5173340313.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Risk Profile Performance Vs Benchmark Asset Mix Performance

Performance Summary May 31, 2019 RICH Fund III ULIF 050 17/03/08 LRICH3 105 Fund Objective: Inception Date March 17, 2008 The objective of the fund is to generate ₹ superior long-term returns from a diversified Assets Invested 248.3 Million portfolio of equity and equity related instruments of companies operating in four Fatema Pacha important types of industries viz., Resources, Fund Manager(s) Funds Managed: 8 (8 Equity) Investment-related, Consumption-related and Human Capital leveraged industries. Benchmark BSE 200 NAV ₹ 26.0105 as on May 31, 2019 Return Risk Profile Fund Performance (As on May 31, 2019 ) Since 1 Month 6 Month 1 Year 2 Year 3 Year 4 Year 5 Year Inception Fund Return 1.62% 8.41% 3.84% 6.2% 9.95% 6.58% 10.13% 8.9% Benchmark Return 1.45% 7.78% 7.14% 9.41% 13.14% 8.98% 11.05% 9.31% Performance Vs Benchmark Asset Mix (As on May 31, 2019) 30.00 4% ₹ 9.28 Million 25.00 20.00 ) ₹ V in ( NA 15.00 10.00 5.00 Jan 10 Jan 12 Jan 14 Jan 16 Jan 18 96% ₹ 238.99 Million Period Equity and Equity related securities Minimum 80% RICH Fund III BSE 200 Debt, Money Market and Cash Maximum 20% Details are as per IRDAI Product Filing. Returns greater than 1 year are annualized. Past performance is not indicative of future performance. Performance Summary May 31, 2019 % of Invested Top 10 Sectors * Assets Financial and insurance activities 24.42% Computer programming consultancy and related activities 12.16% Infrastructure 9.13% Manufacture of coke and refined petroleum products 6.74% Manufacture of chemicals and chemical products 5.75% Manufacture of tobacco products 4.81% Manufacture of motor vehicles trailers and semi-trailers 3.71% Manufacture of pharmaceuticalsmedicinal chemical and botanical 2.98% products Manufacture of electrical equipment 2.44% Manufacture of other non-metallic mineral products 2.32% OTHERS 25.54% *As per IRDAI NIC industry classification Details are as per IRDAI Product Filing. -

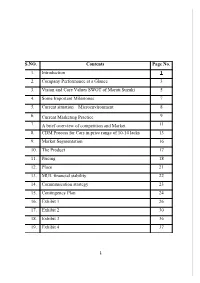

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4

S.NO. Contents Page No. 1. Introduction 1 2. Company Performance at a Glance 3 3. Vision and Core Values SWOT of Maruti Suzuki 5 4. Some Important Milestones 7 5. Current situation – Microenvironment 8 6. Current Marketing Practice 9 7. A brief overview of competition and Market 11 8. CDM Process for Cars in price range of 10-14 lacks 13 9. Market Segmentation 16 10. The Product 17 11. Pricing 18 12. Place 21 13. MUL financial stability 22 14. Communication strategy 23 15. Contingency Plan 24 16. Exhibit 1 26 17. Exhibit 2 30 18. Exhibit 3 36 19. Exhibit 4 37 1 1. I NTRODUCTION Maruti Suzuki India Ltd. – Company Profile Maruti Suzuki India Ltd. (current logo) Maruti Udyog Ltd. (old logo) Maruti Suzuki is one of the leading automobile manufacturers of India, and is the leader in the car segment both in terms of volume of vehicle sold and revenue earned. It was established in February, 1981 as Maruti Udyog Ltd. (MUL), but actual production started in 1983 with the Maruti 800 (based on the Suzuki Alto kei car of Japan), which was the only modern car available in India at that time. Previously, the Government of India held a 18.28% stake in the company, and 54.2% was held by Suzuki of Japan. However, in June 2003, the Government of India held an initial public offering of 25%. By May 10, 2007 sold off its complete share to Indian financial institutions. Through 2004, Maruti Suzuki has produced over 5 million cars. Now, the company annually exports more than 50,000 cars and has an extremely large domestic market in India selling over 730,000 cars annually. -

