Agreement Between the Government of Gibraltar

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Place of Alcohol in the Lives of People from Tokelau, Fiji, Niue

The place of alcohol in the lives of people from Tokelau, Fiji, Niue, Tonga, Cook Islands and Samoa living in New Zealand: an overview The place of alcohol in the lives of people from Tokelau, Fiji, Niue, Tonga, Cook Islands and Samoa living in New Zealand: an overview A report prepared by Sector Analysis, Ministry of Health for the Alcohol Advisory Council of New Zealand ALAC Research Monograph Series: No 2 Wellington 1997 ISSN 1174-1856 ISBN 0-477-06317-9 Acknowledgments This particular chapter which is an overview of the reports from each of the six Pacific communities would not have been possible without all the field teams and participants who took part in the project. I would like to thank Ezra Jennings-Pedro, Terrisa Taupe, Tufaina Taupe Sofaia Kamakorewa, Maikali (Mike) Kilioni, Fane Malani, Tina McNicholas, Mere Samusamuvodre, Litimai Rasiga, Tevita Rasiga, Apisa Tuiqere, Ruve Tuivoavoa, Doreen Arapai, Dahlia Naepi, Slaven Naepi, Vili Nosa, Yvette Guttenbeil, Sione Liava’a, Wailangilala Tufui , Susana Tu’inukuafe, Anne Allan-Moetaua, Helen Kapi, Terongo Tekii, Tunumafono Ken Ah Kuoi, Tali Beaton, Myra McFarland, Carmel Peteru, Damas Potoi and their communities who supported them. Many people who have not been named offered comment and shared stories with us through informal discussion. Our families and friends were drawn in and though they did not formally participate they too gave their opinions and helped to shape the information gathered. Special thanks to all the participants and Jean Mitaera, Granby Siakimotu, Kili Jefferson, Dr Ian Prior, Henry Tuia, Lita Foliaki and Tupuola Malifa who reviewed the reports and asked pertinent questions. -

Tokelau the Last Colony?

Tokelau The last colony? TONY ANGELO (Taupulega) is, and long has been, the governing body. The chairman (Faipule) of the council and a village head ITUATED WELL NORTH OF NEW ZEALAND and (Pulenuku) are elected by universal suffrage in the village SWestern Samoa and close to the equator, the small every three years. The three councils send representatives atolls of Tokelau, with their combined population of about to form the General Fono which is the Tokelau national 1600 people, may well be the last colony of New Zealand. authority; it originally met only once or twice a year and Whether, when and in what way that colonial status of advised the New Zealand Government of Tokelau's Tokelau will end, is a mat- wishes. ter of considerable specula- The General Fono fre- lion. quently repeated advice, r - Kirlb•ll ·::- (Gifb•rr I•) The recently passed lbn•b'a ' ......... both to the New Zealand (Oc: ..n I} Tokelau Amendment Act . :_.. PMtnb 11 Government and to the UN 1996- it received the royal Committee on Decoloni • •• roltfl•u assent on 10 June 1996, and 0/tlh.g• sation, that Tokelau did not 1- •, Aotum•- Uu.t (Sw•ln•J · came into force on 1 August 1 f .. • Tllloplol ~~~~~ !•J.. ·-~~~oa wish to change its status ~ ~ 1996 - is but one piece in ' \, vis-a-vis New Zealand. the colourful mosaic of •l . However, in an unexpected Tokelau's constitutional de change of position (stimu- velopment. lated no doubt by external The colonialism that factors such as the UN pro Tokelau has known has posal to complete its been the British version, and decolonisation business by it has lasted so far for little the year 2000), the Ulu of over a century. -

