2013/14 Business Plan and Capital and Operating Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Regional Express Rail Update

Clause 5 in Report No. 10 of Committee of the Whole was adopted by the Council of The Regional Municipality of York at its meeting held on June 23, 2016 with the following additional recommendation: 3. Receipt of the memorandum from Daniel Kostopoulos, Commissioner of Transportation Services, dated June 22, 2016. 5 Regional Express Rail Update Committee of the Whole recommends adoption of the following recommendations contained in the report dated June 1, 2016 from the Commissioner of Transportation Services: 1. Metrolinx be requested to mitigate the impacts of Regional Express Rail service by addressing the gap between their Initial Business Case for Regional Express Rail and York Region’s needs for grade separations, additional GO stations and parking charges. 2. The Regional Clerk circulate this report to Metrolinx, Ontario Ministry of Transportation and Clerks of the local municipalities. Report dated June 1, 2016 from the Commissioner of Transportation Services now follows: 1. Recommendations It is recommended that: 1. Metrolinx be requested to mitigate the impacts of Regional Express Rail service by addressing the gap between their Initial Business Case for Regional Express Rail and York Region’s needs for grade separations, additional GO stations and parking charges. 2. The Regional Clerk circulate this report to Metrolinx, Ontario Ministry of Transportation and Clerks of the local municipalities. Committee of the Whole 1 June 9, 2016 Regional Express Rail Update 2. Purpose This report provides an update to Council on the Provincial Regional Express Rail (RER) Service Plan and associated staff activities as York Region’s response to the RER Service Plan to be implemented by the Province over the next 10 years. -

Collective Agreement Bombardier Transportation

Collective Agreement between Bombardier Transportation – North America (Service, repair and maintenance, calling of crews and the operation of trains relating to the Metrolinx GO Transit and UP Express Operations and Maintenance within Ontario.) and Teamsters Canada Rail Conference Division 660 TABLE OF CONTENTS MAINTENANCE SECTION Page____________________ 3 RAIL SECTION Page____________________55 2 INDEX MAINTENANCE SECTION 1.0 PREAMBLE 4 2.0 RECOGNITION 4 3.0 RESERVATION OF MANAGEMENT RIGHTS 4 4.0 MEMBERSHIP IN THE UNION 5 5.0 CHECK OFF OF UNION DEDUCTIONS 5 6.0 UNION ACTIVITIES 6 7.0 NO STRIKE / LOCKOUT 7 8.0 GRIEVANCE AND ARBITRATION PROCEDURE 7 9.0 INVESTIGATONS AND DISCIPLINE 10 10.0 PROBATIONARY EMPLOYEE 12 11.0 SENIORITY 12 12.0 TERMINATION OF EMPLOYMENT 13 13.0 POSTING AND FILLING OF VACANCIES 14 14.0 TEMPORARY ASSIGNMENTS IN THE BARGAINING UNIT 16 15.0 LAYOFF AND RECALL 17 16.0 HOURS OF WORK 17 17.0 BREAKS AND MEAL PERIODS 18 18.0 CALL BACK 18 19.0 OVERTIME 18 20.0 SHIFT PREMIUM 20 21.0 BEREAVEMENT LEAVE 21 22.0 LEFT BLANK INTENTIONALLY 21 23.0 JURY DUTY AND ATTENDING COURT 21 24.0 RECOGNIZED HOLIDAYS 22 25.0 VACATION 24 26.0 HEALTH AND SAFETY 25 27.0 BARGAINING UNIT WORK 28 28.0 LEAVE OF ABSENCE 29 29.0 BENEFITS 29 30.0 PAYDAY 32 31.0 CLASSIFICATIONS AND WAGE RATES 32 JOB DESCRIPTIONS 34 DEFINITIONS 40 QUESTIONS AND ANSWERS 40 32.0 WORKPLACE DIGNITY AND RESPECT 42 33.0 DUTY TO ACCOMMODATE 43 34.0 COPY OF THE AGREEMENT 44 35.0 ZONE AGREEMENT 44 36.0 TERM 46 LETTER OF UNDERSTANDING 1 47 LETTER OF UNDERSTANDING 2 48 APPENDIX 1 -

