Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hassle-Free EV Charging Solutions

A Lotte Invested Company AI and Computer Vision Smart EV Charging System Hassle-free EV Charging Solutions Classified Document. © 2019 oneCHARGE Solutions Limited. All rights reserved. ABOUT oneCHARGE Established 2017 From Hong Kong and now in Korea Expanding rapidly in Asia Hong Kong, Macau and Korea and some Asia location Strong reference Invested and co-operating with Lotte Group World’s first Computer Vision + AI Huge analytics data + customer engaging solutions Bridge between properties & client Transform the demand of EV charging into revenue & important analytics data WHAT WE DO EV Charging Application Open management Systems with payment solution with analytics INNOVATION Auto. Charging Experience Computer Vision & AI Based Load-balancing Automation - PATENTED Customer Analytics System Technology Load balancing maximizes number of EV chargers intelligently. Successful Case Significantly reduce the wait time Expansion in progress Satisfy charging demand Huge amount of analytics Providing tones of information for management and customers marketing No-longer endless promotion Payment system and management system ready for real-operation Residential Installation No more waiting or queue Sharing to other users Income in vacant time Trackable usage record Everything is trackable Perfect scenario of EV driving Case Study PROBLEMS After meetings with Lotte Management, they are facing Long waiting and Expensive Can only serve 1 Very Complicated Charging time to deploy car per charger Operation PROBLEMS Lack of chargers Takes up huge Requires -

Good Morning Vietnam

February 25, 2021 Good Morning Vietnam To subscribe to our report, please contact us at [email protected] Market performance VIETNAM STOCK MARKET Last trade 1D (%) 1M (%) 1Y (%) VN-INDEX 1,162.01 -1.33 -0.35 27.74 Sharp drop with foreign continued outflow HNX 237.89 -0.37 2.61 123.03 Vietnam stock market saw a sudden drop amid foreign investors continued their net selling UPCOM 76.22 -0.32 -1.55 37.27 on the 3rd consecutive day. VN-Index maintained a slight gain during the morning with MSCI EM 1,376.76 -1.53 -2.37 30.31 sideways trend and steady trading volume. After lunch break, the index suddenly fell while NIKKEI 30,190.71 1.75 4.75 33.56 the volume jumped. Despite seeing somewhat recovery, VN-Index still recorded a HANG SENG 29,718.24 -2.99 -1.46 10.50 significant loss of 15.63 points (-1.33% DoD) to closed at 1,162.01 points. The trading KOSPI 3,053.73 1.96 -4.84 45.17 volume and value maintained high at 603mn shares (flat DoD) and VND15,017bn (-2.62% FTSE 6,658.97 0.50 0.30 -5.11 DoD). S&P 500 3,925.43 1.14 2.19 21.69 Banks and Real Estates stocks was the main cause of market decrease as VHM (-2.37%), NASDAQ 13,597.97 0.99 0.41 47.46 VCB (-1.90%), VIC (-1.64%), GVR (-3.68%), BID (-2.16%) plunged. Valuation Overseas investors recorded a net-selling worth of VND684.62bn on HOSE. -

Library of Congress Classification

R MEDICINE (GENERAL) R Medicine (General) Periodicals. Societies. Serials 5 International periodicals and serials 10 Medical societies Including aims, scope, utility, etc. International societies 10.5.A3 General works 10.5.A5-Z Individual societies America English United States. Canada 11 Periodicals. Serials 15 Societies British West Indies. Belize. Guyana 18 Periodicals. Serials 20 Societies Spanish and Portuguese Latin America 21 Periodicals. Serials 25 Societies 27.A-Z Other, A-Z 27.F7 French Europe English 31 Periodicals. Serials 35 Societies Dutch 37 Periodicals. Serials 39 Societies French 41 Periodicals. Serials 45 Societies German 51 Periodicals. Serials 55 Societies Italian 61 Periodicals. Serials 65 Societies Spanish and Portuguese 71 Periodicals. Serials 75 Societies Scandinavian 81 Periodicals. Serials 85 Societies Slavic 91 Periodicals. Serials 95 Societies 96.A-Z Other European languages, A-Z 96.H8 Hungarian Asia 97 English 97.5.A-Z Other European languages, A-Z 97.7.A-Z Other languages, A-Z Africa 98 English 98.5.A-Z Other European languages, A-Z 98.7.A-Z Other languages, A-Z 1 R MEDICINE (GENERAL) R Periodicals. Societies. Serials -- Continued Australasia and Pacific islands 99 English 99.5.A-Z Other European languages, A-Z 99.7.A-Z Other languages, A-Z Indexes see Z6658+ (101) Yearbooks see R5+ 104 Calendars. Almanacs Cf. AY81.M4 American popular medical almanacs 106 Congresses 108 Medical laboratories, institutes, etc. Class here papers and proceedings For works about these organizations see R860+ Collected works (nonserial) Cf. R126+ Ancient Greek and Latin works 111 Several authors 114 Individual authors Communication in medicine Cf. -

