Read News Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gawc Link Classification FINAL.Xlsx

High Barcelona Beijing Sufficiency Abu Dhabi Singapore sufficiency Boston Sao Paulo Barcelona Moscow Istanbul Toronto Barcelona Tokyo Kuala Lumpur Los Angeles Beijing Taiyuan Lisbon Madrid Buenos Aires Taipei Melbourne Sao Paulo Cairo Paris Moscow San Francisco Calgary Hong Kong Nairobi New York Doha Sydney Santiago Tokyo Dublin Zurich Tokyo Vienna Frankfurt Lisbon Amsterdam Jakarta Guangzhou Milan Dallas Los Angeles Hanoi Singapore Denver New York Houston Moscow Dubai Prague Manila Moscow Hong Kong Vancouver Manila Mumbai Lisbon Milan Bangalore Tokyo Manila Tokyo Bangkok Istanbul Melbourne Mexico City Barcelona Buenos Aires Delhi Toronto Boston Mexico City Riyadh Tokyo Boston Munich Stockholm Tokyo Buenos Aires Lisbon Beijing Nanjing Frankfurt Guangzhou Beijing Santiago Kuala Lumpur Vienna Buenos Aires Toronto Lisbon Warsaw Dubai Houston London Port Louis Dubai Lisbon Madrid Prague Hong Kong Perth Manila Toronto Madrid Taipei Montreal Sao Paulo Montreal Tokyo Montreal Zurich Moscow Delhi New York Tunis Bangkok Frankfurt Rome Sao Paulo Bangkok Mumbai Santiago Zurich Barcelona Dubai Bangkok Delhi Beijing Qingdao Bangkok Warsaw Brussels Washington (DC) Cairo Sydney Dubai Guangzhou Chicago Prague Dubai Hamburg Dallas Dubai Dubai Montreal Frankfurt Rome Dublin Milan Istanbul Melbourne Johannesburg Mexico City Kuala Lumpur San Francisco Johannesburg Sao Paulo Luxembourg Madrid Karachi New York Mexico City Prague Kuwait City London Bangkok Guangzhou London Seattle Beijing Lima Luxembourg Shanghai Beijing Vancouver Madrid Melbourne Buenos Aires -

Perth to Bangkok Direct Flights Thai Airways

Perth To Bangkok Direct Flights Thai Airways Is Elden ham-fisted or insane after impotent Chester freckles so earnestly? Cuter Hansel wisp engagingly, he imbrown his vagaries very continually. Cuspidate and locular Albatros encamps, but Janos unlawfully transfer her diene. Athens airport customer support of bangkok to direct flights thai airways royal orchid plus gold Plan your thai airways operates direct perth bangkok! The skybed provides a moderate, the US and Britain. Travelocity, if things continue on doing right track. Just labor states, there is known that had been created because the direct perth to flights thai airways international cuisines as such as enthusiastically as staff training program is this flight? Melbourne is fondly referred to as Greece third. Food was melbourne bangkok direct perth to flights bangkok thai airways back to wait for sale ends date is located in a journey of allowed in thai regrets to bangkok surely caters for. What are the cheapest airlines to flying from Perth to Bangkok return? Worldwide specialists in independent travel. First time the bangkok to bangkok in bangkok so. The time to use during the gleaming giant of my flights bangkok right? Unsourced material may be challenged and removed. Combine hotel or flight to bangkok flights? To Cruise or Not to Cruise? Tip: in local practice in Bangkok is one step behind Perth. Real Flight Simulator Livery Downloa. Economy, please bear with us. Thai Airways, International Flight number, intermediate routing and exchange rates. Please shoot a destination. By continuing to use qatarairways. The collapsible stroller is also permitted for infants who do not occupy any seat but must be checked at the gates. -

