Infigen Energy 2012 Annual Report and Agm Notice of Meeting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

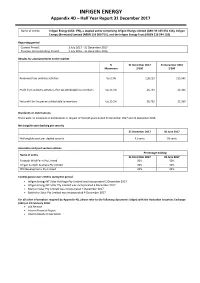

INFIGEN ENERGY Appendix 4D – Half Year Report 31 December 2017

INFIGEN ENERGY Appendix 4D – Half Year Report 31 December 2017 Name of entity: Infigen Energy (ASX: IFN), a stapled entity comprising Infigen Energy Limited (ABN 39 105 051 616), Infigen Energy (Bermuda) Limited (ARBN 116 360 715), and the Infigen Energy Trust (ARSN 116 244 118) Reporting period Current Period: 1 July 2017 ‐ 31 December 2017 Previous Corresponding Period: 1 July 2016 ‐ 31 December 2016 Results for announcement to the market % 31 December 2017 31 December 2016 Movement $’000 $’000 Revenues from ordinary activities Up 2.5% 118,213 115,365 Profit from ordinary activities after tax attributable to members Up 25.1% 26,733 21,366 Net profit for the period attributable to members Up 25.1% 26,733 21,366 Dividends or distributions There were no dividends or distributions in respect of the half‐years ended 31 December 2017 and 31 December 2016. Net tangible asset backing per security 31 December 2017 30 June 2017 Net tangible asset per stapled security 41 cents 38 cents Associates and joint venture entities Percentage holding Name of entity 31 December 2017 30 June 2017 Forsayth Wind Farm Pty Limited 50% 50% Infigen Suntech Australia Pty Limited 50% 50% RPV Developments Pty Limited 32% 32% Control gained over entities during the period Infigen Energy NT Solar Holdings Pty Limited was incorporated 1 December 2017 Infigen Energy NT Solar Pty Limited was incorporated 4 December 2017 Manton Solar Pty Limited was incorporated 4 December 2017 Batchelor Solar Pty Limited was incorporated 4 December 2017 For all other information required -

ATK2-1 Wivenhoe Power Station Geological Inspection Report by 19

QUEENSLAND FLOODS COMMISSION OF INQUIRY STATEMENT OF ANDREW KROTEWICZ TABLE OF EXHIBITS ATK2-1 Wivenhoe Power Station Geological Inspection Report by 19 January 2011 SunWater On 3 November 20111, Andrew Krotewicz of ci Level 2, HQ North Tower, 540 Wickham Street, Fortitude Valley in the State of Queensland, say on oath: I am the former General Manager Generation Operations of Tarong Energy Corporation. I held this position between 1 September 2007 and 30 June 2011. 2. On 1 July 2011, I was appointed the Executive General Manager Asset Strategy of CS Energy at the same time as CS Energy became the successor in law to Tarong Energy Corporation of the Wivenhoe Business Unit as defined in the Government Owned Corporations Act 1993 (QId) (Generator Restructure) Regulation 2011 which includes the Wivenhoe Power Station and rights to move water in and out of Splityard Creek Dam. 3. This statement is supplementary to the two prior statements dated 13 September 2011. For the period 1 October 2010 to 31 March 2011: 4.0 1(a) a description of whether and how the communication requirements set out in the following documents were complied with and 1(b) to the extent that either of these documents were not complied with, and explanation as to why compliance did not occur: Deed of Practice between Seqwater and Tarong Energy Corporation (Tarong Energy) for Wiven hoe Dam and Wivenhoe Power Station. Wivenhoe Power Station Business Procedure for Wivenhoe - High Rainfall, High Dam Water Levels (WI V-OPS-1 5). Deed of Practice 4.1 On 4 October 2010 Seqwater requested under the terms of the Deed of Practice that a notification protocol be initiated to allow Seqwater to receive notice of impending water releases to/ extraction from Lake Wivenhoe by Wivenhoe Power Station. -

