #1 - Quincy 32 7:40 AM C ST PARK NE - MON (4th & 5th) 32 3:10 PM C ST PARK NE - MON (4th & 5th) 11:40 AM 11 7:40 AM C ST PARK NE - MON (6th) 11 3:10 PM C ST PARK NE - MON (6th) 11:40 AM 18 7:20 AM C ST PARK NE - (PIO / K-3rd) transfers to Central Hub 18 3:32 PM C ST PARK NE - (PIO / K-3rd) 11:50 AM HUB #2 - Quincy HUB #2 - Quincy 12 7:40 AM JR HIGH SCHOOL - MON (4th, 5th, 6th) 12 3:10 PM JR HIGH SCHOOL - MON (4th, 5th -6th) 11:40 AM 31 7:18 AM JR HIGH SCHOOL - (PIO / K-3) transfers to Central Hub 31 3:10 PM JR HIGH SCHOOL - MTV / K-3rd) 11:40 AM 31 7:40 AM JR HIGH SCHOOL - MTV / K-3rd) 31 3:26 PM JR HIGH SCHOOL - (PIO / K-3rd) 11:50 AM HUB #3 - Quincy HUB #3 - Quincy 27 7:40 AM 3RD AVE & D ST SW - MON (4th, 5th,-6th) 27 3:10 PM 3RD AVE & D ST SW - MON (4th, 5th, 6th) 11:45 AM 16 7:37 AM 3RD AVE & D ST SW - MTV 16 3:10 PM 3RD AVE & D ST SW - MTV 11:40 AM 6 7:18 AM 3RD AVE & D ST SW - (PIO / K-3rd) 6 3:19 PM 3RD AVE & D ST SW - (PIO / K-3rd) 11:45 AM HUB #4 - Quincy HUB #4 - Quincy 18 7:45 AM 1ST AVE & J ST SW - PIO (K-3rd) 18 3:10 PM 1ST AVE & J ST SW - PIO -

DAVID FLUHR (Continued)

David E. Fluhr, C.A.S. Re-Recording Mixer Awards & Nominations 1 CAS Award; 6 CAS Nominations 9 Emmy Awards; 38 Emmy Nominations (1984-1998) Selected Credits Director/Picture Editor/Production Co. TINKER BELL AND THE GREAT FAIRY RESCUE Bradley Raymond/ Lisa Linder & Kevin Locarro/Disney Toon Studios TANGLED Nathan Greno & Byron Howard/Tim Mertens/ Walt Disney Pic STEP UP 3-D John Chu/Andrew Marcus/Walt Disney Pic PREP & LANDING Kevin Deters & Stevie Wermers/William Caparella/ Walt Disney Pic THE PRINCESS AND THE FROG Ron Clements & John Musker/Jeff Draheim/ Walt Disney Pic SURROGATES Jonathan Mostow/Kevin Stitt/Walt Disney Pic TINKER BELL AND THE LOST TREASURE Klay Hall/Alan Stewart/Disney Toon Studios THE JONAS BROTHERS 3D CONCERT Bruce Hendricks/ Michael Tronick/Walt Disney Pic THE UNINVITED (addl. re-recording) Charles & Thomas Guard/Jim Page/ DreamWorks SUPER RHINO (Short Film) Nathan Greno/ Shannon Stein/ Walt Disney Pic BOLT Byron Howard & Chris Williams/Walt Disney Pic HANNAH MONTANA BEST OF BOTH Bruce Hendricks/Michael Tronick/Walt Disney Pic WORLDS CONCERT TOUR-3D COLLEGE ROAD TRIP Roger Kumble/Roger Bondelli/ Walt Disney Pic ENCHANTED (music re-recording mixer) Kevin Lima/Gregory Perler/Walt Disney Pictures THE GUARDIAN Andrew Davis/Dennis Virkler/Touchstone Pictures MEET THE ROBINSONS Stephen Anderson/Ellen Keneshea/Walt Disney Pic THE LOOKOUT Scott Frank/Jill Savitt/Miramax, Spyglass BARNYARD Steve Oedekerk/Paul Calder/Paramount BLACK SNAKE MOAN Craig Brewer/Billy Fox/Paramount CHICKEN LITTLE Mark Dindal/Dan Molina/Walt Disney Pictures THE GREAT RAID John Dahl/Pietro Scalia/Miramax THE GREATEST GAME EVER PLAYED Bill Paxton/Elliot Graham/Walt Disney Pictures THE ALAMO John Lee Hancock/Eric Beason/Imagine Ent. -

