Chapter 10: Natural

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unconventional Gas and Oil in North America Page 1 of 24

Unconventional gas and oil in North America This publication aims to provide insight into the impacts of the North American 'shale revolution' on US energy markets and global energy flows. The main economic, environmental and climate impacts are highlighted. Although the North American experience can serve as a model for shale gas and tight oil development elsewhere, the document does not explicitly address the potential of other regions. Manuscript completed in June 2014. Disclaimer and copyright This publication does not necessarily represent the views of the author or the European Parliament. Reproduction and translation of this document for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2014. Photo credits: © Trueffelpix / Fotolia (cover page), © bilderzwerg / Fotolia (figure 2) [email protected] http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog) Unconventional gas and oil in North America Page 1 of 24 EXECUTIVE SUMMARY The 'shale revolution' Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking). Economic impacts This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals. The production of tight oil is costly, so that a high oil price is required to make it economically viable. -

Briefing on Carbon Dioxide Specifications for Transport 1St Report of the Thematic Working Group On: CO2 Transport, Storage

Briefing on carbon dioxide specifications for transport 1st Report of the Thematic Working Group on: CO2 transport, storage and networks Release Status: FINAL Author: Dr Peter A Brownsort Date: 29th November 2019 Filename and version: Briefing-CO2-Specs-FINAL-v1.docx EU CCUS PROJECTS NETWORK (No ENER/C2/2017-65/SI2.793333) This project is financed by the European Commission under service contract No. ENER/C2/2017-65/SI2.793333 1 About the CCUS Projects Network The CCUS Projects Network comprises and supports major industrial projects underway across Europe in the field of carbon capture and storage (CCS) and carbon capture and utilisation (CCU). Our Network aims to speed up delivery of these technologies, which the European Commission recognises as crucial to achieving 2050 climate targets. By sharing knowledge and learning from each other, our project members will drive forward the delivery and deployment of CCS and CCU, enabling Europe’s member states to reduce emissions from industry, electricity, transport and heat. http://www.ccusnetwork.eu/ © European Union, 2019 No third-party textual or artistic material is included in the publication without the copyright holder’s prior consent to further dissemination by other third parties. Reproduction is authorised provided the source is acknowledged. This project is financed by the European Commission under service contract No. ENER/C2/2017-65/SI2.793333 2 (Intentionally blank) This project is financed by the European Commission under service contract No. ENER/C2/2017-65/SI2.793333 3 Executive summary There are two types of specification generally relevant to carbon dioxide (CO2) transport, the product specification for end use and the requirement specification for transport. -

Combustion and Heat Release Characteristics of Biogas Under Hydrogen- and Oxygen-Enriched Condition

energies Article Combustion and Heat Release Characteristics of Biogas under Hydrogen- and Oxygen-Enriched Condition Jun Li 1, Hongyu Huang 2,*, Huhetaoli 2, Yugo Osaka 3, Yu Bai 2, Noriyuki Kobayashi 1,* and Yong Chen 2 1 Department of Chemical Engineering, Nagoya University, Nagoya, Aichi 464-8603, Japan; [email protected] 2 Guangzhou Institute of Energy Conversion, Chinese Academy of Sciences, Guangzhou 510640, China; [email protected] (H.); [email protected] (Y.B.); [email protected] (Y.C.) 3 Faculty of Mechanical Engineering, Kanazawa University, Kakuma, Kanazawa, Ishikawa 920-1192, Japan; [email protected] * Correspondence: [email protected] (H.H.); [email protected] (N.K.); Tel.: +86-20-870-48394 (H.H.); +81-52-789-5428 (N.K.) Received: 10 May 2017; Accepted: 20 July 2017; Published: 13 August 2017 Abstract: Combustion and heat release characteristics of biogas non-premixed flames under various hydrogen-enriched and oxygen-enriched conditions were investigated through chemical kinetics simulation using detailed chemical mechanisms. The heat release rates, chemical reaction rates, and molar fraction of all species of biogas at various methane contents (35.3–58.7%, mass fraction), hydrogen addition ratios (10–50%), and oxygen enrichment levels (21–35%) were calculated considering the GRI 3.0 mechanism and P1 radiation model. Results showed that the net reaction rate of biogas increases with increasing hydrogen addition ratio and oxygen levels, leading to a higher net heat release rate of biogas flame. Meanwhile, flame length was shortened with the increase in hydrogen addition ratio and oxygen levels. -

