Media Media Kit Company Info

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MORI HILLS REIT INVESTMENT CORPORATION (CODE:3234) Results of 13Th Fiscal Period (Ended January 31, 2013)

MORI HILLS REIT INVESTMENT CORPORATION (CODE:3234) Results of 13th Fiscal Period (Ended January 31, 2013) MORI HILLS REIT INVESTMENT CORPORATION Mori Building Investment Management Co., Ltd. http://www.mori-hills-reit.co.jp/en http://www.morifund.co.jp/english/ 00 Contents 1. Investment highlights 2 2. 13th period financial highlights 16 3. Operation highlights 20 4. Appendix 29 This document has been prepared by MORI HILLS REIT INVESTMENT CORPORATION (“MHR”) for informational purposes only and should not be construed as an offer of any transactions or the solicitation of an offer of any transactions. Please inquire with the various securities companies concerning the purchase of MHR investment units. This document’s content includes forward-looking statements about business performance; however, no guarantees are implied concerning future business performance. Although the data and opinions contained in this document are derived from what we believe are reliable and accurate sources, we do not guarantee their accuracy or completeness. The contents contained herein may change or cease to exist without prior notice. Regardless of the purpose, any reproduction and/or use of this document in any shape or form without the prior written consent from MHR is prohibited. We will send invitations to future financial results briefings to those who participated in the financial results briefing for the thirteenth period based on the personal information they have shared with us; we guarantee that we make every effort to adequately manage and/or use and protect the information in accordance with the private policy posted on the official website of Mori Building Investment Management Co., Ltd. -

20171214-1.Pdf

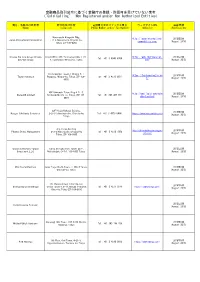

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) 4th Floor, Kioicho Building, 2017年12月 Aeon Group International 3-12 Kioi-cho, Chiyoda-ku, Tel: +81 3 4580 2113 www.aeongroup-intl.com (December 2017) Tokyo, ZIP 102-0094 16th Floor, Gran Tokyo South Tel: +81 3 4588 8167 2017年12月 Aichi BMO International Tower, 1-9-2, Marunouchi, ai-international.com/ Fax: +81 3 4510 3208 (December 2017) Chiyoda-ku, Tokyo, ZIP 100-6640 10F S-GATE Akasaka sanno, Tel: +81 3 4243 3187 www.theasquithgroup.co 2017年12月 Asquith Group 2, Akasaka, Minato-ku, Fax: +81 3 6740 2388 m (December 2017) Tokyo, ZIP 107-0052 Cerulean Tower,26-1 Sakuragaoka- 2017年12月 Cameo Consulting Ltd cho, Shibuya-ku, Tokyo, ZIP 150- Tel: +81 3 4578 9543 cameo-consulting.com/ (December 2017) 8512 ThinkPark Tower, 2-1-1, Osaki, cathaydupont.com/catha 2017年12月 Cathay DuPont Shinagawa-ku, Tokyo, ZIP 141- Tel: +81 3 4579 5738 ydupont/en/home.html (December 2017) 6001 4th Flr. Maya Bldg. 2-5, Minami Tel: +81 6 4560 4048 2017年12月 CHINATSU AND PARTNERS Hon-machi 1-chome Chuo-ku, chinatsupartners.com/ Fax: +81 6 7635 2860 (December 2017) Osaka, ZIP 541-0054 Level 9, 2-1-1 Edobori, Nishi- 2017年12月 Daiwa Asia ku, Osaka, ZIP 553-0002 (December 2017) 816-8, 2F, Akamichi, Uruma City, 2017年12月 Fuji Global Enterprise Corp Tel: +81 9 8989 5475 Okinawa (December 2017) Ito Bldg.6-14, Minami-Honmachi 2017年12月 Gina, Eri and Associates 3-chome -