Modern Slavery Statement 2020 Modern Slavery Statement 2020

Modern Slavery Statement 2020 Modern Slavery Statement 2020 Contents 2 Contact 3 Introduction 4 About CS Energy Our purpose Our values 5 Reporting criteria 1 & 2 Our organisational structure Our operations Our supply chain 8 Reporting criteria 3 Modern slavery risks in our operations and supply chain 9 Reporting criteria 4 Actions taken to assess and address our modern slavery risks 10 Reporting criteria 5 Assessing the effectiveness of our actions 11 Reporting criteria 6 Consultation with owned or controlled entities Contact Brisbane office and registered office CS Energy Limited Level 2, HQ North Tower 540 Wickham Street Fortitude Valley Qld 4006 PO Box 2227 Fortitude Valley BC Qld 4006 P: +61 7 3854 7777 E: [email protected] W: www.csenergy.com.au ABN 54 078 848 745 2 CS Energy Modern Slavery Statement 2020 Introduction CS Energy is proud to present our inaugural Modern Slavery Statement under the Australian Government’s Modern Slavery Act 2018. The statement covers all sites owned or operated by CS Energy (as outlined on page 6) for the financial year ending 30 June 2020. In FY2020, CS Energy spent more than $575 million on goods and services from almost 1,200 vendors. We recognise that a business with this procurement spend has an important role to play in helping to prevent modern slavery. Our immediate focus in FY2020 was to gain an understanding of the modern slavery risks in our supply chains and to establish processes for addressing those risks, with our analysis concluding that the risk in our supply chain is low. -

Energy 2020 (Report 11: 2020–21)

FINANCIAL AUDIT REPORT 4 February 2021 Energy 2020 Report 11: 2020–21 • Queensland • • Audit Office Better public services As the independent auditor of the Queensland public sector, including local governments, the Queensland Audit Office: • provides professional audit services, which include our audit opinions on the accuracy and reliability of the financial statements of public sector entities • provides entities with insights on their financial performance, risk, and internal controls; and on the efficiency, effectiveness, and economy of public service delivery • produces reports to parliament on the results of our audit work, and on our insights, advice, and recommendations for improvement • conducts investigations into claims of financial waste and mismanagement raised by elected members, state and local government employees, and the public • shares wider learnings and best practice from our work with state and local government entities, our professional networks, industry, and peers. We conduct all our audits and reports to parliament under the Auditor-General Act 2009 (the Act). Our work complies with the Auditor-General Auditing Standards and the Australian standards relevant to assurance engagements. • Financial audit reports summarise the results of our audits of over 400 state and local government entities. • Performance audit reports cover our evaluation of some, or all, of the entities’ efficiency, effectiveness, and economy in providing public services. Depending on the level of assurance we can provide, these reports may also take the form of: • Audit insights, which provide some evaluation and share our insights or learnings from our audit work across government • Audit briefs, which set out key facts, involve some evaluation, and may include findings and recommendations • Audit overviews, which help clients and stakeholders understand complex issues and subjects. -

National Greenpower Accreditation Program Annual Compliance Audit

National GreenPower Accreditation Program Annual Compliance Audit 1 January 2007 to 31 December 2007 Publisher NSW Department of Water and Energy Level 17, 227 Elizabeth Street GPO Box 3889 Sydney NSW 2001 T 02 8281 7777 F 02 8281 7799 [email protected] www.dwe.nsw.gov.au National GreenPower Accreditation Program Annual Compliance Audit 1 January 2007 to 31 December 2007 December 2008 ISBN 978 0 7347 5501 8 Acknowledgements We would like to thank the National GreenPower Steering Group (NGPSG) for their ongoing support of the GreenPower Program. The NGPSG is made up of representatives from the NSW, VIC, SA, QLD, WA and ACT governments. The Commonwealth, TAS and NT are observer members of the NGPSG. The 2007 GreenPower Compliance Audit was completed by URS Australia Pty Ltd for the NSW Department of Water and Energy, on behalf of the National GreenPower Steering Group. © State of New South Wales through the Department of Water and Energy, 2008 This work may be freely reproduced and distributed for most purposes, however some restrictions apply. Contact the Department of Water and Energy for copyright information. Disclaimer: While every reasonable effort has been made to ensure that this document is correct at the time of publication, the State of New South Wales, its agents and employees, disclaim any and all liability to any person in respect of anything or the consequences of anything done or omitted to be done in reliance upon the whole or any part of this document. DWE 08_258 National GreenPower Accreditation Program Annual Compliance Audit 2007 Contents Section 1 | Introduction....................................................................................................................... -