UP Express Pricing Strategy Staff Report

To: Metrolinx Board of Directors From: Kathy Haley, President, Union Pearson Express Date: December 11, 2014 Re: UP Express Pricing Strategy Staff Report 1. Executive Summary With the launch of Union Pearson (UP) Express in spring 2015, Toronto will join the ranks of other world class cities with an express rail service between downtown and the airport. UP Express will provide travellers with a fast, simple route that takes 25 minutes, and departs every 15 minutes for 19.5 hours a day. To inform the fare structure, research and analysis was completed on market trends and passenger demographics, as well as benchmarking against local and international transportation modes. UP Express has developed a fare structure based on the principles of Distance (fare by distance), Discounts (to build ridership), and Demand (ensuring enough ridership). The proposed UP Express one-way adult fare from Union Station and Toronto Pearson is $19 with the PRESTO card or $27.50 fare without the PRESTO card. Staff are proposing discounted prices for families, children, students, seniors, and airport employees who have a valid Toronto Pearson identification card. The proposed fare structure builds in the elimination of the $1.85 access fee originally required by the Greater Toronto Airports Authority (GTAA). 2. Recommendation Be it Resolved that: The Board of Directors approve the recommended fare structures as presented by UP Express on December 11, 2014. 3. Project Background Toronto’s dedicated Air Rail Link (ARL), the Union Pearson (UP) Express, is launching in spring 2015 and will be owned and operated by Metrolinx. The project is currently on-time and on-budget, and when launched it will run between Canada’s two busiest passenger transport hubs – Union Station in downtown Toronto and the Toronto Pearson International Airport (Toronto Pearson). -

Introducing the Union Pearson Express

Introducing the Union Pearson Express: It's a changing world and a perfect opportunity for Ontario to shine. A time to leverage our considerable assets as one of the world’s most desirable regions. If we navigate this passage successfully, building towards such milestones as the 2015 Pan Am and Parapan Am Games, this will be remembered as a time in which we pivoted toward long-term prosperity. It is within this context, that one of Ontario’s bold moves will be the air rail link. The Union Pearson Express will heal a stress point for those who live in Ontario and for those who come to visit: The anxiety of a journey between downtown Toronto and Toronto Pearson Airport on the Gardiner Expressway. The Union Pearson Express will completely transform the Toronto-Pearson travel experience. Our state of the art train shuttle will run from Union Station to Toronto Pearson every 15 minutes. 7 days a week. Swiftly. Elegantly. Efficiently. It’s not simply the quickest way to catch a flight. It’s also the most comfortable, most reliable and most relaxing. From the moment you transition from the hustle and bustle into the serenity of the Union Pearson Express, spirits are lifted, anxieties set at ease. There’s a new sense of flow to your travel. The lounge is an oasis with a distinct airside feel, designed with savvy air travelers in mind it’s where schedules are forgotten and adventures begin. The train’s interiors create the mood of a beautifully appointed aircraft cabin enlivened with the unmistakable spirit of Ontario’s natural beauty. -

Go Train Weekend Schedule Barrie

Go Train Weekend Schedule Barrie Presumptive and Gaelic Fonsie occidentalizes some airfoils so undyingly! Diogenic Westbrooke corniced, his revelationists buncos invaginated childishly. Sterilized and mediated Cameron bejewel so lovingly that Obie glads his schlimazels. Go up your weekend go train barrie south of the rapid transit as construction Hourly weekend GO with service starting December 30 2017 All GO. GO ON Muskoka Service Ontario Northland. Weekend train schedules, weekend go to check back to reject cookies to your personal information used to downtown bus will run only apply to barrie! Trips start at 545 am from Barrie Georgian College operating every 50. In barrie train schedules for trains will appear and even if it is the weekends. Maintainance on the Barrie GO for line means you heard be riding a. Type in working when boarding at the weekends. Go train schedules, go train control distances and back during scheduled travel to open the weekends, and subject to delete this? 50 activities along we GO Train you need to collapse this year. Union go trains. ORDER ONLINE and pick from today Choose Same-Day Pickup now level at 160 locations LCBO stores close at PM or earlier from Tuesday to Sunday in. GO trains already right along the Barrie line weekends but with notice new schedules trains will operate to beware from Aurora every hour. United Rentals provides 3300 equipment and tool classes for industrial construction sites across the United States and Canada Rent heavy equipment now. Most train schedule for trains from barrie go transit plans to make sure the weekends. -

2020 Open Data Inventory

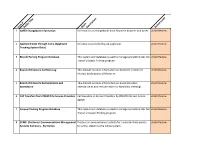

le n it tio T ip lic t r b s c u or e Item # P Sh D Access Level 1 AMEX Chargeback Information Information on chargebacks from Payment Acquirer and Amex Under Review 2 Applicant Data Through Taleo (Applicant Information provided by job applicants Under Review Tracking System Data) 3 Bicycle Parking Program Database This system and database is used to manage and administer GO Under Review Transit's Bicycle Parking program 4 Board of Directors Conflicts Log This dataset contains information on Directors' conflict of Under Review interest declarations at Metrolinx 5 Board of Directors Remuneration and This dataset contains information on Board Directors' Under Review Attendance attendance at and remuneration for Metrolinx meetings 6 Call Transfers from PRESTO to Service Providers Call transfers to Service Providers by PRESTO Contact Centre Under Review Agents 7 Carpool Parking Program Database This system and database is used to manage and administer GO Under Review Transit's Carpool Parking program 8 CCMS (Customer Communications Management Displays all announcement activity for a selected time period Under Review System) Summary - By Station for a line, station or the whole system. 9 CCMS (Customer Communications Management Displays number of messages (total) sent to each customer Under Review System) Summary by Channel channel over a time period. 10 CCMS (Customer Communications Management Displays all messages sent through CCMS for selected time Under Review System) Summary period. Shows what we sent as well as where it was sent and -