ARK Hills Sengokuyama Mori Tower

ARK Hills Sengokuyama Mori Tower ■Toranomon-Roppongi District Class 1 Urban Redevelopment Project : Redevelopment Project Overview and History …2 ■ARK Hills Sengokuyama Mori Tower: Overall Plan/Building Site Environment with Rich Greenery …4 ■ARK Hills Sengokuyama Mori Tower (Offices)/Realizing Greatly Flexible Space …5 ■ARK Hills Sengokuyama Residence/ARK Hills Sengokuyama Terrace (Residences) /Proposing a new way of living in Tokyo …7 ■Commercial Space/Supporting Office Workers, Residents, and Neighbors …8 ■Safety and Security …9 ・High earthquake resistance by incorporating the latest technology ・Ensure business continuity with an emergency power generation system that uses city gas ■Environment …11 ・Promotes realization of a low-carbon society: Officially certified with an S Rank, the highest evaluation granted by CASBEE ・Creation of a green area to promote biodiversity: First project in Japan to be awarded the highest rank (AAA) by the JHEP evaluation ・New gate system “Passmooth” to strengthen energy conservation, safety, and security. ■Culture …14 ・Artwork that will be a symbol of the district: Public art “Infinite” 1 ■ Toranomon-Roppongi District Class 1 Urban Redevelopment Project: Redevelopment Project Overview and History This redevelopment project involves a project site covering approximately 2.0 ha. The district is next to the “Roppongi-Toranomon District Redevelopment Project” designated by Minato Ward (designed in 1988 and revised thereafter to become the “Roppongi-Toranomon District Comprehensive Urban Redevelopment Project -

Toranomon Hills Mori Tower for 5,070 Million Yen and Holland Hills Mori Tower for 9,330 Million Yen As of August 2017

Mori Hills REIT Investment Corporation Results of the 23rd Fiscal Period ended January 31, 2018 Presentation Material March 19, 2018 TSE Code: 3234 (Asset Manager) Mori Building Investment Management Co., Ltd. http://www.mori-hills-reit.co.jp/en/ http://www.morifund.co.jp/en/ Disclaimer This document has been prepared by Mori Hills REIT Investment Corporation (“MHR”) for informational purposes only and should not be construed as an offer of any transactions or the solicitation of an offer of any transactions. Please inquire with the various securities companies concerning the purchase of MHR investment units. This document’s content includes forward-looking statements about business performance; however, no guarantees are implied concerning future business performance. Although the data and opinions contained in this document are derived from what we believe are reliable and accurate sources, we do not guarantee their accuracy or completeness. The contents contained herein may change or cease to exist without prior notice. Regardless of the purpose, any reproduction and/or use of this document in any shape or form without the prior written consent from MHR is prohibited. This document contains charts, data, etc. that were prepared by Mori Building Investment Management Co., Ltd. (hereafter, the “Asset Manager”) based on charts, data, indicators, etc. released by third parties. Furthermore, this document includes statements based on analyses, judgments, and other observations concerning such matters by the asset manager as of the date of -

October 31, 2019 Report on the Management Structure and System

[Translation] October 31, 2019 Report on the Management Structure and System of the Issuer of Real Estate Investment Trust Units and Related Parties Issuer of Real Estate Investment Trust Units Mori Hills REIT Investment Corporation Hideyuki Isobe, Executive Director (Securities Code: 3234) Asset Manager Mori Building Investment Management Co., Ltd. Hideyuki Isobe, President & CEO Inquiries: TEL: 03-6234-3234 1. Basic Information (1) Basic Policy concerning Compliance The directors of Mori Hills REIT Investment Corporation (the “Company”) ensure thorough compliance by complying with the Act on Investment Trusts and Investment Corporations (Act No. 198 of 1951, as amended) (the “Investment Trust Act”), the Financial Instruments and Exchange Act (Act No. 25 of 1948, as amended) (the “Financial Instruments and Exchange Act”), and other relevant laws and regulations and internal rules. In addition, in order to ensure that the supervisory directors exercise their supervisory rights and investigative rights, the Company has established a system by which executive directors report to supervisory directors concerning execution of business 1 and ensures that the Company’s board meetings can be held flexibly (such as by utilizing telephone conference or similar means of communication). With respect to the two supervisory directors, the Company is making efforts to build a strong governance structure by appointing outside experts, namely as a lawyer and a real estate appraiser and by fully utilizing internal checking functions. Mori Building Investment Management Co., Ltd. (the “Asset Manager”) is required to perform its business operations in good faith and with due care of a prudent manager for the Company in line with the purpose of the investment management business, and accordingly performs sincere asset investment and management pertaining to real estate properties based on an appropriate compliance structure and internal control structure in order for the Company to gain high trust from the securities market and investors. -

