Community Investment Tax FY 11 Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Statement of Qualifications

STATEMENT OF QUALIFICATIONS REQUEST FOR QUALIFICATIONS No. 2017-023 REDEVELOPMENT OF THE FORMER H. D. KING PLANT SITE FT. PIERCE, FL SUBMITTED BY: 1200 W. PLATT ST., STE. 201 • TAMPA, FL • 33606 O. (813) 777-6981 • F. (813) 315-7141 CONTENTS Cover Letter 4 About Framework Group 6 Preliminary Development Program 8 Representative Projects 12 References 24 On behalf of Framework Group, LLC, I’m pleased to submit the following response to the City of Ft. Pierce RFQ No. 2017-023 for the redevelopment of the former H.D. King Plant site. Established in 2010 and based in Tampa, FL, Framework Group is a real estate development, consulting, and contracting company focused on high quality multi- family rental housing in exceptional urban neighborhoods. The Framework Team consists of seasoned real estate professionals, each with extensive and diverse industry experience. Framework’s Representative Projects demonstrate the team’s skilled and thoughtful approach to the development business, with each project setting the standard for quality within its submarket. While Framework focuses nearly exclusively on multi-family development, the potential of the H.D. King site as a mixed use development cannot be overlooked. As such, the Preliminary Development Program that follows includes the diversity of uses that this site deserves — a 200-unit apartment community, 120-room hotel, 34,000 SF conference center, and ground level retail and restaurants lining Indian River Drive. A program so ambitious will certainly take the collaboration and cooperation of a number of parties, including additional developers and the City of Ft. Pierce. We propose that Framework acts as Master Developer on the project, responsible for carrying out the residential development and overseeing the eventual Master Development Program in partnership with the City of Ft. -

Master Plan - Phase 1 0 10050 200 Other Logos Here Tampa, Florida February 12, 2019

Tampa’s next chapter Introducing Water Street Tampa, the city’s new downtown. A dynamic waterfront district, the neighborhood will enhance Tampa’s profile on the national stage, attracting professionals, residents, and tourists to explore and enjoy. Tampa, transforming No. 1 Top city for first time city for home buyers entrepreneurs Zillow, 2018 Forbes Magazine, 2017 th highest job and population growth in the nation 4 US Census Bureau, 2017 The Water Street Tampa impact It’s growing up 11 12 9 10 4 6 3,525* 13 3 7 Units Residential 2 13,700** 8 5 { 1 14 Residents 2,390,007* Square Feet Office { 45,000** Hotels Office Residential Future Phase Employees 1 727 Keys 4 564,883 SF Office 8 420 Units 11 Residential & Retail 122,650 SF Retail 52,848 SF Retail 2 519 Keys 12 Office & Retail 5 188,523 SF Office 3 37 Units 3 173 Keys 76,320 SF Retail 29,833 SF Retail 13 Entertainment & Retail Annual visitors 3,169,300** 6 354,306 SF Office 9 481 Units 14 Residential & Retail 10,568 SF Retail 29,833 SF Retail 7 2,000 Employees & Students 10 388 Units * Includes future phases 6,421 SF Retail 13,394 SF Retail ** Downtown, Channel District, Harbour Island Vibrant, spirited, and creative The Water Street Tampa who 25% 20% 13% 4,440 / 17,140 3,330 / 17,140 2,200 / 17,140 Established urbanites Bohemian mixers Digital natives Harbour Island / Davis Islands Channel District Downtown Tampa Wealthy city dwellers with Young, diverse, and mobile Tech-savvy, established advanced degrees, expensive urbanites with liberal millennials living in fashionable, cars, -

