Chapter 11 ) AE Bicycle Liquidation, Inc., Et Al.,1 ) Case No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Current Bicycle Friendly Businesses Through Fall 2016

Current Bicycle Friendly Businesses through Fall 2016 Current Award BFB Number of Business Name Level Since Type of Business Employees City State PLATINUM Platinum 1 California - Platinum Platinum CA University of California, Davis Platinum 2013 Education 20,041 Davis CA Facebook Platinum 2012 Professional Services 5,289 Menlo Park CA Ground Control Systems (previously listed as Park a Bike) Platinum 2014 Manufacturing/Research 14 Sacramento CA Bici Centro/Santa Barbara Bicycle Coalition Platinum 2014 Non-Profit 6 Santa Barbara CA SONOS INC Platinum 2015 Telecommunications & Media 389 Santa Barbara CA Santa Monica Bike Center Platinum 2012 Bicycle Shop 11 Santa Monica CA Colorado - Platinum Platinum CO City of Fort Collins Platinum 2011 Government Agency 551 Fort Collins CO New Belgium Brewing Company Platinum 2009 Hospitality/Food/Retail 410 Fort Collins CO District of Columbia - Platinum Platinum Washington Area Bicyclist Association Platinum 2014 Non-Profit 18 Washington DC Idaho - Platinum Platinum ID Boise Bicycle Project Platinum 2011 Bicycle Shop 12 Boise ID Illinois - Platinum Platinum IL The Burke Group Platinum 2010 Professional Services 168 Rosemont IL Indiana - Platinum Platinum IN Bicycle Garage Indy Downtown Platinum 2016 Bicycle Shop 5 Indianapolis IN Massachusetts - Platinum Platinum MA Urban Adventours Platinum 2008 Hospitality/Food/Retail 25 Boston MA Landry's Bicycles Platinum 2008 Bicycle Shop 24 Natick MA Minnesota - Platinum Platinum MN Quality Bicycle Products Platinum 2008 Bicycle Industry 450 Bloomington MN Target -

The Paterek Manual

THE PATEREK MANUAL For Bicycle Framebuilders SUPPLEMEN TED VERSION Written by: Tim Paterek Photography by: Kelly Shields, Jens Gunelson, and Tim Paterek Illustrated by: Tim Paterek Photolabwork by: Jens Gunelson Published by: Kermesse Distributors Inc. 464 Central Avenue Unit #2, Horsham, PA 19044 216-672-0230 ACKNOWLEDGEMENTS This book would not have been possible without help from the following people: Terry Osell Chris Kvale Roy Simonson Cecil Behringer Kelly Shields Jens Gunelson Dr. Josephine Paterek John Corbett Ginny Szalai Steve Flagg Special thanks must also go to: Dr. Hank Thomas Dr. James Collier Dr. Joseph Hesse John Temple Ron Storm Paul Speidel Laura Orbach Marty Erickson Mary Rankin Terry Doble Todd Moldenhauer Jay Arneson Susan Burch Harvey Probst Alan Cambronne Laurel Hedeen Martha Kennedy Bill Farrell Bill Lofgren Andy Bear The following companies were particularly help ful during the writing of this book: T.I. Sturmey-Archer of America Phil Wood Bicycle Research Binks Blackburn Design Dynabrade Handy Harmon Henry James New England Cycling Academy Strawberry Island Cycle Supply Ten Speed Drive Primo Consorizio G.P. Wilson Quality Bicycle Products Zeus Cyclery True Temper Cycle Products East side Quick Print Shimano Sales Corp. Santana Cycles Modern Machine and Engineering 3M AUTHORS FOREWORD There are many types of bicycle framebuilders and they can be easily categorized in the following way: 1. They offer custom geometrical specifications for each individual customer. 2. They offer any frame components the customer requests. i.e. tubing, lugs, dropouts, crown, shell, etc. 3. They offer custom finishing with a wide range of color choices. 4. They also offer the customer the option of building up a complete bike with any gruppo the customer wants. -

