WASHINGTON AVIATION SUMMARY July 2012 EDITION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Concessioning a Strategy for Enhancing Nigeria's Airport

Int. J. Res. Ind. Eng. Vol. 6, No. 3 (2017) 228–245 International Journal of Research in Industrial Engineering www.riejournal.com Concessioning a Strategy for Enhancing Nigeria’s Airport Operational Efficiency - Lessons from Developed Countries A. O. Adeniran1, K. T. Gbadamosi2 1 Department of Transport Management Technology, Federal University of Technology, Akure, Nigeria. 2Department of Transport Management Technology, Federal University of Technology, Akure, Nigeria. A B S T R A C T This study examines some concessioned airports in the developed countries and their operational performance level with a view to identifying the positive impact of concessioning on their growth, development and operational performance. The ultimate goal of the study is to provide basis for adapting the experience from lessons learnt to Nigeria’s airports as a strategy for realization of airport operational efficiency. The study advocated for the concessioning of two principal airports in Nigeria because of their potentials to enhancing the application of the experience learnt from lessons on concessioning in the developed countries. Data obtained from relevant Government Institutions and Agencies in Nigeria were analyzed using descriptive statistics. It was concluded that Lagos and Abuja International Airport are the two major airports in Nigeria that can be privatized or concessioned in order to improving their level of efficiency. Happenings around the world have shown the efficacy of Government disengagement in running business through the policy of concessioning and privatization. Airport concessioning and privatization has been considered as a major tool to enhance airport efficiency as witnessed in the developed countries. Airport concessioning has the capacity to enhance efficiency of airport operation; reduce cost of airport services to stakeholders; decrease cost to the government for the support of airport sector; and attract private sector participation to free public resources for public services. -

2017-05 Ag En.Pdf

COMBINED ORDINARY AND EXTRAORDINARY SHAREHOLDERS’ MEETING 2017 LEGAL OPENING A I R F R A NPARIS C E - KLM RESULTS* OF THE PRE-SHAREHOLDERS’ MEETING SURVEY OF INDIVIDUAL SHAREHOLDERS Ranking of the expected themes Market outlook and growth relays 69% Results targets 51% Dividend distribution policy 44% The new Trust Together strategic project 38% Financial strategy (investment, operational efficiency, etc.) 30% Changes in the shareholder structure and shareholder loyalty policy 29% Human resources policy and relations with the unions 28% * Survey of Air France-KLM individual shareholders realized electronically during April 2017 COMBINED ORDINARY AND EXTRAORDINARY 3 A I R F R A N C E - KLM SHAREHOLDERS’ MEETING 2017 SHAREHOLDERS’ MEETING AGENDA Legal Opening Corporate Governance 2016 Financial Review Strategy and Outlook Presentation of the Resolutions Statutory Auditors’ Reports Dialogue with Shareholders Vote on the Resolutions Conclusion COMBINED ORDINARY AND EXTRAORDINARY 4 A I R F R A N C E - KLM SHAREHOLDERS’ MEETING 2017 CORPORATE GOVERNANCE NICE A I R F R A N C E - KLM SHAREHOLDER STRUCTURE OF THE GROUP AT MARCH 31, 2017 French individual shareholders* Institutional 9.9% investors Employees (FCPE) 6.2% France: 13.8% United Kingdom: 6.8% 65.9% United States: 24.7% Germany: 1.5% 17.6% French State Netherlands: 1.1% Switzerland: 0.3% 0.4% Treasury stock * In registered form and/or holding more than 1,000 shares in bearer form. COMBINED ORDINARY AND EXTRAORDINARY 6 A I R F R A N C E - KLM SHAREHOLDERS’ MEETING 2017 COMPOSITION OF THE CURRENT BOARD OF DIRECTORS Jean-Marc Peter Maryse Isabelle Jean-Dominique Anne-Marie Jaap JANAILLAC HARTMAN AULAGNON* BOUILLOT* COMOLLI COUDERC* DE HOOP SCHEFFER* Louis Solenne Hans Isabelle Alexander François Antoine Patrick JOBARD LEPAGE N.J. -

