LIVE NATION ENTERTAINMENT, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ad Hoc Announcement

AD HOC ANNOUNCEMENT CTS EVENTIM AG & Co. KGaA and Fnac Darty S.A. start exclusive negotiations on strategic ticketing partnership in France Munich/Ivry, 24 July 2019. CTS EVENTIM AG & Co. KGaA and Fnac Darty S.A. have started exclusive negotiations on a strategic partnership for their French ticketing activities. Under the proposed agreement, CTS EVENTIM would acquire 48 percent of the shares in France Billet, the ticketing subsidiary of Fnac Darty. At the same time, CTS EVENTIM would contribute its existing activities in France to the partnership. CTS EVENTIM would also have the option to acquire a majority stake four years from the date of the closing of the transaction. The project will be presented in detail to the relevant employee representatives in the coming weeks. CTS EVENTIM and Fnac Darty plan to close the transaction by the end of this year. About CTS EVENTIM CTS EVENTIM is one of the leading international providers of Ticketing and Live Entertainment. In 2018, approx. 250 million tickets were marketed using the company’s systems – through stationary box offices, online or mobile. Its online portals operate under brands such as eventim.de, oeticket.com, ticketcorner.ch, ticketone.it, and entradas.com. The EVENTIM Group also includes many concert, tour and festival promoter companies for events like ‘Rock am Ring’, ‘Rock im Park’, ‘Hurricane’, ‘Southside’, and ‘Lucca Summer’. In addition, some of Europe’s most renowned venues are operated by CTS EVENTIM, for example the LANXESS arena in Cologne, the Waldbühne in Berlin and the EVENTIM Apollo in London. CTS EVENTIM AG & Co. -

MXD – Evaluering 2018

EVALUERINGSRAPPORT 2018 Evaluering af MXD’s aktiviteter i 2018 Det er MXD’s mission at øge eksporten af dansk professionel populærmusik og herigen- nem at styrke den kunstneriske udvikling og forretningsgrundlaget for danske kunstnere og musikselskaber. MXD’s Strategi 2016-19 definerer tre hovedopgaver, som skal realisere denne mission: 1. Eksportstøtte 2. Internationale projekter 3. Videndeling og kommunikation. I det følgende beskrives aktiviteterne og resultaterne inden for hver af disse. Ad. 1. Eksportstøtte Danske bands/musikselskaber kan søge MXD om støtte til både egne eksportprojekter og til deltagelse i MXD’s eksportprojekter i udlandet, såsom handelsmissioner, Danish Night At Reeperbahn Festival, Ja Ja Ja Club Night etc. Der kan søges om støtte via tre puljer: 1. Eksportstøtte til markedsudvikling 2. Dynamisk eksportstøtte til unikke markedsmuligheder 3. Eksportstøtte til branchefolk I marts 2017 lancerede MXD og DPA (foreningen for sangskrivere, komponister, tekst- forfattere og producere inden for det kommercielle og populære felt) en ny eksportstøt- tepulje, som har til formål at styrke eksporten af dansk-producerede sange: 4. Eksportstøtte til branchefolk - sangskrivning Støttemidlerne kommer fra Kodas Kulturelle Midler, og puljen administreres af MXD. Læs mere om alle fire puljer (herunder formål, vurderingskriterier og MXD’s uddelings- politik) her: mxd.dk/eksportstoette/ Det samlede bogførte resultat for 2018 blev: Pulje Resultat Budget 1. Eksportstøtte til markedsudvikling 1.595.720 2. Dynamisk eksportstøtte til unikke markedsmuligheder 101.497 3. Eksportstøtte til branchefolk 301.952 Ubrugte midler fra tidligere år -123.512 I alt 1.875.657 1.800.000 4. Eksportstøtte til branchefolk – sangskrivning 124.855 0 Ubrugte midler fra tidligere år -15.955 I alt 108.900 180.000 Samlet resultat 1.984.557 1.980.000 I forhold til budgettet blev resultatet for pulje 1.-3. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

