Emalahleni – Mpumalanga

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MPUMALANGA PROVINCE – 297 Cdws NKANGALA DISTRICT

MPUMALANGA PROVINCE – 297 CDWs NKANGALA DISTRICT Name & Surname Physical Address ID Numbers Contact Numbers Municipality 1. Mirriam Mbuli 693 Emthonjeni 6407170302088 0731969483 Emakhazeni MACHADODORP 2. Nonhlanhla Vivian P.O Box 1004 8207160765080 0736357262 Emakhazeni Shabangu EMAKHAZENI 3. Klara Mthombeni P.O. BOX 15 8209050295087 013-2467414 Emakhazeni WONDERFONTEIN 4. Simon Popoyi Mohlala P.O. BOX 194 BELFAST 7512285542087 0786090617 Emakhazeni 5. Philemon Nqabanisi P.O. BOX 687 BELFAST 8109175658088 0720231783 Emakhazeni Mabuza 6. Frans Mahlangu 6301055486084 0839991809 Emakhazeni 7. Yvonne Maredi 8006201124087 0762161706 Emakhazeni 8. Lungile Sibande 285 Emthonjeni 7709260474084 0825136338 Emakhazeni Machadodorp 1170 9. Sipho Prince Maseko Stand no:264 Mgwenya 7510235628085 0836880588 Emakhazeni Location WatervalBoven 10. Ntombizodwa Zwane 1626 Siyathuthuka Belfast 0735676763 Emakhazeni 1102 11. Evelyn Mahlangu 7708070300083 Emakhazeni 12. Thulisile Ellen Mabanga P.O. BOX 1195 DELMAS 8205240609088 0761907755 Delmas 13. Jan Zandile Mahlangu P.O. BOX 2938 DELMAS 7612285639089 0725624841 Delmas 14. Linah Nomathemba P.O. BOX 4867 DELMAS 6808160565081 0833621604 Delmas Mahlangu 15. Beki Shabalala P.O. BOX 2221 DELMAS 6007025474080 0827854905 Delmas 16. RankitsingJohannes 936 Deipark DELMAS 2210 7305065908085 0732679701 Delmas Sepenyane 17. Hendrietta Mabanga 249 Botleng Delmas 2210 8312150350081 0720634450 Delmas 18. Siponono Mahlangu Plot 14 Leeupoort Farm 7611060848089 0733837296 Delmas Delmas 2210 19. John Mabena 1062 Botleng Delmas 2210 6601135378080 0727728825 Delmas 20. Kgamelo Andrew Kgomo 17 Somerset Nasarethe 5301016791086 0843770203 Steve Tshwete MIDDELBURG 4066282802 21. Mandla Ellias Masango 678 MIDDELBURG 5701095753081 0729142819 Steve Tshwete 22. Josta Mpereke 2389 MIDDELBURG 5701015517087 0834446879 Steve Tshwete 23. Bhekumuzi Evans 3483 Melato Street 8309165421089 0835167888 Steve Tshwete Simelane MIDDELBURGt 24. Thulani Jeffrey Nkosi 3254 Ext 1 Mangosuthu 8208305352081 0737873361 Steve Tshwete MIDDELBURG 25. -

Emalahleni Municipality Final

TABLE OF CONTENTS ..................................................................................................................................................... ...................................................................................................................................................... PERSPECTIVE FROM THE EXECUTIVE MAYOR .................................................................. I PERSPECTIVE OF THE SPEAKER ......................................................................................... II PERSPECTIVE FROM THE MUNICIPAL MANAGER ........................................................... III LIST OF ABBREVIATIONS .............................................................................................................. IV 1 BACKGROUND ........................................................................................................................ 1 1.1 LOCATION ........................................................................................................................... 1 1.2 GUIDING PARAMETERS ........................................................................................................ 5 1.1.1 LEGISLATIVE BACKGROUND ................................................................................................................ 5 2 PROCESS PLAN ..................................................................................................................... 14 2.1.1 COMMUNITY PARTICIPATION MEETINGS .......................................................................................... -

