Current Environment Deal Activity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Confectionery Fresh and Fermented Dairy Pharmaceuticals Processed

Creating new value as “Food and Health” professionals (TSE Section 1: 2269) To enrich the daily lives of customers of all ages by providing them with tastiness and enjoyment as well as products that contribute to their physical and emotional well-being Fresh and Fermented Dairy Confectionery Pharmaceuticals Antibacterial Generic drugs drugs Yogurt Drinking Chocolate/ Gummy milk Chocolate snacks Drugs for CNS disorders Processed Food Nutrition Ice cream Cheese Infant Enteral Sports nutrition formula formula Consolidated Performance and Share Price in Recent Years Net sales Operating income (%) ROE Payout ratio / DOE Share price (July 2014 – October 2017) (JPY1 bn) (JPY1 bn) 20 (%) (%) (JPY) 90 1,200 90 6 16 10,000 7,500 800 60 12 60 4 DOE 8 5,000 400 30 30 2 2,500 4 Payout ratio 0 0 0 0 0 0 3 3 3 3 3 3 3 3 3 3 3 3 E E E 7 0 1 4 7 0 1 4 7 0 1 4 7 0 / / / / 3 3 3 3 / / / / / / / / E / / / / / / / / / / / / / / 3 3 3 1 1 1 1 4 5 6 7 4 5 6 7 4 5 6 7 / / 3 / 4 5 5 5 6 6 6 7 7 7 / / / / 4 5 6 7 / 1 1 1 1 1 1 1 1 1 1 1 1 8 8 8 ' ' ' ' 1 4 1 1 1 5 1 1 1 6 1 1 1 7 ' ' ' ' ' ' ' ' 1 1 1 1 ' ' ' ' ' ' ' ' ' ' 8 ' ' ' ' 1 1 1 1 1 1 1 ' ' ' ' ' ' ' 1 ' History Major Shareholders Number of Percentage of (as of September 30, 2017) shares held total shares Meiji Sugar Co., Ltd., the origin of the Meiji Group, was established. -

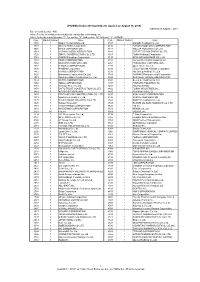

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

"JPX-Nikkei Index 400"

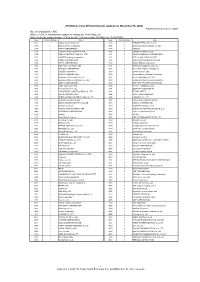

JPX-Nikkei Index 400 Constituents (applied on August 30, 2019) Published on August 7, 2019 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3107 1 Daiwabo Holdings Co.,Ltd. 1333 1 Maruha Nichiro Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1605 1 INPEX CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1719 1 HAZAMA ANDO CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3167 1 TOKAI Holdings Corporation 1721 1 COMSYS Holdings Corporation 3197 1 SKYLARK HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1802 1 OBAYASHI CORPORATION 3254 1 PRESSANCE CORPORATION 1803 1 SHIMIZU CORPORATION 3288 1 Open House Co.,Ltd. 1808 1 HASEKO Corporation 3289 1 Tokyu Fudosan Holdings Corporation 1812 1 KAJIMA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1820 1 Nishimatsu Construction Co.,Ltd. 3349 1 COSMOS Pharmaceutical Corporation 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1824 1 MAEDA CORPORATION 3382 1 Seven & I Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1861 1 Kumagai Gumi Co.,Ltd. 3401 1 TEIJIN LIMITED 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3402 1 TORAY INDUSTRIES,INC. 1881 1 NIPPO CORPORATION 3405 1 KURARAY CO.,LTD. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. 3407 1 ASAHI KASEI CORPORATION 1911 1 Sumitomo Forestry Co.,Ltd. -

Meiji Holdings Co., Ltd. FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing for Analysts and Institutional Investors Q&A Summary

FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing: QA Summary Meiji Holdings Co., Ltd. FYE March 2018 Results and 2020 Medium-Term Business Plan Briefing for Analysts and Institutional Investors Q&A Summary Date and time: May 17, 2018, 1:00 - 2:30 pm Presenters: Masahiko Matsuo President and Representative Director, Meiji Holdings Co., Ltd. Koichiro Shiozaki Member of the Board and Managing Executive Officer, Meiji Holdings Co., Ltd. Kazuo Kawamura President and Representative Director, Meiji Co., Ltd. Daikichiro Kobayashi President and Representative Director, Meiji Seika Pharma Co., Ltd. Q1. In the 2020 Medium-Term Business Plan, sales growth contributes significantly to operating income of JPY 110 billion. If you do not reach your sales targets, how will you achieve your operating income goal? A1. We are assuming that we will successfully increase sales but operating income, JPY 110 billion, may not come from sales growth alone. We will increase profitability by; 1) Improving our product mix, which will involve expanding high-profitability product lines, and 2) Implementing structural reforms to improve productivity Improved revenues from the Drinking Milk business will contribute significantly. We will improve Meiji Oishii Gyunyu brand revenues by promoting its 900 mL product launched in September 2016. We will evaluate low-performing Drinking Milk products and may discontinue some of them. Q2. In Japan, you are experiencing struggles with yogurt and chocolate sales growth recently. What strategies will you implement to stimulate growth for the coming FYE March 2020? A2. The Yogurt market is not recording constant growth. The market trend has been repeating growth and plateau phases. -

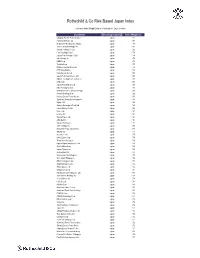

R&Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) McDonald's Holdings Co Japan L Japan 1.29 Idemitsu Kosan Co Ltd Japan 1.12 SoftBank Corp Japan 1.05 Nintendo Co Ltd Japan 0.86 Hitachi Metals Ltd Japan 0.83 Yakult Honsha Co Ltd Japan 0.82 Iwatani Corp Japan 0.81 ENEOS Holdings Inc Japan 0.79 FUJIFILM Holdings Corp Japan 0.78 KDDI Corp Japan 0.75 Toshiba Corp Japan 0.73 Calbee Inc Japan 0.73 Ajinomoto Co Inc Japan 0.72 Eisai Co Ltd Japan 0.72 Nissin Foods Holdings Co Ltd Japan 0.71 Morinaga Milk Industry Co Ltd Japan 0.70 Japan Tobacco Inc Japan 0.66 H.U. Group Holdings Inc Japan 0.66 JCR Pharmaceuticals Co Ltd Japan 0.64 MEIJI Holdings Co Ltd Japan 0.64 Yamazaki Baking Co Ltd Japan 0.63 Chugoku Electric Power Co Inc/ Japan 0.63 Nippon Gas Co Ltd Japan 0.63 PeptiDream Inc Japan 0.62 Chubu Electric Power Co Inc Japan 0.62 Seven & i Holdings Co Ltd Japan 0.62 FP Corp Japan 0.61 Pola Orbis Holdings Inc Japan 0.61 Lion Corp Japan 0.61 Shiseido Co Ltd Japan 0.60 Nippon Telegraph & Telephone C Japan 0.60 Nichirei Corp Japan 0.59 Japan Post Bank Co Ltd Japan 0.59 Kobayashi Pharmaceutical Co Lt Japan 0.59 Anritsu Corp Japan 0.58 Skylark Holdings Co Ltd Japan 0.58 Kyowa Kirin Co Ltd Japan 0.58 Lawson Inc Japan 0.58 Suntory Beverage & Food Ltd Japan 0.57 Kinden Corp Japan 0.57 MS&AD Insurance Group Holdings Japan 0.56 Shimano Inc Japan 0.56 Mitsubishi Corp Japan 0.56 Zensho Holdings Co Ltd Japan 0.56 Tokai Carbon Co Ltd Japan 0.56 Japan Post Holdings Co Ltd -