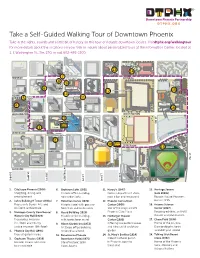

Walking and Tour Map 2020 Final

Take a Self-Guided Walking Tour of Downtown Phoenix Take in the sights, sounds and a little bit of history on this tour of notable downtown locales. Visit dtphx.org/walkingtour for more details about the locations on your trek or inquire about personalized tours at the Information Center, located at 1. E Washington St., Ste. 230, or call 602-495-1500. Herberger St. Mary’s Theater Basilica (1914) Hotel 13 San Carlos 14 (1928) MONROE 7 Hilton Garden MONROE Inn (1932) 8 Heritage Square Heard 9 (Late 1800s) Orpheum Building (1920) Renaissance Lofts Hotel (1931) 6 12 Phoenix Convention Center 15 10 ADAMS Orpheum Hanny’s Theatre (1947) 11 5 (1929) Arizona 4 Science Center City Hall 16 WASHINGTON CityScape WASHINGTON Historic City Hall 1 (1929) Start 5th ST 3 CityScape Here JEFFERSON Luhrs Tower Luhrs Building (1929) (1924) 2 Talking Stick End Resort Arena 18 Here JEFFERSON 17 Chase Field MADISON 7th ST JACKSON VE VE A A 4th ST 3rd 1st AVE CENTRAL AVE 3nd ST 2nd 1st ST 2nd ST 1. CityScape Phoenix (2008) 6. Orpheum Lofts (1931) 11. Hanny’s (1947) 15. Heritage Square Shopping, dining and Historic oce building, Former department store, (Late 1800s) entertainment now urban lofts now a bar and restaurant Rosson House Museum, 2. Luhrs Building & Tower (1920s) 7. Hotel San Carlos (1928) 12. Phoenix Convention built in 1895 Represents Beaux-Arts and Historic hotel with ground- Center (2008) 16. Arizona Science Art Deco architecture floor bars and restaurants Site of the original 1972 Center (1997) 3. Maricopa County Courthouse/ 8. -

The U2 360- Degree Tour and Its Implications on the Concert Industry

THE BIGGEST SHOW ON EARTH: The U2 360- Degree Tour and its implications on the Concert Industry An Undergraduate Honors Thesis by Daniel Dicker Senior V449 Professor Monika Herzig April 2011 Abstract The rock band U2 is currently touring stadiums and arenas across the globe in what is, by all accounts, the most ambitious and expensive concert tour and stage design in the history of the live music business. U2’s 360-Degree Tour, produced and marketed by Live Nation Entertainment, is projected to become the top-grossing tour of all time when it concludes in July of 2011. This is due to a number of different factors that this thesis will examine: the stature of the band, the stature of the ticket-seller and concert-producer, the ambitious and attendance- boosting design of the stage, the relatively-low ticket price when compared with the ticket prices of other tours and the scope of the concert's production, and the resiliency of ticket sales despite a poor economy. After investigating these aspects of the tour, this thesis will determine that this concert endeavor will become a new model for arena level touring and analyze the factors for success. Introduction The concert industry handbook is being rewritten by U2 - a band that has released blockbuster albums and embarked on sell-out concert tours for over three decades - and the largest concert promotion company in the world, Live Nation. This thesis is an examination of how these and other forces have aligned to produce and execute the most impressive concert production and single-most successful concert tour in history. -

Live Entertainment

Live Entertainment This pack has been designed to provide information on setting up a business in the Live Entertainment industry in Scotland, as well as helping to inform the market research section of your business plan. You can find more information on how to write a business plan from the Business Gateway website (www.bgateway.com/businessplan), including an interactive template and tips to get you started. This market report was updated by Business Gateway in June 2018. If you find the information contained in this document useful, tell us about it! Send us feedback here; we will use your comments to help improve our service. What do I need to know about the Live Entertainment market? The following summary statistics have been taken from market research reports and reliable resources that the Information Service uses to compile industry information. They should give you an indication of how your industry is faring at present and whether there is demand for your type of business: ♦ The live music industry is performing extremely well with more than 32 million people attending a music festival or concert in 2016, a 12% rise on 2015. There has been an increase in the number of live events and overseas visitors. Nearly 1 million music tourists from overseas attended a live event in the UK in 2016, up by 20% on 2015 figures. These factors are set to push the music concert and festivals market to an estimated value of £2.202 million in 2017. UK consumers are attending more music festivals than in 2016. Some 24% attended this type of event in 2017 compared to 21% in the previous year. -

