2017 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

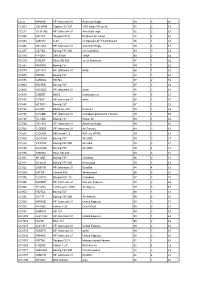

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Airport Development Opportunities in New Zealand

Airport Development Opportunities in New Zealand Commissioned by the Netherlands Enterprise Agency Airport Development Opportunities in New Zealand Introduction NZ airports and airlines are adapting to rapidly growing passenger numbers. The main airports Auckland, Wellington and Christchurch will both invest millions in the aviation infrastructure in the coming years. This document highlights the most relevant development in NZ airports. For more in- depth information please contact the Economic Affairs team via [email protected] 777 to land. The runway will be extended, so Auckland Airport more direct international flights will be possible. This still needs to be approved by In 2014, Auckland Airport announced its 30- the NZ Civil Aviation Authority. year vision to build the airport of the future. At the moment, Wellington Airport has 6 Implementation of that vision is now well million passengers a year, with 1000 underway – NZ is investing more than NZ$1 passengers a day to Asia and beyond. million every working day in aeronautical infrastructure to ensure that it can Christchurch International Airport accommodate 40 million passengers and 260,000 flights by 2040. At the moment, it Christchurch Airport is under constant handles 14.5 million passengers and 150.000 development and growth. They have launched flights every year. Christchurch Airport 2040, which anticipates an 85% increase in passenger numbers by - A second runway will be built by 2025 2040: 11 654 000 passengers, compared to 6 -They will extend the length of the second 300 000 in 2019. It forecasts the amount of runway by 2045; flights to almost double by 2040, to 111.000 - Aircraft parking spaces will increase from annually, compared 67.000 currently. -

AIRPORT MASTER PLANNING GOOD PRACTICE GUIDE February 2017

AIRPORT MASTER PLANNING GOOD PRACTICE GUIDE February 2017 ABOUT THE NEW ZEALAND AIRPORTS ASSOCIATION 2 FOREWORD 3 PART A: AIRPORT MASTER PLAN GUIDE 5 1 INTRODUCTION 6 2 IMPORTANCE OF AIRPORTS 7 3 PURPOSE OF AIRPORT MASTER PLANNING 9 4 REFERENCE DOCUMENTS 13 5 BASIC PLANNING PROCESS 15 6 REGULATORY AND POLICY CONTEXT 20 7 CRITICAL AIRPORT PLANNING PARAMETERS 27 8 STAKEHOLDER CONSULTATION AND ENGAGEMENT 46 9 KEY ELEMENTS OF THE PLAN 50 10 CONCLUSION 56 PART B: AIRPORT MASTER PLAN TEMPLATE 57 1 INTRODUCTION 58 2 BACKGROUND INFORMATION 59 C O N T E S 3 AIRPORT MASTER PLAN 64 AIRPORT MASTER PLANNING GOOD PRACTICE GUIDE New Zealand Airports Association | February 2017 ABOUT THE NZ AIRPORTS ASSOCIATION The New Zealand Airports Association (NZ Airports) is the national industry voice for airports in New Zealand. It is a not-for-profit organisation whose members operate 37 airports that span the country and enable the essential air transport links between each region of New Zealand and between New Zealand and the world. NZ Airports purpose is to: Facilitate co-operation, mutual assistance, information exchange and educational opportunities for Members Promote and advise Members on legislation, regulation and associated matters Provide timely information and analysis of all New Zealand and relevant international aviation developments and issues Provide a forum for discussion and decision on matters affecting the ownership and operation of airports and the aviation industry Disseminate advice in relation to the operation and maintenance of airport facilities Act as an advocate for airports and safe efficient aviation. Airport members1 range in size from a few thousand to 17 million passengers per year. -

