USE of CAPTIVE INSURANCE in ESTATE and BUSINESS PLANNING by Gordon A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Gold Standard of the South Tennessee’S Director of Captive Insurance Belinda Fortman Discusses the State’S Latest Milestone of 700 Risk Bearing Entities

www.captiveinsurancetimes.com The primary source of global captive insurance news and analysis 06 January 2021 - Issue 214 The gold standard of the southTennessee’s director of captive insurance Belinda Fortman discusses the state’s latest milestone of 700 risk bearing entities District of Columbia | New and Emerging Risks | 2021 Predictions | Industry Appointments The World’s Leading Independent Captive Manager SRS Europe is changing the Face of European Captive Management Specialist focus on captive insurance management and consultancy... It’s all we do Offering impartial advice and bespoke solutions without conflicting internal vested interests... It’s how we do it Driven by client service excellence underpinned by flexible, innovative and solid delivery... It’s focused on you Our Services European Operations Captive management Ireland Feasibility studies Liechtenstein Program management Luxembourg and underwriting services Malta Governance, risk & Netherlands compliance consulting Sweden Strategic reviews Switzerland Find out why over 500 captive clients trust SRS strategicrisks.com Captive Insurance Times Issue 214 www.captiveinsurancetimes.com Published by Black Knight Media Ltd 16 Bromley Road, New Beckenham Beckenham, BR3 5JE Editorial Editor: Becky Bellamy [email protected] Tel: +44 (0)208 075 0927 Reporter: Maria Ward-Brennan [email protected] Tel: +44 (0)208 075 0923 Contributor: Maddie Saghir [email protected] Designer: James Hickman [email protected] Marketing and sales Publisher: Justin Lawson [email protected] Associate Publisher: John Savage [email protected] Tel: +44 (0)208 075 0932 Office Manager: Chelsea Bowles Tel: +44 (0)208 075 0930 Follow us on Twitter: @CITimes Copyright © 2021 Black Knight Media Ltd All rights reserved. -

Lloyd's Minimum Standards

LLOYD’S MINIMUM STANDARDS MS1.1 – UNDERWRITING STRATEGY & PLANNING October 2017 1 MS1.1 – UNDERWRITING STRATEGY & PLANNING UNDERWRITING MANAGEMENT PRINCIPLES, MINIMUM STANDARDS AND REQUIREMENTS These are statements of business conduct required by Lloyd’s. The Principles and Minimum Standards are established under relevant Lloyd’s Byelaws relating to business conduct. All managing agents are required to meet the Principles and Minimum Standards. The Requirements represent the minimum level of performance required of any organisation within the Lloyd’s market to meet the Minimum Standards. Within this document the standards and supporting requirements (the “must dos” to meet the standard) are set out in the blue box at the beginning of each section. The remainder of each section consists of guidance which explains the standards and requirements in more detail and gives examples of approaches that managing agents may adopt to meet them. UNDERWRITING MANAGEMENT GUIDANCE This guidance provides a more detailed explanation of the general level of performance expected. They are a starting point against which each managing agent can compare its current practices to assist in understanding relative levels of performance. This guidance is intended to provide reassurance to managing agents as to approaches which would certainly meet the Principles and Minimum Standards and comply with the Requirements. However, it is appreciated that there are other options which could deliver performance at or above the minimum level and it is fully acceptable for managing agents to adopt alternative procedures as long as they can demonstrate the Requirements to meet the Principles and Minimum Standards. DEFINITIONS AFR: actuarial function report Benchmark Premium: The price for each risk at which the managing agent is expected to deliver their required results, in line with the approved Syndicate Business Plan. -