Memorandum N° 56/2017 | 30/03/2017

1 MEMORANDUM N° 56/2017 | 30/03/2017 More than 1,811 Daily Memoranda issued from 2006 to end of 2016, with 21,732 pages of Business Clips issued covering all African, European Institutions and African Union, as well as the Breton Woods Institutions. The subscription is free of charge, and sponsored by various Development Organisations and Corporations. The Memorandum is issued daily, with the sole purpose to provide updated basic business and economic information on Africa, to more than 4,000 European Companies, as well as their business parties in Africa. Should a reader require a copy of the Memoranda, please address the request to fernando.matos.rosa@sapo or [email protected]. 11 YEARS OF UNINTERRUPTED PUBLICATION SUMMARY Senegalese growers in Eastern European markets Page 2 BOAD approves new financing worth CFAF138bn Page 2 Western Sahara should be able to negotiate a fisheries partnership agreement with the EU Page 3 FADES grants two loans for Mauritania water, electricity projects Page 4 Turkish firm announces $1.5bn investment plan in Ethiopia Page 5 Uganda set to connect 6.5MW hydropower plant Page 5 Swaziland: Youth unemployment hits 53 percent Page 6 Chinese aerospace firm signs $10bn deal to build Tangier tech city Page 6 Islamic banking to be licensed by year’s end - Ugandan Central Bank Page 7 Business man Simbi Phiri mulls tallest building in Malawi Page 8 Nigeria seeks Ethiopian Airlines’ help to revive national carrier Page 8 Preliminary funding deal signed for $10 billion tech city in Morocco Page 9 Mozambique, Germany ink cooperation deals Page 9 Bill Gates: Cutting Foreign Aid Makes America Less Safe Page 10 Sugar: Cameroon market stocks in excess of 32,000 tonnes Page 11 Survey reveals access to clean water in Kenya declines Page 11 Three new destinations for Ethiopian Airlines Page 12 IDBZ to construct housing facilities for 11 state universities in Zimbabwe Page 13 2 SENEGALESE GROWERS IN EASTERN EUROPEAN MARKETS Senegalese growers and exporters are increasingly working with European markets. -

Air France-KLM Group for the Year Ended Activity AFR 33 December 31, 2012

Selected fi nancial information 2 Highlights of the 2012 fi nancial year AFR 4 4.6 Note on the methodology for the reporting Corporate governance AFR 5 of the environmental indicators 129 1.1 The Board of Directors 6 4.7 Environmental indicators 132 1.2 The CEO Committee 30 4.8 Statutory Auditor’s Attestation report on the social, environmental and corporate 1 1.3 The Group Executive Committee 30 citizenship information disclosed in the 2012 management report 136 4.9 Statutory Auditor’s Assurance report on a selection of environmental and social indicators of Air France-KLM group for the year ended Activity AFR 33 December 31, 2012. 137 2.1 Market and environment 34 2.2 Strategy 42 2 Activities Financial r eport 139 2.3 Passenger business 45 2.4 Cargo business 53 5.1 Investments and fi nancing 140 2.5 Maintenance business 57 5.2 Property, plant and equipment 143 2.6 Other businesses 62 5 5.3 Comments on the fi nancial statements 146 2.7 Fleet 64 5.4 Key fi nancial indicators 150 2.8 Highlights of the beginning Financial statements AFR of the 2013 fi nancial year 71 5.5 Consolidated fi nancial statements 156 5.6 Notes to the consolidated fi nancial statements 163 5.7 Statutory auditors’ report on the consolidated fi nancial statements 245 Risks and risk 5.8 Statutory fi nancial statements 247 5.9 Five-year results summary 259 management AFR 73 5.10 Statutory Auditor’s report 3.1 Risk management process 74 on the fi nancial statements 260 3 3.2 Risk factors and their management 75 5.11 Statutory Auditors’ special report on regulated agreements and commitments 261 3.3 Market risks and their management 83 3.4 Report of the Chairman of the Board of Directors on corporate governance, internal control and risk management for the 2012 fi nancial year 87 3.5 Statutory auditors’ report prepared in accordance Other information 265 with article L.225-235 of the French Commercial Code (Code de commerce) on the report prepared 6.1 History 266 by the Chairman of the Board of Directors of Air France-KLM S.A. -

