Business Banking Online Credit Direct Entry (DE) User Application / / BBO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

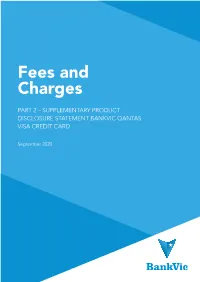

Fees and Charges

Fees and Charges PART 2 – SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT BANKVIC QANTAS VISA CREDIT CARD September 2020 This Fees and Charges brochure is required to be given by us to members when issuing a financial product to them. It contains details that might reasonably be expected to have a material influence on the decision of a customer as to whether to acquire product. This fees and charges table details those transactions for which a fee or charge is payable when using the BankVic Qantas Visa credit card by you. This also forms part of the Visa credit card Terms and Conditions of Use. This Fees and Charges brochure is current as at 01 September 2020. BANKVIC QANTAS VISA CREDIT CARD ACCOUNT FEES Annual fee Nil Late payment - debited on or after the day when an amount that is $9.00 due for payment is not paid on or before its due date. Card issued in normal course of business Nil Disputed transactions voucher retrieval - fee not charged if transaction $25.00 per transaction found to be merchant error BANKVIC QANTAS REWARDS PROGRAM BankVic Qantas Rewards program Nil TRANSACTIONAL Visa international transaction currency conversion fee 2.00% of the AUD transaction amount1 Visa Cash Advance includes: over the counter (domestic & international) $1.80 per transaction Westpac, St George, Bank SA or Bank of Melbourne ATM withdrawal2 $1.80 per transaction LOST/STOLEN CARDS Replacement in Australia $10.00 Emergency replacement overseas $0 Emergency cash overseas $0 AVOIDING CREDIT CARD FEES To avoid fees ensure that BankVic has received your total payment by the due date as outlined below. -

Australia's Best Banking Methodology Report

Mozo Experts Choice Awards Australia’s Best Banking 2021 This report covers Mozo Experts Choice Australia’s Best Banking Awards for 2021. These awards recognise financial product providers who consistently provide great value across a range of different retail banking products. Throughout the past 12 months, we’ve announced awards for the best value products in home loans, personal loans, bank accounts, savings and term deposit accounts, credit cards, kids’ accounts. In each area we identified the most important features of each product, grouped each product into like-for-like comparisons, and then calculated which are better value than most. The Mozo Experts Choice Australia's Best Banking awards take into account all of the analysis we've done in that period. We look at which banking providers were most successful in taking home Mozo Experts Choice Awards in each of the product areas. But we also assess how well their products ranked against everyone else, even where they didn't necessarily win an award, to ensure that we recognise banking providers who are providing consistent value as well as areas of exceptional value. Product providers don’t pay to be in the running and we don’t play favourites. Our judges base their decision on hard-nosed calculations of value to the consumer, using Mozo’s extensive product database and research capacity. When you see a banking provider proudly displaying a Mozo Experts Choice Awards badge, you know that they are a leader in their field and are worthy of being on your banking shortlist. 1 Mozo Experts Choice Awards Australia’s Best Banking 2021 Australia’s Best Bank Australia’s Best Online Bank Australia's Best Large Mutual Bank Australia's Best Small Mutual Bank Australia’s Best Credit Union Australia’s Best Major Bank 2 About the winners ING has continued to offer Australians a leading range of competitively priced home and personal loans, credit cards and deposits, earning its place as Australia's Best Bank for the third year in a row. -

The World's Most Active Banking Professionals on Social

Oceania's Most Active Banking Professionals on Social - February 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) Rank Change 1 Teachers Mutual Bank https://www.linkedin.com/company/285023Australia 451 34 7.54% ▲ 4 2 P&N Bank https://www.linkedin.com/company/2993310Australia 246 18 7.32% ▲ 8 3 Reserve Bank of New Zealand https://www.linkedin.com/company/691462New Zealand 401 29 7.23% ▲ 9 4 Heritage Bank https://www.linkedin.com/company/68461Australia 640 46 7.19% ▲ 9 5 Bendigo Bank https://www.linkedin.com/company/10851946Australia 609 34 5.58% ▼ -4 6 Westpac Institutional Bank https://www.linkedin.com/company/2731362Australia 1,403 73 5.20% ▲ 16 7 Kiwibank https://www.linkedin.com/company/8730New Zealand 1,658 84 5.07% ▲ 10 8 Greater Bank https://www.linkedin.com/company/1111921Australia 621 31 4.99% ▲ 0 9 Heartland Bank https://www.linkedin.com/company/2791687New Zealand 362 18 4.97% ▼ -6 10 ME Bank https://www.linkedin.com/company/927944Australia 1,241 61 4.92% ▲ 1 11 Beyond Bank Australia https://www.linkedin.com/company/141977Australia 468 22 4.70% ▼ -2 12 Bank of New Zealand https://www.linkedin.com/company/7841New Zealand 4,733 216 4.56% ▼ -10 13 ING Australia https://www.linkedin.com/company/387202Australia 1,319 59 4.47% ▲ 16 14 Credit Union Australia https://www.linkedin.com/company/784868Australia 952 42 4.41% ▼ -7 15 Westpac https://www.linkedin.com/company/3597Australia -