How Is Industrial Nitrogen Gas (N2) Produced/Generated?

www.IFSolutions.com 1 What is Nitrogen and How is it Produced Nitrogen (N2) is a colorless, odorless gas which makes up roughly 78% of the earth’s atmosphere. Nitrogen is defined as a simple asphyxiant having an inerting quality which is utilized in many applications where oxidation is not desired. Nitrogen gas is an industrial gas produced by one of the following means: !! Fractional distillation of liquid air (Praxair, Air Liquide, Linde, etc) !! By mechanical means using gaseous air "! Polymeric Membrane "! Pressure Swing Adsorption or PSA www.IFSolutions.com 2 Fractional Distillation (99.999%) Pure gases can be separated from air by first cooling it until it liquefies, then selectively distilling the components at their various boiling temperatures. The process can produce high purity gases but is very energy-intensive. www.IFSolutions.com 3 Pressure Swing Adsorption (99 – 99.999%) Pressure swing adsorption (PSA) is a technology used to separate some gas species from a mixture of gases under pressure according to the species' molecular characteristics and affinity for an adsorbent material. It operates at near-ambient temperatures and differs significantly from cryogenic distillation techniques of gas separation. Specific adsorptive materials (e.g., zeolites, activated carbon, molecular sieves, etc.) are used as a trap, preferentially adsorbing the target gas species at high pressure. www.IFSolutions.com 4 Membrane (90 – 99.9%) Membrane Technology utilizes a permeable fiber which selectively separates the air depending on the speeds of the molecules of the constituents. This process requires a conditioning of the Feed air due to the clearances in the fiber which are the size of a human hair. -

200 LNG-Powered Vessels Planned in Chongqing by 2020

Number #110 April 2016 2016, APRIL 1 Asian NGV Communications is a publication of AltFuels Communications Group. China: 200 LNG-powered vessels planned in Chongqing by 2020 India Emirates 15,000 vehicles MAN showcases converted to CNG natural gas buses in Delhi this year in Dubai 2 ASIAN NGV COMMUNICATIONS 2016, APRIL 3 Summary April 2016 #110 COPIES DISTRIBUTION We print and mail to 24 Asian countries around 4,000 hard copies addressed to conversion pag 04 China: 200 LNG-powered vessels planned in Chongqing by 2020 centres, Oil & Gas companies, OEM NGVs, governmental related offices, filling station 11. MAN showcases natural owners, equipment suppliers, gas buses in Dubai related associations and industries. In addition, the 12. New collaboration electronic version of the magazine is sent to more than boosts LNG use as 15,000 global NGV contacts in marine fuel in Middle 94 countries. East pag 06 New LNG terminal project begins commercial This e-version is also available 13. Pioneer dual fuel engine for free download to all visitors operations in Beihai of www.ngvjournal.com. demonstrated in Korea Below is the list of hard copy 14. Korean scientists develop receivers. Armenia, Australia, engine operating with Azerbaijan, Bangladesh, China, Egyp, India, Indonesia, Iran, hydrogen and CNG Israel, Japan, Kazakhstan, Korea, Malaysia, Myanmar (Burma), 15. Japan: first hydrogen New Zealand, Pakistan, The refuelling station will Philippines, Russia, Singapore, open in Tohoku Taiwan, Thailand, Turkey, United pag 08 India: 15,000 vehicles Arab Emirates, Vietnam, If your 16. New venture will NGV business is in Asia, the converted to CNG in Delhi Pacific, and the Middle East, promote hydrogen fuel since January advertise with us! cell technologies in Japan Asian NGV Communications 1400 - PMB 174, 300-5, Changchon –Ri, Namsan- 17. -

Industrial Gases and Advanced Technologies for Non-Ferrous Mining and Refining Tell Me More Experience, Understanding and Solutions