Maruti Suzuki India Ltd

Business in India Content 1. Success Stories of Japanese companies in India a) Suzuki b) Daikin c) KUMON Global 2. Success story of McDonald in India 3. Corporate Frauds 4. GST Maruti Suzuki India Ltd. Connected For Success Sustained Performance 1.57 million cars in the financial year 2016-17 9.8% growth Hyundai, sold close to 509,707 units in 2016- 17 7 6 5 4 sales (mn) yr 2 3 sales (mn) Yr 1 2 1 0 2015-16 2016-17 Background • Founded in 1981 • To provide affordable mobility to India’s masses • Minute detail-orientation of the Japanese • Observing customers in detail, identifying their needs • Aligning the whole value chain to deliver this need at an appropriate value Guiding Principle . Osamu Suzuki’s conviction . “Cleanliness would drive effectiveness” . Check signs of inefficiency and waste . Every employee is equal . Open offices, one uniform, a common canteen for everyone from sweeper to Managing Director Philosophy that drove Maruti’s success Smaller, lighter, lesser and more beautiful “1 component, 1 gram, 1 yen” initiative . Identify cost improvements of at least ¥1 as well as weight reduction of at least one gram. Mobilized an army of about 6,000 employees Exchange programmes • Adherence to standards • Continuous improvement of standards via Kaizen • Management principles such as 3G, 3K, 3M and 5S. • Phased manufacturing programme • Balance between handholding and leveraging competition • Quality of components: increased cooperation between OEM and supplier • Financially responsible: Displaying real profits in books • Create more value than potential tax “savings” Digital training academy • First large-scale deployment of satellite broadband solution • Facilitating training in a corporate environment. -

Eicher Motors

Techno Funda Pick SiScrip IDiI-Direct Co de AiAction Target UidUpside Maruti Suzuki MARUTI Buy in the range of 5770-5910 6640.00 14% Eicher Motors EICMOT Buy in the range of 23300-23600 27450.00 17% Time Frame: 6 Months Research Analysts Dharmesh Shah [email protected] Nishit Zota [email protected] January 27, 2017 Techno Funda Pick: Maruti Suzuki (MARUTI) Time Frame: 6 Months CMP: | 5885. 00 BiBuying Range: | 5770-5910 Tt|Target: | 6640. 00 UidUpside: 14% Stock Data Key technical observations Recommended Price 5770-5910 The share price of Maruti has remained in a secular uptrend since 2014 as it continues to form higher peak and higher Price Target 6570 trough in all time frame and has consistently generated superior returns for investors over the long term. Within this structural bull run, the stock has undergone periodic phases of consolidation providing fresh entry opportunities for 52 Week High 5974 medium term players to ride the uptrend. We believe the consolidation over the last three months has approached 52 Week Low 3193 maturity and the stock provides a good entry opportunity for medium term investors. 50 days EMA 5474 The stock rebounded from a major support area ... 200 days EMA 4995 The stock after hitting a life-time high of | 5974 in the first week of November 2016 has entered a corrective 52 Week EMA 4888 consolidation phase to work off the excesses post the breakout rally from March 2016 low of | 3185 to the life-time *Recommendation given on i-click to gain on January high of 5974. -

Auto, IT Firms Lead Growth Surge

ADVANCE TAX COLLECTION Auto, IT firms lead growth surge SHRIMI CHOUDHARY such as State Bank of India (SBI) and KEY CONTRIBUTORS New Delhi, 22 June ICICI Bank reported lower (but dou- Amount paid (in ~ cr) YoY growth (%) ble-digit) growth in tax payment. Maruti Suzuki 150 200 Tech Mahindra 190 35 Sharp growth in advance tax payment According to officials, the first- by India Inc has been led mainly by quarter numbers have been compared Hero Motocorp 126 96 SBI 1,910 21 automakers and technology giants with the beginning of the pandemic- TCS 1,160 65 HUL 397 20 including Maruti Suzuki, Hero induced lockdown, so automatically L&T 30 50 Cipla 126 20 MotoCorp, Tata Consultancy (TCS), the figures showed a sharp jump. The and Infosys. second instalment will have a clearer P&G 32 45 NTPC 485 10 These four companies reported a picture, they said. Infosys 720 44 Dr Reddy’s 60 9 jump between 44 per cent and 200 per Meanwhile, final advance tax col- ICICI Bank 800 39 HDFC Bank 2,100 8 cent in the April-June quarter of this lection by companies showed 51 per financial year on account of a low base. cent growth (YoY) for the first quarter. Note: Figures for April 1-June 21 Source: CBDT sources Even top financial institutions Turn to Page 13 > > FROM PAGE 1 Auto, IT firms lead growth surge Earlier, the preliminary data impact on the companies’ increased its tax outflow by Suzuki paid ~150 crore. showed a growth rate of 146 growth. 35 per cent at ~190 crore. -

