Notice of the Convocation of the Ordinary General Meeting of Shareholders for the 101St Business Term

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transparency Report 2019

Transparency Report 2019 2018 9 ______年 月 www.kpmg.com jp / / © 2019 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Transparency Report 2019 1 1. Message from the local Senior Partner As a member of the KPMG network, KPMG AZSA LLC shares a common purpose - to Inspire Confidence, Empower Change – with member firms around the globe. Based on this purpose, we aim to establish the reliability of information through auditing and accounting services and support the change of companies and society towards sustainable growth. AZSA Quality 2019 introduces efforts at KPMG AZSA LLC to improve audit quality, the foundation of which is KPMG’s globally consistent audit quality. In this transparency report, we will additionally introduce KPMG’s system for ensuring audit quality. 2. Who we are 2.1 Our business 2.2 Our strategy KPMG AZSA LLC, a member firm of KPMG International, comprises Our firm’s mission is to ensure the reliability of information by approximately 6,000 people in major cities in Japan, providing audit, providing quality audit and accounting services as well as to attestation, and advisory services such as accounting advisory contribute to the realization of a fair society and healthy services, financial advisory services, IT advisory service and other development of our economy by empowering change. In order to advisory services for initial public offerings and the public sector. execute our firm’s mission, we have following vision: We also offer highly specialized professional services that address To be ‘The Clear Choice’ for our clients, people and society. -

Survey of Integrated Reports in Japan 2018

Survey of Integrated Reports in Japan 2018 Integrated Reporting Center of Excellence KPMG in Japan March 2019 home.kpmg/jp Message from global thought leaders In this, the fifth year this survey report has been issued, KPMG has solicited the observations of thought leaders on corporate reporting. Japanese businesses pride themselves on a longer-term focus compared to the rest of the world, where prioritizing short-term gains has too often become the norm. Focusing on long-term value creation and taking into account all of the resources an organization uses is the sustainable, profitable, and proven way to manage a business. Many Japanese businesses are just beginning to implement integrated thinking and reporting. The findings in this report show that senior management must take ownership to spread integrated thinking in their businesses – not just in accounting but in strategy, operations, marketing, and the rest of the company as well. This report makes me optimistic and excited for Japanese business leaders as they strive to think, act, and communicate in an integrated and sustainable way. Dominic Barton ― International Integrated Reporting Council, Chairman Integrated Reporting improves communication between companies and investors and where most effective, sets the stage for enhanced corporate value creation over the mid to long-term. Investors desire integrated reports which provide comprehensive information disclosure useful for making investment decisions. The International Corporate Governance Network (ICGN) has encouraged integrated reporting for many years. In 2015, ICGN s Disclosure and Transparency Committee ’ released Guidance on Integrated Business Reporting. The Guidance amplifies that strategic decisions should be based on factors that are broader than those reflected in the financial statements. -

Transparency Report 2018

Transparency Report 2018 2018 9 ______年 月 www.kpmg.com/jp/azsa © 2017 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Transparency Report 2018 1 1. Message from the Local Senior Partner As a member of the KPMG network, KPMG AZSA LLC shares a common Purpose - to Inspire Confidence, Empower Change – with member firms around the globe. Based on this Purpose, we aim to establish the reliability of information through auditing and accounting services and support the change of companies and society towards sustainable growth. AZSA Quality 2018 introduces efforts at KPMG AZSA LLC to improve audit quality, the foundation of which is KPMG’s globally consistent audit quality. In this transparency report, we will additionally introduce KPMG’s system for ensuring audit quality. 2. Who we are 2.1 Our business 2.2 Our strategy KPMG AZSA LLC, a member firm of KPMG International, comprises Our firm’s mission is to ensure the reliability of information by approximately 6,000 people in major cities in Japan, providing audit, providing quality audit and accounting services as well as to attestation, and advisory services such as accounting advisory contribute to the realization of a fair society and healthy services, financial advisory services, IT advisory service and other development of our economy by empowering change. In order to advisory services for initial public offerings and the public sector. execute our firm’s mission, we have following vision: We also offer highly specialized professional services that address To be The Clear Choice for our clients, people and society. -

