India Digital Financial Inclusion: Journey Map Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DIGITAL INDIA CORPORATION a Section 8 Company, Ministry of Electronics and Information Technology, Govt

Advt. No. N-21/49/2021-NeGD DIGITAL INDIA CORPORATION A section 8 Company, Ministry of Electronics and Information Technology, Govt. of India Delhi Office: Electronics Niketan Annexe, 6 CGO Complex, Lodhi Road, New Delhi - 110003 Tel.: +91 (11) 24360199 / 24301756 Website: www.dic.gov.in WEB ADVERTISEMENT 18th August 2021 Digital India Corporation has been set up by the ‘Ministry of Electronics & Information Technology, Government of India’, to innovate, develop and deploy ICT and other emerging technologies for the benefit of the common man. It is a ‘not for profit’ Company under Section 8 of the Companies Act 2013. The Company has been spearheading the Digital India programme of the Government of India, and is involved in promoting use of technology for e-Governance, e-Health, Telemedicine, e-agriculture, e-Payments etc. The Digital India programme promotes safety and security concerns of growing cashless economy and addresses challenges confronting its wider acceptance. It also promotes innovation and evolves models for empowerment of citizens through Digital initiatives and promotes participatory governance and citizen engagement across the government through various platforms including social media. Digital India Corporation is currently inviting applications for the following position for covering fixed project duration purely on Contract/ Consolidated basis. Sr. Name of the Positions No of Qualifications and Experiences Salary per Month No. Vacancies (All Inclusive) 1. Consultant/ Lead Business 01 Graduation /B.E/ B. Tech. Commensurate to Analyst (mandatory) and M. Tech. /MBA Qualifications, Skills (desirable) and Experience Qualification can be relaxed in case of exceptional candidates 2. Business Analyst 03 Graduation/B.E/B. -

(CFT) Risk Management in Emerging Market Banks Good Practice Note

Anti-Money-Laundering (AML) & Countering Financing of Terrorism (CFT) Risk Management in Emerging Market Banks Good Practice Note 1 © International Finance Corporation 2019. All rights reserved. 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 Internet: www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The contents of this document are made available solely for general information purposes pertaining to AML/CFT compliance and risk management by emerging markets banks. IFC does not guarantee the accuracy, reliability or completeness of the content included in this work, or for the conclusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. IFC or its affiliates may have an investment in, provide other advice or services to, or otherwise have a financial interest in, certain of the companies and parties that may be named herein. Any reliance you or any other user of this document place on such information is strictly at your own risk. This document may include content provided by third parties, including links and content from third-party websites and publications. IFC is not responsible for the accuracy for the content of any third-party information or any linked content contained in any third-party website. Content contained on such third-party websites or otherwise in such publications is not incorporated by reference into this document. The inclusion of any third-party link or content does not imply any endorsement by IFC nor by any member of the World Bank Group. -

Digitalised Payment the Era of Rising Fintech

INFOKARA RESEARCH ISSN NO: 1021-9056 DIGITALISED PAYMENT THE ERA OF RISING FINTECH Ms. R.Hishitaa, I MBA, SRMIST, Vadapalani e mail id: [email protected] Dr.S.Gayathry Professor, Department of Management Studies, SRMIST, Vadapalani e mail id: [email protected] ABSTRACT For a long time, Indian citizens have remained skeptical about evolving along with the pace that technology has set.But in recent years, the country has embraced change, and it has brought so much advancement in terms of how payments are simplified. An Electronic payment protocol is a series of transactions,at the end of which a payment has been made, using a token issued by a third party.Consumers expect a safe, convenient and affordable globalised payment platform. The security features for such systems are privacy, authenticity and no repudiation. India being a developing country,encourages innovation. A factor behind the rise of digital payments is the Indian Reserve Bank’s recent policy of Demonetization.One of the fintech innovations that have completely revolutionized how payments work in India is the UPI – an instant, real-time payment system developed by the National Payments Corporation of India (NPCI).Tez, built over the UPI interface, was launched in India in September 2017. Google has rebranded its payment app Google Tez to Google Pay to tap into the growing Indian digital payment space.Google Pay has now become the king of UPI apps.The purpose of this paper is to provide a brief background about the most downloaded finance app, Google Pay andits impacton the Indian Economy. KEYWORDS-e payment, payment protocol, digital payment space Volume 8 Issue 11 2019 888 http://infokara.com/ INFOKARA RESEARCH ISSN NO: 1021-9056 DIGITALISED PAYMENT – THE ERA OF RISING FINTECH 1.1. -

