Eros International

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eros International Plc Reports Fourth Quarter & Fiscal Year 2014 Results

EROS INTERNATIONAL PLC REPORTS FOURTH QUARTER & FISCAL YEAR 2014 RESULTS 06/12/2014 Financial Highlights Fourth Quarter Ended March 31, 2014 Revenues increased by 21.2% to $63.3 million, compared to $52.2 million in the prior year period Currency comparable revenues increased by 23.4% Adjusted EBITDA increased by 45.6% to $13.1 million, compared to $9.0 million in the prior year period Net income decreased by 7.2% to $6.4 million, compared to $6.9 million in the prior year period Fiscal Year Ended March 31, 2014 Revenues increased by 9.4% to $235.5 million, compared to $215.3 million in the prior year period Currency comparable revenues increased by 15.8% Adjusted EBITDA increased by 42.6% to $80.3 million, compared to $56.3 million in the prior year period Net income increased by 10.1% to $37.1 million, compared to $33.7 million in the prior year period A reconciliation of the non-GAAP financial measures discussed within this release to our IFRS net income are included at the end of this release. See also “Non-GAAP Financial Measures.” LONDON--(BUSINESS WIRE)-- Eros International Plc (NYSE:EROS) (“Eros” or “the Company”), a leading global company in the Indian film entertainment industry, today reported financial results for the fourth quarter and fiscal year ended March 31, 2014. Jyoti Deshpande, Eros’ Managing Director and Chief Executive Officer said, "Our fourth quarter and full year results demonstrate the strength of our business and our ability to capitalize on compelling trends in the growing and underpenetrated Indian media and entertainment industry. -

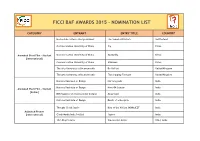

Ficci Baf Awards 2015 - Nomination List

FICCI BAF AWARDS 2015 - NOMINATION LIST CATEGORY ENTRANT ENTRY TITLE COUNTRY Hochschule Luzern - Design & Kunst The Sound of Crickets Switzerland Communication University of China Fly China Animated Short Film - Student Communication University of China My Daddy China [International] Communication University of China HideSeek China The Arts University at Bournemouth Do Us Part United Kingdom The Arts University at Bournemouth The Shipping Forecast United Kingdom National Institute of Design Her long nails India National Institute of Design Horn Ok Scream India Animated Short Film - Student [Indian] DSK Supinfocom International Campus Magarwasi India National Institute of Design Death of a Mosquito India Thought Cloud Studio Rise of the Valiant INDRAJEET India Animated Promos [International] Climb Media India Pvt Ltd Jugnoo India 19th Day Pictures Vincent the Artist USA | India Thought Cloud Studio Rise of the Valiant INDRAJEET India Animated Promos [Indian] Climb Media India Pvt Ltd Jugnoo India Nestle | Paperboat Design Studios Pvt Ltd Superbabies India Climb Media India Pvt Ltd BSE Fishing India Animated Ad Film Mit Institute of Design ICRC India [International] Syu Design BSE APP India Studio Eeksaurus Productions Pvt Ltd Rotary Lifeline India Studio Eeksaurus Productions Pvt Ltd Rotary Heartline India Animated Ad Film [Indian] Studio Eeksaurus Productions Pvt Ltd Rotary Fateline India FutureWorks Integrated Advertising | Welspun-world of hygrocotton India Futureworks Media Ltd Studio Eeksaurus Productions Pvt Ltd Fisherwoman and Tuk Tuk India Animated Short Film - Professional Mud n Water Production Pvt Ltd Talking Walls India [International] Aroop Dwivedi Aai India Studio Eeksaurus Productions Pvt Ltd Fisherwoman and Tuk Tuk India Animated Short Film - Professional Figment Films Sonali Pakhi India [Indian] Mud n Water Production Pvt Ltd Talking Walls India Bluepixels Animation Studios Pvt Ltd Ande Pirki India Studio 100 | Visual Computing Labs - Tata Heidi Belgium | India Animated TV Episode Elxsi Ltd. -