Transience10

a publication of ADVENTURE CYCLING ASSOCIATION AN EPIC ACT OF TRANSIENCE10 $6.95 OCT/NOV 2019 Vol.46 No.8 STACK LONG DAYS. CLIMB LIKE A MOUNTAIN GOAT. Saddle, back, neck and wrist pain no longer get a say in your plans. Our patented drive system brings together the best of traditional and recumbent touring bikes so you don’t have to sacrifice performance for comfort. But we should warn you, your cheeks may hurt from smiling. Adventure Cyclist readers get $100 off the Cruzbike of their choice Use code: ADVENTURE at C ruzbike.com Letter from the Editor online WHAT YEAR IS IT AGAIN? Revolution, evolution, and the march of progress PHOTO CONTEST OPEN NOW ➺I recently found myself standing on a quiet main ’Tis the season for submitting street in front of a small-town Montana theater. I’d your best images to the 11th been on the road for a while and small towns can start Annual Bicycle Travel Photo to look the same, but when I looked up at the marquee Contest. Winning images are published in the May 2020 and saw “Lion King,” for a moment I was sure of EDGERTONADAM neither where I was nor when. Adventure Cyclist, plus these Depending on the level of charity you’re inclined shots appear in our annual to employ, there are either no more ideas left, or we calendar. Send us your best simply evolve the same core idea over and over to at adventurecycling.org/ reintroduce it to new generations. I was certainly thinking about the photcontest now through spectrum of “invention” as I read Bob Marr’s story on page 20 about turn- November 30. -

Cyclist GO the DISTANCE

ROAD TEST 36 FINE TUNED 40 OPEN ROAD GALLERY 47 ADVENTURE CYCLIST GO THE DISTANCE. JUne 2012 WWW.ADVentURecYCLing.ORG $4.95 RIDE WISCONSIN: PLUS: SAGBRAW & BIKE RIDES MADE IN MONTANA the Midwest PROFILE: LIGHTFOOT CYCLES Recumbent Rally RIDING THE IRON CURTAIN Share the Joy GET A CHANCE TO WIN 6:2012 contents Spread the joy of cycling and get a chance to win cool prizes June 2012 · Volume 39 Number 5 · www.adventurecycling.org n For each cyclist you refer to Adventure Cycling, you will ADVENTURE get one chance to win a Giant Rapid 1* valued at over $1,250. The winner will be drawn from all eligible CYCLIST members in January of 2013. is published nine times each year by the Adventure Cycling Association, n Each month, we’ll draw a mini-prize winner who a nonprofit service organization for recreational bicyclists. Individual will receive gifts from Old Man Mountain, Arkel, membership costs $40 yearly to U.S. Ortlieb, and others. addresses and includes a subscrip- tion to Adventure Cyclist and dis- n The more new members you sign up, the more counts on Adventure Cycling maps. chances you have to win! The entire contents of Adventure Cyclist are copyrighted by Adventure Cyclist and may not be reproduced in whole or in part without written * Bicycle model may change with release of new or updated models. permission from Adventure Cyclist. All rights reserved. Adventure Cycling Association adventurecycling.org/joy OUR COVER Cycle Montana riders clip along on their recumbent tandem trike. Photo by Greg Siple. Y (left) A cyclist winds through the HANE forest on the Whitefish Trail in Adventure Cycling Corporate Members K C U Montana. -

Recumbent Table

RECUMBENT TABLE RECUMBENTS, TRIKES, QUADS, TANDEMS, AND FOLDERS Below is a list of popular recumbents, folding bikes, and tandems. If you know of any brands or models missing from this table that are specifically designed for touring or bike travel, email us at [email protected]. — Mike Deme GREG SIPLE RECUMBENTS, TOURING: round, Pino, Kettwiesel, Trix, and METABIKES meta-bikes.com, custom touring configurations Offers the MetaPhysic with 700C, TRISLED trisled.com.au, +61 AZUB azub.eu, +420 774 2982 from $3939. 650C or 26” wheels from $3295. 3 5981 0337. Offers the Gizmo 29. Offers the Six, Max, Mini, and touring trike (from $AU3700). other recumbent bikes and trikes HP VELOTECHNIK hpvelotech NAZCA LIGFIETSEN nazca- from €1890. nik.com, +49 61 92 97 99 2 0. ligfietsen.nl, +31-522-490266. TURNER RECUMBENTS turner Offers the Scorpion (basic model: Offers the Explorer, Gaucho Tour, recumbents.com, 520-290- BACCHETTA bacchettabikes. $3145), Street Machine Gte Fiero, Pioneer, and Paseo. From 5646. Offers the Transport (from com, 866-364-9677. Offers 4 ($2695), and foldable Grasshop- $1925. $960) and the Tribent Tandem versions of the Giro and the Bella per fx ($2895). (call for pricing). from $1700. OPTIMA optima-cycles.nl, ICE TRIKES icetrikes.co, +44 +31(0)251-261222. Offers the VOLAE volaerecumbents.com, CATRIKE catrike.com, 407- 1326 378848. Offers the Falcon, Oryx, and Cougar from 715-340-1133. Offers the Tour 999-0200. Offers the Expedition Adventure from $3010. €1795. (from $1595), Expedition (from and the Road touring trikes from $1595, and the Venture tandems $2550. JUST TWO BIKES justtwobikes. -

