Appendix E. Category IV Petitions | August 10, 2020 Appendix E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UCI Approved List

LIST OF APPROVED MODELS OF FRAMES AND FORKS Version on 11.08.2016 The Approval Procedure of bicycle frames and came into force on 1 January 2011 in accordance with Article 1.3.001bis of the UCI Regulations. From this date, all new models of frames and forks used by licence holders in road (RD), time trial (TT), track (TR) and cyclo-cross (CX) events must be approved on the basis of the Approval Protocol for Frames and Forks available from the UCI website. Approval by the UCI certifies that the new equipment meets the shape requirements set out in the UCI regulations. However, this approval does not certify in any case the safety of the equipment which must meet the applicable official quality and safety standards, in accordance with Article 1.3.002 of the UCI regulations. The models which are subject to the approval procedure are: all new models of frames and forks used by licence holders in road, track or cyclo-cross events, all models of frames and forks under development on 1 January 2011 which had not yet reached the production stage (the date of the order form of the moulds is evidence), any changes made to the geometry of existing models after 1 January 2011. Models on the market, at the production stage or already manufactured on 1 January 2011 are not required to be approved during the transition stage. However, the non-approved models have to comply in any case with the UCI technical regulations (Articles 1.3.001 to 1.3.025) and are subjects to the commissaires decision during events. -

100% Dual Slalom Rotorua March 5Th, 2020 PRO RIDER LIST

100% Dual Slalom Rotorua March 5th, 2020 PRO RIDER LIST # NAME NAT HOMETOWN CATEGORY SPONSORS / TEAM 115 ARMSTRONG Vinny NZL WOMEN | Pro Auckland 106 ASTLE Georgia CAN WOMEN | Pro Whistler Unior Devinci Factory Racing 103 BEECROFT Danielle AUS WOMEN | Pro North Richmond Evil, Shimano, schwalbe, dharco 135 BEERTEN Anneke NED WOMEN | Pro Marienvelde Specialized - DT Swiss - Alpinestars 108 BERNARD Mathilde FRA WOMEN | Pro Beaumont du Ventoux SCOTT/Michelin 105 BROWN Casey CAN WOMEN | Pro Revelstoke C3 project, CLIF, Dakine, Sram, Bell Helmets 104 BURBIDGE-SMITH Harriet AUS WOMEN | Pro Canberra Maxxis, KWT imports 119 CURTIS Leanna AUS WOMEN | Pro Lake Illawarra Yeti Cycles Australia 118 DEACON Lynette GBR WOMEN | Pro Rotorua Devinci NZ, Leatt NZ, Smith Optics, Sixth Element Wheels, MSC Tires, Mudhugger, Absolute Black, Invisiframe 121 FERGUSON Louise GBR WOMEN | Pro Fort William Radon - Funn mtb - Mons Royale 111 GATTO Micayla CAN WOMEN | Pro Squamish Diamondback, Oakley, Schwalbe, Abus, Skinnies 114 GILL Martha GBR WOMEN | Pro Horwich Marin Bikes, Hopetech, WTB, PNW Components, Leatt, Deity 120 GOOMES Robin NZL WOMEN | Pro Rotorua 102 HINES Kialani USA WOMEN | Pro Seattle Pivot, TLD, Maxxis 116 IJURCO Ainhoa ESP WOMEN | Pro Squamish 101 KINTNER Jill USA WOMEN | Pro Bellingham Red Bull, Norco, Shimano 117 MANCHESTER Jessica NZL WOMEN | Pro Rotorua GT Bicycles, Worralls, Torpedo7, CamelBak, Lezyne, Abus, PURE Sports Nutrition 112 MARTH Steffi GER WOMEN | Pro Plessa Trek 110 RAWSON Shania NZL WOMEN | Pro Tauranga Giant NZ 107 SCOTT Jordy USA -