Infigen Energy Annual Report 2018

Annual Report 2019. Infigen Energy Image: Capital Wind Farm, NSW Front page: Run With The Wind, Woodlawn Wind Farm, NSW Contents. 4 About Infigen Energy 7 2019 Highlights 9 Safety 11 Chairman & Managing Director’s Report Directors’ Report 16 Operating & Financial Review 31 Sustainability Highlights 34 Corporate Structure 35 Directors 38 Executive Directors & Management Team 40 Remuneration Report 54 Other Disclosures 56 Auditor’s Independence Declaration 57 Financial Report 91 Directors’ Declaration 92 Auditor’s Report Additional Information 9 Investor Information 8 10 Glossary 1 10 4 Corporate Directory Infigen Energy Limited ACN 105 051 616 Infigen Energy Trust ARSN 116 244 118 Registered office Level 17, 56 Pitt Street Sydney NSW 2000 Australia +61 2 8031 9900 www.infigenenergy.com 2 Our Strategy. We generate and source renewable energy. We add value by firming. We provide customers with reliable clean energy. 3 About Infigen Energy. Infigen is leading Australia’s transition to a clean energy future. Infigen generates and sources renewable energy, increases the value of intermittent renewables by firming, and provides customers with clean, reliable and competitively priced energy solutions. Infigen generates renewable energy from its owned wind farms in New South Wales (NSW), South Australia (SA) and Western Australia (WA). Infigen also sources renewable energy from third party renewable projects under its ‘Capital Lite’ strategy. Infigen increases the value of intermittent renewables by firming them from the Smithfield Open Cycle Gas Turbine facility in Western Sydney, NSW, and its 25MW/52MWh Battery at Lake Bonney, SA, where commercial operations are expected to commence in H1FY20. Infigen’s energy retailing licences are held in the National Electricity Market (NEM) regions of Queensland, New South Wales (including the Australian Capital Territory), Victoria and South Australia. -

Government Owned Corporations (Generator Restructure) Regulation 2011

Queensland Government Owned Corporations (Generator Restructure) Regulation 2011 Explanatory Notes for SL 2011 No. 126 made under the Government Owned Corporations Act 1993 General outline Short title Government Owned Corporations (Generator Restructure) Regulation 2011. Authorising law Section 161 of the Government Owned Corporations Act 1993 Policy objectives and the reasons for them The objective of the regulation is to give effect to the outcomes of the Shareholder Review of Queensland Government Owned Corporation Generators (‘the Generator Review’), the recommendations of which were announced by the then Treasurer and Minister for Employment and Economic Development on 25 November 2010. A key consideration of the Generator Review was to develop a model which would: Government Owned Corporations (Generator Restructure) Regulation 2011 • re-position the Government owned generators to respond to challenging market conditions, including competition from large vertically-integrated retailers and an impending carbon pollution reduction scheme; • enable the Government to best manage its portfolio of generation assets to ensure value for money for all Queenslanders; and • secure the ongoing viability of the generation assets. The Generator Review recommended that the current three Government owned generators (CS Energy Limited (‘CS Energy’), Stanwell Corporation Limited (‘Stanwell’) and Tarong Energy Corporation Limited (‘Tarong Energy’)) be amalgamated into two, and that the existing generation assets be reallocated between the two restructured entities. Following a period of consultation with employees of the three Government owned generators, the final reallocation of generation assets was announced by the Minister for Finance and The Arts on 10 March 2011. Achievement of policy objectives The regulation achieves its objectives by effecting the following reallocations of generation assets between the Government owned generators: 1. -