Industrial gases and advanced technologies for non-ferrous mining and refining tell me more Experience, understanding and solutions When a need for reliable gas supply or advanced technologies for your processes occurs, Air Products has the experience to help you be more successful. Working side-by-side with non-ferrous metals mining and refining facilities, we have developed in-depth knowledge and understanding of extractive and refining processes. You can leverage our experience to help increase yield, improve production, decrease harmful fugitive emissions, and reduce energy consumption and fuel cost throughout your operations. As a leading global industrial gas supplier, we offer a full range of supply modes for industrial gases, including oxygen, nitrogen, argon and hydrogen for small and large volume users, state-of-the-art equipment and a broad range of technical services based on our comprehensive global engineering experience in many critical gas applications. Our products range from packaged gases, such as portable cryogenic dewars, all the way up to energy-efficient cryogenic air separation plants and enabling equipment, such as burners and flow controls. Beyond products and services, customers count on us for over 60 years of technical knowledge and experience. As an owner and operator of over 800 air separation plants worldwide, with an understanding of current and future industry needs, we can develop and implement technical solutions that are right for your process and production challenges. It’s our goal to match your needs with a comprehensive and cost-effective industrial gas system and innovative technologies. “By engaging Air Products at an early stage in our Zambian [Kansanshi copper-gold mining] project, we were able to explore oxygen supply options and determine what we believed to be the best system for our specific process requirements. -

Energy and the Hydrogen Economy

Energy and the Hydrogen Economy Ulf Bossel Fuel Cell Consultant Morgenacherstrasse 2F CH-5452 Oberrohrdorf / Switzerland +41-56-496-7292 and Baldur Eliasson ABB Switzerland Ltd. Corporate Research CH-5405 Baden-Dättwil / Switzerland Abstract Between production and use any commercial product is subject to the following processes: packaging, transportation, storage and transfer. The same is true for hydrogen in a “Hydrogen Economy”. Hydrogen has to be packaged by compression or liquefaction, it has to be transported by surface vehicles or pipelines, it has to be stored and transferred. Generated by electrolysis or chemistry, the fuel gas has to go through theses market procedures before it can be used by the customer, even if it is produced locally at filling stations. As there are no environmental or energetic advantages in producing hydrogen from natural gas or other hydrocarbons, we do not consider this option, although hydrogen can be chemically synthesized at relative low cost. In the past, hydrogen production and hydrogen use have been addressed by many, assuming that hydrogen gas is just another gaseous energy carrier and that it can be handled much like natural gas in today’s energy economy. With this study we present an analysis of the energy required to operate a pure hydrogen economy. High-grade electricity from renewable or nuclear sources is needed not only to generate hydrogen, but also for all other essential steps of a hydrogen economy. But because of the molecular structure of hydrogen, a hydrogen infrastructure is much more energy-intensive than a natural gas economy. In this study, the energy consumed by each stage is related to the energy content (higher heating value HHV) of the delivered hydrogen itself. -

CLIMATE ACTION PLAN Websites

CLIMATE ACTION PLAN Websites Climate action cuts across all sectors of our economy and is being addressed in multiple ways. Information on government actions related to climate action are also found in the following: h LiveSmart BC http://www.livesmartbc.ca/ h The BC Energy Plan: A Vision for Clean Energy Leadership http://www.energyplan.gov.bc.ca/ h The BC Bioenergy Strategy http://www.energyplan.gov.bc.ca/bioenergy/ h The Agriculture Plan: Growing a Healthy Future for BC Farmers http://www.al.gov.bc.ca/Agriculture_Plan/ h The Mountain Pine Beetle Action Plan http://www.for.gov.bc.ca/hfp/mountain_pine_beetle/ h Living Water Smart: British Columbia's Water Plan http://www.livingwatersmart.ca./ h The BC Air Action Plan http://www.bcairsmart.ca/ h The BC Transit Plan http://www.th.gov.bc.ca/Transit_Plan/index.html h Energy Efficient Building Strategy http://www.energyplan.gov.bc.ca/efficiency/ h BC Green Building Code http://www.housing.gov.bc.ca/building/green/ h Pacific Institute for Climate Solutions http://www.pics.uvic.ca/ h Towns for Tomorrow http://www.townsfortomorrow.gov.bc.ca/ h Climate Action Secretariat http://www.climateactionsecretariat.gov.bc.ca/ BRITISH COLUMBIA’S Contents Message from the B.C. Government 1 Highlights 2 The Challenge 6 The Opportunity 10 The B.C. Climate Action Plan – Phase One 12 Section One: Setting the Course 13 Section Two: Acting in Every Sector 25 Acting in Every Sector: Transportation 26 Acting in Every Sector: Buildings 36 Acting in Every Sector: Waste 41 Acting in Every Sector: Agriculture 43 Acting -