Employment Practices Liability Insurance Program EPLI

B5848_EPLI 2/14/06 2:49 PM Page 1 For more information about EPLI … Why your firm needs Employment For instant information on the EPLI program offered through Marsh Affinity Group Services, simply visit Practices Liability Insurance www.proliablity.com/EPLI Think your firm won’t be sued by an employee for wrongful termination … You’ll be able to self-rate, apply for coverage EPLI EPLI and submit your premium payment. Or call discrimination … defamation … failure to make partner … negligent supervision … us at 1-888-601-6667. sexual harassment … or other inappropriate employment conduct? Underwritten by Lloyd’s of London Employment (underwriting syndicates 2623 and Six out of ten employers have faced 623 – Beazley Furlonge Ltd. Rated “A” by Practices employee lawsuits within the past A.M. Best) five years. Beazley / Furlonge – Lloyd’s of London These facts show Beazley Furlonge Ltd. is a large syndicate of Liability it can happen and Lloyd’s of London and a recognized world 67% of all employment cases that leader in Specialty Insurance Services. Beazley how much it will go to litigation result in a judgment for is rated “A” by A.M. Best. For more Insurance cost your firm: the plaintiff. information, see www.beazley.com. Statistics show an Edgewater Holdings Ltd. (Edgewater), a Managing General Agency and consulting Program employer is more likely The average amount paid for out-of-court firm, is a leader in the development and to have an employment settlement is $40,000. delivery of EPLI policies. claim than a property or general liability claim.* Offered by Marsh Affinity Defense of the average EPLI case, through Group Services *Society for Human trial, costs more than $45,000. -

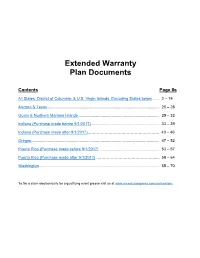

Extended Warranty Coverage

Extended Warranty Plan Documents Contents Page #s All States, District of Columbia, & U.S. Virgin Islands, Excluding States below ...... 2 – 19 Arizona & Texas ..................................................................................................... 20 – 28 Guam & Northern Mariana Islands ......................................................................... 29 – 32 Indiana (Purchase made before 9/1/2017) ............................................................. 33 – 39 Indiana (Purchase made after 9/1/2017)………………………………………………. 40 – 46 Oregon.................................................................................................................... 47 – 52 Puerto Rico (Purchase made before 9/1/2017) ...................................................... 53 – 57 Puerto Rico (Purchase made after 9/1/2017) ……………………………………….... 58 – 64 Washington ............................................................................................................. 65 – 70 To file a claim electronically for a qualifying event please visit us at www.americanexpress.com/onlineclaim. All States, District of Columbia, & U.S. Virgin Islands, Except States below Back to top EXTENDED WARRANTY DESCRIPTION OF COVERAGE Underwritten by AMEX Assurance Company Administrative Office, 20022 N. 31st Ave. MC: 08-01-20 Phoenix AZ 85027 For purchases charged to Your Account, Extended Warranty will extend the terms of the original manufacturer's warranty on warranties of five (5) years or less that are eligible in the United States of America, -

An Experimental Investigation of Extended Warranties

Volume 64 Issue 2 Article 4 7-1-2019 Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties Breagin K. Riley Follow this and additional works at: https://digitalcommons.law.villanova.edu/vlr Part of the Consumer Protection Law Commons Recommended Citation Breagin K. Riley, Protecting Consumers Through Mandatory Disclosures: An Experimental Investigation of Extended Warranties, 64 Vill. L. Rev. 285 (2019). Available at: https://digitalcommons.law.villanova.edu/vlr/vol64/iss2/4 This Article is brought to you for free and open access by Villanova University Charles Widger School of Law Digital Repository. It has been accepted for inclusion in Villanova Law Review by an authorized editor of Villanova University Charles Widger School of Law Digital Repository. Riley: Protecting Consumers Through Mandatory Disclosures: An Experiment 2019] PROTECTING CONSUMERS THROUGH MANDATORY DISCLOSURES: AN EXPERIMENTAL INVESTIGATION OF EXTENDED WARRANTIES BREAGIN K. RILEY* AND AHMED E. TAHA** IMAGINE that you go to a consumer electronics store and buy a large- Iscreen television for $1,499. At the checkout counter, the cashier asks if you also wish to purchase an extended warranty for $249, which will pro- vide you three additional years of coverage beyond the manufacturer’s one-year warranty. Would you buy the extended warranty? What would drive your decision? If you are like most consumers, you would make this decision with little idea of the probability that the television will break down during the extended warranty’s coverage period and the cost of repairing it. But how would your decision and motivations change if the cashier told you there is only a 3% chance of the television needing repair during the first four years you own it and that the average cost of repairing the television is $300? These questions are the focus of this Article. -