Equity Strategy

FOR EXTERNAL DISTRIBUTION TO THE FOLLOWING GROUP OF CUSTOMERS ONLY: 1. Accredited Investors (Singapore: Priority Banking). Further distribution of this publication to other group(s) is STRICTLY PROHIBITED. India Top Picks equity strategy This reflects the views of the Wealth Management Group equities | 07 March 2014 Sensex consolidating in a narrow range Contents No changes to our Top Picks this month Sensex consolidating in a narrow range 1 On Watch: India Top Picks 2 – Maruti Suzuki (MSIL IN) to Cut (waiting for a rebound) India Top Picks Review 2 – Tata Power (TPWR IN) and HPCL (HPCL IN) or Oil India Range-bound till elections 7 (OINL IN) under consideration to Add Technical Commentary 8 Indian markets were up last month because of better-than- India Top Picks – Results Update 18 expected inflation data and pre-election opinion polls suggesting Sector – Performance & Valuations 19 that the BJP-led coalition is the frontrunner for forming the next List of Equity Market Commentary Publication 21 government at the Centre. Important Information 22 Of the stocks we highlight, we believe those with the most favourable technicals are Cipla (CIPLA IN), Lupin (LPC IN) and Tech Mahindra (TECHM IN). We would advocate investors consider adding to these names at current levels. In the Interim Union Budget, the Finance Minister surprised the market by announcing that the FY14 fiscal deficit would be 4.8%, 20bps lower than previously forecast. Other highlights include the lack of populist measures ahead of the budget and excise duty Rob Aspin, CFA reduction in automobiles, capital goods and non-consumer Head, Equity Investment Strategy durables. -

Revision in Market Lot of Derivative Contracts on Individual Stocks

Department : FUTURES & OPTIONS Download Ref No: NSE/FAOP/45895 Date : September 30, 2020 Circular Ref. No: 87/2020 All Members, Revision in Market Lot of Derivative Contracts on Individual Stocks In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specified in the SEBI circular CIR/MRD/DP/14/2015 dated July 13, 2015, the market lots of derivatives contracts shall be revised as follows: Sr. Underlying whose Derivative Count of Annexure No Effective date contract size shall be Underlying Number October 30, 2020 (for Nov 1 Revised Downwards 15 1 2020 & later expiries) 2 Revised Upwards 12 October 30, 2020 (for Jan 2 2021 & later expiries) 3 Unchanged 108 - 3 Revised Downwards but new October 30, 2020 (for Jan 4 lot size is not a multiple of old 1 4 2021 & later expiries) lot size To avoid operational complexities, in case of Annexure 2 and 4 above, following will be applicable: 1. Only the far month contract i.e. January 2021 expiry contracts will be revised for market lots. Contracts with maturity of November 2020 and December 2020 would continue to have the existing market lots. All subsequent contracts (i.e. January 2021 expiry and beyond) will have revised market lots. 2. The day spread order book will not be available for the combination contract of Dec 2020 – Jan 2021 expiry. For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of September 1st – September 30th 2020. This circular shall come into effect from October 30, 2020. -