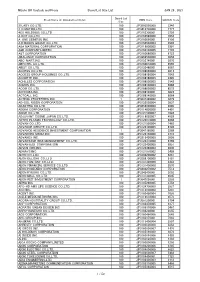

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

Status of Stock Holdings

Supplementary Materials Status of Stock Holdings I. Standards and ways of thinking by category in investments The Group holds investment stocks for the purpose of pure investment in order to reap earnings by an increase in equity value and by receiving dividends and so forth. In addition, the Group holds investment stocks for purposes other than pure investment purposes (hereinafter “non-pure investment stocks”). The purposes of holding non-pure investment stocks are to maintain and to expand long-term, stable business relationships, to maintain and to strengthen business partnerships, and to reap medium- to long-term earnings by an increase in equity value and by receiving dividends and so forth. II. Holdings stocks on Taiyo Life Insurance Company Of the Company and its consolidated subsidiaries, Taiyo Life is the consolidated subsidiary with the largest balance of invest- ment stock. The status of Taiyo Life’s stock holding is as follows: 1. Non-pure investment stocks a. Policies to hold shares, the rationality to hold shares, verification contents at the Board of Directors meetings about the appropriateness to hold individual companies Every year, the boards of directors of the Company and Taiyo Life Insurance Company shall verify the propriety of holding individual non-pure investment stocks by concretely examining the adequacy of the holdings, whether the benefits and risks are commensurate with the capital costs, and other factors. b. The number of stocks and the amounts on Balance Sheets Total of balance sheet The number of stocks -

Mizuho BK Custody and Proxy Board Lot Size List JUN 15 , 2021

Mizuho BK Custody and Proxy Board Lot Size List JUN 15 , 2021 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. 100 JP3389700000 9787 AEON FANTASY CO.,LTD. 100 JP3131420006 4343 AEON FINANCIAL SERVICE CO.,LTD. -

International Allocation Portfolio

INTERNATIONAL ALLOCATION PORTFOLIO Schedule of Investments as of September 30, 2019 (unaudited) Shares Common Stock (84.0%) Value Shares Common Stock (84.0%) Value Australia (3.6%) Brazil (0.7%) - continued 131,115 AGL Energy, Ltd. $1,696,231 27,469 Banco Bradesco SA ADR $223,598 106,326 Altium, Ltd. 2,399,529 10,600 Banco BTG Pactual SA 149,346 40,269 Ansell, Ltd. 745,436 267,200 BR Malls Participacoes SA 931,835 193,457 Aristocrat Leisure, Ltd. 3,999,747 13,935 Centrais Eletricas Brasileiras SA ADR 133,497 362,090 Australia and New Zealand Banking 73,334 Companhia Energetica de Minas Group, Ltd. 6,955,636 Gerais ADR 248,602 789,764 Beach Energy, Ltd. 1,348,062 87,300 Companhia Energetica de Sao Paulo 598,606 332,299 BHP Group, Ltd. 8,211,300 3,771 Companhia Paranaense de Energia 61,200 Breville Group, Ltd. 665,462 ADR 45,290 42,848 BWP Trust 114,283 21,000 Cosan SA 269,339 335,942 Charter Hall Group 2,642,160 55,507 Embraer SA ADR 957,496 8,491 Collins Foods, Ltd. 57,407 29,200 GOL Linhas Aereas Inteligentes SAa 226,645 75,161 Computershare, Ltd. 821,647 122,000 Iochpe-Maxion SA 560,532 66,530 CSL, Ltd. 10,519,193 248,216 Itau Unibanco Holding SA ADR 2,087,496 373,127 Evolution Mining, Ltd. 1,138,406 71,000 JBS SA 559,121 71,798 FlexiGroup, Ltd. 123,802 825,900 Metalurgica Gerdau SA 1,236,380 356,647 G8 Education, Ltd. -

Mizuho BK Custody and Proxy Board Lot Size List JAN 26 , 2021 21LADY

Mizuho BK Custody and Proxy Board Lot Size List JAN 26 , 2021 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A DOT CO.,LTD 100 JP3160590000 7063 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 A&T CORPORATION 100 JP3160680009 6722 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTCALL INC. 100 JP3108140009 6064 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. -