Guernsey 2014

GUERNSEY 2014 From the publishers of GROWTH The captive space continues to demonstrate significant growth on the island STRUCTURE Why insurance-linked securities and PCCs are proving to be popular captive structures LOCATION How Guernsey offers an alternative location to other European domiciles 001_CRGuernsey2014_Cover.indd 1 07/02/2014 16:48 High-flying CORPORATE & COMMERCIAL / TRUST & FIDUCIARY / FUNDS INSURANCE / PROPERTY / DISPUTE RESOLUTION / INSOLVENCY Advocates PO Box 69, La Vieille Cour, La Plaiderie St Peter Port, Guernsey GY1 4BL Tel +44 (0)1481 713371 www.babbelegal.com Untitled-30616BAB_Ad_CaptiveReview_GR_200114_Fnl.indd 1 1 05/02/201420/01/2014 17:3216:10 FOREWORD Strategic thinking puts Guernsey in first position he Guernsey Financial Services Commis- Of particular importance is our regulatory sion (GFSC) licensed 89 new interna- regime which continues to respond to innova- REPORT EDITOR T tional insurers during 2013. This means tive proposals and this was reinforced by the Karolina Kaminska there were 758 international insurers licensed GFSC’s decision to form an Innovation Unit +44 (0)20 7832 6654 in the island at the end of December 2013. within the regulator. [email protected] A signifi cant proportion of the licences is- Guernsey also o ers proportionality STAFF WRITER sued were associated with structures related through meeting the insurance core principles Alexis Burris to insurance linked securities (ILS). This in- of the International Association of Insurance +44 (0) 20 7832 6656 cluded a Shariah-compliant ILS structure that Supervisors (IAIS). The decision taken in Janu- [email protected] was judged as the top innovative deal in Eu- ary 2011 not to seek equivalence with Solvency GROUP HEAD OF CONTENT rope and one of the Islamic fi nance Deals of II looks prescient in the light of the recent an- Gwyn Roberts the Year 2013 by Islamic Finance News. -

English Economic Commission for Latin

LIMITED LC /CAR/L. 210 ( Sem. 1 / 3 ) 3 February 1987 ORIGINAL: ENGLISH ECONOMIC COMMISSION FOR LATIN AMERICA AND THE CARIBBEAN Subregional Headquarters for the Caribbean UNITED NATIONS DEVELOPMENT PROGRAMME UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT Regional Workshop on Trade in Services St. John's, Antigua and Barbuda 10-12 March 1987 CAPTIVE INSURANCE COMPANIES IN THE CARIBBEAN - AN ANALYSIS by Greg L* Christie- The author is a lecturer in law at the University of the West Indies and is Director of the University's LL.M. Insurance Law postgraduate programme at the University's Cave Hill campus in Barbados. He is a member of the Barbados Institute of Insurance. This document has been prepared without formal editing. The views expressed are those of the Consultant and do not necessarily reflect the opinion of the Organizations. CONTENTS c (1) AN OVERVIEW OF CAPTIVE INSURANCE COMPANIES Page 1.1 THE CAPTIVE DEFINED 1 1.2 THE GROWTH DF THE WORLD CAPTIVE INDUSTRY 2 1.3 TYPES OF CAPTIVES 4 1. The Single Parent Owned Captive 2. The Group Captive 3. The Association Captive 4. The Rent-A-Captive 5. The Agency Captive 6. The Direct Writing Captive and the Reinsurance Capt ive 7. The Domestic captive and the Offshore Captive 1.4 REASONS FOR CAPTIVE FORMATION 15 1. Cost Reductions 2. Enhanced Cash Flow and Investment Income 3. Access to Reinsurance Markets 4. Personalized Coverage 5.. Provision of Coverage not Otherwise Available 6. Freedom of Investment and Movement of Funds 7. Enhanced Loss Control and Risk Management 1.5 CRITERIA FOR SELECTING CAPTIVE LOCATION 23 1. -