Rockshox Enduro Stage 3

STAGE 3 RESULTS Bib Number First Name Last Name Division Team Name Stage 3 Time Rank 41 mike west Pro men Yeti/Fox 00:13:14.344 1 46 Nate Hills Pro men SRAM Yeti Smith 00:13:26.188Ergon Oskar Blues2 Maxxis MRP Honey Stinger 118 Tom Doran Pro Men Freedom Vans 00:13:27.352 3 111 Leland Turner Pro Men Avalanche Sports00:13:28.256 / aCOS 4 29 Chris Del Bosco Pro men GT Bicycles oakley00:13:35.111 5 25 Chris HEATH Pro men 00:13:36.121 6 34 Stan Jorgensen Pro men SCOTT sports Easton00:13:37.519 Cycling Race7 Face Continental 119 Austin Hackett-Klaube Pro Men Santa Cruz/Novik 00:13:40.215Gloves/Fox MTB 8 47 Ryan Geiger Pro men FRM Factory Racing00:13:42.545 / Geiger Coaching9 43 Harrison Ory Pro men 00:14:00.037 10 142 Spencer Powlison Pro Men Evol Racing 00:14:03.005 11 26 Fritz Bratschie Pro men None 00:14:08.778 12 121 Dacre Dunn Pro Men 00:14:08.930 13 113 fernando riveros Pro Men EVOC USA 00:14:11.981 14 44 Matt Jones Pro men Momma 00:14:16.778 15 35 Mike Giese Pro men Push Industries Pivot00:14:23.819 Cycles Onyx Mojo16 Wheels Novik Gloves 45 Adam Hart Pro men double diamond 00:14:24.604 17 31 Whitey DeBroux Pro men Team OG 00:14:26.248 18 37 Jamas Stiber Pro men Lenz Sport Oakley00:14:26.783 Swiftwick 19 28 Alex Boday Pro men Santa Cruz Bicycles00:14:37.820 ONE Spy MRP20 Maxxis LiveUnbound GoPro 42 Eric Biboso Pro men 00:14:39.456 21 39 Ryan Clark Pro men Free Agent 00:14:44.578 22 116 Rick King Pro Men ` 00:14:49.390 23 128 Noah Sears Pro Men BH / MRP / ENVE00:14:52.290 24 108 Sam Chipkin Pro Men Venture Sports/Drummer00:15:05.182 Racing -

Current Bicycle Friendly Businesses Through Fall 2016

Current Bicycle Friendly Businesses through Fall 2016 Current Award BFB Number of Business Name Level Since Type of Business Employees City State PLATINUM Platinum 1 California - Platinum Platinum CA University of California, Davis Platinum 2013 Education 20,041 Davis CA Facebook Platinum 2012 Professional Services 5,289 Menlo Park CA Ground Control Systems (previously listed as Park a Bike) Platinum 2014 Manufacturing/Research 14 Sacramento CA Bici Centro/Santa Barbara Bicycle Coalition Platinum 2014 Non-Profit 6 Santa Barbara CA SONOS INC Platinum 2015 Telecommunications & Media 389 Santa Barbara CA Santa Monica Bike Center Platinum 2012 Bicycle Shop 11 Santa Monica CA Colorado - Platinum Platinum CO City of Fort Collins Platinum 2011 Government Agency 551 Fort Collins CO New Belgium Brewing Company Platinum 2009 Hospitality/Food/Retail 410 Fort Collins CO District of Columbia - Platinum Platinum Washington Area Bicyclist Association Platinum 2014 Non-Profit 18 Washington DC Idaho - Platinum Platinum ID Boise Bicycle Project Platinum 2011 Bicycle Shop 12 Boise ID Illinois - Platinum Platinum IL The Burke Group Platinum 2010 Professional Services 168 Rosemont IL Indiana - Platinum Platinum IN Bicycle Garage Indy Downtown Platinum 2016 Bicycle Shop 5 Indianapolis IN Massachusetts - Platinum Platinum MA Urban Adventours Platinum 2008 Hospitality/Food/Retail 25 Boston MA Landry's Bicycles Platinum 2008 Bicycle Shop 24 Natick MA Minnesota - Platinum Platinum MN Quality Bicycle Products Platinum 2008 Bicycle Industry 450 Bloomington MN Target -