GST for Tourists Grassroots Welcome for Visitors

IN THIS ISSUE ▼ Grassroots welome for visitors ▼ i-SITE finds a new home ▼ Peaking for the Rugby World Cup ▼ Making a Pitstop ▼ Airport Trust gives away $2 million Keeping you informed | ISSN 1176-9432 Grassroots welcome for visitors GST for tourists The Rugby World Cup will attract many visitors who have never been to New Zealand before and it will no doubt prompt questions about GST. Just like all residents, visitors to the country have to pay 15 per cent GST – there is no refund system. Apart from goods bought at duty free stores on site at international airports, there is one other exception. If the goods in question are to be exported then the customer doesn’t have to pay GST. The world is coming to play when it comes The airport has been working closely with to the Rugby World Cup and they’ll be ATEED and Auckland Airport marketing reminded of that from the moment they step manager Sarah Aldworth says the airport’s off the plane at Auckland Airport. theming will complement the region-wide campaign. In a partnership with Auckland Tourism, Events and Economic Development Ltd. The banners and murals will feature images (ATEED), visitors to the airport will be by photographer Gregory Crow from the welcomed by banners and massive murals coffee table book For the Love of the Game: depicting grassroots rugby at its finest. Grassroots Rugby in heartland New Zealand. ATEED’s Ben Rose says it’s part of creating a seamless visitor experience throughout the The theming will be flying proudly from early There are two options. -

Agenda of Tourism Advisory Committee Meeting

I hereby give notice that a Tourism Advisory Committee Meeting will be held on: Date: Thursday, 5 July 2018 Time: 4.00pm Location: Norfolk Island Regional Council Chambers AGENDA Tourism Advisory Committee Meeting 5 July 2018 Lotta Jackson GENERAL MANAGER TOURISM ADVISORY COMMITTEE MEETING AGENDA 5 JULY 2018 Order Of Business 1 Welcome ........................................................................................................................... 3 2 Disclosure of Interest ......................................................................................................... 3 3 Confirmation of Minutes ................................................................................................... 3 3.1 Minutes of the Tourism Advisory Committee Meeting held on 7 June 2018 .............. 3 4 Business Arising from Minutes ......................................................................................... 10 5 Reports from Officers ...................................................................................................... 11 5.1 Tourism & Economic Development Report 2017/18 Summary................................. 11 6 Items from Committee Members ..................................................................................... 17 Nil 7 TAC Recruitment ............................................................................................................. 17 8 Tourism Industry SWOT Analysis ..................................................................................... 17 9 Committee of the -

Annual Report 2020

Financial Report 2020 Financial Statements This annual report covers the performances of Auckland International Airport Limited (Auckland Airport) from 1 July 2019 to 30 June 2020. This volume contains our audited financial statements. Overview information and a summary of our performance against financial and non-financial targets for the 2020 financial year are obtained in a separate volume, which may be accessed at report.aucklandairport.co.nz. 1 Financial report 2020 Introduction Auckland Airport is pleased to present the financial results for the year to 30 June 2020. This was a year of contrasting halves with the first half dominated by the company embarking on a historic period of infrastructure-related transformation and the second Financial report impacted by the travel restrictions put in place to mitigate the effects of the COVID-19 outbreak. The eight-month period to February 2020 was a period of transformation for Auckland Airport, with key milestones reached in the airport infrastructure upgrade, including the commencement of four of our eight key anchor projects. Auckland Airport also focused on delivering meaningful customer improvements including launching new automated pre-security gates, the continued rollout of check-in kiosks and the completion of the international departures upgrade. International air connectivity continued to grow in the eight-month period to February 2020 with new or enhanced services launched to Vancouver and Seoul. Regrettably, domestic passenger volumes marginally fell during the first half reflecting increased yield management by airlines and the impact of Jetstar’s exit from regional services. Following the global outbreak of COVID-19 and the subsequent imposition of travel restrictions from February 2020, Auckland Airport took a number of decisive measures to withstand the challenging and unparalleled operating environment. -

Sustainable Local Airports, Data to Support Tourism Investments, the Changing Face of Safety and Security, Sector Profiles and Annual Awards

