Transport & Logistics Sector Morocco

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

World Bank Document

Public Disclosure Authorized Morocco Infrastructure Review May 2020 (originally published in French in December 2019) Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Final version © 2020 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW, Washington, DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org This work was originally published by the World Bank in French in 2019. In case of discrepancies, the original language should prevail. This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this work is subject to copyright. Because The World Bank encourages dissemination of its knowledge, this work may be reproduced, in whole or in part, for noncommercial purposes as long as full attribution to this work is given. Please cite the work as follows: 2020. Morocco Infrastructure Review. World Bank, Washington D. C. Any queries on rights and licenses, including subsidiary rights, -

Morocco: an Emerging Economic Force

Morocco: An Emerging Economic Force The kingdom is rapidly developing as a manufacturing export base, renewable energy hotspot and regional business hub OPPORTUNITIES SERIES NO.3 | DECEMBER 2019 TABLE OF CONTENTS SUMMARY 3 I. ECONOMIC FORECAST 4-10 1. An investment and export-led growth model 5-6 2. Industrial blueprint targets modernisation. 6-7 3. Reforms seek to attract foreign investment 7-9 3.1 Improvements to the business environment 8 3.2 Specific incentives 8 3.3 Infrastructure improvements 9 4. Limits to attractiveness 10 II. SECTOR OPPORTUNITIES 11-19 1. Export-orientated manufacturing 13-15 1.1 Established and emerging high-value-added industries 14 2. Renewable energy 15-16 3. Tourism 16-18 4. Logistics services 18-19 III. FOREIGN ECONOMIC RELATIONS 20-25 1. Africa strategy 20-23 1.1 Greater export opportunities on the continent 21 1.2 Securing raw material supplies 21-22 1.3 Facilitating trade between Africa and the rest of the world 22 1.4 Keeping Africa opportunities in perspective 22-23 2. China ties deepening 23-24 2.1 Potential influx of Chinese firms 23-24 2.2 Moroccan infrastructure to benefit 24 3 Qatar helping to mitigate reduction in gulf investment 24-25 IV. KEY RISKS 26-29 1. Social unrest and protest 26-28 1.1 2020 elections and risk of upsurge in protest 27-28 1.2 But risks should remain contained 28 2. Other important risks 29 2.1 Export demand disappoints 29 2.2 Exposure to bad loans in SSA 29 2.3 Upsurge in terrorism 29 SUMMARY Morocco will be a bright spot for investment in the MENA region over the next five years. -

Railways of the MENA Region, Tools of National and Foreign Policy

DHEEI – Mediterranean Studies Railways of the MENA Region, tools of national and foreign policy Master’s Thesis submitted by GALLOY Théophile Academic year: 2018-2019 Thesis Supervisor: Dr. Silvia Colombo Acknowledgements I wish to express my appreciation to my family, my co-students and CIFE for their valuable support throughout this year. I am also very grateful for the advice given by my fantastic supervisor Dr. Silvia Colombo, who has kindly dedicated some time to read, correct and advise me on my work, whilst allowing me to remain creative in my approach and research. I would also like to extend my thanks to my previous manager, Mr. Stephane Downes, and my previous employer, Mr. Stephane Rambaud-Measson, for opening me the doors of the railway industry and for passing on to me their knowledge and passion for this fascinating sector. I would also like to thank Dr. Ayadi Soufiane, the surgeon who successfully removed my infected appendix in Tunis, which allowed me to continue my work unimpeded. 2 Acknowledgements_____________________________________________________2 Table of Contents_______________________________________________________3 Introduction___________________________________________________________4 Part I: Understanding the political benefits of railway infrastructures______________6 1) The economic and social benefits of rail_____________________________6 2) Rail as a nation building infrastructure, a tool of power________________12 3) Rail as a region building infrastructure, a tool of integration____________19 Part II: -

Project SHEET Offshore Drilling Island and Ice Barriers in Kazakhstan Extreme Weather Conditions and Demanding Logistics