"JPX-Nikkei Index 400"

JPX-Nikkei Index 400 Constituents (applied on November 30, 2020) Published on November 9, 2020 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3086 1 J.FRONT RETAILING Co.,Ltd. 1333 1 Maruha Nichiro Corporation 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1605 1 INPEX CORPORATION 3092 1 ZOZO,Inc. 1719 1 HAZAMA ANDO CORPORATION 3107 1 Daiwabo Holdings Co.,Ltd. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3116 1 TOYOTA BOSHOKU CORPORATION 1721 1 COMSYS Holdings Corporation 3141 1 WELCIA HOLDINGS CO.,LTD. 1766 1 TOKEN CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3167 1 TOKAI Holdings Corporation 1802 1 OBAYASHI CORPORATION 3197 1 SKYLARK HOLDINGS CO.,LTD. 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3288 1 Open House Co.,Ltd. 1812 1 KAJIMA CORPORATION 3289 1 Tokyu Fudosan Holdings Corporation 1820 1 Nishimatsu Construction Co.,Ltd. 3291 1 Iida Group Holdings Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3349 1 COSMOS Pharmaceutical Corporation 1824 1 MAEDA CORPORATION 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1860 1 TODA CORPORATION 3382 1 Seven & I Holdings Co.,Ltd. 1861 1 Kumagai Gumi Co.,Ltd. 3391 1 TSURUHA HOLDINGS INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3401 1 TEIJIN LIMITED 1881 1 NIPPO CORPORATION 3402 1 TORAY INDUSTRIES,INC. -

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

Corporate Governance Report Meiji Holdings Co., Ltd

Corporate Governance Report Last Update: June 29, 2021 Meiji Holdings Co., Ltd. Kazuo Kawamura, CEO, President and Representative Director Securities Code: 2269 https://www.meiji.com/global The corporate governance of Meiji Holdings Co., Ltd. (the “Company,” “we,” or “us”) is described below. 1. Basic Views on Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information 1. Basic Views The Meiji Group's (the “Group”) philosophy is to brighten customers' daily lives as a corporate group in the Food and Health fields. Our mission is to widen the world of “Tastiness and Enjoyment” and meet all expectations regarding “Health and Reassurance.” We do this with the goal of continuing to find innovative ways to meet our customers' needs, today and tomorrow. In this way, we aim to achieve sustainable growth and increase corporate value over the medium to long term. The basic approach to management of the Group is for operating companies to manage businesses autonomously while collaborating with each other under the holding company's control. The main role of Meiji Holdings Co., Ltd. is to advance Groupwide management strategies, create an optimal operating structure, and oversee the business management of operating companies. Responsibility for operational execution is delegated to operating companies appropriately. Within the Group, oversight and execution of business management are separated. Accordingly, the Group has established and operates a corporate governance system including a Board of Directors. Meiji Holdings is a company with audit & supervisory board members. The Board of Directors' oversight and audit & supervisory board members' auditing heighten the objectivity and transparency of business management. -

The Eleventh Mitsui Fudosan Sports Academy for Tokyo 2020 the Olympic and Paralympic Games Tokyo 2020 Movement