Document De Référence Air France-KLM 2008

Document de référence 2008-09 Le présent document de référence comprend le rapport fi nancier annuel Chiffres clés 2 1. Gouvernement d’entreprise 5 5. Rapport fi nancier 107 Le Conseil d’administration 6 Les investissements et fi nancements 108 Le Comité exécutif groupe 23 Les propriétés immobilières et équipements 110 Bourse et actionnariat 24 Commentaires sur les comptes 113 Ratios de performance 117 États fi nanciers consolidés 121 2. Activité 27 Notes aux comptes consolidés 128 Les faits marquants de l’exercice 2008-09 28 Rapport des Commissaires aux comptes Marché et environnement 29 sur les comptes consolidés 206 La stratégie 32 Comptes sociaux 208 L’activité passage 35 Annexe 210 L’activité cargo 42 Rapport des Commissaires aux comptes sur les comptes annuels 220 L’activité maintenance 46 Rapport spécial des Commissaires aux comptes Les autres activités 49 sur les conventions et engagements réglementés 221 La fl otte 51 Les faits marquants du début de l’exercice 2009-10 59 6. Autres informations 223 Historique 224 3. Données sociales Renseignements à caractère général 226 et environnementales 61 Renseignements relatifs au capital 227 Données sociales 62 Renseignements sur le marché du titre 232 Note méthodologique sur le reporting des indicateurs sociaux 68 Renseignements relatifs aux accords conclus dans le cadre du rapprochement Indicateurs sociaux du groupe 70 entre Air France et KLM 234 Les données environnementales 76 Renseignements relatifs aux accords conclus Note méthodologique sur le reporting avec Alitalia-Compagnia Aerea Italiana (Alitalia–CAI) 239 des indicateurs environnementaux 80 Environnement législatif et réglementaire Indicateurs environnementaux du groupe 82 du transport aérien 241 Rapport d’examen d’un des Commissaires Glossaire 244 aux comptes 86 Information et contrôle 248 Tables de concordance 250 4. -

Financial Year 2010-11 Excellent Perfomance in the Second Quarter

Roissy, Amstelveen 17th November 2010 FINANCIAL YEAR 2010-11 EXCELLENT PERFOMANCE IN THE SECOND QUARTER 18.6% rise in revenues to 6.65 billion euros Sharp improvement in operating result: +576 million euros versus -47 million at 30th September 2009 Adjusted operating margin close to 10% STRONG FIRST HALF RESULTS Growth of 14.8% in revenues to 12.37 billion euros Operating income of 444 million euros versus loss of 543 million euros at 30th September 2009 Net income, group share of 1.03 billion euros after Amadeus income and complementary cargo fine provision Significant improvement in the financial position OBJECTIVE FOR FULL YEAR OPERATING INCOME REVISED UP The Board of Directors of Air France-KLM, chaired by Jean-Cyril Spinetta, met on 17th November 2010 to examine the accounts for the First Half of Financial Year 2010-11. Commenting on the First Half, Pierre-Henri Gourgeon, Chief Executive Officer, said: “In the context of a more favourable economic environment, all the strategic actions we have undertaken over the past year have enabled us to return to profit. The second quarter is especially satisfying and, despite the disruption in April, we improved our operating result by some one billion euros in the First Half. This has required a significant commitment from the entire group, and, together with Peter Hartman, President and CEO of KLM, I take this opportunity to thank, all our employees for their efforts. While we have achieved a great deal in a short space of time, we will remain focused on accomplishing the further measures required to ensure that we generate a value-creating level of profitability. -