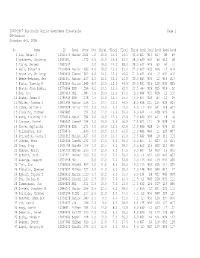

2006-2007 Wisconsin Junior Open/Open Crosstable Page 1 UW-Oshkosh November 4-5, 2006

2006-2007 Wisconsin Junior Open/Open Crosstable Page 1 UW-Oshkosh November 4-5, 2006 No. Name ID Team Rate Pts TBrk1 TBrk2 TBrk3 TBrk4 Rnd1 Rnd2 Rnd3 Rnd4 Rnd5 1 Luo, Brian J 12910173 Madisn 2024 5.0 16.0 15.0 54.0 32.0 W27 W13 W17 W9 W3 2 Mckinney, Christop 12934651 1772 4.5 16.0 14.5 52.0 28.0 W30 W33 W6 W10 D8 3 Yusim, Sergey 12852542 4.0 19.0 14.0 58.0 28.0 W12 W29 W5 W4 L1 4 Bell, Samuel W 21014944 Madisn 1663 4.0 15.0 13.0 51.0 22.0 W22 W35 W16 L3 W14 5 Brown Jr, Christop 12849430 GlenNi 1501 4.0 14.5 12.0 46.0 21.0 W31 W34 L3 W21 W16 6 Webne-Behrman, Ger 12901591 Madisn 1437 4.0 14.5 12.0 43.5 20.0 W43 W36 L2 W19 W13 7 Hintz, Timothy M 12752556 Marion 1545 4.0 13.5 12.0 44.5 20.0 W37 W19 L10 W33 W25 8 Bowen, John Armbru 12779264 USM 1596 4.0 13.5 11.5 42.0 22.5 -H- W26 W15 W14 D2 9 Her, Sou 12805616 MSL 1687 3.5 16.5 12.5 51.0 19.5 W44 W21 W18 L1 D10 10 Bowen, James H 12786949 USM 1278 3.5 14.0 12.5 45.0 15.5 W53 W49 W7 L2 D9 11 Miller, Joshua D 12871494 Marion 1516 3.5 13.5 10.0 44.5 18.0 W38 D15 L14 W24 W29 12 Dumke, Nathan C 12849428 Marion 1227 3.5 13.5 9.0 43.0 16.0 L3 W41 W34 D18 W27 13 Clausing, Michael 12864685 1254 3.0 17.0 10.0 50.0 16.0 W24 L1 W38 W20 L6 14 Wang, Xiaoming Tim 12976014 MadJf 1254 3.0 16.5 12.0 47.5 17.0 W40 W20 W11 L8 L4 15 Lancour, Daniel 12859342 JanesP 1158 3.0 16.0 9.5 46.5 17.5 W23 D11 L8 W28 D18 16 Ghose, Saptarshi 12870578 USM 1271 3.0 14.5 11.0 42.5 13.0 W45 W28 L4 W39 L5 17 Gallenberg, Bob 12779870 1436 3.0 13.5 10.0 41.5 11.0 W41 W46 L1 L25 W37 18 Petrashek, Casey D 12911815 Madisn 1427 3.0 13.0 -

New Summer Season

New Summer Season Furniture Catalog — Live life outdoors® — Nomah® Nomah® 3 Seat Sofa W90" x D36" x H30" $4,699 (Slub Linens fabric) Nomah® Lounge Chair W40" x D36" x H30" $2,749 (Slub Linens fabric) Nomah® Coffee Table W40" x D40" x H12" $599 Choose your own cover from our outdoor fabric range. 5 Bronte The staple table for summer entertaining a b Find our furniture range online at ecooutdoorusa.com a. Bronte Dining Table W87" x D40" x H30" W107" x D40" x H30" W166" x D40" x H30" $2,499 | $2,899 | $4,999 b. Bronte Bench Seat Bronte Stool W69" x D18" x H19" W500 x D500 x H460 W87" x D18" x H19" $399 $999 | $1,199 6 ® Barwon Sophisticated, European-inspired design a. Barwon® Dining Chair W20" x D25" x H35" $499 b. Barwon® Dining Armchair W23" x D25" x H35" $549 c. Barwon® Bar Stool W20" x D25" x H45" $649 ® d. Barwon Side Table a W18" x D16" x H16" $199 Find our furniture range online at ecooutdoorusa.com b c d 9 Porto & Hux Modern & slimline design a. Porto Dining Table W71" x D36" x H30" $1,599 b. Porto Extending Dining Table W87-111" x D40" x H30" a $2,599 c. Porto Dining Table W36" x D36" x H30" $899 d. Porto Bench W63" x D18" x H19" W78" x D18" x H19" $799 | $999 e. Hux Dining Chair W19" x D21" x H34" b $319 Find our furniture range online at ecooutdoorusa.com c d e 10 The Hayfield combines unique curved arms Hayfield and refined componentry for a timeless look. -