Freeride Guide 04

sponsored by THE FOURTH ANNUAL FREERIDE GUIDE The emergence of bike parks, overcoming objections to freeriding and more. Plus, three new IMBA Epic Rides! Fall 2006 Out of the Shadows Richard Cunningham Editor-at-Large, Mountain Bike Action magazine Years ago, hardcore mountain bikers disappeared into the rainforests of the Pacific Northwest to build log rides and ladder bridges over the tangled forest floor. The sport of freeriding has since emerged from the shadows, and mountain biking is much richer for it. All of us, at least once, have been swept by the burst of exhilaration that follows the first successful passage of a once-impossible section of trail. Freeriding provides unprecedented opportunities for that experience. Mountain bikers have always pushed the boundaries of what can be ridden on two wheels. Who hasn’t paused at the edge of a precipice, however small, to watch a better bike handler give it a go, or mustered the courage to ride a section that we once walked. Freeriders have honed the sport’s challenging aspects into a lifestyle. The risk and intensity may exceed anything that the average rider would choose to face, but the core experience is the same. Well, almost. “Freerider” also describes a professional cyclist in jeans and a T-shirt, upside down, 30 feet above a televised crowd, gapping the space between wooden towers plastered with advertisements. It can be argued that daredevils jumping highways, or launching from obscenely huge stunts aboard 10-inch-travel monster bikes have as much in common with exploring the woods on a hardtail as the Stealth Bomber relates to a crow. -

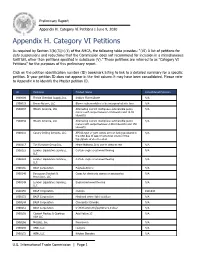

Prelim Appendix H Category 6 Petitions

Preliminary Report Appendix H. Category VI Petitions | June 9, 2020 Appendix H. Category VI Petitions As required by Section 3(b)(3)(c)(ii) of the AMCA, the following table provides: “(VI) A list of petitions for duty suspensions and reductions that the Commission does not recommend for inclusion in a miscellaneous tariff bill, other than petitions specified in subclause (V).” These petitions are referred to as "Category VI Petitions” for the purposes of this preliminary report. Click on the petition identification number (ID) bookmark listing to link to a detailed summary for a specific petition. If your petition ID does not appear in the first column it may have been consolidated. Please refer to Appendix A to identify the Master petition ID. ID Petitioner Product Name Consolidated Petitions 1900009 Florida Chemical Supply, Inc. Sodium Fluorosilicate N/A 1900019 Broan-Nutone, LLC Blower subassemblies to be incorporated into fans N/A 1900037 Hitachi America, Ltd. Alternating current multiphase submersible pump N/A motors with output between 3 kilowatts and 14.92 kilowatts 1900038 Hitachi America, Ltd. Alternating current multiphase submersible pump N/A motors with output between 149.2 kilowatts and 150 kilowatts 1900116 Canary Drilling Services, LLC API 6A type of gate valves are not being produced in N/A the USA due to lack of economic source of the type/grade of steel needed 1900117 T.H Furniture Group Inc. Home Mattress,Only use to sleep or rest N/A 1900123 Lumber Liquidators Services, Certain engineered wood flooring N/A LLC 1900124 -