Letter from the Director Air France-KLM

Air France-KLM +3.1% passenger traffic in September I Letter from the Director Air France -KLM François Robardet Representative of employees and former employee shareholders PS and PNC No. 725, October 14, 2019 If you do not see this page correctly, or if you want to read the English or Dutch versions If you do not see this page correctly, or if you want to read the English or Dutch versions, Als u deze pagina niet goed ziet, of als u de Engelse of Nederlandse versie wilt lezen , follow this link , it is here, vindt u deze yesterday The Press Review on Monday... > Air France-KLM: +3.1% passenger traffic in September (source CercleFinance) October 8 - Air France-KLM reports a 3.1% increase in total passenger traffic for September , based on a 2.4% increase in capacity, resulting in an improved load factor of 0.6 points to 89.2%. More specifically, the Passenger Network activity (Air France and KLM) saw its traffic increase by 2.4%, with a 5.4% increase in connections to North America, while the Transavia low -cost activity increased by 7.6%. For its part, Franco-Netherlands' cargo traffic fell by 3.8% last month on the basis of a 1.4% increase in capacity, resulting in a load factor that fell by 3.1 points to 57%. My comment: Since the beginning of the year, the Air France -KLM group has carried 80 million passengers, up 3.4% compared to the same period in 2018. I note that over these nine months, the load factor of the Franco -Dutch group was 6 points higher than that of the L ufthansa group (88.7% versus 82.8%); a performance to be credited to the combined Air France -KLM teams. -

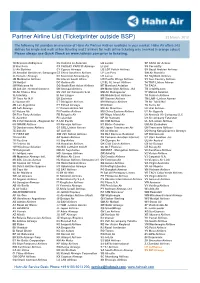

Airlines List in Outside

Partner Airline List (Ticketprinter outside BSP) 23 March, 2012 The following list provides an overview of Hahn Air Partner Airlines available in your market. Hahn Air offers 243 airlines for single and multi airline ticketing and 2 airlines for multi airline ticketing only (marked in orange colour). Please always use Quick Check on www.hahnair.com prior to ticketing. 1X Branson AirExpress CU Cubana de Aviacion LG Luxair SP SATA Air Acores 2I Star Perú CX CATHAY PACIFIC Airways LI Liat SS Corsairfly 2J Air Burkina CY Cyprus Airways LO LOT Polish Airlines SV Saudi Arabian Airlines 2K AeroGal Aerolineas Galapagos CZ China Southern Airlines LP Lan Peru SW Air Namibia 2L Helvetic Airways D2 Severstal Aircompany LR Lacsa SX SkyWork Airlines 2M Moldavian Airlines D6 Interair South Africa LW Pacific Wings Airlines SY Sun Country Airlines 2N Nextjet DC Golden Air LY EL AL Israel Airlines T4 TRIP Linhas Aéreas 2W Welcome Air DG South East Asian Airlines M7 Marsland Aviation TA TACA 3B Job Air - Central Connect DN Senegal Airlines M9 Motor Sich Airlines JSC TB Jetairfly.com 3E Air Choice One DV JSC Air Company Scat MD Air Madagascar TF Malmö Aviation 3L InterSky EI Aer Lingus ME Middle East Airlines TK Turkish Airlines 3P Tiara Air N.V. EK Emirates MF Xiamen Airlines TM LAM - Linhas Aereas 4J Somon Air ET Ethiopian Airlines MH Malaysia Airlines TN Air Tahiti Nui 4M Lan Argentina EY Etihad Airways MI SilkAir TU Tunis Air 4Q Safi Airways F7 Darwin Airline SA MK Air Mauritius U6 Ural Airlines 5C Nature Air F9 Frontier Airlines MU China Eastern Airlines -

Hcm349 Course Title: Introduction to Airline Management 1

NATIONAL OPEN UNIVERSITY OF NIGERIA FACULTY OF AGRICULTURAL SCIENCES COURSE CODE: HCM349 COURSE TITLE: INTRODUCTION TO AIRLINE MANAGEMENT 1 National Open University of Nigeria Headquarters University Village Plot 91, Cadastral Zone, Nnamdi Azikiwe Express way Jabi, Abuja Lagos Office 14/16 Ahmadu Bello Way Victoria Island, Lagos e-mail: [email protected] website: www.nouedu.net Published by National Open University of Nigeria Printed 2017 ISBN: All Rights Reserved COURSE DEVELOPMENT HCM349 INTRODUCTION TO AIRLINE MANAGEMENT TABLE OF CONTENTS PAGE Introduction 1 What you will learn in this Course 1 Course Aims 2 Course Objectives 2 Course Materials 3 Working through this Course 3 Study Units 4 Assignments 4 Tutor Marked Assignments 4 Final Examination and Grading 5 Course Marking Scheme 5 Tutors and Tutorials 5 Summary 6 2 TSM349 INTRODUCTION TO AIRLINE MANAGEMENT 1.0 INTRODUCTION The commercial airline service industry is extremely competitive, safety-sensitive with high technology. People, employees and customers, not products and machines, must be the arena of an organisation’s core competence. The success of an airline, like any other business organisation, depends, to a large extent, on managerial decisions affecting the organisation’s structure, strategy, culture and numerous operational activities. The industry is a knowledge-based service market that requires practitioners or managers to acquire a sound knowledge of management theory and practice. There are some managers who are capable of taking right decisions owing to their practical experience on the job. Others are able to do so because of the knowledge they acquired in the school. All in all, academic knowledge is not a waste as it provides reasons for decisions taken. -