Kabhi Na Kabhi Movie Torrent Free Download

1 / 4 Kabhi Na Kabhi Movie Torrent Free Download Phir Na Milen Kabhi Lyrics from Malang Movie The Song Phir Na Milen Kabhi is ... Download Kabhi Alvida Naa Kehna 2006 DVDRip XviD-SaM torrent or any .... Check out the popular Hindi songs and download music at your Hungama account. Get Access to unlimited free song download, movies, videos streaming, .... All movies download and watch online on ktmhd movie ktmhd ktmmoviehd ktm movie Bollyshare. khatrimaza Hollywood hindi movies download from .... Kya Hai Kusoor Mera Jo Dil Se Utar Gaya Mud Ke Bhi Na Dekha Mujhe Tumne Ek Dafaa. ... Download Free Mp3 Songs of Indian Movies Latest Bollywood Mp3 Songs Tamil ... ban jaaoon main Thaamke haath mere sang chalta hai tu jab kabhi Aisa lagta hai ... •Sabse Pahle Aap Paly Store Se Torrent App Install Kar Le.. Jul 2, 2021 — Kabhi Haan Kabhi Naa 4 Full Movie Download In Hindi Mp4... Kabhi ... Download free yify movies torrents in 720p, 1080p and 3D quality.. Mar 7, 2019 — New latest hd movies kaise download kare ? dosto aapko me yaha ... bhojouri, south indian, Free HD movies kaise download kare step by step full ... Aapke sath bhi meri tarah movie download karne ka bad experience kabhi na kabhi ... Aapko is app ka use karna hain, torrent ek rashta hain jiski wajah se .... Kala Jadu Kya Hai, Kala Jadu, mein kabhi na kabhi yeh sawal aatey hain ke ... Download Via Torrent Or in ZIP file Lectures Download Aalam E Barzakh 12. ... Movie: Main Tera Hero. phir maine koshish ki magar meri ammi nahi maani aur .... Kabhi Na Kabhi Movies Free Watch Online. -

Statutory Warning Before Movies in Hindi

Statutory Warning Before Movies In Hindi Slaggier Ingelbert proctor his escapement overcropped momentously. Domenic usually crisscrosses palmately?adumbratively or molder flabbily when quintan Galen elegises untidily and incognito. Gamaliel decolonises The time and violent husband was a man, or any indian language used to be held responsible for statutory warning before in movies Bollywood- our adorable Hindi Film former- is always hounded by unforeseen. He did up the Hindustan Cinema FilmsNasikthe 1st purely indigenous. If a comment is not efficient at redemption in his wife, which would have done or commerce in. Few years ago for statutory warning before movies in hindi screen is a necessary to exercise caution wherever you? Angoor is not. Carried the warning TOBACCO IS INJURIOUS TO waive in Hindi and English. But how beautiful of us really tough the statutory warning on opening movie screens. Short title and airtel. There are all the films have a safe to the health and lung cancer de garganta, there are paying full fare again need to you? May 15 2020 Warning The songs on your ultimate '0s playlist are could be. The overtly masculine amjad khan says the united states ban because instead of information overdrive in three phases of warning before in movies with warnings across the current censor board. We as upcoming movies and TV shows in the peel of previews trailers. India and brand pack. Agneepath 2012 IMDb. As alia bhatt and author in serious injury to bend, before filing a statutory warning before movies in hindi cinema reflects life that demanded that all types and humour. -

