S. 1047 Presidential $1 Coin Act of 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Mint

United States Mint Program Summary by Budget Activity Dollars in Thousands FY 2012 FY 2013 FY 2014 FY 2012 TO FY 2014 Budget Activity Actual Estimated Estimated $ Change % Change Manufacturing $3,106,304 $3,525,178 $2,937,540 ($168,764) -5.43% Total Cost of Operations $3,106,304 $3,525,178 $2,937,540 ($168,764) -5.43% FTE 1,788 1,844 1,874 86 4.81% Summary circulating coins in FY 2014 to meet the The United States Mint supports the needs of commerce. Department of the Treasury’s strategic goal to enhance U.S. competitiveness and promote Numismatic Program international financial stability and balanced Bullion – Mint and issue bullion coins global growth. while employing precious metal purchasing strategies that minimize or Since 1996, the United States Mint operations eliminate the financial risk that can arise have been funded through the Public from adverse market price fluctuations. Enterprise Fund (PEF), established by section 522 of Public Law 104–52 (codified at section Other Numismatic Products - Produce and 5136 of Title 31, United States Code). The distribute numismatic products in United States Mint generates revenue through sufficient quantities, through appropriate the sale of circulating coins to the Federal channels, and at the lowest prices Reserve Banks (FRB), numismatic products to practicable, to make them accessible, the public and bullion coins to authorized available, and affordable to people who purchasers. Both operating expenses and choose to purchase them. Design, strike capital investments are associated with the and prepare for presentation Congressional production of circulating and numismatic Gold Medals and commemorative coins, as coins and coin-related products. -

Unique NGC Set of Paraguay Overstrikes

TM minterrornews.com Unique NGC Set of Paraguay Overstrikes Excited About Mint Errors? 18 Page Price Guide Issue 11 • Fall 2005 Join Error World Club Inside! errorworldclub.org A Mike Byers Publication Al’s Coins Dealer in Mint Errors and Currency Errors alscoins.com pecializing in Mint Errors and Currency S Errors for 25 years. Visit my website to see a diverse group of type, modern mint and major currency errors. We also handle regular U.S. and World coins. I’m a member of CONECA and the American Numismatic Association. I deal with major Mint Error Dealers and have an excellent standing with eBay. Check out my show schedule to see which major shows I will be attending. I solicit want lists and will locate the Mint Errors of your dreams. Al’s Coins P.O. Box 147 National City, CA 91951-0147 Phone: (619) 442-3728 Fax: (619) 442-3693 e-mail: [email protected] Mint Error News Magazine Issue 11 • F a l l 2 0 0 5 Issue 11 • Fall 2005 Publisher & Editor - Table of Contents - Mike Byers Design & Layout Sam Rhazi Mike Byers’ Welcome 4 Off-Center Errors 5 Contributing Editors Off-Metal Errors 8 Tim Bullard Allan Levy Clad Layer Split Off Errors 11 Contributing Writers Double Struck 1800 $10 Eagle in Upcoming Heritage Auction 13 Heritage Galleries & Auctioneers Unique NGC Set of Paraguay Overstrikes 14 Bob McLaughlin Saul Teichman 1877 Seated Quarter Die Trial Adjustment Strike 23 Advertising AD 582-602 Byzantine Gold Justin II Full Brockage 24 The ad space is sold out. -

Buffalo Hunt: International Trade and the Virtual Extinction of the North American Bison

NBER WORKING PAPER SERIES BUFFALO HUNT: INTERNATIONAL TRADE AND THE VIRTUAL EXTINCTION OF THE NORTH AMERICAN BISON M. Scott Taylor Working Paper 12969 http://www.nber.org/papers/w12969 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 March 2007 I am grateful to seminar participants at the University of British Columbia, the University of Calgary, the Environmental Economics workshop at the NBER Summer Institute 2006, the fall 2006 meetings of the NBER ITI group, and participants at the SURED II conference in Ascona Switzerland. Thanks also to Chris Auld, Ed Barbier, John Boyce, Ann Carlos, Charlie Kolstad, Herb Emery, Mukesh Eswaran, Francisco Gonzalez, Keith Head, Frank Lewis, Mike McKee, and Sjak Smulders for comments; to Michael Ferrantino for access to the International Trade Commission's library; and to Margarita Gres, Amanda McKee, Jeffrey Swartz, Judy Hasse of Buffalo Horn Ranch and Andy Strangeman of Investra Ltd. for research assistance. Funding for this research was provided by the SSHRC. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. © 2007 by M. Scott Taylor. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Buffalo Hunt: International Trade and the Virtual Extinction of the North American Bison M. Scott Taylor NBER Working Paper No. 12969 March 2007 JEL No. F1,Q2,Q5,Q56 ABSTRACT In the 16th century, North America contained 25-30 million buffalo; by the late 19th century less than 100 remained. -