Shot to Death at the Loft

SATURDAY • JUNE 12, 2004 Including The Bensonhurst Paper Brooklyn’s REAL newspapers Published every Saturday — online all the time — by Brooklyn Paper Publications Inc, 55 Washington St, Suite 624, Brooklyn NY 11201. Phone 718-834-9350 • www.BrooklynPapers.com • © 2004 Brooklyn Paper Publications • 16 pages • Vol. 27, No. 24 BRZ • Saturday, June 19, 2004 • FREE Shot to death at The Loft By Jotham Sederstrom Police say the June 12 shooting happened in a basement bathroom The Brooklyn Papers about an hour before the bar was to close. Around 3 am, an unidentified man pumped at least four shots into A man was shot to death early Saturday morning in the bath- Valdes, who served five years in prison after an arrest for robbery in room of the Loft nightclub on Third Avenue in Bay Ridge. 1989, according to Kings County court records. The gunman, who has Mango / Greg Residents within earshot of the club at 91st Street expressed concern thus far eluded police, may have slipped out the front door after climb- but not surprise at the 3 am murder of Luis Valdes, a Sunset Park ex- ing the stairs from the basement, say police. convict. Following the murder, Councilman Vincent Gentile voiced renewed “That stinkin’ place on the corner,” said Ray Rodland, who has lived support for legislation that would allow off-duty police officers to moon- on 91st Street between Second and Third avenues for 20 years. “Even light as bouncers — in uniform — at bars and restaurants. The bill is Papers The Brooklyn if you’re farther away, at 4 in the morning that boom-boom music currently stalled in a City Council subcommittee for public housing. -

City of Tampa Walk–Bike Plan Phase VI West Tampa Multimodal Plan September 2018

City of Tampa Walk–Bike Plan Phase VI West Tampa Multimodal Plan September 2018 Completed For: In Cooperation with: Hillsborough County Metropolitan Planning Organization City of Tampa, Transportation Division 601 East Kennedy Boulevard, 18th Floor 306 East Jackson Street, 6th Floor East Tampa, FL 33601 Tampa, FL 33602 Task Authorization: TOA – 09 Prepared By: Tindale Oliver 1000 N Ashley Drive, Suite 400 Tampa, FL 33602 The preparation of this report has been financed in part through grants from the Federal Highway Administration and Federal Transit Administration, U.S. Department of Transportation, under the Metropolitan Planning Program, Section 104(f) of Title 23, U.S. Code. The contents of this report do not necessarily reflect the official views or policy of the U.S. Department of Transportation. The MPO does not discriminate in any of its programs or services. Public participation is solicited by the MPO without regard to race, color, national origin, sex, age, disability, family or religious status. Learn more about our commitment to nondiscrimination and diversity by contacting our Title VI/Nondiscrimination Coordinator, Johnny Wong at (813) 273‐3774 ext. 370 or [email protected]. WEST TAMPA MULTIMODAL PLAN Table of Contents Executive Summary ........................................................................................................................................................................................................ 1 Introduction and Purpose ......................................................................................................................................................................................... -

Precinct List for District Congress Dist 14

Craig Latimer Date 12/26/2019 Supervisor of Elections Hillsborough County, FL Time 04:45 PM Precinct List for District Congress Dist 14 Registered Voters Inactive Voters Precinct Place_Name Total Dems Reps NonP Other Dems Reps NonP Other 101.0 Port Tampa Community Center 4,065 1,312 1,350 1,330 73 196 259 373 8 103.0 Port Tampa Community Center 4,014 1,312 1,415 1,236 51 222 187 320 12 103.1 Port Tampa Community Center 382 96 134 133 19 1 2 4 0 105.0 Gandy Civic Association 4,535 1,804 1,238 1,423 70 330 161 339 4 107.0 Peninsular Christian Church 4,740 1,645 1,642 1,383 70 248 203 335 5 108.0 Victory Baptist Church 2,276 704 944 589 39 75 111 161 4 109.0 Joe Abrahams Fitness and Wellness C 2,208 738 912 539 19 70 110 86 4 111.0 Elks Lodge 708 1,959 644 826 462 27 82 78 76 3 112.0 Bayshore Presbyterian Church 2,244 643 1,045 530 26 53 62 64 1 113.0 Manhattan Avenue Church of Christ 2,723 1,050 901 744 28 129 120 131 3 115.0 Jan K Platt Regional Library 1,865 684 604 550 27 127 122 145 11 116.0 Manhattan Avenue Church of Christ 1,493 536 562 371 24 107 76 122 4 117.0 Manhattan Avenue Church of Christ 3,061 819 1,574 640 28 58 78 65 2 119.0 Palma Ceia United Methodist Church 3,012 933 1,388 660 31 61 92 59 0 121.0 Covenant Life Church Tampa 2,978 976 1,241 724 37 80 88 97 3 123.0 Tampa Garden Club 3,162 1,145 1,276 705 36 115 116 135 2 125.0 Islands Campus of South Tampa Fello 1,225 354 600 262 9 17 31 19 0 127.0 Marjorie Park Marina 3,054 984 1,302 732 36 76 75 101 1 129.0 Kate Jackson Community Center 2,484 831 987 628 38 106 106 100 -