ISO Country Codes

COUNTRY SHORT NAME DESCRIPTION CODE AD Andorra Principality of Andorra AE United Arab Emirates United Arab Emirates AF Afghanistan The Transitional Islamic State of Afghanistan AG Antigua and Barbuda Antigua and Barbuda (includes Redonda Island) AI Anguilla Anguilla AL Albania Republic of Albania AM Armenia Republic of Armenia Netherlands Antilles (includes Bonaire, Curacao, AN Netherlands Antilles Saba, St. Eustatius, and Southern St. Martin) AO Angola Republic of Angola (includes Cabinda) AQ Antarctica Territory south of 60 degrees south latitude AR Argentina Argentine Republic America Samoa (principal island Tutuila and AS American Samoa includes Swain's Island) AT Austria Republic of Austria Australia (includes Lord Howe Island, Macquarie Islands, Ashmore Islands and Cartier Island, and Coral Sea Islands are Australian external AU Australia territories) AW Aruba Aruba AX Aland Islands Aland Islands AZ Azerbaijan Republic of Azerbaijan BA Bosnia and Herzegovina Bosnia and Herzegovina BB Barbados Barbados BD Bangladesh People's Republic of Bangladesh BE Belgium Kingdom of Belgium BF Burkina Faso Burkina Faso BG Bulgaria Republic of Bulgaria BH Bahrain Kingdom of Bahrain BI Burundi Republic of Burundi BJ Benin Republic of Benin BL Saint Barthelemy Saint Barthelemy BM Bermuda Bermuda BN Brunei Darussalam Brunei Darussalam BO Bolivia Republic of Bolivia Federative Republic of Brazil (includes Fernando de Noronha Island, Martim Vaz Islands, and BR Brazil Trindade Island) BS Bahamas Commonwealth of the Bahamas BT Bhutan Kingdom of Bhutan -

A Solution for the Third International Decade for the Eradication of Colonialism: a ‘Fourth’ Option to Obviate the Need for a Fourth Decade?

A SOLUTION FOR THE THIRD INTERNATIONAL DECADE FOR THE ERADICATION OF COLONIALISM: A ‘FOURTH’ OPTION TO OBVIATE THE NEED FOR A FOURTH DECADE? Elisabeth Perham* I. Introduction Despite concerted efforts by the international community over almost six decades to bring an end to the era of colonialism, 17 territories remain on the United Nations (UN) list of non-self-governing territories.1 In 2011 the UN declared 2011-2020 the Third International Decade for the Eradication of Colonialism,2 but few of the non-self-governing territories appear to be getting much closer to completing the decolonisation process.3 For some of the territories this is in large part due to territorial disputes.4 However, for other territories the stalemate may be due to the fact that the UN currently accepts only the three methods of decolonisation prescribed in UN General Assembly (UNGA) Resolution 15415 as proof that a territory has become self- governing for the purposes of removing it from the list. This article argues that for the decolonisation process to be completed there needs to be more flexibility in determining when a territory has become self-governing: the Secretary-General himself has recognised the need for a “creative approach” in the quest for decolonisation.6 More * Elisabeth Perham, LLB (Hons), BA (Hons). A version of this article was submitted as part of the requirements for the LLB (Hons) degree at Victoria University of Wellington. Elisabeth is grateful to Professor Tony Angelo for his supervision of that paper. 1 Hereinafter referred to as the list. Anguilla, American Samoa, Bermuda, British Virgin Islands, Cayman Islands, Falkland Islands, French Polynesia, Gibraltar, Guam, Montserrat, New Caledonia, Pitcairn, St Helena, Tokelau, Turks and Caicos Islands, United States Virgin Islands, Western Sahara. -