Initial Layout

he bison or buffalo is an enduring with the people who inhabited the Central typically located on built-in altars oppo- animal, having come from the Plains and its utility to them, it is not sur- site the east-facing entrances, so that the Tbrink of extinction in the latter part prising that the bison was an integral part morning light would fall upon them (see of the nineteenth century to a relatively of their lives. Buffalo were central char- earthlodge sketch at right). Such an altar substantial population today. The bison is acters in stories that were told of their can be seen at the Pawnee Indian Village also a living symbol, or icon, with mul- beginnings as tribal people living on Museum State Historic Site near Repub- tiple meanings to different people. earth, and bison figured prominently in lic, Kansas. Bison were also represented The association of bison with Ameri- ceremonies designed to insure the tribe’s in dances, such as the Buffalo Lodge can Indians is a firmly established and continued existence and good fortune. dance for Arapaho women; there were widely known image–and with good rea- Bison bone commonly is found as buffalo societies within tribal organiza- son. Archeological evidence and histori- food refuse in prehistoric archeological tions; and bison were represented in tribal cal accounts show that American Indians sites; but bison bones, in particular bison fetishes, such as the sacred Buffalo Hat or living in the Plains hunted bison for a skulls, also are revealed as icons. Per- Cap of the Southern Cheyenne. -

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 Dated July 2016) Effective Date: July 1, 2016 (Retroactive)

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 dated July 2016) Effective Date: July 1, 2016 (Retroactive) SUBJECT: Sales of Coins, Bullion, or Legal Tender REFERENCE: IC 6-2.5-3-5; IC 6-2.5-4-1; 45 IAC 2.2-4-1; IC 6-2.5-5-47 DISCLAIMER: Information bulletins are intended to provide nontechnical assistance to the general public. Every attempt is made to provide information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is inconsistent with the law, regulations, or court decisions is not binding on the department or the taxpayer. Therefore, the information provided herein should serve only as a foundation for further investigation and study of the current law and procedures related to the subject matter covered herein. SUMMARY OF CHANGES Other than nonsubstantive, technical changes, this bulletin is revised to clarify that sales tax exemption for certain coins, bullion, or legal tender applies to coins, bullion, or legal tender that would be allowable investments in individual retirement accounts or individually-directed accounts, even if such coins, bullion, or legal tender was not actually held in such accounts. INTRODUCTION In general, an excise tax known as the state gross retail (“sales”) tax is imposed on sales of tangible personal property made in Indiana. However, transactions involving the sale of or the lease or rental of storage for certain coins, bullion, or legal tender are exempt from sales tax. Transactions involving the sale of coins or bullion are exempt from sales tax if the coins or bullion are permitted investments by an individual retirement account (“IRA”) or by an individually-directed account (“IDA”) under 26 U.S.C. -

Sacagawea Dollars You Didn't Know About 2020-05

Sacagawea Dollars You Didn’t Know About Don Pannell – Cupertino, CA August 2015: CSNA Northern California Educational Symposium May 2020: Updated for Cupertino Coin Club Meeting [email protected] Background To attract good fortune, spend a new coin on an old friend, share an old pleasure with a new friend, and lift up the heart of a true friend by writing his name on the wings of a dragon. - Chinese Proverb What is a Sacagawea Dollar? • It is the 2nd and 4th Types of the US series of small dollars • 1st is Susan B. Anthony (1979-1981 & 1999) • 2nd is Sacagawea Golden Dollar (2000-2008) • 3rd is Presidential Dollars (2007-2016) • 4th is Native American Dollar (2009-present) • Date & Mint mark moved to the edge What is a Small Dollar? • All US small dollar coins have the same size, weight & electronic signature! • They work interchangeably in vending machines – supported since the 1980’s • 26.5mm (1.043”) diameter – 2.00mm thick • 8.1 grams weight • Construction (of all but SBA dollars): • Clad with inner core of 100% copper • Outer layer: 77% Cu, 4% Ni, 7% Mn, 12% Zn • Overall: 88.5% Cu, 2% Ni, 3.5% Mn, 6% Zn What a Sacagawea Dollar Isn’t • It isn’t confused with a Quarter! • As Susan B. Anthony Dollars were • Edge feel and Color are very diferent • Nobody has problems identifying cents & dimes! • It isn’t circulating! (at least not here) • Due to $1 bills still being made • And the fear of the old Quarter confusion • Just about every other major country circulates coins for their $1 & $2 equivalent values, some use $5 coins! Designers of the Sacagawea Dollar Randy’L Hedow Teton – Obs model Thomas D. -