Filing Under Rule 425 Under the Securities Act of 1933, As Amended Subject Company: Viacom Inc

Filing under Rule 425 under the Securities Act of 1933, as amended Subject Company: Viacom Inc. Subject Company's Commission File No.: 001-09553 TO: All Viacom Employees FROM: Sumner Redstone DATE: June 14, 2005 We have some very exciting and important news to share with you. Today, the Viacom Board of Directors approved the creation of two separate publicly traded companies from Viacom's businesses through a spin-off to Viacom shareholders. Even for a company with a history of industry-leading milestones and significant successes, this is a landmark announcement. This decision was the result of careful and thorough deliberation by the Viacom Board of Directors, who, working with me and with the Viacom management team, considered a number of strategic options that we felt could maximize the future growth of our businesses and unlock the value of our assets. Viacom's businesses are vibrant and we believe that the creation of two separate companies will not only enhance our strength, but also improve our strategic, operational and financial flexibility. In many ways, today's decision is a natural extension of the path we laid out in creating Viacom. We are retaining the significant advantages we captured in the Paramount and CBS mergers and, at the same time, recognizing the need to adapt to a changing competitive environment. We are proud of what we have created here at Viacom, and want to ensure we can efficiently capitalize on our skills and our innovative ideas, as well as all the business opportunities that arise -- while recognizing the significant untapped business and investment potential of our brands. -

Schapiro Exhibit

Schapiro Exhibit 195 Subject: Re: Vanity Fair/Sumner Redstone From: Robinson, Carole -:EX:/O=VIACOM/OU=MTVUSA/CN=RECIPIENTS/CN= ROBINSOC;: To: Freston, Tom Cc: Date: Wed, 01 Nov 2006 02:46:10 +0000 -----Original Message----- From: Freston, Tom To: Robinson, Carole Sent: Tue Oct 31 21:29:322006 Subject: Re: Vanity Fair/Sumner Redstone -----Original Message----- From: Robinson, Carole To: Freston, Tom Sent: Tue Oct 3121:16:032006 Subject: Re: Vanity Fair/Sumner Redstone -----Original Message----- From: Freston, Tom To: Robinson, Carole Sent: Tue Oct 31 18:58:592006 Subject: Re: Vanity Fair/Sumner Redstone -----Original Message----- Highly Confidential VIA09076933 From: Robinson, Carole To: Freston, Tom Sent: Tue Oct 3111:25:52 2006 Subject: Vanity Fair/Sumner Redstone The New Establishment Sumner Redstone and one of the saltwater fishtanks in his home in Beverly Park, California, on October 6. Photograph by Don Flood. Sleeping with the Fishes Happy at last, Sumner Redstone is still far from mellow-witness his public trashing of superstar Tom Cruise and firing of Viacom C.EO, Tom Freston. At home in Beverly Hills, the 83-year-old tycoon and his new wife, Paula, reveal their love story, her role in the Cruise decision, and what he claims was Freston's big mistake. by Bryan Burrough December 2006 High on the slopes above Beverly Hills, so high the clouds sometimes waft beneath it, one of the most exclusive enclaves in Southern California hides behind a pair of mammoth iron gates. If you're expected, a security guard will push a button and the gates will slowly open. -

The Commodification of the Other and Mtvâ•Žs Construction of the Â

Democratic Communiqué Volume 22 Issue 1 Article 2 3-1-2008 Bollyville, U.S.A: The Commodification of the Other and TM V’s Construction of the “Ideal Type” Desi Murali Balaji Follow this and additional works at: https://scholarworks.umass.edu/democratic-communique Recommended Citation Balaji, Murali (2008) "Bollyville, U.S.A: The Commodification of the Other and TM V’s Construction of the “Ideal Type” Desi," Democratic Communiqué: Vol. 22 : Iss. 1 , Article 2. Available at: https://scholarworks.umass.edu/democratic-communique/vol22/iss1/2 This Research Article is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Democratic Communiqué by an authorized editor of ScholarWorks@UMass Amherst. For more information, please contact [email protected]. Balaji: Bollyville, U.S.A: The Commodification of the Other and MTV’s Con Bollyville, U.S.A: The Commodification of the Other and MTV’s Construction of the “Ideal Type” Desi Murali Balaji When the Music Television Network launched MTV Desi in 2005, it promised to bridge the divide between South Asian Americans and their counterparts in the Indian subcontinent.1 This study looks at how MTV Desi tried to create an “ideal type” South Asian American through its programming, presenting an image of South Asian Americans as loving “Bhangra but also Shakira… MTV but also Bollywood.” The author seeks to articulate the political economy of identity by describing MTV’s attempts to define and commodify “Desi-ness.” The author also attempts to explain why MTV Desi ultimately failed and how marginalized audiences can resist commodification by rejecting corporate- defined identity. -