Unlocking the Secrets of Swains Island: a Maritime Heritage Resources Survey

“Unlocking the Secrets of Swains Island:” a Maritime Heritage Resources Survey September 2013 Hans K. Van Tilburg, David J. Herdrich, Rhonda Suka, Matthew Lawrence, Christopher Filimoehala, Stephanie Gandulla National Marine Sanctuaries National Oceanic and Atmospheric Administration Maritime Heritage Program Series: Number 6 The Maritime Heritage Program works cooperatively and in collaboration within the Sanctuary System and with partners outside of NOAA. We work to better understand, assess and protect America’s maritime heritage and to share what we learn with the public as well as other scholars and resource managers. This is the first volume in a series of technical reports that document the work of the Maritime Heritage Program within and outside of the National Marine Sanctuaries. These reports will examine the maritime cultural landscape of America in all of its aspects, from overviews, historical studies, excavation and survey reports to genealogical studies. No. 1: The Search for Planter: The Ship That Escaped Charleston and Carried Robert Smalls to Destiny. No. 2: Archaeological Excavation of the Forepeak of the Civil War Blockade Runner Mary Celestia, Southampton, Bermuda No. 3: Maritime Cultural Landscape Overview: The Redwood Coast No. 4: Maritime Cultural Landscape Overview: The Outer Banks No. 5: Survey and Assessment of the U.S. Coast Survey Steamship Robert J. Walker, Atlantic City, New Jersey. These reports will be available online as downloadable PDFs and in some cases will also be printed and bound. Additional titles will become available as work on the series progresses. Cover Image - Figure 1: Swains Island satellite image: Image Science & Analysis Laboratory, NASA Johnson Space Center. -

Automatic Exchange of Information (AEI) List of Counterparty Jurisdictions for Your Accounts Booked in British Virgin Islands

ab Automatic Exchange of Information (AEI) List of Counterparty Jurisdictions for your accounts booked in British Virgin Islands Disclaimer UBS AG and its affiliated entities (UBS) does not provide legal or tax advice and this summary does not constitute such advice. UBS strongly recommends all persons considering the information described in this summary obtain appropriate independent legal, tax and other professional advice. This summary is for your information only and is not intended as an offer, or a solicitation of an offer to buy or sell any product or other specific services. Although all pieces of information and views expressed in this summary were obtained from sources believed to be reliable and in good faith, neither representation nor warranty, express or implied is made as to its accuracy or completeness. The general explanations included in this summary cannot address your personal situation and financial needs. All information is subject to change without notice. This summary may not be reproduced or copies circulated without prior authority of UBS. The status of a jurisdiction can change at any time. Whilst UBS will use all reasonable endeavors to update this list, there may be changes which become effective before a revised list is published. Information to be reported will depend on the status of the client's jurisdiction(s) of tax residence at the cut-off date for reporting and such status may differ from the status displayed on this list. Information contained in the below table does not imply the expression of any opinion whatsoever concerning the legal status of any territory or of its authorities. -

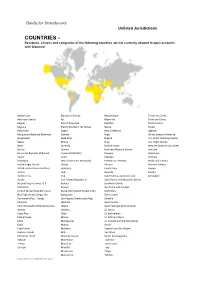

COUNTRIES - Residents, Citizens and Companies of the Following Countries Are Not Currently Allowed to Open Accounts with Glenmuir

Guide for Introducers Unlisted Jurisdictions COUNTRIES - Residents, citizens and companies of the following countries are not currently allowed to open accounts with Glenmuir Afghanistan Equatorial Guinea Mozambique Tristan da Cunha American Samoa Fiji Myanmar Turks and Caicos Angola French Polynesia Namibia Turkmenistan Anguilla French Southern Territories Nauru Tuvalu Antarctica Gabon New Caledonia Uganda Antigua and Barbuda Bahamas Gambia Niger United States of America Bangladesh Gaza Strip. Nigeria U.S. Minor Outlying Islands Belize Ghana Niue U.S. Virgin islands Benin Grenada Norfolk Island Holy See (Vatican City State) Bolivia Guinea Northern Mariana Islands Vanuatu Bolivarian Republic of Bouvet Guinea (CONAKRY) Panama Venezuela Island Guam Pakistan Vietnam Botswana Heard Island and McDonald Palestinian Territory Wallis and Futuna British Virgin Islands Islands Pitcairn Western Sahara British Indian Ocean Territory Honduras Puerto Rico Yemen Brunei Haiti Rwanda Zambia Burkina Faso Iraq Saint Helena, Ascension and Zimbabwe Burma Iran, Islamic Republic of Saint Pierre and Miquelon Samoa Burundi Virgin Islands, U.S. Kiribati Sandwich Islands Cambodia Kosovo Sao Tome and Principe Central African Republic Cocos Korea, Democratic People’s Rep. Seychelles (Keeling) Islands Congo, the Kyrgyzstan Sierra Leone Democratic Rep. Congo Lao People’s Democratic Rep. Somalia Comoros Lebanon South Sudan Commonwealth of Dominica Cook Liberia South Georgia and the South Islands Lesotho Sri Lanka Costa Rica Libya St. Barthelemy Cote d’Ivoire Macao St. Kitts and Nevis Chad Madagascar St. Vincent and the Grenadines Cuba Malawi Sudan Cape Verde Maldives Svalbard and Jan Mayen Cayman Islands Mali Swaziland Christmas Island Marshall Islands Syrian Arab Republic Djibouti Mauritania Tajikistan Eritrea Mauritius Timor-Leste Ethiopia Mayotte Togo Micronesia Tonga Montserrat Tokelau www.glenmuircapitaltrust.com . -