PROJECT SHEET OFFSHORE DRILLING ISLAND AND ICE BARRIERS IN KAZakhstan EXTREME WeatHER CONDITIONS AND DEMANDING LOGISTICS INTRODUCTION features Agip Kazakhstan North Caspian Operating Client Agip KCO Company B.V. (Agip KCO), a consortium of eight leading oil companies, is active in the northern Location Northern section of Caspian Sea section of the Caspian Sea. The gas and oil Period 2003 - 2005 reserves in this area were mapped out in 1998 and 1999. To allow for their exploitation, Boskalis Contractor Boskalis Archirodon VOF (BAVOF ) International has created an artificial island measuring 225 x 225 meters, and underwater berms, for Agip KCO. Four years later, the time is ripe for the construction of the drilling island and ice barriers. Once they are in place, Agip KCO can start to extract and distribute the oil reserves. PROJECT SPECIFICATIONS Boskalis Archirodon VOF (BAVOF) specializes in the construction of marine infrastructure. The company has extensive experience with the execution of complex multidisciplinary projects, both maritime and offshore. So it is a highly suitable partner for the construction of an offshore drilling island and ice barriers. This project in the Caspian Sea involved the construction of two A corridors. One with a total length of 450 meters and 20 meters wide, and the other measuring A Location map more than 550 meters. BAVOF also built Riser B Checking the sheet piling Island, measuring 550 x 90 meters. This drilling C Installing the sheet piling involved incredible precision island will be the starting point later for the D Aerial photo of the work B C D OFFSHORE DRILLING ISLAND AND ICE BARRIERS IN KAZakhstan EXTREME WeatHER CONDITIONS AND DEMANDING LOGISTICS pipelines taking the oil to shore for subsequent from Europe. -

Saudi Arabia 2019

Saudi Arabia 2019 Saudi Arabia 2019 1 Table of Contents Doing Business in Saudi Arabia ...................................................................................................................................... 5 Market Overview ....................................................................................................................................................... 5 Market Challenges ..................................................................................................................................................... 6 Market Opportunities ................................................................................................................................................ 8 Market Entry Strategy ............................................................................................................................................... 9 Political Environment................................................................................................................................................... 10 Selling US Products & Services .................................................................................................................................... 11 Agents and Distributors ........................................................................................................................................... 11 Establishing an Office ............................................................................................................................................. -

21St MBSHC – KINGDOM of MOROCCO 11 To13 June 2019, Cadiz, SPAIN

21st MBSHC – KINGDOM OF MOROCCO 11 to13 june 2019, Cadiz, SPAIN 1 I II III IV V VI 3 The Hydrographic service of the Royal Moroccan Navy was founded in 1986 with the assistance the Naval Oceanographic Office of the USA (NAVOCEANO), under the name of SHOMAR, then it became Division Hydrographie, Océanographie et Cartographie (DHOC) in 2007. Signing of an administrative arrangment with SHOM. In october 2014, the Royal Moroccan Navy was tasked, to take charge of hydrography, océanography and marine cartography in the waters under national jurisdiction, in the atlantic ocean and in the méditerranéan sea. By Royal Dahir N°1-14-84 of 20 Octobre 2014, the DHOC became the National hydrographic Service. 4 The DHOC is tasked to conduct surveys in waters under national jurisdiction, collect data, elaborate and disseminate marine charts and nautical documents, coordinate and exchange informations with public services , related to the domains of hydrography, océanography and marine cartography and représent the Kingdom of Morocco to the IHO and the Regional Commissions. 5 6 Port of Casablanca Casablanca Survey of the port de Tarfaya and its Survey of the port of Agadir and its approaches approaches 7 New port of Safi and its approaches (45%) port de Kser-Sghir and its approaches (90%) 8 A new génération hydro-océanographic vessel of 72 m équiped with two hydrographic skiffs and a large panel of equipment allowing acquisition, treatement of bathymetric data and oceanographic parameters and to conduct geophysic measures. The ship was built by the -

