Eurasian Economic Integration: Origins, Patterns, and Outlooks 42 Tatyana Valovaya 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

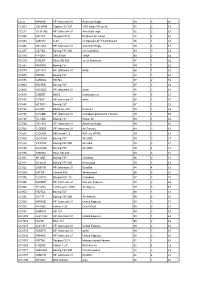

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

WORLD AVIATION Yearbook 2013 EUROPE

WORLD AVIATION Yearbook 2013 EUROPE 1 PROFILES W ESTERN EUROPE TOP 10 AIRLINES SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 R ANKING CARRIER NAME SEATS Lufthansa 1 Lufthansa 1,739,886 Ryanair 2 Ryanair 1,604,799 Air France 3 Air France 1,329,819 easyJet Britis 4 easyJet 1,200,528 Airways 5 British Airways 1,025,222 SAS 6 SAS 703,817 airberlin KLM Royal 7 airberlin 609,008 Dutch Airlines 8 KLM Royal Dutch Airlines 571,584 Iberia 9 Iberia 534,125 Other Western 10 Norwegian Air Shuttle 494,828 W ESTERN EUROPE TOP 10 AIRPORTS SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 Europe R ANKING CARRIER NAME SEATS 1 London Heathrow Airport 1,774,606 2 Paris Charles De Gaulle Airport 1,421,231 Outlook 3 Frankfurt Airport 1,394,143 4 Amsterdam Airport Schiphol 1,052,624 5 Madrid Barajas Airport 1,016,791 HE EUROPEAN AIRLINE MARKET 6 Munich Airport 1,007,000 HAS A NUMBER OF DIVIDING LINES. 7 Rome Fiumicino Airport 812,178 There is little growth on routes within the 8 Barcelona El Prat Airport 768,004 continent, but steady growth on long-haul. MostT of the growth within Europe goes to low-cost 9 Paris Orly Field 683,097 carriers, while the major legacy groups restructure 10 London Gatwick Airport 622,909 their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt ... ... On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. -

5Hjxodwru\ 5Hirup Lq +Xqjdu\

5HJXODWRU\ 5HIRUP LQ +XQJDU\ 5HJXODWRU\ 5HIRUP LQ WKH (OHFWULFLW\ 6HFWRU ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The following countries became Members subsequently through accession at the dates indicated hereafter: Japan (28th April 1964), Finland (28th January 1969), Australia (7th June 1971), New Zealand (29th May 1973), Mexico (18th May 1994), the Czech Republic (21st December 1995), Hungary (7th May 1996), Poland (22nd November 1996), Korea (12th December 1996) and the Slovak Republic (14th December 2000). The Commission of the European Communities takes part in the work of the OECD (Article 13 of the OECD Convention). Publié en français sous le titre : LA RÉFORME DE LA RÉGLEMENTATION DANS LE SECTEUR DE L'ÉLECTRICITÉ © OECD 2000. Permission to reproduce a portion of this work for non-commercial purposes or classroom use should be obtained through the Centre français d’exploitation du droit de copie (CFC), 20, rue des Grands-Augustins, 75006 Paris, France, tel. -

Principles of Macroeconomics Module 7.1

Principles of Macroeconomics Module 7.1 Understanding Balance of Payments 276 Balance of Payments Balance of Payments are the measurement of economic activity a country conducts internationally • Current Account: • Capital Account: 277 Balance of Payments • Current Account: The value of trade of goods and services across boarders • Capital Account: The monetary flows between countries used to purchase financial assets such as stocks, bonds, real estate and other related items Capital Account + Current Account = 0 If Current Account is in deficit, then Capital Account is in surplus If Current Account is in surplus, then Capital Account is in deficit 278 Balance of Payments • Current Account: The value of trade of goods and services across boarders • Capital Account: The monetary flows between countries used to purchase financial assets such as stocks, bonds, real estate and other related items Capital Account + Current Account = 0 If Current Account is in deficit, then Capital Account is in surplus If Current Account is in surplus, then Capital Account is in deficit 279 Balance of Payments Capital Account + Current Account = 0 If Current Account is in deficit, then Capital Account is in surplus If Current Account is in surplus, then Capital Account is in deficit 280 Current Account • Net exports of goods and services, (the difference in value of exports minus imports, which can be written as) NX,(1) • Net investment income • Net transfers à Largest component: Net Exports 281 Factors that Determine Current Account 1. Change in Economic Growth Rates/National Income • Higher domestic growth à more demand overall à more demand for imports too! • Higher foreign growth à more demand for exports • Relative economic growth rates determine if imports or exports rise 2. -