Appendix Table 6-32 Regions and Countries/Economies in World Trade Data

Appendix table 6-32 Regions and countries/economies in world trade data North America Europe Middle East Africa Asia Canada EU Israel All others (continued) All others (continued) Mexico Austria Saudi Arabia Mali Kazakhstan United States Belgium Turkey Mauritania Kyrgyzstan Central and South America Czech Republic United Arab Emirates Mauritius Laos Argentina Denmark All others Mayotte Maldives Brazil Denmark Bahrain Mozambique Mongolia Central America Faroe Islands Gaza Strip Niger Nepal Belize Finland Iran Nigeria North Korea Costa Rica France Iraq Reunion Pakistan El Salvador Germany Jordan Rwanda Papua New Guinea Guatemala Hungary Lebanon Saint Helena, Ascension, and Sri Lanka Honduras Ireland Kuwait Tristan da Cunha Tajikistan Nicaragua Italy Oman São Tomé and Príncipe Turkmenistan Panama Italy Qatar Senegal Uzbekistan Chile San Marino Syria Seychelles Australia/Oceania Colombia Vatican City Yemen Sierra Leone Australia Peru Netherlands Africa Somalia Australia Venezuela Poland Egypt Sudan Christmas Island All others Slovakia Kenya Swaziland Cocos (Keeling) Islands Anguilla Spain Morocco Tanzania Heard Island and McDonald Islands Antigua and Barbuda Sweden Southern Africa Togo Norfolk Island Aruba United Kingdom Botswana Uganda New Zealand Bahamas, The All others Lesotho Western Sahara Cook Islands Barbados Bulgaria Namibia Zambia New Zealand Bermuda Cyprus South Africa Zimbabwe Niue Bonaire Estonia Tunisia Asia Tokelau Bolivia Greece All others China Pacific Islands Cayman Islands Latvia Algeria China American Samoa Cuba Lithuania -

Spiders from Some Pacific Islands

Spiders from some Pacific Islands B. J. MARPLES l KNOWLEDGE OF THE SPIDERS of the Pacific Rarotonga. It consists of several islets scat is largely the result of the work of Berland tered around the reef, with an area of 2 square (1934, et. seqq.). He has published a number miles which is said to be decreasing. I am of papers dealing with the spiders of the New indebted to Dr. G. N. Davies for a collection Caledonian and New Hebridean region; of of eight species, none having been recorded Samoa; and of the Marquesas, Society, and previously. They are all species known from Austral groups, and other islands in the south Samoa. eastern Pacific. Recently I have completed a Rarotonga is one of the Cook Islands, lying study of the spiders of Western Samoa (not some 850 miles east of the Tonga group. It yet published) based on two summers' col is a high volcanic island, rising to about 3,000 lecting. It adds considerably to the list of feet, and has an area of some 26 square miles. species already known, bringing it to a total Berland records five species from there. I am of 123 and includes several families not pre indebted to Dr. G. H. Satchell for the present viously known to have representatives in the collecrion of nine species, which raises the Pacific region. It is clear that much intensive total to 13. One seems to be new and is collecting is needed before more than tenta described here and tentatively placed in a new tive conclusions can be drawn regarding the genus. -