Privacy Gaps in India's Digital India Project

Privacy Gaps in India’s Digital India Project AUTHOR Anisha Gupta EDITOR Amber Sinha The Centre for Internet and Society, India Designed by Saumyaa Naidu Shared under Creative Commons Attribution 4.0 International license Introduction Scope The Central and State governments in India have been increasingly taking This paper seeks to assess the privacy protections under fifteen e-governance steps to fulfill the goal of a ‘Digital India’ by undertaking e-governance schemes: Soil Health Card, Crime and Criminal Tracking Network & Systems schemes. Numerous schemes have been introduced to digitize sectors such as (CCTNS), Project Panchdeep, U-Dise, Electronic Health Records, NHRM Smart agriculture, health, insurance, education, banking, police enforcement, Card, MyGov, eDistricts, Mobile Seva, Digi Locker, eSign framework for Aadhaar, etc. With the introduction of the e-Kranti program under the National Passport Seva, PayGov, National Land Records Modernization Programme e-Governance Plan, we have witnessed the introduction of forty four Mission (NLRMP), and Aadhaar. Mode Projects. 1 The digitization process is aimed at reducing the human The project analyses fifteen schemes that have been rolled out by the handling of personal data and enhancing the decision making functions of government, starting from 2010. The egovernment initiatives by the Central the government. These schemes are postulated to make digital infrastructure and State Governments have been steadily increasing over the past five to six available to every citizen, provide on demand governance and services and years and there has been a large emphasis on the development of information digital empowerment. 2 In every scheme, personal information of citizens technology. Various new information technology schemes have been introduced are collected in order to avail their welfare benefits. -

UL-ISP Licences Final March 2015.Xlsx

Unified License of ISP Authorization S. No. Name of Licensee Cate Service Authorized person Registered Office Address Contact No. LanLine gory area 1 Mukand Infotel Pvt. Ltd. B Assam Rishi Gupta AC Dutta Lane , FA Road 0361-2450310 fax: no. Kumarpara, Guwahati- 781001, 03612464847 Asaam 2 Edge Telecommunications B Delhi Ajay Jain 1/9875, Gali No. 1, West Gorakh 011-45719242 Pvt. Ltd. Park, Shahdara, Delhi – 110032 3 Southern Online Bio B Andhra Satish kumar Nanubala A3, 3rd Floor, Office Block, Samrat 040-23241999 Technologies Ltd Pradesh Complex, Saifabad, Hyderabad-500 004 4 Blaze Net Limited B Gujarat and Sharad Varia 20, Paraskunj Society, Part I, Nr. 079-26405996/97,Fax- Mumbai Umiyavijay, Satellite Road, 07926405998 Ahmedabad-380015 Gujarat 5 Unified Voice Communication B + Tamilnadu K.Rajubharathan Old No. 14 (New No. 35), 4th Main 044-45585353 Pvt. Ltd. C (including Road, CIT Nagar, Nanthanam, Chennai)+ Chennai – 600035 Bangalore 6 Synchrist Network Services Pvt. B Mumbai Mr. Kiran Kumar Katara Shop No. 5, New Lake Palace Co- 022-61488888 Ltd , Director op-Hsg. Ltd., Plot No. 7-B, Opp Adishankaracharya Road, Powai, Mumbai – 400076 (MH) 7 Vala Infotech Pvt. Ltd. B Gujarat Mr. Bharat R Vala, Dhanlaxmi Building, Room No. 309, (02637) 243752. Fax M.D. 3rd Floor, Near Central Bank, (02637) 254191 Navsari – 396445 Gujarat 8 Arjun Telecom Pvt. C Chengalpatt Mr. N.Kannapaan, New No. 1, Old No. 4, 1st Floor, 044-43806716 Ltd(cancelled) u Managing Direcot, Kamakodi Nagar, Valasaravakkam, (Kancheepu Chennai – 600087 ram) 9 CNS Infotel Services Pvt. Ltd. B Jammu & Reyaz Ahmed Mir M.A. -