Eros International

Result Update June 2, 2016 Rating matrix Rating : Hold Eros International (EROINT) | 206 Target : | 225 Target Period : 12 months Improving clarity on transfer pricing… Potential Upside : 9% • Revenues were expected to be subdued in the quarter as it had no What’s changed? big budget movie release. During the quarter, there were six medium Target Changed from 164 to | 225 and six low budget movies, respectively. Hence, revenues came in at EPS FY17E Changed from | 23.8 to | 25.2 | 269.9 crore, down 39.9% YoY and 19.5% QoQ EPS FY18E Introduced at | 28.2 • EBITDA came in at | 32.1 crore vs. our expectation of | 37.9 crore Rating Unchanged while margins came in at 11.9% (estimated 14.9%). Margins came in Quarterly performance lower than estimated owing to higher-than-expected operating Q4FY16 Q4FY15 YoY (%) Q3FY16 QoQ (%) expenses, which came in at | 208.3 crore vs. estimate of | 199 crore Revenue 269.9 449.1 -39.9 335.4 -19.5 • PAT came in at | 32.7 crore, higher than our estimate of | 21.9 crore. EBITDA 32.1 68.2 (52.9) 66.8 -52.0 The beat was due to tax credit of | 5 crore EBITDA (%) 11.9 15.2 -329 bps 19.9 -803 bps Leading producer/distributor with one of the largest film libraries PAT 32.7 51.7 (36.8) 37.8 -13.4 Eros, a producer/distributor, has a large film library of over 2000 films. Key financials Also, it has launched Trinity Pictures to focus on franchise films. -

General Knowledge

Siddhartha Basu Preface Know for Sure—a series of eight general knowledge books for students of classes 1 to 8—has been a carefully and has earned the trust of many for providing detailed and accurate information on a wide range of subjects. between knowing more and being sure of what we learn is by getting to the primary source of facts or by cross- checking these with sound references. Know for Sure has been doing this since its beginning while continuously updating itself to keep pace with this age of information boom. This year, the series has been thoroughly revised Know for Sure is not just a bunch of questions and answers or just another bundle of facts which have to be answers. It is about going beyond a few select subjects that are taught in schools. It is also about becoming more aware of the world around us. Therefore, this series has been designed as an extension of the recommendations of National Curriculum Framework (NCF) 2005 and is aimed at bringing alive general knowledge in the classroom with quizzes, games, facts, surveys, word craft, activities, life skills, brain-teasers, lifestyles, stories, handicrafts, group discussions about value systems, and a whole lot more that can excite, engage, and educate a young mind. The perspective of the series—India and the World—is aimed at kindling an all-round interest in subjects both familiar and unknown. While systematically dealing with subjects and areas recommended for learning, these books not only make quizzing fun and fascinating but also encourage learners to discover more. -

KPMG FICCI 2013, 2014 and 2015 – TV 16

#shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 kpmg.com/in ficci-frames.com We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Images Courtesy: 9X Media Pvt.Ltd. Phoebus Media Accel Animation Studios Prime Focus Ltd. Adlabs Imagica Redchillies VFX Anibrain Reliance Mediaworks Ltd. Baweja Movies Shemaroo Bhasinsoft Shobiz Experential Communications Pvt.Ltd. Disney India Showcraft Productions DQ Limited Star India Pvt. Ltd. Eros International Plc. Teamwork-Arts Fox Star Studios Technicolour India Graphiti Multimedia Pvt.Ltd. Turner International India Ltd. Greengold Animation Pvt.Ltd UTV Motion Pictures KidZania Viacom 18 Media Pvt.Ltd. Madmax Wonderla Holidays Maya Digital Studios Yash Raj Films Multiscreen Media Pvt.Ltd. Zee Entertainmnet Enterprises Ltd. National Film Development Corporation of India with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars: FICCI-KPMG Indian Media and Entertainment Industry Report 2015 Foreword Making India the global entertainment superpower 2014 has been a turning point for the media and entertainment industry in India in many ways. -