Economic Integration: a New Approach to Reform

EEECCCOOONNNOOOMMMIIICCC IIINNNTTTEEEGGGRRRAAATTTIIIOOONNN::: AAA NNNEEEWWW AAAPPPPPPRRROOOAAACCCHHH TTTOOO RRREEEFFFOOORRRMMM TTThhheee EEEBBBCCC RRReeepppooorrrttt ooonnn ttthhheee JJJaaapppaaannneeessseee BBBuuusssiiinnneeessssss EEEnnnvvviiirrrooonnnmmmeeennnttt 222000000777 The European Business Council in Japan ECONOMIC INTEGRATION: A NEW APPROACH TO REFORM The EBC Report on the Japanese Business Environment 2007 The European Business Council in Japan European Business Council in Japan The EBC is the trade policy arm of the following European business organisations in Japan: Austrian Business Council Belgium-Luxembourg Chamber of Commerce in Japan British Chamber of Commerce in Japan Danish Chamber of Commerce in Japan Enterprise Estonia Finnish Chamber of Commerce in Japan French Chamber of Commerce and Industry in Japan German Chamber of Commerce and Industry in Japan Hellenic Foreign Trade Board Iceland Chamber of Commerce in Japan Italian Chamber of Commerce in Japan Japan Ireland Economic Association Netherlands Chamber of Commerce in Japan Norwegian Chamber of Commerce in Japan Polish Chamber of Commerce & Industry in Japan Spanish Institute of Foreign Trade Swedish Chamber of Commerce and Industry in Japan Swiss Chamber of Commerce and Industry in Japan Executive Operating Board Chairman: Richard Collasse Senior Vice-Chairman: Hans Tempel Vice Chairman: Jean-Francois Minier Executive Operating Board: Michael A. Loefflad (Austria) Duco Delgorge (Belgium/Luxembourg) Peter F. Thewlis (Britain) Clas Eilersen (Denmark) Erik Ullner -

MARKET TREND SURVEY of LARGE-SCALE OFFICE BUILDINGS in TOKYO's 23 WARDS (“Ku”)

May 10, 2006 MARKET TREND SURVEY of LARGE-SCALE OFFICE BUILDINGS IN TOKYO’S 23 WARDS (“ku”) (As of December 2005) Supply of extremely large-scale office buildings (buildings with total office floor space of over 30,000 m2) will be concentrated in the three central wards. With more office consolidation, the office environment in the Tokyo Central Business District (CBD) is expected to be further invigorated. Office space demand remains steady, especially in the three central wards. With continuing business expansion, the number of office employees will increase further. What users expect of the office environment: ٤Views of general affairs departments and facility management staff are different from that of office workers; The ideal office environment for the future on the basis of what office workers expect of ٤ offices. Since 1986, Mori Building Company Ltd. (Headquarters: Minato-ku, Tokyo; President and CEO: Minoru Mori) has been regularly conducting surveys of demand and supply trends of large office buildings with total office floor space of over 10,000 m2 (in this survey, they will be referred to as “large-scale office buildings”) throughout Tokyo’s 23 wards. Forecasts of future trends in the office market are also carried out by analyzing the results of this survey from a variety of angles. The results of the survey as of December 2005 are contained in this report. Outline of Market Trend Survey ع Survey date: December end, 2005 Coverage: Tokyo’s 23 wards (“ku”) Type of property: Large office buildings with total office floor space of over 10,000 m2 (built after 1986) (Notes on the contents) ̪ This survey is not only based on publicly available information, but also shows the results of the compilation of on-site observations and direct interviews with developers on the progress and other conditions of each project. -