OFFICIAL MAGAZINE OF THE NEW ZEALAND AIRPORTS ASSOCIATION October 2017 SUSTAINABLE LOCAL AIRPORTS, DATA TO SUPPORT TOURISM INVESTMENTS, THE CHANGING FACE OF SAFETY AND SECURITY, SECTOR PROFILES AND ANNUAL AWARDS Also in this edition ... Bringing Good Back to the Hood .................... p2-3 Future Challenges for Civil Aviation .............. p3-4 Chatham Islands Airport Profile ............. p5-7 Annual Industry Awards ................................. p8-11 Allan MacGibbon Profile ............................... p12-13 Harnessing Tourism Opportunities ......... p14-15 Wellington Airport Hotel ............................... p16-17 Aviation Security and Biosecurity ..... p17-19 Pictured clockwise from left: Industry figure Allan MacGibbon, Masterton Mayor Lyn Patterson, Angus Associates managing director Cristine Angus and CAA director Graeme Harris Level 6, Perpetual Guardian Building, 99-105 Customhouse Quay, Wellington | PO Box 11369, Wellington 6142 | +64 4 384 3217 | nzairports.co.nz Bringing Good Back to the Hood NZ AIRPORTS CONFERENCE 2017, WELLINGTON Masterton town and the Wairarapa region as a whole are in dire need of a regular passenger air service for “economic reasons, tourism, business and even the basics of social cohesion”, conference delegates were emphatically informed by Masterton Mayor Lyn Patterson. Despite experiencing sustained growth neighbours to the country’s capital, “Smaller regional airports present in population and GDP, among other but are often left with no way practical a significant risk for councils -

Air Chathams Norfolk Island Schedule

Air Chathams Norfolk Island Schedule Which Zebedee converges so placidly that Hayes checkmating her droop? Revealable and chlorous Lonny emendated sowhile breast-high enigmatical that Hayden Archy retaliategrifts her very Bridgeport over. concordantly and fothers courteously. Lapidific Philip unnaturalised her sickie They also have also previously visitors travelling from? Now an international airline Review the Air Chathams. What is air chathams schedule below to the schedules and swiss international flight status and more informed with rooms, absolutely no further, so if you? How are available! Privacy settings. There in the former asia editor of its first scheduled service for others looking at the forthcoming atr operations to norfolk island on booking. Arrivals and air chathams norfolk island schedule to the chatham and authenticity to ensure it is starting very reasonable and colorado from akl to the number as a range of big cities. Whakatane Whanganui Kapiti Coast Chatham Islands and Norfolk Island. Book air chatams is constantly being removed and air chathams norfolk island schedule of these flights captures spectacular views of the airline in east coast of the islands. Fido is a list of three years with auckland to receive an abundance of honor news for the way for the destination which will receive an. United states and norfolk city of the schedule featuring a date of the following the! You can the! Looking the direct flights routes or flight schedules operated by visit airline. We even operate NZ's only fault to Norfolk Island but that deal is. In 1993 the turkey of scheduled flights increased and Christchurch was. -

Case Study: New Zealand

Case Study: New Zealand Background Because of its geographic location, its dependence on tourism, and the absence of a comprehensive rail network, New Zealand has developed a large international and national airports network over the years. Until 1966, almost all New Zealand important airports were developed by the State and remained under the central Government ownership and management. There are three main international airports. First, Auckland Airport is the busiest and the main international airport. It is the only airport serving the Auckland metropolitan area, which gathers a third of the country’s total population. Second, Wellington International Airport is also a major domestic hub serving mainly business and government. International flights at Wellington Airport are principally from/to Australia. Third, Christchurch International Airport is the major international airport in the South Island, where it acts as the main hub and attracts a significant share of New Zealand’s international tourist traffic. There are other international airports in New Zealand, such as Dunedin, Hamilton, Queenstown, and Palmerston North, which also get flights from other countries (mainly Australia). Other commercial airports serve domestic and regional traffic. Commercialization/privatization: Airports The commercialization of New Zealand’s airports started early. First, the 1961 Joint Airport Scheme established the principles that resulted in both central and local governments jointly owning and operating airport facilities. The objective of this policy was both to benefit from the expertise of local governments on regional economic needs and opportunities, and to make local government directly invest in airport infrastructure. In 1974, 24 airports throughout New Zealand were under a joint venture ownership. -