Cash Flow 84 $ M 62

29 September 2014 INFIGEN ENERGY – FY14 ANNUAL FINANCIAL REPORT Infigen Energy (ASX: IFN) advises that the attached Annual Financial Report for the Infigen Energy Group for the year ended 30 June 2014, which includes the Annual Financial Report for Infigen Energy Trust, was despatched to securityholders today. The report is also available on Infigen’s website: www.infigenenergy.com ENDS For further information please contact: Richard Farrell, Investor Relations Manager Tel +61 2 8031 9900 About Infigen Energy Infigen Energy is a specialist renewable energy business. We have interests in 24 wind farms across Australia and the United States. With a total installed capacity in excess of 1,600MW (on an equity interest basis), we currently generate enough renewable energy per year to power over half a million households. For personal use only As a fully integrated renewable energy business, we develop, build, own and operate energy generation assets and directly manage the sale of the electricity that we produce to a range of customers in the wholesale market. Infigen Energy trades on the Australian Securities Exchange under the code IFN. For further information please visit our website: www.infigenenergy.com INFIGEN ENERGY INFIGEN | ANNUAL REPORT 2014 INFIGEN ENERGY ANNUAL REPORT 2014 For personal use only For personal use only A LEADING SPECIALIST RENEWABLE ENERGY BUSINESS CONTENTS 02 Business Highlights 51 Directors’ Report 04 About Us 56 Remuneration Report 06 Chairman’s Report 68 Auditor’s Independence Declaration 08 Managing Director’s Report 69 Financial Statements 12 Management Discussion and Analysis 75 Notes to Financial Statements 33 Safety and Sustainability 137 Directors’ Declaration 38 Infigen Board 138 Independent Auditor’s Report 40 Infigen Management 140 Additional Investor Information For personal use only 42 Corporate Governance Statement 143 Glossary 43 Corporate Structure 145 Corporate Directory All references to $ is a reference to Australian dollars and all years refer to financial year ended 30 June unless specifically marked otherwise. -

Queensland Energy Class Action

Queensland Energy Class Action Claim Summary Piper Alderman has been investigating anomalous spikes in the spot price of electricity in the Queensland region of the National Electricity Market (NEM) from 2013 through to 2019. From our research we believe it can be shown that certain price spikes have been caused by Queensland’s State owned electricity generators, Stanwell Corporation Limited and CS Energy Limited adopting “gaming” strategies in their supply of electricity. By gaming of the system the generators create artificial scarcity of supply in the NEM, inflate electricity prices for consumers and prevent other generators from competing for market share. In our view this conduct amounts to a contravention of section 46 of the Competition and Consumer Act 2010 (Cth) because the generators are misusing their market power for the purpose of deterring or preventing a person from engaging in competitive conduct in the NEM. We believe this conduct has caused significant losses to everyday consumers of electricity in Queensland by increasing the price of this essential service. This Qld Energy Class Action proposes to prove this conduct and recover that loss and damage for all consumers within the region. Who are the defendants to the class action? The defendants to the action are Stanwell Corporation Limited (Stanwell) and CS Energy Limited (CSE). Stanwell and CSE operate most of the black coal generating units in the Queensland region of the NEM, meaning they are largely responsible for supplying the minimum level of demand on an electrical grid over a span of time. This is the “baseload” for Queensland electricity consumption. -

State of the Energy Market 2011

state of the energy market 2011 AUSTRALIAN ENERGY REGULATOR state of the energy market 2011 AUSTRALIAN ENERGY REGULATOR Australian Energy Regulator Level 35, The Tower, 360 Elizabeth Street, Melbourne Central, Melbourne, Victoria 3000 Email: [email protected] Website: www.aer.gov.au ISBN 978 1 921964 05 3 First published by the Australian Competition and Consumer Commission 2011 10 9 8 7 6 5 4 3 2 1 © Commonwealth of Australia 2011 This work is copyright. Apart from any use permitted under the Copyright Act 1968, no part may be reproduced without prior written permission from the Australian Competition and Consumer Commission. Requests and inquiries concerning reproduction and rights should be addressed to the Director Publishing, ACCC, GPO Box 3131, Canberra ACT 2601, or [email protected]. ACKNOWLEDGEMENTS This report was prepared by the Australian Energy Regulator. The AER gratefully acknowledges the following corporations and government agencies that have contributed to this report: Australian Bureau of Statistics; Australian Energy Market Operator; d-cyphaTrade; Department of Resources, Energy and Tourism (Cwlth); EnergyQuest; Essential Services Commission (Victoria); Essential Services Commission of South Australia; Independent Competition and Regulatory Commission (ACT); Independent Pricing and Regulatory Tribunal of New South Wales; Office of the Tasmanian Economic Regulator; and Queensland Competition Authority. The AER also acknowledges Mark Wilson for supplying photographic images. IMPORTANT NOTICE The information in this publication is for general guidance only. It does not constitute legal or other professional advice, and should not be relied on as a statement of the law in any jurisdiction. Because it is intended only as a general guide, it may contain generalisations. -