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Marunouchi Kitaguchi Bldg. http://japaninternational 2018年8月 Japan International Commodities 1-6-5, Marunouchi, Chiyoda-ku, commodities.com/ (August 2018) Tokyo, ZIP 100-8262 Resona Dai-Ichi Group/Resona Head Office: 32F, Toranomon Hills, 1-23- https://www.rdgfinancial. 2018年8月 Tel: +81 3 4540 6704 Day-Ichi Group 4, Toranomon, Minato-ku, Tokyo com/ (August 2018) Izumi Garden Tower, 1 Chome-6-1 https://taylormckenzie.ne 2018年8月 Taylor mckenzie Roppongi, Minato-ku, Tokyo, ZIP 106- Tel: +81 3 4579 5691 t/ (August 2018) 0032 48F Shinbashi Tokyu Bldg 4-21-3, http://www.fsajp.com/delw 2018年8月 Delwebb Limited Shinbashi Minato-ku, Tokyo, ZIP 105- Tel: +81 345 405 931 ebb-limited/ (August 2018) 0004 22F Hibiya Kokusai Building, 2018年8月 Kangyo Yokohama Securities 2-2-3 Uchisaiwai-cho, Chiyoda-ku, Tel: +81 3 4579 0434 https://www.kysecurities.com (August 2018) Tokyo 4FL Yusen Building http://phoenixdirectmanagem 2018年8月 Phoenix Direct Management 2-3-2 Marunouchi, Chiyoda-ku Tel: +81 3 4578 7985 ent.com/ (August 2018) Tokyo, ZIP 100-0005 Grace Investment/ Grace Tokyo Shinjuku Park Tower, 29/F, 2018年8月 Investment L.L.C Nishishinjuku 3-7-1, 163-1055 Tokyo (August 2018) IBG Capital Partners Gran Tokyo North Tower, 1-208-5 Yaesu, 2018年8月 Chiyoda-ku, Tokyo (August 2018) 13F Harumi Island Triton Square 2018年8月 Shinhan Daiwa Brokerage Office -

Mixed Use · Winner Izumi Garden

MIXED USE · WINNER IZUMI GARDEN Tokyo, Japan Izumi Garden is located in the Roppongi neighborhood of Minato ward, one of the five wards compos- Development Team ing Tokyo’s downtown core. The neighborhood, known for its nightlife and expatriate community, is Owner/Developer characterized by a hilly topography. The 3.2-hectare (7.9 ac) site area above Roppongi i-chome (“i-chome” Sumitomo Realty and Development means first street) was owned by 60 proprietors and long-term leaseholders. These complications long Company, Ltd. prevented the site from being redeveloped for better land use. Tokyo, Japan The Sumitomo conglomerate’s founding family, however, still owned its feudal estate here: a man- www.sumitomo-rd.co.jp sion that has been preserved as Sen-oku Hakuko Kan, part of the Izumi Garden complex, as a museum Codeveloper for the esteemed Sumitomo Collection of ancient Chinese artifacts. The museum faces the perfectly pre- Mori Building Company, Ltd. served 3,950-square-meter (42,517 sf) garden after which the Izumi Garden complex is named. (Izumi Tokyo, Japan means “fountain,” as in a natural hillside spring, from which water flows continuously in the ancestral www.mori.co.jp garden.) From there, the site drops 20 meters (65.6 ft) to the Roppongi i-chome subway station. In the late 1980s, the planning for the new subway station on Roppongi i-chome prompted Sumi- Architect and tomo Realty and Development Company, Ltd., to lead the assemblage of the site and propose a large- Landscape Architect scale, mixed-use redevelopment within the guidelines of the recently approved District Renewal Program Nikken Sekkei (DRP) for this area of Roppongi. -

Desired Acceleration of Grade-A-Office Investment by J-REIT

NLI Research Institute April 24, 2012 Real Desired Acceleration of Grade-A-Office Investment by J-REIT Estate Real Estate Investment Team Analysis Financial Research Group Mamoru Masumiya Report [email protected] Summary ・Recently, more transactions of Grade-A-offices by J-REITs have been observed in the Tokyo prime office market. Currently, however, Grade-A-offices account for only a small portion of J-REIT portfolios. While property developers own a lot of Grade-A-offices, J-REITs play a very small role in the Tokyo prime office market. ・When more Grade-A-offices are invested by J-REITs, various benefits can be expected in the market. J-REITs can overcome obscurity among investors, especially retail and overseas investors, and can secure the competitiveness of their portfolios even in a more polarized and selective office market. J-REIT market liquidity can improve with the increasing market size, which leads to good accesses to large institutional investors. Regarding the overall property market, the transaction liquidity and the transparency of the Grade-A-office market will possibly improve. Moreover, property developers selling Grade-A-offices can pursue growth opportunities by reinvesting the proceeds from the sales into development projects in Asia. Main Owners of Grade-A Offices in Singapore and Tokyo Singapore Tokyo No. of Projects Ratio No. of Projects Ratio Grade A Ratio in REIT Office Portfolio REIT 19 38.8% 27 13.8% ⇒ 76.0% of the 25 City Offices in S-REIT Portfolios 4.8% of the 566 Tokyo Offices in J-REIT Portfolios Global Investors 9 18.4% 2 1.0% *Ratio is based on the no. -