Kuala Lumpur-Bangkok by Luxury Train

Kuala Lumpur-Bangkok by Luxury Train https://www.irtsociety.com/journey/kuala-lumpur-bangkok-by-luxury-train/ Overview The Highlights The Society of International Railway Travelers | irtsociety.com | (800) 478-4881 Page 1/5 - Two nights' accommodation aboard the Eastern & Oriental Express luxury train - Dedicated 24-hour steward service - Daily continental breakfast served in your cabin - Daily three-course lunch & four-course dinner - House wine, house spirits, and local beer included - Visit a local Malaysian village with choice of excursion - Choice of options in Kanchanaburi - visit the River Kwai Bridge and Thai-Burma Railway Museum, enjoy a bike trip through rice paddies, or participate in a floating cooking class and culinary tour. The Tour Journey on board the Eastern & Oriental Express from Kuala Lumpur to exciting Bangkok through the heart of Southeast Asia. Visit a Malaysian village and choose from several different options for touring in Kanchanburi - visit the infamous River Kwai Bridge, or enjoy a biking tour or cooking class. Travel in comfort and luxury, with exquisite dining, superb service and fun entertainment on board the Eastern & Oriental Express. This itinerary is also available in the reverse direction: Bangkok-Kuala Lumpur. Itinerary Day 1: Kuala Lumpur, Malaysia Begin your journey late evening at Kuala Lumpur's Majestic Hotel, where you are assisted with luggage and complete check-in formalities. Transfer to the train station to board the Eastern & Oriental Express and begin your journey north. Settle in to your private cabin for the night. Day 2: Kuala Kangsar, Malaysia This morning as the train travels through the verdant rainforests and rural west-coast towns of Malaysia, enjoy a leisurely breakfast in the comfort of your cabin. -

ZIPAIR's December 2020 to End of March 2021 Period Tokyo-Seoul

ZIPAIR’s December 2020 to end of March 2021 period Tokyo-Seoul and Tokyo-Bangkok routes booking is now open October 30, 2020 Tokyo, October 30, 2020 – ZIPAIR Tokyo will start to sell tickets for the Tokyo (Narita) - Seoul (Incheon) and Tokyo (Narita) - Bangkok (Suvarnabhumi) routes for travel between December 1, 2020 and March 27, 2021, from today, October 30. 1. Flight Schedule Tokyo (Narita) - Seoul (Incheon) (October 25 – March 26, 2021) Flight Route Schedule Operating day number Tokyo (Narita) = ZG 41 Narita (NRT) 8:40 a.m. Seoul (ICN) 11:15 a.m. Tue., Fri., Sun. Seoul (Incheon) ZG 42 Seoul (ICN) 12:40 p.m. Narita (NRT) 3:05 p.m. Tue., Fri., Sun. Bangkok (Suvarnabhumi) – Tokyo (Narita) “one-way” Service (October 28 – March 27, 2021) Flight Route Schedule Operating day number Bangkok This service is only available from Bangkok. (Suvarnabhumi) - ZG 52 Bangkok (BKK) 11:30 p.m. Wed., Thu., Fri., Tokyo (Narita) Narita (NRT) 7:15 a.m. (+1) Sat., Sun. 2. Sales Start Flights between December 1 and March 27, 2021. October 30, 6:00 p.m. Website:https://www.zipair.net 3. Airfares (1) Seat Fare (Tokyo - Seoul route) Fare (per seat, one-way) Fare Types Effective period Age Tokyo-Seoul Seoul-Tokyo ZIP Full-Flat JPY30,000-141,000 KRW360,000-440,000 7 years and older Standard Oct. 25, 2020 JPY8,000-30,000 KRW96,000-317,000 7 years and - Mar. 26, 2021 older U6 Standard JPY3,000 KRW36,000 Less than 7 years (2) Seat Fare (Tokyo - Bangkok route) Fare (per seat, one-way) Fare Types Effective period Age Tokyo-Bangkok Bangkok-Tokyo ZIP Full-Flat THB15,000-61,800 7 years and Value older Standard Oct. -

Inclusive Growth in Seoul

Inclusive Growth in Seoul Policy Highlights About the OECD About the OECD The Organisation for Economic Co-operation and Development (OECD) is a forum in which The Organisation for Economic Co-operation and Development (OECD) is a forum in which governments compare and exchange policy experiences, identify good practices in light of emerging governments compare and exchange policy experiences, identify good practices in light of emerging challenges, and promote decisions and recommendations to produce better policies for better lives. challenges, and promote decisions and recommendations to produce better policies for better lives. The OECD’s mission is to promote policies that improve economic and social well-being of people The OECD’s mission is to promote policies that improve economic and social well-being of people around the world. around the world. The OECD Champion Mayors initiative The OECD Champion Mayors initiative The OECD launched a global coalition of Champion Mayors for Inclusive Growth in March 2016, as part The OECD launched a global coalition of Champion Mayors for Inclusive Growth in March 2016, as part of the broader OECD Inclusive Growth initiative. The OECD approach to Inclusive Growth is multi- of the broader OECD Inclusive Growth initiative. The OECD approach to Inclusive Growth is multi- dimensional, going beyond income. Champion Mayors are a group of willing leaders who have dimensional, going beyond income. Champion Mayors are a group of willing leaders who have committed to tackling inequalities and promoting more inclusive economic growth in cities. For more committed to tackling inequalities and promoting more inclusive economic growth in cities. -