The Paterek Manual

THE PATEREK MANUAL For Bicycle Framebuilders SUPPLEMEN TED VERSION Written by: Tim Paterek Photography by: Kelly Shields, Jens Gunelson, and Tim Paterek Illustrated by: Tim Paterek Photolabwork by: Jens Gunelson Published by: Kermesse Distributors Inc. 464 Central Avenue Unit #2, Horsham, PA 19044 216-672-0230 ACKNOWLEDGEMENTS This book would not have been possible without help from the following people: Terry Osell Chris Kvale Roy Simonson Cecil Behringer Kelly Shields Jens Gunelson Dr. Josephine Paterek John Corbett Ginny Szalai Steve Flagg Special thanks must also go to: Dr. Hank Thomas Dr. James Collier Dr. Joseph Hesse John Temple Ron Storm Paul Speidel Laura Orbach Marty Erickson Mary Rankin Terry Doble Todd Moldenhauer Jay Arneson Susan Burch Harvey Probst Alan Cambronne Laurel Hedeen Martha Kennedy Bill Farrell Bill Lofgren Andy Bear The following companies were particularly help ful during the writing of this book: T.I. Sturmey-Archer of America Phil Wood Bicycle Research Binks Blackburn Design Dynabrade Handy Harmon Henry James New England Cycling Academy Strawberry Island Cycle Supply Ten Speed Drive Primo Consorizio G.P. Wilson Quality Bicycle Products Zeus Cyclery True Temper Cycle Products East side Quick Print Shimano Sales Corp. Santana Cycles Modern Machine and Engineering 3M AUTHORS FOREWORD There are many types of bicycle framebuilders and they can be easily categorized in the following way: 1. They offer custom geometrical specifications for each individual customer. 2. They offer any frame components the customer requests. i.e. tubing, lugs, dropouts, crown, shell, etc. 3. They offer custom finishing with a wide range of color choices. 4. They also offer the customer the option of building up a complete bike with any gruppo the customer wants. -

Show Daily 08 Show Day One 6

SHOW DAILY 08 MESSE FRIEDRICHSHAFEN, SEPTEMBER 4 SHOW DAY 1 Storck debuts component group A-Team’s A-Plus Ride 05 ‘Storck By Token’ to appear on flagship model Titans of Taiwan industry circle island 18 German bike sales creep higher U.S. market faces uncertainties 06 Sales eke out one percent gain Bike sales flat despite high gas prices 26 Hide what you ride Product Extravaganza! 08 Protanium’s batteries The latest and greatest 32-37 are out of sight A Giant gets bigger 15 World’s biggest bike maker posts record half partner: marketing marketing Kavanagh Beckendorff by: published published Demo Sun shines on ... Day Lezyne designs its future Toolmaker opens new Taiwan factory 38 ~ESD2 Mag FINAL.indd 1 15.09.2008 20:14:21 Uhr ~ESD2 Mag FINAL.indd 2 15.09.2008 19:49:31 Uhr Demo Day News Sun Shines on Eurobike Demo Day NEW VENUE DRAWS DEALER CROWDS tefan Reisinger was all smiles at S the entrance to Eurobike’s Demo Day yesterday morning. Reisinger, Eurobike’s project manager, was pleased with the warm and sunny weather and the strong turnout of dealers who showed up to test-ride bikes. Jan-Willem van Schaik Beckendorff Bike Europe Megan Tompkins Kavanagh Bicycle Retailer & Industry News PROJECT MANAGERS GRAPHIC DESIGN Jo Beckendorff Markus Ziermann Email: [email protected] Reisinger said around 100 him that the company could “You could ride a road bike Email: [email protected] companies exhibited at expand its demo booth for on 80 percent of them; a Tom Kavanagh MARKETING PARTNER / Eurobike’s second annual next year. -