Global Currency Card Funds Redemption Form

Global Currency Card Funds Redemption Form. Complete this form to transfer any remaining balances from your closed Global Currency Card account to a nominated account. Funds Redemption Details. To transfer any remaining funds, provide your Global Currency Card information and Australian bank account details below. Please note, any remaining funds will be paid to you in Australian Dollars (AUD) within 20 business days of receipt of this form. First name: Suburb: Postcode: Middle name: Mobile: Surname: Last 4 digits of your card number: Date of birth: / / Destination BSB: Scan a signed and completed copy of this form to: Bank of Melbourne Global Currency Card Service Centre PO Box 3845 Destination account number: RHODES NSW 2138 Or fax to + 61 1300 781 289 Questions? Please call 1300 804 266 in Australia or +61 3 8536 7873 when travelling for 24/7 support. I authorise Bank of Melbourne to transfer the Available Balance of my Global Currency Card account less any outstanding transactions, fees or amounts owed by me, in accordance with the account details provided by me. Signature Date ✗ / / Internal use only Residual value AUD: Authoriser name: Authoriser signature ✗ The details: Bank of Melbourne Global Currency Card is issued by Cuscal Limited ACN 087 822 455 AFSL 244116 (Cuscal). Cuscal is an authorised deposit taking institution and a member of Visa International and does not take deposits from you. Westpac Banking Corporation is the distributor of the product and is not responsible for and does not guarantee the product or card or your ability to access any prepaid value or the use of the product or card. -

Home Loan Redraw Request Form

Redraw Request Form – Residential Home Loans Note to (1) Redraw is not available for Super Fund Home Loans, Senior Access Home Loans, Senior Access Plus Home Loans and Money borrower(s): For Livings Loans. (2) For variable rate loans, amounts which you have prepaid under your agreement less than a month before a monthly repayment date cannot be redrawn until after that monthly repayment date has passed and the amount redrawn does not result in the balance owing on your loan account exceeding the amount which would be owing if you had paid all scheduled repayments on time. (3) For fixed rate loans, redraw is only available for loans fixed on and after 30 November 2009 and only for excess funds paid into the loan during the current fixed rate period up to the value of the prepayment threshold. (4) Please complete (i) all questions, (ii) use a black pen, AND (iii) use CAPITAL LETTERS. (5) All Borrowers on your loan account must sign. (6) The Bank does not promise it will relend you the redraw amount. This request is subject to its consent. (7) You should obtain your own tax advice in relation to the redraw. (8) The Bank only accepts this request by lending the redraw amount. The Bank is not treated as accepting the request in any other circumstances. (9) Redraw requests up to $30,000 made in a branch can be processed immediately. The processing of other redraw requests using this form will take approximately five working days. Our privacy policy is available at bankofmelbourne.com.au or by calling Date Loan account number 13 22 66 and covers how we handle your / / personal information. -

Customer Identification Form (CIF)

Customer Identification Form (CIF) Information Required Individual Customers must complete section 1, 3 and 4 Sole Traders must complete sections 1, 2, 3 and 4 CIS No. (if known) Account number (if known) Account Name Section 1 Details of Individual to Individual (name in full) Date of birth Gender be identified (Individual Customers and Sole Are you known by any other name(s)? If yes, please specify all names (use a separate sheet if required) Traders) Yes No Residential address (PO Box not allowed) Employment Type: Please select the employment type that reflects your current situation best. Casual Other Social Security Recipient Dependant Contractor Part Time Student Full Time Retired Temporary Independent Contractor Self Employed Unemployed Occupation Purpose of business relationship: This refers to your reasons for engaging with us to obtain products and services. Customers may have multiple reasons for dealing with us. Please indicate all of these reasons below. Transactional Long Term Borrowing Financial Markets Savings Protection Correspondent Banking Short Term Borrowing Wealth Additional information (please specify) Source of Funds: This refers to the origin of the funds that are the subject of the business relationship between you and us. Please note that many customers have multiple sources of funds. Please indicate all sources of funds below. Salary/Wages Superannuation/Pension Redundancy Commission Loan Inheritance Bonus Insurance payment Gift/Donation Business income/earnings Compensation payment Windfall Business profits Government benefits Tax refund Investment income/earnings Sale of assets Additional Sources (please specify) Rental income Liquidation of assets © Bank of Melbourne – A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. -