A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra

International Journal of Marketing, Sales and Brand Management Volume 1 Issue 2 A Fundamental Analysis of Indian Automobile Industry with Special Reference to Tata, Maruti & Mahindra & Mahindra Mukund S Assistant Professor Department of M.B.A Marian International Institute of Management, Kuttikkanam, Kerala Corresponding Author’s email: [email protected] DOI: http://doi.org/ 10.5281/zenodo.3626835 Abstract The intrinsic value or the real value of any stock should be known to the investor prior to the initiation of investment in the particular company. Therefore fundamental analysis can be used to find out the intrinsic value. Fundamental analysis is based on certain factors including industry, competition, operational efficiency, dividend policy, capital structure, ratios etc. Those factors tend to change according to the industry and economy. Indian automobile industry had witnessed a growth rate of 8 % during 2019-20. The fuel prices have played an important role in the growth of automobile industry when it comes to price sensitive consumers in India. This study has attempted to analyze the fundamental components of three Indian made automobiles by using various financial and statistical techniques. Maruti stands No. 1 in the segment followed by TATA. Keywords: Automobile Industry, Dividend policy, Fundamental analysis, Operational efficiency, Ratios. INTRODUCTION to sales. 2017-18 can be considered as Indian automobile industry is a lucrative their best time of sales. It marked a double industry which is currently one of the digit growth rate from 1st April 2017 to largest markets in the world with regards 31st March 2018. We have taken three 1 Page 1-9 © MANTECH PUBLICATIONS 2019. -

Auto Component Firms' Revenues Also Slide As Vehicle Sales Slow Down - the Financial Express

3/12/2019 Auto component firms' revenues also slide as vehicle sales slow down - The Financial Express EXPAND Auto component rms’ revenues also slide as vehicle sales slow down Published: March 10, 2019 3:59 AM Owing to decline in demand by car manufacturers. Hair1The Stop onlyLoss Solution bungalow- Specialist For Is ShockedHairstyle Loss.living At Texperience Howry It Now! Fast Hein Thane Regrows Hair..Read more -> Since August, passenger vehicle and two-wheeler demand began dwindling hit by higher cost of ownership due to rising interest rates, insurance premiums and lack of optimum credit in the system. By Pritish Raj As vehicle sales continue to remain in the slow lane, several auto component companies are witnessing a sluggish demand from the manufacturers, which is dragging down their revenues and protability. The advance order inow by auto companies have fallen signicantly since October compared to the previous months, impacted by moderation in vehicle demand across categories in the domestic as well as overseas markets, say industry sources. “Orders from manufacturers such as Hero MotoCorp and TVS Motor Company have gone down by around 20% since November last year and as such our operating revenue has also seen a signicant decline,” Amit https://www.financialexpress.com/industry/auto-component-firms-motocorp-tvs-motor-company-revenues-also-slide-as-vehicle-sales-slow-down/1… 1/8 3/12/2019 Auto component firms' revenues also slide as vehicle sales slow down - The Financial Express Kothari, joint MD, Kay Jay Forgings, which supplies forging parts and precision sheet metal components, told FE. Nishant Arya, executive director, JBM Group, said the demand from manufacturers in the second half of FY19 is subdued and on an year-on-year basis the order inow is at. -

Marketing Holdings Report

Driehaus Emerging Markets Growth Fund (Unaudited) Security Portfolio for 4/30/2021 Quantity ID Security Description Market Value ARGENTINA 10,672,683.42 46,569 GLOB GLOBANT SA 10,672,683.42 AUSTRALIA 16,547,256.13 3,905,487 LYC AU LYNAS CORP LTD 16,547,256.13 BRAZIL 118,019,154.51 1,236,261 BPAC11 BZ BANCO BTG PACTUAL SA-UNIT 24,351,750.63 3,379,900 HAPV3 BZ HAPVIDA PARTICIPACOES E INVE 8,959,888.07 1,239,527 IGTA3 BZ IGUATEMI EMP DE SHOPPING 8,429,253.66 538,534 PAGS PAGSEGURO DIGITAL LTD-CL A 24,632,545.16 1,001,556 PRIO3 BZ PETRO RIO SA 16,815,365.69 1,236,704 VALE VALE SA-SP ADR 24,882,484.48 1,555,926 WEGE3 BZ WEG SA 9,947,866.82 CANADA 23,378,472.20 734,710 PAAS PAN AMERICAN SILVER CORP 23,378,472.20 CHINA 644,410,922.58 1,072,793 9988 HK ALIBABA GROUP HOLDING LTD 31,074,432.76 239,076 BABA ALIBABA GROUP HOLDING-SP ADR 55,214,602.20 28,193,662 2600 HK ALUMINUM CORP OF CHINA LTD-H 14,699,794.81 103,673 BIDU BAIDU INC - SPON ADR 21,805,542.09 45,728 BGNE BEIGENE LTD-ADR 15,709,397.12 117,239 BILI BILIBILI INC-SPONSORED ADR 12,997,115.54 1,962,182 3968 HK CHINA MERCHANTS BANK-H 15,825,779.95 437,341 601888 C1 China Tourism Group Duty Free 21,084,141.02 567,476 300750 C2 CONTEMPORARY AMPEREX TECHN-A 34,038,037.39 2,334,901 6098 HK COUNTRY GARDEN SERVICES HOLD 24,498,011.84 3,214,825 300059 C2 EAST MONEY INFORMATION CO-A 16,015,754.92 204,611 GDS GDS HOLDINGS LTD - ADR 16,976,574.67 490,035 HTHT Huazhu Group Ltd 28,892,463.60 102,132 600519 C1 KWEICHOW MOUTAI CO LTD-A 31,670,625.82 2,327,086 2331 HK LI NING CO LTD 18,993,563.44 737,364 -