Heater Element Specifications Bulletin Number 592

Technical Data Heater Element Specifications Bulletin Number 592 Topic Page Description 2 Heater Element Selection Procedure 2 Index to Heater Element Selection Tables 5 Heater Element Selection Tables 6 Additional Resources These documents contain additional information concerning related products from Rockwell Automation. Resource Description Industrial Automation Wiring and Grounding Guidelines, publication 1770-4.1 Provides general guidelines for installing a Rockwell Automation industrial system. Product Certifications website, http://www.ab.com Provides declarations of conformity, certificates, and other certification details. You can view or download publications at http://www.rockwellautomation.com/literature/. To order paper copies of technical documentation, contact your local Allen-Bradley distributor or Rockwell Automation sales representative. For Application on Bulletin 100/500/609/1200 Line Starters Heater Element Specifications Eutectic Alloy Overload Relay Heater Elements Type J — CLASS 10 Type P — CLASS 20 (Bul. 600 ONLY) Type W — CLASS 20 Type WL — CLASS 30 Note: Heater Element Type W/WL does not currently meet the material Type W Heater Elements restrictions related to EU ROHS Description The following is for motors rated for Continuous Duty: For motors with marked service factor of not less than 1.15, or Overload Relay Class Designation motors with a marked temperature rise not over +40 °C United States Industry Standards (NEMA ICS 2 Part 4) designate an (+104 °F), apply application rules 1 through 3. Apply application overload relay by a class number indicating the maximum time in rules 2 and 3 when the temperature difference does not exceed seconds at which it will trip when carrying a current equal to 600 +10 °C (+18 °F). -

K-12 Individual No. Name Team Gr Rate Pts Tbrk1 Tbrk2 Tbrk3 Tbrk4

K-12 Individual No. Name Team Gr Rate Pts TBrk1 TBrk2 TBrk3 TBrk4 Rnd1 Rnd2 Rnd3 Rnd4 Rnd5 Rnd6 1 Chakraborty, Dipro 11 2299 5.5 21 24 43 20.5 W27 W12 W5 W32 W8 D3 State Champion, AZ Denker Representative 2 Yim, Tony Sung BASISS 8 2135 5 20.5 23.5 38.5 17.5 W24 W10 D3 D16 W11 W9 3 Aletheia-Zomlefer, Soren CHANPR 11 1961 5 20 23 35.5 18.5 W25 W26 D2 W40 W15 D1 4 Desmarais, Nicholas Eduard NOTRED 10 1917 5 18 20 33 18 W39 W23 W18 L15 W10 W8 5 Wong, Kinsleigh Phillip CFHS 10 1992 4.5 20 20 24.5 15 -X- W17 L1 W26 D7 W15 6 Todd, Bryce BASISC 10 1923 4.5 17 19 26.5 14.5 W38 D18 L9 W23 W21 W16 7 Chaliki, Kalyan DSMTHS 9 1726 4.5 17 18.5 26 15 W46 L16 W28 W22 D5 W17 8 Li, Bohan UHS 9 2048 4 22 25 29 18 W30 W11 W45 W9 L1 L4 9 Mittal, Rohan CFHS 9 1916 4 19.5 20.5 23 17 W47 W22 W6 L8 W20 L2 10 Pennock, Joshua CFHS 10 1682 4 19 22 24 14 W31 L2 W25 W21 L4 W29 11 Aradhyula, Sumhith CFHS 9 1631 4 18 20 22 14 W41 L8 W38 W13 L2 W19 12 Johnston, Nicolas Godfrey CFHS 9 1803 4 18 19.5 21 13 W43 L1 W29 L17 W24 W20 13 Martis, Tyler BRHS 12 1787 4 17 18 21 13 W42 L15 W24 L11 W18 W22 14 Plumb, Justin Rodney GCLACA 10 1700 4 16 17 20 13 W51 L32 W19 L20 W28 W27 15 Martinez, Isaac GLPREP 10 2159 3.5 21.5 24.5 27.5 16 W28 W13 D16 W4 L3 L5 16 Chen, Derek H CFHS 10 1965 3.5 21 23.5 26 15.5 W35 W7 D15 D2 D17 L6 17 Woodson, Tyler GILBHS 1640 3.5 19 19 17.5 14 W50 L5 W30 W12 D16 L7 18 Cancio, Aiya CFHS 9 1469 3.5 18.5 20 17.5 12.5 W36 D6 L4 W46 L13 W25 AZ Girls' Invitational Representative 19 Folden, Kurt CHANPR 10 1207 3 14 18 12 10 L32 W50 L14 W31 W23 L11 20 Thornton, -