Introduction to Eu External Action

UNITED NATIONS UNEP/MED WG.450/Inf.3 UNITED NATIONS ENVIRONMENT PROGRAMME MEDITERRANEAN ACTION PLAN 25 June 2018 Original: English Regional Meeting on IMAP Implementation: Best Practices, Gaps and Common Challenges Rome, Italy, 10-12 July 2018 Agenda item 4: Supporting Resource Mobilization for IMAP Implementation A Funding Strategy for the implementation of the Ecosystem Approach in the Mediterranean, with a special emphasis on the implementation needs of the Integrated Monitoring and Assessment Programme in the Southern Mediterranean For environmental and economic reasons, this document is printed in a limited number. Delegates are kindly requested to bring their copies to meetings and not to request additional copies. UNEP/MAP Athens, 2018 A FUNDING STRATEGY FOR THE IMPLEMENTATION OF THE ECOSYSTEM APPROACH IN THE MEDITERRANEAN, WITH A SPECIAL EMPHASIS ON THE IMPLEMENTATION NEEDS OF THE INTEGRATED MONITORING AND ASSESSMENT PROGRAMME IN THE SOUTHERN MEDITERRANEAN Table of Contents 1. Executive Summary 2. Introduction: The implementation needs of the Ecosystem Approach in the Mediterranean and the overall objective of the draft Ecosystem Approach Funding Strategy: 2.1. Overall policy framework for Ecosystem Approach in the Mediterranean 2.2. Ecosystem Approach Roadmap under the UN Environment/MAP-Barcelona Convention 2.3. Key implementation needs 3. Specific implementation needs of the Southern Mediterranean Countries: Capacity Assessment of IMAP implementation needs of Southern Mediterranean (EcAp-MEDII project beneficiaries) countries (Algeria, Egypt, Israel, Lebanon, Libya, Morocco, Tunisia): 3.1. Algeria 3.2. Egypt 3.3. Israel 3.4. Lebanon 3.5. Libya 3.6. Morocco 3.7. Tunisia 4. Funding opportunities for the implementation of the Ecosystem Approach/IMAP in the Mediterranean under the EU MFF: 4.1. -

Liste Des Guichets Des Banques Marocaines Par Localite Et Par Region

Programme Intégré d’Appui et de Financement des Entreprises LISTE DES GUICHETS DES BANQUES MAROCAINES PAR LOCALITE ET PAR REGION Février 2020 Programme Intégré d’Appui et de Financement des Entreprises LISTE DES GUICHETS DES BANQUES MAROCAINES PAR LOCALITE ET PAR REGION Février 2020 4 LISTE DES GUICHETS DES BANQUES MAROCAINES PAR LOCALITE ET PAR REGION TANGER – TÉTOUAN – AL HOCEIMA 5 L’ORIENTAL 13 FÈS - MEKNÈS 21 RABAT - SALÉ- KÉNITRA 29 BÉNI MELLAL- KHÉNIFRA 39 CASABLANCA- SETTAT 45 MARRAKECH - SAFI 65 DARÂA - TAFILALET 73 SOUSS - MASSA 77 GUELMIM - OUED NOUN 85 LAÂYOUNE - SAKIA EL HAMRA 87 DAKHLA-OUED EDDAHAB 89 LISTE DES GUICHETS DES BANQUES MAROCAINES PAR LOCALITE ET PAR REGION 5 TANGER – TÉTOUAN – AL HOCEIMA 6 RÉGION TANGER-TÉTOUAN-AL HOCEÏMA BANQUE LOCALITES GUICHET TELEPHONE AL BARID BANK AIT YOUSSEF OU ALI AIT YOUSSEF OU ALI CENTRE 0539802032 AJDIR CENTRE RURALE AJDIR 35052 TAZA 0535207082 AL AOUAMRA CENTRE AL AOUAMRA 92050 AL AOUAMRA 0539901881 AL HOCEIMA AVENUE MOULAY DRISS AL AKBAR AL HOCEIMA 0539982466 BV TARIK BNOU ZIAD AL HOCEIMA 0539982857 ARBAA TAOURIRT ARBAA TAOURIRT CENTRE 0539804716 ASILAH 1 PLACE DES NATIONS UNIES 90055 ASILAH 0539417314 ASMATEN CENTRE ASMATEN EN FACE EL KIADA AL HAMRA 93250 ASMATEN 0539707686 BAB BERRET CENTRE BAB BERRET 91100 BAB BERRET 0539892722 BAB TAZA CENTRE BAB TAZA 91002 BAB TAZA 0539896059 BENI BOUAYACHE BENI BOUAYACHE CENTRE 0539804020 BENI KARRICH FOUKI CENTRE BENI KARRICH FOUKI 93050 BENI KARRICH FOUKI 0539712787 BNI AHMED CENTRE BNI AHMED CHAMALIA 91100 BNI AHMED 0539881578 BNI AMMART -