Report: Inquiry Into Aspects of Bank Mergers

The Senate Economics References Committee Report on Bank Mergers September 2009 © Commonwealth of Australia 2009 ISBN 978-1-74229-148-2 Printed by the Senate Printing Unit, Parliament House, Canberra. Senate Economics References Committee Members Senator Alan Eggleston, Chair Western Australia, LP Senator Annette Hurley, Deputy Chair South Australia, ALP Senator David Bushby Tasmania, LP Senator Barnaby Joyce Queensland, NATS Senator Louise Pratt Western Australia, ALP Senator Nick Xenophon South Australia, IND Participating members participating in this inquiry Senator John Williams New South Wales, NATS Former Members Senator Doug Cameron New South Wales, ALP Senator Mark Furner Queensland, ALP Secretariat Mr John Hawkins, Secretary Mr Greg Lake, Principal Research Officer Mr Glenn Ryall, Senior Research Officer Ms Hanako Jones, Executive Assistant Ms Lauren McDougall, Executive Assistant PO Box 6100 Parliament House Canberra ACT 2600 Ph: 02 6277 3540 Fax: 02 6277 5719 E-mail: [email protected] Internet: http://www.aph.gov.au/senate_economics/ iii TABLE OF CONTENTS Membership of Committee iii Chapter 1.............................................................................................................. 1 Introduction .............................................................................................................. 1 Referral of the Inquiry ............................................................................................ 1 Conduct of the inquiry ........................................................................................... -

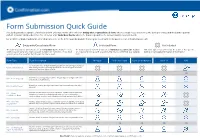

Form Submission Quick Guide This Guide Provides a Sample of Banks and Form Offerings

Form Submission Quick Guide This guide provides a sample of banks and form offerings. Banks offer either an Entity wide / Consolidated form, where a single request is sent to the bank per entity, and the bank responds with all accounts and products for that entity; or offer Individual Forms where the bank responds to the account number provided only. For a full list of banks and forms offered, please refer to the In Network Responder Report generated from the Reports section in Confirmation.com. Entity wide/Consolidated Form Individual Form Not Included The bank responds to form details on an entity wide basis. Auditors send a The bank responds to form details on an individual account basis. Auditors This form type is not offered by the bank as the specific single request using one main account number for reference. If no main are required to set up each account number to be confirmed as a separate bank does not supply information in this manner. account exists the customer identification number is used. form. Form Type Form Description Westpac St George Bank Bank of Melbourne Bank SA NAB For each form sent, the bank will then provide an extensive report of all your Client Consolidated bank dealings for the legal entity specified. No other form types should be submitted if this form option is used. OR An asset account is typically a current, cheque, deposit, savings, investment AU – Asset (Deposit) and any other credit balance. A liability account is typically a bank loans, term loans and any other debit AU – Liability (Loan) balances. -

Financial Services Guide and Credit Guide

Bank of Melbourne Retail and Business Banking Financial Services Guide and Credit Guide Dated: 1 July 2021 Bank of Melbourne – a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. About this Guide. This document (Guide) contains a Financial Services Guide (FSG), Credit Guide, a feedback and complaints section and information about how we handle your personal information to help you decide whether to use the financial and consumer credit services offered by Bank of Melbourne. It contains information about: • some of the financial services and products we can offer you, including details of any remuneration, commission or other benefits that may be paid to Bank of Melbourne or other relevant persons in relation to those services; • the consumer credit services and products we can offer you; • our Privacy Policy and how we handle your personal information; and • our internal and external dispute resolution procedures and how you can access them. In this Guide, the words “we”, “our”, “us” and “Bank of Melbourne” refer to Bank of Melbourne – a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. References to the “Westpac Group” mean Westpac Banking Corporation and all its related bodies corporate. 3 Financial Services Guide. Not Independent. Our employees who give personal advice to retail clients about the financial products and related payment services referred to in this FSG are not independent, impartial, or unbiased because they are employed and remunerated by us and can only advise on our financial products and those products and services listed in this FSG. -