Financial Inclusion in Colombia: a Scoping Literature Review

Intangible Capital IC, 2017 – 13(3): 582-614 – Online ISSN: 1697-9818 – Print ISSN: 2014-3214 https://doi.org/10.3926/ic.946 Financial inclusion in Colombia: A scoping literature review Ulf Thoene , Álvaro Turriago-Hoyos* Universidad de La Sabana (Colombia) [email protected], *Corresponding author: [email protected] Received November, 2016 Accepted March, 2017 Abstract Purpose: The paper provides an extensive, comprehensive and up-to-date qualitative scoping literature review of financial inclusion and other related concepts, and focuses in particular on the Colombian context, and the accessibility as well as barriers to banking services. It structures the themes and dimensions of scholarly debates on financial inclusion in the literature highlighting avenues for future research to fill various gaps. Design/methodology: This scoping literature review rigorously identifies the most relevant research and variables pertaining to financial inclusion and social innovation. Findings: Based on a scoping literature review, a comprehensive framework of key concepts of financial inclusion, scholarly contributions, countries and variables is presented. Research limitations/implications: Owing to the methodological approach of this paper and its rather theoretical nature, this research seeks to enrich scientific debates pertaining to the empirical data displayed, especially on the case of Colombia. Practical implications: The most central variables that are linked to the theme of financial inclusion are explored, and hence this paper forms a basis for future qualitative and quantitative studies. Social implications: This research article contributes to public policy making on financial inclusion aimed at reducing levels of socio-economic inequality. -582- Intangible Capital – https://doi.org/10.3926/ic.946 Originality/value: In business and management research a degree of conceptual confusion prevails on the theme of financial inclusion. -

Towards the Performance Analysis of Apache Tez Applications

QUDOS Workshop ICPE’18 Companion, April 9̶–13, 2018, Berlin, Germany Towards the Performance Analysis of Apache Tez Applications José Ignacio Requeno, Iñigo Gascón, José Merseguer Dpto. de Informática e Ingeniería de Sistemas Universidad de Zaragoza, Spain {nrequeno,685215,jmerse}@unizar.es ABSTRACT For leveraging the performance of the framework, Apache Tez Apache Tez is an application framework for large data processing developers customize their applications by several parameters, e.g., using interactive queries. When a Tez developer faces the fulfillment parallelism or scheduling. Certainly, this is not an easy task, so of performance requirements s/he needs to configure and optimize we argue that they need aids to prevent incorrect configurations the Tez application to specific execution contexts. However, these leading to losings, monetary or coding. In our view, these aids are not easy tasks, though the Apache Tez configuration will im- should come early during application design and in the form of pact in the performance of the application significantly. Therefore, predicting the behavior of the Tez application for future demands we propose some steps, towards the modeling and simulation of (e.g., the impact of the stress situations) in performance parameters, Apache Tez applications, that can help in the performance assess- such as response time, throughput or utilization of the devices. ment of Tez designs. For the modeling, we propose a UML profile Aligned with our work in the DICE project [1, 5], this paper for Apache Tez. For the simulation, we propose to transform the presents the first steps towards the modeling and simulation of stereotypes of the profile into stochastic Petri nets, which canbe Apache Tez applications with high performance behavior. -