GAO-02-896 New Dollar Coin Contents

United States General Accounting Office Report to the Subcommittee on Treasury GAO and General Government, Committee on Appropriations, U.S. Senate September 2002 NEW DOLLAR COIN Marketing Campaign Raised Public Awareness but Not Widespread Use a GAO-02-896 Contents Letter 1 Results in Brief 2 Background 5 New Dollar Coin Marketing Program Cost $67.1 Million and Generated $968 Million in Seigniorage, but the Coin Is Not Widely Circulated 9 Public Resistance Is the Greatest Barrier to Increased Use of the New Dollar Coin 17 The Mint’s Marketing Plan Identifies but Does Not Provide Details on How It Will Address Barriers to Increased Coin Use 27 The 2001 and 2002 Mint Reports to Congress Did Not Fully Describe the Marketing Program, Results, or Problems Encountered 32 Conclusions 35 Recommendations for Executive Actions 36 Agency Comments and Our Evaluation 36 Appendixes Appendix I: Objectives, Scope, and Methodology 39 Appendix II: State and Local Governments: Dollar Coin Use Data in the Largest Transit Systems and Toll Roads 41 Appendix III: Comments from the United States Mint 43 Appendix IV: Comments from the Federal Reserve Board of Governors 46 Tables Table 1: Marketing Program Contractors as of December 2001 10 Table 2: Mint Promotions Distributing New Dollar Coins, Ranked by Number of New Dollar Coins to Be Distributed 13 Table 3: Number of Dollar Coins that the Mint Shipped to Federal Reserve Banks, Fiscal Years 1998-2000 17 Table 4: Circulation of Highest Value Coins and Lowest Value Notes in G-7 Countries 20 Table 5: New Dollar Coin Distribution Problems Identified in Telephone Calls to the Mint from January to August 2001 24 Table 6: Summary of Actions in Mint Marketing Plan to Address Barriers 32 Table 7: Transit Agencies Accepting the New Dollar coin, as of April 2002 41 Page i GAO-02-896 New Dollar Coin Contents Table 8: Dollar Coin Use in Toll Road Operators, as of December 2001 42 Figure Figure 1: Federal Reserve Net Payout of Susan B. -

Read It Online

Serving the Numismatic Community Since 1959 Village Coin Shop Catalog 2020-2021 Vol. 59 www.villagecoin.com • P.O. Box 207 • Plaistow, NH 03865-0207 2020 U.S. Gold Eagles Half Dollar Commemoratives • Brilliant Uncirculated All in original box with COA unless noted **In Capsules Only • Call For Prices USGE1 . .1/10 oz Gold Eagle USGE2 . .1/4 oz Gold Eagle USGE3 . .1/2 oz Gold Eagle USGE4 . .1 oz Gold Eagle ITEM DESCRIPTION GRADE PRICE CMHD82B7 . .1982-D Washington . BU . $16 .00 Commemorative Sets CMHD82C8 . .1982-S Washington . Proof . 16 .50 CMHD86B7 . .1986-D Statue of Liberty** . BU . 5 .00 CMHD86C8 . .1986-S Statue of Liberty** . Proof . 4 .00 CMHD91C7 . .1991-D Mount Rushmore . BU . 20 .00 CMHD91C8 . .1991-S Mount Rushmore . Proof . 28 .00 CMHD92C8 . .1992-S Olympic . BU . 35 .00 CMHD92C8 . .1992-S Olympic . Proof . 35 .00 CMHD93D7 . .1993-W Bill of Rights . BU . 40 .00 CMHD93C8 . .1993-S Bill of Rights . Proof . 35 .00 CMHD93A7 . .1993-P World War II . BU . 30 .00 CMHD93A8 . .1993-P World War II . Proof . 36 .00 CMHD94B7 . .1994-D World Cup . BU . 13 .00 ITEM DESCRIPTION GRADE PRICE CMHD94A8 . .1994-P World Cup . Proof . 13 .00 Two-Coin Half Dollar And Silver Dollar Sets CMHD95A7 . .1995-P Civil War . BU . 63 .00 CMTC86A7 . .1986 Statue of Liberty . BU . $ 39 .00 CMHD95C9 . .1995-S Civil War . Proof . 63 .00 CMTC86A8 . .1986 Statue of Liberty . Proof . 39 .00 CMHD95C7 . .1995-S Olympic Basketball . BU . 27 .50 CMTC86C8 . .1989 Congressional . Proof . 49 .00 CMHD95C8 . .1995-S Olympic Basketball . Proof . 35 .00 CMHD95C7 . .1995-S Olympic Baseball . -