Open'er Festival

SHORTLISTED NOMINEES FOR THE EUROPEAN FESTIVAL AWARDS 2019 UNVEILED GET YOUR TICKET NOW With the 11th edition of the European Festival Awards set to take place on January 15th in Groningen, The Netherlands, we’re announcing the shortlists for 14 of the ceremony’s categories. Over 350’000 votes have been cast for the 2019 European Festival Awards in the main public categories. We’d like to extend a huge thank you to all of those who applied, voted, and otherwise participated in the Awards this year. Tickets for the Award Ceremony at De Oosterpoort in Groningen, The Netherlands are already going fast. There are two different ticket options: Premium tickets are priced at €100, and include: • Access to the cocktail hour with drinks from 06.00pm – 06.45pm • Three-course sit down Dinner with drinks at 07.00pm – 09.00pm • A seat at a table at the EFA awards show at 09.30pm – 11.15pm • Access to the after-show party at 00.00am – 02.00am – Venue TBD Tribune tickets are priced at €30 and include access to the EFA awards show at 09.30pm – 11.15pm (no meal or extras included). Buy Tickets Now without further ado, here are the shortlists: The Brand Activation Award Presented by: EMAC Lowlands (The Netherlands) & Rabobank (Brasserie 2050) Open’er Festival (Poland) & Netflix (Stranger Things) Øya Festivalen (Norway) & Fortum (The Green Rider) Sziget Festival (Hungary) & IBIS (IBIS Music) Untold (Romania) & KFC (Haunted Camping) We Love Green (France) & Back Market (Back Market x We Love Green Circular) European Festival Awards, c/o YOUROPE, Heiligkreuzstr. -

Using Green Man Festival As a Case Study

An Investigation to identify how festivals promotional techniques have developed over the years – using Green Man Festival as a case study Victoria Curran BA (hons) Events Management Cardiff Metropolitan University April 2018 i Declaration “I declare that this Dissertation has not already been accepted in substance for any degree and is not concurrently submitted in candidature for any degree. It is the result of my own independent research except where otherwise stated.” Name: Victoria Curran Signed: ii Abstract This research study was carried out in order to explore the different methods of marketing that Green Man Festival utilises, to discover how successful they are, and whether they have changed and developed throughout the years. The study intended to critically review the literature surrounding festivals and festival marketing theories, in order to provide conclusions supported by theory when evaluating the effectiveness of the promotional strategies. It aimed to discover how modern or digital marketing affected Green Man’s promotional techniques, to assess any identified promotional techniques and identify any connections with marketing theory, to investigate how they promote the festival towards their target market, and to finally provide recommendations for futuristic methods of promotion. The dissertation was presented coherently, consisting of five chapters. The first chapter was the introduction, providing a basic insight into the topics involved. The second contains a critical literature review where key themes were identified; the third chapter discussed the methodology used whilst the fourth chapter presents the results that were discovered, providing an analysis and discussion. The final chapter summarises the study, giving recommendations and identifying any limitations of the study. -

Live Music Matters Scottish Music Review

Live Music Matters Simon Frith Tovey Professor of Music, University of Edinburgh Scottish Music Review Abstract Economists and sociologists of music have long argued that the live music sector must lose out in the competition for leisure expenditure with the ever increasing variety of mediated musical goods and experiences. In the last decade, though, there is evidence that live music in the UK is one of the most buoyant parts of the music economy. In examining why this should be so this paper is divided into two parts. In the first I describe why and how live music remains an essential part of the music industry’s money making strategies. In the second I speculate about the social functions of performance by examining three examples of performance as entertainment: karaoke, tribute bands and the Pop Idol phenomenon. These are, I suggest, examples of secondary performance, which illuminate the social role of the musical performer in contemporary society. 1. The Economics of Performance Introduction It has long been an academic commonplace that the rise of mediated music (on record, radio and the film soundtrack) meant the decline of live music (in concert hall, music hall and the domestic parlour). For much of the last 50 years the UK’s live music sector, for example, has been analysed as a sector in decline. Two kinds of reason are adduced for this. On the one hand, economists, following the lead of Baumol and Bowen (1966), have assumed that live music can achieve neither the economies of scale nor the reduction of labour costs to compete with mass entertainment media. -