The 25Th Taipei Int'l

Taipei World Trade Center TWTC Nangang Exhibition Hall The 25th Taipei Int’l I2047 JIE SU KANG I2046 KE TUNG KENG GREEN GIANT KENT JOY Tern PACIFIC TRANS CHIUAN FA I2030 I2035 I2046 I2038 I2039 I2040 I2041 I2042 U- DAR HAR SOURCE CHUAN- APROVE IUVO TEFUA UNIQUE LEECHE SOLU- YOAN CHIEN FON MONIC KTM Gazelle ASI XIN Bicycle Parts & Accessories I2001 I2002 I2003 I2004 I2005 I2008 I2010 I2011 I2012 I2015 I2017 I2018 I2019 I2020 Image Pavilion LEV BRIGHT SUNG JIUN MATRIX SPANK THA- TUN PETER'S JO- ADVERTI METALS PROPALM BIKEFORCE DNM DURMAS GOOD HORSEHAUNG WEI CHIEH SING UNISTONE ZAW TIEN YI DAR YANTEC INDUSTRIES MES EYES GON Complete Bicycles I0001 I0003 I0004 I0006 I0008 I0009 I0010 I0012 I0013 I0015 I0017 I0019 I0021 I0022 I0024 I0026 I0027 I0028 Overseas Exhibitors Joint-booth Exhibitors CHERN SYMBIOSIS KAMI SHIANG ASHIMA CHEPARK IRWINGAWA I0802 I0301 I0501 I0901a I1002 I1101 EXUSTAR EXU- IBERA TEXPORT DYNAMIC KENG STAR MASSLOAD KEVITA SUZICO S-TECH FORMOSA M & K TANGE INE DESIGN I1401 I1102 I1202 I1301 Media I0201a I0401 I0601 I0701 I0804 I0904 I1003a I1103 CHUHN-E YUAN COLO- HOME JANG EXU- U- ASSIZE INNOVA PROWELL LUNG POWERWAY FINA GLORY ARIX YEU KCNC JEDAN URY SOON HORNG STAR MOUTH I0303a I0503a I0605 I0705a I0903a I1005a I1006 I1105 I1106 I1205a I1206 I1305a I1306 I1405 WHEEL FASEN LOONEY-MAX CHUEH MIT CYCLE WHEEL WELL APSE ORA SG SPORTS I0102 I0606 I0205a I0307 I0405 I0507 I0607 I0705 I0806 I0907a REIN GREAT FORCE HUMPERT- XTENSION AMEN NEO ASIA GO TUM SHOUH I0810 I0909a GUNIOR I1210 - SUN C6 BARADINE SHINE-HO MAC MAO JIUH- CHANG I1110 I0311 I0911a I1007a I1107 I1209a I1309a I1310 YEH BEVATO I0511 Q-LITE I0211a I TEK I0411 I0611 LI WULER LING TAIWAN A-PRO HUA CASTELLO JOY APREBIC YOUN JOHNSON ASTROACCORD I1014a I1313 I1314 TRO ASSESS VISCOUNT MARWI TECH LIVE HELIO-SER I0112 I0213a I0313 I0413a I0513 I0613a I0711 I0812 I0914 I1013a I1114 I1218 I1317 . -

State of Cycling

STATE OF CYCLING Santa Cruz County 2015 INTRODUCTION On sunny weekends, Santa Cruz County is alive lena thaler with people on bikes—cruising on West Cliff Drive, spotting wildlife from the Watsonville Slough Trails, enjoying world-class mountain biking, or just making a run to the grocery store. These cyclists are part of a growing trend, as bicycling becomes an increasingly popular form of recreation and trans- portation. In California, the percentage of biking and walking trips more than doubled between 2000 and 2010. The City of Santa Cruz had the Bicycling continues to grow, and building bike-friendly second highest rate of bike to work trips in the communities is not easy. It takes building protected state from 2008–2012. Bicycling is on the rise, and bike infrastructure that makes cycling easy for it’s here to stay. everyone. It takes the work of dozens of committed organizations, volunteers, and businesses that host All that biking impacts our county in a myriad bike rides, events, and bike safety trainings. And it of positive ways. Visitors come from across the takes determined advocacy to call for improvements country to ride our mountain bike trails or partic- and creative solutions. ipate in local road bike events. Santa Cruz County is home to international bike companies and 11 You can be a part of these changes. We hope that as local bike shops, who together employ over 1,000 you flip through these pages, you are inspired by what people. Commuting to work or running errands you see. Please consider becoming a member of an by bike takes cars off the road, and riding bicycles advocacy organization to add your voice for better helps keep Santa Cruz County residents healthy bicycling, or volunteering with one of the many non- and active. -