Hillsborough Quality Child Care Program Listing

Hillsborough Quality Child Care Program Listing January - June 2017 6800 North Dale Mabry Highway, Suite 158 Tampa, FL 33614 PH (813) 515-2340 FAX (813) 435-2299 www.elchc.org The Early Learning Coalition of Hillsborough County (ELCHC) is a 501(c)(3), not for profit organization working to advance the access, affordability and quality of early childhood care and education programs in Hillsborough County. Through our Quality Counts for Kids Quality Improvement Program (QCFK) and a host of other resources and supports, we help child care centers and family child care homes to improve their program quality so that all children have quality early learning experiences. Contents How to Use this Quality Listing 4 What is Quality & Why Does it Matter? 5 Programs with Star Rating and/or Gold Seal Accreditation 6 Child Care Centers 7 Family Child Care Homes 19 Programs with a Class One Violation 24 Child Care Centers 25 Family Child Care Homes 26 Resources 28 Special Note/Disclaimer: The information provided in this booklet is gathered from public sources and databases as a courtesy. The information is considered accurate at the time of publication. Due to potential changes in provider/program status during the time period between when this information is gathered, printed and distributed, we encourage you to verify a provider’s status as part of your quality child care shopping efforts. The ELCHC does not individually endorse or recommend one provider or early childhood program over another whether or not they are listed within. January - June 2017 | 3 How to Use this Quality Listing Choosing child care is an important decision that requires last 12 months between November 1, 2015 to October 31, 2016. -

Museum Quarterly LSU Museum of Natural Science

Museum Quarterly LSU Museum of Natural Science November 2007 Volume 25, Issue 3 Museum of Letter from the Director... Natural Science Curators and The Latin Connection Directors Sixty years ago, Dr. George Lowery, the Museum’s founder, start- ed sending graduate students to Latin America to collect birds and Frederick H. Sheldon mammals. These youngsters included mammalogists Walter Dal- Director, George H. Lowery, Jr., quest and Al Gardiner, who together collected over a wide area of Professor, and the Neotropics and Mexico and accounted for 23 taxa new to science. Curator of Genetic They also included ornithologists Burt Monroe, of Honduras fame, and John O’Neill, who Resources has discovered more new species of birds than any living person. The Museum’s Latin American program has continued steadily over the decades to the present day, and many Christopher C. Austin LSU graduate students have cut their teeth on biology while tromping through the forests, Curator of deserts, mountains, and savannahs of Middle and South America. As a result of their ef- Herpetology forts, the Museum’s collections are not only rich in Latin American holdings, but our re- search ties to friends and colleagues in the Neotropics and Mexico are unusually strong. Robb T. Brumfield However, despite this long and distinguished record of work in Latin America, Curator of discouragingly few Latin American students have come to LSU to study for graduate de- Genetic Resources grees. As far as I can tell, there have been only five: Alex Aleixo (Brazil), Leda Cas- tro (Costa Rica), Manuel Marin (Chilé), Carlos Quintela (Boliva), and Glenda Quin- Mark S. -

Preparing Citrus and Pecan Trees for Cold Weather by Terri Simon, Master Gardener It’S Hard to Believe but Cold Weather Is Around the Corner

HARRIS COUNTY MASTER GARDENER NEWSLETTER • OCTOBER 2018 UrbanDirt Trees! Gardening Events and Information for Texans Preparing Citrus and Pecan Trees for Cold Weather by Terri Simon, Master Gardener It’s hard to believe but cold weather is around the corner. While Fruit 6-2-4 fertilizer summer is my favorite season, there are two crops I look forward is my favorite, but to in fall and winter. Pecans and citrus are my favorites. I inherited of course you may the love of both from my mother. We always had a bowl of pecans prefer another brand. on our coffee table in our house along with a nutcracker and our Avoid buying any fridge always had fresh citrus when they were in season. I recall citrus that you have riding down back roads with her while she searched for pecan and not researched. Most citrus stands. At that time, the fruit stand sellers allowed you to citrus trees will take taste their harvest. I have great memories of those trips. three to five years to Careful selection of your citrus varieties can extend your har- produce fruit and you vest from late summer through the first of the year. Citrus trees do not want to invest require little maintenance and the smell of their blooms can be your time in a citrus intoxicating. Those blooms also attract the giant swallowtail but- tree that is not suitable terfly. Citrus trees purchased at Urban Harvest sales and Master for our area. Gardener sales should do well in our area. The biggest problem I Tips to prepare for have had so far is from leaf miners. -