311 ~ the Tabernacle ~ Atlanta, GA ~ 7/24-25/2014 » 7/31/14 11:33 AM

311 ~ The Tabernacle ~ Atlanta, GA ~ 7/24-25/2014 » 7/31/14 11:33 AM Home Reviews Photo Photo Ancient Interviews Contests Videos About Contact 31 Jul Login 311 ~ The Tabernacle ~ Atlanta, GA ~ 7/24-25/2014 Tags: Review by Cliff Lummus, Photos by Lucas Armstrong 311, atlanta, concert There are three constants in an ever-changing world that the people of Atlanta can look forward to photography, every summer: sunny skies, Braves baseball, and 311. Georgia, Live Music, The Rolling in fresh off a set at the House of Blues in Myrtle Beach, South Carolina, 311 changed Tabernacle things up for their Atlanta fans quite a bit for their summer tour. permalink Over 90 percent of 311’s Atlanta concerts in the past decade have been at Aaron’s Amphitheater at Lakewood. For the 2014 tour, 311 dropped the humid, summer sundown setting of a 19,000 occupancy, sprawling, generic venue sellout for two packed-house back-to-back nights on Thursday http://jamsplus.com/311-the-tabernacle-atlanta-ga-724-252014/ Page 1 of 6 311 ~ The Tabernacle ~ Atlanta, GA ~ 7/24-25/2014 » 7/31/14 11:33 AM and Friday at The Tabernacle, one of Atlanta’s most intimate and distinctive concert venues. With a scant capacity of 2,600, tickets for either show were a hot commodity, with the Friday date selling out several weeks in advance and Thursday following quickly. The lucky 311 faithful that were able to snag tickets for either date got the chance to swap their usual mile-away lawn space for the up-close-and-personal experience that is The Tabernacle. -

Sponsorship Effects on Music Festival Participants

Copenhagen Business School 2014 MSoc.Sc.Service Management MASTER’S THESIS Sponsorship Effects on Music Festival Participants Victor Guedon David Gramm Kristensen February, 5th, 2014 Supervisor Helle Haurum 111 Pages / 267.755 Characters Abstract While worldwide investments in sole sponsorship fees were expected to reach $53.3 billion in 2013, findings from the academic research on sponsorships’ ability to impact customers’ perception of a sponsor are inconsistent; ranging from positive, small or ambiguous effects to negative or no effects at all. Thus, the objective of the current research was to contribute by researching if participation in a music festival, NorthSide 2013, would influence festival participants’ perception of the main sponsor Royal Beer. To do so, the chosen research design was a pre-post event quasi experimental design with independent samples. It was crucial to have both pre and post event measurements of event participants to investigate a potential change. Moreover, the quasi-experimental strategy was deemed relevant since it features the use of a control group to identify the source of an effect. Identified as one of the reasons for the inconsistent academic findings, the aim was to avoid conscious processing of the respondents by eliciting sponsorships or the two entities together, so that answers collected would account for the effects rather than respondents’ opinions about how this sponsorship affected them. In pursuance of this research several practical steps have been undertaken: a thorough literature review, a face-to-face interview of the Royal Beer brand manager, creation of a beer brand personality scale fitted to the Danish setting, a focus group to translate the brand personality facets and most importantly; the design and data collection of three distinct questionnaires that resulted in a total of 950 valid responses. -

Sponsorship Packages

SPONSORSHIP PACKAGES 6 DECEMBER - TROXY, LONDON WWW.FESTIVALAWARDS.COM Annual Celebration of the UK Festival Industry THE EVENT An awards ceremony that will leave UK festival organisers feeling celebrated, indulged and inspired. A highlight of the UK Festivals Calendar, the UKFA was founded in 2002 and is now celebrating its 15th year. With over 650 festival organisers, music agents and trade suppliers in attendance, the evening brings together the UK Festival scene’s key players for a night of entertainment, networking, street food, innovative cocktails and an exclusive after party – all held at the historic Troxy in London. Recognising the festival industries’ brightest and best, previous award winners include Michael Eavis (Glastonbury Festival), Peter Gabriel (WOMAD), Download Festival, Latitude and TRNSMT. We look forward to celebrating 2018’s triumphs with this year proving to be bigger and better than ever. THE BENEFITS The Awards offer sponsors the opportunity to network with the UK’s leading festival influencers and gain extensive exposure: EXCLUSIVE NETWORKING OPPORTUNITIES With the UK festival industry’s key players in attendance, the Awards offers unparalleled opportunity to network and engage one-on-one with decision makers. POSITION YOUR BRAND IN FRONT OF THE UK’S TOP FESTIVAL ORGANISERS Last year’s shortlisted festivals are the most influential, established and recognisable in the country. The UK’s greatest influencers will be attending the event and sponsors will have the opportunity to showcase products and services to a broad prospect base. UK FESTIVAL AWARDS 2017 SPONSORS & SUPPORTERS SPONSORSHIP OPPORTUNITIES HEADLINE PARTNER SPONSORSHIP Bespoke Sponsor Packages £20,000 If you are looking for a more unique package, contact us for The Headline Partner package is designed to offer your brand details about bespoke sponsorship packages.