Financial Inclusion: the Indian Experience

FINANCIAL INCLUSION - INDIAN EXPERIENCE Financial Inclusion (FI) “Simplicity and reliability in financial inclusion in India, though not a cure all, can be a way of liberating the poor from dependence on indifferently delivered public services. In order to draw in the poor, the products should address their needs — a safe place to save, a reliable way to send and receive money, a quick way to borrow in times of need or to escape the clutches of the money lender, easy to understand life and health insurance and an avenue to engage in savings for the old age.” Raghuram Rajan, Governor, Reserve Bank of India Status of financial coverage in India u 246.7 million households in the country, 58.7% households had access to banking services as per Census 2011 u 54.46% rural u 67.68% urban u The banking network comprises of 128,397 branches and 189,844 ATMs u 38.2% branches and 14.58% ATMs are in rural areas u Left out of this coverage u Villages <2000 population u Migrant labourers and poor working in informal sector u Small and marginal farmers practising rain-fed agriculture u Women Pradhan Mantri Jan Dhan Yojana (PMJDY) National Mission on Financial Inclusion was announced by Shri Narendra Modi, Prime Minister, in his Independence Day Speech on August 15, 2014. Scope and Plan under PMJDY (i) Universal access to banking facilities for all households across the country through a bank branch or a fixed point Business Correspondent (BC) within a reasonable distance (60 million rural and 15 million urban are uncovered). -

Role of Maharashtra Gramin Bank in Rural Development

Excel Journal of Engineering Technology and Management Science (An International Multidisciplinary Journal) Vol. I No. 5 December - January 2013-14 (Online) ISSN 2277-3339 ROLE OF MAHARASHTRA GRAMIN BANK IN RURAL DEVELOPMENT * Dr. H. W. Kulkarni, HOD & Research Guide in Commerce, Shivaji Mahavidyalaya, Udgir Dist. Latur. INTRODUCTION: Developing the rural economy by providing for the purpose of development of agriculture, trade, commerce, industry and other productive activities in the rural areas credit and other facilities, particularly to the small and marginal farmers, agricultural labours, artisans and small entrepreneurs and for matters concern there with and incidental thereto. It is the mission of Maharashtra Gramin Bank. Repositioning the Bank in a competitive market by accomplishing turn around in profitability and NPA reduction, to double the flow of credit to agriculture, to achieve a quantum jump in saving bank deposit mobilization, and pursue the best practices for delivering the value added service to customers by transforming the branches into the most preferred banking outlet in rural areas. It is the vision of Maharashtra Gramin Bank. The regional Rural Bank was first setup by the Government of India on 2nd Oct, 1975, the date of birth of Mahatma Gandhi, under the Regional Rural Banks ordinance. Regional Rural Bank, established under section 3 of the Regional Rural Banks Act, 1976. “There are now 196 RRBs has raised the deposits of Rs.30050/- crores and had advanced Rs.12660/- crores during 1999- 2000 by the way of short term crop loans, term loans for agricultural activities for rural artisans, village and cottage industries, retail trade and self employed, consumption loans. -