2002-00201-01-E.Pdf (Pdf)

report no. 2/95 alternative fuels in the automotive market Prepared for the CONCAWE Automotive Emissions Management Group by its Technical Coordinator, R.C. Hutcheson Reproduction permitted with due acknowledgement Ó CONCAWE Brussels October 1995 I report no. 2/95 ABSTRACT A review of the advantages and disadvantages of alternative fuels for road transport has been conducted. Based on numerous literature sources and in-house data, CONCAWE concludes that: · Alternatives to conventional automotive transport fuels are unlikely to make a significant impact in the foreseeable future for either economic or environmental reasons. · Gaseous fuels have some advantages and some growth can be expected. More specifically, compressed natural gas (CNG) and liquefied petroleum gas (LPG) may be employed as an alternative to diesel fuel in urban fleet applications. · Bio-fuels remain marginal products and their use can only be justified if societal and/or agricultural policy outweigh market forces. · Methanol has a number of disadvantages in terms of its acute toxicity and the emissions of “air toxics”, notably formaldehyde. In addition, recent estimates suggest that methanol will remain uneconomic when compared with conventional fuels. KEYWORDS Gasoline, diesel fuel, natural gas, liquefied petroleum gas, CNG, LNG, Methanol, LPG, bio-fuels, ethanol, rape seed methyl ester, RSME, carbon dioxide, CO2, emissions. ACKNOWLEDGEMENTS This literature review is fully referenced (see Section 12). However, CONCAWE is grateful to the following for their permission to quote in detail from their publications: · SAE Paper No. 932778 ã1993 - reprinted with permission from the Society of Automotive Engineers, Inc. (15) · “Road vehicles - Efficiency and emissions” - Dr. Walter Ospelt, AVL LIST GmbH. -

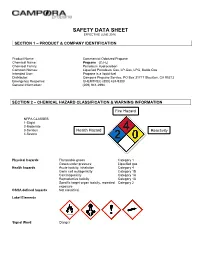

Material Safety Data Sheet

SAFETY DATA SHEET EFFECTIVE JUNE 2016 SECTION 1 – PRODUCT & COMPANY IDENTIFICATION Product Name: Commercial Odorized Propane Chemical Name: Propane (C3H8) Chemical Family: Petroleum Hydrocarbon Common Names: Liquefied Petroleum Gas, LP-Gas, LPG, Bottle Gas Intended Use: Propane is a liquid fuel Distributor: Campora Propane Service, PO Box 31717 Stockton, CA 95213 Emergency Response: CHEMTREC (800) 424-9300 General Information: (209) 941-2994 SECTION 2 – CHEMICAL HAZARD CLASSIFICATION & WARNING INFORMATION Fire Hazard NFPA CLASSES: 1-Slight 2-Moderate 3-Serious Health Hazard Reactivity 4-Severe Physical hazards Flammable gases Category 1 Gases under pressure Liquefied gas Health hazards Acute toxicity, inhalation Category 4 Germ cell mutagenicity Category 1B Carcinogenicity Category 1A Reproductive toxicity Category 1A Specific target organ toxicity, repeated Category 2 exposure OSHA defined hazards Not classified. Label Elements Signal Word Danger Hazard Statement Propane (also called LPG-Liquefied Petroleum Gas or LP-Gas) is a liquid fuel stored under pressure. In most systems, propane is vaporized to a gas before it leaves the tank. Propane is highly flammable when mixed with air (oxygen) and can be ignited by many sources, including open flames, smoking materials, electrical sparks, and static electricity. Severe “freeze burn” or frostbite can result if propane liquid comes in contact with your skin. Extremely flammable gas. Harmful if inhaled. May cause genetic defects. May cause cancer. May damage fertility or the unborn child. May cause damage to Blood through prolonged or repeated exposure. May cause cryogenic burns or injury. Propane is a simple asphyxiant. Precautionary statement General Read and follow all Safety Data Sheets (SDS’S) before use. -