Changes and Continued Growth of Foreign Investment

The Top 20 Korean Multinationals: Changes and Continued Growth of Foreign Investment Seoul and New York, March 5, 2015 Graduate School of International Studies at Seoul National University in Seoul, and the Columbia Center on Sustainable Investment (CCSI), a joint center of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their survey of Korean multinationals today. The survey, conducted during 2014, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets.1 The research for this report was conducted in 2014 and covers the period from 2011 to 2013.2 Highlights In 2013, the top 20 Korean multinationals, ranked by their foreign assets (See Table 1), jointly held US$68.9 billion assets abroad.3 Most firms were subsidiaries of Korea’s eight leading business groups (or chaebols), including Samsung, POSCO, LG, Hyundai Heavy Industries, Hyundai-Kia Motors, SK, Lotte, and Hyosung Group. Five out of the 20 multinationals were also included in UNCTAD’s “Top 100 non-financial TNCs from developing and transition economies” in 2012.4 The average age of the top 20 firms is about 47 years, which is two times the average age of Korea’s top 1,000 firms (ranked in terms of total assets). There is a high concentration by the top players in the list in terms of foreign assets. Among the top 20 companies, Samsung Electronics, POSCO, and Hyundai Motor Company ranked in the top three in that order. There was a significant difference between first and second place, with the foreign assets of Samsung Electronics more than doubling that of POSCO. -

Korea Morning Focus

February 7, 2020 Korea Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) KB Financial Group (105560/Buy/TP: W63,000) KOSPI 2,227.94 62.31 2.88 Doing the best to enhance shareholder value during challenging times KOSPI 200 300.65 8.63 2.96 KOSDAQ 672.69 11.37 1.72 Korean Air (003490/Trading Buy/TP: W30,000) Disappointing results, when adjusting for accounting changes Turnover ('000 shares, Wbn) Volume Value KT (030200/Buy/TP: W36,500) KOSPI 683,230 8,335 5G-driven recovery continues KOSPI 200 108,722 5,351 KOSDAQ 927,730 4,609 Lotte Data Communication (286940/Buy/TP: W63,000) Market Cap (Wbn) Earnings dented by project delays Value KOSPI 1,501,461 KOSDAQ 243,440 KOSPI Turnover (Wbn) Buy Sell Net Foreign 2,192 2,040 152 Institutional 2,039 1,523 517 Retail 4,040 4,728 -688 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 561 495 66 Institutional 200 241 -41 Retail 3,807 3,830 -23 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,795 1,495 301 KOSDAQ 523 478 44 Advances & Declines Advances Declines Unchanged KOSPI 733 130 43 KOSDAQ 996 263 87 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 61,100 1,600 886 KODEX Leverage 14,960 845 496 Shin Poong Pharm. 9,970 1,420 488 KODEX 200 Futures 5,800 -380 363 Inverse 2X KIC Ltd 2,975 480 314 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Celltrion Healthcare 58,900 3,000 164 LabGen 8,210 640 146 HLB 104,500 6,600 131 HDI21 5,310 1,220 125 Welcron 6,240 -500 122 Note: As of February 06, 2020 This document is a summary of a report prepared by Mirae Asset Daewoo Co., Ltd. -

Table of Contents >

< TABLE OF CONTENTS > 1. Greetings .................................................................................................................................................................................... 2 2. Company Profile ........................................................................................................................................................................ 3 A. Overview ........................................................................................................................................................................... 3 B. Status of Registration ........................................................................................................................................................ 6 3. Organization .............................................................................................................................................................................. 8 A. Organization chart ............................................................................................................................................................. 8 B. Analysis of Engineers ........................................................................................................................................................ 9 C. List of Professional Engineers......................................................................................................................................... 10 D. Professional Engineer in Civil Eng.(U.S.A) .................................................................................................................. -