Consumers Guide to Auto Insurance

CONSUMERS GUIDE TO AUTO INSURANCE PRESENTED TO YOU BY THE DEPARTMENT OF BUSINESS REGULATION INSURANCE DIVISION 1511 PONTIAC AVENUE, BLDG 69-2 CRANSTON, RI 02920 TELEPHONE 401-462-9520 www.dbr.ri.gov Elizabeth Kelleher Dwyer Superintendent of Insurance TABLE OF CONTENTS Introduction………………………………………………………………1 Underwriting and Rating………………………………………………...1 What is meant by underwriting and how is it accomplished…………..1 How are rates and premium charges determined in Rhode Island……1 What factors are considered in ratemaking……………………………. 2 What discounts are used in determining final premium cost…………..3 Rhode Island Automobile Insurance Plan…………………..…………..4 Regulation of Rates……………………………………………………….4 The Tort System…………………………………………………………..4 Liability Coverages………………………………………………………..5 Coverages Other Than Liability…………………………………………5 Physical Damage to the Automobile……………………………………..6 Other Optional Coverages………………………………………………..6 The No-Fault System……………….……………………………………..7 Smart Shopping……………………………………………………………7 Shop for True Comparison………………………………………………..8 Consumer Protection Available...…………………………………………8 What to Do if You are in an Automobile Accident………………………9 Your State Insurance Department………………………………….........9 Auto Insurance Buyer’s Worksheet…………………………………….10 Introduction Auto insurance is an expensive purchase for most Americans, and is especially expensive for Rhode Islanders. Yet consumers rarely comparison-shop for auto insurance as they might for other products and services. Auto insurance companies vary substantially both in price and service to policyholders, so it pays to shop around and compare different insurance companies. This guide to buying auto insurance was developed to help you become a more knowledgeable policyholder and to get the combination of price and service best suited to your needs. It provides information on how to shop for coverage and how insurance premiums are determined. You will also find an Auto Insurance Buyer’s Worksheet in the guide to help you compare premium prices among insurers. -

Tax Risk Insurance: Taking It Captive

taxnotes federal ■ Volume 171, Number 4 April 26, 2021 Tax Risk Insurance: Taking It Captive by Ken Brewer and Albert Liguori Reprinted from Tax Notes Federal, April 26, 2021, p. 549 For more Tax Notes content, please visit www.taxnotes.com. © 2021 Tax Analysts. All rights reserved. Analysts does not claim copyright in any public domain or third party content. TAX PRACTICE tax notes federal Tax Risk Insurance: Taking It Captive by Ken Brewer and Albert Liguori is to explore the U.S. tax implications of that meeting. Behold: captive tax risk insurance!3 In our experiences, the use of tax risk insurance has been most prevalent in the mergers and acquisitions context. But as we mentioned in our last article, we have seen it becoming more common in the context of large corporate groups seeking to manage their global tax risks, regardless of whether they are related to M&A.4 In either context, the use of tax risk insurance lends itself to captive arrangements, for the same reasons that have caused captive arrangements to be desirable for other types of insurance risks. Ken Brewer is a senior adviser and Captive Insurance and the U.S. Tax Implications international tax practitioner with Alvarez & Thereof Marsal Taxand LLC in Miami, and Albert Liguori is a managing director in the firm’s New As an alternative to traditional insurance York office. The authors send special thanks to protection, which is obtained from one or more of Brian Pedersen, managing director at Alvarez & the many underwriters offering that coverage to Marsal Taxand, for his contributions and the public, captive insurance is obtained from a review. -

Work in Progress Work Is Underway to Boost Captive Growth in Hong Kong but Will Updated Legislation Be Enough to Draw in New Captives?