Fuel Consumption from Light Commercial Vehicles in India, Fiscal Year 2018–19

WORKING PAPER 2021-02 © 2021 INTERNATIONAL COUNCIL ON CLEAN TRANSPORTATION JANUARY 2021 Fuel consumption from light commercial vehicles in India, fiscal year 2018–19 Author: Ashok Deo Keywords: CO2 standards, fleet average fuel consumption, mini truck, pickup truck, greenhouse gas emissions Introduction This paper examines the fuel consumption of new light commercial vehicles (LCVs) sold in India in fiscal year (FY) 2018–19. These vehicles are the N1 segment in India, and passenger vehicles are the M1 category.1 LCVs in India are not yet subject to any carbon dioxide (CO2) emission standards, even though such standards apply to passenger cars and have proven effective in driving down test-cycle emission levels of new vehicles. This work establishes a baseline of fuel consumption for the N1 segment in India, to help regulators develop an effective CO2/fuel consumption standard. Additionally, we compare the N1 fleets for FY 2014–15, FY 2017–18, and FY 2018–19, understand the characteristics of the mini truck and pickup segments within the N1 category, and compare the performance of major LCV manufacturers in India in terms of fleet average fuel consumption. Finally, we assess the performance of India’s LCV fleet against the LCV fleet in the European Union, considering the differences in the curb weight and size of the vehicles, and examine the performance of LCV manufacturers if a star labeling standard or passenger car fuel consumption standards were to be applied. Background LCVs are used in India as “last-mile” connectivity to move goods to their final destination. The light-duty vehicle market was approximately 87% passenger cars and 13% LCVs in FY 2018 –19.2 This study focuses on India’s LCVs, which are bifurcated into two segments by the Society of Indian Automobile Manufacturers (SIAM), as shown in www.theicct.org Table 1. -

India Light Vehicle Sales Update

August 2018 India Light Vehicle Sales Update Weak July Growth Due to High Base in 2017 India’s Light Vehicle (LV) wholesales inched up by a mere 1% year-on-year (YoY) to 339k units in July, over a high base in the same period a year ago. At the same time, the dispatch of vehicles to dealers was partially impacted by an eight-day truckers’ strike. The overall volume was dragged down in particular by Passenger Vehicles (PVs), which declined by 3% YoY to 274k units. It is important to point out that dealers had depleted their inventory in June 2017 to avoid paying higher taxes under the new Goods and Services Tax (GST) regime that became effective last July. This was then followed by restocking, which bolstered wholesales in July 2017. In contrast, demand for Light Commercial Vehicles (LCVs) with GVW of up to 6 tons surged by 23% YoY to 65k units in July of this year. The LCV segment is bouncing back from the negative impact of demonetization (from November 2016 to Q1 2017) and the GST implementation, while also benefiting from an improved rural economy. On a seasonally adjusted annualized rate (SAAR) basis, sales improved marginally to 4.20 mn units in July, compared to 4.19 mn units in June. While the July SAAR was lower than the record-high selling rates of 4.37 mn units in May and 4.27 mn in April, it was, nevertheless, still a very impressive performance for India, particularly since the SAAR has exceeded 4 mn units for four consecutive months.