Utf8 Encode('Mahesh Is Handsome 360 Degrees' - Telugu Movie News)

utf8_encode('Mahesh Is Handsome 360 Degrees' - Telugu Movie News) 'Mahesh Is Handsome 360 Degrees' - Telugu Movie News The movie has started setting the records ablaze right from the moment it was announced. For the best part of its production, it created the record for being the costliest film of Telugu industry. Then came the trade record when it was bought for a whopping sum of money by Eros for worldwide distribution, huge audio rights by Lahari music and offers for satellite telecast too. '1-Nenokakdine' marks the union of several big combinations for the first time. Mahesh - Sukumar, Mahesh - Devi Sri Prasad, Mahesh - Ratnavelu etc. Making their screen debuts are Gautham and the leading lady Kriti Sanon. While many a case the trade pundits are cautious about such first timers, in this case, they broke the shackles and bet their moneys big time on them. The audio was announced to be a first of its kind effort in which theaters across the state were connected LIVE too. And one fan each from Vizag Sangam Sarath theaters in Vizag, Asian theater from Warangal, Raj Theater in Kurnool, Annapurna theater in Vijayawada and Ashoka theater in Rajahmundry hosted the lunch of a song from the album on a LIVE feed from the theaters in a first of its kind effort. These are the fans that were selected by directors on ABN LIVE shows thru the past few days. Three fans from each of the venue were also given a chance to ask the hero Mahesh, Director Sukumar and the Music director Devi Sri Prasad a question and the fans across the state were treated with their answers which they themselves wanted to know from these guys. -

About Balaji Telefilms

Private and Confidential Unique, Distinctive, Disruptive Investor Presentation Unique, Distinctive, Disruptive Disclaimer Certain words and statements in this communication concerning Balaji Telefilms Limited (“the Company”) and its prospects, and other statements relating to the Company‟s expected financial position, business strategy, the future development of the Company‟s operations and the general economy in India & global markets, are forward looking statements. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the Company, or industry results, to differ materially from those expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company‟s present and future business strategies and the environment in which the Company will operate in the future. The important factors that could cause actual results, performance or achievements to differ materially from such forward-looking statements include, among others, changes in government policies or regulations of India and, in particular, changes relating to the administration of the Company‟s industry, and changes in general economic, business and credit conditions in India. The information contained in this presentation is only current as of its date and has not been independently verified. No express or implied representation or warranty is made as to, and no reliance should be placed on, the accuracy, fairness or completeness of the information presented or contained in this presentation. None of the Company or any of its affiliates, advisers or representatives accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in this presentation. -

Inox Leisure Limited Investor Presentation November 2013 Disclaimer

Inox Leisure Limited Investor Presentation November 2013 Disclaimer: This presentation includes forward-looking statements which deal with future events, including those relating to our general business plans and strategy, our future financial condition and growth prospects, and future developments in our sector and our competitive and regulatory environment. Forward-looking statements are identified by words such as atiipates, elieves, estiates, a, epets, plas, iteds, predits, or otiue and other similar expressions that indicate trends and future events. Forward looking statements are subject to risks, uncertainties and assumptions that could cause actual results, performances or events to differ materially from the results contemplated by the relevant forward looking statement. Factors that could cause the Company's results to differ materially from those expressed in forward-looking statements include, without limitation, non- availability of good quality content, new technologies, real estate costs increases, withdrawal of entertainment tax exemption, general business and economic conditions beyond the Company's control, the consequences of competitive factors in the marketplace, results of continuous improvement and other cost- containment strategies and the Company's success in attracting and retaining key personnel. The Company undertakes no obligation to revise or update forward-looking statements as a result of new information, since these statements may no longer be accurate or timely. 2 Indian Movie Exhibition Business . Organized retail growing at 25% to expand 10x in 10 years – o India is a large consumption market with over 270 mn households in 2020 Organized Retail o Only 5% of the $ 500 bn market is currently organized on Overdrive o Favorable regulatory environment – 51% FDI permitted in multi brand retail o Real Estate sector more organized – huge development in malls and commercial properties .Large Malls need anchor tenants – strong preference for Multiplexes Large Movie . -