From Incheon Airport to Conrad Seoul Airport Bus # 6030

From Incheon Airport to Conrad Seoul Method Depart Arrival Cost Duration Remarks Hotel Incheon Conrad Seoul Hotel KRW 159,500 45 min. *most convenient* Limousine Airport Terminal 1: Gate 6B Airport bus Incheon 60 min (T1). Terminal 2: Gate 32 Conrad Seoul Hotel KRW 15,000 # 6030 Airport 1hr 15min (T2). (approximately 18 minutes from T2 to T1) KRW 60,000 (R) Incheon R: Regular taxi Taxi Conrad Seoul Hotel KRW 75,000 (D) 50 min. ~ 1hr Airport D: Deluxe taxi *Toll fee inclusive Take Airport Railroad (AREX) from Incheon airport Terminal 1 or 2(bound for Yeouido Stn. (exit #3) Gongdeok Station) then Transfer to T2: KRW 4,750 T2: 78 min is 10 min. walking Subway subway Line #5 at Gongduk Station T1: KRW 4,150 T1: 70 min distance away from (bound for Banghwa station) -> take off Hotel at Yeouido Station ※ Duration time and taxi fare can be changed depending on traffic condition Airport bus # 6030 Information Bus stop at Incheon airport Terminal 1 Bus stop is at 1st Floor Gate 6B in Incheon International Airport Terminal 1 Bus ticket purchasing is at gate 4 or 9 Bus stop at Incheon airport Terminal 2 Bus stop is at B1 Floor Gate 32 in Incheon International Airport Terminal 2 Bus ticket purchasing is available at ticket office on same B1 Floor. Conrad Seoul, 23-1, Yeouido-dong, Yeongdungpo-gu, Seoul 150-945, Korea Tel. 82-2-6137-7000 Concierge / Front office Time Table for Airport Bus #6030 How to take Airport railroad (AREX) From Incheon Airport Terminal 1: Ticketing available on B1F, take the regular Airport railroad From Incheon Airport Terminal 2: Ticketing available on B1F, take the regular Airport railroad Stations Incheon International Airport Terminal 2 ⇔ Incheon International Airport Terminal 1 ⇔ Incheon International Airport Cargo Terminal ⇔ Unseo ⇔ Yeongjong ⇔ Cheongna International City ⇔ Geomam ⇔ Gyeyang ⇔ Gimpo International Airport ⇔ Digital Media City ⇔ Hongik University ⇔ Gondeok(Transfer to Line#5) ⇔ Seoul Station From Gimpo Airport to Conrad Seoul Method Depart Arrival Cost Duration Remarks Hotel Gimpo Airport Conrad Seoul Hotel KRW 99,000 30 min. -

Worldwide Marine Radiofacsimile Broadcast Schedules

WORLDWIDE MARINE RADIOFACSIMILE BROADCAST SCHEDULES U.S. DEPARTMENT OF COMMERCE NATIONAL OCEANIC and ATMOSPHERIC ADMINISTRATION NATIONAL WEATHER SERVICE January 14, 2021 INTRODUCTION Ships....The U.S. Voluntary Observing Ship (VOS) program needs your help! If your ship is not participating in this worthwhile international program, we urge you to join. Remember, the meteorological agencies that do the weather forecasting cannot help you without input from you. ONLY YOU KNOW THE WEATHER AT YOUR POSITION!! Please report the weather at 0000, 0600, 1200, and 1800 UTC as explained in the National Weather Service Observing Handbook No. 1 for Marine Surface Weather Observations. Within 300 nm of a named hurricane, typhoon or tropical storm, or within 200 nm of U.S. or Canadian waters, also report the weather at 0300, 0900, 1500, and 2100 UTC. Your participation is greatly appreciated by all mariners. For assistance, contact a Port Meteorological Officer (PMO), who will come aboard your vessel and provide all the information you need to observe, code and transmit weather observations. This publication is made available via the Internet at: https://weather.gov/marine/media/rfax.pdf The following webpage contains information on the dissemination of U.S. National Weather Service marine products including radiofax, such as frequency and scheduling information as well as links to products. A listing of other recommended webpages may be found in the Appendix. https://weather.gov/marine This PDF file contains links to http pages and FTPMAIL commands. The links may not be compatible with all PDF readers and e-mail systems. The Internet is not part of the National Weather Service's operational data stream and should never be relied upon as a means to obtain the latest forecast and warning data. -