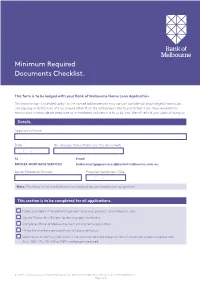

Minimum Required Documents Checklist

Minimum Required Documents Checklist. This form is to be lodged with your Bank of Melbourne Home Loan Application. This transmission is intended solely for the named addressee and may contain confidential or privileged information. The copying or distribution of it by anyone other than the addressee is strictly prohibited. If you have received this transmission in error please telephone us immediately and return it to us by mail. We will refund your costs of doing so. Details. Applicant/s Name Date No. of pages transmitted: (inc. this lead sheet) / / To Email BROKER MORTGAGE SERVICES [email protected] Lender Reference Number Proposed Settlement Date / / Note: The items in the shaded boxes are required for commencing an assignment. This section is to be completed for all applications. Notes provided in the online lodgement (purpose, product, any mitigants, etc) Signed Privacy Act (Except for existing loan increases) Completed Bank of Melbourne short or long term application All tax file numbers removed from all documentation Verification of Identity (VoI) Certificate with the certified copies of identification documents where a new ACT, QLD, VIC, SA, WA or NSW mortgage is required. © 2021 Bank of Melbourne – A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. BOMW0454 0121 Page 1 of 5 Signed Identification Verification Form and/or Certified Identification Form with certified Copy of identification documentation produced (new customers to Bank of Melbourne) Rates Notices for all properties owned Signed Business Purpose Declaration – to be used when loan is wholly or predominantly for business purposes, or non-residential investment purposes. -

Current Home Loan Offers. the 0.40% Cashback Offer*

Current Home Loan Offers. The 0.40% Cashback offer*. You could score 0.40% cashback when you take out a home loan with Bank of Melbourne before 31 March 2021. For example on a $500,000 loan, it’s up to $2,000 back to you in cash. Excludes Portfolio Loans, Relocation Loans, switches and refinances of home loans within the Westpac Group. Offer is in addition to any other cashback offers currently in market (subject to eligibility). Eligible members are only entitled to one 0.40% cashback benefit. Plus get up to $4,000 Refinance Cashback^. $2,000 refinance cashback and a bonus $2,000 refinance cashback for loans with a max LVR of 80%. For new refinance applications received by 31 March 2021 and settled by 30 June 2021. One $2,000 refinance cashback per property refinanced will be paid regardless of the number of loans involved. A $2,000 bonus refinance cashback is for initial application and only 1 cashback will be paid regardless of the numbers of customers, properties or applications involved. Bonus cashback requires a maximum LVR of up to 80%. Available on the Advantage Package and Basic Home Loans. $250k min loan per property. Both offers exclude Portfolio Loans or Relocation Loans, switches and refinances of home loans within the Westpac Group and Owner Occupier with Interest Only repayments. Credit Criteria, terms, conditions, exclusions, fees and charges apply. You’ve got questions? We’ve got time to talk. Call our IPA Partnership Manager Amanda Vella 0466 398 357 [email protected] Bank of Melbourne The details: Conditions, fees and charges, apply. -

Top 5 Interest Rates

TOP 5 INTEREST RATES Information displayed as of 02.04.2019 Top 5 | Variable Rates Owner Occupied Investment $500,000 at 90% LVR $500,000 at 90% LVR 3.55% Bank of Sydney 3.99% Adelaide, Suncorp, Better Choice, Auswide 3.69% BankSA, Suncorp, IMB, Auswide 4.12 % Heritage 3.77% Heritage 4.14% AMP 3.78% Qudos 4.19% Bank of Sydney 3.80% Better Choice 4.24% CBA, St George Group $1,000,000 at 70% LVR $1,000,000 at 70% LVR 3.55% Bank of Sydney, Citi Bank 3.87% Better Choice 3.64% Resimac Prime 3.89% Citi Bank, Resimac Prime 3.67% Heritage 3.99% Adelaide, Bank of Sydney, Suncorp, Auswide 3.68% Qudos 4.02% Heritage Better Choice, BankSA, IMB, Suncorp, Bank 4.04% ING, Myloan Elect 3.69% Australia, Auswide $450,000 at 60% LVR Lo Doc $450,000 at 60% LVR Lo Doc 4.15% ANZ 4.46% ANZ 4.74% Resimac Prime 4.74% Resimac Prime 4.89% Liberty 4.99% Bluestone, La Trobe 4.92% Pepper Money 5.03% Better Choice 4.96% Better Choice 5.31% Pepper Money $450,000 at 80% LVR LOC $450,000 at 80% LVR LOC 3.85% Resimac Prime 3.89% Resimac Prime 4.21% Better Choice 4.49% Suncorp 4.49% Suncorp 4.51% Better Choice 5.05% Heritage 4.74% AMP 5.24% Auswide 5.05% Heritage April 2019 Top 5 | Fixed Rates Owner Occupied | $450K at 85% LVR Investment | $450K at 85% LVR 1 Year 1 Year 3.69% Suncorp 3.99% Heritage, Adelaide, Suncorp 3.75% ING 4.09% Bank of Sydney 3.79% Adelaide 4.14% CBA 3.80% Better Choice 4.19% Maquarie, BOQ 3.83% Premium Capital 4.23% Premium Capital 2 Years 2 Years 3.65% IMB 3.89% St George 3.69% St George, NAB 3.94% Bank of Melbourne, Bankwest, BankSA 3.74% Bank of