Publications Office

Official Journal L 139 of the European Union Volume 64 English edition Legislation 23 April 2021 Contents II Non-legislative acts REGULATIONS ★ Commission Regulation (EU) 2021/662 of 22 April 2021 amending Regulation (EC) No 748/2009 on the list of aircraft operators which performed an aviation activity listed in Annex I to Directive 2003/87/EC on or after 1 January 2006 specifying the administering Member State for each aircraft operator (1) . 1 ★ Commission Regulation (EU) 2021/663 of 22 April 2021 amending Annex III to Regulation (EC) No 396/2005 of the European Parliament and of the Council as regards maximum residue levels for chlordecone in or on certain products (1) . 148 ★ Commission Implementing Regulation (EU) 2021/664 of 22 April 2021 on a regulatory framework for the U-space (1) . 161 ★ Commission Implementing Regulation (EU) 2021/665 of 22 April 2021 amending Implementing Regulation (EU) 2017/373 as regards requirements for providers of air traffic management/air navigation services and other air traffic management network functions in the U-space airspace designated in controlled airspace (1) . 184 ★ Commission Implementing Regulation (EU) 2021/666 of 22 April 2021 amending Regulation (EU) No 923/2012 as regards requirements for manned aviation operating in U-space airspace (1) . 187 (1) Text with EEA relevance. Acts whose titles are printed in light type are those relating to day-to-day management of agricultural matters, and are generally valid for a limited period. EN The titles of all other acts are printed in bold type -

To Readers of the Attached Code-Share List

TO READERS OF THE ATTACHED CODE-SHARE LIST: The U.S. Air Carrier Licensing Division’s code-share list is an informal compilation of code-share relationships between U.S. and foreign air carriers involving the transportation of passengers. As such, it does not represent a complete compilation of all code shares e.g. cargo and mail only. New code-share relationships are continually being negotiated, and the ones reflected in the attached listing may or may not be still in place or be of a continuing nature. Similarly, the list may not reflect all existing code shares of a particular type, or all existing types of code shares. This list is not an official document of the Department of Transportation and, accordingly, should not be relied upon or cited as such. NOTE: THIS LIST IS COMPRISED OF ONLY THOSE CARRIERS WHOSE CODE-SHARE RELATIONSHIPS ARE OF A NEW OR CONTINUING BASIS. DORMANT CODE-SHARE RELATIONSHIPS TO THE EXTENT KNOWN HAVE BEEN DELETED. Block descriptions of certain code-share arrangements approved for the same term may have been compressed into one block description to conserve space. If the authorities are not new or changed, but only compressed, the compressed descriptions will not appear in bold type. Carriers must notify the Department no later than 30-day before they begin any new code-share service under the code-share services authorized. This report is current through July 31, 2021. Changes from the previous reports are noted in bold type. Regional carriers operating for large carriers (e.g. Delta Connection, American Eagle, United Express) will be listed in the endnotes of this report. -

Constellium Se

CONSTELLIUM SE FORM 20-F (Annual and Transition Report (foreign private issuer)) Filed 03/09/20 for the Period Ending 12/31/19 Telephone 33-1-73-01-46-51 CIK 0001563411 Symbol CSTM SIC Code 3341 - Secondary Smelting and Refining of Nonferrous Metals Industry Aluminum Sector Basic Materials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2021, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________________________________ FORM 20-F __________________________________________________________________________ ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 001-35931 __________________________________________________________________________ Constellium SE (Exact Name of Registrant as Specified in its Charter) __________________________________________________________________________ Constellium SE (Translation of Registrant’s name into English) __________________________________________________________________________