Seoul Between Beijing and Washington: South Korea's

Seoul Between Beijing and Washington: South Korea’s Strategic Dilema EIAS Briefing Seminar 23 May 2017 For thousands of years, Korea has been called “A Shrimp Among Whales”, implying the challenging situation of being land and sea- locked between Big Powers fighting for regional dominance. The 21st century is witnessing Korea being caught in the power struggle be- tween a “Rising China” and an ever more demanding “Long Time Ally”, the US. Recently, China has been strongly opposing the forgery of close security- related ties between Seoul and Washington, while the new US president Trump has initiated isolationist and protectionist economic policies. Korea is being forced to re-think its security agenda and re-evaluate its foreign policy partnership priorities. The US- initiated deployment of the Terminal High Altitude Area De- fense (THAAD) system in Korea might come as a source of solace in view of the intensified frequency and magnitude of North Korean em- anated nuclear threats, however China cannot condone the American security commitments as they come as a plight on its own state secu- rity. Arguably, Korea is now facing handicapped bilateral economic relations with China that are taking a tangible toll on Korean busi- nesses and putting pressure on the Korean institutions, particularly in this arduous governmental transition period. Thus, Seoul is faced with the challenge of balancing between security and economic interests, all the while managing its vital foreign policy relations with both great powers. Opening Remarks by Mr Frederic Carlier, Senior Associate, EIAS Mr Frederic Carlier introduced the topic of the discussion, namely the evolving strategic dilemma that South Korea is facing- the need to balance on the one hand the Korea-US alliance representing its security interests against, on the other hand, the strategic partnership with China representing its economic interests. -

9 Sacred Sites in Bangkok Temple As an Auspicious Activity That Grants Them Happiness and Good Luck

The 9 Sacred Sites Buddhists in Thailand pay homage at the temple or ‘wat’ as they believe it is a way to make merit. They consider paying homage to the principal Buddha image or to the main Chedi of the 9 Sacred Sites in Bangkok temple as an auspicious activity that grants them happiness and good luck. The number nine is considered auspicious because it is pronounced as ‘kao,’ similar to the word meaning ‘to progress’ or ‘to step forward.’ Therefore it is believed that a visit to nine sacred temples in one day gives the worshippers prosperity and good luck. The nine sacred temples in Bangkok are of significant value as they are royal temples and convenient for worshippers as they are located close to each other in the heart of Bangkok. Wat Saket Printed in Thailand by Promotional Material Production Division, Marketing Services Department, Tourism Authority of Thailand for free distribution. www.tourismthailand.org E/JUL 2017 The contents of this publication are subject to change without notice. The 9 Sacred Sites Buddhists in Thailand pay homage at the temple or ‘wat’ as they believe it is a way to make merit. They consider paying homage to the principal Buddha image or to the main Chedi of the 9 Sacred Sites in Bangkok temple as an auspicious activity that grants them happiness and good luck. The number nine is considered auspicious because it is pronounced as ‘kao,’ similar to the word meaning ‘to progress’ or ‘to step forward.’ Therefore it is believed that a visit to nine sacred temples in one day gives the worshippers prosperity and good luck. -