Annual Report 2015/16

Building Value. Securing the Future. ANNUAL REPORT 2015/16 STANWELL ANNUAL REPORT 2015/16 | CHAPTER TITLE A TABLE OF CONTENTS ABOUT About Stanwell Energy 1 Chairman’s statement 3 STANWELL Chief Executive Officer’s review 5 Performance indicators 8 Stanwell is a diversified energy business. Asset performance 9 We own coal, gas and water assets, which Strategic direction 10 we use to generate electricity. We sell this electricity directly to business customers and The year ahead 12 we trade gas, coal and electricity products. Sell our energy for the best return 16 Our coal, gas and hydro power stations are located Simplify and streamline our business 20 at eight geographically dispersed sites across Queensland and have the capacity to generate more Secure our future 22 than 4,000 megawatts (MW), or more than half of Corporate governance 26 Queensland’s average daily electricity demand. The safe and efficient operation of our plant is Financial results 35 paramount to Stanwell. Our belief is that our people, Directors’ report 36 contractors and visitors who enter our sites and offices should be able to do so with the knowledge Auditor’s independence declaration 43 they will return home safely to family and friends Financial statements 44 each day. Notes to the consolidated financial statements 52 We are a proud generator of environmentally- responsible energy. Through our portfolio of hydro Directors’ declaration 115 power stations, we have the capacity to generate more than 160 MW of electricity with no greenhouse Independent auditor’s report 116 gas emissions. We also operate two of Australia’s most efficient coal-fired power stations: the supercritical 443 MW Tarong North Power Station and the subcritical 1,460 MW Stanwell Power Station. -

Peak Demand Forecasts

2014 Electricity Statement of Opportunities (ESOO) Stakeholder Workshop Neetika Kapani A/Manager, System Capacity 1 July 2015 1 Agenda Background Purpose Key Findings o Peak Demand Forecasts o Energy Forecasts Interesting Analysis o Capacity Credits by Market Participant o Individual Reserve Capacity Requirement (IRCR) o Solar PV o Battery Questions 2 2014 and 2015 ESOO deferrals Minister for Energy directed IMO on 29 April 2014 to defer certain aspects of the 2014 Reserve Capacity Cycle, by a year. 13 March 2015 to defer certain aspects of the 2015 Reserve Capacity Cycle, by a year. On 17 June 2015, the IMO published 2014 ESOO and sets the Reserve Capacity Target for the 2016-17 Capacity Year Reserve Capacity Information Pack 3 RCM Process http://www.imowa.com.au/home/electricity/reserve-capacity 4 Purpose of the 2014 ESOO Provides market data and information of interest to current and potential WEM participants and stakeholders Sets the Reserve Capacity Target (RCT) for the 2016-17 Capacity Year o RCT for 2016-17 is 4,557 MW o Based on the 10 per cent probability of exceedance (PoE) forecast plus a reserve margin 5 Key Findings • Unusual Early Peak 5 January 2015 15:30- 16:00 TI Demand of 3744 MW • SWIS demand growth flattening • IRCR mechanism continues to be effective • Customer behaviour changing rapidly • Healthy mix and diversity of generation capacity and DSM continues • No new generation or Demand Side Management (DSM) capacity will be required for the 2015 to 2025 forecast period 6 Forecasting presents Challenges