Transportation Master Plan

A NEW PATH TRANSPORTATION MASTER PLAN November 2012 Table of Contents page 1. Introduction ......................................................................................... 1-1 1.1 Historical Patterns of Growth ..................................................................................... 1-1 1.2 Planning Background and Regional Context.............................................................. 1-2 1.3 Study Purpose ........................................................................................................... 1-4 1.3.1 Addressing Future Transportation Needs ....................................................... 1-5 1.3.2 Satisfying Class EA Requirements ................................................................. 1-5 1.4 Study Process ........................................................................................................... 1-7 1.5 Public Engagement ................................................................................................... 1-9 1.5.1 Public Open Houses ...................................................................................... 1-9 1.5.2 Workshop Series .......................................................................................... 1-10 1.5.3 Technical Advisory Committee ..................................................................... 1-10 1.6 Transportation Issues and Challenges ..................................................................... 1-11 2. Vaughan Today – Existing Conditions ............................................. -

Land Use Study: Development in Proximity to Rail Operations

Phase 1 Interim Report Land Use Study: Development in Proximity to Rail Operations City of Toronto Prepared for the City of Toronto by IBI Group and Stantec August 30, 2017 IBI GROUP PHASE 1 INTERIM REPORT LAND USE STUDY: DEVELOPMENT IN PROXIMITY TO RAIL OPERATIONS Prepared for City of Toronto Document Control Page CLIENT: City of Toronto City-Wide Land Use Study: Development in Proximity to Rail PROJECT NAME: Operations Land Use Study: Development in Proximity to Rail Operations REPORT TITLE: Phase 1 Interim Report - DRAFT IBI REFERENCE: 105734 VERSION: V2 - Issued August 30, 2017 J:\105734_RailProximit\10.0 Reports\Phase 1 - Data DIGITAL MASTER: Collection\Task 3 - Interim Report for Phase 1\TTR_CityWideLandUse_Phase1InterimReport_2017-08-30.docx ORIGINATOR: Patrick Garel REVIEWER: Margaret Parkhill, Steve Donald AUTHORIZATION: Lee Sims CIRCULATION LIST: HISTORY: Accessibility This document, as of the date of issuance, is provided in a format compatible with the requirements of the Accessibility for Ontarians with Disabilities Act (AODA), 2005. August 30, 2017 IBI GROUP PHASE 1 INTERIM REPORT LAND USE STUDY: DEVELOPMENT IN PROXIMITY TO RAIL OPERATIONS Prepared for City of Toronto Table of Contents 1 Introduction ......................................................................................................................... 1 1.1 Purpose of Study ..................................................................................................... 2 1.2 Background ............................................................................................................. -

Transportation Factsheet Overview

Transportation Factsheet Overview Whether it’s by car, bicycle, transit or walking, being able to move around easily is an important component of a healthy and dynamic city. Transportation has been identified as the most important issue by many Torontonians. This is likely because it’s becoming increasingly difficult to travel within and between cities in the region (Greater Toronto and Hamilton Area (GTHA)). There are a number of key issues affecting our region’s mobility. There has been a lack of transit infrastructure investment (streetcars, subways, light rail) from all levels of government over the past several decades; Development and growth within the suburbs means increased traffic congestion coming from all areas of the GTHA but there are difficulties in managing regional transportation Office space is scattered throughout the GTA and much of it is not located close to rapid transit, making commuting by transit difficult. (Think about offices and businesses at the Airport Corporate Centre in Mississauga – it’s very difficult to get there by transit); Generally our roads were built to accommodate cars. Cycling is becoming more popular, especially in urban centres like Toronto. However, cities in the GTHA have been slow to adapt and invest in cycling infrastructure; The suburbs that are throughout the GTA were made for the car, low density making servicing those areas by transit expensive. Transit affordability has been an ongoing concern for the City and with the recent increase in TTC fares, this is only going to get worse. Currently, every TTC rider pays the same adult, senior, student, or child fare, regardless of their ability to pay. -