Investment Opportunities in China's Industrial Gas Market

Executive Insights Volume XIX, Issue 31 Investment Opportunities in China’s Industrial Gas Market Due to their wide-ranging downstream • Gas production: air separation gas, synthetic air and applications and impact on the overall market, specialty gas, etc. industrial gases have been dubbed the “blood • Gas supply: on-site pipeline, bulk transport of liquefied gas, gas cylinders, etc. of the industrials market” and hence play an • Downstream applications: mainly metallurgy, chemicals, important role in China’s national economy. electronics, etc. Industrial gases are widely used in metallurgy, Over half of the global value share of the industrial gas market petroleum, petrochemicals, chemicals, is made up of air separation gases (e.g., nitrogen, oxygen and mechanical, electronics and aerospace and are of argon). The remaining market share is split between industrial synthetic gas (e.g., hydrogen, carbon dioxide and acetylene) great importance to a country’s national defense, and specialty gases (e.g., ultra-high-purity gases and electronics construction and healthcare sectors. However, gases), with 35% and 8–10% of the market share, respectively. given the current economic downturn, slowdown Each of the three main downstream applications focuses on different raw materials: metallurgy favors the use of air in growth and excess capacity reduction, investors separation gases, chemical processes primarily consume synthetic may be hard-pressed to determine where new gases and electronics makes use of specialty gases. investment opportunities and growth prospects Three main supply models exist to provide different levels of lie. In this Executive Insights, L.E.K. Consulting flexibility to customers. On-site gas pipelines are suitable for the assesses investment opportunities in this market. -

Producing Fuel and Electricity from Coal with Low Carbon Dioxide Emissions

Producing Fuel and Electricity from Coal with Low Carbon Dioxide Emissions K. Blok, C.A. Hendriks, W.C. Turkenburg Depanrnent of Science,Technology and Society University of Utrecht Oudegracht320, NL-351 1 PL Utrecht, The Netherlands R.H. Williams Center for Energy and Environmental Studies Princeton University Princeton, New Jersey08544, USA June 1991 Abstract. New energy technologies are needed to limit CO2 emissions and the detrimental effects of global warming. In this article we describe a process which produces a low-carbon gaseousfuel from coal. Synthesis gas from a coal gasifier is shifted to a gas mixture consisting mainly of H2 and CO2. The CO2 is isolated by a physical absorption process, compressed,and transported by pipeline to a depleted natural gas field where it is injected. What remains is a gaseousfuel consisting mainly of hydrogen. We describe two applications of this fuel. The first involves a combined cycle power plant integrated with the coal gasifier, the shift reactor and the CO2 recovery units. CO2 recovery and storage will increase the electricity production cost by one third. The secondprovides hydrogen or a hydrogen-rich fuel gas for distributed applications, including transportation; it is shown that the fuel can be produced at a cost comparable to projected costs for gasoline. A preliminary analysis reveals that all components of the process described here are in such a phase of development that the proposed technology is ready for demonstration. ~'> --. ~'"' .,.,""~ 0\ ~ 0\0 ;.., ::::. ~ ~ -.., 01) §~ .5~ c0 ~.., ~'> '" .~ ~ ..::. ~ ~ "'~'" '" 0\00--. ~~ ""00 Q....~~ '- ~~ --. ~.., ~ ~ ""~ 0000 .00 t¥") $ ~ .9 ~~~ .- ..~ c ~ ~ ~ .~ O"Oe) """1;3 .0 .-> ...~ 0 ~ ,9 u u "0 ...~ --.