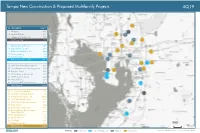

Tampa New Construction & Proposed Multifamily Projects

Tampa New Construction & Proposed Multifamily Projects 4Q19 ID PROPERTY UNITS 1 Wildgrass 321 3 Union on Fletcher 217 5 Harbour at Westshore, The 192 Total Lease Up 730 15 Bowery Bayside Phase II 589 16 Tapestry Town Center 287 17 Pointe on Westshore, The 444 28 Victory Landing 69 29 Belmont Glen 75 Total Under Construction 1,464 36 Westshore Plaza Redevelopment 500 37 Leisey Road Mixed Used Development 380 38 Progress Village 291 39 Grand Cypress Apartments 324 43 MetWest International 424 44 Waverly Terrace 214 45 University Mall Redevelopment 100 Total Planned 2,233 69 3011 West Gandy Blvd 80 74 Westshore Crossing Phase II 72 76 Village at Crosstown, The 3,000 83 3015 North Rocky Point 180 84 6370 North Nebraska Avenue 114 85 Kirby Street 100 86 Bowels Road Mixed-Use 101 87 Bruce B Downs Blvd & Tampa Palms Blvd West 252 88 Brandon Preserve 200 89 Lemon Avenue 88 90 City Edge 120 117 NoHo Residential 218 Total Prospective 4,525 2 mi Source: Yardi Matrix LEGEND Lease-Up Under Construction Planned Prospective Tampa New Construction & Proposed Multifamily Projects 4Q19 ID PROPERTY UNITS 4 Central on Orange Lake, The 85 6 Main Street Landing 80 13 Sawgrass Creek Phase II 143 Total Lease Up 308 20 Meres Crossing 236 21 Haven at Hunter's Lake, The 241 Total Under Construction 477 54 Bexley North - Parcel 5 Phase 1 208 55 Cypress Town Center 230 56 Enclave at Wesley Chapel 142 57 Trinity Pines Preserve Townhomes 60 58 Spring Center 750 Total Planned 1,390 108 Arbours at Saddle Oaks 264 109 Lexington Oaks Plaza 200 110 Trillium Blvd 160 111 -

City of Tampa Parks and Recreation DRAFT Plan to Re-Open for Summer Camp Recreation Division (Updated 5/1/20)

City of Tampa Parks and Recreation DRAFT Plan to Re-Open for Summer Camp Recreation Division (updated 5/1/20) Recreation Division We completely understand that this is a fluid situation and things can change weekly/daily. These are plans to open based on different levels of uncertainty and can start June 1 on any one of the blow phases. In addition, suggest offering camps/programs on a two week basis to enable changes and add additional camps/locations. Start date and time could change if school decides on summer school or start fall earlier. If they do, we can offer afterschool if deemed safe. Summer Camp Plan A: Keep facilities closed and open parks with limited numbers for adults and children-No camp structure. Summer Camp Plan B: Keep facilities closed and open parks for supervised playground camps. Recommended Parks: Lockable Parks closed to the public/Rec centers will be used for inclement weather only-for campers only. Use pavilions for different age groups, spread tables out following the 6’ policy. Camp will be Mon-Fri from 8:00AM-4:00 PM. Cost is Free. Registration: 40-75 per site to ensure that kids and staff follow 6’ distance guidelines. Registration would be open to residents only or essential employees only (depending on current situation) and the age range would be 5 (must have finished kindergarten)-11 years old. Once date is determined, open registration 2 weeks prior. Staff: Use permanent staff only. Staff would work at a ratio of 1 to 10 kids. Staff will play games that do not consist of sharing equipment and will ensure the 6’ distancing rules. -