Japan Pulp & Paper Co.,Ltd. Annual Report 2018

Annual Report 2018 Ever since its founding in 1845, Japan Pulp & Paper Co., Ltd. has grown while meeting the needs of society as a paper trading company that has played an essential role in industrial and cultural development. Today, along with its mainstay Japan Wholesaling business, the Company has expanded into the Non- Japan Wholesaling, Paper Manufacturing & Processing, Resources & Environment, and Real Estate Leasing businesses. By generating Group synergy, the Japan Pulp & Paper Group aims to maximize its overall corporate value. Paper is always around us in our daily lives. And beyond it lie infinite possibilities. The Group is seeking to generate new value by working to solve the issues facing society while pursuing the infinite possibilities of paper. We remain committed to earning the trust of all stakeholders as we work toward our mission of creating a better future for society and the environment. Corporate Philosophy Our Corporate Spirit Nurture people through integrity, foster trust through fairness, support society through harmony. Our Mission Carving a better future for society and the environment. Our Principles Change Change ourselves as society changes. Challenge Challenge new fields with conviction and ambitious spirit. Create Create fresh global value through diversity. Corporate Slogan “ ” 1 The two Os in the OVOL logo symbolize the global expansion of the Japan Pulp & Paper Group. The shape of the striking logo is not only reminiscent of a celestial orbit and ovals, but the repetition within the letter O represents a smooth and never ending continuity, nature and familiarity, as well as the direction of the Japan Pulp & Paper Group in its global expansion, and these are conveyed in a unique way that is both visual and almost aural. -

Constituent Changes TOPIX New Index Series (Effective 31 October 2018)

Constituent Changes TOPIX New Index Series (effective 31 October 2018) Published on 5 October 2018 1. Constituents Change (1) TOPIX Core30 Addition( 2 ) Deletion( 2 ) Code IssueCode Issue 6098 Recruit Holdings Co.,Ltd.7201 NISSAN MOTOR CO.,LTD. 4452 Kao Corporation6902 DENSO CORPORATION (2) TOPIX Large70 Addition( 4 ) Deletion( 4 ) Code IssueCode Issue 7201 NISSAN MOTOR CO.,LTD. 6098 Recruit Holdings Co.,Ltd. 6902 DENSO CORPORATION 4452 Kao Corporation 4543 TERUMO CORPORATION9532 OSAKA GAS CO.,LTD. 6869 SYSMEX CORPORATION4755 Rakuten,Inc. (3) TOPIX Mid400 Addition(11) Deletion(11) Code IssueCode Issue 9532 OSAKA GAS CO.,LTD.4543 TERUMO CORPORATION 4755 Rakuten,Inc.6869 SYSMEX CORPORATION 5301 TOKAI CARBON CO.,LTD.8140 Ryosan Company,Limited 4921 FANCL CORPORATION 9303 The Sumitomo Warehouse Co.,Ltd. 6754 ANRITSU CORPORATION 8609 OKASAN SECURITIES GROUP INC. 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 8016 ONWARD HOLDINGS CO.,LTD. 3769 GMO Payment Gateway,Inc. 8361 The Ogaki Kyoritsu Bank,Ltd. 3288 Open House Co.,Ltd.5413 Nisshin Steel Co.,Ltd. 7518 Net One Systems Co.,Ltd.5949 UNIPRES CORPORATION 7616 COLOWIDE CO.,LTD.8218 KOMERI CO.,LTD. *7747 ASAHI INTECC CO.,LTD. 7222 NISSAN SHATAI CO.,LTD. * This issue will be newly added to TOPIX new index series after the close of trading on October 30. (4) TOPIX Small Addition(17) Deletion(8) Code IssueCode Issue 8140 Ryosan Company,Limited 5301 TOKAI CARBON CO.,LTD. 9303 The Sumitomo Warehouse Co.,Ltd. 4921 FANCL CORPORATION 8609 OKASAN SECURITIES GROUP INC. 6754 ANRITSU CORPORATION 8016 ONWARD HOLDINGS CO.,LTD. 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 8361 The Ogaki Kyoritsu Bank,Ltd. -