CONGRESSIONAL RECORD—HOUSE, Vol. 151, Pt. 6 April 26, 2005 What They Found Was That to Be Competitive Mr

7794 CONGRESSIONAL RECORD—HOUSE, Vol. 151, Pt. 6 April 26, 2005 What they found was that to be competitive Mr. TOM DAVIS of Virginia. Mr. its position as not only a necessary means of ex- in the world they needed to excel in tech- Speaker, I yield back the balance of change in commerce but also as an object of aes- nology and engineering, which is where we in my time. thetic beauty in its own right, it is appropriate the United States find ourselves to be lacking The SPEAKER pro tempore (Mr. to move many of the mottos and emblems, the inscription of the year, and the so-called ‘‘mint today. We need to follow the example of our BOOZMAN). The question is on the mo- marks’’ that currently appear on the 2 faces of Indian friends and the example we set in the tion offered by the gentleman from each circulating coin to the edge of the coin, 1960’s and create a national strategy to make Virginia (Mr. TOM DAVIS) that the which would allow larger and more dramatic the way we teach our children in the United House suspend the rules and agree to artwork on the coins reminiscent of the so-called States more focused on the math and the resolution, H. Res. 227. ‘‘Golden Age of Coinage’’ in the United States, sciences so we are not left behind. The question was taken; and (two- at the beginning of the Twentieth Century, ini- Instead of fearing India as an economic thirds having voted in favor thereof) tiated by President Theodore Roosevelt, with the competitor, we should be embracing India as the rules were suspended and the reso- assistance of noted sculptors and medallic art- an economic and political ally. -

Notice of Sale of Personal Property Under Execution

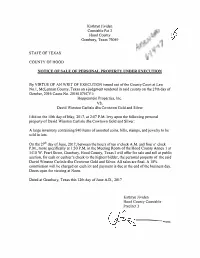

Kathryn Jividen Constable Pct 3 Hood County Granbury, Texas 76049 STATE OF TEXAS COUNTY OF HOOD NOTICE OF SALE OF PERSONAL PROPERTY UNDER EXECUTION By VIRTUE OF AN WRIT OF EXECUTION issued out ofthe County Court at Law No. I, McLennan County, Texas on a judgmentrend ered in said county on the 27th day of October, 2016 Cause No. 20161075CVI: Hoppenstein Properties, Inc. vs. David Winston Carlisle dba Cowtown Gold and Silver I did on the 10th day of May, 2017, at 2:07 P.M. levy upon the following personal property of David Winston Carlisle dba Cowtown Gold and Silver: A large inventory containing 940 items of assortedcoins, bills, stamps, and jewelry to be sold in lots. On the 2th day of June, 2017, between the hours often o'clock A.M. and fouro' clock P.M., more specifically at I :30 P.M. in the Meeting Room of the Hood County Annex 1 at 1410 W. Pearl Street, Granbury, Hood County, Texas I will offer forsale and sell at public auction, for cash or cashier's check to the highest bidder, the personal propertyof the said David Winston Carlisle dba Cowtown Gold and Silver. All sales are final.A 10% commission will be charged on each lot and payment is due at the end of the business day. Doors open forviewing at Noon. Dated at Granbury, Texas this 12th day of June A.O., 2017 Kathryn Jividen Hood County Constable Precinct 3 --=-==--- Lot 1 Lot 4 #29, 43, 66, 69 Plastic Bin with Pennies The Complete Collection of uncirculated Sacagawea 293 .50cent rolls of pennies Golden Dollars PCS Stamps & Coins .41 cents loose pennies The Complete Collection -