The Last Airbender"

NVIDIA Helps ILM Forge Epic Battle Scenes Harnessing the Four Ancient Elements for "The Last Airbender" Giant Fireballs, Swirling Clouds, Dust Storms Simulated 10-15 Times Faster Using Groundbreaking NVIDIA Quadro GPU Technology 'The Last Airbender in 3D' promotional poster Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Photo credit: Zade Rosenthal/Industrial Light & Magic Nicola Peltz plays Katara in the Paramount Pictures/Nickelodeon Movies adventure, 'The Last Airbender.' Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Photo credit: Industrial Light & Magic Shaun Toub plays Uncle Iroh in the Paramount Pictures/Nickelodeon Movies adventure, 'The Last Airbender.' Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Photo credit: Industrial Light & Magic Noah Ringer is the heroic Aang in the Paramount Pictures/Nickelodeon Movies adventure, 'The Last Airbender.' Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Photo credit: Industrial Light & Magic Noah Ringer is the heroic Aang in the Paramount Pictures/Nickelodeon Movies adventure, 'The Last Airbender.' Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Photo credit: Industrial Light & Magic. A member of the Northern Water Tribe waterbending in the Paramount Pictures/Nickelodeon Movies adventure, 'The Last Airbender.' Copyright (C) 2010 Paramount Pictures Corporation. All Rights Reserved. Official 'The Last Airbender' website Paramount Pictures Online Press Site (Registration page for press to obtain clips, additional images) NVIDIA Quadro Case Study: ILM & 'The Last Airbender' SANTA CLARA, CA -- (Marketwire) -- 07/14/2010 -- Paramount Pictures' latest film, "The Last Airbender," features extraordinary battle visual effects created by Industrial Light & Magic (ILM), with the help of NVIDIA Quadro professional graphics technology, NVIDIA announced today. -

Nickelodeon and Toyota Partner to Create 2015 Toyota Sienna Inspired by the Spongebob Movie: Sponge out of Water

Nickelodeon and Toyota Partner to Create 2015 Toyota Sienna Inspired by the SpongeBob Movie: Sponge Out of Water November 18, 2014 NEW YORK – Nov. 18, 2014 – Nickelodeon and Toyota have partnered to transform everyone’s porous pal into a new 3-D concept car based on Paramount Pictures and Nickelodeon Movies’ upcoming film, The SpongeBob Movie: Sponge Out of Water. The SpongeBob Movie 2015 Toyota Sienna features a custom three- dimensional SpongeBob SquarePants exterior, complete with the character’s Superhero Incredibubble mask that blows real bubbles at the top of the car. The interior features seating inspired by each of SpongeBob’s Bikini Bottom pals, along with a wood-grain dashboard, a custom Captain’s steering wheel, a blue-sky head liner and a sand-inspired floor. The one-of-a-kind vehicle will be unveiled on Nov. 18 at the LA Auto Show and will then roll out on a cross-country promotional tour leading up to The SpongeBob Movie’s Feb. 6, 2015 premiere. “SpongeBob SquarePants continues to be at the center of pop culture, and through this promotion with our wonderful partners at Toyota, we have created his next iconic moment with a truly unique vehicle that captures all of the high-octane energy of Paramount’s highly anticipated feature film,” said Pam Kaufman, Chief Marketing Officer, Nickelodeon Group. “Toyota is again teaming up with SpongeBob to help him and his friends go places in a custom ride inspired by their upcoming dry land adventures,” said Jack Hollis, vice president of marketing for Toyota. “The 2015 Sienna is a perfect choice for families and superheroes alike – offering seating for up to eight and a bubble blower attachment feature to boot.” The SpongeBob Movie-themed 2015 Toyota Sienna will bring SpongeBob’s special brand of nautical nonsense to several family-friendly locations, including select Bass Pro Shops across the US, Nickelodeon Suites Resort, Orlando, Fla.; Nickelodeon Universe at Mall of America, Minneapolis, Minn.; the Chicago Auto Show, Chicago, Ill.; and the New York Auto Show, New York, NY.