5/1/2021 to 5/2/2021 Meet Program

Mission Viejo Nadadores HY-TEK's MEET MANAGER 7.0 - Page 1 2021 May 1-2 SCY MVN SPMS Intrasquad - 5/1/2021 to 5/2/2021 Meet Program Heat 2 of 2 Finals Event 1 Mixed 1650 Yard Freestyle 2 Bennett, Mike P M50 MVN-CA 2:16.00 Lane Name Age Team Seed Time 3 Flatman, Ashley A W24 MVN-CA 2:08.28 Heat 1 of 1 Finals 4 Mester, Matt J M41 MVN-CA 2:10.00 2 Moore Barnett, Barbara W60 MVN-CA 29:56.53 5 Bae, Alex W25 MVN-CA 2:16.08 3 Stuart, Margaret L W62 MVN-CA 26:32.89 4 Thomas, Darcy A W52 MVN-CA 29:00.00 Event 8 Mixed 200 Yard IM Lane Name Age Team Seed Time Event 2 Mixed 1000 Yard Freestyle Heat 1 of 1 Finals Lane Name Age Team Seed Time 1 Dolan LaMar, Diana W63 MVN-CA 3:20.00 Heat 1 of 1 Finals 2 Mitchell, Robert E M62 MVN-CA 2:48.48 1 Furukawa, Patty W49 MVN-CA 16:30.00 3 Foos, Todd M45 MVN-CA 2:25.00 2 Moore Barnett, Barbara W60 MVN-CA 14:30.00 4 Mester, Matt J M41 MVN-CA 2:40.00 3 Bae, Alex W25 MVN-CA 13:59.99 5 Thomas, Darcy A W52 MVN-CA 3:20.00 4 Dolan LaMar, Diana W63 MVN-CA 14:00.00 6 Wendzel Brooks, Sherry M W60 MVN-CA 3:39.00 5 Zikova, Alena W54 MVN-CA 16:30.00 6 Montrella, Beverly J W74 MVN-CA 18:30.00 Event 9 Mixed 500 Yard Freestyle Lane Name Age Team Seed Time Event 3 Mixed 400 Yard IM Heat 1 of 2 Finals Lane Name Age Team Seed Time 2 Thomas, Darcy A W52 MVN-CA 8:30.00 Heat 1 of 1 Finals 3 Zikova, Alena W54 MVN-CA 8:00.00 2 Mitchell, Robert E M62 MVN-CA 6:11.93 4 Furukawa, Patty W49 MVN-CA 8:00.00 3 Flatman, Ashley A W24 MVN-CA 5:32.59 5 Frankel, Jonathan M69 MVN-CA 12:50.00 4 Mester, Matt J M41 MVN-CA 6:00.00 Heat 2 of 2 Finals -

Korea Morning Focus

October 22, 2019 Korea Morning Focus Sector News & Analysis Major Indices Close Chg Chg (%) Mobile Components (Overweight) KOSPI 2,064.84 4.15 0.20 IT Corporate Day review: Why now is the time to buy smartphone KOSPI 200 273.79 0.98 0.36 component stocks KOSDAQ 649.18 2.49 0.39 Turnover ('000 shares, Wbn) Volume Value KOSPI 600,283 3,598 KOSPI 200 44,907 1,946 KOSDAQ 754,168 4,694 Market Cap (Wbn) Value KOSPI 1,381,669 KOSDAQ 228,312 KOSPI Turnover (Wbn) Buy Sell Net Foreign 775 896 -121 Institutional 750 696 54 Retail 2,037 1,992 45 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 407 426 -19 Institutional 147 209 -62 Retail 4,120 4,027 93 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 721 807 -87 KOSDAQ 370 383 -12 Advances & Declines Advances Declines Unchanged KOSPI 266 554 77 KOSDAQ 372 862 78 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Feelux 7,050 460 394 Samsung Electronics 50,300 400 220 KODEX Kosdaq150 8,070 300 198 Leverage Hynix 77,500 100 163 KODEX KOSDAQ150 8,125 -170 156 INVERSE KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value HLB 167,800 38,700 752 SillaJen 14,300 1,550 276 Energy Solutions 28,850 6,650 273 Kukil Paper 5,790 -20 232 ViroMed 85,800 1,500 124 Note: As of October 21, 2019 This document is a summary of a report prepared by Mirae Asset Daewoo Co., Ltd.