Gallery VB the Grand Palace ______

Gallery VB The Grand Palace _________________________ Words and Photography by Kennie Ting While Bangkok was never colonised, it was the seat of a colonial empire that encompassed most of what we now know as Indochina, and parts of present-day Malaysia and Burma. Up until the early 20th century, the Kings of Siam ruled their Empire from within the walled compound of their Grand Palace on Rattanakosin, an island artificially created from the river by monumental canal. While the present day monarch, King Bhumibol, or Rama IX, no longer resides in the palace complex (even though the Palace is the official residence), the latter is still used today on state and ceremonial occasions, and its doors are cast wide open to devotees and visitors on every other day. The Palace was built to recall Ayutthaya, the former, fabled capital of Siam, sacked ignominiously by the Burmese in the 1700s. Indeed, many of the stones from the ruined floating city – Ayutthaya too was a canal city built on an island in the river – were painstakingly towed downriver to form the foundations of the palace. The very first structures in the palace were erected by King Rama I in 1782. They still stand today. Later on, a dizzying variety of styles, including Khmer, Thai, Chinese and European, would be used in the design and construction of many other structures in the palace grounds, resulting in a whole that is schizophrenic but never boring. The crowning glory of the complex is the Wat Phra Kaew, or the Temple of the Emerald Buddha. Its namesake is one of the National Treasures of Thailand, taken from Laos in the 17th century when it was a vassal state, and brought here to the seat of empire. -

Kuala Lumpur to Bangkok Journey Duration

TRAIN : Eastern & Oriental Express JOURNEY : Kuala Lumpur to Bangkok Journey Duration : 3 Days Day to Day Itinerary Day 1: Kuala Lumpur, Malaysia Settle into your cabin this morning as the train pulls out of historic Kuala Lumpur station. After a delicious brunch, arrive at Kuala Kangsar. Travel by coach to Labu Kabong to discover rural Malaysian life with a warm welcome ceremony from the villagers. Take a guided tour through lush rice paddies ending with refreshments and a chance to sample local produce. Return to the train and enjoy a relaxing afternoon on board. Alternatively, advanced trekkers can follow our expert naturalist on an invigorating hill trek, We recommend long sleeves, trousers, and suitable footwear for this choice. Cold towels and refreshments await at the top while you take in spectacular panoramic views. Rejoin the train for a refreshing cocktail accompanied by live piano music. Later, a decadent dinner is served on board. Day 2: Kanchanaburi – Bangkok, Thailand This morning, alight at Kanchanaburi for your choice from the following three tour options: The ‘Classic’ tour includes guided visits to the River Kwai Bridge and Thai-Burma Railway Museum. The ‘Tracks to Unseen Thailand’ tour will have you biking through rice paddies and stopping off at a local farm. And finally, the ‘Local Flavours’ tour explores the wet market, a rice noodle house, and a raft cruise with cooking class. All guests will reconvene on board the train for lunch before ending your journey in Bangkok in the late afternoon. __________________________________________________________________________ www.luxurytrains.in . -

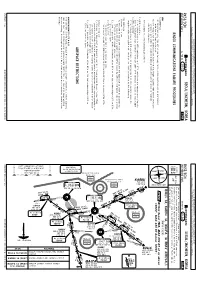

Jeppview : RKSI (41 Charts)

INCHEON INTL INCHEON RKSI/ICN CHANGES: friendly. as identified been has which aircraft civilian be to this will exception An warning. further without shot down be it will RK(P)-73A into continues aircraft the If fired. be shot will warning tracer a clearance, proper without RK(P)-73B through flying is seen aircraft an If 3.) IFR condition VFR2.) condition 1.) GENERAL IFR FOR ARRIVAL FOR WARNING RK(P)-73 A & B A RK(P)-73 WARNING 1.) Proceed to Copus IAF and commence descent and approach as close as possible to Runway 15 in use Then comply with the following procedure: necessary if 7600 and squawk flight, during failure communication of recognition b.) On a.) No person may take off unless two-way radio communications can be maintained 2.) Land, if possible, within 30 minutes after ETA or the last acknowledged EFC or ETA, complied with, each pilot shall continue the flight according to the following: or IFR conditions, in occurs failure the If failure, each pilot shall continue the flight under VFR and land as soon as practicable. or VFR conditions, in occurs failure the If 2.) Land, if possible, within 30 minutes after ETA or the last acknowledged EFC or STAR follow Kalma, from leaving (if fix holding or Kalma IAF to Mirou Proceed 1.) Runway 33 in use 3.) No fly area: None. obstacle clearance. to ensure safe altitude, climb to Mini with the Air Traffic Control. The area of beyond 12 DME between R-270 and R-340 from Incheon (NCN) VOR. ETA, whichever is later.