Draft EIR and Empr and for Notification of the Decision Made by the Competent Authority Once Decision Has Been Made on the Application

Raubex Building (Pty) Limited Kriel Extension 23 Draft Environmental Impact Assessment Report (EIR) and Environmental Management Programme (EMPr) October 2015 Submitted as contemplated in Regulation 23 of the Environmental Impact Assessment Regulations, 2014 of the National Environmental Management Act, 1998 (Act No. 107 of 1998) For the application for Environmental Authorisation in terms of the National Environmental Management Act, 1998 (Act No. 107 of 1998), as amended, and the Environmental Impact Assessment Regulations 2014 Government Notice R983 - Listing Notice 1 of 2014 and Government Notice R984 - Listing Notice 2 of 2014 DARDLEA Reference No.: 1/3/1/16/1N-16 Draft EIR/EMPr: Raubex Building (Pty) Ltd – Proposed Kriel Extension 23 Page i Environmental Impact Assessment Report (EIR) and Environmental Management Programme (EMPr) Raubex Building (Pty) Limited: Kriel Extension 23 Township development DRAFT EIR/EMPr FOR THE PROPOSED KRIEL EXENSION 23 TOWNSHIP DEVELOPMENT (COPY FOR REVIEW BY INTERESTED AND AFFECTED PARTIES) October 2015 RAUBEX BUILDING (PTY) LIMITED COMPILED BY GEOVICON ENVIRONMENTAL (PTY) LIMITED Draft EIR/EMPr: Raubex Building (Pty) Ltd – Proposed Kriel Extension 23 Page i CONTENTS PAGE EXECUTIVE SUMMARY ...................................................................................................................................... 1 1 INTRODUCTION .................................................................................................................................... 4 1.1 Who is Developing the EIR -

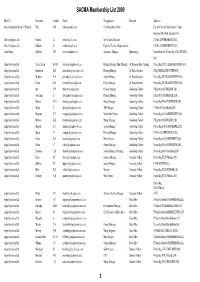

SACMA Membership List 2009

SACMA Membership List 2009 Mine/Co Surname Initials Email Designation Division Address African Exploration M and F C(Pty) Ltd Tlala M R [email protected] Chief Operations Officer 152 Ann Crescent Street, Block C, Upper Grayston Office Park, Sandton,2146 African Explosives Ltd Gumede X [email protected] Snr Technical Assistant P O Box 7249,BIRCHLEIGH,1621, African Explosives Ltd Slabbert S [email protected] Explosive Technical Representative P O Box 7249,BIRCHLEIGH,1621, Andru Mining Galloway H P [email protected] Operations Manager Mpumalanga Postnet Suite 157,Private Bag x7260,WITBANK, 1035 Anglo Operations Ltd Van de Steen B J M [email protected] Regional Manager: Mine Planning AC Divisional Mine Planning Private Bag X13173,LERAATSFONTEIN,1038, Anglo Operations Ltd Donaldson K R [email protected] Planning Manager AC Project Services P/Bag X9,LERAATSFONTEIN,1038, Anglo Operations Ltd McAdam P A [email protected] Section Manager AC Project Services Private Bag X9,LERAATSFONTEIN,1038, Anglo Operations Ltd Vertue M S [email protected] Project Manager AC Project Services Private Bag X9,LERAATSFONTEIN,1038, Anglo Operations Ltd Bye N P [email protected] Projects Manager Goedehoop Colliery P/Bag x410,VANDYKSDRIF,2245, Anglo Operations Ltd Froneman L [email protected] Planning Manager Goedehoop Colliery P/Bag X410,VANDYKSDRIF,2245, Anglo Operations Ltd Mabuza M L A [email protected] Mining Manager Goedehoop Colliery Private Bag X410,VANDYKSDRIF,2245, Anglo Operations Ltd Maepa J [email protected] -

Re Advert Security Tender

REQUEST FOR PROPOSAL TERMS OF REFERENCE FOR THE APPOINTMENT OF A SUITABLE SERVICE PROVIDER TO RENDER GUARDING SECURITY SERVICES FOR MPUMALANGA COMMUNITY EDUCATION AND TRAINING COLLEGE AT HEAD OFFICE IN SIYABUSWA AND AT KWAGUQA COMMUNITY LEARNING CENTRE (CLC) IN EMALAHLENI FOR A PERIOD OF 24 MONTHS RFP NUMBER: MPCETC003-2020 Date Issued: 05 February 2021 Closing date and time: 09 March 2021 at 11:00 Bid Validity Period: 21 days TENDER BOX ADDRESS: Nkangala TVET College – CN Mahlangu Campus Training Centre Road Siyabuswa 0472 CONTENT PART A - INFORMATION ON THE TENDER 1. Background 2. Purpose of this tender 3. Scope and definition of work 4. Deliverables 5. Appropriate qualifications, experience, skills and knowledge 6. Duration of contract PART B – LEGISLATIVE FRAMEWORK 5. Tax legislation 7. Procurement legislation 8. Technical legislation and/or standards PART C – THE BIDDING PROCESS 1. TIMELINE OF THE BID PROCESS 2. Compulsory briefing session 3. Contact and communication 4. Late bids 5. Counter conditions 6. Fronting 7. Supplier due diligence 8. Mandatory bid documents PART D – SUBMISSIONS 1. SUBMISSION OF PROPOSAL 6. Content of the technical submission 2. Financial submission 3. Evaluation Criteria PART E – CONDITIONS I. GENERAL CONDITIONS OF CONTRACT 4. Special conditions of contract 5. Governing law 6. Declaration 7. Conflict of interest, corruption and fraud 8. Misrepresentation 9. Preparation cost 10. Indemnity 11. Precedence 12. Limitation of liability 13. Tax compliance 14. Tender defaulters and restricted suppliers 15. Confidentiality 16. Proprietary information 17. Copyright 18. Responsibility of sub-contractors and bidders’ personnel 19. Service Level agreement 20. Pricing 21. Other important matters to note PART F – MONITORING AND REPORTING I. -

Provincial Gazette Provinsiale Koerant

THE PROVINCE OF MPUMALANGA DIE PROVINSIE MPUMALANGA Provincial Gazette Provinsiale Koerant (Registered as a newspaper) • (As ’n nuusblad geregistreer) NELSPRUIT Vol. 25 20 JULY 2018 No. 2950 20 JULIE 2018 ISSN 1682-4518 N.B. The Government Printing Works will 02950 not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes 9 771682 451008 2 No. 2950 PROVINCIAL GAZETTE, 20 JULY 2018 IMPORTANT NOTICE: THE GOVERNMENT PRINTING WORKS WILL NOT BE HELD RESPONSIBLE FOR ANY ERRORS THAT MIGHT OCCUR DUE TO THE SUBMISSION OF INCOMPLETE / INCORRECT / ILLEGIBLE COPY. NO FUTURE QUERIES WILL BE HANDLED IN CONNECTION WITH THE ABOVE. CONTENTS Gazette Page No. No. PROCLAMATION • PROKLAMASIE 30 Town-planning and Townships Ordinance (15/1986): Rezoning of Erf 1829, eMalahleni (was Witbank) Extension 8 ......................................................................................................................................................... 2950 11 PROVINCIAL NOTICES • PROVINSIALE KENNISGEWINGS 103 Mpumalanga Gambling Act (5/1995), as amended: Application for site operator licence: Mpumalanga Economic Regulator (MER) for operators licence .............................................................................................. 2950 12 104 National Environmental Management Act (107/1998): Tshedza Mining Resources (Pty) Ltd (a subsidiary of Mbuyelo Coal (Pty) Ltd) ..................................................................................................................................... -

South Africa's Coalfields – a 2014 Perspective

South Africa's coalfields – a 2014 perspective 1Hancox, P. John and 2,3Götz, Annette E. 1University of the Witwatersrand, School of Geosciences, Private Bag 3, 2050 Wits, South Africa; [email protected] 2University of Pretoria, Department of Geology, Private Bag X20, Hatfield, 0028 Pretoria, South Africa; [email protected] 3Kazan Federal University, 18 Kremlyovskaya St., Kazan 420008, Republic of Tatarstan, Russian Federation Highlights • South Africa’s Coalfields are presented. • The role of Gondwanan coals as palaeoclimate archives is stated. • Future research fields include palynology, sequence stratigraphy, basin fill. Abstract For well over a century and a half coal has played a vital role in South Africa’s economy and currently bituminous coal is the primary energy source for domestic electricity generation, as well as being the feedstock for the production of a substantial percentage of the country’s liquid fuels. It furthermore provides a considerable source of foreign revenue from exports. Based on geographic considerations, and variations in the sedimentation, origin, formation, distribution and quality of the coals, 19 coalfields are generally recognised in South Africa. This paper provides an updated review of their exploration and exploitation histories, general geology, and coal seam nomenclature and coal qualities. Within the various coalfields autocyclic variability is the norm rather than the exception, whereas allocyclic variability is much less so, and allows for the correlation of genetically related sequences. During the mid-Jurassic break up of Gondwana most of the coals bearing successions were intruded by dolerite. These intrusions are important as they may cause devolatilisation and burning of the coal, create structural disturbances and related seam correlation problems, and difficulties in mining operations. -

NKANGALA District Municipality Dr JS Moroka Nkangala Dr JS Moroka District Municipality

NKANGALA District Municipality Dr JS Moroka Nkangala Dr JS Moroka District Municipality Thembisile Thembisile Emakhazeni Emakhazeni Steve Tshwete Steve Tshwete Emalahleni Emalahleni Victor Khanye Victor Khanye 2012 Strategic Lekgotla Air Quality Lekgotla 2017Social Services Presenter: Mahlangu VMTshabalala EK 02 October 2017 TABLE OF CONTENT 1) Overview of Nkangala District Municipality 2) Overview of the declaration of the Highveld HPA 3) Overview of the HPA Structures (ITT, Authorities Meetings & MSRG) and their roles and responsibilities; 4) NDM Air Quality Management Plan (AQMP) 5) Processes in terms of the development of Annual Implementation Plans; 6) NDM Air Quality Management Capacity 7) Implementation (AEL Application Processing, Awareness Campaigns, Compliance Monitoring, Emissions Reduction Plans, SA Atmospheric Emissions Licensing & Inventory Portal (SAAELIP) Activities, 8) Other Emerging Environmental Issues 9) Lessons learned & challenges Overview of Nkangala District Municipality The Nkangala District Municipality (DC31) is one of the three (3) District Municipalities in Mpumalanga Province. The headquarters of Nkangala District Municipality are in Middelburg (Steve Tshwete Local Municipality). The District is composed of six (6) Local Municipalities: namely; Victor Khanye Local Municipality (MP 311), Emalahleni Local Municipality (MP 312) Steve Tshwete Local Municipality (MP 313), Emakhazeni Local Municipality (MP 314), Thembisile Hani Local Municipality (MP 315) and Dr J S Moroka Local Municipality (MP 316) (see figure 7). The area of the District covers a total area of approximately 16,892 square kilometres with a population of 1 308 129 constituting approximately 32.38% of Mpumalanga’s population. Nkangala District Municipality is regarded to have a high eco-tourism potential, which requires the protection, rehabilitation and enhancement of its attractive natural resources. -

Draft Idp 2021/22

TABLE OF CONTENTS ..................................................................................................................................................... ...................................................................................................................................................... PERSPECTIVE FROM THE EXECUTIVE MAYOR .................................................................. I PERSPECTIVE OF THE SPEAKER ......................................................................................... II PERSPECTIVE FROM THE MUNICIPAL MANAGER ........................................................... III LIST OF ABBREVIATIONS .............................................................................................................. IV 1 BACKGROUND ........................................................................................................................ 1 1.1 LOCATION ........................................................................................................................... 1 1.2 GUIDING PARAMETERS ........................................................................................................ 5 1.1.1 LEGISLATIVE BACKGROUND ................................................................................................................ 5 2 PROCESS PLAN ..................................................................................................................... 15 2.1.1 COMMUNITY PARTICIPATION MEETINGS .......................................................................................... -

COSMO Overview V3

COSMO/CORMO a resource allocation tool for the coal line in Transnet Freight Rail March 2009 EXPORT COAL LOADING SITES NORTH OF ERMELO TO MAPUTO TO STEELPOORT MACHADODORP BELFAST EXPORT LOADING SITES SOUTH OF ERMELO TO ROOSENEKAL DERWENT PANBULT, HLOBANE, BALLENGEICH, PAN SUNBURY TALANA, ENQOLOTHI MIDDELBURG ARNOT DALMANUTHA OLIFANTSRIVIER UITKYK WONDERFONTEIN HILLSIDE WITBANK N OOSBANK E UMCEBO TO PRETORIA MAFUBE E EBOOM LANDAU K WOESTALLE EI BLACKHILL MOEDIG AN RIETKUIL (SUMO) GREENSIDP ER MINNAAR AT OPTIMUM ARBOR W RIF MIDDELBURG D BANK KLIPSPRUIT AS BOSCHMANS L KOORNFONT CAROLINA FROM LEPHALALE OGIES BSX PULLENSHOPE KENDAL KROMKLIPDOUG (GROOTEGELUK) ARGENT SAAIWATER VANDYKS DROOGVALLEI BLINKPAN GOEDGEVONDEN GELUKSPLAAS GOEDEHOOP WITRAND DELMAS NEWCLYDESDALE LEEUWPAN ATC PHOENIX WITCONS TAVISTOCK SOUTH WTB SOUTH LONGVIEW HAWERKLIP HALFGEWONNEN RIETSPRUIT FORZANDO CARLCHEW (1.3) OBAN EENDRAG BREYTEN ESTANCIA KELTY KINROSS KLIPSTAPEL LEVEN WEBSRUS VOORSLAG LEGEND BETHAL Rail network DAVEL HAMELFONTEIN To Lothair TRICHARDT KIPPEN Road network GOLFVIEW BUHRMANSKOP RIETVLEIRUS Export loading sites (private) Export loading sites (future) TWISTDRAAI ERMELO To Amersfoort Export loading sites (leased) MASHALA Small wagon loaders TO RICHARDS BAY 2 A PIENAAR 10 AUGUST '06 Transnet Freight Rail Diagrammatic map Oos-bank Graspan / Black Wattle Goedehoop RBCT: OB RBCT: UTK RBCT: GH Sprint: WIR Sprint: UIK Sprint: BIK Glisa Siding: 844896 Siding: 800201 Siding: 754986 RBCT: BEL Sprint: BFZ Boord Springbok RBCT: SBK Siding: 849448 Sprint: BFI Greenside -

(013) 7955241 6066895 Mpumalanga Aerorand Mi

PRACTICE PROVINCE PHYSICAL SUBURB PHYSICAL TOWN PHYSICAL ADDRESS PHARMACY NAME CONTACT NUMBER NUMBER MPUMALANGA ACORNHOEK ACORNHOEK CORNER MAIN ROAD AND OU ACORNHOEK PHARMACY (013) 7955241 6066895 ORPEN WEG MPUMALANGA AERORAND MIDDELBURG CORNER KEISKAMMEA AND CLICKS PHARMACY MIDWATER (013) 2442604 240680 ORANGE STREETS CENTRE MPUMALANGA BALFOUR BALFOUR 12 JOHNNY MOKOENA DRIVE GREYLINGSTAD PHARMACY (017) 7731364 284297 MPUMALANGA BALFOUR BALFOUR 18 JOHN MUKWENA STREET HOEVELD APTEEK (017) 7730019 6012221 MPUMALANGA BARBERTON BARBERTON CORNER GENERAL AND HILLARY CLICKS PHARMACY BARBERTON (013) 7123402 600830 STREETS MPUMALANGA BARBERTON BARBERTON 86 CROWN STREET M.G. EKSTEEN PHARMACY (013) 7122181 6012272 MPUMALANGA BELFAST BELFAST 23 FITZGERALD STREET VAN BILJON PHARMACY (013) 2531241 6012329 MPUMALANGA BETHAL BETHAL 44A CHRIS HANI STREET KARK APTEEK (017) 6475851 6012647 MPUMALANGA BUSHBUCKRIDGE BUSHBUCKRIDGE MAIN ROAD BOSBOKRAND PHARMACY (013) 7990143 6045693 MPUMALANGA CAROLINA CAROLINA 28 VOORTREKKER STREET DU PREEZ PHARMACY (017) 8431115 6029779 MPUMALANGA CLUBVILLE MIDDELBURG 26 DE VILLIERS STREET CLUBVILLE PHARMACY (013) 2825453 6064159 MPUMALANGA DELMAS DELMAS 32 SAREL CILLIERS STREET C.J. WILLIAMS PHARMACY (013) 6652281 6013384 MPUMALANGA DELMAS DELMAS CORNER SAMUEL ROAD AND CLICKS PHARMACY DELMAS (013) 6652413 367443 VAN DER WALT STREET MPUMALANGA DELMAS DELMAS 31B SAREL CILLIERS STREET LINK PHARMACY - DELMAS (013) 6652091 6013368 GEMS REO NETWORK PHARMACY – MPUMALANGA Page 1 of 9 PRACTICE PROVINCE PHYSICAL SUBURB PHYSICAL TOWN -

Gert Sibande District

SEPTEMBER 2018 OPEN VACANCY LIST: PROMOTIONAL EDUCATOR - AND SUPPORT POSTS IN SCHOOLS Note: Principal posts - All enquiries should be referred to the relevant Circuit Manager as indicated. GERT SIBANDE DISTRICT AMSTERDAM CIRCUIT DRIEPAN PRIMARY SCHOOL (200405) ISIZULU / ENGLISH MEDIUM ISWEPE AREA AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62032-0001 DEPARTMENTAL HEAD: FOUNDATION PHASE SUBJECTS (1) LAERSKOOL AMSTERDAM (200413) AFRIKAANS / ENGLISH MEDIUM AMSTERDAM AREA, TEL: 0178469323 AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62064-0002 PRINCIPAL P2: MANAGEMENT AND ADMINISTRATION (1) SIYEZA PRIMARY SCHOOL (200423) ISIZULU / ENGLISH MEDIUM ISWEPE AREA AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 70106-0003 ADMIN CLERK (1) SWELIHLE PRIMARY SCHOOL (200425) ISIZULU / ENGLISH MEDIUM SHEEPMOOR AREA AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62064-0004 PRINCIPAL P2: MANAGEMENT AND ADMINISTRATION (1) POST REF: 70106-0005 ADMIN CLERK (1) UMLAMBO PRIMARY SCHOOL (200429) ISIZULU / ENGLISH MEDIUM AMSTERDAM AREA AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62032-0006 DEPARTMENTAL HEAD: FOUNDATION PHASE SUBJECTS (1) BUHLEBUYEZA PRIMARY SCHOOL (200442) ISIZULU / ENGLISH MEDIUM AMSTERDAM AREA AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62032-0007 DEPARTMENTAL HEAD: FOUNDATION PHASE SUBJECTS (1) NGANANA SECONDARY SCHOOL (200435) ENGLISH MEDIUM AMSTERDAM AREA, TEL: 0178469506 AMSTERDAM CIRCUIT, TEL: 017 801 5291/93/95 POST(S): POST REF: 62124-0008