World Bank Document

50434 Bazaars and Trade Integration in CAREC Countries Report prepared by the World Bank May 13, 2009 Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Snapshot of the Dordoy bazaar in Kyrgyz Republic taken in August 2008: on the way to a modern shopping mall? Public Disclosure Authorized This report was prepared by a team headed by Saumya Mitra and consisting of Bartlomiej Kaminski (principal investigator) and Matin Kholmatov (economist). The team is grateful for comments from Motoo Konishi and Kazi Matin (World Bank) and Sena Eken and Ana-Lucia Coronel (IMF). The Bank acknowledges with gratitude the generous support of the Multi-Donor Trust Fund for Trade and Development and of the Swiss government to the conduct of this study. P a g e | 1 Contents Summary .............................................................................................................................................................. 3 Introduction ........................................................................................................................................................ 6 1. Bazaars in surveys: salient features and impact on local economies .................................................. 8 A. Nodes of concentric networks: types of surveyed bazaars ............................................................. 8 B. Employment and income effects of surveyed bazaars ................................................................... 12 C. Bazaars and marketing opportunities: positive welfare -

International Capital Movements and Relative Wages: Evidence from U.S

International Economic Studies Vol. 47, No. 1, 2016 pp. 17-36 Received: 08-09-2015 Accepted: 24-05-2016 International Capital Movements and Relative Wages: Evidence from U.S. Manufacturing Industries * Indro Dasgupta Department of Economics, Southern Methodist University, Dallas, USA Thomas Osang* Department of Economics, Southern Methodist University, Dallas, USA* Abstract In this paper, we use a multi-sector specific factors model with international capital mobility to examine the effects of globalization on the skill premium in U.S. manufacturing industries. This model allows us to identify two channels through which globalization affects relative wages: effects of international capital flows transmitted through changes in interest rates, and effects of international trade in goods and services transmitted through changes in product prices. In addition, we identify two domestic forces which affect relative wages: variations in labor endowment and technological change. Our results reveal that changes in labor endowments had a negative effect on the skill premium, while the effect of technological progress was mixed. The main factors behind the rise in the skill premium were product price changes (for the full sample period) and international capital flows (during 1982-05). Keywords: capital mobility, specific factors, skill premium, globalization, labor endowments, technological change JEL Classification: F16, J31. * Corresponding Author, Email: [email protected] * We would like to thank seminar participants at Southern Methodist University and Queensland University of Technology for useful comments and suggestions. We also thank Peter Vaneff and Lisa Tucker who provided able research assistance. 18 International Economic Studies, Vol. 47, No. 1, 2016 1. Introduction investment is an important factor in The U.S. -

A New Geography of European Power?

A NEW GEOGRAPHY OF EUROPEAN POWER? EGMONT PAPER 42 A NEW GEOGRAPHY OF EUROPEAN POWER? James ROGERS January 2011 The Egmont Papers are published by Academia Press for Egmont – The Royal Institute for International Relations. Founded in 1947 by eminent Belgian political leaders, Egmont is an independent think-tank based in Brussels. Its interdisciplinary research is conducted in a spirit of total academic freedom. A platform of quality information, a forum for debate and analysis, a melting pot of ideas in the field of international politics, Egmont’s ambition – through its publications, seminars and recommendations – is to make a useful contribution to the decision- making process. *** President: Viscount Etienne DAVIGNON Director-General: Marc TRENTESEAU Series Editor: Prof. Dr. Sven BISCOP *** Egmont - The Royal Institute for International Relations Address Naamsestraat / Rue de Namur 69, 1000 Brussels, Belgium Phone 00-32-(0)2.223.41.14 Fax 00-32-(0)2.223.41.16 E-mail [email protected] Website: www.egmontinstitute.be © Academia Press Eekhout 2 9000 Gent Tel. 09/233 80 88 Fax 09/233 14 09 [email protected] www.academiapress.be J. Story-Scientia NV Wetenschappelijke Boekhandel Sint-Kwintensberg 87 B-9000 Gent Tel. 09/225 57 57 Fax 09/233 14 09 [email protected] www.story.be All authors write in a personal capacity. Lay-out: proxess.be ISBN 978 90 382 1714 7 D/2011/4804/19 U 1547 NUR1 754 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without the permission of the publishers. -

COVID-19) on Civil Aviation: Economic Impact Analysis

Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Montréal, Canada 11 March 2020 Contents • Introduction and Background • Scenario Analysis: Mainland China • Scenario Analysis: Hong Kong SAR of China and Macao SAR of China • Summary of Scenario Analysis and Additional Estimates: China • Scenario Analysis: Republic of Korea • Scenario Analysis: Italy • Scenario Analysis: Iran (Islamic Republic of) • Preliminary Analysis: Japan and Singapore 2 Estimated impact on 4 States with the highest number of confirmed cases* Estimated impact of COVID-19 outbreak on scheduled international passenger traffic during 1Q 2020 compared to originally-planned: • China (including Hong Kong/Macao SARs): 42 to 43% seat capacity reduction, 24.8 to 28.1 million passenger reduction, USD 6.0 to 6.9 billion loss of gross operating revenues of airlines • Republic of Korea: 27% seat capacity reduction, 6.1 to 6.6 million passenger reduction, USD 1.3 to 1.4 billion loss of gross operating revenues of airlines • Italy: 19% seat capacity reduction, 4.8 to 5.4 million passenger reduction, USD 0.6 to 0.7 billion loss of gross operating revenues of airlines • Iran (Islamic Republic of): 25% seat capacity reduction, 580,000 to 630,000 passenger reduction, USD 92 to 100 million loss of gross operating revenues of airlines * Coronavirus Disease 2019 (COVID-19) Situation Report by WHO 3 Global capacity share of 4 States dropped from 23% in January to 9% in March 2020 • Number of seats offer by airlines for scheduled international passenger traffic; -

India-Tajikistan Bilateral Relations

India-Tajikistan Bilateral Relations Relations between India and Tajikistan have traditionally been close and cordial. There has been a regular exchange of high level visits and important agreements, which helped in cementing the relations. During the visit of Tajik President to India in September 2012, the two countries declared their relationship to ‘Strategic Partnership’ encompassing cooperation in a wide spectrum of areas including political, economic, education, health, human resource development, defence, counter-terrorism, science and technology, culture and tourism. The Tajik side points out that the Tajik version of such declaration reads “strategic cooperation” and not partnership. During the preparation to the State visit of President Shri Ram Nath Kovind the Tajik side proposed that we could negotiate a strategic partnership agreement to sign. 2. Prime Minister Shri Narendra Modi visited Tajikistan in 2015 and President Shri Ram Nath Kovind in 2018. Dr. S. Jaishankar, External Affairs Minister of India visited Tajikistan in June 2019 to attend the 5th Summit Meeting of Conference on Interaction and Confidence Building Measures in Asia. Late Smt Sushma Swaraj, Hon’ble External Affairs Minister led the Indian delegation to 17th SCO Heads of Government meeting, which was held in Dushanbe from 11-12 October 2018. Shri M.J. Akbar, Minister of State for External Affairs visited Tajikistan in May 2018 to attend High Level International Conference on ‘Countering Terrorism and Preventing Violent Extremism’. Shri Nitin Gadkari, Minister for Water Resources, River Development and Ganga Rejuvenation visited Tajikistan in June 2018 to attend the conference on ‘International Decade for Action: Water for Sustainable Development, 2018-2028’. -