1 the Moroccan Colonial Archive and the Hidden History of Moroccan

1 The Moroccan Colonial Archive and the Hidden History of Moroccan Resistance Maghreb Review, 40:1 (2014), 108-121. By Edmund Burke III Although the period 1900-1912 was replete with numerous important social upheavals and insurrections, many of which directly threatened the French position in Morocco, none of them generated a contemporaneous French effort to discover what went wrong. Instead, the movements were coded as manifestations of supposedly traditional Moroccan anarchy and xenophobia and as such, devoid of political meaning. On the face of it, this finding is surprising. How could a French policy that billed itself as “scientific imperialism” fail to consider the socio-genesis of Moroccan protest and resistance? Despite its impressive achievements, the Moroccan colonial archive remains haunted by the inability of researchers to pierce the cloud of orientalist stereotypes that occluded their vision of Moroccan society as it actually was. For most historians, the period of Moroccan history between 1900 and 1912 is primarily known as “the Moroccan Question.” A Morocco-centered history of the Moroccan Question was impossible for Europeans to imagine. Moroccan history was of interest only insofar as it shed light on the diplomatic origins of World War I. European diplomats were the main actors in this drama, while Moroccans were pushed to the sidelines or reduced to vulgar stereotypes: the foolish and spendthrift sultan Abd al-Aziz and his fanatic and anarchic people. Such an approach has a degree of plausibility, since the “Moroccan Question” chronology does provide a convenient way of structuring events: the Anglo-French Accord (1904), the landing of the Kaiser at Tangier (1905), the Algeciras conference (1906), the landing of French troops at Casablanca (1907), the Agadir incident (1911) and the signing of the protectorate treaty (1912). -

Inventory of Municipal Wastewater Treatment Plants of Coastal Mediterranean Cities with More Than 2,000 Inhabitants (2010)

UNEP(DEPI)/MED WG.357/Inf.7 29 March 2011 ENGLISH MEDITERRANEAN ACTION PLAN Meeting of MED POL Focal Points Rhodes (Greece), 25-27 May 2011 INVENTORY OF MUNICIPAL WASTEWATER TREATMENT PLANTS OF COASTAL MEDITERRANEAN CITIES WITH MORE THAN 2,000 INHABITANTS (2010) In cooperation with WHO UNEP/MAP Athens, 2011 TABLE OF CONTENTS PREFACE .........................................................................................................................1 PART I .........................................................................................................................3 1. ABOUT THE STUDY ..............................................................................................3 1.1 Historical Background of the Study..................................................................3 1.2 Report on the Municipal Wastewater Treatment Plants in the Mediterranean Coastal Cities: Methodology and Procedures .........................4 2. MUNICIPAL WASTEWATER IN THE MEDITERRANEAN ....................................6 2.1 Characteristics of Municipal Wastewater in the Mediterranean.......................6 2.2 Impact of Wastewater Discharges to the Marine Environment........................6 2.3 Municipal Wasteater Treatment.......................................................................9 3. RESULTS ACHIEVED ............................................................................................12 3.1 Brief Summary of Data Collection – Constraints and Assumptions.................12 3.2 General Considerations on the Contents -