OFFICE RENTDATA 2019 Tokyo Redevelopment Projects

OFFICE RENTDATA 2019 Tokyo Redevelopment Projects OFFICE RENTDATA 2019 March 2019 Published by Sanko Estate Co., Ltd. Ginza Sanwa Bldg., 4-6-1 Ginza, Chuo-ku, Tokyo Only environmentally-friendly, zero-VOC (Volatile organic compounds)100% vegetable oil inks were used in the printing of this report. Copyright Sanko Estate Co., Ltd. All rights reserved. www.sanko-e.co.jp/en OFFICE RENTDATA 2019 TABLE CONTENTS 01-02 Aerial Photo 11-12 Transition in Office Rents and Economic Trends 03-04 Redevelopment Report 13-16 Office Market 05-06 Redevelopment Map 17-22 Guidelines for Opening an Office 07-08 Completion Timeline 23-24 Special Report 09-10 New Supply 25-26 Company Outline Midtown Tower Sumitomo Fudosan Roppongi Grand Tower Toranomon Hills Mori Tower The Okura Prestige Tower Kasumigaseki Building Toranomon Hills Ark Hills Sengokuyama Mori Tower Business Tower P3 Kamiyacho Trust Tower P4 Atago Green Hills Mori Tower Toranomon~Roppongi Atago Shrine Kamiyacho Sta. Tokyo Tower Onarimon Shiba Sta. Park Kyu Shiba Rikyu GardenGarderderdd n Date: October 21,, 2018 AAltitude:ltitude: aapprox.pprox. 450 m 01 SANKO ESTATE SANKO ESTATE 02 Redevelopment Report *The renderings below are for illustrative purposes only and are subject to change. Accelerating Redevelopment to $7RZHU6\PEROL]LQJ.DPL\DFKR·V7UDQVIRUPDWLRQ Tokyo Establish a Global Business Hub Tokyo into a Global, Creative Area That Generates New Value Toranomon Hills Business Tower Kamiyacho Trust Tower Forming a Community around an area where the projects are located. tors from a wide range of fields includ- A Hub Serving as a Gateway Linking premium luxury hotel brand, Integrated Redevelopment Project Following Toranomon Hills Mori Tower, ing entrepreneurs, new business man- the World to Both Tokyo and Japan and Mori Trust has succeed- completed in June 2014, development agers at large companies to corporate ed in bringing it to Japan for Mori Building Co., Ltd. -

26Th Fiscal Period Ended July 31, 2019 Presentation Material September 17, 2019

Mori Hills REIT Investment Corporation Results of the 26th Fiscal Period ended July 31, 2019 Presentation Material September 17, 2019 TSE Code: 3234 (Asset Manager) Mori Building Investment Management Co., Ltd. https://www.mori-hills-reit.co.jp/en/ https://www.morifund.co.jp/en/ Disclaimer This document has been prepared by Mori Hills REIT Investment Corporation (“MHR”) for informational purposes only and should not be construed as an offer of any transactions or the solicitation of an offer of any transactions. Please inquire with the various securities companies concerning the purchase of MHR investment units. This document’s content includes forward-looking statements about business performance; however, no guarantees are implied concerning future business performance. Although the data and opinions contained in this document are derived from what we believe are reliable and accurate sources, we do not guarantee their accuracy or completeness. The contents contained herein may change or cease to exist without prior notice. Regardless of the purpose, any reproduction and/or use of this document in any shape or form without the prior written consent from MHR is prohibited. This document contains charts, data, etc. that were prepared by Mori Building Investment Management Co., Ltd. (hereafter, the “Asset Manager”) based on charts, data, indicators, etc. released by third parties. Furthermore, this document includes statements based on analyses, judgments, and other observations concerning such matters by the asset manager as of the date of preparation. 1 Contents 1. Executive summary 3 3. Operation highlights 35 Factors that led to changes in dividends per unit from the previous fiscal period 36 2.