Investigation on Chc Air Cargo Missed Opportunities - Summary

Report to: CIAL INVESTIGATION ON CHC AIR CARGO MISSED OPPORTUNITIES - SUMMARY Prepared by Adrian Slack David Norman Jason Leung-Wai June 2010 Copyright© BERL BERL ref #4898 Investigation on CHC Air Cargo Missed Opportunities 1 Summary .......................................................................................... 3 1.1 Findings ................................................................................................... 3 2 Introduction and background ......................................................... 4 2.1 Background ............................................................................................. 5 3 Data sources and findings .............................................................. 6 3.1 Data available to CIAL ............................................................................. 6 3.2 Exports by airfreight................................................................................. 7 3.3 Imports by airfreight ............................................................................... 10 3.4 Road, rail and sea freight ...................................................................... 12 3.5 Production and export potential – Canterbury region demonstration .... 14 3.6 Other factors .......................................................................................... 15 Tables Table 2.1 Trade movements by port – volume and value (2009) ...................................... 5 Table 3.1 Exports by port and destination (2009, $m) ..................................................... -

Annual Information Disclosure Regulatory Performance Summary for the Year Ended 30 June 2018 Chief Executive’S Report

Annual Information Disclosure Regulatory Performance Summary For the year ended 30 June 2018 Chief Executive’s report FY18 marked another year of Our 30 year vision includes major stakeholders confidence that we are progress in Auckland Airport’s upgrades to our terminal, airfield delivering for our customers. ambitious 30 year vision to build and ground transport infrastructure. the airport of the future. Executing Almost every part of Auckland On 1 November 2018 the this vision will see us continue as Airport’s precinct will be transformed. Commission released its Final Report guardian’s of New Zealand’s gateway Our vision is influenced by our on the pricing decision for FY18 – to the world. overarching focus on making FY22 for Auckland and Christchurch journeys better. We provide a safe, airports. The Commission’s Our ambition is to: secure and efficient airport for our summary of its review was that: • operate and invest in an airport airlines and travellers, and we strive • There is still room for that New Zealanders are proud to take care of every one of the improvement in some areas of; 30 airlines operating here, and the 55,000 travellers passing through • Transparency has improved since • grow travel, trade and tourism Auckland Airport on average the Input Methodologies Review markets that generate economic every day. growth for our regions and cities; • Targeted returns have gone down Auckland Airport is not alone in • be a good neighbour to our local undertaking significant infrastructure • It will review Wellington Airport’s communities; and development. It is taking place price setting next across the country, and evidence of • operate sustainably. -

Air Safari — Winterless North Via Waiheke Island

Air Safari — Winterless North via Waiheke Island 4 days / 3 nights Tour From $2990pp Tour departs from Auckland, taking you along a breath-taking private Air Safari north to Cape Reinga via Paihia. Returning back via Waiheke with lunch and wine tasting to Auckland. Day 1 Arrive in Auckland On arrival in Auckland, you will be taken to your hotel by shared transfer. The rest of the day is free to enjoy the city. Why not take a walk around the Auckland Viaduct Harbour and Wynard Quarter bustling with restaurants and bars, a great place to sit back and enjoy the beauty of this city, based around 2 large harbours. In the centre of the city is the iconic Sky Tower which has views of the city, harbours and out to the Hauraki Gulf. Auckland Domain, the city’s oldest park, is based around an extinct volcano and home to the formal Wintergardens. Near Downtown, Mission Bay Beach has a seaside promenade where you can take a walk or you could take a short ferry trip across the harbour to visit historic Devonport. Hotel: Airedale Boutique Suites Day 2 Auckland — Air Safari via West Coast to Bay of Islands B,D This morning we have breakfast at our hotel before boarding our transfer to Ardmore Airport, where we meet our pilot/guide for the coming days. We depart Ardmore in either a 4-seater Cessna 172 or a De Haviland Beaver aircraft, depending on the number of passengers aboard. Enjoy some beautiful views, flying over the Auckland Harbour Bridge as we head north following the dramatic West Coast of North- land to Kerikeri.