H.R. 2479 (Mr. Earl Blumenauer of Oregon)

UNITED STATES INTERNATIONAL TRADE COMMISSION Washington, DC 20436 MEMORANDUM ON PROPOSED TARIFF LEGISLATION of the 109th Congress 1 [Date approved: November 29, 2005]2 Bill no. and sponsor: H.R. 2479 (Mr. Earl Blumenauer of Oregon). Proponent name, location: Bicycle Product Suppliers Association, Montgomeryville, PA. Other bills on product (109th Congress only): None. Nature of bill: Temporary duty suspension through December 31, 2008. Retroactive effect: None. Suggested article description(s) for enactment (including appropriate HTS subheading(s)): Unicycles (provided for in subheading 8712.00.50). Check one: X Same as that in bill as introduced. Different from that in bill as introduced (see Technical comments section). Product information, including uses/applications and source(s) of imports: A unicycle is a rideable machine with a single wheel. A unicycle has a seat mounted on a fork, which holds a twenty to twenty-six inch wheel. Cranks and pedals are mounted directly to the hub of the wheel. China and Taiwan are the leading suppliers of unicycles to the United States. Estimated effect on customs revenue: HTS subheading: 8712.00.50 2005 2006 2007 2008 2009 Col. 1-General rate of duty 3.7% 3.7% 3.7% 3.7% 3.7% Estimated value dutiable imports $8,000,000 $8,000,000 $8,000,000 $8,000,000 $8,000,000 Customs revenue loss $296,000 $296,000 $296,000 $296,000 $296,000 Source of estimated dutiable import data: Commission estimates based on official U.S. Government statistics. 1 Industry analyst preparing report: Ruben Mata (202-205-3403); Tariff Affairs contact: Jan Summers (202-205-2605). -

Freeride Guide 01

Summer 2002 Volume 15, Issue 3 IMBA Special Report page 6-11 making freeriding work www.sterlinglorence.com INSIDE: Making Freeriding Work p. 6 l Sprockids Take Over World p. 3 l IMBA Ballot p. 16 d ÒThe role of mountain i biking in promoting r e fitness and countering c obesity, particularly in t i children, can't be o overestimated.Ó n Strength in Numbers Watching the Tour de France on the Outdoor Life Network last month, I was happy to see Lance Armstrong appear in a League of American Bicyclists membership ad. Lance has unmatched credibility among cyclists that is enhanced every July. His prominent support of the League and IMBA helps both of our organizations grow and do more for bicycling. Of course Lance isn't the only asset we have. To boost mountain biking and improve trail access, we need to connect effectively with the variety of societal trends and statistics that affirm the value of our sport. By now, most Americans have probably heard about U.S. President Bush's new effort to promote physical fitness and active lifestyles. The president has increased his training reg- imen and is encouraging all Americans to join him. The role of mountain biking in promoting fitness and countering obesity, particularly in children, can't be overestimated. It is one of the powerful societal benefits of our sport. When we describe our programs and our organizations, we need to emphasize this. (And let's not overlook the physical benefits of trailwork, either.) The power of mountain biking in enhancing tourism is important, too. -

Current Bicycle Friendly Businesses Through Summer 2015

Current Bicycle Friendly Businesses through Summer 2015 Current BFB Number of Summer Business Name Award Level Since Type of Business Employees City State 2015 Status Platinum Platinum 1 California Platinum CA University of California, Davis Platinum 2013 Non-Profit/Government 20,041 Davis CA Facebook Platinum 2012 Professional Services 5,289 Menlo Park CA Bici Centro/Santa Barbara Bicycle Coalition Platinum 2014 Non-Profit/Government 6 Santa Barbara CA SONOS INC Platinum 2015 Telecommunications & Media 389 Santa Barbara CA New Santa Monica Bike Center Platinum 2012 Bicycle Industry (includes shops) 11 Santa Monica CA Colorado Platinum CO New Belgium Brewing Company Platinum 2009 Hospitality/Food/Retail 373 Fort Collins CO Idaho Platinum ID Boise Bicycle Project Platinum 2011 Bicycle Industry (includes shops) 12 Boise ID Illinois Platinum IL The Burke Group Platinum 2010 Professional Services 168 Rosemont IL Massachusetts Platinum MA Urban Adventours Platinum 2008 Hospitality/Food/Retail 25 Boston MA Landry's Bicycles Platinum 2008 Bicycle Industry (includes shops) 24 Natick MA Minnesota Platinum MN Quality Bicycle Products Platinum 2008 Bicycle Industry (includes shops) 450 Bloomington MN Target Corp Platinum 2014 Hospitality/Food/Retail 10,000 Minneapolis MN Missouri Platinum MO Trailnet Platinum 2010 Non-Profit/Government 32 Saint Louis MO New Mexico Platinum NM Bicycle Technologies International Platinum 2010 Bicycle Industry (includes shops) 42 Santa Fe NM Oregon Platinum OR Alta Planning + Design Platinum 2008 Professional Services -