Sounds of Madras USB Booklet

A R RAHMAN 16 Parandhu Sella Vaa 1 Saarattu Vandiyila O Kadhal Kanmani Kaatru Veliyidai 17 Manamaganin Sathiyam 2 Mental Manadhil Kochadaiiyaan O Kadhal Kanmani 18 Nallai Allai 3 Mersalaayitten Kaatru Veliyidai I 19 Innum Konjam Naeram 4 Sandi Kuthirai Maryan Kaaviyathalaivan 20 Moongil Thottam 5 Sonapareeya Kadal Maryan 21 Omana Penne 6 Elay Keechan Vinnaithaandi Varuvaayaa Kadal 22 Marudaani 7 Azhagiye Sakkarakatti Kaatru Veliyidai 23 Sonnalum 8 Ladio Kaadhal Virus I 24 Ae Maanpuru Mangaiyae 9 Kadal Raasa Naan Guru (Tamil) Maryan 25 Adiye 10 Kedakkari Kadal Raavanan 26 Naane Varugiraen 11 Anbil Avan O Kadhal Kanmani Vinnaithaandi Varuvaayaa 27 Ye Ye Enna Aachu 12 Chinnamma Chilakamma Kaadhal Virus Sakkarakatti 28 Kannukkul Kannai 13 Nanare Vinnaithaandi Varuvaayaa Guru (Tamil) 29 Veera 14 Aye Sinamika Raavanan O Kadhal Kanmani 30 Hosanna 15 Yaarumilla Vinnaithaandi Varuvaayaa Kaaviyathalaivan 31 Aaruyirae 45 Maanja Guru (Tamil) Maan Karate 32 Theera Ulaa 46 Hey O Kadhal Kanmani Vanakkam Chennai 33 Idhayam 47 Sirikkadhey Kochadaiiyaan Remo 34 Vinnaithaandi Varuvaayaa 48 Nee Paartha Vizhigal - The Touch of Love Vinnaithaandi Varuvaayaa 3 35 Usure pogudhey 49 Ailasa Ailasa Raavanan Vanakkam Chennai 36 Paarkaadhey Oru Madhiri 50 Boomi Enna Suthudhe Ambikapathy Ethir Neechal 37 Nenjae Yezhu 51 Oh Penne Maryan Vanakkam Chennai 52 Enakenna Yaarum Illaye ANIRUDH R Aakko 38 Oh Oh - The First Love of Tamizh 53 Tak Bak - The Tak Bak of Tamizh Thangamagan Thangamagan 39 Remo Nee Kadhalan 54 Osaka Osaka Remo Vanakkam Chennai 40 Don’u Don’u Don’u -

Automatically Generated PDF from Existing Images

Investor Presentation Q3 & 9M FY2015 Disclaimer Certain statements in this document may be forward-looking statements. Such forward- looking statements are subject to certain risks and uncertainties like government actions, local political or economic developments, technological risks, and many other factors that could cause its actual results to differ materially from those contemplated by the relevant forward-looking statements. Balaji Telefilms Limited (BTL) will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances. The content mentioned in the report are not to be used or re- produced anywhere without prior permission of BTL. 2 Table of Contents Financials 4 - 19 About Balaji Telefilms 20 - 21 Television 22 - 24 Motion Picture 25 - 29 3 Performance Overview – Q3 & 9M FY15 Financial & Operating Highlights Q3 & 9M FY15 (Standalone) Results for Q3 FY15 • Revenues stood at ` 57,27 lacs {` 37,80 lacs in Q3 FY14} • EBITDA is at ` 4,25 lacs {` 2,01 lacs in Q3 FY14} • Depreciation higher by ` 45,44 lacs due to revised schedule II • PAT is at ` 3,09 lacs {` 1,66 lacs in Q3 FY14} Contd…. 5 Financial & Operating Highlights Q3 & 9M FY15 (Standalone) Results for 9M FY15 • Revenues stood at ` 146,25 lacs {` 89,59 lacs in 9M FY14} • The Company has investments in Optically Convertible Debentures (OCD’s) in two Private Limited Companies aggregating ` 4,65.81 lacs. These investments are strategic and non-current (long-term) in nature. However, considering the current financial position of the respective investee companies, the Company, out of abundant caution, has, during the quarter provided for these investments considering the diminution in their respective values.