August 21, 2017 For immediate release Mitsui Fudosan Co., Ltd. Mitsui Fudosan Residential Co., Ltd. Mitsui Fudosan supports the Olympic Games Tokyo 2020 as a Tokyo 2020 Gold Partner (Real Estate Development) . Mitsui Fudosan Residential Co., Ltd. is a Mitsui Fudosan Group Company Creating Neighborhoods While Utilizing the "Power of Sports" The Eleventh Mitsui Fudosan Sports Academy for Tokyo 2020 The Olympic and Paralympic Games Tokyo 2020 Movement Hosting Decided for Soccer Academy and Nutrition Seminar Presented by Meiji Holdings Co., Ltd. Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, announced today that it will hold the Mitsui Fudosan Sports Academy for Tokyo 2020 on September 3, 2017. Mitsui Fudosan, a Tokyo 2020 Gold Partner sponsor in the category of “Real Estate Development”, holds the Mitsui Fudosan Sports Academy for Tokyo 2020, a sports classroom conducted with The Tokyo Organising Committee of the Olympic and Paralympic Games. Top class athletes are invited to be instructors, and through their classroom descriptions the participants are able to experience the Olympic and Paralympic competitions. The Eleventh Mitsui Fudosan Sports Academy will be held at MIFA Football Park Toyosu, which is located in the Toyosu area where Mitsui Fudosan is moving ahead with a redevelopment project. This will be a Soccer Academy and will welcome Keita Suzuki, who played in the qualifying matches for the Olympic Games Athens 2004, and Karina Maruyama, who appeared in the Olympic Games Athens 2004 and the Olympic Games Beijin 2008 as instructors. Holding the academy in an area where Mitsui Fudosan is engaged in neighborhood creation will help to invigorate the community and foster enthusiasm for the Olympic and Paralympic Games Tokyo 2020. -

Integrated Report 2018 Contents Meiji Group’S Vision 1 Introduction 1 Meiji Group’S Vision 2 at a Glance 4 Product and Market Presence Group Philosophy

Integrated Report 2018 Contents Meiji Group’s Vision 1 Introduction 1 Meiji Group’s Vision 2 At a Glance 4 Product and Market Presence Group Philosophy 6 Our Value Creation Story Our mission is to widen the world of “Tastiness and 6 History Enjoyment” and meet all expectations regarding 8 Meiji Group’s Process for Value Creation “Health and Reassurance.” 10 Process for Medium-and Long-Term Growth 12 Message to Stakeholders Our wish is to be closely in tune with our customers’ 13 Message from the President 18 Medium-Term Business Plan (Food Segment) feelings and to always be there to brighten their 22 Medium-Term Business Plan (Pharmaceutical Segment) daily lives. 26 Special Feature “Creating Markets with a Strong Value Chain” Our responsibility as “Food and Health” professionals 32 Our Activities for Sustainability is to continue finding innovative ways to meet 32 Meiji Group’s Approach to CSR our customers’ needs, today and tomorrow. 40 Directors and Audit & Supervisory Board Members 42 Responsibilities of Members of the Board and Audit & Supervisory Board Members 44 Dialogue with Outside Directors and Their Message 48 Corporate Governance 51 Risk Management Compliance 52 Financial and Non-Financial Section 52 Financial and Non-Financial Highlights (9 Years Summary) 54 Financial and Non-Financial Highlights (Main Indices) 56 MD&A (The Management Discussion and Analysis) 60 Consolidated Financial Statements 97 Independent Auditor’s Report 98 Corporate Information 98 Operating Bases and Group Companies 100 Corporate Data / Stock Information 101 Independent Practitioner’s Assurance of CO2 Emissions Editorial Policy Starting from 2018, Meiji Holdings (the Company) will issue an “Integrated Report” and replace the Annual Report that has been issued up until now. -

CDP Japan Water Security Report 2019

CDP Japan Water Security Report 2019 On behalf of 525 institutional investors with assets of USD 96 trillion CDP Japan Water Security Report 2019 | 2020 March Report writer Contents CDP Foreword 3 Report Writer Foreword 4 Water Security A List 2019 6 Scoring 7 Stories of Change 8 - Kao Corporation - Japan Tobacco Inc. Executive Summary 12 Response to CDP’s Water Security Questionnaire 14 Appendix 22 - CDP Water Security 2019 Japanese companies Please note that the names of companies in the text do not indicate their corporate status. Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2019 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD.