State of the Art Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

T Want There to Be Anything Mysterious About the Way That I Work,' She Says

NG BR text pp1-78 270x230mm v8_AJ / text / pp1-64 / 5 21/10/2010 16:23 Page 14 NG BR text pp1-78 270x230mm v8_AJ / text / pp1-64 / 5 21/10/2010 16:23 Page 15 Fig. 7 Bridget Riley Red with Red 1, 2007 Oil on linen, 177.5 ¥ 255 cm Private collection Fig. 8 Raphael (1483–1520) Saint Catherine of Alexandria, about 1507 (detail) Oil on poplar, 72.2 ¥ 55.7 cm The National Gallery, London (ng 168) and she is happy for them to be seen. ‘I don’t want there to be anything mysterious about the way that I work,’ she says. ‘I mean there is doubt and uncertainty, and the very act of enquiry means that things go wrong and have to be changed and revised. But to me this is part of the pleasure of working.’4 These are just three of the many surviving studies that Seurat used to gather the visual information with which he built his final composition. One study selected by Riley, A River Bank (The Seine at Asnières), about 1883 (plate 20), establishes the location, where he pins down the diagonal division between water and river bank. Seurat makes special use of the striped tidal-measuring post, which helps to carefully balance the compositional components of horizontal, diagonal and vertical. In Study for ‘Bathers at Asnières’, 1883–4 (plate 19), he makes notations of some of the figures that will eventually relate to this location. Lastly, in The Rainbow: Study for ‘Bathers at Asnières’, 1883 (plate 21), he begins to integrate the figures into the space. -

Bridget Riley's Paintings Continue to Mesmerize, Six Decades On

Galerie Max Hetzler Berlin | Paris | London Artsy Cohen, Alina: Bridget Riley‘s Paintings Continue to Mesmerize, Six Decades On November 2019 Bridget Riley’s Paintings Continue to Mesmerize, Six Decades On Alina Cohen Nov 1, 2019 11:47am Bridget Riley, 1963. Photo by Ida Kar. © National Portrait Gallery, Bridget Riley Blue Dominance, 1977 London. ARCHEUS/POST- MODERN British artist Bridget Riley, who is known for bold, blocky, and striped canvases of brilliant hues and contrasts, got her Drst taste of international celebrity back in 1965. Curator William Seitz included two of her paintings, Current (1964) and Hesitate (1964), in his groundbreaking exhibition at the Museum of Modern Art, titled “The Responsive Eye.” The eye-popping black-and-white squiggles of Riley’s Current adorned the catalogue cover, asserting Riley’s prominent position within the show. The exhibition situated her among an impressive roster of global artists whose artwork reconsidered ideas about perception. The group included American painters ranging from Morris Louis to Agnes Martin, along with Brazilian artist Almir da Silva Mavignier and a Spanish collective called Equipo 57. Along with Mavignier, Riley was considered part of a new wave of “Op artists” who exploited visual principles to make work that seemed to vibrate with new energy. Josef Albers, Salvador Dalí, and the museum-going public all swooned at Riley’s work. maxhetzler.com Galerie Max Hetzler Berlin | Paris | London While Op art has gone in and out of style, Riley herself is still working and is beloved on both sides of the pond. London’s Hayward Gallery is displaying a major Riley retrospective through January 26th, celebrating over six decades of the artist’s bold geometric abstratractions. -

The Jackson Pollock Approach to Reading the Bible

The Jackson Pollock Approach to Reading the Bible I am not a fan of most modern or abstract art, but Nope, nope, and nope. What matters is what the there's something about the art of Jackson Pollock I author intended. Language ultimately has no find intriguing. Pollock was a key figure in what is meaning if we define the words in whatever way called Abstract Expressionism. It doesn't look like suits us. That is as irresponsible as the young man Pollock did anything but randomly drip paint on a on a date who says to a woman, "You say 'no,' but I canvas—which is exactly what he did. think you mean 'yes.'" Go ahead and admit it: you look at this painting and We must practice good hermeneutics—how we it reminds you of something your kid drew on his interpret the text. For example: bedroom wall when he was three. You may wish you still had that Keep in mind the type of literature it is. section of his Narrative, prophecy, poetry, and teaching passages bedroom wall, use different styles and structures. When we read because this Psalm 91 as poetry, we don't take verse 4—"He will particular Pollock cover you with his feathers; you will take refuge painting, called under his wings."—to mean God is a giant chicken. Number 17a, sold in 2015 for $200 Read a verse in light of the whole passage. My million. most popular post addresses how Philippians 4:13— "I am able to do all things through him who I can't tell what the painting means or signifies. -

FOR DE KOONING, PAINTING HAS BEEN ‘A WAY of LIVING' by Bennett Schiff, Smithsonian, April 1994

FOR DE KOONING, PAINTING HAS BEEN ‘A WAY OF LIVING' By Bennett Schiff, Smithsonian, April 1994 Arriving in America as a stowaway in the 1920s, the young Dutch artist threw himself into the pure, raw joy of brush on canvas The initial encounter with America of Willem de Kooning-a stowaway fresh off a ship in a strange land-was an instant love affair. As he and the country celebrate his 90th birthday this month, the mutual admiration has lasted for six decades. During that long time, in which this country saw the birth of the first major, independent, plastic art form in its history, de Kooning, who was there at the beginning-who helped to make the beginning-emerged as the closest thing we have to a Living National Treasure. The new art form was, and still is, most commonly known as Abstract Expressionism, but that label doesn't begin to describe all of it. It has also been Willem de Kooning—here, in his studio called Action Painting, which takes in only a part of it, and the New York School, in the 1960s—turns 90 this month. which is perhaps the best description because it embraces the wide variety of its styles, some of them distinctly opposite to one another. Because of its force, vitality and originality, the new painting can be likened to another indigenous American art form-jazz. If one could objectify visually, for example, a Ben Webster or Lester Young or Charlie Parker solo, one might, very reasonably, come up with a de Kooning canvas or, on an opposite visual scale to de Kooning, one by Mark Rothko, also a founding member of the New York School. -

52 Brook's Mews. Mayfair, W1K 4ED T: 02074953101 E: [email protected]

Press Release Not So Original: Carlos Cruz-Diez, León Ferrari, Terry Frost, Cipriano Martinez, Bridget Riley, Jesus Soto and Emilia Sunyer 8th November – 25th January 2014 This November Maddox Arts will be staging ‘Not So Original’ an exhibition that delves into the symbiotic relationship between the print and the original. Though printmaking is often assumed to be an afterthought in an artist’s practice ‘Not So Original’ demonstrates the variety of roles it may play, spurring the artist’s imagination and engaging in a dialogue with their primary practices. Taking Walter Benjamin’s seminal ‘The Work of Art in the Age of Mechanical Reproduction’ as it's starting point, ‘Not So Original’ features the work of five, celebrated 20th century printmakers: Bridget Riley, Carlos Cruz-Diaz, Leon Ferrari, Terry Frost and Jesus Soto, alongside the emerging talents of Cipriano Martinez and Emilia Sunyer. From the Middle Ages to the advent of the digital era, technology has allowed artists to disseminate their images in the form of reproductions to a wider audience than a single canvas would ever be able to reach. In facing the prospect of engaging a wider audience artists are often compelled to formalize their style so that a singular print may surmise an artist’s catalogue. Likewise such technologies have enabled art lovers to acquire a ‘piece’ of an original via a process in which the artist may have had no hand. The rise of e-editions and 3D printing ask further questions as to how we distinguish the original from the reproduction, when an infinite number of copies can be instantly and flawlessly reproduced indefinitely. -

Viewership and How These Binaries Function and Appear Within Abstract Painting

Contextualizing Epiphanies and Theories on a Surface of a Painting THESIS Presented in Partial Fulfillment of the Requirements for the Degree Master of Fine Arts in the Graduate School of The Ohio State University By Maija Helena Miettinen-Harris Graduate Program in Art The Ohio State University 2015 Master’s Examination Committee: Laura Lisbon, Advisor George Rush Amanda Gluibizzi Copyright by Maija Helena Miettinen-Harris 2015 Abstract In this thesis I intend to explore the complex, confusing and often paradoxical nature of my painting practice and the way I see it being influenced by historical, socio-political and ideological underpinnings of my reality. During the course of my thesis, I hope to establish a conceptual and contextual basis for my usage of allover pattern-like configurations, rejection of linear perspective, and the manipulation of competing forms and colors in my abstract paintings. I will focus on to the often-elliptical nature of my paintings through variety of ideas and theories and I hope to demonstrate how cultural theory has helped me to contextualize the essential features of my practice. I will first map out the mostly intuitive epiphanies that are rooted in the observations of my reality, which in turn informs the constructions and orientations of my paintings. I will study these in relation to the notions of artist Bridget Riley. I find her writing especially useful in terms of articulating the dichotomy and paradox between active and passive viewership and how these binaries function and appear within abstract painting. I will then examine the circular and expanding theory of liminality by cultural anthropologist Victor Turner, and centers and margins as well as cultural dirt by anthropologist Mary Douglas. -

Bridget Riley Born 1931 in London

This document was updated March 3, 2021. For reference only and not for purposes of publication. For more information, please contact the gallery. Bridget Riley Born 1931 in London. Live and works in London. EDUCATION 1949-1952 Goldsmiths College, University of London 1952-1956 Royal College of Art, London SOLO EXHIBITIONS 1962 Bridget Riley, Gallery One, London, April–May 1963 Bridget Riley, Gallery One, London, September 9–28 Bridget Riley, University Art Gallery, Nottingham 1965 Bridget Riley, Richard Feigen Gallery, New York Bridget Riley, Feigen/Palmer Gallery, Los Angeles 1966 Bridget Riley, Preparatory Drawings and Studies, Robert Fraser Gallery, London, June 8–July 9 Bridget Riley: Drawings, Richard Feigen Gallery, New York 1967 Bridget Riley: Drawings, The Museum of Modern Art (Department of Circulating Exhibitions, USA): Wilmington College, Wilmington, February 12–March 5; and Talladega College, Talladega, March 24–April 16 Bridget Riley, Robert Fraser Gallery, London Bridget Riley, Richard Feigen Gallery, New York 1968 Bridget Riley, Richard Feigen Gallery, New York British Pavilion (with Phillip King), XXXIV Venice Biennale, 1968; Städtische Kunstgalerie, Bochum, November 23–December 30, 1968; and Museum Boijmans Van Beuningen, Rotterdam, 1969 1969 Bridget Riley, Rowan Gallery, London Bridget Riley: Drawings, Bear Lane Gallery, Oxford [itinerary: Arnolfini Gallery, Bristol; Midland Group Gallery, Nottingham] 1970 Bridget Riley: Prints, Kunststudio, Westfalen-Blatt, Bielefeld Bridget Riley: Paintings and Drawings 1951–71, Arts -

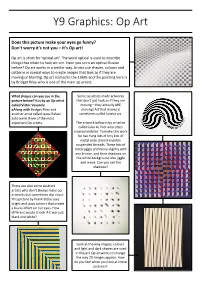

Y9 Graphics: Op Art

Y9 Graphics: Op Art Does this picture make your eyes go funny? Don't worry it's not you – it's Op art! Op art is short for 'optical art'. The word optical is used to describe things that relate to how we see. Have you seen an optical Illusion before? Op art works in a similar way. Artists use shapes, colours and patterns in special ways to create images that look as if they are moving or blurring. Op art started in the 1960s and the painting here is by Bridget Riley who is one of the main op artists. What shapes can you see in the Some op artists made artworks picture below? It is by an Op artist that don't just look as if they are called Victor Vasarely. moving – they actually ARE aAlong with Bridget Riley and moving! Art that moves is another artist called Jesus Rafael sometimes called kinetic art. Soto were three of the most important Op artists. The artwork below is by an artist called Julio Le Parc who often created mobiles. To make this work he has hung lots of tiny bits of metal onto almost invisible suspended threads. These bits of metal jiggle and move slightly with any breeze, and their shadows on the white background also jiggle and move. Can you see the shadows? There are also some abstract artists who don't always make op artworks but sometimes slip into it. This picture by Frank Stella uses bright and jazzy colours that create a buzzy effect on our eyes. -

The Brain's Masterpiece Equation: How Symmetry

THE BRAIN’S MASTERPIECE EQUATION: HOW SYMMETRY REFLECTS A HIDDEN DIMENSION OF AESTHETIC PERCEPTION Rachel A. Diebner Plan II Honors Program The University of Texas at Austin May 1, 2018 ______________________________________ Chiu-Mi Lai, Ph.D. Department of Asian Studies Supervisor ______________________________________ Michael Starbird, Ph.D. Department of Mathematics Second Reader Copyright © 2018 by Rachel Diebner All Rights Reserved Abstract Author: Rachel Diebner Title: The Brain’s Masterpiece Equation: How Symmetry Reflects a Hidden Dimension of Aesthetic Perception Supervisor: Dr. Chiu-Mi Lai Second Reader: Dr. Michael Starbird What is the secret behind an artistic masterpiece? Symmetry is part of the answer. Uniting mathematics, the arts, and psychology, my interdisciplinary study argues that: (1) Aesthetic appeal is founded upon both individual subjective preferences and shared cognitive preferences; and (2) These shared cognitive preferences are informed in part by mathematical principles, specifically by symmetry. Symmetry in modern artworks elicits positive neurobiological responses in observers. The works of Jackson Pollock and Taylor Swift serve as case studies of these common neurobiological responses to visual and auditory symmetry. In-depth analysis of these two case studies establishes the existence of a new dimension of aesthetic appeal: a shared baseline of aesthetic value rooted in principles of human cognition. This shared understanding of aesthetic appeal has valuable and far-reaching implications, both for art -

Abstract Expressionism Annenberg Courtyard: David Smith 1

Large Print Abstract Expressionism Annenberg Courtyard: David Smith 1. Introduction and Early Work Do not remove from gallery Audio tour Main commentary Descriptive commentary 1 Jackson Pollock, ‘Male and Female’ 1 Abstract Expressionism Main Galleries: 24 September 2016 – 2 January 2017 Contents Page 4 Annenberg Courtyard: David Smith Page 6 List of works Page 9 1. Introduction and Early Work Page 12 List of works ExhibitionLead Sponsor Lead Sponsor Supported by The production of RA large print guides is generously supported by Robin Hambro 2 Burlington House 1 2 4 3 You are in the Annenberg Courtyard 3 Annenberg Courtyard Abstract Expressionism David Smith b. 1906, Decatur, IN – d. 1965, South Shaftsbury, VT As the key first-generation Abstract Expressionist sculptor, David Smith created an output that spanned a great range of themes and effects. The works here represent four of the climactic series that Smith produced from 1956 until his untimely death in 1965. They encompass rising forms that evoke the human presence (albeit in abstract terms) and others in which a more stern character, by turns mechanistic or architectonic, prevails. 4 The Courtyard display seeks to recreate the spirit of Smith’s installations in his fields at Bolton Landing in upstate New York. There, not only did each sculpture enter into a silent dialogue with others, but they also responded to the space and sky around them. Thus, for example, the dazzling stainless-steel surfaces of the ‘Cubi’ answer to the brooding, inward darkness of ‘Zig III’. Often, Smith’s imagery and ideas parallel concerns seen throughout Abstract Expressionism in general. -

The Responsive Eye by William C

The responsive eye By William C. Seitz. The Museum of Modern Art, New York, in collaboration with the City Art Museum of St. Louis [and others Author Museum of Modern Art (New York, N.Y.) Date 1965 Publisher [publisher not identified] Exhibition URL www.moma.org/calendar/exhibitions/2914 The Museum of Modern Art's exhibition history— from our founding in 1929 to the present—is available online. It includes exhibition catalogues, primary documents, installation views, and an index of participating artists. MoMA © 2017 The Museum of Modern Art MoMA 757 c.2 r//////////i LIBRARY Museumof ModernArt ARCHIVE wHgeugft. TheResponsive Eye BY WILLIAM C. SEITZ THE MUSEUM OF MODERN ART, NEW YORK IN COLLABORATION WITH THE CITY ART MUSEUM OF ST. LOUIS, THE CONTEMPORARY ART COUNCIL OF THE SEATTLE ART MUSEUM, THE PASADENA ART MUSEUM AND THE BALTIMORE MUSEUM OF ART /4/t z /w^- V TRUSTEES OF THE MUSEUM OF MODERN ART David Rockefeller, Chairman of the Board; Henry Allen Moe, Vice-Chairman;William S. Paley, Vice-Chairman; Mrs. Bliss Parkinson, Vice-Chairman;William A. M. Burden, President; James Thrall Soby, Vice-President;Ralph F. Colin, Vice-President;Gardner Cowles, Vice-President;Wa l ter Bareiss, Alfred H. Barr, Jr., *Mrs. Robert Woods Bliss, Willard C. Butcher, *Mrs. W. Murray Crane, John de Menil, Rene d'Harnoncourt, Mrs. C. Douglas Dillon, Mrs. Edsel B. Ford, *Mrs. Simon Guggenheim, Wallace K. Harrison, Mrs. Walter Hochschild, "James W. Husted, Philip Johnson, Mrs. Albert D. Lasker,John L. Loeb, Ranald H. Macdonald, Porter A. McCray, *Mrs. G. Macculloch Miller, Mrs. Charles S. -

The Jeremy Lancaster Collection to Highlight Christie’S Frieze Week

PRESS RELEASE | LONDON FOR IMMEDIATE RELEASE: 29 JULY 2 0 1 9 THE JEREMY LANCASTER COLLECTION TO HIGHLIGHT CHRISTIE’S FRIEZE WEEK DEDICATED EVENING AUCTION ON 1 OCTOBER 2019 Philip Guston, Language I, 1973, estimate: £1,500,000-2,000,000 London – Christie’s Frieze Week programme will be launched with a dedicated auction of the remarkable private collection of Jeremy Lancaster on 1 October 2019. A chorus of vivid colour, radical form and brilliant innovation, the collection showcases some of the greatest achievements in post-war British painting, complemented by a stellar selection of European and American works. Many of the works were acquired through the gallery of Leslie Waddington, and a number have passed through notable collections such as Herbert Read, E. J. Power and Charles Saatchi. Such distinguished provenance is testament not only to a shared championship of the post-war British art scene, but also to the exchange with the European and American avant-gardes in which Waddington and his clients played such a vital role. Several of the works have been on long-term loan to museum collections and Jeremy Lancaster was a trustee at Birmingham’s Ikon Gallery of contemporary art and the Barber Institute of Fine Arts. A frequent traveller with a keen appetite for art and knowledge, Jeremy Lancaster was in part influenced by the seminal exhibition ‘A New Spirit in Painting’. Undoubtedly a profound moment in the landscape of contemporary art it was staged by London’s Royal Academy of Arts in 1981. The direction of his collecting taste follows a similar dedication to transatlantic discourse in paintings from Frank Auerbach and Howard Hodgkin to Philip Guston, Robert Ryman and Josef Albers.