31 St March 2021. We Request You to Take Note of The

BCC:ISD: 113: 16: 145 09.06.2021 The Vice-President, The Vice-President, B S E Ltd., National Stock Exchange of India Ltd. Phiroze Jeejeebhoy Towers Exchange Plaza, Dalal Street Bandra Kurla Complex, Bandra (E) Mumbai - 400 001 Mumbai - 400 051 BSE CODE - 532134 CODE-BANKBARODA Dear Sir / Madam, Re: Bank of Baroda - Disclosure under Regulation 23(9) of SEBI (LODR) Regulations, 2015 We annex disclosures under Regulation 23(9) of SEBI (LODR) Regulations, 2015 for consolidated disclosure of Related Party transaction and balances for the Half year ended 31 st March 2021. We request you to take note of the above pursuant to Regulation 23(9) of SEBI (LODR) Regulations, 2015 and upload the information on your website. urs faithfully, ~~~, ~-26, ~-~, ~-~cplA1~CR1, ~(~.), $rt- 400 051,1'l'ffil. Baroda Corporate Centre, C-26, G-Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051, India. q;'pr / Phone: 91 22 66985812/5733 • t-~ 1 E-mail: [email protected] • ~ / Web: www.bankofbaroda.in Consolidated disclosure of Related Party transaction and balances for the II aff year ended 31't March 2021 Name of Related Parties & their relationship Related Parties to the Group: a) Associates Perc-e- ntage- of-. - Country of Ownership March Incorporation Name of Associates 31.1021 a) Indo Zambia Bank Limited Zambia 20.00 .- b) Regional Rural Banks i. Baroda U.P. Bank" India 35.00 (Erstwhile Baroda Uttar Pradesh Gramin Bank) India 35.00 ii. Baroda Rajasthan Kshetriya Gramin Bank (Erstwhile Baroda Rajasthan Gramin Bank) India 35.00 iii. Baroda Gujarat Gramin Bank - - .-- -- *As per gazette notification dated 26.11.2019. -

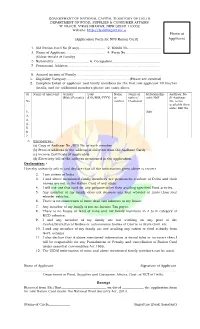

NFS New Ration Card English Form

GOVERNMENT OF NATIONAL CAPITAL TERRITORY OF DELHI DEPARTMENT OF FOOD, SUPPLIES & CONSUMER AFFAIRS ‘K’-BLOCK, VIKAS BHAWAN, NEW DELHI-110002 Website: http://fs.delhigovt.nic. in Photo of (Application Form for NFS Ration Card) Applicant 1. Old Ration Card No (If any)......................... 2. Mobile No................................ 3. Name of Applicant...................................... 4. Form No.................................. (Eldest female of Family) 5 Nationality ................................. 6. Occupation.............................................. 7. Permanent Address......................................................................................... ............................................................................................................................. 8. Annual income of Family................................................................................. 1. Eligibility Category............................................................ (Please see overleaf) 2. Complete Detail of applicant and family members (in the first row applicant fill his/her details, and for additional members please use extra sheet. Sr Name of applicant Gender DoB Name Name of Relationship Aadhaar No. (Male/Female) (DD/MM/YYYY) of father/ with HoF (If Aadhaar No mother Husband No. is not . available then enter EID No. 1. Self 2. 3. 4. 5. 6. 7. 3. Enclosures:- (a) Copy of Aadhaar No./EID No. of each member (b) Proof of address (if the address is different from the Aadhaar Card) (c) Income Certificate (If applicable) (d) Electricity bill of the address mentioned in the application. Declaration: - I hereby solemnly affirm and declare that all the information given above is correct. 2. I am citizen of India 3. I and above mentioned family members are permanent resident of Delhi and their names are not in the Ration Card of any state. 4. I will not use this card for any purpose other then availing specified Food articles. 5. Any member of my family does not possess any four wheeler or more than four wheeler vehicles. -

India Fintech Sector a Guide to the Galaxy

India FinTech Sector A Guide to the Galaxy G77 Asia Pacific/India, Equity Research, 22 February 2021 Research Analysts Ashish Gupta 91 22 6777 3895 [email protected] Viral Shah 91 22 6777 3827 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Contents Payments leading FinTech scale-up in India .................................. 8 8 FinTechs: No longer just payments ..............................................14 Account Aggregator to accelerate growth of digital lending ...............................................................................22 Digital platforms and partnerships driving 50-75%of bank business ...28 Company section ..........................................................................32 PayTM (US$16 bn) ......................................................................33 14 Google Pay ..................................................................................35 PhonePe (US$5.5 bn) ..................................................................37 WhatsApp Pay .............................................................................39