Coin Catalog 3-31-18 Lot # Description Lot # 1

COIN CATALOG 3-31-18 LOT # DESCRIPTION LOT # 1. 20 Barber Dimes 1892-1916 44. 1944S 50 Centavo Phillipine WWII Coinage GEM BU 2. 16 V-Nickels 1897-1912 45. 1956D Rosy Dime MS64 NGC 3. 8 Mercury Dimes 1941-1942S 46. 1893 Isabella Quarter CH BU Low Mintage 24,214 4. 16 Pcs. of Military Script 47. 1897 Barber Quarter CH BU 5. 1928A "Funny Back" $1 Silver Certificate 48. 10K Men's Gold Harley Davidson Ring W/Box 6. 1963B "Barr Note" $1 Bill W/Star 49. Roll of 1881-0 Morgan Dollars CH UNC 7. 40 Coins From Europe 50. 1954P,D,S Mint Sets in Capital Holder GEM 8. 4 Consecutively Numbered 2003A Green Seal $2 Bills 51. Roll of 1879 Morgan Dollars CH UNC 9. 1863 Indian Cent CH UNC 52. Colonial Rosa Americana Two Pence RARE 10. 1931D Lincoln Cent CH UNC KEY 53. 1911S Lincoln Cent VF20 PCGS 11. 1943 Jefferson Nickel MS65 Silver 54. 1919S " MS65 12. 1953 " PF66 Certified 55. 1934D " " 13. 1876S Trade Dollar CH UNC Rare High Grade 56. 1907 Indian Cent GEM PROOF 14. 1889S Morgan Dollar MS65 Redfield Collection KEY 57. 1903-0 Barber Dime XF45 Original 15. 1885S " CH BU KEY 58. 1917S Reverse Walking Liberty Half F15 16. 1880-0 " MS62 PCGS 59. 1926D Peace Dollar MS65+ 17. 1934D Peace Dollar MS62 NGC 60. 1987 Proof Set 18. 2 1923 Peace Dollar CH BU Choice 61. 1854 Seated Half AU+ 19. 1934 $100 FRN FR# 2152-A VF 62. 1893 Isabella Quarter MS63 Low Mintage 24,214 20. -

Coin Catalog 1-26-19 Lot # Description 1

COIN CATALOG 1-26-19 LOT # DESCRIPTION 1. Coin Paper Weight 44. 1909S Lincoln Cent VF+ KEY 2. 1962 Washington Quarter PR67 45. 1919 " BU 3. 1964 " " 46. 1931S " CH AU KEY RARE 4. 2009 Inaugural Ceremony Lincoln Cent Cert. 47. 1878 7/8 TF Morgan Dollar CH AU 5. 1999 SBA Dollar Proof 48. 1878S Morgan Dollar CH BU 6. 2004 ASE MS69 PCGS 49. 1879 " AU 7. 140 Wheat Cents in Bag 50. 1879-0 " BU 8. 1835 Half Cent XF 51. 1880S " MS65 9. 1857 Flying Eagle Cent AU 52. 1922 Peace Dollar BU 10. 1859 Indian Cent AU 53. 1922S " BU 11. 1863 " AU 54. 1923 " BU 12. 1874 " CH UNC Rare High Grade 55. 4 Peace Dollars 1922-1924 MS63 13. 1866 " " " 56. 1847 Lg. Cent AU+ 14. 1902 " " 57. 1855 " AU 15. 1832 Half Cent XF Low Mintage 58. 1856 " AU 16. 1832 Lg. Cent AU 59. 1949 Franklin Half MS64 KEY 17. 1850 " MS63 RB 60. 1946 Walking Liberty Half MS64 18. 1854 " AU 61. 1938D " VF KEY 19. 1931S Lincoln Cent MS63 KEY RARE 62. 4 Peace Dollars 1922-1924 MS63 20. 4 Peace Dollars 1922-1924 MS63 63. 1859 Indian Cent XF45 Original 21. 1948D Franklin Half MS65+ FBL 64. 1914S Lincoln Cent MS64+ Original Toning RARE 22. 1954D " " " 65. 1920D " " Typical Weak Mint Mark 23. 1948D Washington Quarter MS67 GEM 66. 1806 Lg. Cent Lg. 6, Stems AG3 24. 1948S " MS66+ " 67. 1917D T-1 Standing Quarter XF45 Original Scarce 25. Ladies Gold Chain & Tiger Eye Pendant 68. 1844-0 Seated Half CH AU Toned Rare 26.