ASX Owner's Manual '07 Yeti Cycles 600 Corporate Circle, Unit D

ASX Owner’S MANUAl ‘07 YETI CycLES 600 CORPORATE CIRCLE, UNIT D GOLDEN, CO 80401 USA 303.278.6909 / 888.576.9384 www.yeticycles.com Table of Contents Brand Overview 4 Frame Features 6 Geometry 8 Maintenance Schedule 10 Bike Setup Overview 12 ū Shock Setup FOX DHX 5.0 14 ū Shock Setup Quick Start Guide 16 ū Cable Routing 18 Assembly Overview 22 ū Assembly 24 ū Disassembly Tips 30 Exploded Views 32 Part List 34 Warranty 36 Contact Information 37 Overview WELCOME TO THE TRIBE Congratulations on your purchase of a new Yeti bicycle and welcome to the Yeti Tribe. We are confident your new bicycle will exceed your expectations for value, performance, and ride quality. Each frameset and component has been custom specified and designed to enhance your riding experience. Whether you are a beginner cyclist, or a seasoned pro, Yeti bicycles will provide endless hours of two-wheeled fun GENERAL INFORMATION This model specific manual is designed to be used assembly, setup, and maintenance of your bicycle in conjunction with he general Yeti owner’s manual Yeti recommends that all service and repairs be and the manuals supplied by the suspension performed by an authorized Yeti Dealer. manufactures.. If you did not receive the Yeti owner’s This manual contains many “Warnings” and manual or the manual provided by the suspension “Cautions” concerning the consequences of failure manufacturer download the materials off the to maintain or inspect your bicycle. The combination Internet, or contact your dealer. of the safety alert symbol and the word “Warning” Bicycling can be a hazardous activity even under indicates a potentially hazardous situation in which , the best of circumstances. -

2007 USA Cycling MTB National Gravity Calendar Men's Standings

2007 USA Cycling MTB National Gravity Calendar Men’s Standings Rank Name Team Points 1. GRAVES Jared Yeti / Fox Racing Factory Team 495 2. AVALIER Amiel NSW Giant 476 3. LEOV Justin Yeti / Fox Racing Team 334 4. BANGERT Cole Morewood Factory Team 319 5. CARTER Eric Unattached 308 6. RANDO Jared Giant MTB Team 307 7. STROBEL Luke Team MAXXIS 286 8. WARREN Cody C-Dub Racing 264 9. SMITH Waylon Specialize 260 10. LEONARD Kain PC Rider / Maxxis 243 11. MILAN Ross Yeti/ Fox Racing Team 238 12. CRAIG Adam Giant MTB Team 220 13. BENKE Jurgen Old World Plaster 213 14. HERNDON Christpoher Specialized/Cane Creek 207 15. HOUSEMAN Rich Yeti / Fox Racing Team 200 16. SHARP TJ Yeti / Fox Racing Shox 183 17. BOICE Chris Fox Racing 182 18. NEETHLING Andrew Honda/Turner 180 19. FAWLEY Bryan Kenda/X-Fusion 170 20. DECKER Carl Giant 164 21. RIFFLE Duncan Honda IronHorse 164 22. WEST Mike Maverick 160 23. RENNIE Nathan Santa Cruz Syndicate 150 24. HOLMES Dale KHS Bicycles 145 25. CAMP David Unattached 141 26. KRAHENBUHL Eli Trek/Fox/Gamut 138 27. ATKINSON Bryn GT Bicycles 137 28. WENTZ Steve Turner/Fox 136 29. CAMERON Cole Maxxis 133 30. NOBMAN Derrick Ninety Degrees/Iron Horse 130 31. CONDRASHOFF Ryan WTB Santa Cruz X-Fusion 128 32. LINDSLEY Ariel Maverick 127 33. PEAT Steve Santa Cruz Syndicate 120 34. POWELL Chris Avent / Bombshell 120 35. KEENE Curtis SRAM/Specialized 106 36. HANNAH Mick Cannondale 98 37. KLAASSENVANOORSCH David ODI/Southridge/ Utopia 98 38. BENNETT Kieran IronHorse/Utopia/SD 97 39. -