LISTE DES ETABLISSEMENTS ET ENTREPRISES AGREES : Situation Du 30 Juin 2020

LISTE DES ETABLISSEMENTS ET ENTREPRISES AGREES : Situation du 30 juin 2020 Nom de Numéro Date de Ligne N° Direction régionale Service provincial Adresse Activité de l'établissement Etat l'établissement Agrément délivrance Fabrication de produits végétaux 120, Parc Industriel CFCIM, Ouled 1 CASABLANCA SETTAT Médiouna- Nouaceur ATLANTIC FOODS et d'origine végétale congelés PVCS.7.154.17 13-nov-17 Agrément délivré Saleh, province de Nouaceur surgelés Zone industrielle Technopôle, Fabrication de conserves d'autres 2 CASABLANCA SETTAT Médiouna- Nouaceur BAYER Aéroport Mohamed V, province de produits végétaux et d'origine CAPV.7.138.17 06-avr-17 Agrément délivré Nouaceur végétale Huiles alimentaires issues de 3 FES MEKNES Meknès Biosec 34 ZI SIDI Bouzerki Meknès HGO.13.63.16 30-nov-2016 Agrément délivré graines oléagineuses Fabrication de conserves d'autres Lot 110 ZI sidi slimane Moul Kifane 4 FES MEKNES Meknès INDOKA produits végétaux et d'origine CAPV 13.90.19 26-févr-19 Agrément délivré MEKNES végétale Lot n° 18, Parc industriel CFCIM, Fabrication de conserves de 5 CASABLANCA SETTAT Médiouna- Nouaceur LACASEM CFL.7.121.16 21-juil-16 Agrément délivré Ouled Saleh, province de Nouaceur fruits et légumes Fabrication de conserves de 6 FES MEKNES Meknès Les conserves oualili km10 dkhissa CFL.13.55.16 08-août-16 Agrément délivré fruits et légumes 7 FES MEKNES Meknès Les conserves oualili km10 dkhissa Sauces et assaisonnements SA.13.56.16 08-août-16 Agrément délivré Fabrication de conserves de 8 FES MEKNES Meknès Les conserves oualili CT Dkhissa -

Annual Report 2011

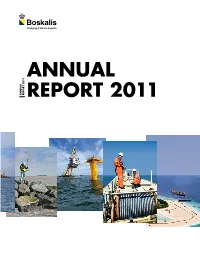

ANNUAL L L T 2011 A R ANNU REPO REPORT 2011 KEY FIGURES (Amounts x € 1 million, unless stated otherwise) 2011 2010 Revenue (work done)* 2,801 2,674 Order book (work to be done) 3,489 3,248 Operating profit 354.1 401.9 EBITDA* 590.5 621.5 Net profit 254.3 310.5 Net group profit* 261.0 312.9 Depreciation, amortization and impairment losses 236.4 219.6 Cash flow* 497.4 532.5 Shareholders’ equity 1,733 1,565 Personnel (headcount) 13,935 13,832 S E R RATIOS (IN PERCENTAGES) Operating result as % of revenue 12.6 15.0 Return on capital employed* 12.1 18.1 KEY FIGU Return on equity* 15.4 21.7 Solvency* 37.4 37.1 FIGURES PER SHARE (IN €) Profit 2.48 3.11 Dividend 1.24 1.24 Cash flow* 4.86 5.30 * Refer to glossary for definitions and abbreviation SHARE INFORMATION 2011 2010 (Share price in €) High 38.46 36.58 Low 20.67 23.16 Close 28.39 35.70 Average daily trading volume 390,069 485,549 Number of issued ordinary shares (x 1,000) 103,472 100,974 Average number of outstanding shares (x 1,000) 102,391 99,962 Stock market capitalization (in € billions) 2.938 3.605 DEVELOPMENT BOSKALIS SHARE PRICE 2011, AEX INDEX REBASED TO BOSKALIS (in €) S LI A K S 40 35 30 t 2011— Bo 25 R EPO 20 R L A 15 JAN FEB MAr apr MAY JUN JUl aUG sep ocT noV dec NNU A Boskalis AEX REVENUE (x € 1 million) NET PROFIT (x € 1 million) CAPITAL EXPENDITURE (x € 1 million) 310.5 2,801 2,674 254.3 2,175 227.9 33 8 32 288 297 260 2009 2010 2011 2009 2010 2011 2009 2010 2011 Disposals Net capital expenditure REVENUE BY SEGMENT (x € 1 million) REVENUE BY GEOGRAPHICAL AREA (x € 1 million)