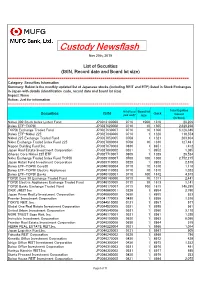

Custody Newsflash Nov 20Th, 2019

Custody Newsflash Nov 20th, 2019 List of Securities (ISIN, Record date and Board lot size) ======================================================================================== Category: Securities Information Summary: Below is the monthly updated list of Japanese stocks (including REIT and ETF) listed in Stock Exchanges in Japan with details (identification code, record date and board lot size) Impact: None Action: Just for information ======================================================================================== R/D(Fiscal Board lot Total Equities Securities ISIN Quick year end)* size Issued (in thou) Nikkei 300 Stock Index Listed Fund JP3013190008 0710 1000 1319 28,209 Daiwa ETF-TOPIX JP3027620008 0710 10 1305 2,829,238 TOPIX Exchange Traded Fund JP3027630007 0710 10 1306 6,126,349 Daiwa ETF-Nikkei 225 JP3027640006 0710 1 1320 118,554 Nikkei 225 Exchange Traded Fund JP3027650005 0708 1 1321 263,604 Nikko Exchange Traded Index Fund 225 JP3027660004 0708 10 1330 127,481 Nippon Building Fund Inc. JP3027670003 0630 1 8951 1,412 Japan Real Estate Investment Corporation JP3027680002 0331 1 8952 1,385 iShares Core Nikkei 225 ETF JP3027710007 0809 1 1329 29,524 Nikko Exchange Traded Index Fund TOPIX JP3039100007 0708 100 1308 2,752,215 Japan Retail Fund Investment Corporation JP3039710003 0228 1 8953 2,618 Daiwa ETF-TOPIX Core30 JP3040100004 0710 10 1310 1,116 Daiwa ETF-TOPIX Electric Appliances JP3040110003 0710 10 1610 1,023 Daiwa ETF-TOPIX Banks JP3040130001 0710 100 1612 4,673 TOPIX Core 30 Exchange Traded Fund JP3040140000 0715 10 1311 2,441 TOPIX Electric Appliances Exchange Traded Fund JP3040150009 0715 10 1613 1,141 TOPIX Banks Exchange Traded Fund JP3040170007 0715 100 1615 146,295 ORIX JREIT Inc. -

JAPAN TAPPI JOURNAL January1 2019 CONTENTS Vol

JAPAN TAPPI JOURNAL January1 2019 CONTENTS Vol. 73, No. 1 The Special Issue of the 61st―2018 JAPAN TAPPI Annual Meeting at Omiya,Saitama 2 General Review of the 61st―2018 JAPAN TAPPI Annual Meeting at Omiya, Saitama……Planning Subcommittee,JAPAN TAPPI 11 Keynote Speech 61st―2018 JAPAN TAPPI Annual Meeting in Omiya,Saitama “Innovation and progress by creating technical innovation to lead to the future” ……Kazufumi Yamazaki 17 Lecture by Winner of 2017 JAPAN TAPPI Prize 19 List of Exhibitors & Exhibits 2018 Technical Report 22 High Pressure Washer for Canvas「Blower Suction type Super Cleaner」 ……Chihiro Murayama 27 Development and High Efficiency of Vertical Separater,Washer,and Fiber Recovery “Vertical Z”…… Masayasu Kamijo,Takefumi Ide and Saki Ueda 32 MaxiTrasher System and Continuous Detrash System ―Suggestion of the Latest Contaminants Removal Method for Lower Quality Waste Paper― ……Keiji Yasuda 37 Pulping and Detrashing Technology for the Solution of Contaminants Treatment ……Masamori Tanaka 41 New Counter Mesurement Against the Fabric Defect Combined with Dryer Section Deposits Prevention and High Recovery,High Pressure Cleaner ……Tomohiko Nagatsuka 47 Selection and Development of Trapping Tools for Effective Best Management ……Tomohiro Ohba Topics & Information 51 How The Paper Industry in Japan Has Technologically Responded to The Paradigm Shifts of The Japanese Society Part 5:Key–technologies,Information Revolution and the Summary of the Series ……Kiyoaki Iida Research Report(Original Paper) 58 Surface Modifications of Cellulose Nanocrystals