Bicycles Mcp-2776 a Global Strategic Business Report

BICYCLES MCP-2776 A GLOBAL STRATEGIC BUSINESS REPORT CONTENTS I. INTRODUCTION, METHODOLOGY & Pacific Cycles Launches New Sting-Ray .............................II-16 PRODUCT DEFINITIONS Mongoose Launches Ritual ..................................................II-16 Multivac Unveils Battery-Powered Bicycle .........................II-17 TI Launches New Range of Mountain Terrain Bikes ...........II-17 II. EXECUTIVE SUMMARY TI Inaugurates its First Cycleworld Outlet ...........................II-17 Shanghai Greenlight Electric Bicycle Launches 1. Introduction................................................................. II-1 Powerzinc Electric ............................................................II-17 Smith & Wesson Introduces Mountain Bikes in 2. Industry Overview ...................................................... II-2 Three Models....................................................................II-17 Historic Review......................................................................II-2 Diggler Unveils a Hybrid Machine.......................................II-17 Manufacturing Base Shifting to Southeast Asia .....................II-2 Avon Introduces New Range of Bicycle Models..................II-18 Manufacturing Trends............................................................II-3 Dorel Launches a New Line of Bicycle Ranges ...................II-18 Factors Affecting the Bicycle Market.....................................II-3 Ford Vietnam Launches Electric Bicycles............................II-18 Characteristics of the -

Cannondale Alpine Bikes World Enduro Peebles, Scotland | May 30-31 RESULTS

Cannondale Alpine Bikes World Enduro Peebles, Scotland | May 30-31 RESULTS Rank # NAME NAT CLASS TEAM HOMETOWN OVERALL BEHIND STAGE 1 RANK 1 STAGE 2 RANK 2 STAGE 3 RANK 3 STAGE 4 RANK 4 STAGE 5 RANK 5 STAGE 8 RANK 8 PENALTIES 1 1 Tracy MOSELEY GBR E1 WOMEN Trek Factory Racing Enduro Team Malvern 00:37:17.49 00:05:08.44 1 00:04:25.25 1 00:03:47.29 1 00:05:03.05 1 00:05:29.84 1 00:13:23.62 2 2 2 Anne Caroline CHAUSSON FRA E1 WOMEN Ibis Cycles Enduro Race Team Pernes Les Fontaines 00:38:23.08 +1:05.59 00:05:31.60 2 00:04:34.93 2 00:03:54.43 3 00:05:10.76 3 00:05:38.38 3 00:13:32.98 3 3 3 Cecile RAVANEL FRA E1 WOMEN Commençal Vallnord Enduro Montauroux 00:38:34.65 +1:17.16 00:05:36.79 4 00:04:41.10 5 00:03:50.44 2 00:05:16.65 5 00:05:34.39 2 00:13:35.28 4 4 4 Anneke BEERTEN NED E1 WOMEN Specialized Racing Marienvelde 00:38:44.13 +1:26.64 00:05:33.85 3 00:04:38.69 3 00:04:01.94 5 00:05:07.33 2 00:06:16.96 5 00:13:05.36 1 5 9 Isabeau COURDURIER FRA E1 WOMEN Rocky Mountain Urge BP Rally Team Gardanne 00:39:58.82 +2:41.33 00:05:42.81 9 00:04:40.04 4 00:04:04.68 6 00:05:13.72 4 00:06:09.62 4 00:14:07.95 10 6 6 Anita GEHRIG SUI E1 WOMEN Ibis Cycles Enduro Race Team Falera 00:40:21.99 +3:04.50 00:05:39.94 7 00:04:53.39 8 00:04:13.42 7 00:05:33.21 9 00:06:20.14 6 00:13:41.89 5 7 10 Katy WINTON GBR E1 WOMEN Endura Bergamont Factory Team Peebles 00:40:59.51 +3:42.02 00:05:51.99 13 00:04:53.84 9 00:04:15.83 9 00:05:24.78 6 00:06:30.89 8 00:14:02.18 7 8 5 Ines THOMA GER E1 WOMEN Canyon Factory Enduro Team Wildpoldsried 00:41:02.74 +3:45.25 00:05:38.43