2-JICA-Investment-Opportunities-2014

Source: United Nations Cartographic Section Abbreviations ASEAN Association of South䇲East Asian Nations BOI Board of Investment CAD Computer Aided Design CAGR Compound Average Growth Rate CBTA Cross Border Transportation Agreement CIS Commonwealth of Independent States CMT Cut Make and Trim E/D Embarkation/Disembarkation EU European Union F/S Financial Statement FAOSTAT Food and Agriculture Organization stat GDP Gross Domestic Product ICT Information and Communication Technology IMF International Monetary Fund IT Information Technology JICA Japan International Cooperation Agency JNTO Japan National Tourist Organization KATO Kyrgyz Association of Tour Operators KPI Key Performance Indicator KSSDA Kyrgyz Software and Services Develops Association LNG Liquefied Natural Gas MBA Master of Business Administration MRP Machine Readable Passport NSC National Statistical Committee of the Kyrgyz Republic OECD Organisation for Economic Co-operation and Development OEM Original Equipment Manufacturing OJT On-the-Job Training PET Polyethylene Terephthalate SPA Speciality store retailer of Private label Apparel TSA Tourism Satellite Account UAE United Arab Emirates UNCTAD United Nations Conference on Trade and Development UNWTO United Nations World Tourism Organization WTO World Trade Organization Table of contents Summary .................................................................................................................................. 1 1. Selection of promising industries(initial macro data-based selection) ................................ -

Capital Flows and Emerging Market Economies

Committee on the Global Financial System CGFS Papers No 33 Capital flows and emerging market economies Report submitted by a Working Group established by the Committee on the Global Financial System This Working Group was chaired by Rakesh Mohan of the Reserve Bank of India January 2009 JEL Classification: F21, F32, F36, G21, G23, G28 Copies of publications are available from: Bank for International Settlements Press & Communications CH 4002 Basel, Switzerland E mail: [email protected] Fax: +41 61 280 9100 and +41 61 280 8100 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2009. All rights reserved. Brief excerpts may be reproduced or translated provided the source is cited. ISBN 92-9131-786-1 (print) ISBN 92-9197-786-1 (online) Contents A. Introduction......................................................................................................................1 The macroeconomic effects of capital account liberalisation ................................ 1 An outline of the Report .........................................................................................5 B. The macroeconomic context of capital flows...................................................................7 Introduction ............................................................................................................7 Capital flows in historical perspective ....................................................................8 Capital flows in the 2000s ....................................................................................17 -

INTERNATIONAL ELECTION OBSERVATION MISSION Russian Federation – Presidential Election, 18 March 2018

INTERNATIONAL ELECTION OBSERVATION MISSION Russian Federation – Presidential Election, 18 March 2018 STATEMENT OF PRELIMINARY FINDINGS AND CONCLUSIONS PRELIMINARY CONCLUSIONS The 18 March presidential election took place in an overly controlled legal and political environment marked by continued pressure on critical voices, while the Central Election Commission (CEC) administered the election efficiently and openly. After intense efforts to promote turnout, citizens voted in significant numbers, yet restrictions on the fundamental freedoms of assembly, association and expression, as well as on candidate registration, have limited the space for political engagement and resulted in a lack of genuine competition. While candidates could generally campaign freely, the extensive and uncritical coverage of the incumbent as president in most media resulted in an uneven playing field. Overall, election day was conducted in an orderly manner despite shortcomings related to vote secrecy and transparency of counting. Eight candidates, one woman and seven men, stood in this election, including the incumbent president, as self-nominated, and others fielded by political parties. Positively, recent amendments significantly reduced the number of supporting signatures required for candidate registration. Seventeen prospective candidates were rejected by the CEC, and six of them challenged the CEC decisions unsuccessfully in the Supreme Court. Remaining legal restrictions on candidates rights are contrary to OSCE commitments and other international standards, and limit the inclusiveness of the candidate registration process. Most candidates publicly expressed their certainty that the incumbent president would prevail in the election. With many of the candidates themselves stating that they did not expect to win, the election lacked genuine competition. Thus, efforts to increase the turnout predominated over the campaign of the contestants.