REVIEW REPORT on Tokelau's Clinical Health Services and Patient

REVIEW REPORT on Tokelau’s Clinical Health Services and Patient Referrals Scheme Prepared by: Tracie Mafile’o, Sunia Foliaki, Tanya Koro, Helen Leslie*, Michelle Redman- MacLaren, Caryn West, Matthew Roskrudge November 2019 *Helen Leslie contributed to the review report as a review team member up until July 2019 Table of Contents LIST OF FIGURES ..............................................................................................................................................III LIST OF TABLES ...............................................................................................................................................III ACRONYMS .................................................................................................................................................... IV GLOSSARY ...................................................................................................................................................... IV ACKNOWLEDGEMENTS ................................................................................................................................... V EXECUTIVE SUMMARY ................................................................................................................................... VI PURPOSE .............................................................................................................................................................. VI APPROACH ........................................................................................................................................................... -

United Nations Nations Unies

United Nations Nations Unies HEADQUARTERS , SIEGE NEW YORK, NY 10017 TEL.; 1 (212) 963.1234 • FAX; 1 (212) 963.4879 Distr. RESTRICTED P RS/2018/C RP. 10 ORIGINAL: ENGLISH THIRD INTERNATIONAL DECADE FOR THE ERADICATION OF COLONIALISM Pacific regional seminar on the implementation of the Third International Decade for the Eradication of Colonialism: towards the achievement of the Sustainable Development Goals in the Non-Self-Governing Territories: social, economic and environmental challenges Saint George's, Grenada 9 to 11May 2018 STATEMENT BY THE REPRESENTATIVE OF THE UNITED NATIONS DEVELOPMENT PROGRAMME r I Presentation to C-24 Committee Roleof the United Nations system in providing development assistance to Non-Self-Governing Territories Stephen O'Malley, RC/RR, Barbados and the OECS 9 May 2018 (CHECK AGAINST DELIVERY) First, let me begin by thanking the members of the committee for the invitation to be here today. I have consulted with my UN colleagues in the Caribbean and the Pacific and will endeavor to provide a brief overview of the main activities of the UN Country Teams in the non-self-governing territories that are the subject of this meeting. This includes activities in Tokelau in the Pacific, and in Anguilla, Bermuda, the British Virgin Islands, the Cayman Islands, Montserrat, and the Turks and Caicos Islands. According to our records, the UN does not have significant development programming in the other ten non-self-governing territories. I am also very pleased that Dale Alexander of ECLAC is here to speak about the support of the UN's regional commissions. In the Caribbean, UN agencies continue to collaborate with all of the non-self-governing territories, with the exception of the USVI. -

Results from Cook Islands, Niue, Samoa and Tokelau

Independent evaluations of the Cook Results from Cook Islands, Niue, Samoa and Tokelau Recommendations from the evaluations Islands, Niue, Samoa and Tokelau The evaluation concluded that New Zealand’s development cooperation has contributed to sustainable The independent evaluation recommended that we take a country Programmes economic and human development in the Cook Islands, Niue, Samoa and Tokelau. more strategic approach when deploying our resources and addressing public/private sector issues. ASI recommended strengthening of the environment for the private sector and in-country government capacity. Results highlighted by ASI are outlined below. ASI recommended the following actions to improve country KEY FINDINGS Programme assistance in the future. OUR RELATIONSHIPS Cook Islands Develop a new process for country strategies in partnership with Adam Smith International (ASI) found that we have strong and Our support for tourism has led to demonstrable economic development outcomes. The New Zealand government agencies. enduring relationships with the four Pacific Island countries. next step should see them address a number of challenges to ensure sustainability. This could result in country strategies highlighting major Investment in renewable energy has also had an impact. An example being the Te Mana Our strategic framework of assistance works well. High level constraints to economic and human development. It could also o Te Ra project which meets 5% of Rarotonga’s electricity needs. priorities are incorporated into each country Programme. articulate how all New Zealand resources will be used to address The Health Specialist Visits Programme, our most significant health investment, operates constraints. effectively and achieves good outputs. It is highly regarded by Cook Islanders.