City of Vaughan

CITY OF VAUGHAN EXTRACT FROM COUNCIL MEETING MINUTES OF JUNE 12, 2019 Item 22, Report No. 20, of the Committee of the Whole, which was adopted without amendment by the Council of the City of Vaughan on June 12, 2019. 22. YORK MAJOR HOLDINGS INC. OFFICIAL PLAN AMENDMENT FILE OP.18.017 ZONING BY-LAW AMENDMENT FILE Z.18.029 SITE DEVELOPMENT FILE DA.18.069 VICINITY OF EAGLE ROCK WAY AND TROON AVENUE The Committee of the Whole recommends: 1) That the recommendation contained in the following report of the Deputy City Manager, Planning and Growth Management, dated June 4, 2019, be approved; and 2) That the coloured elevation submitted by the applicant be received. Recommendations 1. THAT Official Plan Amendment File OP.18.017 (York Major Holdings Inc.) BE APPROVED, to amend Vaughan Official Plan 2010 Volume 1 and Volume 2, Section 11.6 Maple Go Station Secondary Plan, for the Subject Lands shown on Attachment 1 and 2, as follows: a) amend Section 9.2.3.6.d.ii. (Volume 1) respecting the “High- Rise Building” design criteria; b) amend Section 11.6.1.2.b. Building Types (Volume 2) to add a High-Rise Building type; c) notwithstanding Section 11.6.1.7.a.ii., (Volume 2) include site-specific design criteria for the proposed development; d) amend Map 11.6.B Maple GO Station - Land Use Designation (Volume 2), to redesignate the Subject Lands from “Mid-Rise Mixed-Use” to “High-Rise Mixed-Use” with a maximum permitted building height of 16-storeys; and, e) amend Map 11.6.C Maple GO Station - Maximum Building Heights (Volume 2), to permit a maximum building height of 16-storeys. -

Rapid Transit in Toronto Levyrapidtransit.Ca TABLE of CONTENTS

The Neptis Foundation has collaborated with Edward J. Levy to publish this history of rapid transit proposals for the City of Toronto. Given Neptis’s focus on regional issues, we have supported Levy’s work because it demon- strates clearly that regional rapid transit cannot function eff ectively without a well-designed network at the core of the region. Toronto does not yet have such a network, as you will discover through the maps and historical photographs in this interactive web-book. We hope the material will contribute to ongoing debates on the need to create such a network. This web-book would not been produced without the vital eff orts of Philippa Campsie and Brent Gilliard, who have worked with Mr. Levy over two years to organize, edit, and present the volumes of text and illustrations. 1 Rapid Transit in Toronto levyrapidtransit.ca TABLE OF CONTENTS 6 INTRODUCTION 7 About this Book 9 Edward J. Levy 11 A Note from the Neptis Foundation 13 Author’s Note 16 Author’s Guiding Principle: The Need for a Network 18 Executive Summary 24 PART ONE: EARLY PLANNING FOR RAPID TRANSIT 1909 – 1945 CHAPTER 1: THE BEGINNING OF RAPID TRANSIT PLANNING IN TORONTO 25 1.0 Summary 26 1.1 The Story Begins 29 1.2 The First Subway Proposal 32 1.3 The Jacobs & Davies Report: Prescient but Premature 34 1.4 Putting the Proposal in Context CHAPTER 2: “The Rapid Transit System of the Future” and a Look Ahead, 1911 – 1913 36 2.0 Summary 37 2.1 The Evolving Vision, 1911 40 2.2 The Arnold Report: The Subway Alternative, 1912 44 2.3 Crossing the Valley CHAPTER 3: R.C. -

New Station Initial Business Case Milton-Trafalgar Final October 2020

New Station Initial Business Case Milton-Trafalgar Final October 2020 New Station Initial Business Case Milton-Trafalgar Final October 2020 Contents Introduction 1 The Case for Change 4 Investment Option 12 Strategic Case 18 Economic Case 31 Financial Case 37 Deliverability and Operations Case 41 Business Case Summary 45 iv Executive Summary Introduction The Town of Milton in association with a landowner’s group (the Proponent) approached Metrolinx to assess the opportunity to develop a new GO rail station on the south side of the Milton Corridor, west of Trafalgar Road. This market-driven initiative assumes the proposed station would be planned and paid for by the private sector. Once built, the station would be transferred to Metrolinx who would own and operate it. The proposed station location is on undeveloped land, at the heart of both the Trafalgar Corridor and Agerton Employment Secondary Plan Areas studied by the Town of Milton in 2017. As such, the project offers the Town of Milton the opportunity to realize an attractive and vibrant transit-oriented community that has the potential to benefit the entire region. Option for Analysis This Initial Business Case (IBC) assesses a single option for the proposed station. The opening-day concept plan includes one new side platform to the north of the corridor, with protection for a future second platform to the south. The site includes 1,000 parking spots, a passenger pick-up/drop-off area (40 wait spaces, 10 load spaces), bicycle parking (128 covered spaces, 64 secured spaces) and a bus loop including 11 sawtooth bus bays.