Tampa New Construction & Proposed Multifamily Projects 1Q20

Tampa New Construction & Proposed Multifamily Projects 1Q20 ID PROPERTY UNITS 128 1 Icaria on Pinellas 236 129 130 4 Addison at Sunlake, The 307 5 Union on Fletcher 217 10 Parc at Wesley Chapel 248 13 Central on Orange Lake, The 85 122 17 Sawgrass Creek Phase II 143 Total Lease Up 1,236 30 Notch 112 31 Haven at Hunter's Lake, The 241 35 Altis @ Preserve 350 Total Under Construction 703 49 Waverly Terrace 214 50 University Mall Redevelopment 100 55 Bridge Haven 100 120 56 Cypress Town Center 230 126 57 Central on Orange Lake, The Phase II 50 13 Total Planned 694 124 57 10 119 121 92 Kirby Street 100 17 125 93 Bowels Road Mixed-Use 101 94 Bruce B Downs Blvd & Tampa Palms Blvd West 252 4 55 56 35 123 95 East Fowler Avenue 292 127 119 Arbours at Saddle Oaks 264 120 Bexley North - Parcel 5 Phase 1 208 121 Lexington Oaks Plaza 200 1 31 122 Trillium Blvd 160 133 123 Wiregrass 249 124 Summerset Senior 86 125 Wyndrush Townhomes 106 94 126 Cotee River 240 Honeymoon 127 Trinity Pines Preserve Townhomes 60 Island 5 State Park 50 128 Forest Oaks Boulevard 117 Temporarily 95 129 Spring Center 750 Closed 130 Spring Center Phase II 750 49 93 133 Venetian Isles 86 92 30 Total Prospective 4021 2 mi Source: Yardi Matrix LEGEND Lease-Up Under Construction Planned Prospective Tampa New Construction & Proposed Multifamily Projects 1Q20 Caladesi Island State Park Philippe Park 111 ID PROPERTY UNITS 74 12 Harbour at Westshore, The 192 15 1100 Apex 134 91 Total Lease Up 326 110 15 90 28 22 Grove Isle 298 72 24 Cortland Westshore 589 71 27 Pointe on Westshore, The 444 28 Novel Midtown Tampa 390 St. -

Transforming Tampa's Tomorrow

TRANSFORMING TAMPA’S TOMORROW Blueprint for Tampa’s Future Recommended Operating and Capital Budget Part 2 Fiscal Year 2020 October 1, 2019 through September 30, 2020 Recommended Operating and Capital Budget TRANSFORMING TAMPA’S TOMORROW Blueprint for Tampa’s Future Fiscal Year 2020 October 1, 2019 through September 30, 2020 Jane Castor, Mayor Sonya C. Little, Chief Financial Officer Michael D. Perry, Budget Officer ii Table of Contents Part 2 - FY2020 Recommended Operating and Capital Budget FY2020 – FY2024 Capital Improvement Overview . 1 FY2020–FY2024 Capital Improvement Overview . 2 Council District 4 Map . 14 Council District 5 Map . 17 Council District 6 Map . 20 Council District 7 Map . 23 Capital Improvement Program Summaries . 25 Capital Improvement Projects Funded Projects Summary . 26 Capital Improvement Projects Funding Source Summary . 31 Community Investment Tax FY2020-FY2024 . 32 Operational Impacts of Capital Improvement Projects . 33 Capital Improvements Section (CIS) Schedule . 38 Capital Project Detail . 47 Convention Center . 47 Facility Management . 49 Fire Rescue . 70 Golf Courses . 74 Non-Departmental . 78 Parking . 81 Parks and Recreation . 95 Solid Waste . 122 Technology & Innovation . 132 Tampa Police Department . 138 Transportation . 140 Stormwater . 216 Wastewater . 280 Water . 354 Debt . 409 Overview . 410 Summary of City-issued Debt . 410 Primary Types of Debt . 410 Bond Covenants . 411 Continuing Disclosure . 411 Total Principal Debt Composition of City Issued Debt . 412 Principal Outstanding Debt (Governmental & Enterprise) . 413 Rating Agency Analysis . 414 Principal Debt Composition . 416 Governmental Bonds . 416 Governmental Loans . 418 Enterprise Bonds . 419 Enterprise State Revolving Loans . 420 FY2020 Debt Service Schedule . 421 Governmental Debt Service . 421 Enterprise Debt Service . 422 Index .