Looking for a Rebound from Tough Times SHOWING WHY LICENSING

LICENSING INFORMATION AND IDEAS TO BETTER YOUR BUSINESS J u n e 1 4 A Global Perspective: Looking for a Rebound From Tough Times 2011 As the U.S. economy makes its way through the early stages of a slow but steady recovery, there is every reason to believe that the licensing business is beginning on that same path. Anecdotal evidence WHAT’S INSIDE indicates that – after a long period in which many potential agreements seemed to be frozen by uncer- tainty about economic conditions, as well as retail conservatism – the atmosphere in the U.S. is more positive. Retail sales are creeping up, and business seems to be on the upswing. The Legal Corner: In the following pages, we’ve asked LIMA’s Managnig Directors and representatives from around the The Importance of Maintaining world to give a picture of conditions in their local licensing markets. Brand Standards Page 2 Japan Charity Campaign: 2:46 p.m. on 11th March 2011 is a moment in time that will “I Give Because I’m Grateful” remain etched on Japanese minds forever -- the unprecedented Page 3 triple crisis of an earthquake, tsunami and nuclear accident in To- hoku and Fukushima. The TV images were indescribable, the num- Nominees for the 2011 bers inconceivable -- a magnitude 9 earthquake, nearly 10 meter- International Licensing high tsunami waves, over 15,000 deaths, more than 9,000 missing, Excellence Awards 5,000 injured, over 125,000 buildings damaged or destroyed, in- Page 8 frastructural damage estimated at JPY25 trillion (US$306 billion). At retail, lost sales has been estimated to be ¥18 trillion (US$220 billion); that represents 3.3% of overall annual Japanese Comment Deadline Approaching retail economy. -

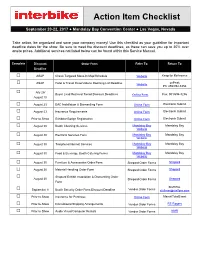

Action Item Checklist

Action Item Checklist September 20-22, 2017 ● Mandalay Bay Convention Center ● Las Vegas, Nevada Take action, be organized and save your company money! Use this checklist as your guideline for important deadline dates for the show. Be sure to meet the discount deadlines, as these can save you up to 30% over onsite prices. Additional services not listed below can be found within this Service Manual. Complete Discount Order Form Refer To: Return To Deadline □ ASAP Check Targeted Move-In Map/Schedule Website Keep for Reference onPeak □ ASAP Hotel & Travel Reservations Rooming List Deadline Website Ph: 855/992-3353 □ July 26/ Buyer Lead Retrieval Tiered Discount Deadlines Online Form Fax: 301/694-3286 August 10 □ August 23 EAC Installation & Dismantling Form Online Form Electronic Submit □ August 23 Insurance Requirements Online Form Electronic Submit □ Prior to Show Exhibitor Badge Registration Online Form Electronic Submit □ August 30 Booth Cleaning Services Mandalay Bay Mandalay Bay Website □ August 30 Electrical Services Form Mandalay Bay Mandalay Bay Website □ August 30 Telephone/Internet Services Mandalay Bay Mandalay Bay Website □ August 30 Food & Beverage Booth Catering Forms Mandalay Bay Mandalay Bay Website □ August 30 Furniture & Accessories Order Form Shepard Order Forms Shepard □ August 30 Material Handling Order Form Shepard Order Forms Shepard Shepard Exhibit Installation & Dismantling Order □ August 30 Shepard Order Forms Shepard Form Staff Pro: □ September 8 Booth Security Order Form Discount Deadline Vendor Order Forms [email protected] □ Prior to Show Insurance for Purchase Online Form Marsh/TotalEvent □ Prior to Show International Shipping Arrangements Vendor Order Forms RE Rogers □ Prior to Show Audio Visual/Computer Rentals Vendor Order Forms NMR Exhibitor Information September 20-22, 2017 ● Mandalay Bay Convention Center ● Las Vegas, Nevada CARTLOAD SERVICE SHOW MOVE-IN* Cartload service is a less expensive alternative to the standard Sunday, September 17 8:00 am – 6:00 pm drayage program for smaller exhibits.