www.captiveinsurancetimes.com The primary source of global captive insurance news and analysis 27 May 2020 - Issue 199 Work in progress Work is underway to boost captive growth in Hong Kong but will updated legislation be enough to draw in new captives? Barbados Insight CIC Services vs IRS Emerging Talent Justin Cole of DGM Financial Sean King of CIC Services discusses Mike Scott Group discusses the current the firm’s upcoming case against Assistant vice president captive climate in Barbados the IRS in the Supreme Court Global Captive Management Captive Insurance Times Issue 199 www.captiveinsurancetimes.com Published by Black Knight Media Ltd 16 Bromley Road, New Beckenham Beckenham, BR3 5JE Editorial Editor: Becky Bellamy [email protected] Tel: +44 (0)208 075 0927 cover image by weerasak_saeku/shutterstock.com Reporter: Maria Ward-Brennan [email protected] Tel: +44 (0)208 075 0923 Contributor: Maddie Saghir [email protected] Designer: James Hickman [email protected] Marketing and sales Associate Publisher: John Savage [email protected] Tel: +44 (0)208 075 0932 Publisher: Justin Lawson [email protected] Office Manager: Chelsea Bowles Tel: +44 (0)208 075 0930 Follow us on Twitter: @CITimes Copyright © 2020 Black Knight Media Ltd All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without permission in writing from the publisher. Company reg: 0719464 www.captiveinsurancetimes.com WE KNOW CAPTIVE INSURANCE. For more than 70 years, no firm has had a more complete understanding of the captive and self- insured market than Milliman. -

Auto Insurance and How Those Terms Affect Your Coverage

Arkansas Insurance Department AUTOMOBILE INSURANCE Asa Hutchinson Allen Kerr Governor Commissioner A Message From The Commissioner The Arkansas Insurance Department takes very seriously its mission of “consumer protection.” We believe part of that mission is accomplished when consumers are equipped to make informed decisions. We believe informed decisions are made through the accumulation and evaluation of relevant information. This booklet is designed to provide basic information about automobile insurance. Its purpose is to help you understand terms used in the purchase of auto insurance and how those terms affect your coverage. If you have questions or need additional information, please contact our Consumer Services Division at: Phone: (501) 371-2640; 1-800-852-5494 Fax: (501) 371-2749 Email: [email protected] Web site: www.insurance.arkansas.gov Mission Statement The primary mission of the State Insurance Department shall be consumer protection through insurer insolvency and market conduct regulation, and fraud prosecution and deterrence. 1 Coverages Provided by Automobile Insurance The automobile insurance policy is comprised of several separate types of coverages: COLLISION, COMPREHENSIVE, LIABILITY, PERSONAL INJURY PROTECTION, UNINSURED MOTORIST, UNDERINSURED MOTORIST and other coverages. You are required by law to purchase liability protection only. All others are voluntary unless required by a lienholder. LIABILITY Under Legislation passed in 1987 and 1999, it is unlawful for any person to operate a motor vehicle within this state unless the vehicle is insured with the minimum amount of liability coverage: $25,000 for bodily injury or death of one person in any one accident; $50,000 for bodily injury or death of two or more persons in any one accident and $25,000 for damage to or destruction of the property of others. -

Republic of Vanuatu Insurance Act No. 54 of 2005

REPUBLIC OF VANUATU INSURANCE ACT NO. 54 OF 2005 Arrangement of Sections PART 1 PRELIMINARY 1 Interpretation 2 Meaning of insurance policy 3 Marine Insurance Act PART 2 – THE COMMISSION’S ADMINISTRATION OF THE ACT 4 The objectives of insurance supervision 5 Applications to the Commission 6 Powers of the Commission to obtain information and documents 7 On site inspections 8 Variations to an advertisement, brochure or similar document 9 Policy classification 10 Appointment of Inspector 11 Investigation by inspectors 12 Exchange of information with other insurance supervisors 13 Confidentiality PART 3 LICENCES 14 Licence to conduct insurance business 15 Domestic insurers to maintain assets 16 Licensing of insurance broker, insurance agent and independent insurance salesperson 17 Application for licence 18 Additional information and consideration of a licence application 19 Licence 20 Conditions of licence 21 Variation and cancellation of conditions of a licence 22 A licensee’s obligation 23 Reporting duties of an insurance manager 24 Restriction on activities of insurer 25 Suspension of a licence 26 Revocation of the suspension of a licence 27 Cancellation of licence 28 Failure to commence or continue a licensed business 1 29 Prohibition on using certain words or doing certain acts 30 Unlicensed person cannot conduct insurance business PART 4 CAPITAL ADEQUACY 31 Minimum capital 32 Maintenance of financially sound condition 33 Assets of an insurer 34 Categories of assets 35 Deeming provisions of assets 36 Life insurer’s liabilities 37 General